Executive Summary

Banks plays vital role in the economy of the country. Countries development greatly depends on the activities of the banks. Commercial banks take deposit & give away loans. This loan build on industrialization’s Commercial Bank helps in savings. Savings create investment. Investment contributes the GDP. Finally the commercial banks play on important role in import of country through opening of back L/Cs. It helps to earn foreign currency by helping the exporters in export.

This report is prepared on the basis of my three months practical experience at Shahjalal Islami Bank Limited. The internship program helped me to learn about the practical situation of a financial institution. This program helped me to implement my theoretical knowledge into practical & realistic work environment.

In the age of modern civilization bank is playing its spending role to keep to the economic development wheel moving. The cooperation of the bank is needed in every economic activity. Bank provides means & mechanisms of transferring command over resources from those who have an excess of income over expenditure to those who can make use of the same for adding to the volume of productive capital. There are a large number of small savers with small amount of savings who are generally reluctant to invest their surplus income because of their lack of adequate knowledge about complicated investment affairs. The bank provides them with the safety, liquidity and profitability by means of different savings media offering varying degrees of a mix of liquidity return and safety of savings. The saving banks use as their key of business. They invest the savings in higher degree of return and maximize their profit in business.

Shahjalal Islami Bank Limited is a scheduled Islamic commercial bank registered by the Bangladesh Bank. Shahjalal Islami Bank follows the rules and regulations prescribed by the Bangladesh Bank for Scheduled commercial banks. The functions of the bank co0ver a wide range of banking and functional activities to individuals, firms, corporate bodies and other multinational agencies.

Introduction

Managing the function of each department efficiently and a proper flexible payment procedure is enough for a Bank & financial institution success. A prudent bank management should always try to make an appropriate balance between the payments & receive .The payments & receive flexibility with in a short time give the customer satisfaction, which leads the more clients in the bank. The transaction will be automatically high and increase the commission and profit of the Bank. A bank financial institution might be fault with inappropriate function of department and payment procedure for the purpose of maximizing its potential return.

In such a situation, the banking financial institutions might find itself in serious financial distress, instead of improving its financial health. Consequently, not only the depositors but also the donor agency or general shareholders will be deprived of getting back their money from the bank. The deterioration of loan quality also affects the intermediaries’ efficiency of the financial institution and thus economic growth process of the country. This is the reason for an appropriate function of each department on the bank and payment procedures are being regulated in all banks and financial institutions.

Origin of the Report

I have completed my Master’s of Business Administration Program from Stamford University Bangladesh & internship program is compulsory for MBA students of the faculty of Business Administration. This program is for three months. However I was assign to Gulshan-1 Branch of SJIBL to complete the program. During this period I worked in the branch & after completing the practical work I prepare the report.

Shahjalal Islami Bank Limited is one of the popular Banks in Bangladesh which recruit me in its Gulshan-1 branch as internee & help me to prepare this report. Under the efficient supervision of experienced staff & executive this report is made. I have prepared the report on this topic by counseling with my honorable course supervisor.

Objective of the Study

The main objective of this report is to fulfill partial requirements of M.B.A program. The objectives of the study are to have some practical knowledge about the function of each department of Shahjalal Islami Bank. The study objective is to evaluate the function of department and payment procedure performance. Thus I have tried to find out some means, which may help to improve Bank performance.

As one of the main objectives of internship is to gather experience, I have tried to put some of the experiences that I have learnt from my internship in this report.

The objectives of the study can be pointed out as follows:-

To present an overview of Shahjalal Islami Bank Ltd.

To evaluate the performance of Shahjalal Islami Bank during financial years.

To appraise financial performance of Shahjalal Islami Bank Ltd.

To examine the performance indicator of each department.

To develop self-knowledge and skill in the professional field and finding the way

to further research in future

Rational of the Study

Bangladesh is one of the underdeveloped countries in the world. It is so, because of several reasons. The economy of Bangladesh is more or less a mixed economy. For this reason various measures have been taken since the post liberation war period.

In an economy like this, banking sector can play an important role to improve the overall socio-economic condition of the country. The banks by playing the role of an intermediary can mobilize the excess fund of surplus sectors to provide necessary finance, to those sectors, which are needed to promote for the sound development of an economy.

The process of economic development of Bangladesh has been seriously constrained by the continuing crisis of banking service with affordable price. This paper attempts to discuss this vital issue is designed to provide theoretical and empirical insights to this problem

A number of studies have been made to evaluate the performance of Shahjalal Islami bank Ltd, in the field of Function of department and payment procedure. The reason behind doing this to manage the bank service daily efficiently and customer can withdraw the cash easily within short time from the bank.

Scope of the Study

We know from the early study that, the Shahjalal Islami bank Ltd is a prominent commercial bank in Bangladesh. Shahjalal Islami bank Ltd provides various product & services in various sector. It launches its 51st Branch just few days ago. Each of branches is providing services on department basis .Such as Accounts, Deposit, Advance, Card, Remittance, Foreign exchange, Clearing and CIBTA department.

I have outlined all the topics earlier, but this study covers only “GENERAL BANKING SYSTEM OF SHAHJALAL ISLAMI BANK LTD”. This is an effort to analyze performance of the Bank.

Methodology of the Study

The study is based on, Both the Primary and Secondary data. The primary data is collected from the Shahjalal Islami bank Ltd. Booklet, recorded files, products & services, interest rates & charges, banking operations, organization structure, management personnel, and data bank of Shahjalal Islami bank Ltd. Head office.

The secondary data are collected from the interview of different officers and stuffs of various departments like Remittance, Foreign exchange, Account, Advance and CIBTA department etc.

Related literature of study is collected from various journals, books. The book and writers are addressed in the bibliography section.

Methodology what I have applied to prepare this Report

Observation

Projection Techniques

Depth Interviews

Interaction with the Customers and Bank Officers.

Sources of Data

Doing practical work in different desks

Study of old files and documents

Personal investigation.

Bank Officers and Customers

Collection of Data from different statements and abstracts.

Internet, Brochures, annual report etc.

Report Preview

This report contains eight chapters. Chapter one is about relevant introductory information about the report. Chapter Two will provide overview of The Shahjalal Islami bank Ltd. Chapter Three covers general banking procedure of Shahjalal Islami bank Ltd. Chapter Four is contain financial information of SJIBL. Chapter Five is contain risk management of SJIBL. Chapter Six is contain function of Gulshan-1 BRANCH of SJIBL. Chapter seven contains other activities of SJIBL. Chapter Eight draws Conclusion, Recommendations and Bibliography.

