Introduction

The OCP Report titled as “recruitment & selection process of NBL & SCBL” is submitted in practical requirement for the fulfillment of the Degree of Bachelor of Business Administration (BBA) under the faculty of Business Studies of International Islamic University Chittagong (Dhaka campus). OCP program is the systematic process of gathering, recording, analyzing and presenting data about the subject that a student goes to learn on the program. The aim of this OCP report is to connect practical knowledge with theoretical knowledge since everyone must be expert in both theoretical and practical knowledge for the competitive world.

The report will mainly focus on how National Bank Limited & Standard Charterd Bank Limited is performing their recruitment & selection process. The whole report is designed to get an idea about how a bank meeting the challenges of effective staffing and selection process.

This OCP Report was carried out within a short span of time, but I have tried my best to provide the most accurate and reliable information regarding my topic.

Objectives of the study

Broad objective:

To evaluate the Recruitment and selection process of NBL & SCBL.

Specific objectives

- To know the Recruitment and selection process of NBL & SCBL.

- To asses the present Recruitment and selection process.

- To focus on strategic development process.

- To assess the manpower selection process of NBL & SCBL.

- To highlight the sources of Recruitment

- To compare between the recruitment and selection process of NBL and SCBL.

- To provide some recommendations to improve recruitment and selection process practicing in NBL & SCBL.

Methodology of the Study

Types of data used:

This Report is qualitative in nature. In-depth interview of the Bank personnel, various official documents are analyzed to collect the information. Personal interview was taken from the officials of different wings of HRD.The study contains a huge amount of data and information that is prepared according to both primary and secondary data.

Data collection: Source of data of this report had divided into two categories:

Primary Sources:

- Face to Face conversation with the respective senior management of NBL & SCBL, both in HR and other functional departments.

- Interviewing other officers and staffs.

- In-depth study of selected cases.

- Sharing practical knowledge of officials.

- Related files, books study provided by the officers concerned.

Secondary Sources:

- Annual Report, Employee Record by HRD of NBL & SCBL.

- Different published documents of National Bank Limited & Standard Chartered Bank.

- Relevant books, Research papers, Newspapers and Journals relating human resources, article

relating employee training and welfare.

- Website of NBL & SCB.

- Other websites on Current HR Practices

Importance and scope of the report

1. This report will provide a value insight to student on the topic.

2. This report will help to get the practical knowledge in employee hiring in the organization.

3. The report will equip me for my future in H. R. M.

Limitations of the study

- Organization did not disclose full information.

- Data collected in this field are not sufficient.

- It is impossible to properly complete this type of report, because information is not processed through computer.

- Printed data are not available for preparing the report.

- It was very much costly to collect data.

- Less analytical power

- Non-cooperative behavior of some officials of the bank.

Historical Background:

National bank Ltd is the first and major private sector commercial bank in Bangladesh fully owned by the Bangladeshi Entrepreneurs. The Bank started its operation from 23rdMarch 1983. As a result of the collective effects of the some eminent bankers, of failure in playing due to role in mobilizing small savings of the teeming millions and providing improved clients services to them in our country, the Government gave right decision to allow establishing banks in private sector. National Bank Limited was born as the first hundred percent Bangladeshi owned Bank in the private sector. From the very inception it is the firm determination of National Bank Limited to play a vital role in the national economy. It is determined to bring bank the long forgotten taste of banking services and flavors. It wants to serve each one promptly and with a sense of dedication and dignity.

NBL prudently and boldly faced the challenges of various adverse situations prevailing in the post independence Bangladesh and has now established it self as one of the most successful bank of the country. People in all regions can easily avail of the services of NBL through its 98 branches spread all over the country. Besides, the bank has been smoothly conducting its overseas activities with utmost efficiency through its 358correspondents in 67 countries of the world. NBL has drawing with 18 overseas exchange houses including the gulf overseas exchange. In order to provide modern banking services to satisfy the demand of the country and the people, all branches of the bank have been brought under computer network. It is able to reach with lighting speed the hard-earned foreign exchanges of non-resident Bangladeshis to their near and dear onset home through the world renewed Western union. The bank maintains round the clock communication with the external world using the latest information technology services of SWIFT and REUTERS. In order to give improved and risk free banking services to the valuable clients, all arrangements for launching line banking are its final stage.

