Executive Summary

In “Internship Program National Universit’s BBA Students have to prepare an Internship Report at the end of the semester. Our honorable course facilitator Md. Kamruzzaman assigned me to prepare this report based on activities of the General Banking system in Bangladesh. The report is prepared on “Practical Orientation in General Banking System”. I try to highlight the activities that performed by Dutch-Bangla Bank Ltd,Ring Road Branch , Baitul Aman Tower, 840 – 841 Ring Road Adabar, Dhaka – 1207 and also the activities of whole Dutch-Bangla Bank Limited. I try my best to highlight every activities of different department that I learn during the preparation of my report. But there is some limitation to collect the brief information about each and every department. Here I show the history and background of DBBL their profit & loss statement, cash flow statement and balance sheet, export, import L\C, procedure to open a L\C. By preparing the report I saw there are some limitations. At last I try my best to make the report more effective, and thanks to almighty Allah who creates us and gives us sound mind and health, and to our parents who gave birth to us and always inspire us. And special thanks to our honorable course facilitator who always inspire and support me and gave me the opportunity to make the report.

Internship program is a scope for acquiring practical knowledge after successful completion of academic curriculum. Theoretical knowledge gets a complete shape only when it is applied in a practical field. To breeze up the gap between theory and practice, NationalUniversity has introduced the internship program for BBA course to bring the student closer to the practical work. This is undoubtedly a valuable appreciable addition to the institutional education.

The course is designed with excellent combination of theoretical and practical aspects to provide an opportunity to the student on the job exposure, the students are sent to different organizations with a view to fulfilling their degree requirement.

Finally, I rounded up the total discussion with a precise conclusion.

Introduction

In this age of modern civilization bank is playing its splendid role to keep to the economic development wheel moving. The co-operation of bank is needed in every economic activity. In fact there is hardly any aspect of development activity, whether state inspired or otherwise, where banks do not have a major role to play.

Bank provide means and mechanism of transferring command over resources from those who have an excess of income over expenditure to those who can make use of the same for adding to the volume of productive capital. There are large numbers of small saver with small amount of savings who are generally reluctant to invest their surplus income because of their lack of adequate knowledge about complicated investment affairs. The bank provide them with the safety, liquidity, and profitability by means of different savings media offering varying degrees of a mix of liquidity, return and safety of savings. These savings bank use as their key of business. They invest the savings in higher degrees of return and maximize their profit in business.

Origin of the Report

This report about ‘Practical Orientation in Bank submitted on 09th May, 2013 to Md. Kamruzzaman In-charge, Department of BBA, Mohammadpur Kendreya Universtiy College give me the permission to prepare this report. I was assigned to do my practical orientation in Dutch-Bangla Bank Ltd,Ring Road Branch , Baitul Aman Tower, 840 – 841 Ring Road Adabar, Dhaka – 1207

Background of the Report

All over the world the dimension of Banking has been changing rapidly due to deregulation, technological innovation and globalization. Banking in Bangladesh has to keep pace with the global change. Now, Banks must compete in the market place both with local institution as well as foreign ones. To survive and thrive in such a competitive banking world, two important requirements are: Development of appropriate financial infrastructure by the central bank and Development of ‘professionalism’ in the sense of developing an appropriate manpower structure and its expertise and experience.

To produce skilled Banker, only theoretical knowledge in the field of banking studies is not sufficient. An academic course of the study has a great value when it has practical application in real life situation. So, I need proper application of my knowledge to get some benefit from my theoretical knowledge to make it more tactful. When I engage myself in such fields to make proper use of my theoretical knowledge in my practical life situation such an application is made possible through internship. When theoretical knowledge is obtained from a course of study at only the half way of the subject matter Internship implies on other the full application of the methods and procedures through rich acquired of subject matter can be forcefully applied in my day to day life situation. Such a procedure of practical application is known as internship.

National University introduced Bachelor of Business Administration (BBA) which is considered as a Milestone of Banking education in Bangladesh. NationalUniversity has been given the responsibility of introducing and running the BBA program with a view to supply adequate number of fresh graduates having modern education in banking and finance, who are expected to bring a qualitative change in the efficiency level of the financial system.

To relate the theoretical knowledge with the practice we the student of BBA were assigned in the practical orientation in bank. During my learner period, I was attached with Dutch-Bangla Bank Ltd,Ring Road Branch , BaitulAmanTower, 840-841 Ring Road Adabar, Dhaka – 1207. The Officer of this Branch help me to perform practical jobs in different department at different desk which help me to gather some practical knowledge for various banking functions and completed this report.

Objective of the Report

The objective of the practical orientation is to familiarize BBA students with the real life banking and to compare it with the banking theories that we have learnt.

The main objectives of the practical orientation are as follows:

- To understand the role of banks in Loans and Advances.

