1.1INTRODUCTION

The report is an opportunity for readers and it bears a great significant for me. It familiarizes readers with the practical business operations of EXIM Bank. Readers of report get the chance to understand the real business world closely and familiarize themselves with internal and external expects of business. It gives them an opportunity to develop the analytical skill and scholastic aptitude.

All over the world the dimension of banking has been changing rapidly due to Deregulation, Technological innovation and Globalization. Commercial banks in Bangladesh have to keep pace with the change in global business. Now banks have to compete in market place both with local institutions as well as with the foreign institutions.

To survive and thrive in such a competitive banking world, two important requirements are development of appropriate financial infrastructure by the central bank and development of “professionalism” in the sense of developing an appropriate manpower structure and its expertise and experience. To introduce skilled banker, only theoretical knowledge in the field of banking studies is not sufficient. An academic course of the study has a great value when it has practical application in real life situation.

So, I need proper application of my knowledge to gate some benefit from my theoretical knowledge make it more tactful. Such theoretical knowledge is obtained from a course of study at only the half way of the subject matter. Report paper implies on other the full application of the method and procedures through rich acquire of subject matter can be forcefully applied in my day-to-day life situation. Such a procedure of practical application is known as report paper.

Basically I tried hard to find out a proper picture of EXIM Bank’s investment operation through analyzing its annual report of 2009 and 2010. I also interviewed some personnel of EXIM Bank to know the hidden information about investment operation.

1.2 REASONS OF THE REPORT

To have an overall idea about Islamic Banking System that is based on the Al-Quran and Sunnah.

To know about the interest free Banking System and how it could be processed.

To find out the difference between conventional banking system and Shariah based banking system.

To know the different modes of Investment of EXIM Bank Bangladesh Ltd.

This paper is an attempt to evaluate the Different Modes of Investment of EXIM Bank Bangladesh Ltd. in terms of productivity and effectiveness.

1.3 METHODOLOGY

Every report is prepared by following a concrete methodology. The success of the report depends on the followed methodology in major portion. My study is performed based on the information extracted from different sources collected by using a specific methodology. All the methodology is mentioned below:

Variables: In the report banking system variables are used. Two variables are:

Islamic system

Conventional system

Analytical Method:

Descriptive method

Conventional versus Islamic banking

Performance and Growth

SWOT analysis

1.4 SOURCES OF DATA

All the relevant data regarding this study are collected from two sources:

Primary Sources

Interviewing with the bank officials of EXIM Bank Ltd.

Official records.

Face to face conversation with the officer.

Secondary Sources

Annual report of EXIM Bank Ltd.

Published Booklet of the Bank.

Website of EXIM Bank Ltd.

Various published documents.

1.5 SCOPE OF THE STUDY

This report has been prepared through discussion with bank employees and with the clients. Annual report provided the bank mainly helps to prepare the report. At the time of preparing the report, I had a great opportunity to have an in depth knowledge of all the banking activities theoretically by the EXIM Bank Limited.

1.6 LIMITATIONS OF THE STUDY

The officers are very co-operative but they are too busy to give me time to get knowledge about their activities. Moreover they have to deal in a very competitive environment based on money related activities. I have to prepare this report alone. I faced some usual constraints during preparing the report. These are as follows:

I had to complete this report writing within a shorter period of time. So the time constraint of the study hindering the course of vast area and time for preparing a report within the mentioned period is really difficult.

The officials had some times been unable to provide information because of their huge routine work.

Many officials are not well informed about different systems of EXIM bank. They know but less. I had to face much difficulty to collect this information.

Some desired information could not be collected due to confidentially of business.

The study was conducted mostly on secondary data.

Since banks are the financial institution. So, most of the personnel were not agree to provide accurate data due to their privacy.

PROFILE OF EXIM BANK

2.1 INTRODUCTION

Export Import Bank of Bangladesh Limited (EXIM Bank), a scheduled commercial bank in the private sector, started its banking operation on the 3rd of August, 1999. From 1st July, 2004 the bank converted its banking operation into Islamic Banking based on Islamic Shariah from traditional banking operation. During the same year, the bank issued 3,138,750 ordinary shares through IPO placement. The bank carries out its banking activities through fifty nine branches operating as per Islamic Shariah in the country. Within a short period of time the bank has earned good reputation among the people of this country. This is clearly evidenced by the tremendous growth of its business and operating results. Of its very beginning EXIM Bank Bangladesh limited was known as BEXIM Bank Limited. But some legal constraints the bank renamed as EXIM Bank, which means Export Import Bank of Bangladesh Limited.

