This report is an effort to reflect a clear idea about the strategies, activities and performance of Southeast Bank Ltd. regarding its commercial activities with a special reference to Credit management or Business. The researcher was assigned it in the Dhanmondi Branch of Southeast Bank Limited (SEBL) as an intern. The researcher presents this report on the basis of the knowledge and experience gained during the internship period of 6 weeks (22 August to 22 October 2010)

Dhanmondi Branch of Southeast Bank Ltd. Started its operation from the year 1998. During the short span of its operation, the bank had been widely acclaim by the business community from small business to industrial conglomerates for forward looking business outlook and innovative financial solutions. The bank is gaining popularity due to its improved quality of sen ice. reliability, product variety, versatility and flexibility.

In credit business the bank improve its performance year to year and the ultimate benefits of them through increase in earnings from the operations. In other section the bank is almost like all other commercial banks in the country. Bank has a major problem in marketing itself and its products.

To prepare this report the researcher use both primary and secondary data. Therefore this report contains two parts-Organization profiles, a glimpse through the Theories and Working report. The Working Report part is based on the departments (General Banking, Credit, Accounts and Foreign Exchange) states how the practice differs from the theories. The analysis part has been performance analysis (based on the annual reports of past 5 years). The report also contains some recommendations.

ORIGIN OF THE REPORT

This report is an outcome of twelve weeks’ Internship Program, a part of BBA- program of Department of Management studies, University of Dhaka, Bangladesh. The topic of the report is “Commercial Banking Operation with Special Reference to Credit Management in Southeast Bank Limited, Dhanmondi Branch.” Actually this is a feedback which department accepts from the students who join in an organization after the completion of theoretical part of the BBA Program. And this report is prepared to fulfill the partial requirement of the BBA program.

OBJECTIVE OF THE PROGRAM

The main objective of the program is to have a practical knowledge of the professional life and to relate the one-year theoretical learning to business. More importantly, it was required for the partial fulfillment of the MBA program. Specially, the objectives are in point:

- Partial fulfillment of three months internship in the Southeast Bank Limited, Dhanmondi Branch.

- To gain practical knowledge in Banking operation and activities.

SCOPE OF THE REPORT

The report is prepared based on the commercial banking operations of the Dhanmondi Branch, Southeast Bank Limited. These activities involve the following:

- General Banking activities

- Credit operation

- Accounting section’s operations etc.

But special emphasis is given on the credit activities of the branch.

ORGANIZATIONAL OVERVIEW

HISTORICAL BACKGROUND OF SOUTHEAST BANK LIMITED

After the liberation war in order to bring equality in different level of the society Govt. owned all banks. Govt. wants the participation from all levels of the society in development activities through providing banking service at their doorsteps. But it produces nothing except inefficiency, corruption etc. So govt decides to allow private bank to bring competition in the banking sector.

On the other hand Bangladesh economy has been experiencing a rapid growth. Industrial and agricultural development, growth in exports and imports, inflow of wage earners remittance, local and foreign investment in construction, communication, power, food processing and service enterprises altogether encountered an era of economic activities in both private and public sector. Concurrently, urbanization and changes in lifestyle of people created a growing demand for personal banking products and services to support the new initiatives as well as to encourage consumer investments and savings in a profitable manner. So the boom of private banks has begun in the year 1995-96, which ultimately gave birth to the Southeast Bank Limited.

COMMENCEMENT

Southeast Bank Limited (SBL) is a second generation private commercial bank -established under the ambit of The Bank Companies Act 1991 and incorporated as a public limited company under The Companies Act 1994 on March 12, 1995. And, it started its commercial banking operation from May 25, 1995 at the Principal Branch located at 1, Dilkusha Commercial Area, Dhaka. The government of Bangladesh as a scheduled bank in the private sector has licensed the bank in pursuance of the policy of liberalization of banking and financial services and facilities in the country.

The inception of SBL is the outcome of a successful group of prominent investors whose vision was to contribute to the country’s economy through commercial banking. The founder chairman of the bank was Mr. M. A. Quasem who is a prominent businessperson of the country. The first Managing Director (MD) was Mr. Syed Anisul Haque and the present MD is Mr. Abu Naser Bukhtear Ahmed. Both of them are very renowned in the spheres of business of the country. The present Chairman is Mr. Ragib Ali who is respectable personnel not only in the local business community but at the international level as well.

MISSION, VISION AND OBJECTIVES OF SEBL

Mission

The mission of the bank is to become a highly competitive modern and transparent institution comparable to any of this kind at home and abroad.

Vision

A Bank with Vision is the motto of Southeast Bank Limited. The vision is to be the most efficient financial intermediary in the country through reducing the investment and savings gap of the economy by savings mobilizations and encourage the pace of industrialization. The relentless journey to achieve that vision started in 1995, since the very inception of the Bank. The journey still continues and will never stop. SBL sets a high standard for itself and every achievement of the bank is a striving agent to reach a new height.

Objectives

Whether in treasury, consumer, or corporate banking, SBL is committed to provide the best. Meeting the demand of discerning customers is not the sole objective. The Bank believes that to provide standard financial services is to deliver a quality that makes every transaction a pleasurable experience. The bank also believes that Customer is always right and in the core of everything. So providing them friendly and personalized service, tailor-made solutions for business needs, global reach in trade and commerce at the doorsteps and high yield on investments are the core objectives of the bank.

