Executive summary:

Investment Corporation of Bangladesh (ICB) being a statutory corporation is mainly an investment bank. As an investment bank is a financial institution, which mobilizes fund from the surplus economic units and develops funds to the deficit economic units.

The main objective of ICB is to encourage and broaden the bases of investment, to develop the capital market and to accelerate the mobilization of fund.

The study has mainly concerned with the performance of ICB in three broad functional areas like: pooling of funds, making of portfolios and formulating and implementing a sound dividend policy. In doing the study, in depth analysis has been conducted on these three main issues. First of all, the company analysis and the profiles has been done to have an idea about the company. In this regard, The objectives of the company, basic functions, business policies, manpower’s and different business areas of ICB has been explained. Meanwhile, the company’s management and administration part has also been included in the begging part of the report where company’s institutional and regulatory framework has been explained along with the human resources.

ICB operates the business operations by the help of a huge numbers of departments in it. So, a different chapter has been included to explain the functions and activities of those departments. Due to the diversified functions performed by ICB, it consist of many departments. These department are engaged in different activities to perform the business functions.

In this repot, ICB’s operational and functional areas have also been explained to have a clear idea about different functional areas of ICB. The operational areas have been explained with their results in the related field. However, ICB in some cases increase and curtail its operational areas according to its convenience and by the management decision. In this part, ICB’s financial results in these areas has also been discussed for the last two years. Among the different functional areas IPO issuing and lease finance are common.

Among the three main issues of the report, one of them is mobilization of fund. ICB acts a very important role in the mobilization of fund by collecting fund from the people who has excess fund in their hand out of their expenditures. ICB collects those funds by two major ways. One of them is ICB mutual fund and the other is ICB unit fund. Actually, ICB simultaneously raising fund from the households’ investors by these two way. Till now, ICB has collected fund up to Eight ICB mutual fund. Most recently ICB has created another mutual fund for the non-resident, which has not been included in this report due to the lack of proper information.

ICB’s another way of collecting fund from the households’ investors is ICB unit fund. This sort of fund does the same job like ICB mutual fund. This is just another vehicle of raising fund from the people and invests again in the capital market by making a good portfolio. The report consists of the number of these issues by ICB including the reason why the individuals invest their fund in the mutual and unit funds.

The second issue is the making of portfolio by ICB with the fund that has been collected from the investors. This not an easy task so far. Because, in this regard, ICB has to take the decision carefully in which areas it will invest he fund. First of all, ICB take decision in which industry it will invest the funds. After taking the decision and section of the industry, ICB thinks about different stocks of the companies. Once it takes its decision and determine its stocks of the company, ICB then thinks about he weight it will provide in each of the stock. And this way ICB make the portfolio. The detailed process of making portfolio has been explained in the report inside.

Dividend policy is one of the important decision by the ICB. Once it eared profit from its investment, the management takes decision about the declaration of the dividend for the investors. Here may be two scenarios, one is that, the management may declare the divined and the other is further expansion. If the management takes decision for further investment it does not declare any dividend for the investors. However the process of declaration has been discussed in the report inside.

Background information and methodologies:

Overview:

Investment Corporation of Bangladesh (ICB) is a statutory corporation. It is mainly an investment bank. As an investment bank is a financial institution, which mobilizes fund from the surplus economic units through various mutual funds and sale of securities and develops funds for the deficit economic units through purchase and/or underwriting of securities..

The Investment Corporation of Bangladesh (ICB) was established on 1 October 1976. under “The Investment Corporation of Bangladesh Ordinance, 1976” (No. XL of 1976). The establishment of ICB was a major step in a series of measures undertaken by the government to accelerate the pace of industrialization and to develop a well-organized and vibrant capital market particularly securities market in Bangladesh. ICB caters to the need of institutional support to meet the equity gap of the industrial enterprises. In view of the national policy of accelerating the rate of savings and investment to foster self-reliant economy, ICB assumes an indispensable and pivotal role. Though the enactment of the Investment Corporation of Bangladesh (Amendment) Act, 2000 (No. of XXIV of 2000), reforms in operational, strategic and business polices have taken place by establishing and operating subsidiary companies under ICB.

Statement of the problem:

ICB has a strong impact in the capital market in Bangladesh. It has diversified objectives since its inception. The main concern of the present study is to assess the performance of ICB, i.e to measure to what extent it has achieve its objectives and for this ICB’s three major functional areas have been evaluated. These are mobilization of funds, making of portfolios and formulating and implementing a dividend policy that have contribution to further expansion of the organization.

Rationale of the study:

The study has been conducted to identify how ICB is performing in the three major functional areas and in the same time how contribution it has in the development of the capital market. The study has also assessed whether the other financial organizations and the individual investors are benefited by its performance. Meanwhile, the study has also assessed how much contribution it has in creating the bases of investment and mobilization of savings as part of its commitment. Finally, the study has reflected how ICB is contributing to the financial market by its functions and activities.

Objective of the study:

The broad objective of the study is to assess the performance of ICB in three broad functional areas like: pooling of funds, making of portfolios and dividend policy as its contribution in the financial market in Bangladesh. Investment Corporation of Bangladesh is a state-own statutory organization, which was mainly, established to strengthen and reenergize the final market of Bangladesh.

The specific objectives of the study are to assess:

1) The role of ICB to broadening and encouraging the base of investment;

2) The role of ICB in mobilization of savings from the households and channeling them to the financial markets;

3) Success of ICB in the development of the capital market;

4) Performances of ICB in the recent years in the three major functional areas;

5) Making of ICB’s portfolios after mobilizing funds from the investors; and

6) The dividend policy of ICB

Methodologies:

The evaluation has been made by assessing in three major areas of ICB. The study has been designed in a way that, it reflects the details functions and activities of the organization of the firm. The methodologies that have been used are- the mobilization of funds by the ICB from the general households, the making of portfolios by the generated funds and the dividend policy and further expansion

Besides the above-mentioned approach, the methodologies covered the following:

Sources of data: In conducting the study data and information have been collected from the diversified sources. Firstly, data have been collected from the published financial statement and prospectus of the company. Each and every year the firm published the financial report. So, this information from the report has been used for the study. Again, many other published materials are here in the collection of ICB. So, this information has also been used. Meanwhile, there are a lot of published materials, which will also be used for this study purpose. The last but not the least thing is that, assistance from the Internet has also be en taken for the study purpose. However, in conducting the study, mainly the assistance from the financial statements and report of the firm has been taken for the study.

Quality Control:

In the part of the quality control, throughout the data collection, quality control was the special concern. Whenever, data have been collected, special care was given in this respect so that accurate information can come for the accurate calculation. So, this thing has been done with special care. Again in collecting the data from the financial statement of the firm, various years’ data has been taken for the accurate calculation of the study. Meanwhile special care has been devoted at the time of copying the digits from the financial statement to the calculations sheet. In collecting the information, most recent published data and information has been taken from the reliable sources for ensuring the quality control.

Data Processing:

Data that have been collected from different sectors was not be available in the processed form. So, after getting the data the second job is to process those data into form so that they were in the arranged form. In processing the data, most recent published data and information has been taken from the reliable sources. For example, five years data has been taken for the performance analysis of the firm. So, in taking the samples most recent data and information was taken for the accurate measurement of the performance. At the time of processing the data special care was given so that the digits are not changed mistakenly when they were shifted from the report to the calculation sheet.

Expected outcome of the study and its use:

The study has been conducted to assess the performances of ICB. Among the many functional areas of ICB three major areas have been evaluated to assess the performance of ICB. However, so far he study has been done the information form the all groups of people to have an idea about the ICB can use the report. The information can deliver the ideas about ICB in some of the important functional areas. General investor can use the information from the study to determine about their investment decision at ICB. As ICB pools fund from the general households and invest this fund again in different areas, so the investor can have idea about it from this report. Meanwhile, the information in the report can also been used for the further study.

Limitation of the study:

This report so far has some limitations in some areas. In preparing the report a lot of data and information were required data, but sufficient information and data has not been found for the report to be made really impressive. However, in spite of the scarcity, effort has been given much to make the report acceptable and reliable. Meanwhile, to assess the performance of ICB, not all the functional areas has been considered In this respect, three major areas were considered to evaluate the performance of ICB.

