ACKNOWLEDGEMENT:

The internship program is very helpful to bridge the gap between the theoretical knowledge and real life experience as part of Bachelor of Business Administration (BBA) program. This internship report has been designed to have a practical experience through the theoretical understanding.

It is my privilege that I had the opportunity to do internship in Trust Bank Limited, Dhanmondi Branch. I would like to thank all the people on whom I carry out my internship.

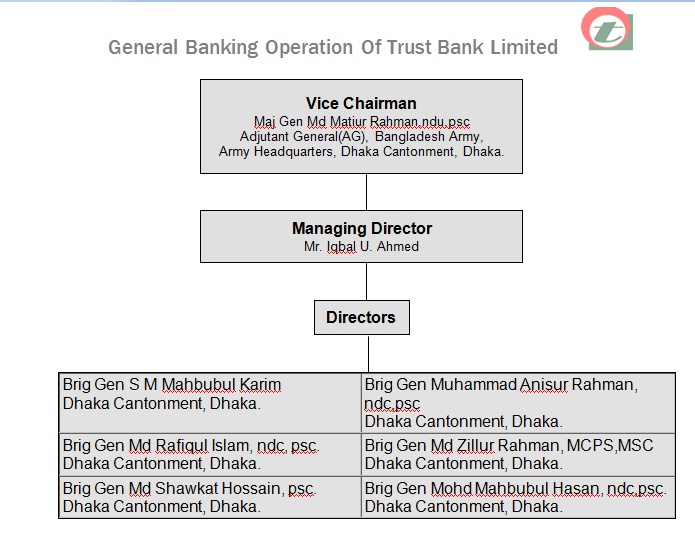

I express my deep gratefulness to Mr. Iqbal U. Ahmed, Managing Director; Mr. Ishtiaque Ahmed Chowdhury, Deputy Managing Director & Mr. Shahud Ahmed, SVP & Head of HRD for selecting me to do internship at Trust Bank Limited, Dhanmondi Branch, Dhaka, Bangladesh.

I am grateful especially to Mr. Md. Mozakkerul Islam, AVP and Manager; Mr. Mohammad Mostafa, AVP and Sub- Manager; and all the staffs of this branch for giving me the pleasure of doing internship.

My heartfelt appreciation and thanks should reach to Mr. Md. Mosharraf Hossain, senior officer, Mr.Khandaker Abdul Hafiz, Nure Alam khondaker officer who co-operated to collect various requirement supports from various sources & helped me to complete this internship report.

I am also thankful to all other officers & all the personnel working at TBL, Dhanmondi Branch for their cordial co-operation and support.

Especially, I would like to extend my great gratitude to my department supervisor Mr. Mohammad Maksudul Karim for his guidance and useful comments on the preparation of the report.

EXECUTIVE SUMMARY:

Today necessity of a Bank as a financial institution is undeniable. A country is financially rich when it has modern financial institutions of its own. These institutions play a vital role in the field of financial stability of a country. Banking sector is one of the stable financial institutions of a country. Due to Globalization and Technological changes, the banking business has become very competitive now a day. All banks are competing to give effective real time service to their customers. For giving friendly service to the customers they need experienced and well-educated working force.

The overall approach of the report is a Descriptive one as it goes into the depth of service quality of Trust Bank Ltd. Here both primary and secondary information were used. Interview was the basic techniques comply to collect primary data from any people within the organization. Information about the varieties of activities within the Correspondent Banking Department was collected through interviewed. Among the secondary sources to collect data regarding the company’s performance over the past six years are Publications, Annual reports of Trust Bank Ltd., Different circulars and papers of Trust Bank Ltd, Term papers of TBL Training manuals, Guidelines for Foreign Exchange Transactions, General Banking Operation manual, Banking Lecture sheet within the organization helped me to gather data about the organization.

The report contains six chapters. The first chapter of the report describes the introductory words of the internship report in which Introduction of Topic, Rationale of the Study, Objective of the Report, Scope of the Report, Methodology, Activity Schedule & Limitations. The second chapter contains the Background of “Trust Bank Ltd.”, Organization Structure of “Trust Bank Ltd.”, Vision of “Trust Bank Ltd.”, and Mission Statement of “Trust Bank Ltd.” In third chapter, it contains the Topic Analysis and Description.

Based on the study, findings in different departments of the bank have come in the chapter four. In general banking department, the banking procedure is not fully computerized, cash counter is congested, service of remittance section is not as prompt as the customers demand and introducer is one of the problems to open a new account etc. The loans and advance department takes a long time to process a loan.

Different Problems, suggestions, recommendations have come at the end of the report. The Problems findings during the three-month long internship period & suggestions are given from observation, comparative analysis, strategic point of view etc. To increase the efficacy in customer service Trust Bank Ltd. should try to develop the process of providing services.

Trust Bank Ltd. has passed a long way since it is providing services. Already it has earned a strong positioned in the field of customer service. To continue to hold the position and be perfect in this sector it will have to keep more and more attention to the customer retention and development.

TABLE OF CONTENTS:

| ACKNOWLEDGEMENT EXECUTIVE SUMMARY | ||

CHAPTER ONE INTRODUCTION

| ||

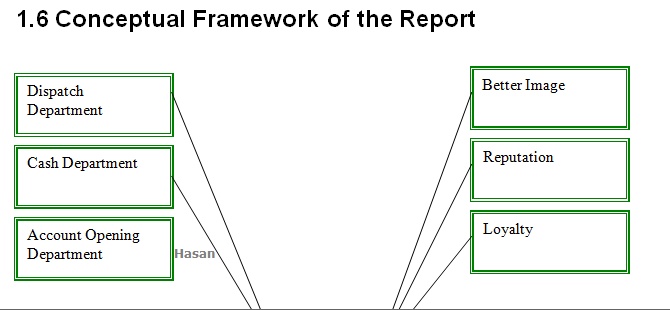

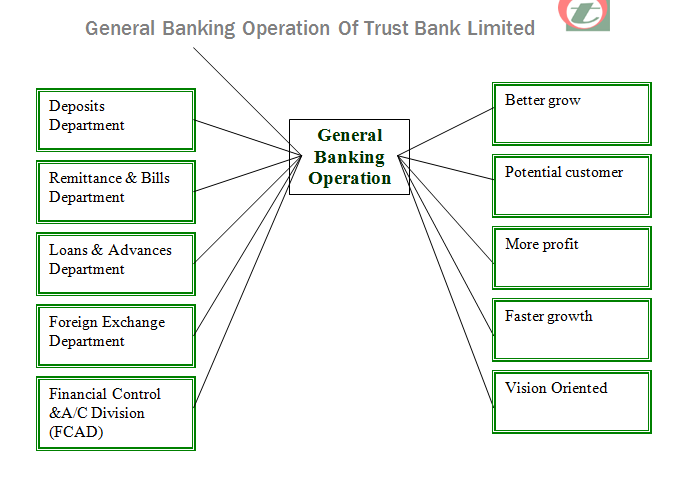

1.0 Introduction 1.1 Introduction of Topic 1.2 Rationale of the Study 1.3 Objective of the Report 1.3.1 Specific Objective 1.3.2 Broad Objective 1.4 Scope of the Report 1.5 Methodology 1.6 Conceptual Framework of the Report 1.7 Model Used Trend Analysis Ratio Analysis 1.8 Limitation CHAPTER TWO COMPANY Overview 2.0 Company Overview 2.1 Background of “Trust Bank Ltd.” 2.2 Nature of Business 2.3 Board of Director 2.4 Organization Structure of Trust Bank Limited2.5 Vision of Trust Bank 2.6 Mission Statement of Trust Bank 2.7 Branches

3.0 Topic Analysis and Description 3.1 Dispatch Department 3.1.1 Inward Register 3.1.2 Outward Register 3.2 Cash Department 3.3 Deposits Department 3.4 Remittance & Bills Department 3.5 Product & Schemes 3.5.1 Deposit Products 3.5.2 Investment Products 3.5.3 International Trade 3.5.4 Others 3.6 Account Opening Department 3.6.1 Savings Account 3.6.2 Current Account 3.6.3 Short Term Deposit (STD) Account 3.6.4 Fixed Deposit Account 3.7 New Deposit Products 3.7.1 Trust Smart Savers Scheme (TSSS) 3.7.2 Trust Digoon Laav Scheme (TDLS) 3.7.3 Trust Money Making Scheme (TMMS) 3.7.4 Trust Education Scheme (TES) 3.8 Other Services 3.8.1 Locker Service 3.8.2 ATM Card 3.9 Loans & Advances Department 3.10 International Banking 3.11 Foreign Exchange Department 3.11.1 Import Operation 3.11.2 Export Operations

3.12 Credit Department 3.13 Foreign Remittance Department 3.14 Performance of the Bank: As a Whole 3.13.1 Trend Analysis 3.13.2 Ratio Analysis 3.15 Performance of the Bank: Dhanmondi Branch 3.14.1 Profitability Analysis 3.14.2 Inter Branch Profitability Analysis | ||

CHAPTER FOUR OVERALL FINDINGS

| ||

4.0 Overall Findings | ||

CHAPTER FIVE PROBLEMS AND RECOMENDATIONS

| ||

5.0 Problems and Recommendations 5.1 Problems 5.2 Recommendations

| ||

CHAPTER SIX CONCLUTION

| ||

6.0 Conclusion

| ||

| APPENDIX BIBLIOGRAPHY

| ||

CHAPER ONE:

Introduction:

Introduction of Topic:

This internship is a part of the Bachelor of Business Administration (BBA) program that provides an on-the-job experience to students. I was placed at Trust Bank Limited, Dhanmondi Branch as an internee officer for three months. This internship program was my very first on-the-job exposure and provided me with learning experience and knowledge in several areas. During the first few weeks of my internship period, I was able to get accustomed to the working environment of Trust Bank Limited. As the internship continued, I not only learned about the activities and operations of correspondent Bank, but I also gathered some knowledge about the basic business activities of banking in first one-month of my internship period.