An overview of Shahjalal Islami Bank Ltd

Shahjalal Islami Bank Limited (SJIBL) commenced its commercial operation in accordance with principle of Islamic Shariah on the 10th May 2001 under the Bank Companies Act, 1991. During last nine years SJIBL has diversified its service coverage by opening new branches at different strategically important locations across the country offering various service products both investment & deposit. Islamic Banking, in essence, is not only INTEREST-FREE banking business, it carries deal wise business product thereby generating real income and thus boosting GDP of the economy. Board of Directors enjoys high credential in the business arena of the country, Management Team is strong and supportive equipped with excellent professional knowledge under leadership of a veteran Banker Mr. Muhammad Ali.

During this time bank has highly recognized & praised by the business community, from the small entrepreneurs to large traders & industrial conglomerates. It has 52 branches at present.

Vision of SJIBL

To be the unique modern Islami Bank in Bangladesh and to make significant contribution to the national economy and enhance customers’ trust & wealth, quality investment, employees’ value and rapid growth in shareholders’ equity.

Mission of SJIBL

To provide quality services to customers.

To set high standards of integrity.

To make quality investment.

To ensure sustainable growth in business

Strategy of SJIBL

To strive for customers best satisfaction & earn their confidence.

To manage & operate the Bank in the most effective manner.

To identify customers needs & monitor their perception towards meeting those requirements

To review & updates policies, procedures & practices to enhance the ability to extend better services to the customers.

To train & develop all employees & provide them adequate resources so that the customers needs are reasonably addressed.

To promote organizational efficiency by communicating company plans, polices & procedures openly to the employees in a timely fashion.

To cultivate a congenial working environment.

To diversify portfolio both the retail & wholesale markets.

Our Motto: Committed to Cordial Service.

Management and Organization structure

The share holders as investors are in the position of proprietors, but the actual Direction of Shahjalal Islami Bank Ltd is in the hand of their elected representative.

The Board of Directors:

The board of is comprised of 22 members. Among them, it is elected directly by the share holders by the period of two years. The Managing Director of the Bank is also the member of the Board of Directors by the virtue of his office. The Board of Directors is headed by and elected Chairman.

The Board of Director is a bridge between shareholders and the executive body. Its activities concerned with policy formatting, strategic planning, board control over executive function etc.

Management:

The managing director (MD) of the SJIBL is the Chief Executive of the bank. His duty is numerous. He is responsible for administrating the business affaires of the bank. He is also concerned with planning and its implementation. The managing director also represents the bank to the meeting & response to the various inquiry of the board of directors. The managing director maybe appointed on contractual basis for certain period or maybe promoted from among the deputy managing director for certain period. Under the leadership of the managing director, there are three (03) managing Deputy Managing Director (DMDs) sixteen (16) divisions are found in SJIBL, each division is lead by either an executive Vice President (EVP) or Senior Vice President (SVP) or Vice President (VP) or Assistant Vice President (AVP)

Core Values

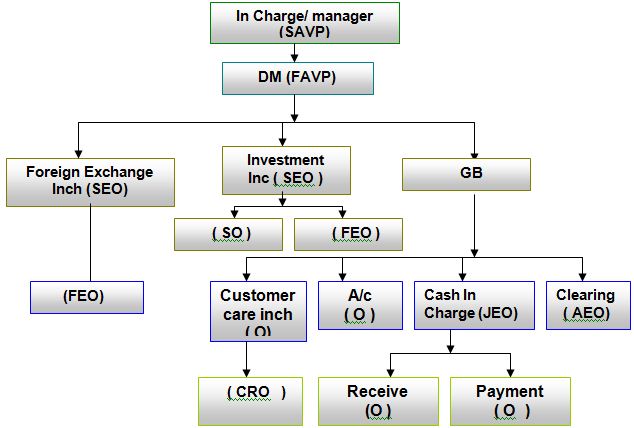

Organgram of SJIBL of Bijoynagar branch is shown here:

Future Direction

The objective for the years ahead is to become a highly professional and profitable bank to contribute to the economic development of the country. Priorities have been identified for implementation in the near future. These include looking out for new business lines, developing more products & services, widening branch network and introducing newer banking technology.

Even through global and national economy offers no immediate sign of fast growth, there is an apparent advantage of our bank in attracting business by offering better service at competitive terms. We believe the bank is well structured, well focused and in right platform to become a top ranking bank of the country within few years.

Human Reswource Division (HRD)

Human Resources Development:

In today’s competitive business environment, the quality of human resources makes the difference. The Bank’s commitment to attract high quality persons to work for it is reflected in the efforts of the Bank. In the face of today’s globalization, the Bank envisages to develop highly motivated workforce and equip them with latest skills and technologies. The Bank evolves human resources development strategy with a view to ensuring good working environment, a high level of loyalty and commitment, devotion and dedication on the part of the employees.

DEFINITION OF CREDIT

A transaction in cash or kind with an obligations repay at some specified time in the future is generally termed as credit or advance.

PRINCIPLES OF SOUND LENDING

The function of lending is very crucial to the banker. To ensure sound lending some principles should be followed. These are –

a) Safety

Safety is the mostly important thing to exercise the lending function. It also exercised only when it is safe and that the risk factor is adequately mitigated and covered. The success of the public depends upon the confidence of the depositing public. Safety depends upon:

The security offered by the borrower, and

The repaying capacity and willingness of the debtor to repay the loan with interest.

So the Banker should ensure that the securities offered are adequate and readily realizable and the borrower is a person of integrity, good character and reputation.

b) Security

The securities of the customers are insurance and Banker can fall back upon them in times of necessity. For the sake of safety he should ensure that the securities are adequate, marketable and free from encumbrances. Securities, which could be marketed easily, quickly and without loss, should be preferred.

c) Liquidity

Liquidity refers to the ability of an asset to convert into cash without loss within short time. The Banks should keep its funds in liquid state to meet the demand of the depositors in time. Short-term loans are granted against securities such as goods can be converted into cash easily and so liquid. So a bank should take adequate care so that the liquidity is not compromised.

e) Profitability

Like all other commercial institution banks also run for profit. Banks earn profit to pay interest to depositors, declare dividend to shareholders, meet establishment charges and other expenses, provide for reserve and for bad and doubtful debts, depreciation, maintenance and improvement of property owned by the bank and sufficient resources to meet contingent loss. So profit is an essential consideration. a banker should employ his funds such a way that they will bring him adequate return: The main source of profit comes from the difference between the interest received on loans and those paid on deposit. Anyway a banker should never give undue importance to profitability.