Background:

Investment Corporation of Bangladesh (ICB) is a statutory corporation. It is mainly an investment bank. As an investment bank is a financial institution, which mobilized fund from the surplus economic units by savings securities and developed funds to the deficit economic unit also by buying/underwriting securities. After liberation in view of social economic changes, the scope for private sector investment in the economy was kept limited by allowing investment in projects up to tk. 25 lac. The new investment policy, which was announced in July, 1972 provides for an expanded role of private sector by allowing investment in a project up to tk. 3 crore. The ceiling has further being raised to tk. 10 crore in spite of the adequate facilities and incentives provided to the private sectors encouraging response was not for the coming. One of the reasons among other was the lack of institutional facilities, which provides underwriting support (Like former ICB) to industrial enterprise that was required to raise much need equity fund. Thus, the need for reactivation for capital market, stock market was keenly felt.

The Investment Corporation of Bangladesh (ICB) was established on 1 October 1976. under “The Investment Corporation of Bangladesh Ordinance, 1976” (No. XL of 1976). The establishment of ICB was a major step in a series of measures undertaken by the Government to accelerate the pace of industrialization and to develop a well-organized and vibrant Capital Market particularly securities market in Bangladesh. ICB caters to the need of institutional support to meet the equity gap of the industrial enterprises. In view of the national policy of accelerating the rate of savings and investment to foster self-reliant economy, ICB assumes an indispensable and pivotal role. Though the enactment of the Investment Corporation of Bangladesh (Amendment) Act, 2000 (No. of XXIV of 2000), reforms in operational strategic and business polices have taken place by establishing and operating subsidiary companies under ICB.

Objective of ICB:

The objectives of the corporation are:

- To encourage and broaden the base of investments,

- To develop the capital market,

- To mobilize savings,

- To promote and establish subsidiaries for business development,

- To provide for matters ancillary thereto.

The business policies of ICB are in the following:

- To act on commercial consideration with due regard to the interest of industry, commerce, depositors, investors and to the public in general,

- To provide financial assistance to projects subject to their economic and commercial viability,

- To arrange consortium of financial institutions including Merchant Banks to provide equity support to projects,

- To develop and encourage entrepreneurs,

- To diversify investments,

- To induce small and medium savers for investment in securities,

- To create employment opportunities,

- To encourage investment in Agro-based and IT sectors.

Basic functions:

In order to achieve the previously mentioned objectives, the corporation may carryout the following functions:

- Direct purchase of shares and debentures including placement and equity participation,

- Participating in and financing of joint-ventures companies,

- Providing lease finance singly and through syndication,

- Managing existing Investor’s Accounts,

- Managing existing Mutual Funds and Unit Fund,

- Managing Portfolios,

- Conducting computer training program,

- Providing advance against ICB Unit and Mutual Fund certificates,

- To act as Trustee and Custodian,

- Providing Bank Guarantee,

- Providing investment counseling to investors,

- Participating in Government divestment program,

- Introducing new business products suiting market demand,

- Dealing in other matters related to Capital Market.

Organization’s manpower:

The general direction and superintendence of corporation is created in a board of directors, which consists of clever (11} persons including the chairman and managing director of ICB. This is the most powerful board compare to other govt. financial institutions in terms of their experience and knowledge. The managing director is the chief executive of the organization. Two general managers assist him, viz. G.M. (Operation) and G.M. (Admin.). Total manpower of ICB at present is 372.

Business area of ICB:

- Private Placement: ICB is authorized to act as an agent of issuers and investors for private placement of securities. Under this arrangement, ICB places securities to individuals/institutions on behalf of the issuer for which it charges fees. ICB also acquires shares/securities for its own portfolios.

- Underwriting: In order to raise long-term debt equity from the primary market, the Government bodies, enterprises, corporation or Companies may seek intermediary assistance from ICB in the form of underwriting. Because of its long and proven experience, reputation, asset back up and established network of regional offices, ICB is in an excellent position to attract the potential investors to the proposed issue of shares, debenture and other securities for successful floatation of IPO & placement.

- Custodian and Banker to the Issues: To act as the custodian to the public issue of Open-end & Mutual Funds, ICB provides professional services. It also acts as the Banker to the issues and provides similar services through the network of its branches. Fees in this regard are negotiable.

- Merger and Acquisitions: Companies willing to expand their business through mergers or acquisitions or to divest projects that no longer fit into present scale of operation contact the corporation. ICB provides professional services & advice in respect of shaping up the cost and financial structures to ensure best possible operation results.

- Corporate Financial Advice: Companies and Government enterprises intending to go public often seek professional & financial advice on corporate restructuring & reengineering. ICB through its expertise provide such services.

- Lease Financing: ICB provides lease finance mainly for machinery, equipment and transport. ICB is in a position to provide professional advice and financial assistance to the intending clients. The period of lease, rental, changes and other terms and conditions are determined on the basis of assets and the extent of assistance required by the applicants.

- Advanced against ICB Mutual Fund Certificates Scheme: Advanced against ICB Mutual Fund Certificates Scheme was introduced in 2003, designed for the ICB Mutual Fund certificate holder to meet their emergency fund requirement. One can borrow maximum of 50% value of last one year’s weighted average market price of certificates at the time of borrowing by deposing his/her certificates under lien arrangement from any of the ICB’s offices. The rate of interest on the loan is reasonable and also competitive.

- Bunk Guarantee Scheme: As part of ICB’s business diversification program, the corporation introduced bank guarantee scheme during the year 2002-2003 ICB provides (1) bid bond for enabling the business people to participate in any tender or bidding; (2) performance bond for helping the business community to continue their business smoothly by fulfilling their obligations promised by them to their clients; (3) customs guarantee for solving different disagreements between the customs authority and the business classes at the initial stage. The maximum limit of guarantee is tk. 2.00 crore and would be issued against at least 20% cash and 80% easily encashable securities or against 100% cash margin. Re-guarantee from other financial institutional is required for guarantee against the amount exceeding tk. 2.00 crore.

- ICB Mutual Fund: ICB has so far floated eight close-ended Mutual Funds. The first ICB Mutual Funds was floated on 25April, 1980, while the eight ICB Mutual Fund was floated on 23 July 1996. The aggregate size of these funds is tk. 17-5 crore. About 35,000 certificates holders own these funds. Dividends declared on the funds were very attractive ranging from 13.5 to 180 per certificate for 2002-2003. Investors show overwhelming interest in all the ICB Mutual Funds. One can invest in such funds through the stock exchanges with which these funds are listed. Through corporate restructuring, new mutual funds are being floated through “ICB Asset Management Company Limited”, subsidiary company of ICB.

- ICB Unit Fund: It is an open-ended Mutual Fund scheme launched in April 1981, through which the small and medium savers get opportunity to invest their savings in a balanced and relatively low risk portfolio. ICB has so far declared attractive dividends on units every year ranging from taka 12 to 25 per unit. Investment in units enjoys tax benefit, amount being applicable as per law. However, under the ICB’s restructuring program new unit certificate are being sold by ICB’s new subsidiary company “ICB Asset Management Company Limited”.

- Investors Scheme: The Investors’ Scheme was introduced in June 1977. Over the years, this scheme has grown tremendously. ICB, at its discretion, may grant up to times loan against the assets of the account subject to a maximum limit of tk. 3 lac. An account holder may use the combined balance of his/her equities and loan to buy shares/securities. To help the investors to develop diversified and balanced portfolio to minimize risk and earn a reasonable return, ICB provides professional advice and other support services. Under the restructuring program, ICB operates and manage only the old accounts and new accounts are being opened and managed by the ICB Capital Management Limited, a subsidiary of ICB.

Share Capital Ownership Pattern of ICB:

Classification of Shareholders as on 1 January 2004

Shareholder | No. Of Shareholders | No. Of Shares | Percentage |

Government of Bangladesh | 1 | 1350000 | 27.00 |

Nationalized Commercial Banks | 4 | 1137220 | 22.74 |

Development Financial Institutions | 2 | 681550 | 13.63 |

Insurance Corporations | 2 | 628691 | 12.57 |

Bangladesh Bank | 1 | 600000 | 12.00 |

Denationalized Private Commercial Banks | 2 | 454262.5 | 9.09 |

Private Commercial Banks | 4 | 28571 | 0.57 |

Foreign Commercial Banks | 2 | 42830 | 0.86 |

First BSRS Mutual Fund | 1 | 6900 | 0.14 |

Other Institutions | 9 | 13024 | 0.26 |

General Public | 1026 | 56951.5 | 1.14 |

Total | 1054 | 5000000 | 100.00 |

Source: ICB annual report 2005-06.