Generally by the word “Bank” we can easily understand that the financial institution deals with money. But there are different types of banks such as; Central Banks, Commercial Banks, Savings Banks, Investment Banks, Industrial Banks, Co-operative Banks etc. But when we use the term “Bank” without any prefix, or qualification, it refers to the ‘Commercial banks’. Commercial banks are the primary contributors to the economy of a country. So we can say Commercial banks are a profit-making institution that holds the deposits of individuals & business in checking & savings accounts and then uses these funds to make loans. Both general public and the government are dependent on the services of banks as the financial intermediary. As, banks are profit-earning concern; they collect deposit at the lowest possible cost and provide loans and advances at higher cost. The differences between two are the profit for the bank.

A company can increase efficiency through a number of steps. These include exploiting economies of scale and learning effects, adopting flexible manufacturing technologies, reducing customer defection rates, getting R&D function to design products that are easy to manufacture, upgrading the skills of employees through training, introducing self-managing teams, linking pay to performance building a companywide commitment to efficiency through strong leadership, and designing structures that facilitate cooperation among different functions in pursuit of efficiency goals.

Efficacy of customer service is related with progression of operation. We can identify the efficacy of customer service by studying the progress of “Trust Bank Ltd.” from starting to at present. The progress of “Trust Bank Ltd.” is very rapid with the concern of its profit making and growth of its operation within the country towards the country’s economy.

Trust Bank Limited pursues decentralized management policies and gives adequate work freedom to the employees. This results in less pressure for the workers and acts as a motivational tool for them, which gives them, increased encouragement and inspiration to move up the ladder of success. Overall, I have experienced a very friendly and supporting environment at Trust Bank Limited, which gave me the pleasure and satisfaction to be a part of them for a while. While working in different departments of this branch I have found each and every employee too friendly to us to cooperate. They have discussed in details about their respective tasks. I have also participated with their works.

Rationale of the Study:

The internship program is very helpful to bridge the gap between the theoretical knowledge and real life experience as part of Bachelor of Business Administration (BBA) program. This internship report has been designed to have a practical experience through the theoretical understanding.

Internship program is essential for every student, especially for the students of Business Administration, which helps them to know the real life situation. For this reason a student takes the internship program at the last stage of the degree, to launch a career with some practical experience. As a Complete fulfillment of Internship Program introduce the students with the real life business situation.

This report is a part of my academic program. The internship program has been set for three (3) months period at “Trust Bank Ltd” as a part of my BBA program. In our BBA Program all courses based on theoretical and we have to learn practically. The program has helped me a lot to understand the organizational atmosphere and behavior and I gather some practical Knowledge about “General Banking Operation of Trust Bank Ltd.”

Objective of the Report:

Broad Objective:

The objective of the internship program is to familiarize students with the real market situation, to compare them with the business theories & at the last stage make a report on assigned task. The main objective of this report is to have an assessment about overall activities of “Trust Bank Ltd.”. How the Bank is providing facilities to its clients & to suggest remedial measure for the development of overall banking activities of “Trust Bank Ltd.”. In addition, the study seeks to achieve the following objectives:

Specific Objective:

- To present an overview of “Trust Bank Ltd. ”

- To get an overall idea of banking from banker’s point of view.

- To apply theoretical knowledge in the practical field.

- To make a bridge between the theories and practical procedures of day to day Banking operation.

- To assess the decision undertaken by the top-level management to keep the rein with the competitiveness of the market.

- To understand the recent complexity of banking in the wake of rising terrorism and fundamentalism.

- To relate the theories of banking with the practical banking activities.

- To review the techniques used by the bank to make it lucrative

- Determining the drawbacks of the existing system.

- To study existing banker-customer relationship, particularly the efficacy of customer services of the bank.

- Recommending some guidelines to improve the effectiveness

Scope of the Report:

This internship report covers all the trade related products handled by the “Trust Bank Ltd.” such as Foreign Exchange, Cash Dept., Dispatch, Account Opening, Remittance, Accounts, Administration and Loans & Advances etc.

This report has been prepared through extensive discussion with bank employees and with the customers. While preparing this report, I had a great opportunity to have an in depth knowledge of all the banking activities practiced by the “Trust Bank Ltd.” It also helped me to acquire a first hand perspective of a leading private Bank in Bangladesh.

Interview was the basic technique complied to collect primary data from any people within the organization. Information about the varieties of activities within the Correspondent Banking Department was collected through interviews. Data regarding the types of product offered to the clients and the descriptions for each of those products were gathered through interviews. Besides, on-the-job experience has also helped me learn quite a few things about the Correspondent Banking Department and the organization as well.

On the other hand, secondary sources were used to collect data regarding the company’s performance over the past five years, Publications, Database, Annual report of Trust Bank Ltd (2001, 2002, 2003, 2004, 2005 and 2006), Different papers of Trust Bank Ltd, Different textbooks, Term papers of TBL Training manuals,

Transaction in foreign Exchange, Principles & Practice (By M.R. Sinha), Guidelines for Foreign Exchange Transactions, General Banking Operation manual and Lecture sheet within the organization helped me to gather data about the organization. Data have also been collected by going through different circulars issued by the head office and Bangladesh bank during the tenor of the internship.

MODEL USED :

The performance evaluation of the TBBL has been conducted based on the trend analysis and ratio analysis.

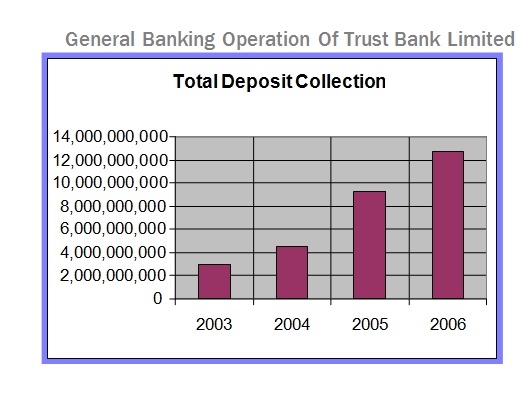

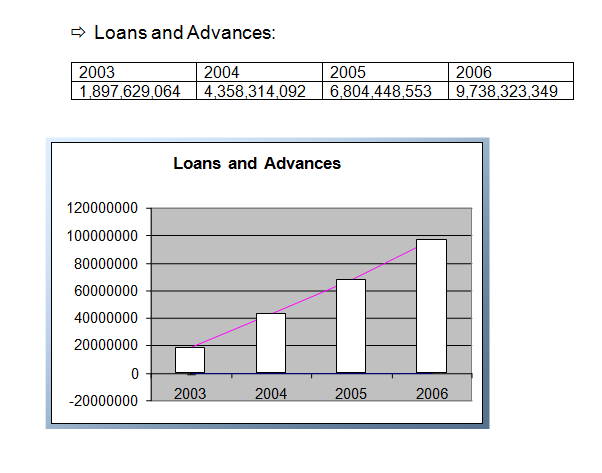

Trend Analysis: In the report trend analysis has been used in order to indicate the changes in the level of progress and growth over the last three years starting from 2003. It would show whether the present growth trend of the TBBL is excellent, good, satisfactory or bad.

Ratio Analysis: In the report, significant analysis has been made through the following ratios –

- Capital Adequacy Ratio

- Capital Fund to Deposit Liabilities Ratio

- Liquid Asset to Deposit Liabilities Ratio

- Loan to Deposit Liabilities Ratio

- Earning Asset to Deposit Liabilities Ratio

- After Tax Return on Average Asset Ratio

- Net profit to Gross Income

- After Tax Return on Equity

Limitations:

The present study was not out of limitations. But it was a great opportunity for me to know the banking activities of Bangladesh specially “Trust Bank Ltd.” Some constraints are appended bellow–

- The main constraint of the study is inadequate access to information, which has hampered the scope of analysis required for the study. As it is a new bank it could not start all its operation, it was unable to provide some formatted documents data for the study.

- Due to time limitations, many of the aspects could not be discussed in the present report.

- Every organization has their own secrecy that is not revealed to others. While collecting data i.e. interviewing the employees, they did not disclose much information for the sake of the confidentiality of the organization.

- Another problem is that creates a lot of confusions regarding verification of data. In some cases more than one person were interviewed to clarify each concept as many of the bankers failed to provide clear-cut idea about the job they perform.

- The clients were too busy to provide me much time for interview.

- I have had no opportunity to compare the general banking system of the TBBL with that of other contemporary and common size banks. It was mainly because of the shortage of time and internship nature.