DIFFERENT CREDIT FACILITIES OFFERED BY SHAHJALAL ISLAMI BANK LTD.

Depending on the various nature of financing, all the lending activities have been brought under the following major heads:

OVER DRAFT

When a current account holder is permitted by the bank to draw more than what stands to his credits, such an advance is called an overdraft. The banker may take some collateral security or may grant such advance on the personal security of the borrower. Shahjalal Islami Bank Limited has given this overdraft facility to its clients.

Overdraft is of three kinds

Overdraft

—————————————————————-

I I I

Temporary Clean Secured

Overdraft (TOD) Overdraft (COD) Overdraft (SOD)

Temporary Overdraft

TOD is allowed to honor an important check of a valued client without any prior arrangement. As this facility is allowed for a very short period, it is called temporary Overdraft.

Clean Overdraft

Sometimes overdrafts are allowed against Land, Building etc. is called clean overdraft. Usually PBL, Dilkusha, branch does not maintain these two types of overdraft.

Secured Overdraft

When overdrafts are allowed against financial obligation, they are called secured overdraft. Overdraft (SOD). SOD is generally granted for smooth running of the client’s business.

CASH CREDIT

So far I have observed in this desk, a cash credit is an arrangement by which the customer is allowed to borrow the money up to a certain limit. This is a permanent arrangement and the customers need not to draw the sanctioned amount of money at a time. The borrower can draw the money as and when repaired. The borrower can put back any surplus. Interest is changed only to the amount withdrawn and not the whole amount sanctioned. Cash credit arrangement is usually divided into two ways:

Cash Credit pledge

Cash Credit Hypothecation

Cash Credit Pledge

In case of cash credit pledge, the possession of the goods belongs to bank and ownership of the goods belongs to the borrower and bank takes the possession of the goods as primary security.

The goods stored in go down under lock and key and it is under direct supervision of the bank. If the borrower wants to sell any portion of the pledged goods needs the bank permission with returning the value of the loan amount. It is therefore regarded as the most secured type of advance. PBL does not practice this type of loan facility.

Cash credit Hypothecation

In case of “Hypothecation”, possession of goods is not transferred to the bank and therefore, such an advance is not better than a clean loan, such an advance can thus only be granted to a person with full integrity, where the bank has full confidence on the client. Cash credit in the” Hypothecation” is normally accompanied with mortgage of immovable properties. The party/ borrower possesses the lock and key of the go down.

Rate of interest: 15% – 16% per annum.

Renew system: It can be renewed after one year.

CONSUMER CREDIT SCHEME

Consumer credit scheme offer the customer to buy their needed item without paying the full cost of the item. Bank used to buy the product in favor of the customer. Customer needs to repay the loan with a fixed installment for a certain period of time. The installment consists of principal payment as well as interest.

THE LENDING PROCEDURE

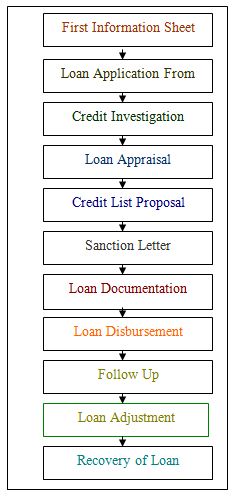

This process starts with building up of relationship with customer through account opening. The stages of credit approval are done both at the branches and at the Head Office levels. The lending procedure as observed in Shahjalal Islami Bank is described below-

INTERVIEW

Customers come in the bank to describe their want about loan. The credit officer takes an interview of the client.

SELECTION OF BORROWER

Before allowing credit facility a banker should be satisfied that the applicant qualifies the following five essentials, which may be termed as 5C’s. These includes –

- Character – Borrowers Integrity, honesty, intention to repay the loan money, commitment, credit record, dependability etc.

- Capacity – Borrower’s business ability, cash flow, Debt service coverage, COGS, Sales, Business experience, Technical knowledge, Age, particularly profitability.

- Capital – Financial strength to cover a business risk, Stake in business, Solvency, retention of earning, ability to infuse more money etc

- Condition – It is general business condition. Economic trends, Industry Growth, competitive & regulatory environments, working conditions etc.

- Collateral – Borrower’s ability to produce additional securities. Asset quality, type, Location, Title, Forced sales value etc.

CREDIT APPLICATION

A borrower seeks credit facility from the bank in a bank’s prescribed credit form. The borrower has to provide relevant information in the credit application including his personal profile, last five years business performance, project details and fund requirements. In case of a new business next five years projected business statistics has to be submitted.

ACCOUNT OPENING

In this stage banker asked the customer to open an account. By opening account banker will be able know the customer.

COLLECTION OF SUPPORTING DOCUMENTS

Bankers receive supporting documents from the client. These are –

# Loan sanctions advice of other banks.

# Loan statements of other banks.

These are required because in the CIB report details status of loans repayment are not obtained.

OBTAINING CIB REPORT

After receiving the loan application from the client, bank sends a letter to Credit Information Bureau of Bangladesh Bank for obtaining a credit inquiry report of the customer. This report is called CIB (Credit information Bureau) report. The purpose of this report is to be informed whether or not the borrower has taken loans and advances from any other banks and if so, what the status of those loans and advances.

TRADE CHECKING

Bank officials of the credit department inspect the project for which the loan is applied; this is termed as trade checking.

ANALYSIS OF COLLECTED INFORMATION

Any loan proposal needs to be evaluated on the basis of financial information provided by the loan applicant. Financial spreadsheet analysis, which consists of a series of quantitative techniques, is employed to analyze the risks associated with a particular loan and to judge the financial soundness and credit worthiness of the borrower. Besides, CRG (Credit Risk Grading) is prepared to evaluate the borrower.

Preparation of Credit Proposal

The branch starts processing the loan at this stage. Based on the analysis (credit analysis) done by the branch, the branch prepares a credit proposal & send it to the head office.