But the bank also tries to do the best in conjunction with achieving the ultimate objective of a business organization – Wealth Maximization.

STRATEGIES OF SEBL

SBL believes in the practice of Market-Oriented Strategic Planning, developing and maintaining a viable fit between the organization’s objectives, skills and resources. The aim of such approach is to shape and reshape the bank’s businesses and services so that they yield target profits and growth. The strategic planning of SBL involves repeated cycles of corporate and business planning as well as divisional and product or marketing planning. The strategic planning of SBL consists of two organizational levels, which are

- Location Based Strategy

- Business Level Strategy

Location Based Strategy

Since the growth and profits of banking business largely depend upon the locations of branches where large concentration of other businesses and industries are involved, SBL primarily focuses on location-based strategy. Every year an overall profit target as well as individual targets for each line of business (export, import, loans & advances etc) is set for each branch location by the corporate bodies in collaboration with the regional heads and branch managers. The 20 branches of SBL are divided into three different regions, which are

1. Dhaka Division, comprising 10 branches of Dhaka city

2. Chittagong Division, comprising 9 branches of Chittagong, Sylhet and Moulavi Bazar

3. Khulna Division, comprising 1 branch in Khulna.

The concentration of businesses and lifestyles of the people are not the same in these three areas. So, the strategies of the three areas differ from one another; feet theft designed with distinctive local touch. The Branches Control & Inspection Division Head office constantly monitors the progresses of all the three areas and with Marketing and Outreach Division for search for new location.

Business Level Strategy

The business strategy of the Bank is to strengthen its traditional lending in small retail business, following a conservative lending approach. But the Bank’s major portion of the profit generates from its Corporate Banking.

Corporate Banking Strategy

Building upon the base of trust and relationship in line with the management approach of maintaining adequate loan quality, the bank has been able to create a corporate client base in the large and medium scale industrial ventures which includes companies like Bashundhara Group; Grameen Phone & Telecom; Flora Telecom; Rangs Industries & Electronics; Rahimafrooz; GQ Ball Pen, Industries & Properties; IDLC (Industrial Development & Leasing Company); Butterfly Marketing Limited, Shinepukur Ceramincs Ltd. and many others. The present strategy of the Bank is to maintain and nurture this large corporate client base and search for sponsoring new upcoming ventures in the medium scale industries.

Broad Strategy

TQM: SBL believes in ensuring Total Quality Management in every sphere of its businesses processes and personnel. The strategy of the bank is to reengineer and upgrade its products and services regularly to fulfill customer expectations and constantly monitoring and improving delivery standards to ensure maximum customer service. The people are also routinely up skilled and empowered to be able to effectively respond to customer needs. The bank also looks ahead in the future to make complete automation of its processes and all the branches being online to reduce delivery times.

Search for New Market Scope: Realizing the importance of having a good network for its entry to low cost savings deposits, the bank has initiated to develop some new deposit schemes and E-cash credit line, which are described in details in section 1.8.

ORGANIZATION STRUCTURE OF SEBL

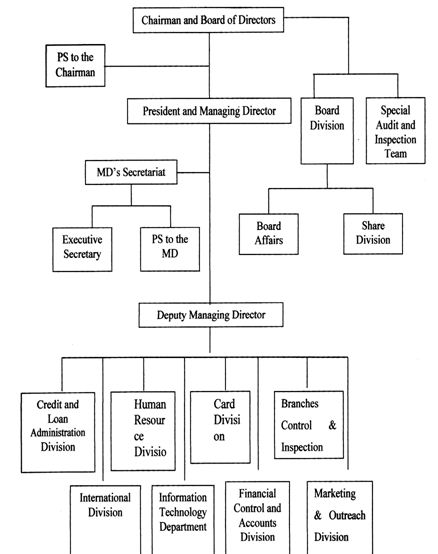

Like all the other local banks, SB£ has a conventional organizational structure. A corporate body conducts a meeting on a weekly basis; the committee is called the Executive Committee. The committee includes Chairman, Vice Chairman, and the group of Directors, Managing Director (MD), Deputy Managing Director (DMD). and Company Secretary. This executive committee approves the various proposals brought by the management prior to implementation. All the proposals are placed to the committee through the Managing Director of the Bank.

A number of top executives work under the DMD; they are – 5 Senior Executive Vice Presidents, 5 Executive Vice Presidents, 4 Senior Vice Presidents, and 8 Vice Presidents. The proposals are initiated by the mid level managers and then forwarded to the Managing Director through the Head of Branches or the head of the divisions. The Bank has also a legal advisor (an advisor firm) to solve the legal problems and issues faced by the bank.