CHAPTER TWO:

Company overview:

Background of “Trust Bank Ltd:

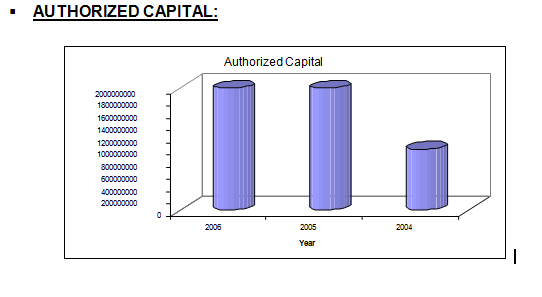

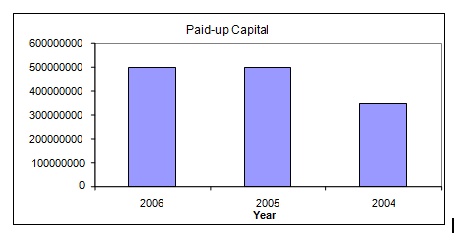

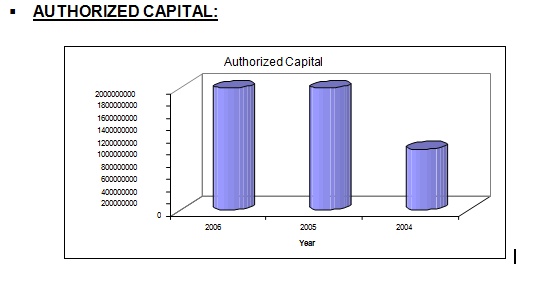

Trust Bank Ltd. is a private, commercial, scheduled Bank, which obtained license from Bangladesh Bank on July 15, 1999. Presently Army Welfare Trust is the major shareholder. The authorized capital of the Bank is Taka two thousand million and paid-up capital of Taka five hundred million. Public shares are expected to be floated in the near future. The Bank was formally inaugurated and listed as a scheduled Bank on November 1999.

The idea of setting up a Bank by Bangladesh Army was first conceived in 1987 and on November 29, 1999 the first branch of Trust Bank Ltd came into operation

Composition of the Board of TBL consists of Ex-officio Directors of in-service senior Army personnel, with the Chief of Army Staff as its Chairman and the Adjutant General as its Vice-Chairman.

Trust Bank Ltd. having a spread network of 20 branches across Bangladesh and plans to open few more branches to cover the important commercial areas in Dhaka, Chittagong, Sylhet and other areas in 2006. The Bank sponsored by the Army Welfare Trust (AWT), is first of its kind in the country with a wide range of modern corporate and consumer financial products. Trust Bank Ltd. has been operating in Bangladesh since 1999 and has achieved public confidence as a sound and stable Bank.

In order to provide up-to-date information on the bank at fingertips to the trade and business communities of the world, their own IT team has developed a E-mail address and a web page for the bank. It can be accessed to under the domain: tbl@global-bd.net and www.trustbankbd.com

In addition to ensuring quality, Customer services related to general banking the bank also deals in Foreign Exchange transactions. In the mean time, the bank has extended credit facilities to almost all the sector of the country’s economy. The bank has plans to invest extensively in the country’s industrial and agricultural sectors in the coming days.

It has also plans to promote the agro-based industries of the country. The bank has already participated in syndicated loan agreement with other banks to promote textile sectors of the country. Such participation would continue in the future for greater interest of the overall economy. Keeping in mind the client’s financial and banking needs the bank is engaged in constantly improving its services to the clients and launching new and innovative products to provide better services towards fulfillment of growing demands of its customers.

Trust bank limited recently at the end of the year 2006 changed their name from “The Trust Bank Limited” to “Trust Bank Limited” and also changed their logo to bring the bank more closer to the general public.

CORPORATE INFORMATION AT A GLANCE:

- Banking License received on : 15th July. 1999

- Certificate of incorporation received on : 17th June 1999

- Certificate of Commencement of business received on: 17th June 1999

- First branch licenses on : 9th August 1999

- Formal inauguration on : 29th November 1999

- Sponsor Shareholders : Army Welfare Trust

- Number of Branch : 20

Nature of Business:

Trust Bank Ltd offers full range of banking services that include:-

- Deposit banking

- Loans & advances

- Export

- Import

- Financing inland

- International remittance facilities

The bank offers a full scale commercial banking includes:–

- Personal

- Credit

- Consumer & Corporate Banking

The bank has plans to invest extensively in the country’s industrial and agricultural sectors in the coming days. The bank has participated in syndicated loan agreement with other banks. Such participation would continue in the further for greater interest of the overall economy. The bank is keen to constantly improve its services to the clients and launching new & innovative products to provide better services towards fulfillment of growing demands of its customers.

Board of Directors:

Chairman |

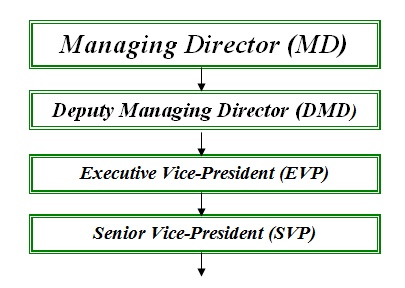

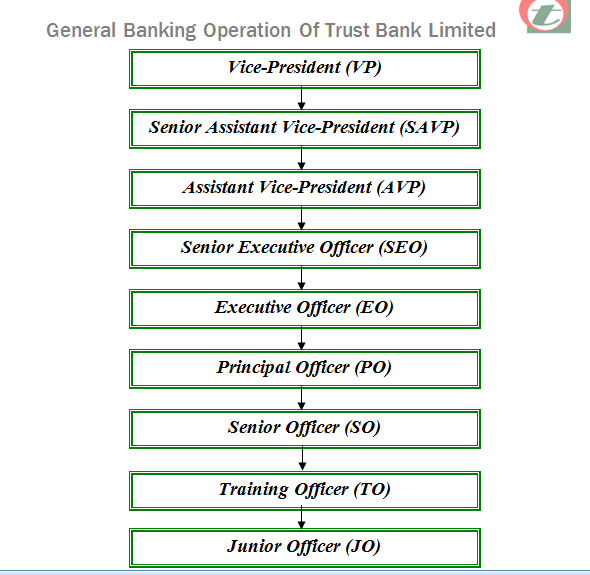

Organizational Structure of Trust Bank Ltd.

Vision Statement of “Trust Bank Limited:

- To build a sustainable and respectable financial institution.

- To be a leading Commercial Bank, with a social focus, assisting in the economic development of the country.

- The Profit of the bank used for the Socio-economic development of the members of the Bangladesh Army and thereby the nation as a whole.

Mission Statement of “Trust Bank Limited:

- Achieving sound and profitable growth in Assets & Liabilities, with focus to maintain non-performing assets at acceptable levels.

- To build long-lasting, credible and mutually dependable relationships with customers.

- Efficiently managing interest and operating costs.

- To excel in rendering superior customer service.

- To be the preferred employer among Banks in Bangladesh.

Branches:

The bank now continues its operation with 27 branches across the country mainly in Dhaka, Chittagong, Jessore, Sylhet, Sirajgong and Mymensingh. The district wise pictorial presentation of the branches appears as follows:

Twenty Seven branches of Trust Bank Limited are located in the following areas:

SL No. | Branch Name | Region |

01. | Head Office | 36, Dilkusha, Dhaka |

02. | Principal Branch | Dhaka Cantonment, , Dhaka |

03. | SKB Branch | 195, Motijheel, , Dhaka |

04. | Bogra Cantt. Branch | Bogra |

05. | Comilla Cantt. Branch | Comilla |

06. | Ctg. Cantt. Branch | Chittagong |

07. | Rangpur Cantt. Branch | Rangpur |

08. | Jessore Cantt. Branch | Jessore |

09. | Mymensingh Cantt. Branch | Mymensingh |

10. | Savar Cantt. Branch | Savar |

11. | Jalalabad Cantt. Branch | Sylhet |

12. | Agrabad Branch | Chittagong |

13. | SSC Branch, Ghatail | Tangail |

14. | Dhanmondi Branch | Road-02, Dhanmondi R/A, Dhaka |

15. | Khatungonj Branch | Chittagong |

16. | Gulshan Branch | Gulshan, Dhaka |

17. | Dilkusha Branch | Dilkusha, Dhaka |

18. | RWGH Branch | Mohakhali, Dhaka |

19. | KYAMCH Branch | Enayetpur, Sirajgong |

20. | CDA Branch | Chittagong |

21. | Sylhet Branch | Sylhet

|

22. | Halishahar Branch | Chittagong |

23. | Uttara Corp. Branch | Uttara,Dhaka |

24. | Beani Bazar Branch | Sylhet

|

25. | Maulavi Bazar Branch | Maulavibazar |

26. | Millenium Corp. Branch | B S Jahangir Gate,Dhaka

|

27. | Goalabazar Branch | Sylhet

|

CHAPTER THREE

Topic Analysis and Description:

Dispatch Department:

Dispatch is one of the primary departments of banking activities. Dispatch can be categorized into two parts:

Inward Register:

Outward Register – (a) Courier

(b) By Post

Inward Register :

In inward register all the incoming documents are received and registered according to date. Then, Documents are transferred to different departments according to their destiny.

Outward Register:

The documents, which are needed to mail to different branches of TBL in Bangladesh or outside Bangladesh, are registered in outward register and mailed by courier or by post, which one is suitable.

Cash Department:

- ØOpening of Cash: Beginning balance is used to start daily transaction.