SANCTIONING OF CREDIT

If the proposal is approved by the head office, then head office declared the branch to take the next step.

SANCTION ADVICE

The branch issues a sanction letter to the borrower with a Duplicate Copy. branch of the bank. This duplicate copy returned by the applicant proves that the borrower agrees with the terms and conditions of the credit offered by the bank

Figure 4-1: Loan Sanction

After issuing the sanction advice, the bank collects necessary documents. Documents vary on the basis of types of facility, types of collateral etc.

Document is of two types –

- Legal documents – All securities are legal document. Ex – Cheque, Mortgage.

- Charge document – Those documents which proved that one takes loan. These includes –

# Letter of Guarantee: This letter of guarantee is two sided. One is borrower side guarantee and another one is guarantor side guarantee. Borrower side guarantee consists of agreement of all terms and conditions of Bank as well as assurance of proper repayment of installment. Guarantor side guarantee is the undertaking by the guarantor to pay the installments in case of failure of the client.

# Letter of Hypothecation: It signifies that the goods/items are hypothecated to the Bank.

# Demand Promissory Note: It is the promise of borrower to pay on demand to the Bank the overdue or total outstanding if necessary.

# Letter of Installment: In this documents borrower promise to pay all regular and irregular installments in due time.

# Letter of Disbursement: This is the declaration of disbursement of Loan to the borrower.

# Letter of agreement: This is the agreement that the borrower is bound to pay all dues together with all other charges and the borrower gives the bank the authority to discharge the agreements any time due to the fault in borrower side.

#Letter of Authority: This is the letter the borrower gives the Bank the Authority to debit the account if necessary.

DISBURSEMENT OF LOAN

After completion of all formalities bank disburses the loan as per conditions of sanction letter. All the disbursements and repayment installments take place through bank account.

Credit Administration

This stage involves monitoring, control and recovery of the disbursed credits, i.e. after loan disbursement, continuous follow up of the loanee is done by the bank.

COLLECTION / MONITORING STEPS

| Days Past Due (DPD) | Collection Action |

| 1-14 | Letter, Follow up & Persuasion over phone |

| 15-29 | 1st Reminder letter & Sl. No. 1 follows |

| 30-44 | 2nd reminder letter + Single visit |

| 45-59

| ü 3rd reminder letter ü Group visit by team member ü Follow up over phone ü Letters to Guarantor, Employer, Reference all above effort follows ü Warning on legal action by next 15 days |

| 60-89

| ü Call up loan ü Final Reminder & Serve legal notice ü Legal proceedings begin ü Repossession starts |

| 90 and above

| ü Telephone calls/Legal proceedings continue ü Collection effort continues by officer & agent ü Letter to different banks/Association |

Credit and Risk Management (CRM)

Credit Assessment

A thorough credit and risk assessment should be conducted prior to the granting of loans, and at least annually thereafter for all facilities. The results of this assessment should be presented in a Credit Application that originates from the relationship manager/account officer (“RM”), and is approved by Credit Risk Management (CRM). The RM should be the owner of the customer relationship, and must be held responsible to ensure the accuracy of the entire credit application submitted for approval. RMs must be familiar with the bank’s Lending Guidelines and should conduct due diligence on new borrowers, principals, and guarantors.

It is essential that RMs know their customers and conduct due diligence on new borrowers, principals, and guarantors to ensure such parties are in fact who they represent themselves to be. All banks should have established Know Your Customer (KYC) and Money Laundering guidelines which should be adhered to at all times.

Credit Applications should summaries the results of the RMs risk assessment and include, as a minimum, the following details:

– Amount and type of loan(s) proposed.

– Purpose of loans.

– Loan Structure (Tenor, Covenants, Repayment Schedule, Interest)

– Security Arrangements

Investment

Investment is the action of developing funded with intension and expectation that they will earn a return for their owner. When resources are spent to purchase fixed and current assets for use in a production process or for trading process, then it can be termed as real investment. On the other hand purchase of a legal right to receive an income in the form of profit and dividend may be called as financial investment.

Islamic Mode of Investment

Money is deposited with an Islamic Bank; the Bank makes investment under different modes approved by Islamic Shariah with a view to earn profit. Not only a bank but also an individual or organization can use Islamic modes of investment to earn profit for wealth maximization. To provide interest-free Banking Shahjalal Islami Bank has adopted the following modes of investment:

Musharaka

Ventures may be undertaken jointly when a person requiring funds does not have enough resources of his own thus involving others as a sharer in the business. Partners enjoy similar business rights and have unlimited liability to their creditors. They share the profits of the business in the agreed proportion and bear losses, if any, in proportion to the capital supplied. This partnership relationship in Islamic low is termed as Musharaka.

Types of Musharaka

1. Permanent Musharaka and

2. Diminishing Musharaka.

1. Permanent Musharaka

In this case, the bank participates in the equity of a company and receives an annual share of the profit on a per rate basis. The period of termination of the contract is not specified. These financing techniques also referred to as continued Musharaka.

2. Diminishing Musharaka

Diminishing Musharaka is a special form of Musharaka, which ultimately culminates in the ownership of the assertor the project by the client. It appears in the following manner. The bank participates as a financial partner, in full or in part, in a project with a given income forecast. The partner and the bank through which the bank receives a share of profit as a partner sign an agreement. The partner is entitled to keep the rest in this way, the banks share of the equity is progressively reduced and the partner eventually becomes full owner.

Economic Analysis of Musharaka

The nature of financing Musharaka is investment based. The capital provider has full control in the management of fund. He must also bear the risk up to the full extent of the capital as well as of the opportunity cost of capital for the whole period of the contract. The rate of return is completing uncertain in this mode. The cost of capital is also uncertain and exist perfect correlation between the relationship of cost of capital and rate of return like Musharaka.

Mudaraba

This is a business contract under which the entrepreneur obtains finance from a financier on the condition that will be conducted the business alone without taking any help from the financier. This prescribes that under such an arrangement. The entrepreneur of the manager will share in the profit of the business as agreed in the contract. If there any loss, entire losses are to be borne by the financier and the manager will go simply unrewarded, under Islamic low this business practice is known as Mudaraba or profit sharing.

(A) Establishing a Mudaraba project

The bank provides the capital as a capital owner. The Mudaraba provides the effort and expertise for the investment of capital in exchange of a share in profit agreed upon.