- To familiarize with practical banking.

- To know the General Banking practices.

- To know how to deal with Foreign Exchange.

- To observe banker-customer relationship.

- To relate the theories of banking with the practical banking.

- To examine the profitability and productivity of the Bank.

Methodology of the report

Data have been collected from two sources. These are as follows:

The Primary Sources of Data:

- Face to face conversation with the bank officers and staff.

- Direct conversation with the clients.

- File study of different section.

- Desk work: During my practical orientation I worked according to the following routine.

Section | Duration |

| General Banking | From 24/03/2013 to 23/04/2013 |

The Secondary Sources of data:

- Annual Report of Dutch-Bangla Bank Ltd.

- Different publications of Dutch-Bangla Bank Ltd.

- Unpublished data received from the Branch.

- Different text books.

- The main constraint of the study was insufficiency of information which is highly required for the study.

- Since the Bank personnel are very busy with their activities, as a result they failed to co-operate with me to complete this report.

- Such a study was carried out by me for the first time. So, in-experience is one of the main factors that constituted the limitation of the study.

- The duration of our orientation was not enough to cover all aspects of banking for this reason it is too difficult to cover all functions of the different desk to make understandable.

Limitation of the study

- The main constraint of the study was insufficiency of information which is highly required for the study.

- Since the Bank personnel are very busy with their activities, as a result they failed to co-operate with me to complete this report.

- Such a study was carried out by me for the first time. So, in-experience is one of the main factors that constituted the limitation of the study.

- The duration of our orientation was not enough to cover all aspects of banking for this reason it is too difficult to cover all functions of the different desk to make understandable.

Plan of Presentation

The report is divided into five chapters; Chapter-1 contains an introduction about the report preparing. Chapter-2 contains a brief idea about the DBBL which includes history of DBBL, its management, income statement, Balance sheet and function. Chapter-3 describes the general banking function and its process. General banking includes deposit, cash remittance and accounts department. Chapter-4, discusses the functions of foreign Exchange department. Chapter-5 contains the Recommendation and Conclusion about the performance of DBBL.

A Brief Idea about Dutch-Bangla Bank

History of DBBL

Dutch-Bangla Bank Limited a Bangladeshi-European joint venture scheduled bank with equity participation from the Netherlands Development Finance Company. It started banking operations in Bangladesh on 3 June 1996. The authorized and paid up capital of the bank is Tk 400 million and Tk 180 million respectively. The paid up capital represents the face value of 1.8 million ordinary shares of Tk 100 each and is fully paid by the sponsors. The equity of the bank was Tk 244.96 million in 1999 and its reserve fund was Tk 22.54 million in 2000.

The bank conducts all types of commercial banking activities including customer services related to local and foreign remittances but its core business is trade financing. It also extends short and medium-term loans to industrial undertakings on a limited scale. Innovative products on credit and deposit scheme introduced by the bank are commission free remittance, the ‘Money Plant’ scheme, monthly term deposits, and small credit facilities for shop owners, small-scale taxi cab loans, small-scale transport loans and consumer credit. Foreign Exchange business dealt by the bank was equivalent to Tk 5,817 million in 1999 and the transactions included export servicing (Tk 1,177 million), import financing (Tk 4,413 million), and remittance services (Tk 227 million). The bank has correspondent relationships with 17 foreign banks

In addition to its banking activities, Dutch-Bangla Bank Limited takes part in different national activities promoting sports, culture, social awareness, etc. Participation in these activities as sponsors is part of its business development policy.

An 8-member board of directors comprising a chairman and four representatives from local sponsors and three representatives from the Netherlands Development Finance Company oversees the management of the bank. The managing director is appointed by the board with the approval of Bangladesh bank. He runs the bank’s day-to-day business with the assistance of its 248 other employees working in various grades. In December 2000, the bank had 9 branches in different towns of Bangladesh.

As on 31 December 2000, total deposits mobilized by the bank amounted to Tk 6,073.3 million and total loans and advances stood at Tk 4,588.1 million was disbursed mainly to small and medium sized enterprises. On that date, its classified loan was Tk 33 million (0.72% of total). In 2000, the bank’s investment was Tk 842.31 million, which comprised Tk 710 million in treasury bills, Tk 1.15 million in shares and securities, Tk 30 million in debentures of Investment Corporation of Bangladesh (ICB) and Tk 100 million in other government securities. On the other hand, the bank borrowed Tk 90 million in 2000 from the inter-bank call market. Total assets of the bank in that year were valued at Tk 7,000 million and its off-balance sheet activities accounted for Tk 3,362 million. During 2000, the gross income of the bank was Tk 766.6 million against gross expenditure of Tk 523.5 million, resulting in an operating profit of Tk 243.1 million and a net profit of Tk 86.6 million. Return on equity of the bank in 1999 was 13.77%.