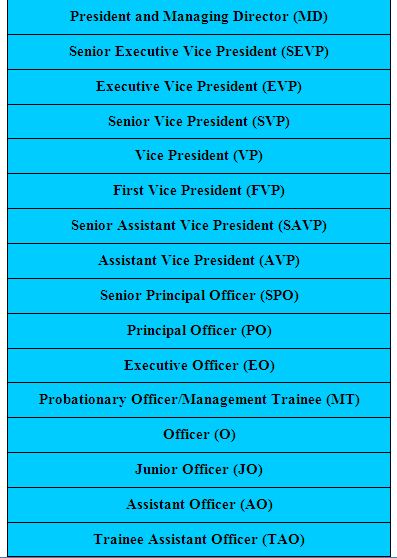

Management hierarchy of Southeast Bank Limited

ACTIVITIES OF DIFFERENT DIVISION

Financial Control and Accounts Division (FCAD)

- Financial planning, budget preparation and monitoring

- Payment of salary

- Controlling inter-branch transaction ^ Disbursement of bills

- Preparation of financial reports and annual reports

- Preparation/Review of returns and statements

- Maintenance of Provident Fund, Gratuity, Superannuation Fund

- Reconciliation

International Division (ID)

- Agency arrangement and credit line with correspondent banks

- Compile and circulate the foreign exchange circulars (daily exchange rates., special instruction etc) to the branches

- Reconciliation of Nostro Accounts ^ Foreign remittance

- Controlling Test Key and Authorized Signature

- Issuance of power of attorney

Credit and Loan Administration Division

- Loan administration

- Loan disbursement

- Project evaluation

- Processing and approving credit proposals of the branches

- Documentation, CIB (Credit Information Bureau) report etc

- Arranging different credit facilities

- Providing related statements to the Bangladesh Bank and other departments

Human Resource Division (HRD)

- Recruiting

- Training and development

- Compensation, employee benefit, leaves and service rules program and up gradation

- Placement and performance appraisal of employees

- Preparing related reports

- Reporting to the Executive Committee/ Board on related matters Promotional campaign and press release

Information Technology (IT) Department

- Software development

- Network management and expansion

- Software and Hardware management

- Member banks reconciliation

- Data entry and processing

- Procurement of hardware and maintenance

Branches Control & Inspection Division

- Controlling different functions of the branches and search for location for expansion

- Conducting internal audit and inspection both regularly and suddenly

- Ensuring compliance with Bangladesh Bank (BB), monitoring BB’s inspection and external audit reports

Board Division

- Maintenance of different Board affairs

- Preparation of extracts and minutes

- Forwarding different memos to the Board of Directors/ Executive Committee

- Administration of company’s’ share related affairs like issuance, settlement, providing coupons, right share issuance etc.

Card Division

- ATM card and system operation and maintenance

- SWIFT operation

- Credit Card Operation (Proposed)

- Customer and vendor relationship

Marketing & Outreach Division

- New product development and marketing analysis on financial services

- Mass media, event management and protocol

- Liability marketing

- Improvement of policies and strategies

- Management Information System (MIS)

Organogram of Head Office, Southeast Bank Limited

PRODUCTS & SERVICES OF SOUTHEAST BANK LTD.

Products

Deposit Schemes

- Saving Account (SB)

- Current Account (CD)

- Short Term Deposit (STD)

- Fixed Deposit (FDR)

Customer Friendly Deposit Schemes

- Pension Savings Scheme (P.S.S.)

- Education Savings Scheme (E.S.S.)

- Marriage Savings Scheme (M.S.S.)

- Savers Benefit Deposit Scheme (SBDS)

- Bearer Certificate of Deposits (3,6,12 months)

Loan Schemes

- Consumer Credit Scheme (CCS)

- Equity & Entrepreneurship Fund (EEF)

Services

- ATM Service

- Locker Service

INDUSTRY ANALYSIS AND COMPETITIVE CONDITION OF SOUTHEAST BANK

It is observed that the Private Commercial Banks (PCBs) made sizeable contributions towards registering positive growth rates in all the key performance indicators4. It is also observed that the 2nd generations PCBs, on an average, have relatively higher performance growth records in respect of key indicators compared to the 1st generation PCBs. The 3rd generation5 PCBs, however, are yet to come up with reasonable performance standards excepting a few ones.

SBL’s export, import and guarantee business has been growing at a good pace since its inception. The import business of the Bank is in line with its competitors. Export business had a growth of about 100% each year for the last four years. But if it is compared with the competitors, it appears that Southeast Bank will have to go a long way to keep pace with the like banks.

The following Table shows a brief comparative analysis of some 2nd generation banks in the year 2005 including Southeast Bank Limited, which may be helpful to find out the condition of the Bank in the industry6.

A comparative picture of financial position of second generation PCBs as on Dec 2005 is in point.

| Southeast Bank(SBL) | Prime Bank (PBL) | Dhaka Bank (DBL) | Eastern Bank (EBL) | |

| Deposits | Tk. 12,630.25 million | Tk. 13,259.87 million | Tk. 17,705.85 million | Tk. 13,277.00 million |

| Loans and Advances | Tk. 9,1783.03 million | Tk. 9074.94 million | Tk. 9,944.10 million | Tk. 9,946.00 million |

| Investments | Tk. 1, 727.44 million | Tk. 1730.74 million | Tk. 1274.46 million | Tk. 1,258.00 million |

| Foreign Exchange Business | Tk. 14862.42 million | Tk. 27,614.20 million | Tk. 23831.60 million | Tk. 16,817.00 million |

| Guarantee Business | Tk. 1,854.50 million | Tk. 2175.00 million | Tk. 2,123.09 million | Tk. 1,054.00 million |

| Total Income | Tk. 1748.18 million | Tk. 1987.58 million | Tk. 1925.25 million | Tk. 1603.55 million |

Source: Annual report 2005 SBL, PBL, DBL, EBL

Table 1: Comparative Study on Financial Position of some 2nd Generation PCBs

SWOT ANALYSIS OF SEBL

SWOT analysis is the detailed study of an organization’s exposure and potential in perspective of its strength, weakness, opportunity and threat. This facilitates the organization to make their existing line of performance and also foresee the future to improve their performance in comparison to their competitors. As though this tool, an organization can also study its current position, it can also be considered as an important tool for making changes in the strategic management of the organization.