(B) The results of Mudaraba

The two parities calculate earning and divide the profits at the end of the Mudaraba; this cam be done periodically in accordance with the agreement along with observance to legal rules.

(C) Payment of Mudaraba capital

The banks recover the Mudaraba capital it contributes before dividing the profits between the two parities because the profit is protection of capital. In case of agreement to distribute profits periodically before the final settlement it must be on account until the security of capital is assured.

(D) Distribution of wealth resulting from Mudaraba

In case of loss, the capital owner (the bank) bears the loss. In the event of profits, they are divided between the two parties in accordance with the agreement between them with observance to the principal “profits is the protection of capital”.

Economic Analysis of Mudaraba

It is an investment based on mode of financing. The provider of the capital in Mudaraba has no role in the management of the fund. But he has to bear the risk to full extent of the capital as well as of the opportunity cost of capital for the entire period of the contract. The rate of return is quite uncertain and the cost of capital is also uncertain. Hence, there is a perfect correlation between cost of capital and rate of return on capital.

Bai-Murabaha

The term Bai-Murabaha has been derived from Arabic words Bai and Ribhum. The word Bai means purchase and sale and Ribhum means agreed upon profit. Bai-Murabaha means sale on agreed upon profit. Bai-Murabaha may be defined as a contract between buyer and seller under which the seller sells certain specific goods permissible under Islamic Shariah and the low of the land to the buyer at a cost plus agreed profit payable in cash or on any fixed future date in lump-sum or by installments. The profit marked up may be fixed in lump-sum or in percentage of the cost price of the goods.

Bai-Muajjal

Shahjalal Islami Bank Limited operates its investment activities mainly through three mechanisms i.e. Bai-Mechanism, Share-Mechanism, Ijara-Mechanism. The term Bai-Muajjal has been derived from Arabic word Bai and Ajal. The word Bai means purchase and sale and the word Ajal means a fixed time and a fixed period. Bai-Muajjal means sale for which payment is made at a future fixed date or within a fixed period. In short, it is a sale on credit or on deferred payment. Bai-Muajjal is a contract between the bank and the client (buyer & seller) under which the bank sells to the client certain specified goods.

Bai-Salam

There can be a contractual agreement between the businessman and financier that the former will arrange a deferred supply of the goods to be produced, imported or produced by him, at a concession rate, on the condition of an advance payment by the letter. This is a business arrangement, which as per Islamic low, is termed as Bai-Salam.

Bai-Istisna

When a manufacturer, an artisan or a craftsman takes orders with or without advance payment for manufacturing the articles himself or through hired the laborers the arrangement is known as Istisna.

Quard

Quard-Al-Hasana is a contract under which one of the parties (the lender) puts under the ownership of other party (borrower) a definite amount of his property, so that the borrower may pass on to the lender like of it, or in case of inability, the price of the same.

In Pakistan, Quard-Al-Hasana is included in the lending mode of financing.

Investment Portfolio

Total investment of the Bank stood at Tk.43,958.26 million as on 31.12.2009 as against Tk. 32,918.77million of 31.12.2008 registering an increase of Tk.11,039.49 million, i.e. 33.54% growth. The Bank is careful in deployment of the fund. Mode wise investments portfolio as on 31.12.2009 is given below:

Sl. No | Modes of Investments | Taka in million | Percentage of Total Investment |

1 | Mudaraba | 8261.10 | 18.79% |

2 | Bai-Muajjal | 19855.00 | 45.17% |

3 | Hire purchase & Ijara | 10520.72 | 23.93% |

4 | Investment against L/C | 17.32 | 0.04% |

5 | Bill purchased / discounted | 3588.62 | 8.16% |

6 | Investment against scheme deposits | 810.61 | 1.84% |

7 | Quard | 132.55 | 0.30% |

8 | Others | 771.59 | 1.76% |

Total | 43,958.26 | 100.00% |

Bank Guarantee

A contract of guarantee has special significance in the business of banking as a means to ensure safety of funds lend to the customers. In case, the customer is unable to provide the security of tangible assets or the value of the asset falls bellow the amount of the investment and the client’s personal security is not considered sufficient, an additional security is sought by the banker in the form of a guarantee given by a third person. On the other hand, in the course of normal trading client may need guarantee to be given by the bank. Guarantee may be two types, they are:

(a) Guarantee taken by a bank as security against its investment.

(b) Guarantee required by a client from bank in the course of their normal trading.

Guarantee by the Banker

In the ordinary course of business, client may request a banker to support a trading transaction by giving a guarantee to a third party. As a service to the clients, bankers issue various types guarantees and indemnities. By this, the bank undertakes a contingent liability on behalf of its clients.

Security

Security means things deposited as a guarantee of an undertaking or loan, to be forfeited in case of default. There are two types of security, these are:

(a) Primary Security,

(b) Collateral Security.

(a) Primary Security

Primary Security may be either personal or impersonal security or both. Primary security is a cover for an advance.

(b) Collateral Security

Collateral Security is a security belonging to and deposited by borrower himself or by a third party to secure loans and advances. Additional security is taken for advance.

Method: Create Charge on Security

(A) Pledge,

(B) Hypothecation,

(C) Mortgage,

(D) Assignment,

(E) Lien &

(F) Set-off.

(A) Pledge

Pledge means bailment or delivery of goods or documents of title to goods by the borrower to the creditor with the intension of creating a charge thereon as security for the debt.

(B) Hypothecation

It is an equitable charge in lenders favor over goods where neither ownership nor possession is passed to the creditor.

(C) Mortgage

Mortgage is a transfer by the borrower to the lender of the former interest in specific immovable property as security for the payment of a debt. The borrower is known as the mortgagor and lender as the mortgage.

(D) Assignment

It means a transfer by one person of a debt, right or property to another person. An assignment may be legal or equitable.

(E) Lien

Lien is the right of one person to retain the goods or securities belonging to another person until a debt due from the latter are paid to the former.

(F) Set-off

Set-off is a right which in the absence of any agreement to the contrary, enables a creditor to adjust wholly or partially a debt balance in the debtors account with any evident balance laying in his (debtor) favor.

Policy Statement

Broad of Management Committee of the Bank should set out policy statement in at list for the following and an annual review should be done taking into consideration of changes in the balance sheet and market dynamics.