Mission:

Dutch-Bangla Bank engineers enterprise and creativity in business and industry with a commitment to social responsibility. “Profits alone” do not hold a central focus in the Bank’s operation; because “man does not live by bread and butter alone”.

Vision:

Dutch-Bangla Bank dreams of better Bangladesh, where arts and letters, sports and athletics, music and entertainment, science and education, health and hygiene, clean and pollution free environment and above all a society based on morality and ethics make all our lives worth living. DBBL’s essence and ethos rest on a cosmos of creativity and the marvel-magic of a charmed life that abounds with spirit of life and adventures that contributes towards human development.

Core Objectives:

Dutch-Bangla Bank believes in its uncompromising commitment to fulfill its customer needs and satisfaction and to become their first choice in banking. Taking cue from its pool esteemed clientele, Dutch-Bangla Bank intends to pave the way for a new era in banking that upholds and epitomizes its vaunted marques “Your Trusted Partner”.

Strength of DBBL:

♦ DBBL is the first Bangladeshi-European Joint venture Bank in Bangladesh.

♦ DBBL Directors and/or their family member’s do not maintain any sort of bank account with DBBL, since its inception.

♦ DBBL directors do not avail of any facility or even any fee/remuneration from the Bank for attending Meetings of the Board/Executive Committee/Audit Committee.

♦ DBBL’s sponsoring shareholders did not take any dividend for the initial 5 years in order to increase the capital base of the Bank.

♦ DBBL allows all local remittances such as TT, DD, and PO etc. free of cost.

♦ DBBL’s classified loan as on December 31, 2004 is only 0.16% of total loans and advances.

♦ DBBL’s Regulatory capital as on December 31, 2004 stood at Taka 1.43 billion (i.e. Taka 143 crore).

♦ DBBL’s Capital Adequacy Ratio (CAR) as on December 31, 2004 stood at 10.13% as against Bangladesh Bank’s minimum requirement of 9.00%.

♦ DBBL maintains general provision on unclassified Loans and Advances @ 3% instead of minimum requirement of 1% as set forth by Bangladesh Bank’s regulatory provision.

♦ DBBL extends free medical facilities under its “Rural Health Service Program” to the members of the general public around the rural branches.

♦ DBBL supports humanitarian and charitable activities and causes and spends a substantial amount from its income for these purposes.

♦ DBBL promotes different socio-cultural and sports activities.

♦ DBBL awarded 500 scholarships to meritorious and needy students of the country till this year. From the year 2007, the number of scholarships will be 1250 for which the Bank will need to provide Taka 3.75 Crore each year.

♦ DBBL provides 27% of its total advances as Term Loan and a substantial amount as working capital loan to support industrial development and boost up export earnings of the country.

♦ DBBL has set up the Dutch-Bangla Bank Foundation for carrying out social and charitable activities. From the last year, 5% of the Bank’s annual operating profit is earmarked for the Foundation which was 2.50% earlier.

♦ DBBL distributes up to 2.50% of its annual profit among its employees as profit sharing.

♦ DBBL, in addition to its Statutory Auditor, M/s. Rahman Huq has engaged M/s. Hoda Vasi Chowdhury & Co. as Special Auditor to conduct detail audit Committee of the Board and thus help the Committee to discharge its duties more professionally and accurately. This exceptional step has been taken by the Boards of Directors of DBBL with a view to bringing absolute transparency ands accountability in the overall performance of the Bank.

♦ DBBL’s objective is not only to make profit, but also simultaneously contribute towards social and human development through various generous activities.

Foreign Remittance through Exchange House:

At the beginning of the year 2005, our Bank has been exerting much emphasis on INWARD REMITTANCE. By this time the Bank established extensive drawing arrangement network with Banks and Exchange Companies located in the important countries of the world namely in the United Arab Emirates, State of Kuwait, State of Qatar, State of Bahrain, Italy, Canada and United States of America.

In the meantime, Dutch-Bangla Bank Limited gained the faith of the Bangladeshi Wage Earners in sending their hard-earned money to their respective beneficiaries in Bangladesh in shortest possible time. Expatriates Bangladeshi Wage Earners residing in those countries can now easily remit their hard-earned money to Bangladesh with confidence, safety and speed.

Western Union:

Western Union Financial Services Inc. U.S.A. is the number one and reliable money transfer company in the world. This modern Electronic Technology based money transfer company has earned world wide reputation in transferring money from one country to another country within the shortest possible time.