The Strengths, Weaknesses, Opportunities, and Threats (SWOT) analysis of SBL is described in the following table (Table 1.3):

Strengths:

Southeast Bank Limited has already established a favorable reputation in the banking industry of the country. It is one of the leading private sector commercial banks in Bangladesh. Thfe bank has already shown efficiency at staff recruitment.

– By using good recruitiflg policy SBL has provided its banking service with a top leadership and management position.

– Southeast Bank Limited bring new dimension in recruitment policy by providing recruitment to Fresh MBA’s and BBA’s in mid level. The Bank is First in this nature to recruit 40 Business Graduate to bring new flame in HR practice.

– SBL has an interactive corporate culture. The working environment is very friendly, interactive and informal. And, there are no hidden barriers or boundaries while communicate among the superior or the employees. This corporate culture provides as a great motivation factor among the employees.

– SBL has the reputation of being the provider of good quality services too its, potential customers by its skilled employee.

– SBL also offers an attractive compensation package to attract new employees as well as retain existing employees.

Weakness:

– The main important thing is that the bank has no clear mission statement and strategic plan. The vision of the bank — “A Bank with Vision” is very vague. The banks not have any tong-term strategies of whether it wants to focus on retail banking or become a corporate bank. The path of the future should be determined now with a strong feasible strategic plan.

– SBL’s HR is very much slow to evaluate the employees’ performance appraisal which causes the delay of employees’ promotion. And this is reason for slow recruitment Employees also recruited through directors’ reference that causes sometimes the inefficient and unskilled stuff recruitment.

– The bank failed to provide a strong quality-recruitment policy in the lower and some mid level position. As a result the services of the bank seem to be dues in the present days.

– The poor service quality has become a major problem for the bank. The quality of the service at SBL is higher than some local banks like the Dhaka Bank, Prime Bank or Dutch Bangla Bank etc. But the bank has to compete with the Multinational Bank located here.

– Some of the job has no growth or advancement path. So lack of motivation exists in persons filling those positions. This is a weakness of SBL that it is having a group of unsatisfied employees.

– In terms of promotional sector, the bank is in a great problem. It has no marketing campaign. But all other competitors expense a lot in marketing. For example Dutch-Bangla Bank’s social campaign or Brae Bank’s marketing activities for it’s different offers.

Opportunity:

– SBL can cluster the jobs needed and recruit accordingly

– SBL can arrange entry exams to get the best personnel prevail in the market There is a possibility of arranging job fair in all reputed universities to recruit the best graduates

– Opportunity in retail banking lies in the fact that the country’s increased population is gradually learning to adopt consumer finance. Our population is constantly increasing at a rate of 2.7% per year. The bulk of our population is middle class. Different types of retail lending products have great appeal to this class. So a wide variety of retail lending products has a very large and easily pregnable market.

– A large number of private banks coming into the market in the recent time. In this competitive environment SBL must expand its product line to enhance its sustainable competitive advantage. It can introduce credit card system for their potential customer.

– In addition of those things, SBL can introduce special corporate scheme for the corporate customer or officer who have an income level higher from the service holder.

Threats:

– All sustaining multinational banks and upcoming foreign, private banks posses an enormous threat to Southeast Bank Limited.

– There is a threat of leaving the organization by the probationary employees after getting their confirmation.

– The low compensation package of the employees from mid level to lower level position threats the employee motivation. As a result, good quality employees leave the organization and it effects the organization as a whole.

The following table can be used to see the above mentioned factors at a glance.

S |

|

W |

|

O |

|

T |

|

CREDIT MANAGEMENT, DHANMONDI BRANCH, SEBL

OVERVIEW OF CREDIT DIVISION

The Credit Division has been compiled to serve as guide to the procedure for assisting the Officers & employees of the Bank who are entrusted with the responsibilities for handling day to day business dealings relating to management of Credit Operation of the Bank. Credit Operation of any Banking Institution is a combination of certain accepted standards and other dynamic factors dictated by the realities of changing situations. The accepted standards relate to safety, liquidity & profitability of the advance whereas the dynamic factors relate to aspects such as the nature and extent of risk, interest on margin, credit spread, credit dispersal and general guidelines about the conduct of advances issued by Head Office.

In business dealings officers and employees must be well equipped to safeguard the interest of the Bank with day to day operational knowledge guided by the principles of honesty and integrity. They should strictly adhere to the Banking Practices, Rules and Regulations and the Instructions issued by Bangladesh Bank / Head Office from time to time. In formulating a credit judgement and making quality credit decisions the lending officer must be equipped with all information needed to evaluate borrower’s character, management competence, capacity, capital, ability to provide collateral’s and external conditions which may affect his ability in meeting financial obligations.