2.2 ISLAMIC BANKING

From 1st of July of 2004 the bank became Shariah Based Islamic Bank and from then it is rendering banking services according to Islamic banking principles. For smooth operations the Board of Directors established a Shariah Board, which decides on the banking principles according to which the bank will operate its business.

2.3 CORPORATE MISION

The bank’s vision and mission are the following:

The bank has chalked out the following corporate objectives in order to ensure smooth achievement of its goals:

To be the most caring and customer friendly and service oriented bank.

To create a technology based most efficient banking environment for its customers.

To ensure ethics and transparency in all levels.

To ensure sustainable growth and establish full value of the honorable shareholders and

Above all, to add effective contribution to the national economy

Eventually the bank emphasizes on:

Providing high quality financial services in export and import trade

Providing efficient customer service

Maintaining efficient customer service

Maintaining corporate and business ethics

Being trusted repository of customer’s money and their financial adviser

Making its products superior and rewarding to the customers

Display team spirit and professionalism

Sound Capital base

Enhancement of shareholders wealth

Fulfilling its social commitments by expanding its charitable and humanitarian activities

2.4 CORPORATE VISION

The gist of the vision is ‘Together, Towards, Tomorrow’. Export Import Bank of Bangladesh Limited believes in togetherness with its customers, in its march on the road to growth and progress with services. To achieve the desired goal, there will be pursuit of excellence at all stages with a climate of continuous improvement, because, in EXIM Bank, they believe, the line of excellence is never ending. Bank’s strategic plans and networking will strengthen its competitive edge over others in rapidly changing competitive environments. Its personalized quality services to the customers with the trend of constant improvement will be cornerstone to achieve their operational success.

2.5 SOCIAL COMMITMENT

The purpose of banking business is obvious to earn profit, but the promoters and the equity holders are aware of their commitment to their society to which they belong. A chunk of the profit is kept aside and/or spends for socio economic development through trustee and in patronization of art, culture and sports of the country. The institution wants to make a substantive contribution to the society where it operates, to the extent of its separable resources.

2.6 OPERATIONAL AREAS

Like other commercial banks, the bank provides all traditional banking services including the wide range of savings and credit scheme products, foreign exchange and ancillary services. However, the main focus of the bank is on export and import, trade handling and on the development of entrepreneurship and patronization of private sectors.

The core business of the bank comprises of trade finance, term finance, working capital finance and corporate finance. The bank is also providing personal credit services related to local and foreign remittances and several product related services. The schemes of the bank, which are designed to help the fixed income group in raising standard of living are competitively priced and have been widely appreciated by the customers.

2.7 PRODUCTS & SERVICES

L/C (Import & Export) Products

EXIM Bank is posed to extend L/C facilities to its importers / exporters through establishment of correspondent relations and Nostro Accounts with leading banks all over the world.

Investment Products

The bank provides credit services such as, corporate finance, industrial finance, lease finance, hire purchase finance, commercial investments, and project finance and syndicate loans.

Deposit Products

The bank introduced a number of financial products and services since its banking operation. Among them Mudaraba Savings Deposit,Mudaraba Short Term Deposit Mudaraba Term Deposit, Mudaraba Monthly Income Scheme, Mudaraba Monthly Saving Scheme, Mudaraba Super Savings Scheme, Mudaraba Hajj Scheme.

Foreign Exchange

Non Resident Foreign Currency Deposit Account (NFCD)

Foreign Currency Deposit Account

Letter of Credit (L/C) facilities through establishment of correspondent relations with leading banks all over the world.

E-cash/ ATM Service

The bank is currently providing Credit Card Service (Master Card) to the privileged customers of the bank in collaboration with the Standard Chartered Bank.