Dutch-Bangla Bank Limited has set up a Representation Agreement with Western Union Financial Services Inc. U.S.A. as on 14th February 2006. Millions of people have confidence on Western Union for sending money to their friends and family. Through Western Union Money Transfer Service, Bangladeshi Wage Earners can send and receive money quickly from over 225,000 Western Union Agent Locations in over 197 countries and territories world wide- the world’s largest network of its kind, only by visiting any branches of Dutch-Bangla Bank Limited in Bangladesh.

Name of the Exchange Companies and Banks:

Serial No. | Country | Name of the Exchange Co./Bank |

01 | U.A.E. |

|

02 | Kuwait |

|

03 | Italy |

|

04 | Bahrain |

|

05 | Qatar |

|

06 | Canada |

|

07 | U.S.A. |

|

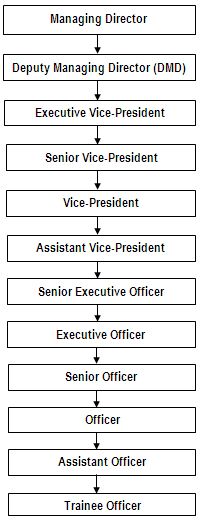

Hierarchy of Position in DBBL

Last Five years’ Comparative Performance of the DBBL

(Figures in million taka)

| Particulars | 2008 | 2009 | 2010 | 2011 | 2012 |

| Balance Sheet: | |||||

| Authorized Capital | 400.00 | 400.00 | 400.00 | 400.00 | 400.00 |

| Paid up Capital | 180.00 | 202.14 | 202.14 | 202.14 | 202.14 |

| Share Money Deposit/Share Premium | 18.20 | 11.07 | 11.07 | 11.07 | 11.07 |

| Total Capital | 407.00 | 664.35 | 909.00 | 1,136.29 | 1,429.02 |

| Capital Surplus/(deficit) | 2.30 | 27.90 | 98.27 | 136.23 | 159.26 |

| Reserve fund | 62.56 | 117.47 | 176.67 | 253.09 | 352.90 |

| Retained Earnings | 98.12 | 170.64 | 236.51 | 325.78 | 407.24 |

| Deposits | 6119.57 | 11,457.76 | 15,975.45 | 17,133.81 | 21,067.56 |

| Loans & advances | 4588.09 | 8,044.43 | 9,391.64 | 11,431.32 | 14,976.06 |

| Import | 8328.95 | 11,215.04 | 11,858.01 | 17,549.60 | 25,974.44 |

| Export | 3434.34 | 4,800.62 | 5,015.94 | 7,659.17 | 13,581.71 |

| Total assets | 6966.34 | 13,463.23 | 17,865.66 | 19,965.60 | 24,560.55 |

| Total earning assets | 6511.95 | 12,387.63 | 16,457.32 | 18,342.87 | 22,161.76 |

| Total non-earning assets | 454.39 | 1,075.60 | 1,408.35 | 1,622.73 | 2,398.79 |

| Total contingent liabilities | 3363.50 | 3,640.22 | 3,583.34 | 6,786.52 | 11,588.25 |

| Income Statement: | |||||

| Total operating income | 766.57 | 1,299.27 | 1,897.40 | 2,115.49 | 2,366.91 |

| Total operating expense | 527.79 | 902.01 | 1,473.84 | 1,661.70 | 1,734.50 |

| Total income from investment | 43.60 | 58.17 | 102.33 | 224.32 | 126.62 |

| Profit before provisions | 238.78 | 397.26 | 423.56 | 453.79 | 632.41 |

| Total provision | 32.01 | 122.72 | 127.56 | 71.68 | 133.39 |

| Profit before tax | 206.77 | 274.54 | 296.00 | 382.10 | 499.02 |

| Provision for tax | 82.71 | 111.74 | 118.40 | 171.95 | 262.67 |

| Net profit (after tax) | 124.06 | 162.80 | 177.60 | 210.16 | 236.35 |

| Ratios & Statistics: | |||||

| Return on equity (%) | 41.09 | 37.85 | 31.50 | 29.63 | 26.70 |

| Capital adequacy ratio (%) | 8.05 | 8.20 | 10.09 | 10.23 | 10.13 |

| Loan deposit ratio (%) | 75.00 | 70.00 | 59.00 | 66.72 | 71.09 |

| Amount of classified Advances (Tk) | 32.97 | 41.19 | 56.41 | 41.58 | 23.24 |

| Provision kept against classified Advances (Tk) | 5.44 | 6.94 | 19.04 | 19.04 | 19.04 |

| Provision surplus/(deficit) (Tk) | 0.36 | – | 1.75 | 10.38 | 13.70 |

| Classified loans to total loans (%) | 0.72 | 0.51 | 0.60 | 0.36 | 0.16 |

| Return on assets (%) | 2.27 | 1.59 | 1.13 | 1.11 | 1.06 |

| Return on Investment (ROI) (%) | 57.61 | 54.76 | 33.31 | 22.98 | 26.12 |

| Cost of Fund (%) | 7.97 | 7.86 | 8.65 | 8.53 | 6.90 |

| Earning per share (Tk) | 68.92 | 80.54 | 87.86 | 103.97 | 116.93 |

| Dividend per share (Tk) | 15.00 | 17.50 | 20.00 | 20.00 | 22.50 |

| Price Earnings (P/E) Ratio (Times) | – | 5.30 | 4.64 | 4.15 | 15.84 |

| Net asset Value (NAV) per share (Tk) | 199.38 | 248.01 | 309.88 | 391.85 | 484.03 |

| Number of shareholders | 7 | 588 | 471 | 451 | 403 |

| Number of employees | 248 | 309 | 401 | 436 | 401 |

| Number of branches | 9 | 11 | 17 | 17 | 19 |

Profit & loss account for the year ended 2011 and 2012.

| Particulars | 2012 (Taka) | 2011 (Taka) |

| Interest income | 1,801,553,799 | 1,607,738,916 |

| Less: Interest paid on deposits & borrowings | 1,264,334,948 | 1,291,708,740 |

| Net interest income | 537,218,851 | 316,030,176 |

| Income from investment | 126,620,851 | 224,317,597 |

| Commission, exchange and brokerage | 346,681,280 | 244,737,126 |

| Other operating income | 92,062,436 | 35,937,181 |

| Total operating income | 1,102,583,418 | 821,022,081 |

| Salary ands allowances | 222,526,033 | 179,303,371 |

| Managing Director’s Salary ands allowances | 5,150,600 | 4,205,754 |

| Rent, taxes, insurance, electricity etc | 53,644,991 | 41,801,511 |

| Legal expenses | 297,045 | 120,177 |

| Postage, stamp, telecommunication etc. | 13,447,616 | 10,923,146 |

| Audit fees | 200,000 | 150,000 |

| Printing, stationary ands advertisement | 37,119,831 | 34,454,423 |

| Repairs, maintenance and depreciation | 60,477,017 | 48,230,561 |

| Other expenses | 77,308,100 | 48,047,926 |

| Total operating expense | 470,171,233 | 367,236,869 |

| Profit before provisions | 632,412,185 | 453,785,211 |

| Specific Provision | . | . |

| General Provision | 106,409,677 | 61,625,500 |

106,409,677 | 61,625,500 | |

| Provision for diminution in value of investment | 33,180 | . |

| Provision for DBBL foundation | 26,945,450 | 10,055,000 |

| Total provisions | 133,388,307 | 71,680,500 |

| Profit before tax | 499,023,878 | 382,104,711 |

| Provision for tax | 262,673,526 | 171,947,120 |

| Profit after tax | 236,350,352 | 210,157,591 |

| Appropriations: | ||

| Statuary reserve | 99,804,775 | 76,420,942 |

| Dividend equalization account | 5,053,375 | |

| Proposed dividend @ Tk,22.50 per ordinary share of Tk. 100 each | 45,480,375 | 40,427,000 |

| Dividend distribution tax @ 10% on proposed dividend | 4,548,038 | 4,042,700 |

154,886,563 | 120,890,642 | |

| Retained earnings carried forward | 81,463,789 | 89,266,949 |

| Earning per share | 117 | 103.97 |

The General Banking Department does the most important and basic works of the banks .All other department are linked with this department. It also plays a vital role in deposit mobilization of the branch. For proper functioning and excellent customer service this department is divided into various sections namely as follows:General Banking Department

- Accounts opening section

- Cash section

- Deposit section

- Remittance section

- Clearing & collection section

- Accounts section

- Dispatch section

- Personal and establishment section

Accounts Opening Section

This section deals with opening of different types of accounts. It is also deals with issuing of check book and different deposits book to the different accounts opener. A customer can open different types of accounts through this department such as:

- Current account

- Saving bank deposit account

- Fixed deposits account

- Monthly saving scheme

- Special deposits scheme

Requirements of opening an accounts

There are some requirements have to be completed for opening an account such as:

Current Account

Current account is an account where numerous transactions can be made by the accounts holders within a working day. There is no restriction on the number and the amount of withdrawals from the current account within availability of funds.

As the banker is under this obligation to re pay this deposit on demand. NO interest is paid in this A/C. Generally, current account is opened for businessmen and traders for easy transaction. But a person can open CD A/C for special purpose. Requirements for the different types of accounts holder are discussed below:

Proprietorship Firm

There is a different account opening form for proprietorship firm provided by the Dutch Bangla Bank Ltd., Banani Branch; Requirements of opening CD A/C for proprietorship are mentioned below:

- Trade license

- Seal of the firm

- Attested photograph (2 copies)

Partnership Firm

There is a different account opening form for partnership firm. Instruction for running an account is given in this form documents required to open these types of account as follows:

- Attested (2COPIES) of those who will operate the account.

- Partnership deed.

- Resolution of the firm regarding account opening should be given.

- Trade license.

For opening every types of account a signature card and different register for different types of account is maintained in the bank. An account number is given in each account and the description of the account is entered in the computer.

Limited Company

A separate account opening form is used for limited company. The banks always take precautions for opening account these types of customer. Several documents are submitted by them which should be checked carefully by the bank to be legally in a safe position. Requirements to open an account as follows:

- Memorandum of association

- Article of association.

- Attested photographs (two copies each) of those who will operate the account.

- Letter of commencement (for public ltd co.)

- Letter of incorporation.

- List of the directors and their number of share and status.

- Registration: the company must be registered and certificate related to this issue is obtained from the registered office of Joint Stock Company.

- Resolution: specimen of resolution to be passed by a limited company for opening an account with the bank.

Saving Bank Deposits Account

SB account is meant for the people of the lower and middle classes who wish to save part of their incomes to meet their future needs and intended to earn to an income form their savings. Therefore, the banks impose certain restriction on the savings bank account also offer reasonable rate of interest. The cash reserve maintained by the bank against these deposits is comparatively smaller than current account.

Fixed Deposit Account

These are deposits which are made with the bank for a fixed period specified in advance. The banks do not maintain cash reserves against these deposits and therefore. The bank offers higher rates of interest on such deposits. These deposits generally constitute 50% or more of the total deposits. Usually customers are allowed to open this A/C for a certain period. The rate of interest varies in accordance with the terms of the deposit. The terms and their rate of interest of DBBL Banani Branch are as follows:

| Term | Interest Rate Charged |

| 1 Months | 8.00% |

| 3 Months | 10.00% |

| 6 Months | 11.50% |

| 12 Months | 12.00% |

The amount of FDR is payable once at a time. After the term of which the A/C was opened the FDR gets its maturity. The claim is then fulfilled by paying the principle amount plus interest and bank deduct the Income tax on interest amount.

Opening of FDR

There is prescribed form for opening FDR. No introducer is required for opening this A/C. A minimum amounts as determined by the H.O. is required to open such A/C.

Dormant Account

Accounts in which no operation either deposit or withdrawal takes place for period of one year should be treated as Dormant Account. Such account should be transferred to a separate Auxiliary ledger called “Dormant Account Ledger”. As a measure of precautions against a fraud the specimen signature cards of all the dormant accounts should be also be removed from the box of active account signature cards and kept in a separate signature card box. The first withdrawal from such account should be allowed with closing and other incidental charges and surrender the unused check leaves. The account should be debited for the account closing charges etc. and unused check leaves should destroyed by the authorized officer of the bank. In case of Joint A/C the application for closing the account should be signed by the entire Joint A/C holder.

Procedures of Closing Account

A customer may close out his account any time by submitting an application to the branch. The customer should be asked to draw the final check for the amount standing to the credit of his account less the amount of closing another incidental charge and surrender the unused cheque leaves. The account should be debited for the account closing charge etc. and unused cheque leaves should be destroyed by the authorized officer of the bank. In case of joint account the application for closing the account should be signed by the joint account holder.

Cash Section

There several counters work simultaneously in cash section of DBBL, Banani Branch. There is also some electronic counting machines by which a huge amount of cash money can be counted within a few minutes. This branch also allows evening hour transaction only in case of deposit of money.

Cash Receiving Procedures

The work of cash receiving counter is examining deposit slips. Depositor will use the prescribed deposit slip supplied by the bank to deposit cash, cheque, draft, pay order, etc. In all types of deposit the teller must check the following things:

- The slip has been properly filled-up.

- The title of the account and its number.

- The amount in figure and in words is same.

- Instrument signed by the depositor.

- Date of the instrument.

After checking all these things the teller will accept cash, cheque, draft, pay order, etc. against deposit slip. The Teller will place the cash in the cash drawer according to denominations. The teller will place sign and affix “cash receipt, rubber stamp” and return the customer’s copy to the customer.

Cash payment Procedures

Precaution

In order to safe guard his position; the paying banker has to observe the following precaution before honouring a cheque:

- A cheque must be looked whether it is an open or crossed cheque.

- The paying officer should see whether the cheque is drawn on his/her branch.

- He must see the cheque is post dated or pre dated. A teller must not pay any post dated cheque.

- The officer must carefully see the apparent tenor of the cheque. If it is mutilated or materially altered then the officer must not honour it.

- The officer must compare the signature of the cheque with the signature on the specimen signature card.

- The officer must verify the regularity of the endorsement.

- The officer may allow overdue against a cheque if prior arrangement is done with the bank.