To assist the Officers and employees of the Bank entrusted with Credit Administration and Portfolio Management “Credit Policy Guide” has been introduced. In addition to said Guideline, it is considered necessary to adopt Credit Operation detailing a comprehensive and uniform guidelines required for analyzing, processing and handling of various types of credit proposals including completion of documentation formalities required to safeguard the interest of the Bank.

The “Credit Operation – 1996” has been compiled to provide comprehensive operational procedure to be followed in day-to-day operation for handling various types of credit facilities. To safeguard Bank’s interest, this Manual prescribes the types of legal and charge documents to be obtained from different types of borrowers.

All the staff and officers including Managers as well as of Credit Division of the Head Office, dealing with the Administration and Management of the “Credit Portfolio” of the Bank must keep themselves thoroughly conversant with the contents

of this Manual and follow them meticulously. It will be the responsibility of the Managers / Head of Credit Division at Head Office to ensure that the procedural guidelines lay down herein is strictly followed at their end.

FUNCTIONS OF CREDIT DEPARMENT

1. Interviewing the prospective borrower.

2. Receiving the credit information assembled and placed in the customers credit file.

3. Processing and sanctioning of credit facilities to the customer

4. Disbursement of credit facilities to borrowers in accordance with established procedures.

5. Recording of credit facilities

6. Preparing vouchers pertaining to credit facilities disbursed and recording of relevant entries.

7. Controlling of securities and proper custody of documents

8. Follow up and recovery of credit as per due date

9. Computation and checking of interest accrued on loans, advances, and recording entries there of.

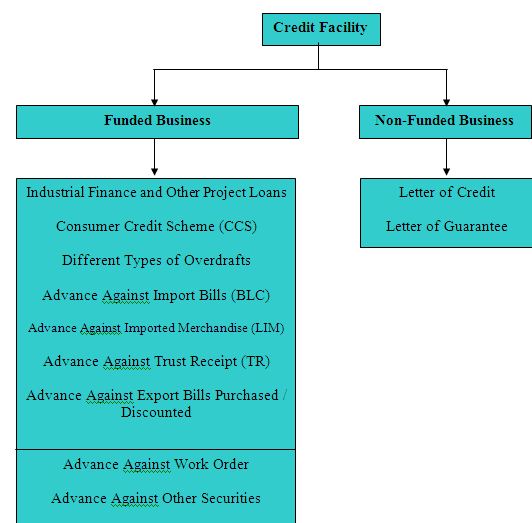

DIFFERENT TYPES OF CREDIT FACILITY

FUNDED BUSINESS

A funded credit facility that a bank offers to a customer result in actual disbursement of cash to the customer or to any designated supplier of the customer.

INDUSTRIAL FINANCE AND OTHER PROJECT LOANS

Project loan normally has fixed maturity and it relates to term investment. As such it requires appraisals of those proposals to have a rational decision. Appraisal may be termed as assessment of viability over a period of time. These loans are usually made for:

- Setting up of industries and to meet working capital

- Balancing, Modernization, Replacement and Expansion (BMRE) of existing industries.

- Construction of commercial / Residential Building / Warehousing etc.

CONSUMER CREDIT SCHEME (CCS)

Objectives

The objective of this loan is to provide essential Household durables to the fixed income group (Service holders) and other eligible borrowers under the scheme. The abbreviated name of the scheme will be “conserve”.

Items of Investment

i. Refrigerator / Deep Freeze

ii. Television/VCR/VCP/Dish Antenna

iii. MusicCenter

iv. Motor Car / Motor Cycle

v. Air -Cooler / Air – Conditioner

vi. Personal computer

vii. Washing Machine

viii. Household Furniture & Fixtures

ix. Sewing Machine

x. Kitchen appliances like Oven, Toaster, Pressure Cooker, Blender etc.

xi. Any other item not specified above but considered essential.

Eligibility

The criteria to become eligible for availing the facility under the scheme are given below:

i. The borrower must be confirmed official of any of the following organizations:

a) Government Organization.

b) Semi-Government Organization / Autonomous body.

c) Multinational Organizations.

d) Banks & Insurance Companies.

e) Reputed Commercial Organizations.

f) Professions.

Entitlement

i. Eligibility borrower can avail the facility to purchase more than one article but the amount of total loan shall not exceed the maximum limit fixed by Head office from time to time.

ii. Further loan may be allowed to the same borrower if 50% of the previous loan is recovered from him but the same shall not exceed the maximum limit.

iii. Amount of bank’s investment will be fixed in such a manner that the monthly deduction from borrower salary / income against payment of bank’s dues shall not normally exceed 50% of his net income. Exceptional cases may be considered if the bank is satisfied about the repayment capacity if the client.

Period of Investment: Maximum three years.

Client’s Equity

Prescribed margin as fixed by Head Office from time to time on the total value of the

articles shall have to be deposited with the bank by the client as equity before

disbursement of loan.