Since the very beginning the bank extended much emphasis on overseas operation and handled a sizeable quantum of homebound foreign remittance. The Bank established extensive drawing arrangement network with Banks and Exchange companies, located in important countries of the world. Expatriates Bangladeshi wage earners residing in those countries can now easily remit their hard earned money to the country with confidence safety and speed.

NBL has been able to create a special image at home and abroad by introducing different banking products in accordance with the expectations requirements of people of the country. NBL was the pioneer bank to allow back-to-back LC facility without any margin to the entrepreneurs of garment industry during the Eighties, thereby helping the industry thrive to its present position. This has not only contributed to enrich of the country’s foreign exchange reserves, but also opened employment opportunities for a large numbers of labor force of the country. As a pioneer in this sector, NBL’s name will remain in golden letters.

NBL has been the pioneer in promoting readymade garment industries and still is the single largest financier in this sector. In the early 80’s when garment industry in Bangladesh was experiencing a process of trial, the bank foresights the bright prospect of this sector and extend finance to the deserving and promising entrepreneurs. It provided them with financial support including market information and advice and today the garment sector constitutes about 66% of the total export of the country.

NBL is the first bank to introduce international Master Card in Bangladesh, which has facilitated the users to get benefit to different facilities in home and abroad. NBL is the first among private sector banks, which has set an uncommon precedence of extending fully, supervised collateral agriculture credit in the brained area of Rajshahi district to help small farmers to grow.

The wise directions and guidance of a prudent and versatile Board of directors and concerted efforts of a team of well-qualified and professionally heightened executives and officials have brought an extraordinary distinctiveness for the bank. Above two thousand dedicated executives, offers and staffs’ working day and night to serve its customers satisfactorily. Through strong commitment base, the bank has introduced new products like Credit card. E-cash. The popularity of the bank has gained momentum with quick money transfer arrangement anywhere in world in association with Western Union’s U.S.A

Nature of Business:

The Bank engaged in all types of commercial Banking services within the stipulations laid down by Bank Companies Act 1991 and directives as received from Bangladesh Bank from time to time. The Bank within the stipulations laid down by Bank CompaniesAct-1991 and directives as received from Bangladesh Bank from time to time provides all types of Commercial Banking Services. Mainly National Bank Limited collects deposit from the people at lower rate and invests the same to the people again at higher rate. And difference between lower rate of deposit and higher rate of investment is the earnings of the Bank. National Bank Limited mainly invests in industrial sector like short-term, middle term as well as long term for import of capital machineries, establish new industry and working capital assistances with this Bank play’s a significant role in Bangladesh economy.

The function of the Bank mainly three categories:

- General Banking

- Credit and investment

- Foreign Trade (Import, Export & Remittance)

Principles and values:

The National Bank Limited is committed to some core business principles:

- Outstanding customer service.

- Effective and efficient operations.

- Strong capital and liquidity.

- Prudent lending policy.

- Strict expense discipline.

- Loyal and committed employees who make lasting customer relationships and international teamwork easier to achieve support the business principles.

- National Bank Limited also operates according to certain key business values.

- The highest personal standards of integrity at all levels.

- Commitment to truth and fair dealing.

- Hands-on management at all levels.

- Commitment to quality and competence.

- A minimum of bureaucracy.

- Fast decisions and implementation

- Putting the team’s interests ahead of the individual’s.

- The appropriate delegation of authority with accountability.

- Fair and objective employer.

- A diverse team.

Mission

Efforts for expansion of our activities at home and abroad by adding new dimensions to our banking services are being continued unabated. Alongside, we are also putting highest priority in ensuring transparency, account ability, improved clientele service as well as to our commitment to serve the society through which we want to get closer and closer to the people of all strata. Winning an everlasting seat in the hearts of the people as a caring companion in uplifting the national economic standard through continuous up gradation and diversification of our clientele services in line with national and international requirements is the desired goal we want to reach.

Vision

Ensuring highest standard of clientele services through best application of latest information technology, making due contribution to the national economy and establishing ourselves firmly at home and abroad as a front ranking bank of the country are our cherished vision.

Objectives:

The objectives of National Bank are mentioned below:

- Offering quick and improved clientele services through application of modern information technology.

- Playing an important role in the national progress by including improved banker-customer relationship.

- Ensuring highest possible dividend to the respected shareholders by making best use of their equity.