- ØMaintenance of Receipt and Payment Registers while receiving & paying

Different amount of cash.

- Previously issued cheque will be paid if issued 6 months before.

- Advance issued cheque cannot be made payment even one day before.

- Evening Banking: Can only receive cash. No payment can be made except

some special cases.

- TBL Dhanmondi Branch provides “Sheba Service” in this branch

- Issue Note: Notes issued by the bank & accepted by the people, fresh

notes.

- Non-issue Note: Notes cannot be issued for public like torn, mutilated

notes Soiled Notes etc.

Deposits Department:

- Payment through Cash

Clients give their cheques with their signatures. These signatures are justified with specimen signature cards. If these signatures are correct, then A/C numbers are posted into the computer and required balances are given to them after checking that they have sufficient balance in their accounts.

- Payment through Transfer

This transfer is made through account to account, not in cash.

- Payment through Clearing House

Payment is made through clearing house. In this case the parties are account holders different banks. The clearing-house in Bangladesh bank makes the clearing tasks in working day where the representatives of every scheduled bank are present there to collect their own banks’ cheque.

- Objections to unpaid cheque

- When cheque are returned from clearinghouse, they mention the cause of

returning. TBL Return memo includes the following causes:

(A) Insufficient Fund

(B) Not arrange for.

(C) Effects not cleared, may be presented.

(D) Exceed arrangements.

(E) Full Cover Not Received.

(F) Payment stopped by drawer.

(G) Payee’s endorsement irregular\ illegible\ required.

(H) Payee’s endorsement irregular, required bank’s confirmation.

(I) Drawers, signature differs/ required.

(J) Alterations in date/ figures/ words require drawer’s full signature.

(K) Cheque is post dated/ out of date/ mutilated

(L) Amount in words and figure differs

(M) Crossed cheque must be presented through a bank

(N) Clearing stamp required/ requires cancellation.

(O) Addition to bank discharge should be authenticated

(P) Cheque crossed “Account, Payee Only”.

(Q) Collecting Bank’s discharge irregular/ required.

2. After returning of cheque the cause is notified to the client to take necessary

action.

3. Also the vouchers are made reversal after returning of cheque i.e. Bills lodged debited and Bills for collection credited.

- Secrecy

1. The account information of a client is a secret matter.

2. Bank will not disclose it to unauthorized persons.

3. Only the account holder has the opportunity to get information of his

personal account or, who have got the authority from the account holder to

get such information,

- § Summation

Summation is nothing but the sum of the debit and credit sides. Now using computer automatically does it.

- § Supplementary

Formation of different head of accounts separate in supplementary forms. Supplementary is made every end of the working day. As now transactions are computerized, computer gives an output of such supplementary at the end of the day and matched with the manual supplementary. There are two types of supplementary:

(a) Debit Supplementary

(b) Credit Supplementary

- § Different heads of supplementary form are:

- Account Number, name of accounts

- Cash Balance

- Clearing Balance

- Transfer Balance

- Total Balance

- § Dormant Account:

After opening an account if no transaction is made within 6 (six) months, then it is known as dormant account.

- § Inoperative Account:

It is also like the above account. The account is not operating by the client for a long time/3 years.

- § Standing Instruction:

The client himself gives this type of instruction. Account holder instructs his bank not to make payment from his account before further instructions.

- § Stop Payment:

Due to unavoidable circumstances like burned or lost cheque, the client will make an application to the branch manager to stop all payments from his account and the will immediately freeze the particular account.

- § Statement of Account:

Bank will give statements if the account holder wants it. This statement will be about the amount consists in account / the latest balance amount in the particular account.

- § Transfer of Accounts:

The transfer of accounts can be of two types:

1) Fund transfer from one account to another

2) Account Transfer from one branch to another

- § Closing of Account & Disposal of Unutilized Cheque:

- Application to the manager for closing the account

- Bank takes Tk.50 as closing charge

- The application form and specimen sign card is marked as closed

- The customer has to submit any unutilized portion of cheque and bank will destroy these.

Remittance & Bills Department :

Local remittance is one of the main components of general banking. The components of local remittance are —

Telegraphic Transfer,

Demand Draft issue,

Saving Certificate Issue (Sanchaypatra issue),

Pay order.

Remittance & bills section plays a very vital role in case of Banks Customer Service Section. Roles & Responsibilities of remittance section knows no bound. The activities of

Remittance & Bill sections are:

- Ø Issue and payment of Pay Order, Pay Slip, Demand Draft, SDR etc.

- Ø Execution of Inward and Outward Telegraphic Transfer

- Ø Non client services like T.T. and Pay Order

- Ø Follow up with clients

- Ø Internal and local collection of cheque and bills.

Telegraphic Transfer (TT):

It is an order from the issuing branch to the drawee bank / branch for payment of a certain sum of money to the beneficiary. The payment instruction is sent by telephone and funds are paid to the beneficiary through his account maintained with the drawee branch or through a pay order if no account is maintained with the drawee branch. No charge is required for TT.

ii. Demand Draft (DD) Issue:

Sometimes customers use demand draft for the transfer of money from one place to another. It is must need for sending money out side Dhaka city. For getting a demand draft, customer has to fill up an application form. The form contains date, name and address of the applicant, signature of the applicant, cheque number (if cheque is given for issuing the DD), draft number, name of the payee, name of the branch on which the DD will be drawn and the amount of the DD. The form will be duly signed by the applicant and by the authorized officer. TBL charges 15% commission on the face value of DD as service charge.

iii. Shanchaya Patra:

Shanchaya patra is received from Bangladesh bank (BB). People purchasing these bonds by depositing money in this branch and payment are made on maturity to customers from this branch only. Every transaction is reported to Bangladesh bank. In case of issuance, report to be reached to BB within 48 hours, otherwise penalty is imposed. Money is realized from BB after making payment to customer.

Various types of Shanchaya Patras are sold here. They are as follows:

- 5 years Bangladesh Shanchaya patra (5 BSP) :

Duration of this Shanchaya patra is 5 years. Any person who purchase this Shanchaya patra can withdraw his/her interest only after 5 years at the time of maturity along with capital.

Any single individual can buy Bangladesh Shanchaya patra for up to TK. 50 lac. And jointly can buy for up to TK.1 Crore. Interest Rate: 12.00% After 5 years.

- 3 Month Profit Based Sanchaya patra(3MPBS):

Duration of this Shanchaya patra is 3 years. Any person who purchases this Shanchaya patra can withdraw his/her interest in every 3 month but capital can be withdrawn after the maturity period.

Any single individual can buy 03 MPB Shanchaya patra up to TK. 50 lac. And jointly can buy for up to TK.1 Crore.

Interest Rate: 11.50% after 3 year

After every three (03) month 2,875/= Tk. will be given against 1 Lac. Taka.

- Pensioner’s Sanchaypatra:

Duration of this Shanchaya patra is 5 years. Any person who purchases this Shanchaya patra can withdraw his/her interest in every 3 month but capital can be withdrawn after the maturity period. Any single individual can buy Pensioner’s Sanchaypatra up to TK. 30 lac.

Interest Rate: 12.50% after 5 year

After every three (03) month 3,125/= Tk. will be given against 1 Lac. Taka.

iv. Pay Order

For issuing a pay order, the client is to submit an application in the prescribed form. This form should be properly filled up and signed. The procedure of the issuing pay order is similar to that of the Telegraphic transfer. For issuing pay order TBL charges commission on the following rate—

|

| Pay Order [Local] issuance | No charge for account holder Tk. 20/- for non-customers/clients |

| Pay Order[Local] cancellation | Tk. 20/- per instrument

| |

| Issuance of Duplicate Instrument | Tk. 100/- per instrument plus stamp charges for indemnity at actual. |

Note: No charge for army personnel

SOURCE: From interview with the In-charge of remittance department of Trust Bank Ltd, Dhanmondi Branch.

Payment of Pay Order: The pay order is presented to the bank either through clearance or for credit to the client’s account. While payment, relative entry is given in the pay order register with the date of payment.

In case of collecting DD, P0, PS following things are to be carefully checked:

- Ø Instrument of TBL

- Ø Crossing Seal

- Ø Clearing Seal

- Ø Branch Name

- Ø Amount same in word & figure

- Ø Signature verification

- Ø Avoid the stop order PO, DD

- Ø Test key verification. Every TT must have test key. DD over Tk.50000/

- Ø must have test key

- Ø Maintenance of PO/TT/DD issue & payable books

- Ø Balancing at the end of the month.

Product & Schemes :

Deposit Products:

- Current Deposit Account

- Savings Deposit Account (interest calculated on monthly minimum balance of Tk.2000 and above)

- Fixed Deposit (3 months to 3 years term)

- Savings Certificate

- Trust Smart Savers Scheme(TSS)

- Trust Digoon Laav Scheme(TDLS)

- Trust Money Making Scheme(TMMS)

- Trust Education Scheme(TES)

- Corporate Financing

- Trust Consumer Durable Scheme (TCDS)

- Trust Marriage Loan Scheme (TMLS)

- Trust Car Loan Scheme (TCLS)

- Trust House Building Loan Scheme (THLS)

- Trust Micro Credit for Renovation & Reconstruction of Dwelling Houses

International Trade:

- International Banking

- Private Foreign Currency Accounts

- Non Resident Foreign Currency Deposit Account

- Resident Foreign Currency Deposit Account

- Travelers’ Endorsement (Cash and Travelers Cheque)

- Remittance of Foreign Currency

- Import and Export Transaction

- Foreign Exchange Dealing

- Purchase of Foreign Currency Drafts, Cheque, Travelers Cheque

- Wage Earner’s Development Bond

Others:

- Trust Locker Service (TLS)

- Trust Tele Banking

Account Opening Department:

A bank has to maintain different types of accounts for different purposes. Trust Bank limited (TBBL) offers the general deposit products in the form of various accounts.