1. Loan Deposit Ratio (LD)

The LD ratio should be 80%-85%. However, the Loan Deposit ratio of the Bank should go up to 110%. The Loan Deposit Ratio = (Deposit + Capital + funded reserve). The ratio will be fixed based on the banks capital, banks reputation in the market and overall depth in the money market.

2. Wholesale Borrowing Guideline

The guideline should be set in absolute amount depending on Banks borrowing capacity, historic market liquidity. The limit should be capped at the banks highest level of past borrowing. However, this limit can be increased based on the match fund basis.

3. Commitment

The commitment guideline limits should not exceed 200% of the unused wholesale borrowing capacity of the last twelve months. This can be increased if there are natural limitations on customer direction to draw against committed liens or a banks access to additional via realization of surplus statutory holdings.

4. Medium Term Funding Ratio

The MTF Ratio of a Bank should not less then 30%. The Ideal Scenario of current market, it will be suitable to move towards the MTF Ratio limit of 40% as we progress.

5. Maximum Cumulative Outflow

MCO up to one month bucket should not exceed 20% of the balance sheet.

6. Liquidity Contingency Plan

A liquidity contingency plan needs to be approved by the board. A contingency plan need to be prepared keeping in the mind that enough liquidity is available to meet the fund requirement in liquidity crisis situation. An annual review of the contingency planning should be made.

Foreign Exchange

Foreign Exchange is a process which is converted one national currency into another and transferred money from one country to another country. According to Mr.H.E.Evitt “Foreign Exchange is that section of economic science which deals with the means and method by which right to wealth in one country currency is converted into rights to wealth in terms of another country currency”. It involved the investigation of the method by which the currency of the country is exchanged for that of another, the causes which rented such exchange is necessary the forms which exchange may take and ratio or equivalent values at which such exchange are effected.

Foreign exchange means the exchange of currency in terms of goods from one country to another. This is the most well know and well-organized business uniform in world business. Foreign exchange mainly has two parties:

(a) Exporter

(b) Importer

Foreign Exchange means foreign currency and includes:

- Traveler’s cheques, letter of credit and bills of exchange, expressed or drown in Indian currency but payable in any foreign currency.

- All deposits, credits and balance payable in any foreign currency and any drafts.

- Any instrument payable, at the option of the drawer or holder thereof or any other party thereto. Either in Indian currency or in foreign currency or partly in one and partly in the other. Thus the foreign exchange includes foreign currency.

Principles of Foreign Exchange

The following principles are involved in Foreign Exchange:

- The entire system.

- The media used.

- The momentary unit.

FOREIGN EXCHANGE MARKET AND BANGLADESH

Foreign Exchange Market allows currencies to be exchanged to facilitate international trade and financial transactions. Evolution of the market in Bangladesh is closely linked with the exchange rate regime of the country. It had virtually no foreign exchange market up to 1993. BANGLADESH BANK, as agent of the government, was the sole purveyor of foreign currency among users. It tried to equilibrate the demand for and supply of foreign exchange at an officially determined exchange rate, which, however, ceased to exist with introduction of current account convertibility. Immediately after liberation, the Bangladesh currency taka was pegged with pound sterling but was brought at par with the Indian rupee. Within a short time, the value of taka experienced a rapid decline against foreign currencies and in May 1975, it was substantially devalued. In 1976, Bangladesh adopted a regime of managed float, which continued up to August 1979, when a currency-weighted basket method of exchange rate was introduced. The exchange rate management policy was again replaced in 1983 by the trade-weighted basket method and US the dollar was chosen as intervention currency. By this time a secondary exchange market (SEM) was allowed to grow parallel to the official exchange rate. This gave rise to a curb market.

Up to 1990, multiple exchange rates were allowed under different names of export benefit schemes such as, Export Bonus Scheme, XPL, XPB, EFAS, IECS, and Home Remittances Scheme. This led to a wide divergence between the official rate and the SEM rate. The situation also gradually gave rise to a number of conflicting regulations, poor risk management, and various types of implicit or explicit government guarantees to the users of foreign exchange. This resulted in a number of macro-economic imbalances prompting the government to adjust the official rate in phases…

FOREIGN EXCHANGE PRODUCT IN BANGLADESH

Bangladesh Krishi Bank (BKB) has been engaged in Foreign Exchange Business since 1980. It deals in all kinds of export, import, remittance and other sorts of foreign exchange business. BKB has got 200 major correspondent banks globally and maintain sufficient number of Nostro accounts in various foreign currencies with different leading banks in important business centers of the world. BKB has taken a massive foreign exchange programmer to increase business.

Different Foreign Exchange rates in Bangladesh:

The Bangladeshi government tightly controls the exchange rate of the taka against the U.S. dollar and major regional currencies. During the last decade the value of the currency showed a steady decline, mainly due to the devaluation of many of the neighboring currencies

| Exchange rates: Bangladesh |

Recent Reference Exchange Rates:

| Currency | Buying | Selling |

| 2nd September, 2010 | ||

| A. USD/BDT Rates (based on interbank transaction) | ||

| USD | 69.5800 | 69.6000 |

| B. Cross Rate | ||

| SGD | 51.6517 | 51.7049 |

| SEK | 9.5413 | 9.5558 |

| JPY | 0.8238 | 0.8243 |

| GBP | 107.4941 | 107.5598 |

| EUR | 89.1250 | 89.1715 |

| CAD | 66.2162 | 66.2542 |

| AUD | 63.3735 | 63.4056 |

Table 3.5. Exchange Rates

The graph below shows historical exchange rates between the Bangladeshi Taka (BDT) and the US Dollar (USD) between 4/20/2010 and 8/16/2010

CATEGORY WISE POSITION OF INTER BANK FX TRANSACTION IN BANGLADESH

Important information about this Product Disclosure Statement (PDS). A PDS is an information document. Its purpose is to provide you with enough information so that you can decide if the product will meet your needs. A PDS is also a tool for comparing the features of other products you may be considering. This PDS relates to FX Transactions. A FX Transaction is a sophisticated financial product requiring a good understanding of the way foreign exchange contracts and markets work. You should read and consider all sections of this PDS carefully before making a decision about the suitability of this product for you. You may also wish to obtain independent expert advice about this. If you have any questions about this product, please contact us on any of the numbers listed at the back of this PDS. If you decide to enter into a FX Transaction, you should keep a copy of this PDS and any associated documentation. You should also promptly tell us if at any time you experience any financial difficulty. The information set out in this PDS is general in nature. It has been prepared without taking into account your objectives, financial situation or needs. Because of this, you should consider its appropriateness having regard to your objectives, financial situation and needs. By providing this PDS, Westpac does not intend to provide financial advice or any financial recommendations. The information in this PDS is subject to change. Westpac will provide updated information by issuing a supplementary or replacement PDS (if this were required, such as if the change were materially adverse to you) or by posting the information on our web site. You can get a paper copy of any updated information without charge by calling us. This PDS is intended for retail clients in Australia only. Distribution of it in jurisdictions outside Australia may be restricted by law and persons who come into possession of it, who are not in Australia, should seek advice. If you are in Australia and have received it electronically, we will give you a paper copy on request, without charge. To obtain a copy, refer to the contact details listed at the back of this PDS.