Milestone of ICB:

Milestones | Date/Establishment Commencement |

Date of Establishment/ Commencement ICB | 1st October 1976 |

lnvestors’ Scheme | 13th June 1977 |

First ICB Mutual Fund | 25th April 1980 |

ICB Unit Fund | 10th April 1981 |

Second ICB Mutual Fund | 17 June 1984 |

Third ICB Mutual Fund | 19 May 1985 |

Fourth ICB Mutual Fund | 6 June 1986 |

Fifth ICB Mutual Fund | 8 June l987 |

Sixth ICB Mutual Fund | 16 May 1988 |

Nomination as the country’s Nodal DFI in SADF | 7 May 1992 |

Seventh ICB Mutual Fund | 30Junel995 |

Eighth ICB Mutual Fund | 23 July 1996 |

Purchase of own Land & Building | 11 December 1997 |

Participation in Equity of SARF | 16 January 1998 |

Advance Against ICB Unit Certificates Scheme | 12 October 1998 |

Lease Financing Scheme | 22 April 1999 |

“The Investment Corporation of Bangladesh (Amendment) | 5 and 6 July 2000 |

Formation and Registration of 3 Subsidiary Companies of ICB | 5 December 2000 |

Computer Training Program | 25 March 2001 |

Commencement of business operations of the subsidiary companies | |

ICB Capital Management Ltd. | 01 July 2002 |

ICB Asset Management Company Ltd. | 01 July 2002 |

ICB Securities Trading Company Ltd. | 13 August 2002 |

Registration as a Trustee with SEC | 20 August 2002 |

Registration as a Custodian with SEC | 20 August 2002 |

Bank Guarantee Scheme | 21 June 2003 |

Advance Against ICB Mutual Fund Certificate Scheme | 21 June 2003 |

Consumers Credit Scheme | 15 February 2004 |

Received BASIS-SEDF Best IT Use Award in SOFTEXPO,2004 | 28 November 2004 |

Source: ICB annual report 2005-06.

Company information

Institutional framework:

Investment Corporation of Bangladesh is a corporate body as per section 3 of Investment Corporation of Bangladesh Ordinance, 1976 and deemed to be a banking company within the meaning of the Banking Companies Ordinance, 1962 (LVII of 1962). The shares of corporation are listed with the stock exchange. ICB is an authorized broker of DSE.

Regulatory framework:

As the mentioned earlier the regulatory framework of ICB is the, Investment Corporation Bangladesh Ordinance, 1976. This ordinance and regulations laid under the authority of the ordinance is the source of all power and authority of ICB. Through the recent enactment of ” The Investment Corporation of Bangladesh (Amendment) Act, 2000″ (XXIV) of 2000, scope of ICB’s activities through the formation of subsidiaries, have been expanded. In addition to these, to resume its duties and functions, it has to compelled by Companies Act 1994, trust Act 1882, Insurance Act 1983. Security and Exchange Commission Act 1993, Banking Companies Act 1993, Foreign Exchange Regulation 1974, Income Tax Act etc.

It is to note that no provision of law relating to the winding up of companies or bank shall apply to the Corporation and the Corporation shall not be wound up save by order of the government and in such manner as it may direct.

Management of ICB:

The Head office of the corporation as per the requirement of the ordinance of ICB is located al Dhaka. The general direction and superintendence of the corporation is created in a board of directors, which consist of 11 persons including the chairman and managing director of ICB.

- The Board of directors consists of the following directors:

- The chairman to be appointed by the government,

- The directors to be appointed by the government from among persons serving under the government,

- One director to be nominated by the Bangladesh Bank,

- The managing directors, Bangladesh Shilpa Bank, Ex-office,

- The managing directors, Bangladesh Shilpa Rin Sangstha, Ex-office,

- Four other directors to be elected by the share holders other than the government, BB,BSB,&BSRS.

Administration and Human resources:

Investment Corporation Of Bangladesh (ICB) providing different category of financial and banking services. Nature of the different division departments vary, such that Economic and Business Research (EBR) Department requires teamwork, Loan Appraisal division requires professional work. Funds divisions need chain work. Managing Director is entrusted with authority to transact the regular business of the organization; he may delegate some authority to the officials of the Corporations. However, most of the policy decisions are taken by the different committee with the approval of managing Director and where required of the Board. It is the discretionary authority of the Board to constitute the execute committee and to maintain its Chairman to assist the Board in the discharging of the function stated under the ordinance. The board may appoint such other committee (s) as it thinks fit to assist it in the efficient discharge of its function. So far, board has appointed two such committees. Economic and Business Research (EBR) committee and Loan Appraisal committee headed by General Manager.

Board of directors:

The Board is comprised of 11 directors. Exchange managing Director, all directors are non-executive and independent and represent government, banks, Insurance Corporation, financial institutions and general public.

Future contrivance of the organization:

ICB is going to float two new Mutual Funds. ICB AMCL, a subsidiary of the state owned institutional investor, will launch and operate the funds. The Funds are:

- ICB AMCL Pension Holder Unit Fund and

- ICB AMCL Islamic Mutual Fund, each worth Tk. 10 crore.

- A great deal of planning effort of the corporation has been towards future IT structure and related operations. In the roadmap the following goals have been set:

- Establishing ICB firmly on IT industry not only as a consumer but also as a formidable IT solution provider especially in the financial sector.

- In the long run, ICB may consider establishing a separate business entity on IT, if found viable.

- ICB is considering going for starting full pledge activity in the field of IT area.

- ICB is actively considering to provide web-based online services to its clients and to connect all its branches through WAN with head office. So that customers at any corner of the country can get instant services.

Departments

Personnel department:

This department deals with the human resources of the organization. It makes the rules and regulation of the right person to the right place. The process may be held by two ways:

- Direct recruitment

- Promotion

- This department takes disciplinary action gradually to that employee who violates the rules and regulation of the organization. This action is of two types:

- Light Punishment

- Heavy punishment

- The other functions of this department are as follows:

- Make necessary rules, regulations, and policies for efficient administration of the Corporation;

- Handle all personnel matter including confirmation, posting, transfer, fixation, leaves etc.

- Process all promotion, time-scale encashment;

- Process registration, retirement cases;

- Deal with retirement benefits including gratuity, pension, provident fund etc.

Central accounts department:

All kinds of receipts and payments of ICB are done by the Central Account Department. The bill of all departments end destination is account department. Account department holds and maintain all accounts separately. For this reason adjustment and rectification of any transaction of all departments become easier to this department.

Loan appraisal department:

ICB provide credit facilities to the public limited companies to meet heir equity gap. There are two modes by which ICB provides credit facilities to the prospective public limited companies, through:

- Direct underwriting for BMRE and

- Underwriting through bridge financing

Economic and business research department:

- The functions of the EBR department are as follows:

- Performance portfolio management decision

- Conduct meeting of the securities and sale committee

- Prepare annual reports for ICB, Unit Fund and Mutual Fund

- Convey securities sell or purchase decision to the merchandising division

- Prepare and distribute annual Report

- Maintain information related to DSE, CSE, dividend, right share, bonus declared by different companies, public issues, half yearly accounts of listed companies etc.

- Maintain liaison with Ministry of Finance, Bangladesh Bank and provide TCB related information to interested parties,

- Prepare board memo regarding declaration dividends on ICB’s own portfolio, unit and mutual funds

Unit sales department:

ICB unit is an open end Mutual Fund through which the small and medium savers get opportunity to invest their savings in a balanced and relatively low risk portfolio. It ensures a continuous and regularly flows of incomes for the holders and is easily cashable. The responsibility undertaken for managing the fund, management fee charges @ Tk. 1.00 per unit sold. Units are sold through ICB offices and other authorized bank branches. In lieu of cash dividend, one can reinvest his/her dividend income under Cumulative Investment plan (CIP) to purchase additional units with a price rebate.

ICB stopped selling of Unit Certificates from 1st day of July after the business operation starts of ICB Asset Management Company Limited.

The main functions of this department are to sale, repurchase and transfer of Unit

Certificates.

- Act as manager of Unit Fund,

- Promote sales of Unit Certificates,

- Sell and issue Unit Certificates to the applicants,

- Repurchase Unit Certificates,

- Issue new Unit Certificates in lieu of mutilated, lost or defaced Unit Certificates.