Savings Account:

Savings bank deposit is popular account maintained in Banks. The different matters relating SB account are described in the following discussion. The summary of the rules and regulations to open a savings account is as follows:-

- Any person or persons of more than 18 years having sound mind can open and operate this account singly or jointly.

- In case of a minor (a person below 18 years), a guardian can open and operate this account on his or her behalf.

- Clubs, Societies, Sole Proprietorship firms, Partnership firms, Limited Companies either public or private and other similar organization are eligible to open such account.

- More than one account cannot be opened in the same name.

- A minimum initial deposit of Tk. 500.00 is required to open such account.

- Money will be withdrawn through cheque. Withdrawal cannot be more than twice a week and generally the amount will not be more than 25% of the balance available, subject to maximum Tk. 20,000.00.

- In case of closure of any account, the bank deducts Tk. 100.00 as closing charge.

Current Account AND Short Term Deposit (STD) Account:

Most businessmen maintain Current Deposit accounts in order to make their daily business activities. This account’s funds change most frequently than any other accounts because customers use to withdraw and deposit funds in regular basis. The summary of the rules and regulations to open a current account & short term deposit (STD) account as follows:-

- A minimum deposit of Tk. 1000.00 is needed to open a current account.

- The bank charges an incidental charge of Tk 50.00 for every six (6) months

for the maintenance of the account.

- In case of the closure, the bank charges Tk. 100.00 as closing charge of the account.

- Withdrawal of money is allowed only through the leaves of the cheque

book issued by the bank.

Fixed Deposit Account:

The bank allows people to keep their idle money secured and profitable as Fixed Deposit. The interest rate that the bank offers to the fixed depositors is as follows:

SL No | Amount or Slab wise Deposit | Interest rate on Deposit: Maturity wise but based on amount | |||

1 Month | 3 Months | 6 months | 1 Year and above | ||

| 01. | Any amount but less than Tk 5 crore. | 11.00% | 11.25% | 12.00% | 12.00% |

| 02. | Tk 5 crore & above but less than Tk. 10 crore. | 11.00% | 11.25% | 12.00% | 12.00% |

| 03. | Tk 10 crore & above but less than Tk. 25 crore | 11.00% | 11.25% | 12.00% | 12.00% |

| 04. | Tk. 25 crore and above | 11.00% | 11.25% | 12.00% | 12.00% |

| * Subject to 10% government tax on interest earnings.

| |||||

The Bank deducts the Excise duty, the compulsory levy of the government, on the interest earnings in the following structure:

Minimum Deposit | Maximum Deposit | Excise Duty |

10,001 | 1,00,000 | 120.00 |

1,00,001 | 10,00,000 | 250.00 |

10,00,001 | 1,00,00,000 | 550.00 |

1,00,00,001 | 5,00,00,000 | 2500.00 |

5,00,00,001 | 99,99,99,99,999 | 5000.00 |

- § Afferent Provisions:

For FDR minimum period is 01 month and maximum period has no limit. FDR may be joint or individual.

- § Payment on Maturity:

After maturity period the customer gets the interest plus principal back.

- § Payment on death:

It is a critical process when FDR holder dies. The rest of the family members must have to submit the following documents:

- Succession Certificate: Court mentioning, who will get & what portion.

- Death Certificate: The payee must make an application including the above documents. The branch will forward it to the head Office. It is very important to note that in these cases, the bank have to be very careful. Some FDR mentions either or survivor, in this case survivor will get the amount.

- § Either or Survivor:

In case of Joint FDR, if one partner dies, then the survivor i.e. who is alive will get the money at maturity or the person’s name in favoring.

- § Renewal of FDR:

The FDR account will be renewed automatically on the maturity date. The renewed period shall be the prevailing rate for Fixed Deposits.

- § Duplication:

If the customer lost the FDR receipt, then he has to make application to the bank by filling up an Indemnity bond. For duplicate FDR TBL charges TK.25

- § Indemnity Bond:

Here the reason of loosing FDR receipt shall be stated in detail. Stamp of

Tk.1501/- is needed in this case.

- § Custody Indemnity Bond:

The bank will have to maintain these indemnity bonds with care in a safe custody or vault.

- § FDR Block

A receipt, given to the applicant after opening the FDR account, will show it after maturity to take his money back.

- § Specimen Card:

The signature of the FDR account holder is maintained in the specimen card.

- § Closure:

After payment at maturity period the FDR account is closed. The FDR account holder must surrender his FDR receipt during the payment. It is to notify that in case FDR, the bank entries the full amount at maturity date in advance when a customer opens a FDR account. After the maturity FDR receipt and FDR form are attached together and on the front page of the FDR form bank authority writes “Close of FDR account” and gives entry in the ledger.

PRE REQUISITE OF OPENING AN ACCOUNT:

To open a savings, current, STD account, the following documents are mandatory:

a) FOR INDIVIDUAL ACCOINT:

- Two copies of Passport size Photograph of the Clients (Attested by introducer or Verified with Passports)

- Passports/ Nationality Certificate/ Employer’s Certificate of the Proprietor.

- Customer Profile.

- Transaction Profile.

- Photograph of the Nominee(s) attested by the account holder.

- TIN Certificate.

b) FOR JOINT ACCOUNT:

- Passports/ Nationality Certificate/ Employer’s Certificate of the Proprietor.

- Customer Profile.

- Transaction Profile.

- Photograph of the Nominee(s) attested by the account holder.

- TIN Certificate.

- Relationship between the account holders.

- Purpose of opening of the Joint account.

c) FOR PROPRIETORSHIP ACCOUNT:

- Two copies of Passport size Photograph of the proprietor

(Attested by introducer or Verified with Passports)

- Passports/ Nationality Certificate/ Employer’s Certificate of the Proprietor.

- Customer Profile.

- Transaction Profile.

- Photograph of the Nominee(s) attested by the account holder.

- TIN Certificate.

- Trade License.

- VAT Registration (if available)

d) FOR PERTNERSHIP CONCERN:

- Two copies of Passport size Photograph of each partner(Attested

by introducer or Verified with Passports)

- Passports/ Nationality Certificate.

- Company Profile.

- Transaction Profile of the concern.

- Personal Profile of the partners.

- Photograph of the Nominee(s) attested by the account holder.

- TIN Certificate.

- Trade License of the concern.

- VAT Registration (if available)

- Relationship between the partners.

- Attested Photocopy of the Partnership Deed (Deed on Tk 1000.00 stamp)

- Resolution regarding opening and operation of the account.

e) FOR COMPANY ACCOUNT:

- Attested or Certified copy of the Memorandum and Articles of

Association.

- Certificate of Incorporation.

- Certificate of Commencement of Business.

- Two copies of Passport size Photograph of all Directors (Attested by introducer or Verified with Passports)

- Passports/ Nationality Certificate of all Directors of the company.

- Company Profile.

- Transaction Profile of the company.

- Personal Profile of all Directors as per enclosed sheet in the

Company’s letterhead pad.

- TIN Certificate.

- Trade License.

- VAT Registration (if available).

- Board resolution of the company regarding opening and operation of the account.

f) FOR PRIVATE SCHOOL/COLLEGE/MADRASA:

- Attested or Certified copy of the Constitution.

- Registration Certificate.

- List of all Executive Members (as per enclosed format).

- Two copies of Passport size Photograph of the account operators (Attested by introducer or Verified with Passports)

- Passports/ Nationality Certificate of the account operators.

- Personal Profile of all members of the governing body and Managing Committee.

- Board resolution regarding opening and operation of the account.

g) FOR NGO/ CLUB-SOCIETY/CO-OPERATIVE ACCOUNT:

- Registration Certificate from the Joint Stock Company/ Ministry of Social Welfare.

- List of all Executive Members (as per enclosed format).

- Board resolution as per Memorandum regarding opening and operation of the account.

- Attested or Certified copy of the Constitution/Bylaws.

- Two copies of Passport size Photograph of all Members (Attested by introducer or Verified with Passports)

- Passports/ Nationality Certificate of all Members.

- Profile of the Firm.

h) Minor’s Account:

- Putting the word “MINOR” after the title of the account (with red color).

- Recording of the special instruction of operation of the account.

The AOF is to be filled in and signed by either the parents or the legal guardian appointed by the court of law and not by the minor.

“No Objection Certificate” from the Ministry of Social Welfare.