- Pushing the policy of nurturing balanced growth of the bank in all sectors

- Consolidating our position in the competitive market by introducing innovating banking products.

- Ensuring highest professional excellence for our workforce through enhancement of their work efficiency, discipline and technological knowledge

- Expanding the bank’s area of investment by taking part in syndicated large loan financing

- Increasing finances to small and medium enterprise sector including agriculture and agro based industries, thus making due contribution to the national economy.

- Upholding the image of the bank at home and abroad by pushing dynamic and time befitting banking activities.

10. Ensuring maintenance of capital adequacy and highest profit through successful implementation of the Management Core Risk Program.

Business Ideology:

Alongside providing the best services to the clienteles, patronizing and taking part in social development activities as well as making due contribution to growth of the national economy.

Organizational Strategy:

As the financial services industry is a very competitive industry, the main strategy of NBL is the organic growth – to build branches and strengthen their distribution network. They will continue to invest and expand in Bangladesh as fast as local regulations allow.

The principle strategies are –

- People– Attract, retain and reward top performers.

- Profitable Growth– Growing sales and increase the revenues.

- Execution– Performing with skill and speed.

- Credit Quality– Maintaining credit quality and understand the role in managing losses.

- Customer Centered– Always providing exceptional customer service.

- Ownership– The performance and results should be owned.

- Efficiency– Lowering the costs and wise use of resources.

Functions of National Bank Ltd:

Some general function of National Bank are given below-

- To maintain all types of deposit Accounts.

- To make investment

- To conduct of reign exchange business.

- To conduct other Banking services.

- To conduct social welfare activities.

- To work for continues business innovation and improvements

- To bui1d up strong-based capita1ization of the country.

- To ensure the best uses of its creativity, well disciplined, well manages and perfect growth.

Introduction

Standard Chartered Bank started its business in Bangladesh in 1948, opening its first branch in the port city of Chittagong. The bank increasingly invested in people, technology and premises as its business grew in relation to the country’s thriving economy. At present the bank has 6 offices in Dhaka Chittagong and Sylhet, including the country’s only offshore banking unit inside the Dhaka Export Processing Zone at Savar.

Extensive knowledge of the market and essential expertise in a wide range of financial services underline our strength to build business opportunities for corporate and institutional clients at home and abroad. Continuous upgrading of technology and control systems has enabled the bank of offer new services, which include unique ATMs and Phone banking.

Standard Chartered’s services in Bangladesh, ranges from Personal & Corporate Banking to Institutional Banking, Treasury and Custodial services.

Recent Achievements

Extensive knowledge of the market and essential expertise in a wide range of financial services underline our strength to build business opportunities for corporate and institutional clients at home and abroad. Continuous upgrading of technology and control systems has enabled the bank of offer new services, which include unique ATMs and Phone banking.

- First commodity derivatives in Bangladesh and cotton hedge for the Group for Square Textiles

- Standard Chartered services in Bangladesh, ranges from Personal & Corporate Banking to Institutional Banking, Treasury

- Record Call Account growth in RAJUK fund – Ranked first among all collecting banks

- Enhancement of Microfinance: BRAC, BURO, Shakti

- First country to go live with IFRS compliant IMEX

- Consumer Banking new asset product system e-Lending introduced

- Rolled out RCMS on eBBS, first time in Group

- Pioneer country in e-CDD rollout

- ‘Best Bank’ for Corporate Social Responsibility for 2006 by Bankers’ Forum

- ‘Best Retail Bank in Bangladesh’ award in The As Accountants

- “Best IT Use Award 2007” by Bangladesh Association of Software & Information Services (BASIS)

- ‘Best Employer of IBA Graduates’ in 2008 by IBA Alumni Association

- “Best Foreign Commercial Bank in Bangladesh” by FianaceAsia in 2009 & 2010

Five Values of Standard Chartered Bank

Building trust can take forever. Losing takes only moments. Standard Chartered Bank has five values and these values are key to their success. These value determine how the employees achieve their goals, the way they work together and how it feels to be a part of Standard Chartered Bank. In brief these values are:

Courageous: Being courageous is about confidently doing what’s right. Often the task may seem insurmountable but with courage and tenacity, the odds can be overcome. A truly courageous act both inspires and builds character.

Responsive: How we response to our customer will influence their belief in our commitment to them. A proactive response is often unexpected and more effective for that. It clearly demonstrates our willingness to go beyond the unexpected.

International: As a member of global village we view the world from the widest perspective. We are all global citizens and the world is full of new opportunities and exciting possibilities. We also deliver world class products and services.

Creative: Creativity belongs to those of us who are excited by challenges and engage them in fresh thinking and an open mind. Creative thinkers are not limited by convention but allow their minds to soar beyond predictable solutions.

Trustworthy: Trust is the foundation of every successful relationship. We trust because we believe in the sincerity.

Mission of SCB

Standard Chartered Bank in Bangladesh operates with the same mission as the Group SCB subscribes to worldwide. The bank in Bangladesh has the best and dedicated human resource in the private sector banking. With an experience of 150 years, the bank has a surprising efficiency in the operational areas. The bank has a mission to build and grow on its 150 years of experience and the positive image that it has earned over the years. The underlying factor of its business mission is manifested by its five values –

- Responsive

- International

- Trustworthy

- Responsive and

- Courageous

Vision of SCB

Their vision is leading the way by providing best customer services their brand promise is to be the right partner.

Aim / objectives of SCB

- Planning and control

- Realization of organizational goals

- Existing deployment, Creating and maintaining inventory

- Adjust with the external environment.

- Help organization to meet the goal through mission, vision, structure and objectives.

- Ensure the right people in right place.

- Reduce the labor costs, Utilize employee capabilities effectively

- Establish employment equity goals.

To develop recruitment tools and strategies that attract and promote faculty and staff from diverse groups who enhance the reputation and distinctiveness.

Recruitment

Human Resource Recruitment is defined ad any practice or activity carried on by the organization with the primary purpose of identifying and attracting potential employees. The goal of an organizational recruitment program is to ensure that the organization has a number of reasonably qualified applicants (who would find the job acceptable) to choose from when a vacancy occurs. National Bank Limited recruits the most talented individuals from the external market to supplement our internal pipeline of talent. Their Human Resources department provides guidance on the use of psychometric tests and has robust recruitment criteria to ensure that all candidates are treated fairly, equally and with respect. It has a global Graduate Recruitment Program; where in the region of 150 graduates are recruited each year on a management trainee program across all businesses, functions and countries.

The present recruitment methods in National Bank Limited

In today’s competitive business world it is very difficult to survive without highly qualified manpower. It is obvious that successful recruitment and selection will be expensive and time-consuming. But unsuccessful recruitment and selection can be a cause of the death of the business. As an employer, National Bank also has certain practices and policies regarding recruitment and selection, which are discussed here.

Strategic Approach to Recruiting

A strategic approach to recruiting becomes more important as labor markets shift and become more competitive. An initial and National decision is whether recruiting will be done by HR staff or other organizational employees or not. NATIONAL Bank follows the organizational based approach for most of the recruiting activities. Selecting the source of recruitment, preparing and placing the advertisements, all these are the responsibilities of the employees of HR department. They handle all these activities except preparing and conducting the written test, which is outsourced usually by the TeachersTrainingCollege. Outsourcing is a practice where the organization uses an outside organization for certain services. Outsourcing is a logical choice when the organization does not have expertise or it does not want to invest time and energy.

Recruitment Sources

Most employers combine the use of internal and external sources of recruitment. Organizations that face a rapidly changing competitive environment and conditions may put emphasis on external sources in addition to developing internal sources. Promoting from within the organization is known as internal recruitment and hiring from outside the organization is known as external recruitment. However, the HR department of National Bank emphasizes more on the external recruitment sources rather than internal sources.

Internal Sources of Recruitment

Existing employees of an organization provide the internal sources. At National Bank, promotion, transfer and job postings are sometimes used for recruiting people internally. Employee referral is another source of internal recruitment which is not used in National Bank now.

Promotion

The most important source of filling vacancies from within is through promotions. Promotion involves movement of employees from a lower level position to a higher level position accompanied by changes in authority, duties, responsibilities, status and remuneration . In this case, National Bank has some specific criteria for promoting an employee. If there is any vacancy and then all those employees having all the qualifications of the senior level post apply for the job. Obviously each employee can get this opportunity for higher status, remuneration, job facilities with vital responsibilities through a formal interview.

Transfer

National Bank also practices this method of internal recruitment through transferring the employees from one department to another without changing status and remuneration. As Khan (2008) mentioned, transfer is a lateral movement within the same grade, from one job to another without any change in remuneration. Generally, after 3 to 5 years, an employee is transferred from one department to another. National Bank uses this transfer method for several reasons such as,

- To create motivation and to remove monotony from the job.

- To keep an employee interested in his or her main responsibilities.

- To secure its business operation by removing dishonest activity in a particular department.

- To keep balance in a particular department by transferring experienced employees to another department, when a department is filled by a greater number of new employees.

Job Posting

National Bank also utilizes the benefits of internal recruitment by posting the job internally.Job posting is a system of providing notices of job openings and employees respond to by applyig. When a new job position is created, HR department of National Bank informs the other departments and branches through phone and sometimes by giving a formal letter.

External Sources of Recruitment

National Bank mostly utilizes the external sources of recruitment such as advertisements in newspapers and websites. When an organization desires to communicate to the public that it has a vacancy, advertisement is one of the most popular methods used (Khan, 2008). The media of advertisement often depends on the type of the job. National Bank gives job advertisements only in reputable daily newspapers. In the case of internet advertisements, National Bank does not use any job board, even though job boards are getting popular increasingly among the employers.

Newspaper Advertisement

To draw the right candidates, National Bank HR unit publishes their advertisement

for several positions in national daily newspapers, such as, Prothom Alo, Ittefaq, etc.

Website Advertisement

National Bank, like many employers has found its own website to be more effective

and efficient for recruiting employees. The job seekers are encouraged to e-mail their resume or complete online applications on the website of National Bank that is, www. Nationalbanklimited.com

Recruitment and Selection Responsibility

To complete the responsibility of hiring human resources, National Bank HR unit has established four recruitment and selection committees.

Committee-1: This committee consists of the Managing director, and board members who are directors of National Bank. This committee is established nationally for recruiting or filling positions for Managing director (M.D) and Deputy Managing Directors.

Committee-2: This committee consists of the General Managers, Managing director, members from the ministry and Bangladesh Bank. This committee is established for recruiting or filling mid-level positions, such as General Manager (G.M), Deputy General Manager (D.G.M), Assistant General Manager (A.G.M), Manager and Deputy Manager (D.M).

Committee-3: This committee consists of the General Manager, Managing director and particular members from the ministry and Bangladesh Bank for recruiting entry- level positions, such as, Assistant Manager, Officer, and Assistant officer.

Committee-4: This committee consists of the General Managers from all departments of National Bank for recruiting applicants who come through internal references. This committee is inactive now as applicants not allowed coming through internal references now

As stated earlier, recruitment is the process of location, identifying and attracting capable applications for jobs available in an organization.

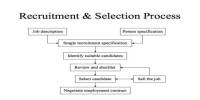

Accordingly the recruitment process comprises the following five steps:

- Recruitment planning

- Strategy development

- searching

- screening

- Evaluation & control.

Recruitment planning

The first involved in the recruitment process is planning.Hire,planning involves to draft a comprehensive job specification for the vacant position, outline it’s major & minor responsibilities, the skills, experience and qualifications needed ‘grade & level of pay, starting date ,whether temporary or permanent,& mention of special condition, if any attached to the job to be filled.

Strategy development:

Once it is known how many with what qualification of candidates are required, the next step involved in this regard is to device a suitable strategy for recruitment the candidates in the organization. the strategic considerations to be considered many include issues like whether to prepared the required candidates themselves or hire it from outside, what type of recruitment method is to be used, what geographical area be considered, for searching the candidates, which source of recruitment to be practiced, and what sequence of activities to be followed in recruiting candidates in the bank.

Searching

These steps involved attracting job seeders to the bank. There are broadly two sources used to attract candidates. These are:

- Internal sources

- External sources

Screening:

Through some view screening as the starting point of selection, we have considered it as an integral part of recruitment. The reasons begin the selection process starts only after the application have been screened and short listed. Applications are screened against the qualifications, knowledge, skills, abilities, interest and experience mentioned in the job specification. Those who qualify are straight way eliminated from the selection process. The techniques used for screening candidates are very depending on the source of supply and method used for recruiting. Preliminary applications, de-selections test and screening interviews are common techniques used for screening the candidates.

Evaluation & control:

Given the considerable involved in the recruitment process, its evaluation and control is, therefore, imperative. the cost generally incurred in a recruitment process include:

- Salary of recruiters

- Cost of time spent for preparing job analysis, advertisement, etc,

- Administrative expenses

- Cost of outsourcing or overtime while vacancies remain unfilled.

- Cost incurred in recruiting a suitable candidate.

Philosophies of recruitment

In traditional philosophy of recruiting has been to get as many people to apply for a job as possible. a large number of job seekers are waiting in queues would made the final selection difficult, often resulting in wrong selection. Job dissatisfaction and employee turnover are the consequences of this. A persuasive agreement can be made the matching the needed of the bank to the needs of the applicants will enhance the effectiveness of the recruitment process. the result will be workforce which is likely to stay with the organizations longer and performs at the higher level of effectiveness.

Two approaches are available to bring about match. They are:

- Realistic job preview (RJP)

- Job compatibility questionnaire (JCQ)

Realistic job preview:

Realistic job preview provides complete job related information. both positive and negative to the applicants. the information provided will help the job seekers to evaluate the compatibility among the jobs and their personal ends before hiring the decisions are made.RJP can results in self selection process-job applicant can decide where to attend the interviews and test for final selection.RJP are more beneficial for bank hiring at entry level, when there are unemployment .otherwise the approach may increase the cost of recruiting by increase the average time it takes to fill each job.

Job compatibility questionnaire:

Job compatibility questionnaire was developing to determine whether the applicant performances for work match the characteristics of the job. the JCQ is designed to collect the information on accept of a job, which has bearing on employees performance,absentism,and turnover and job atisfaction.the underlying assumption of the JCQ is that greater the compatibility between and the job seeker, the greater he profitability of employee effectiveness and longer the tenure. The JCQ is a 400 item job instrument that measure job factors. Which are related to performance, satisfaction turnover and absenteeism. Items cover the following factors:

- Task requirement

- Physical environment

- Customer characteristics

- Peer characteristics

- leader characteristics

- compensation preference

- task variety

- physical demands

- job autonomy and

- Work schedule.

While placing an advertisement to reach to the potential candidates, the following three points need to borne in mind:

- To visualize the type of the applicant one is trying recruit; To write out a list of the advantages the job will offer;

- To decide where to run the advertisement, i.e., newspaper with local,

- State, nation-wide and international reach or circulation.

SELECTION PROCESS

The Selection process of NBL is based on technical knowledge of the candidate. Main things taken into consideration while selecting the candidate are:-

• National qualification

• Technical qualification

• Job experience

• Specialized working area

ROLE OF SELECTION

The role of selection in an organization’s effectiveness is crucial for at least, two reasons; first, work performance depends on individuals. The best way to improve performance is to hire people who have the competence and the willingness to work. Arguing from the employee’s viewpoint, poor or inappropriate choice can be demoralizing to the individual concerned (who finds himself or herself in the wrong job) and de-motivating to the rest of the workforce. Effective selection, therefore, assumes greater relevance.

Second, cost incurred in recruiting and hiring personnel speaks about volumes of the selection. Costs of wrong selection are greater.

Selection for National Bank Limited

Until recently, the National hiring process was performed in a rather unplanned manner in many organizations. In some companies, each department screened and hired its own employees. Not any more. Selection is now centralized and is handled by the human resources department. Ideally, a selection process involves mutual decision-making. The NBL decides whether or not to make a job offer and how attractive the offer should be. The candidate decides whether or not organization and the job offer fit his or her needs and goal. In reality, the selection process is highly one-side. When the job market is extremely right, several candidates will be applying for a position, and the bank will use a series of screening devices to hire the candidates it feels is most suitable. When there is a shortage of qualified workers, or when the candidate is a highly qualified executive or professional who is being sought after by several organizations, the NBL will have to sweeten its offer and come to a quicker decision.

ELECTION PROCESS – THEORY

Successful selection activities entail a lot of careful planning & careful thought. The standard pattern of selection activities are of seven steps, which are given below:

National Bank Limited recruits employees on the basis of newspaper circulation & by online e-application on National Bank Limiter’s web site. At the e-application section candidates are obligatory to drop their CV & on the foundation of National Bank Limiter’s vacancy & precedence candidates are required to follow their selection procedure as follows:

Step 1:

Completed application

The application form is given in the online and completely filled applications are carried forward for the preliminary test (employment test).

Step 2:

Employment test

The Human Resource department mails the admit card to the applicants who have completed the online application successfully via post card. The questionnaire of the test is based on mathematics, English and the respective job questions. It is usually held on 100 marks. The employment test typically holds in any government major educational center. Such as teachers training college of Dhaka, etc.

Step 3:

Comprehensive interview

The applicants passed in the employment written test are called by the bank. They are mailed an invitation for the viva-voce for their post. The applicants have to bring their original educational certificates for producing the same before the interview committee. The certificates are tested here with the application form information. And if any disparity is found the applicant is not allowed confront the interview committee. The passed applicants are given conditional job offer. For permanent job offer they have to pass background examination & medical test steps.

Step 4:

Background examination

The Human Resource Department scrutinizes the background of the applicant and tries to find out all ins and outs of the respective applicant. The applicants are kept unknown about the background enquiry source.

Step 5:

Medical test

The applicants are to go for a medical check-up to the authorized medical center by National Bank Limited. National Bank Limited does not carry the medical fees. It is to be carried by the applicant himself. The test report directly goes to the Human Resource Department and the applicants are not permitted to see it.

Step 6:

Permanent job offer

If the 6th, Background examination, and the 7th

Medical test, steps are passed successfully, Human Resource Department of National Bank Limited sends an’ Appointment as Probationary Officer’ letter.

At the amalgamation day, the applicants are bound to sign up a ‘Letter of Undertaking’ for five years continuous service to the bank from the date of confirmation. If he leaves before completion of 5 years confirmed service or during the probation period he will have t refund to the bank 50% of total salary and allowances draw to him.

Challenges faced by HR Manager

- Working with people of different cultures

- Managing workforce diversity

- Helping employees balanced work life conflict

- Up gradation of employees according to the environment

- Cost cutting

Before an organization can fill a job vacancy, it must find people who not only are qualified for the position but also who want a job. Recruitment refers to organizational activities that influence the number and type of applicants who apply for a job and whether the applicants accept the jobs if offered. Thus recruitment is directly related to both human resource planning and selection.

Although it can be quite expensive, organizations have not always viewed recruitment as systematically as other HR functions such as selection. During the coming years, however the importance of recruitment will increase for many organization’s for at least two reasons:

- A majority of companies think that they will face shortage of employees who posses the necessary skills for the jobs.

- The downsizing and cost saving measures undertaken by many companies in recent years have left recruitment budgets much smaller than before.

Thus recruiters will have to become acquainted with new and more cost-effective ways of attracting qualified applicants. A process of finding and attracting capable applicants for employment. The process begins when new recruits are sought and ends when their applications are submitted. The result is a pool of applications from which new employees are selected.

It is the process to discover sources of manpower to meet the requirement of staffing schedule and to employ effective measures.

Recruitment of candidates is the function preceding the selection, which helps create a pool of prospective employees for the organization so that the management can select the right candidate for the right job from this pool. The main objective of the recruitment process is to expedite the selection process.

Who are they recruiting?

1. Bright, young graduate or a postgraduate, who cannot wait to start his/ her career in the financial services industry.

2. Consistent academic performer throughout his/her education.

3. Career-oriented person

4. Energetic, ambitious, innovative and business-oriented person.

Recruitment Criteria:

Standard Chartered Bank recruits the most talented individuals from the external market to supplement their internal pipeline of talent. Their Human Resources department provides guidance on the us of psychometric tests and has robust recruitment criteria to ensure that all candidates are treated fairly, equally and with respect. It has a global Graduate Recruitment Program; where in the region of 150 graduates are recruited each year on management trainee program across all businesses, functions and countries. .

Recruitment Process of SCBL

Standard Chartered Bank (SCB) is committed to have best possible stuff and to retain them through continuous development. The organization believes in integrity and merit for its employees who have the potential to enhance and utilizes their skills and knowledge. SCB fully supports the philosophy of non-discrimination in employment.

Jobs are the building blocks of the structure of any organization. Jobs can be sources of

Psychological stress and even mental stress and physical impairment. The process of determining the tasks that make up a job and the skills, abilities, and responsibilities needed to perform the job. Knowledge about jobs and their requirements are collected through a process

of job analysis. Simply stated, job analysis is a procedure for obtaining pertinent job

information

Job analysis consists of three distinct components, which are:

- Job description

- Job specification and

- Job performance standards

So, Job Description + Job specification + Job Performance Standards = Job Analysis.

