Credit Risk Management

Contemporary banking organizations are exposed to a diverse set of market and non-market risks, and the management of risk has accordingly become a core function within banks. Banks have invested in risk management for the good economic reason that their shareholders and creditors demand it. But bank supervisors, such as the Bangladesh Bank, also have an obvious interest in promoting strong risk management at banking organizations because a safe and sound banking system is critical to economic growth and to the stability of financial markets. Indeed, identifying, assessing, and promoting sound risk management practices have become central elements of good supervisory practice.

What is credit?

In banking terminology, credit refers to the loans and advances made by the bank to its customers or borrowers. Bank credit is a credit by which a person who has given the required security to a bank has liberty to draw to a certain extent agreed upon. It is an arrangement for deferred payment of a loan or purchase. (Wikipedia dictionary)

Credit means a provision of, or commitment to provide, funds or substitutes for funds, to a borrower, including off-balance sheet transactions, customers’ lines of credit, overdrafts, bills purchased and discounted, and finance leases. (Guideline on credit risk management, Bank of Mauritius)

What is credit risk?

Risk means the exposure to a chance of loss or damage. Risk is the element of uncertainty or possibility of loss that exist in any business transaction. Credit risk is the likelihood that a borrower or counter party will be unsuccessful to meet its NBLigation in accordance with agreed terms and conditions. (Wikipedia dictionary)

Credit risk means the risk of credit loss those results from the failure of a borrower to honor the borrower’s credit NBLigation to the financial institution. (Guideline on credit risk management, Bank of Mauritius). Credit risk is most simply defined as the potential that a bank borrower or counterparty will fail to meet its NBLigations in accordance with agreed terms (Basel Committee on Banking Supervision, 2000).

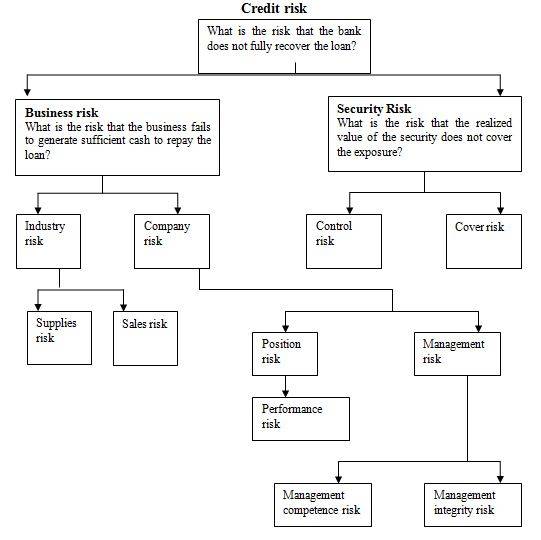

The constituent elements of credit risk can be viewed from the following flowchart:

Source: Chowdhury, L.R., (2002), A Text Book on Banker’s Advances, 2nd edition

What is credit risk management?

IdentNationalation

A bank’s risks have to be identified before they can be measured and managed.

Typically banks distinguish the following risk categories:

— Credit risk

— Market risk

— Operational risk

Measurement

The consistent assessment of the three types of risks is an essential prerequisite for successful risk management. While the development of concepts for the assessment of market risks has shown considerable progress, the methods to measure credit risks and operational risks are not as sophisticated yet due to the limited availability of historical data.

Calculation of Credit risk

Credit risk is calculated on the basis of possible losses from the credit portfolio. Potential losses in the credit business can be divided into

— expected losses and

— unexpected losses

(Credit Approval Process and Credit Risk Management, 2005, Oesterreichische National Bank )

Expected losses are derived from the borrower’s expected probability of default and the predicted exposure at default less the recovery rate, i.e. all expected cash flows, especially from the realization of collateral. The expected losses should be accounted for in income planning and included as standard risk costs in the credit conditions.