NEW DEPOSIT PRODUCTS:

To keep in touch with competitive market, the bank has recently introduced four attractive deposit products. The products having their distinctive have already gained and are gaining the response from the existing and prospective clients. The products are as follows:

Trust Smart Savers Scheme (TSSS):

Under the TSSS, the following category of deposit and maturity payment has been declared:

Monthly Deposit | Amount Payable at Maturity (3 years) | Amount Payable at Maturity (5 years) | Amount Payable at Maturity (7 years) | Amount Payable at Maturity (10 years) |

500 | 20,897 | 38,514 | 59,801 | 1,00,000 |

1,000 | 41,794 | 77,027 | 1,19,601 | 2,00,000 |

2,000 | 83,588 | 1,54,055 | 2,39,202 | 4,00,000 |

3,000 | 1,25,380 | 2,31,100 | 3,58,800 | 6,00,000 |

4,000 | 1,67,170 | 3,08,100 | 4,78,400 | 8,00,000 |

5,000 | 2,08,970 | 3,85,100 | 5,98,000 | 10,00,000 |

RULES AND REGULATION:

- The maximum number of TSSS account from a single family can not exceed five.

- The first installment is to be deposited on any date of the month but the subsequent installment is to be deposited by the 10th day.

- Advance payment of three installments is acceptable.

- One copy of Passport size Photograph of the account holder is needed to open TSSS.

- One copy of Passport size Photograph of the Nominee(s) [attested by the account holder] is also required.

- In the event of failure of to pay installment, the arrear installment(s) should be paid before or along with the next due installment subject to the penalty of Tk. 50.00 for per installment to be paid.

- In case of premature closure of the account, Tk 100.00 is charged as closing charge.

- Loan may be allowed up to 80% of the deposited amount but not below Tk 1,00,000.00 against lien or pledge of the same account.

- Any account can be transferred from any branch to another subject to Tk. 25.00 as Account transfer fee.

In any installment remains unpaid for six consecutive months, the account will be closed automatically and the account will be settled as below:

| Different duration Treatment | Applied rate of Interest |

| Less than six month | No interest |

| More than six month but less than three years | Prevailing interest rate on Savings Account |

| More than three years but Less than five years | Matured value of three years and rest as per the prevailing interest rate on Savings Account |

| More than five years but Less than seven years | Matured value of five years and rest as per the prevailing interest rate on Savings Account |

| More than seven years but Less than ten years | Matured value of seven years and rest as per the prevailing interest rate on Savings Account |

SOURCE: From interview with the In-charge of FDR department of Trust Bank Ltd, Dhanmondi Branch.

Trust Digoon Laav Scheme (TDLS):

Under the Scheme, the amount deposited at the very inception is doubled in 7 years. The basic structure of this Scheme is as follows:

Deposit Value | Matured Value | Year | Effective Rate of Interest (EAI) |

| 10,000.00 or multiple thereof | Double of the deposited amount | 7 years | 10.40% |

SOURCE: From interview with the In-charge of FDR department of Trust Bank Ltd, Dhanmondi Branch.

The bank lags behind in this project. Other contemporary banks offer the scheme with a maturity period of 6 years that result in the Effective Interest Rate (EAI) of 12.25%.

Trust Money Making Scheme (TMMS):

Under the Scheme, the client has to pay a down payment of Tk 7,500.00 or multiple thereof and the bank contributes Tk 42,500.00 or multiple thereof to form a fixed deposit of Tk 50,000.00 or multiple thereof with the bank. The client is allowed an interest rate of 10.00% on that deposit. The client has to pay the amount due to the bank through monthly equal installment of Tk 855.00 or multiple thereof in 6 years. The client is entitled to get the interest on FDR.

Summary of the scheme:

| Client’s Own Deposit | Tk 7,500.00 or multiple thereof |

| Bank’s Contribution | Tk 42,500.00 or multiple thereof |

| FDR Value | Tk 50,000.00 or multiple thereof |

| Tenor | 6 years |

| Installment Size | Tk 855.00 or multiple thereof |

| Interest Size | 10.00% |

SOURCE: From interview with the In-charge of FDR department of Trust Bank Ltd, Dhanmondi Branch.

Trust Education Scheme (TES):

The TES has been introduced to assist the poor students financially and chronologically. Under the scheme, a student may deposit Tk 10,000.00 for a period of three or five years. After the maturity period he or she may get a lump-sum amount of Tk 13,400.00 (for three years maturity) or Tk 16,000.00 c or he/she may get monthly education allowance of Tk 430.00 (for three years maturity) or Tk 520.00 (for three years maturity) for a period of three years after maturity.

Summary of the scheme:

Term | Deposit Amount | monthly education allowance after maturity of 3 years continuity | lump-sum amount payable at maturity |

3 years | Tk. 10,000.00 | Tk. 430.00 | Tk. 13,400.00 |

5 years | Tk. 10,000.00 | Tk. 520.00 | Tk. 16,000.00 |

SOURCE: From interview with the In-charge of FDR department of Trust Bank Ltd, Dhanmondi Branch.

There are two services offered by the bank exclusively on distinguishable terms and conditions. The aforesaid services are-

Locker Service:

There are some more than 500 lockers at the Dhanmondi Branch of TBBL. The lockers are now rented on Security Deposit Basis instead of yearly or monthly rental Basis. The lockers are allotted on most flexible term and meager Security Deposit refundable at the time of closing the locker.

Size of Locker:

| Size | ||||||||

| Small | Medium | Large | ||||||

| Height | Width | Length | Height | Width | Length | Height | Width | Length

|

| 4.5” | 7” | 21.5” | 4.5” | 14” | 21.5” | 9” | 14” | 21.5”

|

Security Deposit of Locker

Floor | Security Deposit | ||

Small | Medium | Large | |

| Ground Floor | 7,500 | 10,000 | 15,000

|

| First Floor | 5,000 | 7,500 | 10,000

|

ATM Card:

The bank offers its clients “Free of Cost” ATM (Q- Cash) card. To be a holder of the Card the person needs nothing but to be a client or account holder of the bank. The bank charges no initial card processing cost or no yearly or monthly service charge. It seems to be a value added service to the clients.

Loans & Advances Department:

The bank lends the deposited money on different sectors and at different rates. A summary of sector wise lending and lending rate is as follows:

There are two types of Loan:

1) Short-Term Loans: Time period is less than 1 year

2) Long -Term Loans: Time period is 1 year & above

Loans and advances Department is the most important department of a bank. Banks borrows money from the public by accepting Deposits from them and then lending it to a borrower for a specific period of time to be repaid with a certain amount of interest. This Dept. is one of the main sources of TBL’s profits.

When bank wants to give loans of advances to a borrower, first of all he has to do LRA (Lending Risk Analysis) and when loan amount is 20, 00,000 & above this analysis is compulsory. Because the amount, which is given to, a borrower, actually comes from the public and it is repayable on demand. So, bank has to be careful when giving loans and advances. When banks can not collect the loan amount with interest, they have to bear losses.

If TBL agrees to give loans and advances to a borrower after analyzing all sorts of risk, then the borrower writes an application addressing the manager and the amount, business types, securities etc. also are mentioned in the application. After getting the application the manager scrutinizes it for justifying all information whether genuine or not. and after doing this he sanctions the loan. He can also collect the borrower’s credit report from CIB(Credit Information Bureau ) Department of Bangladesh Bank (If the borrower takes loans above Tk. 1,00,000 from any bank, that bank will send this credit reports to the Bangladesh Bank.

The manager can sanction specific amount of loans and advances (In this branch it is Tk. 15, 00,000). If the loan amount crosses this limit, then he will recommend it to regional office. Regional manager also has limit for sanctioning loans and advances. If the amount of loans and advances above his limit, he will recommend it to the head office. Then head office will sanction that loans and advances.

TBL sanctions loans and advances under certain terms of conditions. When the borrower‘s loan is sanctioned, he is known through intimation/ a copy of sanction letter. If he accepts all terms of conditions, then he has to come within 3, 7, or 15 days whatever mentioned in the sanction letter.

- § Selection of Borrower:

In extension of bank credit, nothing is more significant than selection of borrower. While choosing a borrower, bank must study three things: Character, Capacity and in Capital or in other words Reliability, Responsibility, Resourcefulness of a party.

- § LENDING SCHEMES:

The bank lends the deposited money on different sectors:

a) TRUST CONSUMER DURABLE SCHEME :

Loans up to Tk, 60,000.00 available for purchase of household durable. Tenure ranges from 6 months to 24 months.

b) TRUST MARRIAGE LOAN SCHEME:

Bank Provides loan up to Tk. 1,00,000.00 for marriage. Easy monthly installment for a maximum period of 48 months.

c) TRUST CAR LOAN SCHEME:

Loan up to Tk. 3,00,000.00 available for purchase of car. Maximum period for repayment is 48 months only.

d) TRUST HOUSING LOAN SCHEME (THLS):

House Building loan up to Tk. 12.50 lac available for expansion of residential buildings. Easy monthly installment for a maximum period of 07 years.

e) TRUST MICRO CREDIT FOR RENOVATION & RECONSTRUCTION OF DWELLING HOUSE:

Small loans of Tk. 20,000.00 Tk. 30,000.00 and Tk. 40,000.00 are given to the low-income group for improving standard and quality of living.

Retail Products:

- TBL Car Loan,

- TBL House Hold Durables Loan,

- TBL Doctors Loan,

- TBL Advance Against Salary Loan,

- TBL Any Purpose Loan,

- TBL Hospitalization Loan,

- TBL Education Loan,

- TBL Travel Loan,

- TBL Marriage Loan,

- TBL CNG Conversion Loan,

- TBL Apon Nibash Loan

INTERNATIONAL BANKING:

Trust Bank Limited, with its wide correspondent relationship with major banks in the world is totally capable to meet your needs of foreign currency transactions and foreign trade services. You can open and maintain Accounts in foreign currencies like US Dollar, Pound Sterling, and Japanese Yen and even in Euro with us. With its own Dealing Room, TBL is able to offer competitive Exchange Rate for all major currencies of the world.