Other Services

Other services include utility bill collection for Grameen Phone from its users in all the branches and for Palli Biddut somity of Gazipur from its consumers in Gazipur branch.

2.8 OVERALL PERFORMANCE

| SL | Particulars | 2006 | 2007 | 2008 | 2009 | 2010 |

| 1 | Authorized Capital | 3500.00 | 3500.00 | 3500.00 | 10000.00 | 10000.00 |

| 2 | Paid-up Capital | 1713.76 | 2142.2 | 2677.75 | 3373.96 | 6832.27 |

| 3 | Statutory Reserve | 810.88 | 1134.64 | 1532.55 | 2092.97 | 3154.76 |

| 4 | Deposits | 35032.02 | 41546.57 | 57586.99 | 73835.46 | 94949.40 |

| 5 | Investment (General) | 32641.27 | 40195.24 | 53637.68 | 68609.91 | 93296.65 |

| 6 | Investment ( Shares on Bonds) | 2233.25 | 2457.72 | 2894.02 | 2189.54 | 6012.86 |

| 7 | Foreign Exchange Business | 96175.1 | 117900.14 | 156434.57 | 162604.61 | 227966.60 |

| 8 | Net profit after provision and tax | 650.29 | 930.84 | 1096.63 | 1694.1 | 3476.01 |

| 9 | Investment as a % of total Deposit | 93.18% | 96.75% | 93.14% | 92.92% | 98.26% |

| 10 | No. of Foreign Correspondent | 246 | 256 | 278 | 333 | 354 |

| 11 | Number of Employees | 1020 | 1104 | 1312 | 1440 | 1686 |

| 12 | Number of Branches | 30 | 35 | 42 | 52 | 59 |

| 13 | Return on Assets | 1.73% | 2.00% | 1.83% | 2.19% | 3.54% |

2.9 HISTORICAL BACKGROUND OF THE BANKING INSTITUTIONS IN BANGLADES

The banking system at independence consisted of two branch offices of the former State Bank of Pakistan and seventeen large commercial banks, two of which were controlled by Bangladeshi interests and three by foreigners other than West Pakistanis. There were fourteen smaller commercial banks. Virtually all banking services were concentrated in urban areas. The newly independent government immediately designated the Dhaka branch of the State Bank of Pakistan as the central bank and renamed it the Bangladesh Bank. The bank was responsible for regulating currency, controlling credit and monetary policy, and administering exchange control and the official foreign exchange reserves. The Bangladesh government initially nationalized the entire domestic banking system and proceeded to reorganize and rename the various banks. Foreign-owned banks were permitted to continue doing business in Bangladesh. The insurance business was also nationalized and became a source of potential investment funds. Cooperative credit systems and postal savings offices handled service to small individual and rural accounts. The new banking system succeeded in establishing reasonably efficient procedures for managing credit and foreign exchange. The primary function of the credit system throughout the 1970s was to finance trade and the public sector, which together absorbed 75 percent of total advances.

The government’s encouragement during the late 1970s and early 1980s of agricultural development and private industry brought changes in lending strategies. Managed by the Bangladesh Krishi Bank, a specialized agricultural banking institution, lending to farmers and fishermen dramatically expanded. The number of rural bank branches doubled between 1977 and 1985, to more than 3,330. Denationalization and private industrial growth led the Bangladesh Bank and the World Bank to focus their lending on the emerging private manufacturing sector. Scheduled bank advances to private agriculture, as a percentage of sectoral GDP, rose from 2 percent in FY 1979 to 11 percent in FY 1987, while advances to private manufacturing rose from 13 percent to 53 percent. . The rate of recovery on agricultural loans was only 27 percent in FY 1986, and the rate on industrial loans was even worse. As a result of this poor showing, major donors applied pressure to induce the government and banks to take firmer action to strengthen internal bank management and credit discipline. As a consequence, recovery rates began to improve in 1987. The National Commission on Money, Credit, and Banking recommended broad structural changes in Bangladesh’s system of financial intermediation early in 1987, many of which were built into a three-year compensatory financing facility signed by Bangladesh with the IMF in February 1987. The National Commission on Money, Credit, and Banking recommended broad structural changes in Bangladesh’s system of financial intermediation early in 1987, many of which were built into a three-year compens Foreign exchange reserves at the end of FY 1986 were US$476 million, equivalent to slightly more than 2 months worth of imports. This represented a 20-percent increase of reserves over the previous year, largely the result of higher remittances by Bangladeshi workers abroad. The country also reduced imports by about 10 percent to US$2.4 billion. Because of Bangladesh’s status as a least developed country receiving concessional loans, private creditors accounted for only about 6 percent of outstanding public debt. The external public debt was US$6.4 billion, and annual debt service payments were US$467 million at the end of FY 1986.