Mode of Disbursement

a. Client will procure the specified articles from dealer / agent / shops acceptable to bank.

b. All papers / Cash memos etc. related to the procurement of the goods will be in the name of bank ensuring ownership of the goods. Wherever applicable, the ownership shall be transferred in the of the client after full adjustment of Bank’s dues.

c. The client shall have to bear all the expenses of license, Registration, Insurance etc. of the articles wherever necessary. The insurance will be with the Bank mortgage clause. The premiums shall be paid by the borrower by debt to his account.

d. The client shall have to bear the cost of Repair & maintenance of the acquired articles.

Mode of Recovery

Dues shall be recoverable in the following manners:

a. In equal monthly installments.

b. The monthly installment shall be payable by the 7th of every month, but the first installment shall be payable by the 7th of the subsequent month of disbursement.

c. Through deduction from the monthly salary of the client wherever applicable, by his employer. In this regard the concerned employee shall authorize irrevocably his employer to deduct the said amount from his monthly salary. The client can only revoke this authority with the concurrence of the bank.

Documentation

Allow the advance after obtaining the following documents duly stamped:

ii. Demand Promissory Note

iii. Letter of Arrangement,

iv. Letter of Continuity,

v. Letter of Disbursement,

vi. Letter of Revival

vii. Letter of Guarantee,

viii. General Letter of Hypothecation with Supplementary Agreement,

ix. Trust Receipt,

x. Letter of Authority to the Employer to deduct the installment from monthly salary.

xi. Acceptance of Letter of Authority by the Employer, xii. Post dated cheques from the client mentioning the amount each installment.

3. DIFFERENT TYPES OF OVERDRAFTS

Arranged Overdraft:

In this case the customer is allowed on the basis of prior arrangements overdraw his current account by drawing checks for amounts exceeding the balance upto an agreed limit within certain period of time not exceeding one year. These facilities are granting after the credit standing, financial ability and status of the customer as well as the purpose have been established.

Overdraft against Pledge of Goods / stocks:

Under this arrangement, the credit facility is granted to the borrower against the security of pledge of goods or produce in the form of raw materials or finished products subject to credit /margin restrictions. The borrower signs a letter of pledge and surrenders the physical possession of the goods / produce under banks effective control but retains the ownership with himself. In case of default the bank can sell the goods on serving proper notice to the borrower and adjust the outstanding out of sell proceeds. Sometimes collateral securities by way of legal or equitable mortgage of immovable properties are also obtained.Overdraft against Hypothecation of goods / stocks /plant & machinery. Under this method facilities are extended to borrower on his signing a letter of hypothecation, creating a charge against the goods / produce, plant & machinery’s etc. hypothecated for the amount of agreed limit of the debt subject to credit / margin restrictions. The control / possession as well as the ownership of the hypothecated goods ‘produce etc. is retained by the borrower but binding himself to surrender possession of the goods to the bank as and when called upon to do so. The bank only acquires a right or interest over the goods hypothecated. The bank may ask for collateral securities by way of legal or equitable mortgage of immovable properties and or guarantees where deemed fit

4. ADVANCE AGAINST IMPORT BILLS (BLC)

Advance against Bills under Letter of Credit are originated from the lodgment of shipping documents received from foreign banks against letter of credit established by the bank.

5. ADVANCE AGAINST IMPORTED MERCHANDISE (LIM)

Under loan against imported merchandise bank release the imported goods through the nominated clearing agent of the bank. In this case bank holds the possession of the goods. Importer takes delivery of the goods from the bank’s godown against payment. It is one type of forced loan.

6. ADVANCE AGAINST TRUST RECEIPT (TR)

Advance against Trust Receipt to the client are to release shipping documents for taking delivery of merchandise which is hypothecated to the bank.

8. ADVANCE AGAINST EXPORT BILLS PURCHASED / DISCOUNTED

Discount:

Banks allow advances to the clients by discounting bill of Exchange / pro. note which matures after a fixed tenor. In this method , the bank calculates and realize the interest at a prefixed rate and credit the amount after deducting the interest from the amount of instrument.

Purchase of bill:

Banks also make advances by purchasing bills, instead of discounting, which are accompanied by documents of title of goods such as bill of lading or railway receipts etc. In this case the bank becomes the purchaser / owner of such bill which are treated as security for the advance. This is allowed primarily relying on the credit worthiness of the client.

9. Advance Against Work Order

Advance can be made to a client perform work order. The following points are to be taken into consideration:

- The client’s management capability, equity strength, nature of the scheduled. Work and feasibility study should be judiciously made to arrive at a logical decision.

- If there is a provision for running bills for the work, appropriate amount to be deducted from each bill to ensure complete adjustment of the liability within the payment period of the final bill.

- Besides assignment bills receivables, additional collateral security may be insisted upon.

- Disbursement should be made only after completion of documentation formalities and fulfillment of arrangements by the client to undertake the contract.

- The progress of work under contract be reviewed periodically.