Unit registration and procurement department:

The following are the functions of this department:

- Registration and transfer Unit Certificates,

- Maintain a separate register for unit holder under CIP,

- Verify signature of transfer deed,

- Issue dividend warrants and CTP certificates to the holders,

- Procure unit certificates of various denominations from the printing.

Mutual fund department:

Broadly the functions of Mutual Funds Department consist of:

- Act as manager of all mutual funds,

- Maintenance of ledger with the name, address and number of certificates along with distinct folio number for each Mutual Fund separately,

- Verify the signature of the holders in the 117 forms,

- Preparation of dividend list from the ledger position,

- Issue dividend warrants to the holders of the certificates,

- Distribution of final dividend warrants to the certificate holders after completing necessary formations.

Investors department:

The main task of Investors Department is to accumulate the investment of small and new investors of the capital market by helping them open an investment account in the concern department. This department deals with ‘Investors scheme’.

The following are the main functions of this department:

Open and maintain Investment accounts:

Sanction loans against deposits in Investment Accounts;

Buy and sale shares on behalf of the investors;

Counsel investors in respect of building up their portfolios;

Withdraw funds and shares from Investment Accounts;

Share department:

The shares act as the custodian of securities. These department facilities the physical transfer of shares. For performing the above mentioned activities Share Department is divided into five sections. These sections are:

Investors portfolio section

Sale and withdrawal section

Funds portfolio section

Securities reconciliation section

System analyst department:

The main functions of this department are:

System administration of the entire network setup;

Performing system analysis wherever ICB feels the need for periodic change in computerization setup;

Performing miscellaneous small hardware and software related servicing tasks on the many workstations, network system, sever and other components and provide training to staff of other departments about computer usage,

Any other assignment given by the management.

Public issue department:

The public issue department is a vital department in the ICB as the ultimate objective of sanction loan is to help the project to go for public issue. The department is engaged in:

Visit and collect audited financial statement from the sponsors,

Analyzing the financial statement of on going projects,

Advice and pursue sponsors of on going projects,

Assists in preparing prospectus for issuing shares and debentures,

Examines the prospectus submitted by the sponsors and help getting approval,

Advise companies in issuing allotment letters and warrants,

Make necessary adjustments of bridge loan of the concerned company,

Make liaison with the recovery and follow up department regarding realization of dues and overdue.

Law department:

Law department is a specialized department; handle any kind of legal affairs of ICB. ICB takes the resource of legal actions against the defaulting borrowers who did not come forward to repay loans despite repeated persuasion and reminders.

Project implementation department:

The following are the tasks of this department:

Placement of IPO,

Justify the projects terms and conditions,

Help implementation of sanctioned projects,

Review progress of implementation of projects and recommend disbursement of funds,

Process the case for cancellation of sanctioned projects,

Inspect the site and books of accounts of projects.

Recovery and follow up department:

Loan recovery and follow-up department is the key operation as it ensures the recovery of funds provided as credit. There remains two ‘Task Forces’ and the ‘Review & Monitoring Committee’ for giving necessary guidelines for accelerates process of recovery. As a result, ICB recovered an amount of tk. 7.67crore during 2002-2003, which was 2.27% higher than the recovery of tk. 7.5crore during 2001-2002. Interest of loan recovered in quarterly basis.

Secretary department:

The main functions of this department are:

Arrange meetings of the Board of Directors, Executive Committee and other Committee,

Communicate with the directors of the Corporation,

Call board meeting,

Prepare work schedule of directors meeting and collect signature of the Chairman,

Send work schedule to Govt. and board of directors,

Call Annual General Meeting.

Public relation department:

The main function of this department is to:

Maintain close liaisons with the Ministry of Finance and other concerned officers

Help publish all types of official advertisements

Furnish management with the relevant newspaper cuttings

Help focusing ICB through mass media

Meet all adverse comments about the Corporation published in Different newspapers and periodicals

Publish internal newsletter or journal

Appraise the management of its overall relation to public

Audit department:

Department under Audit & Method Division are showing in the following:

1. Audit & Method Head Office

2. Audit & Method Branches

This department with regard to ICB does three kinds of Audit:

Internal Audit: Accomplished by Head Office Audit Department

External Audit: Accomplished by Ministry of Finance

Commercial Audit: Accomplished by Government Audit Department

Audit Department mainly performs two types of audit:

Pre Audit: Done before the starts of the job,

Post Audit: Done after the completion of the job.

Operational and functional areas and results

ICB’s role in the financial market:

As in the previous year, ICB and its subsidiaries played very important and expanded roles through participation in the both primary and secondary markets to quicken the pace of industrialization and to develop and enlarge a vibrant and sustainable capital market in the economy.

As on 30 June 2006, the number of ICB assisted securities was 122 out of 303 listed securities of the Dhaka Stock Exchange Ltd.

Out of 213 listed securities of the Chittagong Stock Exchange Ltd. ICB assisted securities was 80.

Operational activities:

ICB has continued to provide financial and other assistance to projects in different forms with a view to accelerating the pace of industrialization as well as to develop a well organized and vibrant capital market.

- Commitments

During 2005-06, ICB made commitment of total financial assistance of Tk. 57.15 crore to 11 projects. In 2004-05, ICB;s commitment of total financial assistance was Tk. 149.05 crore to 11 projects.

Details of commitments made by ICB during 2004-05 and 2005-06n are shown below in the following table:

(Amounts in Crore Tk.)

Nature of financial assistance | 2005-06 | 2004-05 | Decrease in amount(%) | ||

| no. of projects | Amounts | No. Of projects | Amounts | ||

| Pre IPO placement of shares | 2 | 2.5 | 2 | 16.5 | 84.85 |

| Purchase of preference share | 1 | 4 | 1 | 20 | 80 |

| Equity participation | 1 | 3.75 | 1 | 5 | 25 |

| Advance against equity | 2 | 30 | |||

| Purchase of debentures | 4 | 15.85 | 6 | 57 | 72.19 |

| Lease financing | 2 | 1.05 | 1 | 50.55 | 97.92 |

| Total | 11 | 57.15 | 11 | 149.05 | 61.66 |

Source: ICB annual report 2005-06.

Other operational activities:

Other operational activities of ICB includes advance against ICB mutual certificates. bank guarantee scheme and consumer credit scheme.

Advance against ICB mutual certificates:

Disbursement under this scheme amounted to Tk. 4.65 crore in the year2005-06 which was Tk. 4.66 crore in the previous year registering a decrease of 0.21 percent. Icb provides advance against the certificates of Icb unit /Mutual funds and ICB AMCL unit fund.

Consumer credit scheme:

As part of business diversification program of ICB, “consumer credit scheme” was introduced in 2003-04. Under this scheme the cumulative amount of loan-disbursed up to 30 June 2006 was Tk. 2.82 crore including Tk. 1.54 crore during the year under review.

Merchandising operations:

Merchandising operation has been one of the foundations of ICB functions, which are discussed, in detailed form in the separate part. ICB has continued its pivotal contribution significantly to the capital market through merchandising operations like management of mutual funds and investment accounts.

ICB has three other subsidiaries. Among them, ICB Asset Management Company Limited started its operation in 1 July 2002 to carry out merchant banking and fund management activities respectively

Recovery and rehabilitation activities:

As in the previous year, ICB continued to put strong emphasis on recovery of overdue project loans during the year 2005-06 from the projects financed by ICB. At the same time, increased focus as given on recovery of dues on account of dividend/interest on securities and fees and commissions of different schemes. In order to make recovery drive more effective, two task forces and a “Debt collection unit for written- off loans” comprising senior officers of ICB make necessary guidelines and follow up. Besides the concerned executives also maintain relentless efforts to make the recovery drive successful.

Participation in international activities:

ICB also participate in some international activities. Among them, some are discussed below:

ICB’s involvement with South Asian Development Fund (SADF)

SAARC fund for regional projects (SFRP) and SAARC Rejional Fund were established in 1991 with the collaboration of member countries of the SAARC. The established of SADF was officially declared by dissolving SFRP and SRF in a meeting of the member countries held in Dhaka in June 1996.

Investment in South Asian Regional Fund:

To facilitate investment in SAARC member countries a development fund of US$ 200.00 million, namely, the South Asia Regional Fund (SARF) was launched in the Commonwealth Summit held in 1997. The fund is maanaged by a wholly owned subsidiary of Commonwealth Development Corporation(CDC) incorporated in Mauritius.