Foreign Exchange Business

Total Foreign Exchange Business handled during the year 2008 was Tk.78,396.10 million as against Tk. 44,868.60 million of 2007 registering an increase of Tk.33,527.50 million, i.e. 74.72% growth. The particulars of Foreign Exchange Business are given below:

Particulars | Amount in Million Taka | Percentage of Total |

Import | 39543.12 | 49.77 |

Export | 29434.03 | 37.05 |

Foreign Remittance | 10473.09 | 13.18 |

Total | 78,396.10 | 100.00% |

During the year 2009 SJIBL opened 39543.12 Import Letter of Credit as against 11,117 of 2008 and handled 29434.03 Export bills in 2009 against 12,746 of 2008.

Parties to the Documentary Credit Transaction

Issuing Bank

The L/C issuing bank issues L/C at the request of their Customers. The L/C issuing bank undertakes absolute obligations to pay upon presentation of proper documents stipulated in the L/C.

Customer application

The L/C applicant is the party on which requests the L/C issuing bank issues L/C. The customer is normally obligated to reimburse the issuing bank for any payment made under the L/C & the customer often provides collateral to source the reimbursement authorization.

Beneficiary Exporter

The beneficiary is the party entitled to drawn to demand payment under the L/C. The beneficiary will have to present the required documents in compliance with the L/C terms when payment is demanded through the nominated bank.

Advising bank

After verification of authority of the L/C advising bank gives notification to the beneficiary that a L/C has been issued by the bank. The advising bank does not itself under take any obligation to know the beneficiaries claim. Its obligation is limited to accurately advising of the credit.

Confirming bank

At the request of the L/C issuing bank, confirming bank may add their confirmation to a L/C. The bank becomes directly obliged to honor the claims of the negotiating bank normally a bank in the beneficiary location.

Negotiating Bank

Negotiating means giving values of credit confirm documents to the beneficiaries. Negotiating bank means, the bank specially authorized in the credit to negotiate documents drawn under the credit. In the case of a freely negotiable credit any bank be negotiating bank if it is expressly consented to by such bank.

Reimbursing Bank

If the L/C issuing bank nomination a 3rd bank (The reimbursing Bank) in the L/C to honor the claim of the negotiating bank. The reimbursement bank may honor the claim accordingly. If the reimbursing fails to honor the claim of negotiating bank, L/C issuing bank is obliged to honor the claim of negotiating bank.

Notify party

The notify party is the party to whom the notification shipment particulars is provided as per L/C stipulations.

Letter Of Credit

A letter of credit is an instrument issued by a bank to a customer placing at the letter disposal such agreed sums in foreign currency as stipulated. An importer is a country requests his bank to open a credit in foreign currency in favor of his exporter at a bank in the letters of country. The letter of credit is issued against payment of amount by the importer or satisfactory security. The L/C authorizes the exporter to draw a draft under its term and sell to a satisfied bank in his country. He has to handover the bank, with the bill of exchange, shipping document and such other paper as may be agree upon between the exporter and the importer. The exporter is assured of his payment because of the credit while importer is protected because documents in respect of export of goods have to be delivered by the exporter to the playing bank before the payment is made.

Credit means any arrangement however named or described, whereby a bank (issuing bank) acting at the request and the instructions of a customer (the applicant) or of its own behalf.

- Is to make payment to or to the order of a third party (beneficiary), or is to accept and pay bill of exchange (drafts) drawn by the beneficiary.

- Authorizes another bank to effect such payment, or to accept and pay such bill of complied with.

- Authorizes another bank to negotiate.

Against stipulated documents, provided that the terms and conditions of the credit are complied with.

Letter of Credit Operation of SJIBL

Today SJIBL is one of the leading and most successful Banking enterprises in the country. It plays great role in the economy of the country. By export-import business the bank play a great role to the economy of Bangladesh. SJIBL is one of the greatest banks in export-import business.

Foreign trade plays a vital role in the economy advancement process of a nation. So the trend of country’s foreign trade; i.e. import and export of a great concern to the government of a country. Fluctuation is the parameters of foreign trade immediately bring about some impact on the total economy. As such the nature, trend and volume of foreign trade are required to keep peace with the national economic needs and objective. There may be some areas where emphasis is to be given where there may be others which deserve restrictions and discouragement. Moreover the items of import and export value and volume of the same, the corresponding time period, sources of fund for payment and receipt, all these factors are to be considered very carefully for making necessary adjustment to match with the national economic policies as well as achieve balanced economic growth through the inter policy co-ordination. International trade policy relates to commercial policy which has to maintain components of import policy and export policy.

As the policy matter and operational of import and export are quite different, two separate policies for import and export trade are formulated by the government. The main purpose of the policy is to conserve scare foreign exchange & to ensure its utilization for the import of their goods and services which have national priority. Importers can import goods and entitled in each year as per import policy by opening letter of credit (L/C) through bank.

Back to Back L/C

The branch may open back to back import L/C against export L/C through foreign exchange & Karwan bazaar branch received by export oriented industrial units opening advice the beneficiary under the bonded warehouse systems, subject to observance of domestic value addition requirement prescribed by the NBR/Ministry of Commerce from time to time.