2.10 BRANCH NETWORK

Branch Information (EXIM Bank has 55 Branches in Bangladesh)

Local office, Motijheel Branch, Panthapath Branch, Gazipur Chowrasta Branch, Imamgonji Branch, Gulshan Branch, Nawabpur Branch, Naranyangonj Branch, Shimrail Branch, Rajuk Avance Branch, New Eskaton Branch, Uttara Branch, Mirpur Branch, Elephant Road Branch, Mawna Branch, Malibagh Branch, Ashulia Branch, Ashugonj Branch, Sat Mosjid Road Branch, Bashundhara Road , Branch, Savar Branch , Karwan Bazar Branch , Head Office Corporate Branch, Naria Branch, Agrabad Branch, Khatungonj Branch, Jublee Road Branch, Sonaimuri Branch, Laksham Branch, CDA Avenue Branch, Chowmuhana Branch, Comilla Branch, Modaffargonj Branch, Chhagalnaiya Branch, Pahartoli Branch , Sylhet Branch, Fenchugonj Branch, Moulvi Bazar Branch , Golapgonj Branch , Jessore Branch, Kushtia Branch, Khulna Branch, Rangpur Branch, Rajshahi Branch.

INVESTMENT PROGRAMS OF EXIM BANK

3.1 INTRODUCTION

Investment is the action of deploying funds with the intention and expectation that they will earn a positive return for the owner. Funds may be invested in either real assets or financial assets. When resources are used for purchasing fixed and current assets in a production process or for a trading purpose, then it can be termed as real investment. The establishment of a factory or the purchase of raw materials and machinery for production purposes are examples in point. On the other hand, the purchase of a legal right to receive income in the form of capital gains or dividends would be indicative of financial investments. Specific examples of financial investments are: deposits of money in a bank account, the purchase of Mudaraba Savings Bonds or stock in a company. Ultimately, the savings of investors in financial assets are invested by the respective company into real assets in the form of the expansion of plant and equipment. When money is deposited with an Islamic Bank, the bank, in turn, makes investments in different forms approved by the Islamic Shariah with the intent to earn a profit. Not only a bank, but also an individual or organization can use Islamic modes of investment to earn profits for wealth maximization.

3.2 INVESTMENT OF EXIM BANK

The total amount of investment of the bank stood at TK 99,309.51 million as on December 31, 2010 as against TK 70,799.45 million as on December 31, 2009 showing an increase of TK. 28,510.06 million with the growth rate of 40.27%. Investments are the core asset of the bank. The bank gives emphasis to acquire quality assets and does appropriate investment risk analysis while approving commercial and trade investment to clients.

Year | Investment (Tk. in million) |

| 2010 | 99,309.51 |

| 2009 | 70799.45 |

3.3 INVESTMENT OBJECTIVES OF EXIM BANK

The objectives and principles of investment operations of the Banks are:

The investment fund strictly in accordance with the principles of Islamic Shariah.

To diversifies its portfolio by size of investment, by sectors (public and private), by economic purpose, by securities and by geographical area including industrial, commercial and agricultural.

To ensure mutual benefit both for the Bank and the investment client by professional appraisal of investment proposals, judicious sanction of investment, close and constant supervision and monitoring therefore.

To make investment keeping the socio-economic requirement of the country in view.

To increase the number of potential investors by making participatory and productive investment.

To finance various developments schemes for poverty alleviation, income and employment generation with a view to accelerating sustainable socio-economic growth and up-liftmen of the society.

To invest in the form of goods and commodities rather than give out cash money to the investment clients.

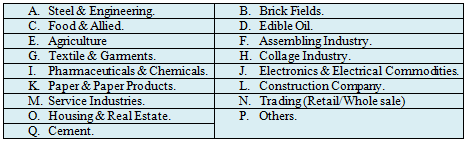

3.4 INDUSTRY AND BUSINESS SEGMENT FOCUS

The bank provides suitable investment services & products for the following sectors

3.5 MAJOR INVESTMENT CATEGORIES

The Bank has primarily divided all investment facilities into two major categories. In this section they are discussed in details.

Izara Bill Baia: These are the investment made by the Bank with fixed repayment schedules.

The terms of investment are:

Short term : Up to 12 months

Medium term : More than 12 and up to 36 months

Long term : More than 36 months.

Investment facility available under this category is:

Izara Bill Baia (General): Short term, Medium term & long term investment allowed to individual/firm/industries for a specific purpose but for a definite period and generally repayable by installments fall under this head. This type of investment is mainly allowed to accommodate financing under the categories (i) Large & Medium Scale Industry and (ii) Small & Cottage industry.

Continuing loans: These are investment having no fixed repayment schedule, but have an expiry date at which it is renewable on satisfactory performance. Investment facilities available under this category are:

Bai-Muazzal: Continuous Investment allowed to individual/firm for trading as well as wholesale purpose or to industries to meet up the working capital requirements against hypothecation of goods as primary security fall under this type of lending. It is allowed under the categories (i) “Commercial Lending” when the customer is other than an industry and (ii) “Working Capital” when the customer is an industry.

Murabaha: Financial accommodations to individual/firm for trading as well as for wholesale or to industries as working capital against pledge of goods as primary security

fall under this head of investment. It is also a continuous investment and like the above allowed under the categories (i) “Commercial Lending” and (ii) “Working Capital”.

3.6 OTHER MAJOR CATEGORIES OF INVESTMENT

Investment facilities of the Bank are also categorized under seven prime categories:

3.6.1 Agriculture

Investment facilities to the agricultural sector fall under this category. It is subdivided into two major heads:

Investment to primary producers: Financing under these categories refers to the investment facilities allowed to production units engaged in farming, fishing, forestry or livestock.

Investment to dealers/distributors: It refers to the financing allowed to input dealers and (or) distributors in the agricultural sectors.

3.6.2 Izara Bill Baia for Large & Medium Scale Industry

This category of investment accommodates the medium and long term financing for capital structure formation of new industries or for expansion of the existing units who are engaged in manufacturing goods and services. Investment Facility available under this category is:

Izara (Lease Finance): It is one of the most convenient sources of acquiring capital machinery and equipment whereby a client is given the opportunity to have an exclusive right to use an asset usually for an agreed period of time against payment of rent. It is a term financing repayable by installment.

3.6.3 Izara Bill Baia to Small & Cottage Industries

These are the medium and long term investment allowed to small & cottage manufacturing industries.

3.6.4 Working Capital

Investment allowed to the manufacturing units to meet their working capital requirements, irrespective of their size-big, medium or small, fall under the category. These are usually continuing investment and as such fall under the head “Bai-Muazzal”

3.6.5 Investment on Export

Investment facilities allowed to facilitate export of all items against Letter of Credit and/or confirmed export orders fall under this category. Investment Facilities available under this category are:

Musharaka Pre-shipment (Export Cash Credit): Financial accommodation allowed to a customer for exports of goods fall under this head and is categorized as “Investment on Export”. The loans are liquidated out of export proceeds with 180 days.

Musharaka Pre-shipment (Packing Credit): Investment allowed to a customer against specific L/C contract for processing/packing of goods to be exported falls under this head and is categorized as “Mushraka Pre-shipment”. The investments are adjusted from proceeds of the relevant exports within 180 days.

Foreign Documentary Bill Purchase (F.D.B.P): Payment made to a customer through purchase/negotiation of a foreign documentary bills falls under this head. This temporary investment is adjustable from the proceeds of the shipping/export documents.

Local Documentary Bill Purchase (LDBP): Payment made against documents representing sell of goods to Local export oriented industries that are deemed as exports and which are denominated in Local Currency/Foreign Currency falls under this head. This temporary liability is adjustable from proceeds of the Bill.