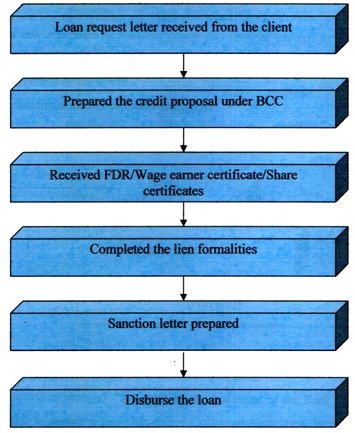

CASH BACK/ COLLATERAL LOAN SANCTION

There is a Credit Committee exists hi branch this is called Branch Credit Committee (BCC). This Credit Committee could provide loan up to 50 (fifty) Lac against cash back. In this case they don’t need to get sanction from Head Office. Under cash back they receive FDR / Sanchayapatra / Wage earner certificates / Share certificates and lien this or stop the payment.

The Process of Cash back loan:

SECURITY AGAINST ADVANCES

Security is a Cover against loans and advances. It ensures recovery of loans and advances. Though now-a-days greater emphases are put on the purpose of the loan rather than securities, nevertheless the securities play an extremely important role to take a decision.

Types of Security:

The types of securities offered vary from place to place. In metropolitan cities, it may be Govt. bonds / share / assignment of Book debt / Bills receivable etc. whereas, in the industrial area raw materials & finished goods etc. may be offered as securities. Again agricultural produce is the principal securities in the agricultural centers. Further, a bank also accepts moveable & immovable properties, life insurance policy etc. as securities.

COLLATERAL SECURITIES:

The tangible securities pledged / assigned by the borrower to the bank and additionally held by the bank to secure a loan are called Collateral Securities. In case of advances against pledge / hypothecation of goods, bank may insist on immovable properties as collateral.

Good collateral security must have the following characteristics:

- Tangible

- Transferable / negotiable

- Easily marketable

- Price stability

- Durability (not perishable)

- Ascertain ability of market value

- Genuineness of title (free from encumbrance)

GUARANTEE:

At times when the personal security of the borrower is not considered sufficient or when the risk involved is a border line case and the borrower is not in a position to offer sufficient collateral to the loan, the bank may ask for a guarantee of a third party whose financial ability and credit standing is acceptable to the bank, A guarantee is an undertaking given to the bank by a third party, called the guarantor to be answerable to the bank for the debt of the borrower upon his default in repayment of the loan. It should be remembered that such security for the loan depends on the continued solvency of the guarantor. To safeguard the bank’s interest a continuing guarantee in the bank’s standard form should be obtained.

MARGIN:

The difference between the market value / asset valued of the goods, merchandise and produces pledged / hypothecated to secure a loan / advances and the amount of the loan / advance (normally the drawing power) is known as MARGIN. The margin to be retained for each type of loan / advances will be in accordance with instructions issued from time to time by Bangladesh bank / Head office of the bank. In case where minimum margin is specified, the percentage may be increased according to market conditions, salability / durability / storage capacity and inspection facility of the goods.

Charge Documents

a. Promissory Note

debt(s) on demand or at a fixed or determinable future date along with interest at a stated rate. The demand promissory note must be obtained while extending any type of credit facilities.

b. Borrowing Resolutions

This is a certified copy of a resolution adopted by the Board of Directors of a corporate body authorizing designated officers to borrow and pledge, hypothecate, mortgage, etc. the assets of the corporate body for the purpose of securing the loan/ advance granted to them in accordance with the borrowing power laid down in the Memorandum and Articles of Association of the organization.

c. Letter of hypothecation

A ‘hypothecation Agreement’ must be obtained when the collateral is in the name of a person other than the borrower, Bank should ensure the person executing the agreement owns that hypothecated commodities/ goods etc. are solely. If the securities are owned by more than one person all of them must sign the Hypothecation Agreement, even though it may be jointly owned and payable to either or survivor.

The borrowers agree to Hypothecate to the bank goods and merchandise or any other securities in consideration of credit facilities granted to them. They give the Bank the right to sell the securities without notice to them and adjust their outstanding and other expenses from the sale proceeds.

d. Subordination Agreement:

“Letter of Subordination” is an agreement on the part of one party not to collect or enforce an indebtedness of a second party until certain obligations of such second party to a third party (bank) are fully met. In other words, the claim of the third party (Bank) is considered as a primary lien.

e. Power of Attorney:

This document authorities the bank to sign or endorse documents on behalf of the party executing the power. If it is given by a corporate body it must be accompanied by a corresponding copy of a resolution of the board of Directors authorizing the execution.

f. Letter of Arrangement:

The borrowers confirms the execution of charge / other documents and also acknowledges the bank’s right to cancel the credit lines allowed at anytime with or without notice and promises to repay on demand all outstanding including interest and other charges

g. Letter of Continuity:

In consideration of the bank allowing credit facilities, the borrower agrees to execute all relevant documents and to remain liable for repayment of all outstanding as principal debtor, or as guarantor. The borrower undertakes to remain liable on the promissory note and other loan documentation notwithstanding that his liabilities may have been fully or partly adjusted during the period of the credit facilities and even though his overdrawn account may show credit balance from time to time.

h. Letter of Revival:

This letter refers to and constitutes as an integral part of the loan documentation executed by the borrowers including the promissory notes. The letter is obtained in order to preclude any question of law of limitation.

i. Letter of Pledge:

When securities are pledge to the bank in consideration of credit facilities extended to the borrowers, these remain in possession of the Bank and can be sold in case of default and the sale proceeds be adjusted towards borrowers liabilities. Other terms and conditions are similar to those under the letter of Hypothecation.