Letter of Trust

By executing the standard letter of trust the customer acknowledge receipts of the documents of title to the goods, as the case may be and agrees to hold them and relative goods, when delivery thereof its taken by him, in trusts as agents for the bank until the goods are sold or used for the express purpose for which were released to him. The customer also undertakes to keep the transaction separate and assign and deposit with the bank the sale proceeds immediately realization but in any case not later then time period stipulated in the letter. Further, the customer undertakes to keep the goods insured and in the event the goods or may part thereof cannot be used by him for the declared purpose or on demand being made by the bank for the return of the documents / goods, he promise to restore the goods or documents to the bank’s custody. The trust receipt thus enables the importer customer to take re-delivery of the documents.

SWOT Analysis of SJIBL

The Strengths, Weaknesses, Opportunities and Threats (SWOT) analysis of SJIBL is described in the following:

Strength

Sound profitability and growth with good internal capital generation.

Larger corporate client base.

Experienced and efficient management team and human resource.

Quaity products and services.

Better infrastructural facilities.

Company reputation and goodwill.

Weakness

Small market share.

Limited branch network.

High concentration on fixed deposits and largescale loans.

Lack of full scale automation.

Opportuinity:

Scope of market penetration through diversified products.

Automation of transaction processes and online branch banking.

Government’s policy of encouraging heavy inflow of foreign investment.

Regulatory environment favoring private sector development.

Value addition in products and services.

Increasing purchasing power of people.

Increasing trend in international business

Threat:

Increased competition for market share in the industry.

Frequent changes of banking rules by the Central Bank.

Market pressure for lowering of lending rate.

National and global political unrest.

Default culture of credit.

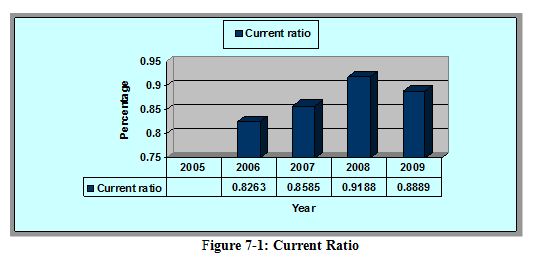

RATIO ANALYSES

Financial statements provide information about a form’s position at a point time as well as its operation over some past period. However the real value of financial statements lies in the fact that they can be used to help predict a firm’s financial position in the future and to determine expected earnings and dividend. I shall point out and explain some ratios with graphical presentations that are below:

Findings:

While I was working at SJIBL, Bijoynagar Branch, I had attained to a newer kind of experienced regarding activities in the work. After collecting and analyzing the data for MBA internship report purpose. I have got some findings about the SJIBL those are given below:

As the process of sanctioning loan is loan manually, it takes a long time to process a loan.

Sometimes the securities taken against the loan are deliberately overvalued by the employee to unlawfully help the client. As a result if he fails to repay the loan , the bank authority cannot collect even the principal money invested by the selling those assets

Usually banks are responsible to provide loan to those who are legible for the loan. But in reality, small investors do not get the loan easily. They have to fulfill more terms and condition than those who have greater influence in the business community.

Political influence is one the major problems in Bangladesh. due to political influence bank has to provide loans in most of the cases, which are rarely recovered.

The banking system is impaired by a wed of weak balance sheets, weak demand from creditworthy borrowers and heavy reliance on liquid asset –based lending.

SJIBL bank uses manually system to verify specimen signature of clients it consumes a lot of time.

From the clients view introducer is one of the problems to open an account. it is general problem to all commercial bank

The number of branches is not sufficient to cover the country most.

Besides all these findings , there are one major point that has been found regarding SJIBL, that is it (SJIBL) has own training institution for its employees, so it doesn’t require to train them in other training institution , it’s really a good sign in their recruitment system

Recommendation

I have the practical experience in SJIBL for only three months. Shahjalal Islami Bank Ltd introduces a new dimension of business among the local bank in the financial market of Bangladesh in Retail Product Management. But in the complex business environment and diversified business world these products cannot meet the customer needs. Today, customer classes are vibrant and it is difficult to keep the customers without an appropriately designed and also is not properly market driven. Developing a market driven product management system is essential for any company if the company would like to win the competitive condition and would like to survive in futuristic competitive market setting. In this regard, following specific recommendations are forwarded for the development of product management of Shahjalal Islami Bank Ltd.

Officials whom are involved in Customer Services should be trained properly. Because some time they cannot give proper suggestions to the customer queries. Though they try to give their best.

Their jobs should be mentioned more frequently

They should be made somewhat free from doing business

Link between Customer Service Officer’s and Customer Service Manager should be easier

Number of ATM booth can be increased

ATM should take good care. Because it has been seen that most of the time they remain out of order or out of cash

Relationship between Bank and customer should be increased

Charges and fees may be reduced for more customer satisfaction

There should be a code of conduct for the SJIBL officials, which should followed

The website of SJIBL should up to date regularly

Last but not the list, the employees must be motivated when they do something good and creative.

Conclusion

Shahjalal Islami Bank Ltd, Bijoynagar branch is one of the most potential Islami banks in the Islami banking sector. It has a large portfolio with huge assets to meet up its liabilities and the management of this bank is equipped with the expert bankers and managers in all level of management. So it is not an easy job to find out the drawbacks of this branch as a new branch. But the branch needs more employees for its substantial growth. I would rather feel like producing my personal opinion about the ongoing practices in Bijoynagar Branch.

Shahjalal Islami Bank limited is a leading Private Islami bank in Bangladesh with superior customer bases that are loyal, faithful, worthy towards the bank. The service provided by the young energetic officials of the Shahjalal Islami Bank Limited is very satisfactory. As an Islami bank SJIBL has to follow the rules of Bangladesh bank despite the fact that these rules sometime restrict the foreign business to some extent. During my internship in this branch I have found its General Banking and Investment department to be very efficient; therefore this department plays a major role in the overall profitability of the branch and to the Bank as a whole.

The Bank’s drive towards market leadership as well as quality in choosing business will continue in the coming years although competition is intensified with the opening of more financial institutions. The Bank is optimistic that the volume of business will increase in future through pragmatic and market friendly policies. The Bank shall continue to explore new Branches for Banking. We shall endeavor to adopt customer-oriented policies and introduce new techniques that will help to earn profit and increase greater confidence of the existing/ prospective customers. If Shahjalal Islami Bank Ltd, Bijoynagar Branch adopts professionalism within the frame work of Shariah, they will be able to earn handsome “Halal Profit” and higher return to the depositors and share holders. Ultimately, public will get more confidence on this type of Banking.