Financial results:

Total income:

ICB earned a total income of Tk. 166.41 crore in 2005-06 which was 2.33 percent lower than Tk. 170.38 crore earned in 2004—05. Though the total income in 2005-06 was lower than that of previous year, the income was 10.23 percent higher than the previous.

Total expenditures:

During 2005-06 the total expenditure stood at Tk.143.22 croreas compared to Tk. 148.45 crore in the year 2004-05.

Net income:

During 2005-2006 ICB’s net income after tax stood at Tk. 23.19 crore as compared to net income of Tk. 21.93 crore earned in the year 2004-05 showing as increased of 5.71 percent.

Dividend:

The Board of Directors declared dividend at the rate of Tk. 12.0 per share for 2005-06. The same of rate of dividend was declared in the previous.

Appropriation of profits:

The board of directors recommended appropriation of net profit of Tk. 23.19 crore in the manner as stated below:

Comparative position of appropriation of profit

(Tk. In crore)

| Particulars | 2005-06 | 2004-05 |

| Dividend: 12.0 percent(Proposed) | ||

| (2004-05: 12.0 percent) | 6 | 6 |

| General reserve | 2 | 1 |

| Reserve for building | 14.5 | 14 |

| Benevolent reserve | 0.4 | 0.3 |

| Retained profit | 0.29 | 0.63 |

| Total | 23.19 | 21.93 |

Source: ICB annual report 2005-06.

Financial analysis:

The overall financial position of ICB remained satisfactory during the reporting year. Financial results of ICB own and after consolidation of accounts including its subsidiaries along with some key financial ratios relating to profitability, liquidity and solvency are given below:

| Particulars | ICB | Consolidated | ||

| (ICB and its subsidiaries) | ||||

| 2005-06 | 2004-05 | 2005-06 | 2004-05 | |

| Financial results | ||||

| Total income (Tk. In crore) | 166.41 | 170.38 | 180.2 | 187.82 |

| Total expense (Tk. In crore) | 119.17 | 82.72 | 122.9 | 86.82 |

| Profit before provision | 47.24 | 87.66 | 57.3 | 101.53 |

| Provision made | 24.05 | 65.73 | 26.84 | 69.85 |

| Net profit (Tk. In crore) | 23.19 | 21.93 | 30.46 | 31.68 |

| Financial ratios | ||||

| Net profit to income (percentage) | 13.93 | 12.87 | 16.9 | 16.87 |

| Return on investment (Percentage) | 10.68 | 9.27 | 13.02 | 14.5 |

| Return on equity (percentage) | 14.45 | 15.73 | 17.19 | 20.91 |

| EPS | 46.38 | 43.87 | 60.92 | 63.36 |

| Book value per share | 325.92 | 281.63 | 361.8 | 307.11 |

| Dividend yield (percentage) | 8.45 | 6 | ||

| Dividend payout ratio(percentage) | 25.88 | 27.35 | 19.7 | 18.94 |

| P/E ration | 3.06 | 4.56 | 2.33 | 3.16 |

| Current ratio | 1.18:1 | 1.11:1 | 1.24:1 | 1.15:1 |

| Debt equity ratio | 26.74 | 32.68 | 24.76 | 31.69 |

Source: calculated on the basis of the performance published in the annual report 2005-06.

Mobilization of fund

ICB mutual fund:

Mutual funds are very attractive investment means due to its provision of professional asset management services and “instant diversification” at less brokerage cost than smaller investor. ICB has played a pioneering role in the field of closed-end funds. Up to June 2003 the corporation floated eight closed-end mutual funds with total paid up capital of TK. 17.50 crore. The funds have been goods source of consistent income for the certificate holders. These funds have gain wide spread popularity at home and abroad because of having scope of capital gain as well as satisfactory return in term of dividend.

Roles and Performance of ICB Mutual Fund in the Capital Market:

ICB has played a pioneering role in the development of close-ended mutual fund in Bangladesh. The country’s first mutual fund that is the “ First ICB Mutual Fund was launched on 25 April 1980. Since then, ICB has floated eight mutual funds of total capital of TK. 17.5 crore over the years. ICB mutual funds have become very popular due to among others payment of constantly attractive dividend.

Comparative Performance of ICB Mutual Funds:

Mutual funds seek to offer comparatively safe and attractive investment revenue to small and medium investors. Here below analyzed comparative performance of ICB mutual funds in year 2005.

| Table:01 Comparative Performance of ICB Mutual Funds | (Yr. – 2005) | ||||||

Name of the Mutual Fund | Size of Fund (Tk in crore) | Market Value of Portfolio | Market Price per Certificate at DSE (Taka) | Dividend Declared per Certificate | No. Of Certificate Holders | Cost of Portfolio (crore) | Market Capitalization (crore) |

1st ICB Mutual Fund | .50 | 13.09 | 2655 | 210 | 973 | 3.12 | 13.28 |

2nd ICB Mutual Fund | .50 | 3.12 | 820 | 55 | 994 | 2.84 | 4.10 |

3rd ICB Mutual Fund | 1.00 | 4.73 | 697 | 52 | 2748 | 4.17 | 6.97 |

4th ICB Mutual Fund | 1.00 | 4.57 | 564 | 48 | 2152 | 3.82 | 5.64 |

5th ICB Mutual Fund | 1.50 | 7.13 | 341 | 27 | 3923 | 5.99 | 5.12 |

6th ICB Mutual Fund | 5.00 | 10.02 | 217 | 18.5 | 9712 | 9.42 | 10.89 |

7th ICB Mutual Fund | 3.00 | 12.21 | 217 | 16 | 3163 | 11.09 | 6.53 |

8th ICB Mutual Fund | 5.00 | 12.79 | 205 | 15 | 7671 | 11.54 | 10.26 |

Source: ICB annual report from year 2001 to year 2006.

First ICB Mutual Fund:

First ICB Mutual Fund was established in April 1980, under regulation 29A of ICB (general) regulations with a total capital of TK. 50 lac divided into 50000 Certificates of Tk. 100 each. The management of the fund is vested with ICB.

In the above Table-01 shown that as on 30th June, 2005 market value of portfolio of First ICB Mutual Fund consisting of 973 certificate holders amounted to TK. 13.09 crore as against cost of portfolio TK. 3.12 crore. That means capital appreciation of TK. 9.97 crore. In year 2005 market price per certificate at DSE was TK. 2655 and First Mutual Fund was declared a dividend of per certificate was TK. 210.

Second ICB Mutual Fund:

Second ICB Mutual Fund was established in June 1984, under regulation 29A of ICB (general) regulations with a total capital of TK. 50 lac divided into 50000 Certificates of Tk. 100 each. The management of the fund is vested with ICB.

In year 2005 Second ICB mutual fund no of certificate holders was 55 and market price per certificate at DSE was TK. 820. In that year market value of portfolio was Tk. 3.12 and cost of portfolio was Tk. 2.84 crore. In year 2005 Second ICB mutual fund declared a dividend of Tk. 55.

Third ICB Mutual Fund:

Third ICB Mutual Fund was established in May 1985, under regulation 29A of ICB (general) regulations with a total capital of TK. 1 crore divided into 100,000 Certificates of Tk. 100 each. The management of the fund is vested with ICB.

In the above Table-01 shown that as on 30th June, 2005 market value of portfolio of third ICB Mutual Fund consisting of 2748 certificate holders amounted to TK. 4.73 crore as against cost of portfolio TK. 4.17 crore. That means capital appreciation of TK. 0.56 crore. In year 2005 market price per certificate at DSE was TK. 697 and Third Mutual Fund was declared a dividend of per certificate was TK. 52.

Fourth ICB Mutual Fund:

Fourth ICB Mutual Fund was established in June 1986, under regulation 29A of ICB (general) regulations with a total capital of TK. 1 crore divided into 100,000 Certificates of Tk. 100 each. The management of the fund is vested with ICB.

As on June 30, 2005 the market value of the portfolio consisting 2152 certificate holders amounted to Tk. 4.57 crore as against cost of portfolio of Tk. 3.82 crore indicating capital appreciation of Tk. 0.75 crore. In year 2005 market price per certificate at DSE was TK. 564 and Fourth Mutual Fund was declared a dividend of per certificate was TK. 48.

Fifth ICB Mutual Fund:

Fifth ICB Mutual Fund was established in June 1987, under regulation 29A of ICB (general) regulations with a total capital of TK. 5 crore divided into 500,000 Certificates of Tk. 100 each. The management of the fund is vested with ICB.