j. Trust Receipt:

Two different types of trust receipts will be in use to cover the following area of credit lines:

i) Letter of trust receipt (For Release of shipping Documents)

This is executed by the borrowers to release shipping documents for taking delivery of merchandise which is hypothecated to the bank. The Borrowers agree to take delivery of merchandise as the Bank’s agents and acknowledges that the ban remains owner of the goods and they will be holding the goods on behalf of the bank, as Trustees until complete repayment of the debts to the bank.

ii) Letter of Trust Receipt (For Pre-shipment Financing) This is executed by the borrowers for availing pre-shipment finance by creating lien on the original letter of credit. The borrower also undertakes that the credit facilities will be utilized to purchase / process the merchandise for shipment as per terms of the credit.

k. Supplementary Agreement:

This is an integral part of the letter of pledge / Hypothecation / Letter of Trust Receipt /Packaging Credit Trust Receipt / General Letter of Trust Receipt. It describes the securities referred to in the above mentioned documents.

l. Counter Guarantee:

In consideration of the bank issuing guarantees / indemnities from time time to time, the borrower agrees to keep the bank indemnified from all liabilities, costs and legal actions that may arise from the guarantee.

Counter Shipping Guarantee:

In consideration of the bank issuing from time to time letter of indemnity / guarantee to enable the borrowers to secure delivery of goods without production of original relevant documents, the borrowers agree to indemnify the bank from any claims arising in the connection with the guarantee / indemnity issued by the bank and to honor by acceptance and /or payment of any draft relevant to the cargo presented to them. The borrowers agree to obtain Bill of Lading and / or other documents at the earliest endorsed in the Bank’s or its nominee’s favor

RISK MANAGEMENT -LENDING DECISION:

(A) To safeguard bank’s interest over the entire period of the advance, a comprehensive view of the capital, capacity, integrity of the borrower, adequacy, nature of security, compliance with all legal formalities, completion of all documentation and finally a constant watch on the account are called for. Where advances are granted against the guarantee of a third party, that guarantor must be subjected to the same credit assessment as made for the principal borrower. The basis of security valuation will be expert third party assessments, current market price and forced sale value.

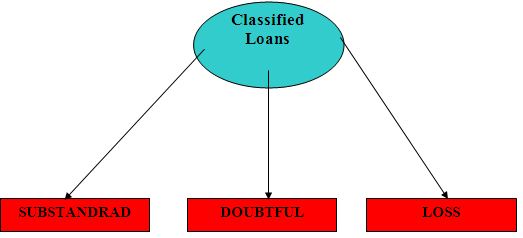

CLASSIFIED LOANS

The objectives/importance of loan classification are:

• To find out Net Worth of a bank;

• To assess financial soundness of a bank;

• To calculate the required provision and the amount of interest suspense;

• Strengthen credit discipline;

• To improve loan recovery position and

• To put the bank on sound footing in order to develop sound banking practice in Bangladesh.

SUBSTANDARD :

A well-defined weakness is present hi loans f this category, which could affect the ability of the borrower to repay. This is clearly a troubled situation, for one reason or another that requires immediate and intensive effort to correct and reduce the possibility of loss.

DOUBTFUL:

A serious doubt must exist that full repayment will not be forthcoming but the exact amount of the loss cannot be ascertained at the time of classification.

LOSS:

Advances, or portions of advances, which are determined to be uncollectable, based on presently known factors.

CONCLUSION

Modern Commercial Banking is challenging business. The rewards are modest; the penalties for bad looking are enormous. Commercial Banks are great monetary institutions, important to the general welfare of the economy more than many other financial institutions.

Southeast Bank is an emerging bank. The bank has only completed seven years of banking services. At the initial stage of business, every institution has to go through the difficult path of survival. To achieve the confidence of the customers, the bank must execute some improvements in its marketing and operational areas – SBL should try to win customers faith by providing them efficient and dependable services, credit facility and updating with user friendly modern technologies. The bank should redesign all sorts of banking procedures to be more user-friendly, attractive and impressive.

Southeast Bank limited started with a vision to be the most efficient financial intermediary in the country and it believes that the day is not far off when it will reach its desired goal. SBL looks forward to a new horizon with a distinctive mission to become a highly competitive modern and transparent institution comparable to any of its kind at home and abroad.

RECOMMENDATIONS

In specific level following recommendations are suggesting:

For General Banking

- Efficiency should be ensured

- Customer service should be pleasant and prompt.

- Speed in general banking activities

- Product of General banking activities should be increase

For Accounts Section

• A sound working environment should be ensured

• Overlapping of duties should be reduced

For Foreign Exchange Division

- Efficiency level should be improved

- Bank should take initiative to secure valuable customer

- The divisional activities should be more organized

- Historical record should be maintained

For Credit Division

- Credit product should be increase and categorized

- Terms and conditions of credit should be more flexible

- Marketing of credit products should be increase

- Divisional activities should be more organized

Broad Recommendations

- SEBL should be increase Marketing activities to be competitive in the marketplace.

- SEBL can pursue a Diversification Strategy in expanding its current line of business

- By expanding Business Portfolio, SEBL can reduce its business risk

- SEBL should increase efficiency Online Banking System for efficient transaction of business.