Unexpected losses result from deviations in losses from the expected loss. Unexpected losses are taken into account only indirectly via equity cost in the course of income planning and setting of credit conditions. They have to be secured by the risk coverage. (Credit Approval Process and Credit Risk Management, 2005, Oesterreichische National Bank )

Aggregation

When aggregating risks, it is important to take into account correlation effects which cause a bank’s overall risk to differ from the sum of the individual risks. This applies to risks both within a risk category as well as across different risk categories.

Planning and management

Furthermore, risk management has the function of planning the bank’s overall risk position and actively managing the risks based on these plans.

The most commonly used management tools include:

— Risk-adjusted pricing of individual loan transactions

— Setting of risk limits for individual positions or portfolios

— Use of guarantees and credit insurance

— Securitization of risks

— Buying and selling of assets

Monitoring

Risk monitoring is used to check whether the risks actually incurred lie within the prescribed limits, thus ensuring an institution’s capacity to bear these risks. In addition, the effectiveness of the measures implemented in risk controlling is measured, and new impulses are generated if necessary. (Basel Committee on Banking Supervision, 2000)

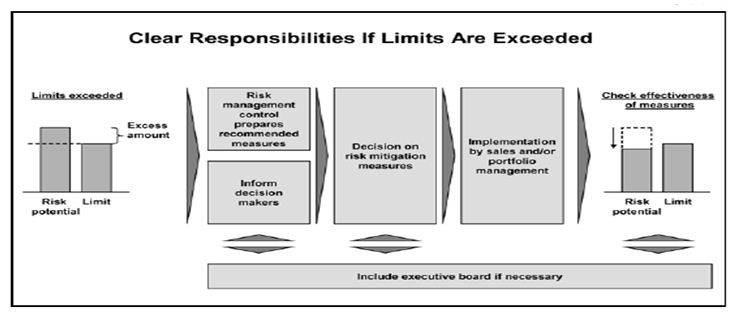

Figure : Risk Management

Source: (Credit Approval Process and Credit Risk Management, 2005, Oesterreichische National Bank )

PRISM Model of credit risk management

PRISM model is a contemporary model used in the credit risk management in modern world. It is called PRISM, an acronym for –

P = Perspective

R = Repayment

I = Intention

S = Safeguards

M = Management

Management, a PRISM component, centers on what the borrower is all about, including history and prospects. Intention or loan purpose serves as the basis for repayment. Repayment focuses on internal and external sources of cash. Internal operations and asset sales produce internal cash, whereas new debt or equity injections provide external cash sources. Internal safeguards originate from the quality and soundness of financial statements, while collateral guarantees and covenants provide external safeguards. The final component, Perspective, pulls other sections together: the deal’s risks and rewards and the operating and financing strategies that are broad enough to have a positive impact on shareholder value while enabling the borrower to repay the loan (Morton Glantz 2004).

Prerequisites for Efficient Risk Management

Methods

The methods used show how risks are captured, measured, and aggregated into a risk position for the bank as a whole. In order to choose suitable management processes, the methods should be used to determine the risk limits, measure the effect of management instruments on the bank’s risk position, and monitor the risk positions in terms of observing the defined limits and other requirements.

Processes and organizational structures

Processes and organizational structures have to make sure that risks are measured in a timely manner that risk positions are always matched with the defined limits, and that risk mitigation measures are taken in time if these limits are exceeded. Concerning the processes, it is necessary to determine how risk measurement can be combined with determining the limits, risk controlling, as well as monitoring. Furthermore, reporting processes have to be introduced. The organizational structure should ensure that those areas which cause risks are strictly separated from those areas which measure, plan, manage, and control these risks.

IT systems and an IT infrastructure

IT systems and an IT infrastructure are the basis for effective risk management.

Among other things, the IT system should allow

— The timely provision and administration of data;

— The aggregation of information to obtain values relevant to risk controlling;

— as well as an automated warning mechanism prior to reaching critical risk limits.

Why manage credit risk?

The reasons behind managing credit risks are as follows (Amitabh Bhargava,2004):

a) Increase shareholder value

— Value creation

— Value preservation

— Capital optimization

b) Instill confidence in the market place

c) Alleviate regulatory constraints and distortions thereof.

Risk Strategy

A successful, bank-wide risk management requires the definition of a risk strategy which is derived from the bank’s business policy and its risk-bearing capacity. Risk strategy is defined as

— the definition of a general framework such as principles to be followed in dealing with risks and the design of processes as well as technical-organizational structures; and

— the definition of operational indicators such as core business, risk targets, and limits.

The risk strategy in an operational sense should be prepared at least every year, with risk management and sales cooperating by balancing risk and sales strategies. The sales units contribute their perspective concerning market requirements and the possible implementation of the risk strategy. The proposal for a risk strategy thus worked out will be presented to the executive board, and following their approval, passed on to the supervisory board for their information. The risk strategy serves to establish an operational link between business orientation and risk-bearing capacity. It contains operational indicators which guide business decisions. (Credit Approval Process and Credit Risk Management, 2005, Oesterreichische National Bank )

Limits

The definition of limits is necessary to curb the risks associated with bank’s activities. It is intended to ensure that the risks can always be absorbed by the predefined coverage capital. When the limits are exceeded, risks must be reduced by taking such steps as reducing exposures or using financial instruments.

Methods of Defining Limits

The risk limits in the bank’s individual business units are based on the bank’s business orientation, its strategy, and the capital allocation method selected. A consistent limit management system should be installed to define, monitor, and control the limits. Such a system has to meet the following requirements:

— The parameters used to determine the risks and define the limits should be taken from existing systems. The parameters should be combined using automated interfaces. This ensures that errors due to manual entry cannot occur during the data collection process.

— The defined indicators should be used consistently throughout the bank. The data should be consistent with the indicators used in sales and risk controlling.

— Employees should be able to understand how and why the indicators are determined and interpreted. This is intended to ensure acceptance of the data and the required measures, e.g. when limits are exceeded.

— In order to guarantee effective risk management, it is essential to monitor risks continuously and to initiate clear control processes in time. Therefore, credit decision and credit portfolio management should be closely linked to limit monitoring. (Bernanke, 2006)

Limit Structure

The maximum risk limit is determined by the capital allocated to cover credit risks in the planning process. The bank’s organizational structure has a signNationalant impact on the way in which the limits are designed. One important success factor in the effective use of limits for risk controlling purposes is that a unit or an employee has the appropriate responsibility for an organizational unit which is assigned a limit. This is the only way to ensure that compliance with the limits is monitored and suitable measures are taken. (Bernanke, 2006)

Product, business area, country, and industry limits

Product limits can be defined, among other things, for loans to retail and corporate customers, for real estate loans, as well as for project finance. Banks with an international focus can also define country limits in order to manage their risks arising from transactions in other regions. They also define industry limits in order to avoid a concentration of risks in individual industries that are subject to a degree of risk depending on the business cycle. (Bernanke, 2006)

Risk class limits

Monitoring and limiting the concentration of exposures in certain risk classes is necessary to be able to detect a deterioration of the portfolio in time, and thus to be able to avoid losses as far as possible by withdrawing from certain exposures. (Bernanke, 2006)

Limits on unsecured portions

The definition of limits for unsecured portions restricts loans that are granted without the provision of collateral or which are collateralized only partly. These limits allow banks to manage their maximum risks efficiently, as it is easy to determine and monitor unsecured portions.

Individual customer limits

Limits for individual borrowers represent the most detailed level of risk controlling. The main purpose for their application is the prevention of cluster risks in the credit portfolio. The more precisely the limits are defined; the more likely they are to yield control impulses that can be taken into account already at the time of approval of individual loans. (Bernanke, 2006)

Rigidity of Limits

In order to allow the use of limits to manage risks, it is necessary to define how strictly these limits should be applied. In practice, the rigidity of limits varies in terms of their impact on a bank’s business activities.

— Certain limits are defined rigidly and must never be exceeded, as otherwise the viability of the bank as a whole would be endangered.

— In addition, there are early warning indicators that indicate the risk of exceeding limits ahead of time.

This differentiation ensures that control signals are sent out not only after the (rigid) limits has been exceeded, but that early warning indicators point out the risk of exceeding a rigid limit in time to make sure that appropriate countermeasures can be taken immediately (Burns and Stanley, 2001)

Limit Monitoring and Procedures Used When Limits Are Exceeded

The stipulated limits can have a direct impact on the credit approval. It needs to be determined if compliance with the limits should be examined before or after the credit decision is taken. In practice, this compliance is usually checked ex post, i.e. after the credit approval based on the portfolio under review, and is not a component of the individual loan decision. The credit decision is taken based on the borrower’s credit standing and any collateral, but independently of the portfolio risk. Such ex-post observation can result in a relatively high number of cases in which limits are exceeded, thus reducing the effectiveness of the limit stipulations. (Amitabh Bhargava, 2004)

Some banks check the compliance with the limits immediately during the credit approval process. Prior to the credit decision, compliance with the relevant limits is checked in case the credit is approved. Bringing limit monitoring into play at this early stage is also referred to as ex-ante monitoring. This helps prevent the defined limits from being exceeded in the course of approving new loans. Ex-ante monitoring is quite complex.

The limit utilization has to be documented in the credit risk report. Processes and responsibilities concerning measures to be taken when limits are exceeded have to be defined clearly. The decision makers responsible have to be informed depending on the extent to which the limits are exceeded and the approach taken to remedy the situation.

Credit Risk Management Process

Credit risk management process should cover the entire credit cycle starting from the origination of the credit in a financial institution’s books to the point the credit is extinguished from the books (Morton Glantz, 2002).

Credit Processing/Appraisal

Credit processing is the stage where all required information on credit is gathered and applications are screened. Credit application forms should be sufficiently detailed to permit gathering of all information needed for credit assessment at the outset. In this connection, financial institutions should have a checklist to ensure that all required information is, in fact, collected. Financial institutions should set out pre-qual Nationalities screening criteria, which would act as a guide for their officers to determine the types of credit that are acceptable. For instance, the criteria may include rejecting applications from blacklisted customers. These criteria would help institutions avoid processing and screening applications that would be later rejected.

Moreover, all credits should be for legitimate purposes and adequate processes should be established to ensure that financial institutions are not used for fraudulent activities or activities that are prohibited by law or are of such nature that if permitted would contravene the provisions of law. Institutions must not expose themselves to reputation risk associated with granting credit to customers of questionable repute and integrity.

The next stage to credit screening is credit appraisal where the financial institution assesses the customer’s ability to meet his NBL migrations. Institutions should establish well designed credit appraisal criteria to ensure that facilities are granted only to creditworthy customers who can make repayments from reasonably determinable sources of cash flow on a timely basis (Morton Glantz, 2002).

Financial institutions usually require collateral or guarantees in support of a credit in order to mitigate risk. It must be recognized that collateral and guarantees are merely instruments of risk mitigation. They are, by no means, substitutes for a customer’s ability to generate sufficient cash flows to honor his contractual repayment NBL migrations. Collateral and guarantees cannot obviate or minimize the need for a comprehensive assessment of the customer’s ability to observe repayment schedule nor should they be allowed to compensate for insufficient information from the customer.

Care should be taken that working capital financing is not based entirely on the existence of collateral or guarantees. Such financing must be supported by a proper analysis of projected levels of sales and cost of sales, prudential working capital ratio, past experience of working capital financing, and contributions to such capital by the borrower itself.

Financial institutions must have a policy for valuing collateral, taking into account the requirements of the Bangladesh Bank guidelines dealing with the matter. Such a policy shall, among other things, provide for acceptability of various forms of collateral, their periodic valuation, process for ensuring their continuing legal enforceability and realization value (Morton Glantz, 2002).

In the case of loan syndication, a participating financial institution should have a policy to ensure that it does not place undue reliance on the credit risk analysis carried out by the lead underwriter. The institution must carry out its own due diligence, including credit risk analysis, and an assessment of the terms and conditions of the syndication. As a general rule, the appraisal criteria will focus on:

— amount and purpose of facilities and sources of repayment;

— integrity and reputation of the applicant as well as his legal capacity to assume the credit NBLigation;

— risk profile of the borrower and the sensitivity of the applicable industry sector to economic fluctuations;

— performance of the borrower in any credit previously granted by the financial institution, and other institutions, in which case a credit report should be sought from them;

— the borrower’s capacity to repay based on his business plan, if relevant, and projected cash flows using different scenarios;

— cumulative exposure of the borrower to different institutions;

— physical inspection of the borrower’s business premises as well as the facility that is the subject of the proposed financing;

— borrower’s business expertise;

— adequacy and enforceability of collateral or guarantees, taking into account the existence of any previous charges of other institutions on the collateral;

— current and forecast operating environment of the borrower;

— background information on shareholders, directors and beneficial owners for corporate customers; and

— management capacity of corporate customers (L.R.Chowdhury,2004).

Credit-approval/Sanction

A financial institution must have in place written guidelines on the credit approval process and the approval authorities of individuals or committees as well as the basis of those decisions. Approval authorities should be sanctioned by the board of directors. Approval authorities will cover new credit approvals, renewals of existing credits, and changes in terms and conditions of previously approved credits, particularly credit restructuring, all of which should be fully documented and recorded. Prudent credit practice requires that persons empowered with the credit approval authority should not also have the customer relationship responsibility.

Approval authorities of individuals should be commensurate to their positions within management ranks as well as their expertise. Depending on the nature and size of credit, it would be prudent to require approval of two officers on a credit application, in accordance with the Board’s policy. The approval process should be based on a system of checks and balances. Some approval authorities will be reserved for the credit committee in view of the size and complexity of the credit transaction.

Depending on the size of the financial institution, it should develop a corps of credit risk specialists who have high level expertise and experience and demonstrated judgment in assessing, approving and managing credit risk. An accountability regime should be established for the decision-making process, accompanied by a clear audit trail of decisions taken, with proper identNationalation of individuals/committees involved. All this must be properly documented.

Credit Documentation

Documentation is an essential part of the credit process and is required for each phase of the credit cycle, including credit application, credit analysis, credit approval, credit monitoring, collateral valuation, impairment recognition, foreclosure of impaired loan and realization of security. The format of credit files must be standardized and files neatly maintained with an appropriate system of cross-indexing to facilitate review and follow up.

The Bangladesh Bank will pay particular attention to the quality of files and the systems in place for their maintenance. Documentation establishes the relationship between the financial institution and the borrower and forms the basis for any legal action in a court of law. Institutions must ensure that contractual agreements with their borrowers are vetted by their legal advisers (L.R.Chowdhury,2004).

Credit applications must be documented regardless of their approval or rejection. All documentation should be available for examination by the Bangladesh Bank. Financial institutions must establish policies on information to be documented at each stage of the credit cycle. The depth and detail of information from a customer will depend on the nature of the facility and his prior performance with the institution. A separate credit file should be maintained for each customer. If a subsidiary file is created, it should be properly cross-indexed to the main credit file (L.R.Chowdhury,2004).

For security reasons, financial institutions should consider keeping only the copies of critical documents (i.e., those of legal value, facility letters, signed loan agreements) in credit files while retaining the originals in more secure custody. Credit files should also be stored in fire-proof cabinets and should not be removed from the institution’s premises.

Financial institutions should maintain a checklist that can show that all their policies and procedures ranging from receiving the credit application to the disbursement of funds have been complied with. The checklist should also include the identity of individual(s) and/or committee(s) involved in the decision-making process (Morton Glantz, 2002).

Credit Administration

Financial institutions must ensure that their credit portfolio is properly administered, that is, loan agreements are duly prepared, renewal notices are sent systematically and credit files are regularly updated. An institution may allocate its credit administration function to a separate department or to designated individuals in credit operations, depending on the size and complexity of its credit portfolio (Credit Risk Management: Industry Best Practices2005, Bangladesh Bank).

A financial institution’s credit administration function should, as a minimum, ensure that:

— credit files are neatly organized, cross-indexed, and their removal from the premises is not permitted;

— the borrower has registered the required insurance policy in favor of the bank and is regularly paying the premiums;

— the borrower is making timely repayments of lease rents in respect of charged leasehold properties;

— credit facilities are disbursed only after all the contractual terms and conditions have been met and all the required documents have been received;

— collateral value is regularly monitored;

— the borrower is making timely repayments on interest, principal and any agreed to fees and commissions;

— information provided to management is both accurate and timely;

— responsibilities within the financial institution are adequately segregated;

— funds disbursed under the credit agreement are, in fact, used for the purpose for which they were granted;

— “back office” operations are properly controlled;

— the established policies and procedures as well as relevant laws and regulations are complied with; and

— on-site inspection visits of the borrower’s business are regularly conducted and assessments documented (L.R.Chowdhury,2004).

Disbursement

Once the credit is approved, the customer should be advised of the terms and conditions of the credit by way of a letter of offer. The duplicate of this letter should be duly signed and returned to the institution by the customer. The facility disbursement process should start only upon receipt of this letter and should involve, inter alia, the completion of formalities regarding documentation, the registration of collateral, insurance cover in the institution’s favour and the vetting of documents by a legal expert. Under no circumstances shall funds be released prior to compliance with pre-disbursement conditions and approval by the relevant authorities in the financial institution (L.R.Chowdhury,2004).

Monitoring and Control of Individual Credits

To safeguard financial institutions against potential losses, prNBLem facilities need to be identified early. A proper credit monitoring system will provide the basis for taking prompt corrective actions when warning signs point to a deterioration in the financial health of the borrower. Examples of such warning signs include unauthorised drawings, arrears in capital and interest and a deterioration in the borrower’s operating environment (Morton Glantz, 2002). Financial institutions must have a system in place to formally review the status of the credit and the financial health of the borrower at least once a year. More frequent reviews (e.g at least quarterly) should be carried out of large credits, prNBLem credits or when the operating environment of the customer is undergoing signNationalant changes.

In broad terms, the monitoring activity of the institution will ensure that:

— funds advanced are used only for the purpose stated in the customer’s credit application;

— financial condition of a borrower is regularly tracked and management advised in a timely fashion;

— borrowers are complying with contractual covenants;

— collateral coverage is regularly assessed and related to the borrower’s financial health;

— the institution’s internal risk ratings reflect the current condition of the customer;

— contractual payment delinquencies are identified and emerging problem credits are classified on a timely basis; and

— problem credits are promptly directed to management for remedial actions.

More spec Nationalally, the above monitoring will include a review of up-to-date information on the borrower, encompassing:

— opinions from other financial institutions with whom the customer deals;

— findings of site visits;

— audited financial statements and latest management accounts;

— details of customers’ business plans;

— financial budgets and cash flow projections; and

— any relevant board resolutions for corporate customers.

The borrower should be asked to explain any major variances in projections provided in support of his credit application and the actual performance, in particular variances respecting projected cash flows and sales turnover (Credit Risk Management: Industry Best Practices2005, Bangladesh Bank).

Monitoring the Overall Credit Portfolio (Stress Testing)

An important element of sound credit risk management is analyzing what could potentially go wrong with individual credits and the overall credit portfolio if conditions/environment in which borrowers operate change sign Nationalantly. The results of this analysis should then be factored into the assessment of the adequacy of provisioning and capital of the institution. Such stress analysis can reveal previously undetected areas of potential credit risk exposure that could arise in times of crisis (Morton Glantz, 2002).

Possible scenarios that financial institutions should consider in carrying out stress testing include:

— Sign Nationalant economic or industry sector downturns;

— Adverse market-risk events; and

— Unfavorable liquidity conditions.

Financial institutions should have industry profiles in respect of all industries where they have signNationalant exposures. Such profiles must be reviewed /updated every year. Each stress test should be followed by a contingency plan as regards recommended corrective actions. Senior management must regularly review the results of stress tests and contingency plans. The results must serve as an important input into a review of credit risk management framework and setting limits and provisioning levels (Morton Glantz, 2002).

ClassNationalation of credit

It is required for the board of directors of a financial institution to “establish credit risk management policy, and credit impairment recognition and measurement policy, the associated internal controls, documentation processes and information systems;”

Credit classNationalation process grades individual credits in terms of the expected degree of recoverability. Financial institutions must have in place the processes and controls to implement the board approved policies, which will, in turn, be in accord with the proposed guideline. They should have appropriate criteria for credit provisioning and write off. International Accounting Standard 39 requires that financial institutions shall, in addition to individual credit provisioning, assess credit impairment and ensuing provisioning on a credit portfolio basis. Financial institutions must, therefore, establish appropriate systems and processes to identify credits with similar characteristics in order to assess the degree of their recoverability on a portfolio basis.

Financial institutions should establish appropriate systems and controls to ensure that collateral continues to be legally valid and enforceable and its net realizable value is properly determined. This is particularly important for any delinquent credits, before netting off the collateral’s value against the outstanding amount of the credit for determining provision. As to any guarantees given in support of credits, financial institutions must establish procedures for verifying periodically the net worth of the guarantor.

Managing Problem Credits/Recovery

A financial institution’s credit risk policy should clearly set out how problem credits are to be managed. The positioning of this responsibility in the credit department of an institution may depend on the size and complexity of credit operations. The monitoring unit will follow all aspects of the problem credit, including rehabilitation of the borrower, restructuring of credit, monitoring the value of applicable collateral, scrutiny of legal documents, and dealing with receiver/manager until the recovery matters are finalized.

The collection process for personal loans starts when the account holder has failed to meet one or more contractual payment (Installment). It therefore becomes the duty of the Collection Department to minimize the outstanding delinquent receivable and credit losses. This procedure has been designed to enable the collection staff to systematically recover the dues and identify / prevent potential losses, while maintaining a high standard of service and retaining good relations with the customers. It is therefore essential and critical, that collection people are familiar with the computerized system, procedures and maintain effective liaison with other departments within the bank (Prudential regulations for consumer financing 2004, Bangladesh Bank).

Collection objectives

The collector’s responsibility will commence from the time an account becomes delinquent until it is regularized by means of payment or closed with full payment amount collected. The goal of the collection process is to obtain payments promptly while minimizing collection expense and write-off costs as well as maintaining the customer’s goodwill by a high standard of service. For this reason it is important that the collector should endeavor to resolve the account at the first time worked. Collection also protects the assets of the bank. This can be achieved by identifying early signals of delinquency and thus minimizing losses. The customers who do not respond to collection efforts – represent a financial risk to the institution. The Collector’s role is to collect so that the institution can keep the loan on its books and does not have to write-off / charge off.

Ident Nationalities and allocation of accounts

When a customer fails to pay the minimum amount due or installment by the payment due date, the account is considered in arrears or delinquent. When accounts are delinquent, collection procedures are instituted to regularize the accounts without losing the customer’s goodwill whilst ensuring that the bank’s interests are protected.

Collection Steps

To identify and manage arrears, the following aging class Nationalities is adopted:

For all products other than credit cards

Table : Credit recovery steps

| Days Past Due (DPD) | Collection Action |

1-14 | Letter, Follow up & Persuasion over phone (Annexure V) |

15-29 | 1st Reminder letter & Sl. No. 1 follows |

30-44 | 2nd reminder letter + Single visit |

45-59 |

|

60-89 |

|

90 and above |

|

Source: (Prudential regulations for consumer financing 2004, Bangladesh Bank)

For credit cards:

Table : Credit recovery steps for credit card

Days Past Due (DPD) | Collection Action |

X |

|

30-59 |

|

60-89 |

|

90-119 |

|

120-149 |

|

150+ |

|

Source: (Prudential regulations for consumer financing 2004, Bangladesh Bank)

Legal actions could be taken on the basis of Artha Rin Adalat Ain 2003 which has been enacted to encourage speedy settlement of legal cases. It provides support for both the financial institutions and the borrower.