In the above Table-01 shown that market value of portfolio of Fifth ICB mutual fund was Tk. 7.13 crore and cost of portfolio was Tk. 5.99. In that year market price per certificate at DSE was Tk. 341 and number of certificate holders was 3923. Fifth Mutual Fund was declared a dividend of per certificate was TK. 27 in year 2005.

Sixth ICB Mutual Fund:

Sixth ICB Mutual Fund was established in June 1988, under regulation 29A of ICB (general) regulations with a total capital of TK. 1.50 crore divided into 150,000 Certificates of Tk. 100 each. The management of the fund is vested with ICB.

In the above Table-01 shown that market value of portfolio of Sixth ICB mutual fund was Tk. 10.02 crore and cost of portfolio was Tk. 9.42. In that year market price per certificate at DSE was Tk. 217 and number of certificate holders was 9712. Sixth Mutual Fund was declared a dividend of per certificate was TK. 18.5 in year 2005.

Seventh ICB Mutual Fund:

Seventh ICB Mutual Fund was established in July 1995, under regulation 29A of ICB (general) regulations with a total capital of TK. 3 crore divided into 300,000 Certificates of Tk. 100 each. The management of the fund is vested with ICB.

As on June 30, 2005 the market value of the portfolio consisting 3163 certificate holders amounted to Tk. 12.21 crore as against cost of portfolio of Tk. 11.09 crore indicating capital appreciation of Tk. 1.12 crore. In year 2005 market price per certificate at DSE was TK. 217 and Seventh Mutual Fund was declared a dividend of per certificate was TK. 16.

Eight ICB Mutual Fund:

Eighth ICB Mutual Fund was established in August 1996, under regulation 29A of ICB (general) regulations with a total capital of TK. 5 crore divided into 500,000 Certificates of Tk. 100 each. The management of the fund is vested with ICB.

In the above Table-01 shown that market value of portfolio of Eighth ICB mutual fund was Tk. 12.79 crore and cost of portfolio was Tk. 11.54. In that year market price per certificate at DSE was Tk. 205 and number of certificate holders was 7671. Eighth Mutual Fund was declared a dividend of per certificate was TK. 15 in year 2005.

Cause Behind Investing in ICB Mutual Fund:

ICB Mutual fund is regarded as the most trusted medium of investment in the country and it is very much popular with the small and medium investors. The close it for various reasons, these are-

Diversified Investment: 25% investors come here because of this reason.

Free from Tax: Investment in mutual fund is free from income tax. This advantage of mutual fund attracts mainly the businesspersons to invest here. They study shows that 5 per cent investors come here with this vision.

High Return: Most small and medium investors seek a smooth return from their investment. The dividend payment against each certificate was very much attractive. This brings satisfaction to the investors. From the study was found that 10 per cent investors come here because of the security of their investment.

Free of Harassment: Many investors want to avoid the harassment in the investment process. That is why they do not for buying share from the primary or secondary market. Moreover, it was found that 5 per cent investors interested because of this reason.

Risk Free: Small and medium investors are very much carious about the security of their investment and they found that there is no chance to loss their savings and not doubt about the institution that is will not close its operation without any notification.

ICB Unit fund:

ICB Unit Fund is an open end Mutual Fund and its share capital is not fixed like other companies or closed end finds like ICB Mutual Fund. The Fund issue Unit Certificates freely on the basis of demand and fix the unit prices as and when deemed necessary considering the underlying value of its own assets. The factors responsible for fluctuations in the quoted price of shares in the stock market are not applicable to the unit certificates. With the approval and cooperation of the government, investment corporation of Bangladesh (ICB) Launched ICB Unit Fund Scheme on 10 April 1981. The scheme induces the small and medium savers to participate in the activities of industrial development of the country

Unit Fund” means the Fund constituted of all the assets for the time being held or deemed to be held on account of the ICB Unit Certificate excluding any amount standing to the credit of dividend distribution account, any sum payable to the corporation as its management charge and other charges in establishment and administration of the fund and any amount for purposes of meeting any requirement of the fond. The corporation issue unit certificate against unit fund. Unit certificate means a certificate issued by the corporation for the share in the Unit Fund.

Objectives of the unit fund:

Its main objective is to mobilize savings through sale of its units to small investors and invest these funds in marketable securities. Thus, the scheme induces the small and medium savers to participate in the activities of industrial development of the country.

Advantages of investing in ICB unit fund:

Generally investment in open-end mutual fund enjoys the following

Advantages.

Unit fund mobilizes the savings of small investors and channels them in to lucrative investment opportunities- As a result open-end mutual fund adds liquidity of the market. Moreover, given that the fund is long-term investment vehicle, it reduces market volatility by offering support to scrip price,

Due to diversified portfolio, open-end mutual fund helps in reducing investment risk of small investors.

Diversified portfolio of the fund help the small investors access to the whole market, which is difficult at individual level.

The investors save a great deal in transaction costs as he/she has access to a large number of securities by purchasing a single unit of mutual fund.

As funds are professionally managed, investors are relieved from the emotional stress associated with day-to-day management of individual investment portfolio,

Only the open —end mutual fund operate simultaneously both at the demand as well as the supply side of the market.

Investment in open-end mutual fund may relief investors from various rules and regulations applicable to individual investment parameters,

Expertise in stock selection and timing is made available to investors by gathering higher return to them,

Mutual fund helps investors to liquidate their fund out of the investment.

Investment in unit fund contributes not only to economic growth but also broaden the base of investment.

Unit fund is an open-end mutual fund through small and medium savers an opportunity to invest in a balanced portfolio at relatively low risk.

Management of the ICB Unit Fund:

Under the Capital Market Development Program initiated by the Govt. of Bangladesh and Asian Development Bank ICB Asset Management Company Ltd. has been formed as per the provision of the Investment Corporation of Bangladesh (Amendment) Act, 2000 (XXIV of 2000) and started their operation from the first day of July 2002. Accordingly ICB stopped selling of Unit Certificate from the same date. There are some provisions regarding management of ICB Unit Fund whish are as follows:

Fund share holdings shall be registered in the same of the corporation on behalf of the Unit Fund with the respective companies whose shares are so acquired.

The fund share holdings shall be retained and held by the corporation for the benefit of the unit fund certificate holders subject to the provisions of the Articles of Associations of the respective companies.

The corporation will collect all dividends and other income in respect of the fund shareholdings and deal with and act in respect of, the fund share holdings as shareholders of the companies without reference to the certificate holders.

The corporation will provide necessary staff for management and administration of unit fund and realize the expenditure incurs there fore provided, however, such expenditure should not be added to the price of the unit certificate exceeding five percent of the total sale price while determining the price of the unit certificate.

The corporation shall keep separate books of account relating to the income and expenditure of and connected with the unit fund. The said books of account shall be opened to inspection only by the Directors of the corporation and the corporation shall not be accountable to any one expect to its Board in respect of the income and expenditure relating to any unit fund.

The accounting records of the unit fund will be kept on the basis of accounting period ending of the last day of June in each calendar year.

At least one in every year the auditors will audit the accounting records of the unit fund. The fees of the auditor’s -will be charged against and payable out of the income of the said fund. The statement relating to each period with the auditors report annexed shall be conclusive and binding and copies thereof shall be opened for inspection during usual business hours by any certificate holder at the head officer of the corporation of with agents. The corporation shall be absolutely protected in retying on and shall act upon an audited statement.

The profits if any, available in respect of the unit fund at the end of accounting period will be distributed to the registered certificate holders in proportion to the number of certificate help by them on the accounting date.

Deducting the management shall assess the amount available for distribution in respect of any accounting period and administration charge from the total income received by the cooperation in the accounting period by way of interest, divided and other receipts and after making such adjustments as the corporation may think it.

Bonus shares and right shares acquitted in respect of fund shareholding may be added to the portfolio of the unit fund or, in the discretion of the corporation may be sold and its proceeds added to the income of the said fund.

The corporation shall be competent to do all other acts that, in the opinion of the board may be necessary to promote the interest of the certificate holders and that may be necessary in view of the capital market and the investment climate in Bangladesh and warranted by commercial considerations.

Issue of Unit Certificates:

ICB units are issued as registered which can be bought and sold by Govt. recognized charitable institutions only 10,000 certificates. The corporations have the right to restrict the acquisition by a person of the units over and above certain numbers from time to time. Units may be offered for sale to institutions also it the Board may so determine.