- FA Account (Foreign Nationals)

- FC Account (Bangladeshi Nationals)

- NFCD A/C

- RFCD A/C

PREREQUISITE OF OPENING AN FC ACCOUNT (Foreign Nationals):

- Completed Account opening Form signed by the account holder/s and introduced by an existing customer who has a relationship with us at least for 6 months.

- Copy of 1st six pages of passport and relevant page with more than 6 months visa of staying in Bangladesh. (Photocopy of document must be certified as “Original seen/sighted”) Photograph/s of the signatory/signatories/account holders duly attested by the introducer. Form QA- 22 (in duplicate) Copy of work permit from Ministry of Industries (where applicable) Documented proof of address verification to be retained with the mandate. This is also applicable for;

- To open an account when the person not being present personally i.e. in a non-face to face scenario is to obtain at least one additional form of evidence (e.g. copy of utility bills/bank statements/tax clearance certificate/ employer letter/home visit) over and above what would have been obtained in the corresponding face to face situation.

- Local Legal & Compliance should be consulted, in case of doubt on the acceptable identification evidence for a particular customer type.

- Welcome & follow-up letter’ as part of additional address verification.

- Completed KYC template.

Foreign Exchange Department:

Foreign exchange means the exchange of currency in terms of goods from one country to another. This is the most well-known and well-organized business uniform in world business. Foreign exchange mainly has two parties:

Import Operations:

There are different other parties who are also related to this foreign exchange process. But Bank is the most important of all the other parties. Bank works as

Intermediary in case of foreign exchange. So, we can say that the foreign exchange is nothing but the combination of export and import in international platform.

If an importer wants to buy goods from foreign countries he has to communicate with the exporter or he may also communicate through indenting firms.

When an importer & exporter are agreed to come into a contract for buying & selling goods, then the importer issues a L\C for the exporter, for issuing a L\C at TBL the importer has to submit some necessary papers\ documents. These are the following:–

- § IRC (Import registration certificate):

To become an importer a person has to get IRC which is issued by CCI& E (Chief Controller of Import & Export).

- § Proforma Invoice/ Indent Letter:

After the agreement between importer & exporter for buying & saling goods, the exporter will send a proforma invoice for the importer. If the importer is unknown about the foreign sellers, he may contact with indenting firms \ agent’s \ dealers. In this case the exporter will send an indent letter for the exporter through the indent firm. Proforma invoice indent letter includes quality; price etc of ordered the goods/ products.

- § Current VAT& TAX Certificate:

An importer is definitely a businessman. As a businessman he must has to pay VAT & TAX to the govt. For opening L\C has to submit VAT & TAX certificate.

- § L\C Authorization Application form:

TBL provides this form for opening a L\C. Importer fill up this form.

- § IMP (Import) form:

Importer also has to fill up this form which is provided by TBL.

- § Letter of Application:

After getting the proforma invoice/indent letter from the exporter, the importer writes an application favoring the manager of the branch where the subject is “Request to open a L/C”.

- § Application & Agreement for confirmed irrevocable without:

Resource to drawer’s letter of credit:

This form includes either the goods \ products will come directly by ship \ air or by transshipment & other necessary condition.

Export Operations:

- § For becoming an Exporter a person needs:-

- Current A/C in TBL

- ERC (Export Registration Certificate) issued by CCI & E (Chief Controller of Import & Export).

- Permission from sponsoring Authority such as Board of Investment for industries, Department of Textile for garments etc.

- Traders Association’s certificate

- VAT (Value Added Tax) & TIN (Tax Identification Number) certificates.

- § Common documents involved in the transportation of goods:

The main documents required are Airway Bill / Bill of Lading, Commercial Invoice, Consular Invoice, Packing List, Certificate of Inspection, Certificate and Certificate of origin.

- § Airway bill:

This document is a receipt issued by an its for the carriage of goods. Goods are delivered to the consignees when they have identified themselves as the party named in the airway bill. It has two variants: (1) Master Airways Bill (MAWB) and (2) House Airway Bill (HAWB). The Forwarder of the cargo incorporation the L/C terms uses it.

- § Bill of Lading (B/L).

The bill of lading is not the actual contract between the owner of the goods and the carrier, although it does provide evidence of the contract. It is a receipt for goods shipped on board a vessel (for marine B/Ls), and is a document of title to the goods, which are the subject of the contract between the buyer and the seller. This is why a marine B/L can be negotiated.

- § Commercial invoice:

As in a domestic transaction, the commercial invoice is a bill for the goods from the buyer to the seller. A commercial invoice should include a description of the goods, address of shipper and seller, and the delivery and payment terms. The buyer needs the invoice to prove ownership and arrange payment. Some government agencies use the invoice to access customs duties.

- § Certificate of Origin:

Certain countries, especially USA, Canada, EU, Japan, Australia etc. require a signed statement to verify the origin of the export item in order to monitor import tariffs and quotas. Such certificates are usually obtained through a semi-official organization such as a local chamber of commerce, and must be certified by the chamber of commerce. A certificate may be required even though the invoice

contains all the necessary information. Documentation that requires a notary stamp or chamber of commerce stamp can be completed by freight forwarder.

- § Export packing list:

The export-packing list is considerably more detailed and informative than a standard domestic packing list. An export packing list itemizes the material in each individual package, and shows the individual net, legal, tare and gross weights. Package markings should be shown along with the shipper and buyer’s references. The packing list is attached to the outside of the package in a clearly marked waterproof envelope. The list can be used to determine the total shipment weight and whether the correct cargo is shipped. Customs officials may use it to check the cargo at inspection points.

- § Inspection certificate:

Some purchasers and countries may require a certificate of inspection, which authenticates the specifications of the goods shipped, this is usually performed by a third party and obtained from independent testing companies.

- § Insurance certificate:

If the seller provides insurance, the insurance certificate states the type and amount of coverage.

- § Consular invoice:

Consular invoice are generally required by Middle East countries issued by the embassy of the importer’s country. A consular invoice allows the importer’s country to collect information on the value, volume, quality, and source of the goods. The invoice is purchased or obtained from the consulate of the country to which the goods are being shipped and must be prepared in the language of that country.

Credit Department:

Credit is an arrangement whereby bank acting at the request and on the instructions of a customer or on its own behalf to make a payment to or to the order of a third party or is to accept and pay bills of exchange drawn by the beneficiary. In an economy banks play the role of an intermediary that channels resources from the surplus group to the deficit group. So, one of the core functions of Commercial banks is to sanction credit facility to its customers as per requirement. Trust Bank Limited Mission is to actively participate in the growth and expansion of our national economy by providing credit to variable borrowers in most efficient way of delivery and at a competitive price.

Bank can lend up to 15% of its capital fund without having any approval from Bangladesh bank. The maximum limit can go up to 100% of the bank’s capital fund. Trust Bank Limited complies with the ceiling set by Bangladesh Bank.

PRINCIPAL OF CREDIT:

Basic principle governs the extension of credit. These principles are strictly maintained to shape and define the acceptable risk profile of Trust Bank and guides to respond business opportunities as they arise. Basic lending principles are;

- Know your customer

- Liquidity of the customer

- Safety

- Security

- Profitability (from both bank’s and customer’s purpose of the loan’s perspective)

- Diversification

- National interest

Types Of Loans And Advances Offered By Trust Bank:

Basically Trust Bank offers both funded and non-funded credit facilities.

Funded Loan Facility:

Any type of credit facility which involves direct outflow of Bank’s fund on account of borrower is termed as funded credit facility, the funded facilities of loans and advances are:

Cash Credit:

Cash credit is a continuous credit facility usually provided for working capital fund requirements purpose of the customer. Cash credit is generally given to traders, Industrialist for meeting up their working capital requirements. Cash Credit can be given on Hypothecation of goods or pledge. Trust Bank only practices Cash Credit on Hypothecation.

ð Features of Cash Credit:

- A certain limit of credit amount is set at the time of initiation of Cash Credit facility.

- An expiration date is set, which is not more then one year.

- The drawings are subject to drawing power.

- A service charge, which in effect an interest charge is normally made as a percentage of the value of purchases.

- The primary security of Cash credit facility is stock of goods, which maybe hypothecated to Trust Bank as collateral.

Over Draft:

Over draft facility is also a continues loan arrangement on a customer’s current account permitting him to overdraw up to a certain approved limit for an agreed period. Here the withdrawal of deposits can be made any number of times at the convenience of the borrower, provided that the total overdrawn does not exceed the agreed limit.

Customer can return any amount at any time within the pre-fixed time of the facility. Turn over of an OD facility is the most important phenomenon on which renewal of the facility depends. Over draft facility is given to the businessman for financing working capital requirement and high net worth individual to overcome temporary liquidity crisis.

Secured over draft:

This is a type of over draft facility given by keeping sufficient collateral from the customer. This facility provides specific right to a client to over draw within a pre fixed limit for a certain period of time. SOD is normally granted against the security of tangible asset such Lien of FDR, Bonds, Sanchay Patra etc. Interest charge on SOD is calculated on the basis of the security liened.