Foreign Bill Purchase (FBP): Payment made to a customer through purchase of foreign currency cheques/drafts fall under this head. This temporary loan is adjustable from the proceeds of the cheque/draft.

3.6.6 Commercial Lending

Short-term loans and continuing investments allowed for commercial purposes fall under this category. It includes export-import financing, financing for internal trade, service establishment etc. No medium and long-term investments are accommodated here. Loan Facilities available under this category are:

Bai-Muazzal (Export): investments allowed for purchasing foreign currency for payment against L/Cs (Back to Back) where the exports do not materialize before the date of import Payment fall under this head. This is also a investment for temporary period, which is known as export finance.

Murabaha Import Bills (MIB): Payment made by the Bank against lodgment of shipping documents of goods imported through L/C falls under this head. It is an interim investment connected with import and is generally liquidated against payment usually made by the party for retirement of the documents for release of imported goods from the customs authority.

Murabaha Post Import (MPI) Loans allowed for retirement of shipping documents and release of goods imported through L/C taking effective control over the goods by pledge in go down under bank’s lock & key fall under this type of investment. This is a temporary investment connected with import that is known as post-import finance.

Trust Receipt (TR) Loan allowed for retirement of shipping documents and release of goods imported through L/C falls under this head. The goods are handed over to the importer under trust with the arrangement that sale proceeds should be deposited to liquidate the investment within a given period. This is also a temporary loan connected with import and known as post-import finance.

Inland Bills Purchase (IBP) Payment made through purchase of inland bills/cheques to meet urgent requirement of the customer falls under this type of loan facility. This temporary loan is adjustable from the proceeds of bills/cheques purchased for connection.

3.6.7 Others

Any investment that does not fall in any of the above categories is considered under the category “Others”. It includes loans to i) Transport equipments, ii) Construction works including house (commercial/residential), iii) work order finance, iv) personal loan etc. Investment Facilities available under this category are:

Izara Bill Baia (House Building): Investment allowed to individual/enterprises for construction of building for commercial purpose fall under this type of investment. The amount is repayable by monthly installment with a specified period.

Izara Bill Baia (Staff House Building): investment allowed to Bank’s employees for purchase/construction of house falls under this Loan.

Other Loan to Staff: Investment allowed to employees other than for House Building is grouped under head Staff Izara Bill Baia (General).

Izara Bill Baia (Hire Purchase): It is a type of installment-based loan under which the purchaser agrees to take the goods on hire at a stated rental, which is inclusive of the repayment of principal as well as profit for adjustment of the loan within a specified period.

House Hold Durable Scheme (HDS): It is a special investment scheme of the Bank to finance purchase of consumer durable to the fixed income group to raise their standard of living. The investments are allowed on soft terms against personal guarantee and deposit of specified percentage of equity by the customers. The investment is repayable by monthly installment within a fixed period.

Quard (General/Financial Obligation): Investment allowed to individual/firms against financial obligation (i.e. lien on MTDR/PSP/BSP/Insurance Policy/Share etc.).

Bai-Muazzal (Work Order): Investment allowed against assignment of work order for execution of contractual work falls under this head. This investment is generally allowed for a definite period and specific purpose not for continuous purpose.

Loan Facilities for single borrower/Group or syndication

The bank from time to time allows loan facilities to a single customer/Group (Funded & non funded) up its 50% of total capital out of which funded facilities does not exceed 25% of total capital. In case a proposal in submitted to Head Office, then the Bank considers the extent of the Bank’s global exposure (risk) to that customer group.

3.7 INVESTMENT FACILITY PARAMETERS

Tenure: Bank does not ordinarily go for any loan facilities for long-term basis.

Short-term loan facilities are for 3 months to 12 months.

Medium term loan facilities are for 12 months to 36 months.

Long-term loan facilities are for more than 36 months.

Size:

Maximum 50% (Funded & non-funded) of total capital of the Bank.

Maximum 25% (funded) facilities of total capital of the Bank.

Security: All assets (Bai-Muazzal & Murabaha) are to be covered under proper insurance risk with enlisted Insurance Companies.

Some More Parts-

Report On Investment Analysis Of Exim Bank (Part-1)