These can be bought from the offices of ICB, approved bank branches of different commercial bank in Dhaka and other districts.

The units can be transferred using such forms available for the purpose. Inter officer transfer of units are allowed it the unit holder so desires.

ICB units are available in 1, 5, 10, 50, 100, 250, 500, 1,000 and 5,000 denominations and issued at the discretion of a buyer at the time of acquisition. Every holder shall be entitled to exchange any or all of his certificates for one or new certificates of such denominations as he may require for the aggregate number of his against payment of prescribed fee.

The units can be sold back of ICB unit fund of its repurchase price. Only the issuing office of ICB or banks can repurchase the units at the prevailing repurchase price.

The units can be pledged with banks for obtaining loans by the unit holders in terms of circular of Bangladesh Bank.

The units are regarded as an approved security for investment and are entitled to investment allowance under income Tax Act.

The corporation may issue new certificates for worn out mutilated or defaced ones or in case of last, stolen or destroyed ones upon satisfactory proof against payment of prescribed fees.

In case of the death of any one of the Joint holders of unit certificates, the corporation as having the title of ownership in these units shall recognize the survivor or surveyors.

In case of an individual holders death his successors shall be recognized by the corporation provided they produce a succession certificate issued by a court as having the title to the units.

The books of the fund remain closed during the month of July every year and sale and repurchase of units remain suspended in all the officers of ICB and authorized bank branches.

The income derived from professional management of the fund and capital appreciation from its operations are determined on the basis of audited accounts as on 30th June each year. The annual dividend is declared by the fund in July and al holders of units are entitled to full amount of dividend whose names appear in the register as on the ebbing date, irrespective of their date of purchase.

institutional investment and is subject to 15% deduction of source. In case of individuals, amount of dividends exceeding Tk. 10,000 is subject to 10% deduction at source.

Fresh units can be obtained at confessional rate 1 (One) taka per unit less on the opening sale price by the existing unit holders through option for reinvestment of their dividend income under cumulative investment plan (CIP). No limit of sale/holding of unit certificates shall apply to those under CIP scheme.

The opening sale and repurchase price of units are refined after declaration of dividend, which comes into effect from 1st August each year.

Role and Performance of Unit Fund in the Capital Market:

Unit Fund is an open-end Mutual Fund, which the small and medium savers get opportunity to invest their savings in a balanced portfolio in a profitable way with a relatively lower risk. Investment in unit fund does not only contribute to the economic and industrial development of the country buy also broadens the base of the ownership in the securities. So, its main objective is to accelerate the pace of economic development particularly for meeting the demand growing industrial development by way of mobilizing savings of small and medium savers and channeling those in the productive industrial sector. The flotation of open-end mutual fund demand of securities in the capital market.

Initially, to develop a healthy and well-organized capital, open-end Mutual Fund played a significant role in the securities segment of the capital market, the investment corporation of Bangladesh (ICB) started open end Mutual Fund. The investment corporation of Bangladesh (ICB) has been successful in secondary market merchandising through open end Mutual Fund. It is the response is highly satisfactory. The open end Mutual Fund has also played a significant role in activating the stock market. The investment corporation of Bangladesh regularly participates in the trading on the floor of Dhaka stock exchange (DSE) as its member to buy/sell listed securities on behalf of ICB itself, unit/Mutual Fund and of the investment account holders. Infect, ICB has been the single larger trader in the last few years. Hence, the activities of open end Mutual Fund have provided the basis for the demand of securities, which is interest part of the development of capital market.

Comparative Position of ICB Unit Fund:

ICB operated an open-end Unit fund since April 1981. As a result of business of ICB Asset Management Company LTD. From 1 July 2002 the corporation has discontinued sale of Unit certificate. However, the existing portfolio of ICB Unit Fund is being managed by ICB.

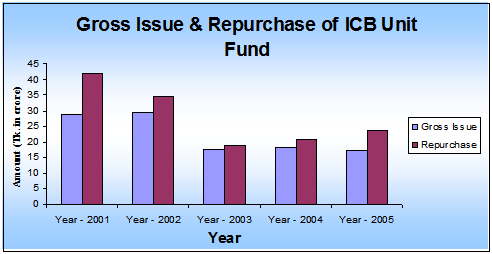

Here below shown comparative performance of ICB Unit Fund from year 2001 to year 2005. This table shows performance of gross issue, repurchase, net issue, investment costs, market price of investment, no. of securities held in the portfolio, total amount of dividend and dividend per unit.

Sl. No. | Particulars | Year – 2001 | Year – 2002 | Year – 2003 | Year – 2004 | Year – 2005 |

|

|

|

|

|

|

|

1 | Gross Issue | 28.75 | 29.26 | 17.44 | 17.97 | 17.09 |

2 | Repurchase | 41.99 | 34.54 | 18.60 | 20.79 | 23.46 |

3 | Net Issue | (13.24) | (5.28) | (1.16) | (2.82) | (6.37) |

4 | Investment at Cost | 423.55 | 397.76 | 431.33 | 604.59 | 637.09 |

| 5 | Investment at Market Price | 376.76 | 270.28 | 314.75 | 626.63 | 700.89 |

6 | No. of Securities Held in The Portfolio | 247 | 254 | 262 | 266 | 271 |

7 | Dividend Per Unit (Taka) | 12 | 12.30 | 12.30 | 11.50 | 12.00 |

8 | Dividend Amount | 50.06 | 50.70 | 50.57 | 47.00 | 48.42 |

Source: ICB annual report 2005-06.

From the above Table- shows that during 2004-2005, a total of gross issue were Tk. 17.09 crore and Tk. 23.46 crore were repurchased under the Cumulative Investment Plan (CIP). As on 30 June 2005, the net issued stood Tk. 463.09 crore. In that year investment at cost were Tk. 637 crore and market value of investment were Tk. 700.89 crore. During that time no. of securities held in the portfolio were 271 and dividend per unit was Tk. 12.

Cost of Investment and Market price of Investment of ICB Unit Fund:

Source: ICB annual report 2005-06.

Above Graph- shows cost of investment and market price of investment of ICB Unit Fund from year 2001 to year 2005. In year 2005 total investment at cost of ICB Unit Fund was Tk. 637.01 crore, which is highest investment cost in compare to other four years. In year 2002 total investment at cost was Tk. 397.32 crore, which is lowest investment cost in compare to other four years.

In year 2005 market price of investment of ICB Unit Fund was Tk. 700.89 crore, which is highest market price of investment in compare to other four years. In year 2002 market price of investment was Tk. 270.28 crore, which is lowest market price of investment in compare to other four years. From the above graph we see that both cost of investment and market price of investment were increase year to year.

Portfolio Making and management:

Making of portfolio:

Portfolio management is the cornerstone of ICB’s activities. Being a leading institutional investor, ICB contributes significantly to the development of the country’s capital market through active portfolio management.

By pooling of funds from different sources especially from the households investors ICB make portfolio to invest the funds in the best possible opportunities. During, 2005-06, a total investment of Tk. 87.03 crore was made in the portfolio of ICB including Tk. 2.5 crore in shares of two companies through different tools.

Choosing investment areas:

ICB pools fund from the different sources and invest the fund, which will bring maximum benefit to the investors. For this purposes, ICB continuously look for different suitable areas where it can invest the fund to procure the best benefits. Usually ICB look for those areas which carry maximum amounts of yield.

Allocating funds in different investment:

Once ICB find out the investment areas for the investment purpose, the second step is to take decision how much amount of fund will be invested in the different areas. In this purpose, ICB follows a criterion on the basis of the possible rate of return from the investment areas. Firstly, ICB invest funds in that sector which will carry maximum amount of benefit. In the portfolio setting, then come the subsequent investment proposals. So, on the basis of the possible rate of return from the different areas the weight is given.

As on 30 June 2006, the market value of the securities of ICB’s investment portfolio was Tk. 394.35crore against the net investment value of Tk. 421.12 crore. 7.4 Pre IPO placements

Pre IPO placements:

During the year 2005-06, a total investment of Tk. 87.03 crore was made in the portfolio of ICB including Tk. 2.5 crore in shares of two companies through pre-IPO placement, Tk. 2.22 crore in right shares of eight companies, Tk. 15.51 crore in debentures of 5 companies and Tk. 2.35 crore in the preference shares of two companies.

Investment in marketable securities:

Despite the sluggish trend prevailing in the securities market in 2005-2005, ICB earned Tk. 48.67 crore as capital gains through sale of securities of Tk. 41.62 crore out of its investment portfolio, which was 31.0 percent lower than the capital gain of Tk.70.53 crore made in the year 2004-05. During 2005-06, an amount of Tk.19.04 crore was earned as dividend on shares and interest on debentures as against Tk. 20.67 crore in 2004-05,registering a decreased slightly than that of the previous mainly due to declaration of lower rates of cash dividend and declaration of stock dividend by a number of companies in lieu of cash dividend during the year.

Dividend policy

Dividend or further expansion:

The amounts of funds ICB collects from the investors through different tolls are invested in different areas. The yield from the investment ICB gets is whether distributed to the investors or use the money for further investment. If the amount is used for further investments, then the investors do not get the divined in cash rather in other way. For example, ICB has three other subsidiaries namely: ICB capital Management, ICB Asset Management Company Limited and ICB securities Trading Company Limited. These are the one sort of further investment projects, which are owned by the investors.

Market Capitalization of ICB Mutual Fund in the Capital Market

Name of the Mutual Fund | Year-2001 | Year-2002 | Year-2003 | Year-2004 | Year-2005 |

|

|

|

|

|

|

1st ICB Mutual Fund | 7.50 | 7.50 | 8.37 | 12.50 | 13.28 |

2nd ICB Mutual Fund | 1.99 | 1.95 | 2.20 | 3.00 | 4.10 |

3rd ICB Mutual Fund | 4.32 | 4.10 | 4.60 | 6.98 | 6.97 |

4th ICB Mutual Fund | 3.90 | 3.40 | 3.62 | 5.00 | 5.64 |

5th ICB Mutual Fund | 3.47 | 3.23 | 3.35 | 4.80 | 5.12 |

6th ICB Mutual Fund | 7.99 | 8.10 | 7.95 | 9.72 | 10.89 |

7th ICB Mutual Fund | 4.74 | 4.20 | 4.25 | 5.40 | 6.53 |

8th ICB Mutual Fund | 7.27 | 6.86 | 6.80 | 8.36 | 10.26 |

Source: ICB annual report 2005-06.

Source: ICB annual report 2005-06.

Dividend Declared By ICB Mutual Fund in the Capital Market:

Name of the Mutual Fund | Year-2001 | Year-2002 | Year-2003 | Year-2004 | Year-2005 |

|

|

|

|

|

|

1st ICB Mutual Fund | 170 | 175 | 180 | 200 | 210 |

2nd ICB Mutual Fund | 40 | 42 | 45 | 50 | 55 |

3rd ICB Mutual Fund | 45 | 50 | 50 | 50 | 52 |

4th ICB Mutual Fund | 38 | 40 | 40 | 45 | 48 |

5th ICB Mutual Fund | 23 | 24 | 24 | 24 | 27 |

6th ICB Mutual Fund | 17 | 17.50 | 17.50 | 17.5 | 18.5 |

7th ICB Mutual Fund | 14 | 14.50 | 14.50 | 15 | 16 |

8th ICB Mutual Fund | 13 | 13.50 | 13.50 | 14 | 15 |

Source: ICB annual report 2005-06.

Source: ICB annual report 2005-06.

No. Of Certificate Holders of ICB Mutual Fund:

Name of the Mutual Fund | Year-2001 | Year-2002 | Year-2003 | Year-2004 | Year-2005 |

|

|

|

|

|

|

1st ICB Mutual Fund | 1129 | 1090 | 1100 | 1066 | 973 |

2nd ICB Mutual Fund | 1134 | 1087 | 1085 | 1074 | 994 |

3rd ICB Mutual Fund | 2908 | 3047 | 3030 | 2952 | 2748 |

4th ICB Mutual Fund | 2528 | 2430 | 2390 | 2335 | 2152 |

5th ICB Mutual Fund | 4320 | 4195 | 4172 | 4114 | 3923 |

6th ICB Mutual Fund | 11067 | 10524 | 10382 | 10076 | 9712 |

7th ICB Mutual Fund | 3649 | 3459 | 3400 | 3335 | 3163 |

8th ICB Mutual Fund | 9117 | 8811 | 8771 | 8694 | 7671 |

Source: ICB annual report 2005-06.

Source: ICB annual report 2005-06.

Market price Per Certificate of ICB Mutual Fund in DSE:

Name of the Mutual Fund | Year-2001 | Year-2002 | Year-2003 | Year-2004 | Year-2005 |

|

|

|

|

|

|

1st ICB Mutual Fund | 1500 | 1500 | 1675 | 2500 | 2655 |

2nd ICB Mutual Fund | 397 | 390 | 440 | 599.25 | 820 |

3rd ICB Mutual Fund | 432 | 410 | 460 | 698.50 | 697 |

4th ICB Mutual Fund | 390 | 340 | 362 | 500 | 564 |

5th ICB Mutual Fund | 232 | 215 | 223.50 | 320 | 341 |

6th ICB Mutual Fund | 160 | 162 | 159 | 194.50 | 217 |

7th ICB Mutual Fund | 158 | 140 | 141.75 | 180 | 217 |

8th ICB Mutual Fund | 145 | 137.25 | 136.25 | 167.25 | 205 |

Source: ICB annual report 2005-06.

Source: ICB annual report 2005-06.

Market Value of Portfolio of ICB Mutual Fund in the Capital Market:

Name of the Mutual Fund | Year-2001 | Year-2002 | Year-2003 | Year-2004 | Year-2005 |

|

|

|

|

|

|

1st ICB Mutual Fund | 7.89 | 6.92 | 7.74 | 11.15 | 13.09 |

2nd ICB Mutual Fund | 2.75 | 2.41 | 2.80 | 3.37 | 3.12 |

3rd ICB Mutual Fund | 3.49 | 2.38 | 2.42 | 4.21 | 4.73 |

4th ICB Mutual Fund | 4.69 | 3.64 | 3.96 | 4.47 | 4.57 |

5th ICB Mutual Fund | 4.06 | 2.96 | 3.42 | 5.73 | 7.13 |

6th ICB Mutual Fund | 6.23 | 5.77 | 5.50 | 8.72 | 10.02 |

7th ICB Mutual Fund | 6.43 | 4.25 | 7.02 | 10.15 | 12.21 |

8th ICB Mutual Fund | 8.44 | 5.66 | 7.07 | 10.83 | 12.79 |

Source: ICB annual report 2005-06.

Source: ICB annual report 2005-06.

Dividend Per Unit Declared By ICB Unit Fund:

Source: ICB annual report 2005-06.

Above Graph- shows dividend per unit declared by ICB Unit Fund from year 2001 to year 2005. In year 2002 and year 2003 amount of dividend per unit was Taka 12.30 respectively, which is the highest dividend per unit declared by ICB in compare to other four years. Lowest dividend per unit was made in the year 2004, which was Taka 11.50.

No. Of Securities Held in the Portfolio:

Source: ICB annual report 2005-06.

Findings:

As we know, the main objective of ICB was to encourage and broaden the base investment, to develop capital market and to mobilize savings from the surplus unit and many other issues. Although there in no doubts that, in the recent years the performance if ICB was not that much satisfactory. In almost all the areas, ICB’s performance was deterioration in compared to the past few years. Some of the issues are as follows:

Dividend payment in the year 2006 was not increased in compared to the previous year. It was a rate of 12.00% in both years.

Net operating income of ICB was decreased in the year 2006, which was Tk. 592915361but in the year 2005 net operating income was Tk. 985838483. So, net operating income in the year 2006 was tk. 392923122 less than the previous year.

Operating profit also decreased in the year 2006, which was Tk.465114496 in the year 2006, whereas in the year 2005, the operating profit was Tk. 860445114.

In terms of sale securities, ICB’s capital gain has also decreased in the year 2006 in compared to 2005. The reason may be identifies as the inept choosing of shares in the market.

The amount of its investment in the main operational areas has also been decreased. In terms of lease financing, Project commitments etc the amount of allocation is decreasing.

In terms of recovery of loans and advances the performance was not that much satisfactory.

From the above findings, it is seen that, in the recent years performance of ICB is not that much satisfactory in compared to the past few years. Whereas almost in all the areas the performance has been deteriorated compared to the past few years.

Justification: