Introduction

Non-Bank Financial Institutions (NBFIs) play a significant role in meeting the diverse financial needs of various sectors of an economy and thus contribute to the economic development of the country as well as to the deepening of the country’s financial system. As the development process proceeds, NBFIs become prominent alongside the banking sector. Both can play significant roles in influencing and mobilizing savings for investment. Their involvement in the process generally makes them competitors as they try to cater to the same needs. However, they are also complementary to each other as each can develop its own niche, and thus may venture into an area where the other may not, which ultimately strengthens the financial mobility of both.

In relatively advanced economies there are different types of non-bank financial institutions namely insurance companies, finance companies, investment banks and those dealing with pension and mutual funds, though financial innovation is blurring the distinction between different institutions. In some countries financial institutions have adopted both banking and non-banking financial service packages to meet the changing requirements of the customers. In the Bangladesh context, NBFIs are those institutions that are licensed and controlled by the Financial Institutions Act of 1993 (FIA ’93). NBFIs give loans and advances for industry, commerce, agriculture, housing and real estate, carry on underwriting or acquisition business or the investment and re-investment in shares, stocks, bonds, debentures or debenture stock or securities issued by the government or any local authority; carry on the business of hire purchase transactions including leasing of machinery or equipment, and use their capital to invest in companies.

The importance of NBFIs can be emphasized from the structure of the financial system. In the financial system of Bangladesh, commercial banks have emerged in a dominant role in mobilizing funds and using these resources for investment. Due to their structural limitations and rigidity of different regulations, banks could not expand their operations in all expected areas and were confined to a relatively limited sphere of financial services. Moreover, their efforts to meet long term financing with short term resources may result in asset-liability mismatch, which can create pressure on their financial base. They also could not broaden their operational horizon appreciably by offering new and innovative financial products. These drawbacks led to the emergence of NBFIs in Bangladesh for supporting industrialization and economic growth of the country.

Islamic Finance and Investment Limited

- Objectives of the study:

Objectives are to highlight different features and product base of Islamic Finance and Investment Limited, the effects of banks’ entry into the non-bank financing area, identifying the challenges faced by NBFIs in Bangladesh.

- Rationale of choosing the topic:

Non-bank financial institutions usually lease out capital machinery to various economic sectors, allows home loans to individuals, etc. Obtaining loans from such NBFIs is easy and quicker than banks. There is no hassle and less time consuming in obtaining such loans. Security and loan documentation process are also easy. All of above helped a lot in industrialization of Bangladesh as well as making the dream of individuals true having own property under home loans. Such home loans in turn help growth of another economic sector. As such we have chosen this topic to highlight few issues & most strong positioning of NBFIs in Bangladesh.

- Methods:

- Source of data

The analyses have been conducted on the basis of the secondary data obtained from different sources like Review of Banking and Financial Institution Of Bangladesh, Bangladesh Bank Annual Report, Bangladesh Leasing and Finance Companies Association (BLFCA) Year Book And Bangladesh Bank (2008), “Financial Sector Review”. Bangladesh Bank‘s NBFIs Guide Line. And IFIL company rules and frame work.

- Basic parameters

The basic Parameter of the Non Banking Financial Institution is annual growth rate, their types and sector of investments and target market against each type of investment or finance. Financing process.

- Analytical techniques / tools

Direct observe vision and work with related activities and Focus Group Discussion.

Basic institution(s) / issue / industry

Initially, NBFIs were incorporated in Bangladesh under the Companies Act, 1913 and were regulated by the provision relating to Non-Banking Institutions as contained in Chapter V of the Bangladesh Bank Order, 1972. But this regulatory framework was not adequate and NBFIs had the scope of carrying out their business in the line of banking. Later, Bangladesh Bank promulgated an order titled ‘Non Banking Financial Institutions Order, 1989’ to promote better regulation and also to remove the ambiguity relating to the permissible areas of operation of NBFIs. But the order did not cover the whole range of NBFI activities. It also did not mention anything about the statutory liquidity requirement to be maintained with the central bank. To remove the regulatory deficiency and also to define a wide range of activities to be covered by NBFIs, a new act titled ‘Financial Institution Act, 1993’ was enacted in 1993 (Barai et al. 1999). Industrial Promotion and Development Company (IPDC) was the first private sector NBFI in Bangladesh, which started its operation in 1981. Since then the number has been increasing and n December 2006 it reached 29.1 Of these, one is government owned, 15 are local (private) and the other 13 are established under joint venture with foreign participation.

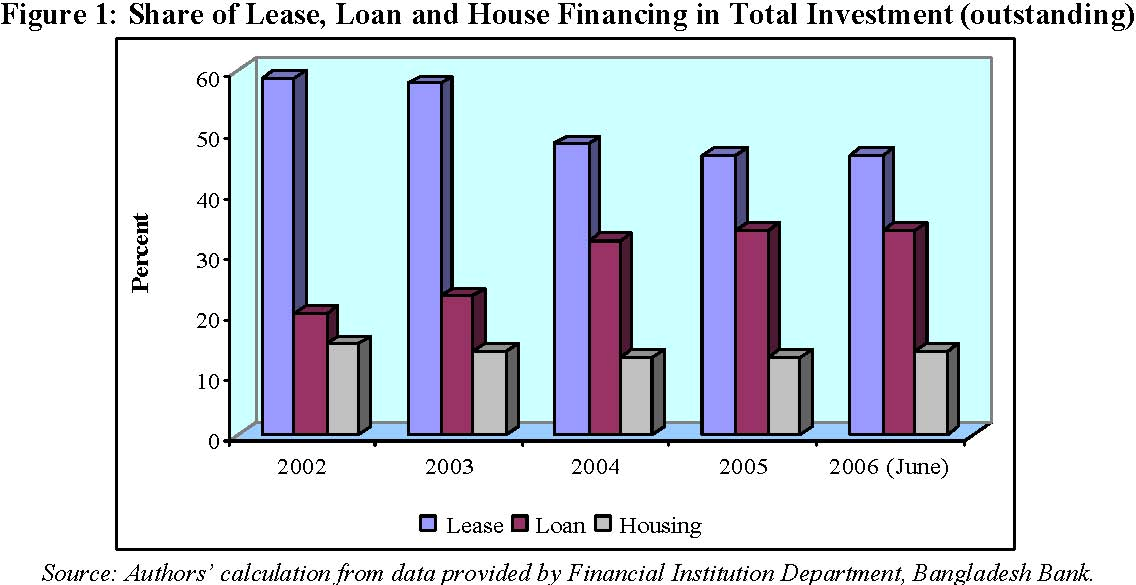

The major business of most NBFIs in Bangladesh is leasing, though some are also diversifying into other lines of business like term lending, housing finance, merchant banking, equity financing, venture capital financing etc. Lease financing, term lending and housing finance constituted 94 percent of the total financing activities of all NBFIs up to June 2006. A break-up of their financing activities reveals that the share of leasing and housing finance in the total investment portfolio of NBFIs has gradually decreased from 59 and 15 percent, respectively, in 2002 to 46 and 14 percent in June 2006. The share of term loans, on the other hand, has increased from 20 percent to 34 percent during the same period implying increased focus on the former. The evolvement of NBFI business activity is observed in Figure 1. It can also be seen from the figure that the portfolio mix of NBFIs has become quite stable from 2004.

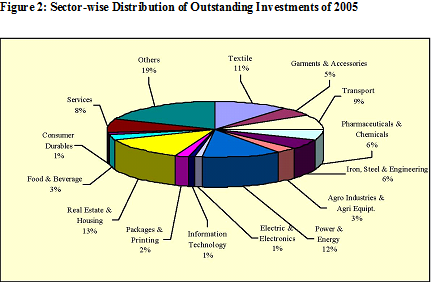

NBFIs offer services to various sectors such as textile, chemicals, services, pharmaceuticals, transport, food and beverage, leather products, construction and engineering etc. The percentage of the sector-wise distribution of NBFIs investment in 2005 is given in Figure 2. Although an individual NBFI may have a different portfolio as per its business strategy, the aggregated data shows that NBFIs mainly focus on real estate & housing (13%), power & energy (12%), textile (11%) and transport sector (9%). Service (finance and business) is another area of importance for NBFIs. From the perspective of broad economic sectors, investment in the industrial sector (42%) dominated that in the service sector (33%) in 2005. NBFIs are also exploring other sectors namely ‘pharmaceuticals & chemicals’, ‘iron, steel & engineering’, ‘garments & accessories’, ‘food & beverage’ and ‘agro industries & equipment’. The weight of these sectors is 23 percent of the total portfolio.

Source: BLFCA Year Book-2005

Products and Services Offered by NBFIs

Non-Bank Financial Institutions play a key role in fulfilling the gap of financial services that are not generally provided by the banking sector. The competition among NBFIs is increasing over the years, which is forcing them to diversify to a wider range of products and services and to provide innovative investment solutions. NBFIs appear to offer flexible options and highly competitive products to help customers meet their operational and financial goals. The table below provides a summary of the product range offered by existing NBFIs of Bangladesh.

Different Products and Services of NBFIs

| Type of Activity |

Key Features

TargetMarket Lease Financing

Finance/Capital Lease

Operational Lease

Hire Purchase

Leveraged Leases

Provide a long-term solution that allows customers to free up working capital

An operational lease entails the client renting an asset over a time period that is substantially less than the asset’s economic life. It offers short-term flexibility, which may allow the customer to take advantage of off-balance sheet accounting treatment.

A hire purchase is an alternative to a lending transaction for the equipment purchase. It is usually employed for retail or individual financing of smaller items, such as consumer products. However, hire purchase option is also suitable for business houses depending on tax practices.

Leases generally for large transactions involving three parties: a lessee, a lessor and a funding source. These leases infuse third-party non-recourse debt underwritten by the customer’s ability to raise capital in the public and private capital markets for a significant portion of the cost.

Corporate, SMEs , Individual business enterprises.

Corporate, SMEs, individual business enterprises.

Clients that have an established credit history with the institution can manage the down payment and assume a stake in the leasing agreement.

Securities Services Brokerage Services CDBL Services as full service Depository Participant (DP) Mostly corporate houses

| Type of Activity | Key Features | Target Market |

| Synthetic Leases |

Sale/LeasebacksSynthetic lease structure is generally provided for property that retains value over an extended period of time such as aircraft, railroad rolling stock, manufacturing equipment and certain types of real estate.

Ideal for customers looking to generate liquidity from their existing equipment and reinvest the proceeds back into the business.

Mostly corporate houses

Corporate, SMEs , individual business enterprisesHome Loan and Real Estate Financing

House loan and real estate financing is extended for purchase of apartment and house, construction of residential house, purchase of chamber and office space for professionals, purchase of office space and display center, purchase and construction of commercial building, real estate developer for construction of apartment project. Mostly mid to long term in nature.Individuals, Professionals, & Corporate BodiesShort Term Loans

Factoring of Accounts Receivables

Work Order FinancingFinancing against invoices raised by the supplier after making the delivery successfully. Major Features are Revolving Short Term Facility, Permanent Assignment of Payment, Financing against invoices, Post-delivery Financing

Finance against the assignment of bill arising out of work orders on a revolving basis. The company shall take assignment of suitable work orders and / or invoices and finance the client against those.Small and medium size companies having regular supplies to corporate bodies

Medium and large clients with continuous flow of work orders from customersCorporate Finance

Bridge Finance

Syndication of Large Loans

Advisory Services

Merger and Acquisition

SecuritizationBridge Finance is a kind of Short Term Finance extended in anticipation of immediate long term financing such as public issue, private placement, loan syndication, lease syndication, loan, lease & debenture.

Making available a large financing for a corporate client. Arrange syndicated financing in the mode of loan, lease, equity, working capital, or any combination thereof. Particularly useful for large projects requiring large scale investment and no single financier wants to take the whole risk. Example: Greenfield project.

Advisory services are comprehensive financial, economic and strategic advice to companies for growth, profitability, and sustainability. This includes providing wide range of services, such as corporate counseling, project counseling, capital restructuring, financial engineering, diagnosing financial problems.

Help find appropriate organization for best possible synergy, conduct valuation of companies and select suitable merger and acquisition methods, negotiate and execute deal beneficial for all the parties involved.

Securitization is the issuance of financial instruments backed by assets and/or cash flows. This is one of the modern financial services, which solves specific type of financial needs of business organizations.Company going for an IPO or expecting to avail a long term loan or Working Capital within one year or so..

Financing new large project; Financing BMRE (Balancing, Modernization, Replacement and Expansion); Refinancing a large project.

All large corporate houses

Medium and large corporate bodies

All corporate bodies

| Type of Activity | Key Features | Target Market |

| Merchant Banking |

Issue Management

Underwriting

Portfolio Management

Corporate AdvisingThe Issue Management group is capable of devising innovative solution for raising capital – debt e.g. placement of bonds and debentures, and raising equity through private and public placement – from the market suiting the unique needs and constraints of the corporate clients.

Underwriting refers to the guarantee by the underwriters that in the event of under-subscription, the underwriter will take up the under-subscribed amount on pro-rata basis upon payment of price of that option

Merchant banks allow small investors to open investor account with merchant banks and provide support for the purchase and sales of shares . Clients shall have absolute discretionary power to make investment decisions.

Through corporate advising, the merchant bank helps the issuer analyze its financing needs and suggest various ways to raise needed funds.All corporate bodies

All corporate bodies

Individuals, Professionals, & Corporate Bodies

All corporate bodiesSecurities Services

Brokerage Services

CDBL Services as full service Depository Participant (DP)Provide services for Trade Execution (Dhaka and Chittagong Stock Exchanges), Pre -IPO private placement, Asset allocation advice, Opportunities for trading in different financial instruments.

Apart from the brokerage services, securities services also provide the services like BO (Beneficial Owner) accounts opening and maintenance, Dematerialization, Re-materialization, Transfers and multiple accounts movement, Lending and borrowing etc.All corporate bodies

Individuals, Professionals, & Corporate Bodies

Company Profile and Background

The government of Bangladesh in 1991 decided to allow private capital investment to take initiative concerning the formation of new and dynamic financial institution. This company is a public limited company within the meaning of clause of section 2(1) of companies’ act, 1994 in Bangladesh fully owned by Bangladeshi nationals.

Islamic Finance and Investment Limited (IFIL) was incorporated on February 27, 2001 as a Public Limited Company with the Registrar of Joint Stock Companies (RJSC) under the Companies Act 1994 with the following Capital Structure:-

- Authorized Capital : Tk.100 Officerre

- Share Holders Equity : Tk.36.055 Officerre.

- Paid Up – Tk.27.478 Officerre.

- Statutory Reserve – Tk.37.995 Officerre.

- Retained Earnings – Tk.47.776 Officerre.

The Bangladesh Bank (BB) issued license to IFIL to operate as NBFI on April 12, 2001. IFIL started its commercial operation (Investment) on April 19, 2001 with establishment of it’s registered at Noakhali Tower, 55, Purana Paltan, Dhaka-1000, Bangladesh by 23 Bangladeshi businessman. In August 2001 IFIL shifted its registered Office to the present address at ChandMansion, 66, Dilkusha C/A, Dhaka-1000. From the very beginning of its operation, IFIL is playing an important role in private sector leasing and real estate business. As a full fledged financial institution it receives deposits and extend Investments through better counseling and effective services to the client for the socio-economic development of the country. The company continued to be a major financier to Industrial sector and has also supported sectors like Real Estate, Trading and other sectors.

IFIL Investment Products:

As the market and client demand may dictate, IFIL’s principal activities remain focused on the followings:

Lease Finance

Leasing is the core business of the IFIL. The IFIL is carrying on business of lease financing transactions of capital goods, plants and equipment, etc. for large to Small and Medium sized industries both corporate and retail in nature. Some of the preferred terms and conditions are as follows:-

- Running projects having business prospect and profitability for at least last 2 years.

- Investment amount – As per credit worthiness of the customer.

- Tenure – 48 to 60 months.

- Profit rate – 17%-19% depending upon the inherent risk of the project.

Real Estate Financing (Hire Purchase Shirkatul Melk-HPSM)

HPSM is the another core product of the IFIL.IFIL provides real estate financing under HPSM to its customers which includes House building construction, finishing and renovation, Flat purchase, Factory construction, Commercial space and shops purchase. Some of the preferred terms and conditions are as follows:-

- Projects at development stage; for Flats and Shops, we prefer ready flat/shop financing.

- Investment amount – As per credit worthiness of the customer.

- Tenure – Maximum 60 months.

- Profit rate – 17%-19% depending upon the cash flow of the customer.

Bai Muajjal Financing (BAIM):

IFIL provides Bai Muajjal Financing (Trade Finance) by way of purchasing products for its clients for the ultimate sale by the client to their customers. In nature it is Trading finance which buying of cloths, Raw Materials, Papers, General items for shops etc. Some of the preferred terms and conditions are as follows:-

- Business having good prospects and cash flow as well as profitability.

- Investment amount – As per credit worthiness of the customer.

- Tenure – Maximum 36 months.

- Profit rate – 17%-19% depending upon the cash flow of the customer.

SME Finance:

IFIL extends Small and Medium Enterprise (SME) Financing to cater their business needs. SME is an investment scheme for the purpose of raw materials/goods/commodities and/or fixed asset purchase to the small and medium sized trading, manufacturing, service, agriculture, non-farm activities, agro based industries etc. Some of the preferred terms and conditions are as follows:-

- Business having good prospects and cash flow as well as profitability.

- Investment amount – As per credit worthiness of the customer.

- Tenure – Maximum 48 months.

- Profit rate – 18%-19% depending upon the cash flow of the customer.

Project Finance:

The Company provides, or arrange financing, for specific projects of any size. It assist its clients, also, in the planning and implementation of such projects

IFIL Deposit Products:

IFIL being a licensed Financial Institution operating under Bangladesh Bank is also authorized to take deposits from General Public, Corporate bodies, Governments and Semi-Governments institutions. The Board of Directors in its 84th meeting approved actual profit rate of 10.19% for 1 weightage.On the basis of this actual rate provisional rates of profit on different dispost products are determined to be as follows:

Product Name:

1.MTD

(Mudaraba Term Deposit)At maturity

2.MTD

(Mudaraba Term Deposit) Monthly

Basic rules for MTD

- Mudaraba Term Deposits can be opened by cheque, pay order or bank draft from individuals (single and joint), firms (propietorship/partnership), limited companies, autonomous bodies, charitable institutions, association, educational institution, local bodies, trusts, etc.

- The account holder is not allowed to withdraw the amount before maturity date. But on obtaining the IFIL’s prior consent the depositor(s) may withdraw the deposit before maturity without any profit i.e. no profit no loss basis.

- If the profit amount is not withdrawn it will automatically be added to the principal amount annually and the entire amount will earn profit/loss.

- Matured deposit if not encashed within one month of maturity, the deposit shall automatically be renewed for the period one year.

- Depositors can avail Quard up to 70% of their deposit amount for MTD(At maturity) 1 year,2 years,3 years & above.

- The IFIL retains the right of refusing to accept any deposit from any person in MTD account without assigning any reason.

- The IFIL reserves the right to add or alter any or all the rules.

Schemes:

1.Mudaraba Pension Deposit Scheme

2.Mudaraba House Owning Deposit Scheme

3.Mudaraba Hajj Deposit Scheme

4.Mudaraba Higher Education & Marriage Deposit Scheme

Other attractive schemes:

Mudaraba Special Deposit Scheme

Mudaraba Marriage Saving Scheme

Mudaraba Mohor Deposit Scheme

Mudaraba Education Saving Scheme

Basic rules for Schemes:

- Any desirous person may open the A/C, deposited on monthly basis.

- Monthly installments have to be deposited by 15th of each month.

- Any depositor may open one or more account in the same name in the same branch.

- TAX, VAT, Excise Duty as applicable by Government will have to be borne by the depositor.

- IFIL has the authority to change/amend the rules and regulations regarding the scheme as and when required and the depositor must abide by the rules.

- In case of Death of the depositor the amount payable will be paid to the nominee. If there is no nominee by submitting Succession certificate the amount will be paid to legal successor of the depositor

Approval Process of Lease /HPSM/BAIM/SME

Basic Appraisal of lease/HPSM/BIAM/SME

Business or project appraisal is a technique of evaluating and analyzing Business from various aspects, primarily the risks associated with that business enterprise. At the time of appraisal of any manufacturing, trading or service related organization, factory or industry; one has to perform a feasibility study on the different aspects. These are:

- Management and Personal Aspects

- Technical Aspects

- Marketing Aspects

- Financial Aspects

- Social Economic Aspects

- Security Aspect

a. Management and personal aspects: During the appraisal prosecute the Officer should endeavor to obtain details about the prospective borrowers, some of which are:

- Business related information

- Credit History

- Liquidity Information

- Management Background

In considering the above, one should look at the business is managed. The Officer should also consider clients previous credit history like facilitates sought and availed, loan repayment an overdue record, if any.

One should also check the client bank account and amount of balance maintained. Management’s qualification, experience, successor and maintenance of records should provided insight in to the business.

b. Technical Aspects: From a business perspective, this aspects deals with design of the system in place, the operation of the business, the different type of physical resources used, the technology used, the capacity to handle business and all other inputs (labor, raw materials, utilities etc.)

Among the technical factors to be investigated during an appraisal are:

- The size of project

- The process, materials, equipment, and reliability of technical systems to be used

- Location of projects

- Sustainability of the plans, layout and design used

- Total quantity of the goods /Service produced/Traded monthly

- Environment of the business and its surrounding areas

- Availability to various factors of production, both physical and human

- Raw materials availability, price level and its variation to be considered

c. Marketing Aspects: A Investment Officer should consider the following factors of a business before making any loan commitment with a customer:

Total demand and supply of the products in the market that the business operates in growth of sales and major marketing threats that the business may face.

d. Financial Aspects: This aspects allows us to check the financial health of a business, Through an analysis of the profit and loss account, balance sheet, cash flows, ratios and requirement of working capital. If the collection of the financial data can be done properly, then it may be able to make a somewhat realistic picture of the business financial position. How ever, all the data collected must be Officerss-checked as much as possible with the physical features of business.

The following things are to be considered and determined at the time of verifying the financial feasibility of the business:

- Current year’s profit/Loss of the business and probable profitability of business after taking the loan

- Determination of assets, liabilities and net worth of the manufacturing/ trading / service institution before and after taking loan

- Present net cash flow of the business after disbursement of loan should be determined,

- To know the cash position of the institution

- To know the source of income, production and other expenditure of the business probable financial risks of the business

e. Socio Economic Aspects: Here the analyst like to observe the contribution of the business to the country’s GDP, the employment generated, the sort of adverse impact of the business on the environment, if an other benefit to the country.

f. Security Aspects: Along with observation of different aspects and views of the projects, the Officer should also see closely the aspects of the projects and ensure about the reliability to the mortgaged property/assets. Ensure proper survey or verification of the security offered .Ensure attachment of survey report.

Organizational layout of IFIL SME loan

- Account Division

- Investment Division

- IT Division

Reason of SME program from the view point of IFIL

The main focus of IFIL is to develop human and economic position of a country. It’s function is not limited only to providing and recovering of loan. But also try to develop economy of a country. So reason for this program from the viewpoint of IFIL are:

- Support Small Enterprise: The small enterprise which requires 2 to 30 lacks taka loan, but these has no easy access to the banks/financial institutions. For example: In the of 3 to 8 lacs amount of loans is provided without any kind of mortgage.

- Economic Development: Economic development of a country largely depends on the small and medium seal enterprises. Such as, if we analyze the development history of Japan, the development of small & medium scale enterprises expedite the development of that country.

- Employment Generation: The bank gearing employment opportunities by two ways:

Firstly, by providing loan to the small enterprises expanding, these business requires more workers.

Secondly, Small & Medium Enterprise (SME) program requires educated and energetic people to provide savories to entrepreneurs.

- Profit Marking: SME program is a new dimensional banking system in the banking world. Most of the Officer’s are providing door to door services to the entrepreneurs. The entrepreneurs are satisfied by the service of this bank and the bank also makes more profit.

- Encourage Manufacturing: A focus of IFIL is to encourage manufacturing by the entrepreneurs who are producing by purchasing various types of materials. Officer’s try to educate them to produce material if possible because if they can produce in line of purchase profits will be high.

- Spread the experience: Another reason of IFIL is to spread the knowledge of regarding various businesses. The customer services officer get knowledge from various businesses is and try to help the entrepreneurs who have shortage of the gathered knowledge by Officer’s.

The Officer’s who are the driving force of Investment division of IFIL also gather knowledge about various businesses and make stronger knowledge base

Security and Documentation Against Lease/BIAM/SPSM/ SME

A document is a written statement of facts and a proof or evidence of particular transaction between parties involved. While allowing any disbursements against credit facilities to borrowers, it should be ensured that prior to any disbursements; security documentation is fully and properly completed.

Purpose of Decorate Documentation and its Importance

Documentation is necessary for the acknowledgement of a debt and its terms and conditions by the borrower and the creation of charge on the securities in favor of the IFIL by the borrower. Correct and proper documentation allows a bank to take legal measures against the borrowers in the of non-payment of the debt.

If filing a suit with the courts against a default borrower becomes necessary, the court will first review all documents. If any of the documents is found to be defect or incomplete, the very purpose of security documentation will be defeated and a court ruling in favor the bank can not expected. Proper care should, therefore, be taken while completing security documentation.

Type of Securities

The following listed securities may be obtained from borrower against loan to enterprises, either individually or in a combination. It is really up to the bank what they would like to accept as security from the borrower as not all the securities stated below are suitable:

- Mortgage of loan and other immovable property with power of attorney to sell

- Lien of Fixed Deposits receipts with banks and other non-banking financial institutions, lined, these have to confirmed by the issuer ( Now these are rarely accepted)

- Lien of Pratirakshay sanchay patra, Bangladesh sanchay patra, ICB unit certificates and wage earner development bond, all considered Quasi or Near cash items. All these instruments, one liend, have to be confirm by the

- Lien of shares quoted in the stock exchange ( This is rarely accepted)

- Pledge of goods (Banks are akin to stay away from such securities now a days)

- Hypothecation of Goods, Book Debt & Receivables, Plant & Machineries

- Charge on fixed assets of a manufacturing enterprise

- Lien of cheque, Drafts and order

- Lien of work orders, payment to be routed through the bank and confirmed by the issuer.

- Shipping documents of imported goods

Land related securities documentation process

Each SME unit office will lilies with at least two local lawyers who will work on behalf of the bank. These always will be employed whenever a loan sanction is accepted by a borrower and where the security will be landed and immovable property.

Any one of the lawyers will be provided with photocopies of all the relevant land related documents and while handing over show the original documents to them,. The lawyers will carry out checks of the originals and if satisfied returned to the borrower. The documents generally provided are:

- Title Deeds or Deed of conveyance otherwise known as ‘Jomeer Dalil’ which signifies ownership of a particular land.

- Baya Dalil or Chain of Documents which signifies that the conveyance of titles has been proper and legal.

- Mutation Certificate if Khatian which signifies that the title if the land has been duly registered in the Government/Sub-registerar’s records.

- Duplicate Carbon Receipt or DCR

- Latest Khajna or land rent receipt

- Purchase such as CS Khatian, SA Khatian and BS Khatian

- Mouja Map

- Municipal rent receipts if the land falls within a municipal area

The lawyer will then carry out a search at the Sub-registrar of land’s office to check if the proffered land is actually registered in the name of the proposed mortgagor and whether the said land is free from any encumbrances. The Sub-register’s office, which means that the land or immovable property can be mortgaged to the bank, then the lower, will provide his own opinion on the acceptability of the property, whether it is legally held and explain the chain of ownership.

If all is acceptable, the lawyer will draw up the Mortgage Deed that will be registered, the irrevocable power if attorney to sell the land and the Memorandum of Deposit of Title Deed.

The lawyer will have the borrower or the Mortgagor, if different or 3rd party, sign the documents in front of the Sub-registrar of land to register the mortgage, The Officer must ensure that the receipt for the original Mortgage deed must be signed off (Discharged) at the back of the receipt so that the bank may obtain the originals in the future. The borrower will bear all the charges and will pay directly at the Sub-Registrar’s office including the cost of the stamp paper required.

The cost of the lawyer will also be realized from the borrower be an account payee cheque in favor of the lawyer and handed over to the lawyer straight away. The charges related to the creation of mortgagee and other associated costs are incorporated in a separated sheet and are attached herewith.

The Officer will have all other security documents, as sent by SME HO, signed by the borrower and hand carry all the security documents including all the original land documents and deliver those to the credit administration officer who will check the list of documents and receive those through a check list in writing. The credit administration officer once satisfied will prepare the disbursement memo to disburse the loan.

There are two type of mortgagee’s that are popular and usually accepted in Bangladesh:

i) Equitable Mortgage or Memorandum of Deposit of Title Deeds

It is created by a simple deposit of title deeds supported by a Memorandum of Deposit of Title Deeds along with all the relevant land documents. All the searches and verification of documents as stated above must be carried out to validate the correct ownership of the property. This deed also provides the bank power to register the property in favor of the bank for further security, if needed.

ii) Registered Mortgage

It is created by an execution of a Mortgage Deed registered irrevocably in favor of the bank at the Sub-Registrar of land’s office. This virtually gives the bank the right to posses and self if accompanied with a registered irrevocable power of attorney to sell the property executed by the owner of the property, in case of default.

Basic Charge Documents

Sanction Letter

Once a loan is approved, the borrower is advised by a ‘Sanction or offer letter’ which states the terms and condition s under which all credit facilities are offered and which forms an integral part of there security documentation. If the borrower accepts, then a contract between the IFIL and the borrower is formed and which both party are obligated to perform. Accordingly, all other charge documents and securities are drawn up and obtained. A standard sanction letter is attached herewith.

All documents shall be stamped correctly and adequately before or at the time of execution. An un-stamped or insufficiently stamped document will not form basis of suit. Stamps are of 4 (Four) kinds. These are Judicial, Non judicial, Adhesive and Embossed impressed.

Documents to be executed (Signed) by the borrowers concerned must be competent to do so in official capacity. Following precautions should be taken at the time of execution of the security documents:

- The signature on the documents should be made in the presence of the Officer. The Officer should sign as witness on all charge documents.

- The document are to be filled in with permanent ink or typed

- If the document consist more than I page, the borrower should sign on each page

- If the signature of any third party is required to be obtained whose specimen signature is not available, then the main applicant should verity the specimen signature of the third party

- No document or column in any document should remain blank

- As far as possible there should be no erasure, cancellation or alternation in the document. If, however, there is any correction, overwriting or alteration, then that must be authenticated by a full signature of the signatory.

After stamping and execution of documents, the question of registration comes up. However, not all documents are required to be registered.

For the extension of any type of credit/loan facility, the following loan documents, which are considered basic, should be obtained from all borrowers:

- Demand Promissory Note

- Letter of Continuity ( This is not always taken if there is only loan disbursement)

- Letter of Arrangement

- General Lease/ HPSM/BAIM /SME Loan Agreement

- Letter of Disbursement

- General Loan Agreement

- Letter of Disbursement; Basically a letter requesting disbursement of the loan

- Letter of Installment, in case the facility is to be repaid in installment

Other Basic Charge Documents

i) Demand Promissory Note (DP Note)

It is a written promise by a borrower to pay the whole amount of existing or future loans/credit facilities on demand. It also gives the banks power to ask the borrower to repay the loan amount with interest without any prior notice.

Section 4 of the Negotiable Instrument Act 1881 defines a promissory note as an instrument in writing, signed by the maker, to pay a certain sum of money only to, or the order of, a certain person, or to the bearer of the instrument, following precautions are to be taken while preparing a promissory note.

Type the amount of the credit facility/loan in words and in figures

Type the rate of interest for the loan which the borrower will subject to verify the signature of the borrower.

ii) Letter of Continuity

This instrument is used in conjunction with the demand promissory note. This is to secure rights of recovery for existing and future credit facility, which are advanced in parts or on a recovery basis. Loan accounts may from time to time be reduced or even the balance in the said loan account may be in credit so this instrument, validates the said D.P Note, for making further drawings under the facility continuously possible

iii) Letter of Arrangement

This is a right given by the borrower to the bank to cancel the facility at any time without having to assign any reason. This is also an acknowledgement by the borrower that the credit facility has been approved in his favor and the borrower has to execute all necessary documents to avail credit facility.

IV) General Lease Agreement

A loan agreement is an agreement of contract stating the general terms for the extension of a loan or credit facilities. The General loan agreement sets out the general standard terms and conditions governing the existing or future extension of loan or erudite facilities to the borrower.

v) Letter of Disbursement

This is simple a letter requesting disbursement of the loan/credit facilities at the agreed rate of interest.

Other Security Documents

i) Letter of Undertaking

This is a Deed of agreement executed by the borrower agreeing to commit to carry out any or a particular obligation to avail of loan/credit facility.

ii) Letter of Hypothecation of Goods & Stocks and Book Debt and Receivable:

These letters Hypothecation are actually two different sets of documents but because of their similarity, these are being explained together. These documents create an equitable or floating charge in favor of the bank over the goods and services and/ or book debts and receivables that are being financed where neither the ownership nor the possession is passed to the bank. Under this agreement, the borrower undertakes to keep the percent stock of goods and that which may increase from time to time in future in good condition. This hypothecation gives the bank the power to possesses and sell the mentioned goods and stocks or claims the book debts directly from the debars in order to settle the borrower’s dues to the bank.

iii) Letter of Hypothecation of Plant & Machinery

Under this agreement, the Borrower undertakes to keep the present plant and machinery at the present location in good condition and which gives the bank the power to posses and sell the mentioned plant and machinery to meet the borrower’s dues to the bank.

In case of limited company, both private and public, these Letters of Hypothecation with schedules are usually registered with the Registrar of Joint Stock of Companies (RJSC) which provide more security to the banks.

lv)Letter of Lien

A lien the right of one person to retain property in his hands belonging to another until certain legal demands against the owner of the property by the person in possession are satisfied. Thus a bank or a creditor who has in its possession a lien over the goods in respect of the money due by the borrower, as a general rule has the right to exercise certain powers to hold on to the security. In addition, if the bank has right to set off the value of the said goods or instrument in its possession, then the bank can sell the goods or encase the instrument to liquidate the dues by the borrower.

v) Right of Set Off

This deed of agreement gives the bank the right to offset the value of the goods or financial instrument in its possession and which has been discharged by the owner of that asset, against dues owned by the borrower.

vi) Letter of Disbursement

This agreement gives the bank the right to possess goods and other assets in a rented or leased premises of the borrower despite the fact that owner or the premises may be unable to realize dues from the borrower himself.

vii) Personal Guarantees

This is a guarantee of a person or third who is not the direct beneficiary of the loan/credit facility, but is equally liable for the loan. The involvement of a 3rd party creates additional pressure on the borrower to minimize the risk. The guarantor is the has to pay the entire outstanding loan and interest if the borrower fails to pay for any reason.

Selection of Potential Enterprise for SME

Enterprise Selection Criteria

The success of SME will largely depend on the selection of a business and man behind it. In terms of the business (Enterprise), the following attributes should be sought:

- The business must be in operation for at least one year

- The business should be environment friendly, no narcotics or tobacco business

- The business should be legally registered, i.e., valid trade license, income tax or VAT registration, wherever applicable.

- The business should be in legal trade, i.e.; smuggling will not be allowed or socially unacceptable business will not be entertained.

- The business must have a defined market with a clear potential growth

- The business must be located ideally close to the market and the source of its raw materials/suppliers. It should have access to all the utilities, skilled manpower’s that are required.

- Any risk assessed by the management in turn will become a credit risk for the bank. So effort should make to understand the risk faced by the business.

Entrepreneur Selection Criteria

In order to understand the capability of the management behind the business, the following should be assessed:

- The entrepreneur should be physically able and in good health, preferably between the age of 25-50. If he/she is an elderly person closer to 50, it should be seen what the succession process will be and whether it is clearly defined or not.

- The entrepreneur must have the necessary technical skill to run the business, i.e academic background or vocational training, relevant work experience in another institution or years of experience in this line of business.

- The entrepreneur must have and acceptable social standing in the community (People should speak highly of him), he should possess a high level of integrity (Does not cheat anyone, generally helps people), and morally sound (Participates in community building)

- The entrepreneur must possess a high level of enthusiasm and should demonstrate that he is in control of his business ( Confidently replies to all queries ) and has the ability to take up new and fresh challenges to take the business forward.

- Suppliers or creditors should corroborate that he pays on time and is general in nature

- Clear-cut indication of source of income and reasonable ability to save.

Guarantor Selection Criteria

Equally important is the selection of a guarantor. The same attribute applicable for an entrepreneur is applicable to a guarantor. In addition he should posses the followings:

- The guarantor must have the ability to repay the entire loan and is economically solvent ( Check his net worth)

- The guarantor should be aware about all the aspect of SEDF loan and his responsibility

- Govt. and semi-govt. officials can be selected as a Guarantor such as schoolteacher, college teacher, doctor etc.

- Police, BDR and Army persons, political leaders and workers, and Imam of mosque can not be selected as a guarantor.

- The guarantor should know the entrepreneur reasonable well and should preferably live in the same community.

Terms and Conditions of Lease ,HPSM, BAIM/SME Loan

The SME department of IFIL will provide small loans to potential borrower under the following terms and condition:

- The potential borrowers and enterprises have to fulfill the selection criteria

- The Lease/SPSM/BAIM/SME amount is between tk 1 lac to 1000 lacs.

- SME will impose loan processing fees for evaluation / processing a loan proposal as following;

1. Service fee is 0.25% of total

2. Documentation fee is 0.50% of total

Lease, BAIM,HPSM and SME can be repaid in two ways:

a) In equal monthly loan installment with monthly interest payment, or

b) By one single payment at maturity, with interest repayable a quarter end residual on maturity

- Lease/ SPSM/SME Loan may have various validates, such as, 3 months, 4 months, 6 months, 9 months, 12 months, 15 months, 18 months, 24 months, 30 months and 36 months.

- The borrower must open a bank account with the same bank and branch where the SME has its account

- Loan that approved will be disbursed to the client through that account by account payee cheque in the following manner: Borrower name, Account name, Banks name and Branch’s name

- The loan will be realized by 1st every months, starting from the very next months whatever the date of disbursement, through account payee cheque in favor of IFIL A/C . With Bank’s named and branches name

- The borrower has to issue an account payable blank cheque in favor of IFIL before any loan disbursement along with all other security.

- The borrower will install a signboard in a visible place of business of manufacturing unit mentioned that financed by “IFIL”.

- The borrower has to give necessary and adequate collateral and other securities as per bank’s requirement and procedures.

- SME, IFIL may provide 100% of the Net Required Working Capital but not exceeding 75% of the aggregate value of the Inventory and Account Receivables. Such loan may be given for periods not exceeding 48 months. Loan could also be considered for shorter periods including one time principal repayment facility, as stated in loan product sheet.

- In case of fixed asset Financing 50% of the acquisition cost of the fixed asset may be considered. While evaluating loans against fixed asset, adequate grace period may be considered depending on the cash generation after the installation of the fixed assets. Maximum period to be considered including grace period may be for 36 months.

Monitoring

Monitoring is a system by which a bank can keep track of its clients and their operations. So monitoring is an essential task for a Officer to know the borrowers activities after the loan disbursement. These also facilitate the build up of an information base for future reference.

Important of Monitoring

Through monitoring a Officer can see whether the enterprise invested the sanctioned amount in the pre-specified area of his business, how well the business is running, the attitude of the entrepreneur, cash credit sales and purchase, inventory position, work in process and finished goods etc, This information will help the Officer/IFIL to recover the loan accruing to the schedule and to take the necessary decisions for repeat loans. Moreover, monitoring will also help to reduce delinquency. Constant visit over the client /borrower ensures fidelity between the bank and the borrower and tends to foster a report between them.

Area of Monitoring

The purpose is to know the entire business condition and all aspects of the borrowers so that mishap can be avoided.

a. Business Condition:

The most important task of the Officer to monitor the business frequently, it will help him to understand whether the business is running well or not, and accordingly advice the borrower, whenever necessary. The frequency of monitoring should be at least once month if all things are in order.

b. Production:

The Officer will monitor the production activities of the business and if there is any problem in the production process, the OFFICER will try to help the entrepreneur to solve the problem. On the other hand the OFFICER can also stop the misuse of the loan other than for the purpose for which the loan was disbursed.

c. Sales:

Monitoring sales proceed is another important task of the OFFICER it will help him to forecast the monthly sales revenue, credit sales etc. which will ensure the recovery of the monthly loan repayments from the enterprise as well as to take necessary steps for future loans.

d. Investment:

It is very important to ensure that the entire loan has been invested in the manner invented. If the money is utilized in other areas, than it may not be possible to recover the loan.

e. Management of raw materials:

In case of a manufacturing enterprise, management of raw materials is another important area for monitoring. If more money is blocked in raw materials then necessary, then the enterprise may face a fund crisis. On the other hand the production will suffer if there is not enough raw materials.

Monitoring System

a. The Officer can consider the following things for monitoring:

The Officer will monitor each business at least once a month. He will make a monitoring plan/ schedule at beginning of the month

During monitoring the Office must use the prescribed monitoring from and preserve in the client file and forward a copy of the report to the head office immediately.

b. A branch will maintain the following files:

The file will contain

Purchase Receipt,

Delivery Memo’s,

Quotations and All other papers related to furniture and fixture procurement

c. Other fixed assets and refurbishment

All fixed assets and refurbishment related papers such as purchase receipt, Delivery memo’s, Quotation, Guarantee and Warrantee papers, Servicing related papers and any other paper related to fixed assets are refurbishment will be in this file.

d. Lease agreement file

This file will contain all papers related to lease agreement between the office and owners of the leased premises

e. Individual client file

Individual files are to be maintained for each borrower and will hold loan application, Loan Proposal, Copies of Loan Sanction Letter, Disbursement Memo, Monitoring Report, CIB application and Report, Credit report from other bank and all other correspondents including bank receipt.

f. Statement file

All types of statement sent to Head office will be kept in this file chronologically

g. Office instruction file

All kind of office instruction regarding administration should be kept in this file.

h. Operating instruction and guideline files.

All kind office instruction and guidelines related to operating should be kept in this file

i. New forms introduction file

All minutes of meeting, whenever held, should be kept in this file.

j. Security documents and legal aspect file

One set of security documents and lawyer’s opinions and suggestions regarding issue will be kept in this file. The original should be send to SME head office on a weekly basis

k. Survey form file

After conducting survey, all survey will be kept in this file chronological.

Customer Handling

In our country there are about 52 banks and 29 financial institutions working with the people with varieties of their attractive products and services and there is a high level amongst competition each other. For sustaining, they offering various types of innovation for better service for the clients, so, to reach the closer best to the clients direct marketing gaining momentum in the country. In terms of Lease, HPSM, BAIM and SME its targeted entrepreneurs are the subject of dealings to achieve the objectives of IFIL and its policy is to contact with clients directly with a confident manner. Some key activities of a Officer:

- Conducting Survey Properly

- Individual contact with entrepreneur for selecting potential borrower

- Deliver IFIL’s products and other services

- Keeping in close touch with clients to develop mutually beneficial long term relationship

There are two types of dealings which customer services officer do as follows:

Regular : The main duty of a Officer is to search new potential customer by providing door to door services. They talk with clients and monitor their manners, activities of their business and then provide the loan of the potential customers.

Unique: They also handle some unique customers who come to their unit offices to get the loan. Especially these clients demand 10-20 lacs for their business. In this case, clients have to provide collateral securities in favor of IFIL. The securities may be land or fixed deposits. It takes little bit of time to disburse the loan for an Officer.

Challenging Issues for NBFIs in Bangladesh

(a) Sources of Funds

NBFIs collect funds from a wide range of sources including financial instruments, loans from banks, financial institutions, insurance companies and international agencies as well as deposits from institutions and the public. Line of credit from banks constitutes the major portion of total funds for NBFIs. Deposit from public is another important source of fund for NBFIs, which has been increasing over the years. NBFIs are allowed to take deposits directly from the public as well as institutions. According to the central bank regulation, NBFIs has the restriction to collect public deposits for less than one year, which creates uneven competition with banks as banks are also exploring the business opportunities created by NBFIs with their lower cost of fund. Although recent reduction of the minimum tenure of the term deposit from one year to six months for institutional investor has had a positive impact on their deposit mobilization capacity. NBFIs can develop attractive term deposit products of different maturities to have access to public deposits as these are one significant source of their funds.

(b) Cost of Fund

The structure of cost of fund for NBFIs does not follow any unique trend. Banerjee and Mamun (2003) showed that weighted average cost of fund for the leasing companies is always positioned much higher than that of banks. According to their study, cost of funds for leasing companies varied between 12.5 to 15.5 percent while that of banks was between 8.5 to 9.5 percent. Choudhury (2001) mentioned that about 15 percent of the deposit of the banking sector was reported to be demand deposits, which are interest free while 35 percent constituted low cost saving deposits having an average of 4 to 5 percent interest rate and the rest were fixed deposits bearing an average of 9 percent interest rate. Thus the weighted average cost of fund for banks would be at best 7 to 8 percent, which is almost half of that of IFIL.

(c) Asset-Liability Mismatch

Asset-liability mismatch is another cause of concern for NBFIs. Demand for funds to meet the increasing lending requirements has increased many times. But the availability of funds has become inadequate as NBFIs are mostly dependent on loan from commercial banks. International Finance Corporation (1996) observed that leasing companies are in a great dilemma while managing the mismatch between their asset and liability. According to IFC, the average weighted life of the company’s business portfolio should be less than the average weighted life of its deposits and borrowing in its operating guidelines for a leasing company. Only one company in Bangladesh was successful in maintaining the above guideline (Banerjee and Mamun (2003)). Therefore, NBFIs have to explore alternative ways for raising funds.

(d) Investment in High Risk Portfolio

It is already mentioned that cost of funds for NBFIs are higher than that of banks. In order to sustain the high cost of borrowing, NBFIs may be inclined to invest in the high return segments, which can expose them to commensurately higher risks. Moreover, fierce competition among competitors may also force many NBFIs to reduce the margin at the expense of quality of the asset portfolio. This strategy may eventually create the possibility of an increase in the non-performing accounts. Unless adequate risk management capabilities are developed, the growth prospects of NBFIs would not only be hindered but it might also be misapprehended (Sarker, 2004).

(e) Product Diversification

NBFIs emerged primarily to fill in the gaps in the supply of financial services which were not generally provided by the banking sector, and also to complement the banking sector in meeting the financing requirements of the evolving economy. With regard to deployment of funds, the total outstanding lease, loan and investment by NBFIs stood over BDT 34 billion, BDT 26 billion and BDT 3billion respectively by the end of September, 2006. NBFIs are permitted to undertake a wide array of activities and should therefore not confine themselves to a limited number of products only. Leasing, no doubt, presents a good alternative form of term financing. Even in leasing, investments were not always made in the real sector and non-conventional manufacturing sector. Almost all the leasing companies concentrated on equipment leases to BMRE (Balancing, Modernization, Replacement and Expansion) units only. New industrial units were hardly brought under the purview of leasing facilities. This implies that the new customer base has not been created and the growth of industrial entrepreneurship could not be facilitated through NBFI financing packages. Diversifying the product range is a strategic challenge for NBFIs in order to become competitive in the rapidly growing market.

(f) Competition with Banks

With the advent of new NBFIs, the market share is being spread over the competing firms and the demand facing each firm is becoming more elastic. Active participation of commercial banks in the non-bank financing activities has further increased the level of competition in the industry. Leasing was considered as a non-bank financing activity until recently. But a large number of banks has also shown their interest in the leasing business and has already penetrated the market. For banks, public deposit is one major source of funds which they can collect with relatively lower cost. Thus the business environment for NBFIs has become more challenging as they have to face uneven competition with banks in terms of collecting funds.

(g) Lack of Human Resource

Skilled and trained human resource is considered as an important component for the development of any institution. Due to the recent growth of NBFIs, availability of experienced manpower is a challenge for this industry. The supply shortage of efficient resource personnel has been leading to a significant increase in the compensation package, which is also a cause of concern for NBFIs. The industry experts believe that although there exist enormous growth opportunity the market is still quite small and scope of work for skilled personnel is very limited compared to that of banks. This makes the competent personnel to switch from NBFIs to other institutions after a certain period implying low retention rate of skilled human resource.

(h) Weak Legal System

Although the default culture has not yet infected NBFIs to any major extent, they face difficulties in recovering the leased assets in case of a default. Moreover delays in court procedures create another cause of concern. The situation cannot be improved only by making the legal system stronger through enactment of new laws rather ensuring proper implementation existing ones is more of concern

(i) Lack of a Secondary Market

Even in cases when the defaulted asset is recovered, the disposal of the same becomes difficult because of lack of an established secondary market. For the promotion of a secondary market, NBFIs may consider initiating the concept of operating lease instead of the prevalent mode of finance lease incase of these recovered assets to create a demand for second hand or used machinery and equipment.

Suggested Alternatives

(a) Exploring Alternative Sources of Funds

The finance and leasing companies aOfficerss the world are using different sources for collecting funds. NBFIs in Bangladesh may also explore the possibilities of gaining access to new sources of funds like issuance of commercial paper and discounting or sale of lease receivables. However, in releasing such new products, some regulatory changes have to be made. Another innovative and promising source of funds may be the securitization of assets. In this connection, IPDC launched first asset backed securities in 2004 as an alternative source of funding. This new instrument emerged as an important tool and added a new dimension in the financial market. The core attraction of this scheme was the tax benefit made available to investors at the rate of 10 percent at the time of credit of such interest or at the time of payment thereof, whichever is earlier, and this deduction was deemed to be final

Discharge of tax liability (Chowdhury, 2005). But changes in taxation policy in 2005 by the government have made the future of this instrument less attractive for the concerned financial institutions.

(b) Competition and Product Diversification

NBFIs in Bangladesh are operating in a highly competitive environment. The competition for NBFIs is even more challenging as they have to compete with banks. Given the changes in the business environment, the need for product diversification is very important. At present, lease financing constitutes 55 percent of the total long term assets of NBFIs. The remaining part concentrates mainly on term financing and housing finance. Some of NBFIs are primarily engaged in leasing, some are also diversifying into other lines of business like merchant banking, equity financing etc. Currently, 22 NBFIs (out of 29) specialize in lease financing. NBFIs are permitted to undertake a wide array of activities and therefore should not confine themselves to one or two types of product only. Leasing, no doubt, presents a good alternative form of term financing but NBFIs should also venture into diversified use of their funds such as merchant banking, venture capital financing, factoring, etc. for a healthy growth of the capital market.

(c) Enhancing Capital Market Activities

NBFIs around the world carry out a significant role in the development of the capital market. Strong institutional support is necessary for a vibrant capital market which is the core of economic development in any market based economic system. NBFIs through their merchant banking wing can act in this regard. A total of 30 companies are now listed as merchant banks in Bangladesh, of which 23 are full-fledged, 6 are issue managers, and only one is a portfolio manager. Only nine NBFIs have registered with SEC for performing merchant banking activities. But their activities in the capital market are rather limited (Financial Sector Review, Bangladesh Bank, 2006). Active participation of merchant banks is essential to accelerate the capital market activities which can expedite the economic growth of the country. The success of merchant banking operations is largely linked to the development of the security market. So NBFIs should concentrate more on their opportunities in the capital market.

(d) Issues of Taxation

The financing mode of lending and leasing are totally different from one another. The concept and procedure particularly the accounting and taxation system are also quite different. So it is advisable not to mix up the two different operations, otherwise it might distort the basic financial norms. As the tax treatment is totally different in leasing business, mixing up of lending and leasing in the same business portfolio might create the possibility of tax evasion (Sarker, 2004).

(e) Market Segmentation

It has been discussed earlier that though banks and NBFIs compete with each other they can also perform complementary functions. As suggested by Jamal (2004) and Sarker (2004), to function as complementary institutions both banks and NBFIs should follow some ethical and technical norms. Banks wishing to enter in the leasing business, which is essentially a core operation of NBFIs, should do so through opening subsidiaries so that a level playing field for NBFIs can be maintained. This is needed as banks have access to lower cost funds compared to NBFIs, which puts the former in an advantageous position. Alternatively, banks can go for joint financing under syndication arrangements with leasing companies on any project proposal. Again, banks can concentrate on working capital finance and foreign exchange operations, which matches more with their asset-liability management.

Long term investment like financing capital machineries can be done by NBFIs and in the event when banks want to engage in such activities they can place their funds with an NBFI to extend lease facility for those machineries. Jamal (2004) mentioned that this is important for two reasons: “first, in case of lease facility, the machineries will remain under the ownership of leasing companies, who will have absolute authority and control on their assets. Second, machineries will be imported in the name of a leasing company and letter of credit will be opened against its name. So, over invoicing or under invoicing may be averted and thereby more transparency will be ensured and tax evasion may be plugged”.

Conclusion

Banks and Non-Bank Financial Institutions are both key elements of a sound and stable financial system. Banks usually dominate the financial system in most countries because businesses, households and the public sector all rely on the banking system for a wide range of financial products to meet their financial needs. However, by providing additional and alternative financial services, NBFIs have already gained considerable popularity both in developed and developing countries. In one hand these institutions help to facilitate long-term investment and financing, which is often a challenge to the banking sector and on the other, the growth of NBFIs widens the range of products available for individuals and institutions with resources to invest. Through their operation NBFIs can mobilize long-term funds necessary for the development of equity and corporate debt markets, leasing, factoring and venture capital. Another important role which NBFI’s play in an economy is to act as a buffer, especially in the moments of economic distress. An efficient NBFI sector also acts as a systemic risk mitigator and contributes to the overall goal of financial stability in the economy. NBFIs of Bangladesh have already passed more than two and a half decades of operation. Despite several constraints, the industry has performed notably well and their role in the economy should be duly recognized. It is important to view NBFIs as a catalyst for economic growth and to provide necessary support for their development. A long term approach by all concerned for the development of NBFIs is necessary. Given appropriate support, NBFIs will be able to play a more significant role in the economic development of the country.

Stock in Bangladesh has been developing over the passage of time respect to the base, scope product, member and investors. This has two stock exchanges, good number of brokers, sub brokers, listed companies,1 depository institution, depository participants,34merchant bankers, underwriters, Debenture trustees,16 portfolio managers, banker to Issues, 2 credit rating agencies , and Venture capitalist firm, Number of investors in the stock market has also been increasing.

The market is experiencing increased number of IPOs the primary market and record volume of transaction of securities in the organized stock exchanges. Corporate firms are becoming aware of opportunities for rising from the stock market. Besides, they are also coming to know the different alternatives to the collection of funds from the stock market the opportunity of stock market is attracting to huge number institutional investors and individual investors. Apart from this, this has invited other parties –existing and potential to the stock market for exploiting emerging opportunities. This expansion of stock markets in Bangladesh experienced many ups and down in the stock market in the past. Investor lost capital to the market and consequently, lost confidence in the stock market. Under these circumstances, adequate and effective risk management system in the stock market is essential in order to protect the interest of all parties involved and thereby ensuring the integrity of the stock market in Bangladesh. Security and Exchange Commission and stock exchanges have already taken both regulatory and administrative measures for stabling effective risk management system.

Stock market in Bangladesh has undergone sea change in technology in order to the make the market modern and thereby giving apace to the risk management system. Technological change in modus operandi of stock market has brought it at par of international stock market community. This change also caused and unexpected degree of systematic risk which calls for effective regulatory and administrative measures in place. Transparent, vibrant and efficient stock market to provide avenue for developments of saving for capital formation and economic growth.

Investment decisions both are an art and science. To succeed in investing, we must think in term of what is expected to happen. We know what has happened, but the past may or may not repeat itself. Although future is uncertain, it is manageable, and a through understanding of the basic principles of investing will allow investors to cope intelligently.

Basically share price depends upon:

- Economic / Market Factor

- Industrial Factor

- Company Factor

Economic / Market Factor: There are many sub factors are in the economic factor.

These are:

1. Global Economy

2. Macro Economic factor of a country

3. Investment Rules and Regulation

4. Export import Policy

5. Political Condition

6. Exchange rate

7. Interest rate

Industrial Factor: In industrial factor.

These are: 1. Business life cycle

Company Factor: Company related 1. Management

2. New Investment

3. New Product Development

4. New Market Development

Objective of the study: Find out time period when the share price go up and go down.

Reason for choosing the topic: It will help the investor to buy or sell share of Shariah based Company and renowned Pharma and Cement Company.

Scope of the Report: Company’s Financial Analysis ad

Methodology: Using FGD and trend analysis.

Source of Data:Dhaka Stock Exchange Library. Last 5 years Daily and Monthly Data.