- Incase of FDR with Trust Bank 13%, with other bank is 14%

- Incase of Sanchay Patra purchased from Trust Bank 13%, from other bank is 14%

- The common thing is 2.5% spread is kept in charging interest. Interest is calculated on outstanding amount at daily basis.

Term loan:

Term loans are given to finance the acquisition of capital asset. Loan agreements often contain restrictive covenant and loan is repayable in accordance to amortization schedule. Collateral is must for term loan.

Under term loan there are three categories:

- Short term loan – less then 1 year falls with this category

- Midterm – this loan facility is extended for more then 1 year but less the 3 year. Trust Bank encourages midterm loan.

- Long term – tenure of long term loan is more then 5 years

- Inland Bill Purchased (IBP)

- House Building Loan

- Marriage Loan

- Car loan(Staff & Others)

- Consumer Durable Scheme(CDS)

- Loan Against Trust Receipt (LTR)

- Any Purpose Loan

Non-funded facilities:

Non-funded facilities also known as “contingent facilities” are those where bank fund is not required directly. A non-funded facility can turned to a funded facility as per situation creates. Bank receives commission rather than interest income by providing non-funded facilities. Following non-funded facilities are provided by Trust Bank –

Letter of Credit (L/C):

A letter of credit is a credit line given by a bank to an importer to facilitate both foreign and inland transactions. This is a contingent liability which can be converted to a funded facility incase bank makes the payment on behalf of the importer. A letter of credit can be revocable or irrevocable, restricted or negotiable so on.

Guarantee:

Trust Bank offers guarantee for its reliable and valuable customer as per requirements. This is also a Credit facility in contingent liabilities from extended for participation in development work like supply of goods and services.

ð Features of Bank Guarantee;

- It is a written document on non-judicial stamp

- Expiry date is mentioned specifically with other terms and conditions

- Trust Bank receives commission quarterly @ 0.50% of the guaranteed amount.

Trust Bank offers two types of Guarantee, which are as follows:

Tender or Bid Bond Guarantee:

In time of tender bidding either cash or bank guarantee is required in case payment of earnest money. The tender guarantee assures that the tenders shall uphold the conditions of his tender during the period of the officer as binding and that he /she will also sign the contract in the event of the order being granted.

Process of Bid bond Guarantee:

- Request letter from customer along with board resolution in case of Limited company

- Trade license in case of Proprietorship Company

- Copy of tender form

- Margin:

- Incase of reliable client 10% to 20%

- For a new client 100% margin is required

- Bank guarantee is issued in 150 Tk Stamp pad

- Note is initiated

- Approval of Bank guarantee is given.

Performance Guarantee:

Trust Bank also gives guarantee on behalf of the customer on completion of the delivery or performance after getting the tender. Beneficiary finds that as a guarantee, the contract will be fulfilled in every respect and can retain the guarantee as per provision for long time. Including a clause stating that the supplier can claim under the guarantee, by presenting an acceptance certificate signed by the buyer, can counteract this. Document required for performance guarantee;

- Tender schedule.

- Guarantee letter.

A guarantee can be converted into funded facility if it is en cashed. If the client is unable to meet up banks demand a loan account is created like Over Draft as Bank is liable to pay to the beneficiary of the guarantee. If Bank guarantee is not used then the beneficiary or party to whom the guarantee was given on behalf of the client will sign on the back of the Bank Guarantee stamp and write the word ‘Released’. Then the facility will be expired as well as banks liability.

Special Loan facility given by Trust Bank:

Syndicate Loan:

Bank can lend up to 15% of its paid up capital with out any approval by Bangladesh Bank. If the loan amount is more then 50% of its paid up capital Bank goes for Syndicate loan. Lead bank makes the arrangement. Head office makes facility agreement by bank’s lawyer. All terms and conditions such as security sharing, mode of repayment, covenants of the loan are written on this facility agreement.

ð Loan Portfolio Management & Credit Admin. Strategies of Trust Bank:

- § Lending Authority:

Trust Bank’s organizational structure has two levels – Branch and Head office. The credit proposal moves through different management approval levels according to the amount of risk. There are three approval Levels in Trust Bank:

1. Branch manger

2. Credit committee of corporate office

3. Board of directors of the bank

- Lending Policies:

A loan policy gives loan officers and the bank’s management specific guidelines in making individual loan decisions and in shaping the bank’s overall loan portfolio. One of the most important ways a bank can make sure its loans meet regulatory standards and are profitable is to establish a written loan policy.

Trust Bank Limited also has a good loan policy and the most important elements of that policy are as follows:

- A goal statement for the bank’s loan portfolio (in terms of types, maturities, sizes, and quality of loans).

- Specification of the lending authority given to each loan officer and loan committee (measuring the maximum amount and types of loan that each person and committee can approve)

- Lines of responsibility in making assignments and reporting information within the loan department.

- Operating procedures for soliciting, reviewing, evaluating, and making decisions on customer loan applications.

- The required documentation that is to accompany each loan application and what must be kept in the bank’s credit files (required financial statements, security agreements, etc.)

- Lines of authority within the bank, dealing who is responsible for maintaining and reviewing the bank’s credit files.

- Guidelines for taking, evaluating, and perfecting loan collateral.

- A presentation of policies, and procedures for setting loan interest rates and fees and the terms for repayment of loans.

- A statement of quality standards applicable to all loans.

- A statement of the preferred upper limit for total loans outstanding (i.e. the maximum ratio to total loans to total assets allowed).

- A description of the bank’s principal trade area, from which most loans should come.

- A discussion of the preferred procedures for detecting, analyzing, and working out problem loan situations.

A written loan policy statement carries a number of advantages for the bank adopting it. It communicates to employees working in the loan department what procedures they must follow and what their responsibilities are. It helps the bank moves toward a loan portfolio that can successfully blend multiple objectives, such as promoting the bank profitability, controlling its risk exposure, and satisfying regulatory requirements.

ðBorrower’s credit worthiness analysis by Trust Bank following 6 “C”s:

The question that must be dealt with before any other is whether or not the customer can service the loan – that is pay out the credit when due with a comfortable margin for error. This usually involves a detailed study of six aspects of the loan application:

character, capacity, cash, collateral, conditions, and control. All must be satisfactory for the loan to be a good one the lender’s (Trust Bank’s) point of view.

Character:

The loan officer must be convinced that the customer has a well-defined purpose for requesting bank credit and a serious intention to repay. Responsibility, truthfulness, serious purpose, and serious intention to repay all the monies owed make up what a loan officer calls character.

Capacity:

The customer requesting credit must have the authority to request a loan and the legal standing to sign a binding loan agreement.

Cash:

The borrower should have the ability to generate enough cash, in the form of cash flow, to repay the loan. This cash flow of borrower can be generated from sales or income, from the sale of liquidation of assets or funds raised by using debt or equity securities.

Collateral:

The borrower must possess adequate net worth or enough quality assets to provide adequate support for the loan.

Conditions:

The recent trend of borrower’s line of work or industry must be aware of by the lender.

Control:

The lender should careful about whether changes in law and regulation could adversely affect the borrower and whether the loan request meets the bank’s and the regulatory authorities’ standards for loan quality.

ðLending procedure of Trust Bank:

The lending procedure starts with building up relationship with customer through

account opening. Control of credit operations is done at branch and Corporate Office

level.

- Step-one:

A loan procedure starts with a loan application from a client who must have an account with the Bank. At first it starts form the branch. Branch receives application from client for a loan facility. In the application, client mentions what type of credit facility he/she wants form the bank including his personal information and business information. Branch Manager or regarding Officer in-charge of credit department conducts the initial interview with the customer.

- Step-two:

After receiving the loan application form, the bank sends a letter to Bangladesh Bank for obtaining a credit inquiry report of the customer from there. This report is called CIB (Credit information Bureau) report. This report is usually collected if the loan amount exceeds Tk. 50 thousand. The purpose of this report is to be informed that whether the borrower has taken loan from any other bank or not, if ‘yes’ then whether these loans are classified or not.

- Step-three:

If Bangladesh Bank sends positive CIB report on that particular borrower and if the Bank thinks that the prospective borrower will be a good one, the bank will inspect the documents. Required documents are:

– Incase of Corporate Client, Financial documents of the company of last three to five years. If the company is new then projected financial data are required.

– Personal net worth of the borrower/Borrowers.

– In this stage, the Bank will look whether the documents are properly filled up and signed. Credit in charge of the relevant branch is responsible to know about the ins and outs of the client’s business through discussing with him.

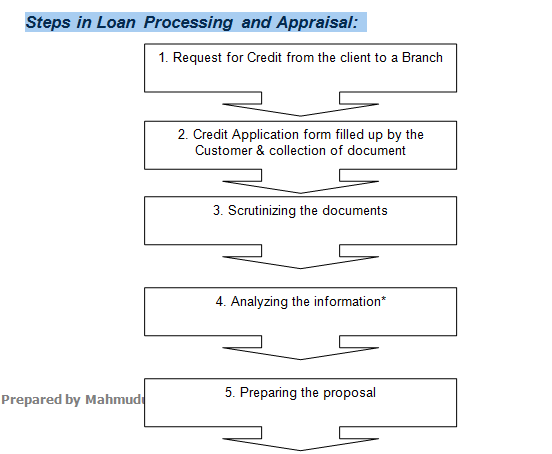

- Step-four: