HR Operation of BRAC Bank Limited

Over the last few years, the economy of Bangladesh has been passing through transitional phase. Bank as vital institution of the economy is no exception to this. The role of banking in the field of promotion of capital, encouragement of entrepreneur, generation, of employment opportunities need hardly to be over emphasized.

Normally the term “default” refers the non-repayment of loans and advances within prescribed time limit that subsequent default is termed as “defaulter”. But a very precarious situation is now prevailing in the banking sector of the country specially private banking sector. BRAC Bank one of the leading private commercial Bank, performs in addition to other than traditional type of business through expansion of branches for expansion of its services into rural areas to mobilize rural savings more effectively and extended credit facilities.

BRAC Bank has embarked with an avowed policy to promote broad based participation in the Bangladesh economy through the provision of high quality banking service based on latest information technology. The Bank will ensure this by increasing access to economic opportunities for all individuals and businesses in Bangladesh with a special focus on currently under served enterprises and households across the rural-urban spectrum. By increasing the ability of underserved individuals and enterprises to build their asset base and access market opportunities will increase the economic well being for all Bangladeshis.

BRAC Bank Limited, a scheduled commercial Bank, started its business operation in Dhaka, Bangladesh on 4th July 2001. It is an affiliate of BRAC which is the largest NGO in Bangladesh. The Bank has positioned itself as a new generation Bank with a focus to meet diverse financial needs of a growing and developing economy. At present BRAC Bank is one of the fastest growing banks in the country. Today, BRAC has emerged as an independent, virtually self-financed paradigm in sustainable human development.

Scope of the report:

Human resources are very essential for any organization specially for the development and growth. And obviously Human resource department is the heart of any organization as they do all the important works of an organization. By the human resource department an organization can easily gain knowledge about their employees condition means their satisfaction, dissatisfaction and so on. This report will give a clear idea about the Human Resource Department of BRAC Bank Limited.

How effective BRAC Bank is towards its customers? What types of benefits they offer towards their employee? Why employees turnover is high in BRAC Bank? What are the aims to develop training program? To have answers of all these questions, I have tried to get information during my entire internship period and discussed with my supervisor.

Methodology:

Both the primary and secondary data are used to make the report more rich and informative.

Primary data are collected through:

- Observation within the total internee period

- Information from my supervisor

- Discussions with internal employees

- Survey

Secondary data are collected through:

- Website browsing

- Annual report of BRAC Bank

History of BRAC Bank:

BRAC (Bangladesh Rural Advancement Committee) founded by Fazle Hasan Abed in 1972 is an renowned Non-governmental organization which helps a lot of poor people to become economically powerful and one of its affiliate is BRAC Bank. BRAC Bank was founded on 4thJuly 2001 as a private commercial bank focused on SME means Small and Medium Enterprise.BRAC Bank believes in sustainable banking philosophy to uphold its 3P agenda: Planet, People and Profit. As part of the sustainable banking initiative BRAC Bank has launched a green initiative quoted as ‘Go Green with e-statement’ for its valued. BRAC Bank pledges to return as much green to the planet as possible against the tree fallen for paper-statements. BRAC Bank established Green Banking Unit (GBU) under Risk Management Division for designing, evaluating and administering related to green banking issues. The bank also has Green Banking Policy to be followed by every employee so that environment friendly activities can be ensured throughout the bank.

Some of the bank‟s Green Banking initiatives are :

- Planet card

- E-statement

- Solar Powered Unit Offices

- Supporting Renewable Energy Sector by financing Bio-Gas Project

BRAC Bank carries a strong emphasis on Corporate Social Responsibility-initiatives that support the people and protect the planet. To expand social activities and carry out them in a focused way, BRAC Bank has launched a CSR Desk with a dedicated team assigned for the desk. The desk initiated in line with guidelines of Bangladesh Bank, will help the bank put focus its on different CSR activities and ensure transparency.

Currently BRAC Bank‟s CSR activities are focused on:

- Environment

- Education

- Health

- Young leadership

- Culture and Heritage

- Community Development

It has 157 branches,435 SME Unit office,350+ ATM Booth,47 CDM. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh. It has 5 subsidiaries, which are Bkash,BRAC EPL (Brokerage), Bits, EPL (Investment), BRAC Sajaan.It achieved Global Brand Excellence Award for Sustainable Marketing Excellence in 2014,In 2011 it got the best Retail Bank in Bangladesh award, In 2013 it got The Best Bank of Bangladesh award.

BRAC bank limited, with institutional shareholding by BRAC, International Finance Corporation (IFC) and Shore Cap Exchange, has been the fastest growing bank for last several years.

International Finance Corporation:

IFC is the subsidiary of World Bank. It helps to promote the development of private sectors and also create opportunities for poor people to remove poverty and live a standard life. IFC is a 9.5% shareholder of BRAC Bank limited.A new assistance program signed in August 2005 aims to double the bank‟s number of small and medium enterprise clients in 18 months through campaigns to target women entrepreneurs and rural clients, introduce new products and train branch managers.

Shore cap International:

Shore Bank Corporation, America‟s first and leading community development and environmental Banking Corporation launched shore Cap. Shore Cap International (SCI) aims to provide socially responsible appreciation of capital through investments that enhance the growth and capacity of financial institutions serving micro and small enterprises in developing countries and transitional economies. Shore Cap International is a 6.99% shareholder of BRAC Bank.

SME Banking:

SME stands for Small and Medium Enterprise. For SME Loan operation BRAC Bank has total 900 unit offices,80 zonal office,12 territory and 1800 Customer Relationship Officer. CRO‟S duty is to help clients in getting loans. When CROs get the loan application and if it is less than 500,000 TK then zonal officers have the authority to approve the loan. But if it is above 500,000 then the CROs send it to Head Office for all necessary approval. After approving the loan then Asset Operation Department starts its work.

Under Small Enterprise in Fixed asset there are 5 lac to 10 core amounts are fixed asset and within this amount they give service. And the amount of human resource is 10 to 25.On the other hand under the number of staff the trading or service amounts are 50 lacs to 10 core. In Medium Enterprise the amount of fixed assets is 1 core to 15 core and the people are 50 to 100. Again under no of staff the amount of taka is above 10 cores and below 30 cores. Where the amount of people are 100 to 250. It contribute 25% in GDP and employment generation percentage is 60%.The SME Market share is 5.28%.

Retail Banking:

Retail Banking is a banking process where bank do transaction directly with consumers. Currently BRAC Bank has re-organized its retail business according to customer profile. This segmentation has been done to deliver more standardized services and reduce operating costs as well. The segments are as follows:

- Premium Banking

- Supreme Banking

- Excel Banking

- Easy Banking

Those who maintains at least BDT 50 lacs (6 month average) is called premium customers. They are highly prioritized. They also enjoy different gift and discount through BRAC Bank. Currently BRAC Bank has around 1000 premium customers.

Where who maintain a balance between BDT 10 lacs to below 50 lacs (6month average) are treated as supreme clients. They enjoy separate service booth and cash deposit booth in the branch along with many other services. Customer who maintains a balance between BDT 50 thousand to below 10 lacs in an average of 6 months are called excel group of guest. These are the general customers who do day-to-day and traditional banking with the bank. They only require a minimum balance in the account (up to BDT 50 thousand).

Corporate Banking

Corporate Division provides full range of commercial banking products and services to any potential corporate clients including multinationals, large or medium local corporate, NGOs, institutional bodies.

Corporate Loan Products

- Overdraft – This is an on-demand credit facility designed to meet day-to-day operational activities of the business, including purchase of raw materials and expenses.

- Term Loan – Short Term Loan/Revolving Loan: This scheme is to meet different short- term fund requirements of the client. Payment of duty, Tax, VAT and other expenses related to the release of goods from customs through pay orders in the name of customs authority or Bangladesh Bank cheque is payable through this scheme.

- Lease Finance – One of the more convenient long-term sources of acquiring capital machinery and equipment. The client is given an opportunity to have exclusive rights to use an asset, for an agreed period of time, against payment of rent.

- Loan Against Trust Receipt (LATR) – This is advancement against a Trust Receipt provided to the client when the documents covering an import shipment are given without payment. Under this system, the client will hold the goods of their sale proceeds in trust for the bank, until the loan allowed against the Trust Receipt is fully paid.

- Work Order Finance – BRAC Bank provides Work Order finance facility for its valued clients. Through this arrangement, clients can avail loan facilities against valid Work Orders up to a certain proportion.

- Medium Enterprise – The products offered under this sort of financing are versatile in nature and each product is tailored according to the need of the borrower, under certain parameters. The range of organizations this sort of financing caters to include proprietorship concerns, private limited companies, educational institutions as well as NGOs.The purpose of this unit is to serve medium enterprises having facility requirements like a large corporate in nature, but smaller in volumes. The facilities may range from a single- funded or non-funded limit to a composite credit facility that includes various corporate products. The Bank believes that the emerging medium enterprise of today is tomorrow‟s large corporate that will facilitate the true growth of the nation.

Trade Finance:

Letter of Credit (LC):This facility is related to import or local purchase of different items. It is also provided for the import and export of goods (such as raw materials, machinery, equipment, any trading item).

Letter of Guarantee (LG): To meet different contractual requirement such as participating in Bid, Performance Guarantee and Advance Payment guarantee for different contractual requirements.

Corporate Cash Management:

NCS –BRAC Bank will collect clients‟ bills through their Bills Pay Machines in the strategic locations of the city and also at the correspondent branches, where the BRAC Bank branches are not available and at the booths. NCS stands for Nationwide Collection Service.

PTS – PTS will allow clients to disburse all kinds of payments anywhere in the country through BRAC Bank‟s own branch network in Dhaka, Chittagong, Sylhet, Savar, Feni and the partner bank branches all over the country. PTS for Payment Transfer Service.

Treasury

BRAC Bank has a strong presence in the Treasury Market in Bangladesh. The Money Market Desk of the Treasury Division mainly deals in Bangladeshi Taka transactions. The basic activities undertaken by the Money Market Desk are:

- Daily Funds & Liquidity Management

- Investment Management

- Treasury Services

- Call/Overnight Lending & Borrowing

- Term Money Borrowing & Lending

- Repurchase Agreement

- Treasury Bills (T-Bills)

Human Resource Department of BRAC Bank Limited

- Different types of employees

- Human Resource Division

Different types of employees:

The BRAC Bank Limited has in different employee‟s criteria. There are different types of employees working in different places inside BRAC Bank. The types of employees are-

- HR Contractual: Contractual employees are taken for specific period like six months basis. Along with their salary, they get attractive performance bonus if they achieve their target which determined by organization. HR temporary contract are for those categories whose Job description is such, where he/she needs to be under the direct supervision of Bank‟s authority, whose performance is monitored by the Bank Management. They might be specialist, consultant, and specially assigned staff. Staff under HR contract are those people who directly or indirectly deals with customer, has access to Bank‟s confidential data‟s& valuable properties (car, etc.), deals with sensitive areas, also where staff need to deal with customer as a representative of BRAC Bank directly.

- Regular/ Full time employee: In full time category, employees are joined as probationary for six months or one year depending on job category. They also have to sign a deed for 5 years a long with depositing taka 2 lacs refundable. The regular employees are allowed to get the bonus, incentives and other allowances with their basic salaries. And these types of employees also have the benefit of getting extra facilities the BRAC Bank limited is providing for their employees.

- Outsource Staff: Other contractual employees are not entitled for any service agreement. They will be recruited through outsource agencies. The requirement of any support staff through outsource agency must come through HR signed by the Division Head. HR will send the requirement to provide staff by the Outsource Agency. Outsource Staff recruitment depends on the budgeted requisition of the staff from the respective departments. However, for non-budgeted requisition it will go through after the approval process of MANCOM. The bank reserves the right to terminate the contract with the Outsource Agency without assigning the reason whatsoever. The Outsource Staffs salaries are fixed and they won‟t get any allowances with their salary.

- Intern: To encourage and help human resource development in the financial industry the Bank may decide to offer internship programs to individuals or educational institutions. The decision to enter such an engagement will be decided by the MD& CEO on the recommendation of the Department Head. The HRD will prepare the proposal of such engagement with individual/institution and forward it to the MD& CEO for consideration with the recommendation of the Head of HR. Individuals engaged as Internees will be paid a consolidated Honorarium of Tk. 5000/- per month, as decided by the MD/MANCOM and will not be entitled to any other benefits. Managing Directors & CEO will determine and analyze the necessity of intern on the basis of yearly budget and also requirement of special projects. As per requirements Department Head will make the intern requisition and after receiving intern requisition HR will take 15 days for an intern to join. All Internships program will be for a three months. Prior approval by MD& CEO internship program can be extended for a maximum period of six months.

- Management Trainee Officer (MTO): Management Trainee Officers highly qualified students of BRAC Bank Limited. The MTO‟s are regular employee but they have to learn as a student inside BRAC Bank for the period of one year. After one year if they can complete their learning period successfully they will become a senior officer directly from the MTO.

Functions of the HRD

According the HR discipline, they too have a recruitment division, training & development division, compensation & benefits planning division and there are performance measurement methods and rewards for good performance as a motivational drive in BRAC Bank HRD‟s policy. The HR Administration division and MIS & Strategic Planning division were out of the ordinary HR theory. The Human Resources Department currently has 3 different wings. These are:

- HR Relationship, Process Management and Recruitment

- Compensation, Pay and Benefits

- HR Operation/ Administration

HR Relationship, Process Management and Recruitment

The recruitment division is responsible for collection of CVs, Job Applications for vacant posts, Internship Applications etc. The recruitment officers collect and store these hard copies and also update, maintains computer databases regularly. The recruitment officers‟ task is to organize CVs for potential candidates so that in time of recruitment they can be found and short listed within a reasonable time. The very general idea about the functions of recruitment division is that after CV short listing, the short listed candidates are contacted (usually by telephone) for interviews. In case of large number of candidates, letters are mailed to the applicants/candidates mailing address. These are done according to the interview schedule made before contacting the candidates. The interview or written test schedule is made prior to contacting with the short listed candidates by communicating with respective departments who submitted requisition for the needed workforce. The respective Department Heads accompany the Head of HR in the interview board and cross Department Heads also join the board. After the interview the recruitment division acquires the Interview Score Sheet which is printed and handed to Interview Board before starting the interviews. The filled out Interview Score Sheets are then used to list the finally selected candidates for the respective posts. According to the Score Sheets, the Recruitment Division issues Offer Letters/Appointment Letters to the finally selected candidates and requests them to collect their Letters from the HRD. The new employees are then greeted to finish all the official formalities (e.g. Bond Signing, PIN number assignment etc.) and assigned a joining date in their respective departments. Written tests are only arranged when necessary, usually in case of large number of applicants. Before a recruitment process is completely finished, the recruitment officers must communicate with the Learning & Organization Development officers so that they can arrange orientation or initial training sessions for the newly recruited employees on time. This is done frequently because most of the time the posts getting filled up require an initial training or orientation.

BRAC Bank also provides a large number of internship opportunities for students all over the country. Communicating with different departments and finding out open internship scopes is one of the tasks for a recruitment officer. Departments, Branches also communicate with Recruitment Team whenever there is an Internship opportunity is available in their respective stations. Matching the subject studied by the student and the open department enables the recruitment officer to make decision in selecting an intern. BRAC Bank HRD gives priority to interns (who have successfully completed their internship in any department or branch of BRAC Bank) when they apply for a vacant post.

The steps involved in a recruitment process are as follows:

- A properly filled-out Staff-Requisition Form is submitted by the concerned Department Head or Manager.

- The Manpower Budget should support the Requisition for the year; otherwise, a Non-Budgeted Requisition must be signed and approved by the Managing Director upon stating valid reason for the recruitment.

- Determining the type of recruitment is the next step so that source of CVs can be identified. For a Full-Time/Regular post an Internal Job Watch must be circulated with details of the post throughout the bank using Lotus Mail. External CVs are also accepted for a post offered through mail but in these cases, internal source is preferred by the concerned department as some posts require existing, experienced employees within the bank. For example, a Regular post open in Unsecured Value Center usually prefers an HR Contract working in Unsecured Value Center for past two years with satisfactory performance.

Criteria for existing Regular employees to apply in an Internal Job Watch are:

a) the employee must have worked 1 Year after his/her confirmation and completed 1 continuous year of service in his/her current department. b) Must have minimum performance rating „P‟ (for Proficient) c) Must have completed 8 mandatory E-Learning courses.

- Condition for HR Contracts is 2 years of continuous service in the current department.

- For external CVs the Recruitment wing looks into the archive of CVs applying for any suitable post and for large recruitments we publish circular in Newspapers. Usually in “”Prothom Alo” and “The Daily Star”.

On the day an Internal Job Watch closes or a Paper Ad reaches deadline for CV submission, the Recruitment wing checks all the CVs as an initial screening and then sends the CVs for final short listing to the concerned departments who submitted requisition. The finally selected applications are then called (issued interview cards in case of large recruitments e.g. CRO’s for SME Banking) for an interview after setting an interview date and venue.

The recruitment wing manages Internal Job Postings, recruiting HR Temporary Staffs and Outsourcing Staffs.

The Recruitment Policy:

- All regular employees will appointed by the Managing Director.

- All HR contract and outsource contract employees will be appointed by The Head of Human Resource Division.

- The schedule of recruitment will be created according to the Service Level Agreement (SLA).

- The interview board will with The Head of Department of that post, The Supporting Department Head and The Head of HRD.

- Officer Grade I and Officer II can appoint directly after the interview.

- From Senior Officer and more there will be a second interview with the Managing Director of BRAC Bank Limited after the first interview.

- For internal job posting the employee can only apply if he has the service time in BRAC Bank is more than two years and also need to recommend the candidate‟s application by the reporting supervisor of the employee.

- The HR Contract employee can apply for the regular post after servicing more than two years in the BRAC Bank.

- Outsource Staff can apply for the regular post after servicing more than three years in the BRAC Bank.

- The new recruited will get the probationary period of one year if the employee has less than three years of working experience and will get the probationary period of six months if he has more than three years working experience.

Compensation, Pay & Benefits:

The remuneration policy of the bank will cover all persons engaged in permanent service of the bank. Various job grades of HR are-

- Deputy Managing Director

- Executive Vice President

- Senior Vice President

- Vice President

- Senior Assistant Vice President

- First Assistant Vice President

- Assistant Vice President

- Senior Principal Officer

- Principal Officer

- Senior Officer

- Management Trainee Officer (Direct Recruit)

- Officer Grade II

- Officer Grade I

The salary are also structured by the above mentioned grade.

The remuneration of employees consists of:

Basic Salary, House Rent and Medical Allowance Salaries are confidential between the employees concerned and the Management. The salary ranges for these job grades are reviewed from time to time. HR Temporary & outsource staff do not have any assigned job grade. The contracts get a consolidated payment per month and there are no other entitlements applicable except commission based on job criteria.

Basic Pay

Basic Salary Ranges (BSRs) is commensurate with the job grades and is determined by the Board on the recommendation of the Managing Director. The Board reviews the BSR at least once every two/three years.

House rent allowance:

House Rent Allowance may be paid to the employees at such rates and on such conditions as may be prescribed by the Competent Authority from time to time.

Medical allowance:

Medical Allowances may be paid in accordance with the job grades and on such conditions that may be prescribed by the Competent Authority from time to time.

Festival Bonus

All regular and confirmed employees get two bonuses each year. One in Eid-Ul-Fitr and another during Eid-Ul-Azha only for Muslims and employees of different religion gets that bonus during their respective religious festival. There is also a performance bonus system maintained by the Compensation, Pay & Benefits wing. But final evaluation is always decided by the MANCOM.

Other than the above benefit there is a Provident Fund System, a Gratuity System, Group Hospitalization Insurance Policy, Employee Security and Welfare Fund maintained by the Bank. Regular and confirmed employees can apply for House Building Loan and Car Loan. Allowances are also available to only regular and confirmed employees but Car Allowances are only for the grades above Senior Principal Officer (SPO).

There is an annual increment for all regular and confirmed employees on their joining anniversary.Festival Bonus will be paid to all confirmed officers/staff at one month basic salary which will be reimbursed twice in each calendar year. All confirmed employees would get one bonus during Eid-ul-Fitre and another one for Muslims during Eid-ul-Azha and for others based on their respective religious festival.

- Non-confirmed employees will be entitled to get Festival bonus as pro rata basis depending on his/her BBL joining Date.

- HR Contract & Outsource Staff would get 1 bonus, which is 50% of this gross salary. The Board of the Directors will decide the annual salary revision and recommendation will be based on:

Performance Bonus (PB) ;( once a year): The Board of Directors at its discretion, based on the Bank‟s profit will declare a certain percentage of the pre-tax profit as Performance Bonus.The contribution measurement will be coming from the Performance Matters. Performance Matters for such purpose shall be made on the criteria set by the management from time to time. Amount of Performance Bonus will be 3% based on net profit after tax and method of distribution will be based at Management discretion.

No bonus will be applicable to the employees rating marginal & unsatisfactory. Final Evaluation will be decided by the MANCOM for the entire bank after going through a „rating‟ process to ensure that a consensus is reached for the entire bank.

Leave Fare assistance (LFA); (once a year):

Leave Fare Assistance is a non-recurring benefit for all the permanent employees of the Bank who have completed at least one year service. According to Bangladesh Bank policy all the permanent employees have to take 15 days mandatory leave in one go and LFA will give in this leave period, so that everyone will be encouraged to avail the leave. The Board has approved the LFA in its 92nd Meeting. BRAC Bank provides Leave Fare Assistance to its Employees to ensure that the employees enjoy a sound mandatory leave of 15 days in one go. This will definitely enhance the employees‟ satisfaction and it will enhance competitiveness with peer organization in the industry.

Every Permanent employee of the bank is eligible to receive the LFA who have completed at least one year service. This benefit is available at the time of mandatory Leave. However, after completion of one year service and being confirmed, calendar year must have the option to accommodate staff mandatory leave.

LFA will be given at the time when an employee will avail the 15 days mandatory leave. LFA will be the one-month‟s basic salary of processing month for current and future treatment. For previous treatment, the amount will be one month‟s basic salary of Mandatory Leave Availing month.

Every Confirmed Employee is entitled to receive LFA only once in a year. If any staff fails to go to mandatory leave his/her LFA will not be carried forward. That means in a calendar year only one LFA will be given to the staff.

The Staff has to have enough leave balance to accommodate 15 days one go leave, otherwise s/he will not be entitled to have the Leave with LFA. Staff can‟t claim the mandatory leave after separation situation arise that means if an employee resigns from the services or in the notice period s/he can‟t claim for mandatory leave with LFA. The other hand if any staff is terminated/ dismissed s/he can‟t claim for mandatory leave with LFA after receiving the letter. Government rules and regulations will be followed regarding tax issue. LFA will be included in the income certificate of staff for tax return purpose. After receiving Mandatory Leave application HRD will produce the Pay Slip. Head of HR will approve this slip and send to FAD (Funding Allowance Document) for payment and FAD will pay accordingly.

It will be come into force from January 2008 according to approval of the board.

Telephone policy:

Employees from AVP and above are entitled to have mobile phone sets with all facilities (T&T incoming, outgoing, and ISD connection) Employees of the bank below AVP are requested to take up a post-paid mobile at their own expense according to departmental need and also given a ceiling on the basis of their job functionality.

All others except SME will have to get their monthly bill approved by the departmental/divisional head prior to submission for payment disbursement. Others may avail a bank‟s mobile, provided they seek prior approval from the competent authority.

Hospitalization Insurance:

In the event where hospitalization or surgery is required for a member of the officer‟s (confirmed employee) dependent (Spouse and Children) including hospitalization on account of maternity – the Bank will reimburse the officer (Group C) up to a maximum of Tk.35,000/- per annum, for executives (Group B) Tk.100,000/- per annum and 200,000/- per annum for MANCOM (Group A).

Travel allowance:

An employee of the Bank may be allowed to draw traveling allowance in respect of journeys performed for the purposes authorized by the competent authority which include:

– On officially assigned tour

– To give evidence in a court of law

– On transfer

– On compulsory recall from leave

– To appear at a departmental/professional examination as authorized by the competent authority

– To attend a course of training sponsored by the Bank

– To bear the cost of travel of deceased employee Types of allowances under travel policy:

– Traveling Allowance (Mode of Transport)

– Accommodation Allowance (Hotel Rent)

Daily Allowance Gratuity: The Gratuity Fund is a terminal benefit that an employee receives at the time of retirement/resignation.

Eligibility: Regular confirmed employees who have completed at least 5 Years continuous service are entitled to receive Gratuity Benefit.

Gratuity Calculation: Last month‟s basic Salary multiplied by the year of service completed e.g., if an employee serves The Bank for 6 years and then resigns/retires his Gratuity Calculation shall be (Let‟s assume his Basic Salary is Taka 20,000.00): Taka 20,000.00 x 6 years = Taka 1, 20,000.00 The custody, management, investment and control of the fund shall be vested in the board of trustees.

Regular employees after confirmation need to fill up and submit the “Application for Enrollment as Member” to become a member. There shall be at least 6 trustees of the fund. The MD will nominate trustees. The MD shall be an Ex-Officio Member and Chairman of the Board of Trustees. The Head of Human Resources – Ex-Officio Member. The Head of Financial Admin – Ex-Officio Member. At least three representatives from the members as nominated by the Chairman. If there is a shortage of member of the board of trustees due to resignation then the Chairman can nominate trustee/s to reach the minimum number. The Board of Trustees shall meet at least 4 times in a calendar year. At least 7 days prior- notice should be given to the trustees before a meeting. All money of the fund shall be deposited in a Special Account with any bank, This should be mentioned here that the Account is maintained jointly by authorized members of the board of trustees. The Trustees are authorized to invest the surplus money of the fund in accordance with the provisions of Company Act 1994 and Income Tax Rules 1984.

Security Fund:

The objective of the fund is to provide predetermined monetary benefit against Death and Permanent Disability of regular confirmed staff to his/her Dependent/Heir/Nominee by the Bank. All Regular Confirmed employees are eligible to avail this benefit. The fund for this benefit is created solely with The Bank‟s Contribution.

The Bank will contribute Taka 5.00/Thousand on a yearly basis against the last basic salary of each eligible employee. (The rate of contribution may be changed subject to the approval of the board.) The Bank maintains a liability account to manage the fund. The total amount of benefit will be equal to 36 times of the last basic salary of the employee.

Two forms of benefits:

a) Death Benefit: If an eligible employee dies within the term of employment.

b) Permanent and Total Disability (PTD): Disability resulting from accidental means that is continued for at least Six months and is certified by Bank‟s designated doctor as incurable.

For both cases the benefit shall be paid to the nominee upon receipt of necessary proof. (In case of minor nominee, the benefit will be paid to the legal guardian of the nominee)

Exclusion from Employee Security Benefit:

Employees will not be eligible for the benefit, if Death or disability is caused by:

– For further injury of Employees with pre-existing degree of disablement.

– Attempted suicide or self-inflicted injury.

– Civil commotion, Assault, homicide or any war like operations.

– Making an arrest as an officer of law.

– Committing a felony.

– Racing on wheels.

– Alcohol/Drug affects accident.

The Board of Directors reserves the power to close fund at anytime. At such event the fund shall be refunded to the Bank.

Payment:

At the time of resignation or retirement, the employee is entitled to receive the employer‟s contribution and the accumulated interest subject to his or her length of membership in the contributory provident fund. If the employee has been a member for less than or equal to year then he/she will not be eligible to receive any of the above mentioned contributions. He/she will only be able to obtain his added contributions over the period of his membership.

If the duration of membership has been equal to or less than three years then the member will be entitled to receive 50% of the employer‟s contribution and accumulated interest.

If the duration of membership has been more than 3 years then the member will be entitled to receive 100% of the accumulated interest and employer‟s contribution. In case a member is dismissed due to negligence or incompetence, he or she will be entitled to receive her/her own contribution along with the accrued interest thereon at the settled interest rate. The bank‟s contribution however may be forfeited and distributed among the members according to the individual balances of the members.

The same is applicable in case of an employee dismissed from the bank due to misconduct or fraud. However, for such purposes, only the trustees shall be the sole judge of whether the cause of dismissal or forced retirement is significant enough or not.

Welfare Fund:

The motive behind establishing the welfare fund is to be able to provide the regular confirmed employees from JO to SPO with financial support for incidents or events when the cost may not be affordable for the employees. These may include the following:

– Accidents on the job

– Extended illness

– Education for children

– Marriage of children Employees of the grade JO to SPO may be the members of this fund.

House Building loan:

Employees who have had a service length of 5 years and above are eligible to apply for house building loan. A committee will oversee the loan application and monitor the location for house building the debt burden ration of the employee and other relevant issues. The debt burden ratio for the employee has to be 50% or below for the loan to be approved. The repayment schedule for the loan has to be before the retirement of the employee. The interest rate of the loan is 3%.

Termination Benefit:

In case a confirmed employee is asked to resign from his/her services by the relevant authority without stating any reason, he/she is eligible to receive one month‟s notice in writing or one month‟s gross salary as payment. If the employee is duly notified with one month‟s notice, he/she will not be entitled to receive any form of compensation for the termination of services.

Suspension Benefit:

In the event that a report/information about misconduct or fraud is received against an employee, he/she has to undergo stages of disciplinary proceedings. The employee is presented with charge sheet and is given 4 days to come up with an explanation. A preliminary enquiry committee is formed and an enquiry notice is issued that marks the beginning of a proper domestic enquiry. If, according to the committee‟s report, the employee is found guilty he is duly punished. In case the employee is found not guilty, he/she is retained with due respect. During the period of enquiry, the employee may be suspended and will only receive 50% of his basic salary. In case he/she is proven to be not guilty, then the full amount of salary must be refunded to the employee.

HR Administration:

The HR Operations or administration covers the following tasks:

Leave System:

The policies followed for employee leaves management based on the types of leaves and their criteria are given below:

- Annual Leave: All officers will become eligible for annual leave of 24 working days after completion of one-calendar year. Of these 24 days 15 days must be taken as consecutive leave each year. Any pending leave may be carried forward to the next year. Annual leave encashment facilities may be allowed to the person for a maximum of 90 days at the time of Employee‟s leaving the bank. Any leave taken in advance to be adjusted during the final settlement period.

- Casual/Sick Leave: Casual leave up to 14 calendar days can be granted per year to an employee who may be unable to attend duty due to sudden illness or urgent private affairs. Not more than 2 days casual leave can be taken at a time in a month. Casual Leave more than 3 days will be considered as sick leave and has to be supported by medical reports. In case of prolonged illness the Managing Director may grant medical leave in excess of sick/casual leave with full pay and allowances for a period up to one month.

- Maternity Leave: Female (confirmed) employees will enjoy 4 months maternity leave. One employee will be entitled to avail this leave for 2 times in her entire service period.

- Study Leave: Study leave of maximum 2 years can only be granted to an employee without pay and allowances provided he/she has put in at least three years of service. This Leave is only granted to those employees who have achieved a minimum of 3 years of service record with the bank and also to those who are due to retire within 5 years of the date on which he/she is likely to return from the study leave. This leave shall, however be allowed in the entire period.

Leave without Pay:

Leave without pay may be granted to an employee in special circumstances where no other leave is admissible under these rules. In case of Leave without Pay, the period does not exceed 60 days.

Under HR Operation promotion are also occur and also resignation process. Resignation Process is as follow:

- Resignation submitted to line manager

- With the acceptance & recommendation line manager forwards it to departmental/ divisional Head

- Resignation letter forwarded to HR

- HR will take final approval from Managing Director to start the process

- Resigned staff will collect clearance form from HR which to be cleared by all concerned Departments

- The filled up clearance form will then sent to Finance for final settlement

- After final settlement HR will take exit interview of the resigned staff

- HR will prepare the release letter and a certificate

Reward:

Reward and Recognition is a way to express appreciation for another employee’s hard work, dedication and contribution to the Bank. There are many levels of Reward and Recognition, to ensure both small contributions as well as the larger ones is recognized. There are four levels of rewards and recognition:

- LEVEL 1: Individual Contribution Award & SME Monthly Award

- LEVEL 2: Departmental Committee Award

- LEVEL 3: Organizational Competence Award

- LEVEL 4: Chairman‟s Excellence Award

Question Analysis

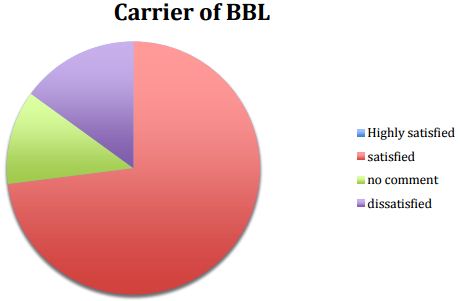

Question 1: As employees how do u feel about the carrier growth of BBL?

On the scale of 100 around 73% are satisfied and 15% are dissatisfied while 12% didn‟t do any comment.

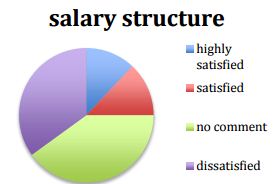

Question 2: How do you define the salary structure?

From the below pie chart we could see that more of the employees are dissatisfied with the salary structure

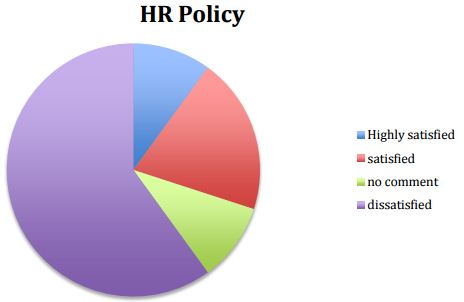

Question 3: “How do you define your level of satisfaction regarding HR Policy of BRAC bank Ltd?”

From the above pie chart we can see that 19% employees are highly satisfied, 20% are satisfied,10% employee didn‟t do any comment, 60% employees are dissatisfied.

SWOT Analysis:

Strength:

- Well-organized team. While they work as a team they are supportive to each other‟s, which are very helpful to fulfill their work.

- Well-maintained CV database. All the CVs are stored in monthly basis so it is easy to find out the CVs when it is needed.

- Well-planned training schedule with sufficient time allotment. All the trainings take place as scheduled before. The time prearranged for each training is also based on the type of the training so that every necessary point can be covered.

- Training opportunity provided to employees working in every level. For better performance of every employee training is provided.

- Effectively Stringed with other departments of BRAC Bank. The communication among each and every department is quite good and all of them have better understanding. As a result they get effective output.

Weakness:

- Salary structure should be changed because the amount is not equal enough with the worl load.

- Online recruitment system is not upgraded. References from superior levels are also entertained as those CVs are always given priority in times of recruitment even if the candidate is unfit or unqualified for the vacant post.

Opportunity:

- BRAC Bank huge number of workforces helps this bank to get various ideas and plans and increases its productivity.

- The Human Resource Division is always thinking to do something new with their employees that can help to motivate the employees and can able to make them better resources/assets for the BRAC Bank Limited. Very few Bangladeshi organizations have this kind of opportunity to be used.

Threat:

- The resignation rate is too high

- As this bank has a huge number of employee so it is really hard to maintain this by HR.

Concluding Statement

BRAC Bank Limited intends to set standards as the market leader in Bangladesh. It demonstrates that a locally owned institution can provide efficient, friendly and modern banking service on a profitable basis. Human Resource Division is the most confidential department for any organization as well as Human Resource Division in BRAC Bank Limited. As an intern limited information was collected for preparing this report because of too much confidentiality.

It was an honor to work as an intern in a reputed organization like BRAC Bank Limited. The BRAC Bank Limited is a bank that confirms the best service to the customers as well as to the employees by Human Recourse Division. BRAC Bank Limited is the fastest growing bank in Bangladesh. By working in Human Recourse Division the knowledge was learnt would be helpful enough to sustain with the real organization environment.

Recommendations for University Strategic Actions: Though there is a big difference between text books and real workplace scenario, BRAC Bank HRD‟s functions does not differ much. But our university need to do lot of things to improve the students. They are given below:

- Workshop on CV writing process.

- Provide different training for professional field.

- Student placement opportunity should be increased.

- More seminar should be organized for the students.

Suggestion for Improvement in Course of Action

In this part of recommendation, some valuable issues of BRAC Bank Ltd. (BBL) are discussed. These were the aspects that came out while working as an intern at BBL. These were related to various parts of BRAC Bank Limited and thus are placed in the list of general improvements.

- BRAC Bank has to make their salary structure attractive to their employees through survey with the other related organizations in the market.

- BRAC Bank has to make proper succession planning to promote the eligible employee to the higher level and it also work as motivational factor.

- Reduce the extra workload of the employees and for that BRAC Bank has to increase their manpower to related field.

- They should improve their Performance Management system to track the employees‟ performance to the point.

- The Human Resource Division‟s control must be structured through chain of command.

- There must implement rule, policy or guideline provided to the recruitment officers for the CVs which are rejected after an interview.

- Need to maintain a CV archive to store the CVs.

- There must have transparency at the time of recruitment.

- Arrange co-curricular activities for employee’s refreshment which is motivational and reduce the turnover rate. Arrange proper training for the employee to increase the efficiency of the potential employee.

- The training should be motivational to the employee. Upgrade online recruitment system to reduce the work load.

- Extra benefits should be provided like overtime, performance bonus, increment and should be rational.

- Foreign Training should be provided to gain knowledge about international work process.

- Finacle software should be upgraded.

They should go for the newspaper advertisement whenever they need