Passing the Cheque

If the cheque has no defect and it is payable, the in charge will sign in the cheque affixing signature verification seal along with his/her initial and will cancel the cheque by striking it with pen. The officers will handover the payment to the appropriate payee.

Dishonour of Cheque

A banker can dishonour a cheque in following situation:

- Insufficient fund

- Payment stopped by drawer

- Alteration required drawer signature

- Effect not clear in cheque

- Exceed arrangement in cheque

- Full cover not received

- Payee’s endorsement irregular/illegible/required

- Drawer signature differed and required

- Cheque is post dated/mutilated/out of date

- Crossed cheque must be presented through a bank

- Clearing stamp required cancellation

- Cheque crossed “Accounts payee only”

- Collecting bank’s discharge irregular/required

Deposit Section

The function of the Deposit section is very important. It is fully computerized. The officer of the deposit section maintains account number of the all customers of the bank. They are used different code number for different account. By this section a depositor/drawer can know what the present position of his account is. The officer make posting three types of transaction, such as: Cash, Transfer and Clearing. This section performs following tasks:

Remittance Section

Banks have a wide network of branches all over the country and offer various kinds of remittance facilities to the public. The remittance of the funds by banks is made through different methods. They are:

- Demand Drafts

- Pay Order

- Pay Slip

- Mail Transfer

- Telegraphic Transfer

Demand Drafts (DD)

Demand draft is an order to pay money, drawn by one branch of a bank upon another branch of the same bank for a sum of money payable to order on demand. A draft cannot be drawn payable to named payee. Draft may be purchased by customer or non-customer of the banks. The purchaser of the draft must fill in the relative application form with his name, amount, name of the payee, the branch on which draft is desired, sign it. He has to tender the amount in cash for the draft and bank charge, if any .If the purchaser has an account to the bank can debit D.D amount. The draft is prepared with care regarding the name of the payee, the amount and the office on which it is drawn. In order to ensure safety, the purchaser is advised to cross the draft and the bank given test number. The issuing officer send to the drawee branch an advice containing the particulars of the draft.

Pay Order (PO)

Banks payment order is an instrument which contains an order for payment to the paid to effect local payment whether on behalf of the bank or its constituents. In the beginning stage, PO was issued o

nly to effect local payment of banks own obligations .But at present it is also issued to the customers which they can purchase to deposit as secondary money of carnets money. The banks payment offers are in the form of receipts and issued by the joint signature of two officials. It ensures payment to the payee as the money deposited by the purchaser of PO is kit in the banks own A\C named. Payment of the instrument to be made from the branch it has been issued. It is not transferred and therefore it can only be paid to:

- The payee in identification

- The payees’ banker, who would certify that the amount will be credited to payees account.

- A person, holding the latter of authority from the payee whose signature must be authenticated by the payee.

- The purchaser, by cancellation provides the original PO is surrendered by him to the bank.

Transaction Listing

It is the document of every day’s head wise transaction with particular account suppose , M r. X is a cash credit (general) account holder , Mr.Y is also an account holder, if the same types of credit – they both made transaction . In this case, the transaction listing would show both the transactions with the transaction number, account number, account heading, the amount of the transaction etc. each and every bit of activity of the branch is reflected here. This statement shows the following information.

- Voucher number.

- Types of transaction (whether it is depositing transaction or withdrawal transaction)

- Code number of the transaction.

- Whether the transaction is Debit or credit balance and the amount.

- ID number.

- Transaction number.

- Account number.

- Heading of the account.

- Particulars of the account.

Statements that are sent by Account Department to the Head Office

The account Department has to send various types of statements to the head Office such as:

- Daily statement

- Weekly Statement

- Monthly Statement

Brief description about these statements is as follows:

Daily statement:

In this statement every branch has to send its every day’s last resources position to its Head Office.

Weekly Statement:

In weekly statement every branch sends all the particulars of two types of deposit.

- Time Deposit

- Demand Deposit

Monthly Statement:

Every branch has to send monthly statement to the Head Office in earlier part of the month. In this statement there are all particulars of every accounts, how income the branch is generating, how much expenditure they are making, how much loans and advance they are providing to the parties, how much recovery has been achieved, how much loans has been stucked-up, how much deposit has been collected, what is the performance of the branch in foreign exchange business, etc. are included in the monthly statement.

Dispatch Section

The literal meaning of the term “Dispatch” is to send away hostily/quickly or to receive an official message. There are two types of dispatch maintained by the dispatch section.

- Dispatch of Letter

- Dispatch of Telegram

For convenient of the work dispatch of letter has been classified into two groups mainly:

- Inward Mail

- Outward Mail

Outward mail is again classified into:

- Ordinary Letter

- Registered Letter/Registered Parcel

Each branch will maintain a deposit account with the local telegram office to which the amount of initial deposit will be paid by debiting to the Charge Account under advice to accounts division. Where a record of all such deposit paid by branches are maintained. The receipt for the deposit will be recorded in the branch document register and retained with other documents.

Personal and Establishment section

This section is under general banking department. The function of the Personal and Establishment section is as follows:

- Supply of office stationary and furniture & fixture

- Maintenance of all fixed assets

- Placement, transfer, promotion letter issuing to the employees

- Correspondence with different department and executives

- Maintenance of stores

- Preparation of expense bill for all kind of expenses

- Maintenance of all expenditure register

Findings and Recommendation

Findings

General Banking Department

- The location of the DBBL is very much suitable for deposit mobilization, and the external and internal appearance is also attractive.

- The space of the branch is much extended, so different function can be done very easily.

- Accounts opening department is required to be well furnished with modern desk.

- The officers, who work with computer, are not so well trained. If sometimes any problem arises they take time to overcome it.

- There is no computer in remittance section. So, at least one computer is required in the remittance section for quick and prompt service.

- Payments against instruments are faster.

- All decoration of the entire branch is necessarily to be reconstructed for attracting actual and potential customers in competitive market.

- Accounts department needs another permanent officer to perform the job quickly.

- The bank use software named Flex-cube Retail which is good but it needs lots of improvement to perform better and provide faster service to the customer.

- In foreign exchange department, sufficient number of employee needed to perform better service and to sustain in the competitive market.

- Some times, return documents against L/C are not found according to the terms and conditions of L/C.

- Pre-shipment inspection certificate should obtain from the exporter of back to back L/C.

Foreign Exchange Department

Recommendation of the Study

Now some recommendations based on the findings of the study are given below:

- In cash department to ensure more prompt service and to reduce risk an electronic scanning machine should be installed to verify signature on the cheques.

- The officer of front desk should well mannered and of pleasing personality. They should be more professional in their work.

- The officers of the different department should be well trained. The organisation could arrange training program for them in their training institute.

- Transfer of internal instruments should be done quickly on the same day.

- Clearing cheques should be presented and collected on the following day receipt of such cheques.

- Out-station cheques and other instruments should be sent for collection on the same day by registered post.

- In case of instruments received for collection from outstation branches, payment should be effected by the following working day. Intermission/advice thereof should be communicated promptly.

- Balance confirmation on quarterly basis must be sent to CD/SB Account holders. Statement of accounts and passbook, if requested for, must be provided to clients.

- Bank personnel should come to office, at 15 minutes before commencement of business hour. This will enable them to plan their work for the day and to attend the clients at 9 A.M. sharp.

- At the peak-banking hour, Manager should move around CD/SB Departments and counters for overall supervision and smooth functioning of the branch.

- Counter should be neat and clean and counter personnel should be smart, tidy and well groomed.

- When customer approaches bank personnel with a problem, which is not actually related to him, the customer should not be avoided. Rather he should be guided to the relevant person.

- Special emphasis must be given for collecting credit report and status report of the borrower when loan exceeds more than fifty thousand.

- Strict supervision must be adopted in case of high-risk borrowers. Time to time visit to the project should be done by the bank official.

- As the office deals with a huge number of clients in a day. Therefore, most efficient employees of this bank should send to this branch for greater work force productivity.

Conclusion:

This report has attempted to explain the banking services and policy allowed by the DBBL and also attempted to harmonize and link the theoretical knowledge acquired in the previous term with the experience gathered during the period of practical orientation.

Comparing practical knowledge with theoretical involves identification of weakness in the branch activities and making recommendation for solving the weakness identified.

Since all departments and sections are covered in internship program, it is not possible to go to the depth of each activities of branch because of time limitation.

So, the objective of internship program has not been fulfilled with complete satisfaction. However, highest effort has been given to achieve the objectives of the internship program.

DBBL is playing an important role in the banking system and in the payment system of Bangladesh. The bank has taken suitable policy, strategies and modern technologies to deal with different situations.

Finally, I think that Authority needs to think more about customer services and customer awareness – how to improve the service strategies, how to bring more speed in banking process, how to achieve more efficiency, and above all how to obtain more deposit with lower cost. Otherwise it will be very difficult for the bank to compete with the other commercial banks that already have achieved such level of efficiency. Also every Bank has to be very careful about the credit/advance banking. Overall awareness of both borrowers and the leaders has to be developed. At present DBBL is successful in effectively and efficiently managing these vital issues. In spite of that, in order to keep its success continue and reach at the pinnacle of success it, its managers, board of directors and employees must have the comprehensive and clear idea about the reserve, fund, loan, capital, deposit and liquidity regarding the smooth control of bank and continue its vital operation toward country’s economic development.