The new job description and job specification as well as job performance standard will increase

management‘s understanding and involvement in determining the level of responsibility attached to each job. SCB always follow the HR procedures and that‘s why the organization analysis the job carefully and this job analysis involves in the following steps:

- Determine the use of job analysis information

- Collect background information

- Select the positions to be analyzed

- Collect job analysis data

- Review information with participants

- Develop a job description and job specification

Sources of Recruitment

After job analysis the HRD recruit employees from two sources and within this sources the best

Individuals are selected for employee testing and selection process.

(A) External Sources

- Personal applications

- New / Fresh graduate from famous educational institution

- Internee Employees ( In case of Outstanding Performance)

- Newspaper ads

- Internet

(B) Internal Sources

- Transfers

- Promotions

- Employee

- Recommendation

- Retrained employee

Methods of Recruitment in Standard Chartered Bank Limited

- Internal Methods:

- JOB POSTING

- SKILLS INVENTORY

- JOB BIDDING

- REFERRALS

- External Methods:

- SCHOOL AND COLLEGE RECRUTING

- ADVERTISING

- PRIVATE EMPLOYMENT AGENCIES

- INTERNET & WWW

Internal recruiting methods

Job posting

Many positions can be filled as a result of posting the job opening on the bulletin boards, announcing the opening in a company newsletter or posting announcement on the company’s intranet. A job posting procedure enables employees to strive for a better position within the company. Notices of important openings should include all-important information about the job. Some firms have turned to computers to make their job posting more fruitful. All employees who wish to participate to complete questionnaires about themselves, which include items concerning relocation willingness and preferences as well as training and educational backgrounds. A few skills are selected out of the total that best represent their functional skills. When a position needs to be filled the requirements are matched and candidates selected. Although positing jobs can be an efficient method of recruiting, number of problems has been associated. Example it can lead to personal bias and stiff competition.

Skills inventory

Another recruiting method is the use of skill inventories. Essentially a skills inventory includes a list of employee names, their education, training, present position, work experience, relevant job skills and abilities and other qualifications. The organization can search through the company skill inventory to identify potential candidates for the position opening.

Job bidding

These procedures typically specify that all jobs covered by the agreement must be fitted by qualified applicants from within the bargaining unit. Those interested in the vacancy bid for the job by applying if they are qualified. The individual fills the position with the highest seniority from among the qualified applicants. In some cases applicants take competitive examinations. However only current employees are eligible. Using a job bidding system is normally very easy. However it can present some difficulties.

Referrals

An excellent source of information is current employees who may know someone who would be qualified and interested in the open position. To entice employees to make job referrals, some companies offer a referral bonus. People tend to associate with people like themselves, if the employee fits the organization, chances are his or her referrals will be good. Employees, whose referrals are hired, are often willing to serve as a mentor to ensure their referrals succeed in the company.

External Recruiting Methods

School and college recruiting

Recruiting at high school or vocational schools is often a strategic approach adopted by organizations with position openings at the entry level or internal training programs. Recruiting at the college level serves as a major source for acquiring managerial, professional and technical skills. The gap that exists between the skills that organization will need over the next several years and those currently possessed by potential employees is growing. The number of jobs requiring a college degree is on the increase. Unfortunately for the organization it’s a very time consuming and expensive exercise. But pressures from the external environment will continue to force organizations to be highly visible and active in this kind of recruiting. In college recruiting the organization sends an employee usually called a recruiter, to campus interview candidates and describes the organization to them. Coinciding with the visit, brochures and other literature about the organization are often distributed. The organization also runs ads to attract the candidates. In the typical procedure, those seeking employment register at the college placement service. This placement service is a labor market exchange providing opportunities for students and employers to meet and discuss potential hiring. Preliminary interview with employers is done. Students are given detailed influence about the job and the profile. Salaries are negotiated. The expenses are borne by the organization. Many of the changes are designed to reduce overall recruiting costs while maintaining a strong applicant’s flow into the organization. The trend seems to be for an organization to develop a stronger, ongoing relationship with a relatively select number of schools.

Advertising job openings in newspapers, magazines, newsletters and other media sources is a relatively inexpensive recruiting mechanism. Advertising is useful for filling open position quickly. Advertising usually does not target a specific audience. Specified defined advertisements will attract qualified applicants, dissuade unqualified ones from applying and make the recruitment process more efficient.

Private employment agencies

Private employment agencies vary considerably in size and effectiveness as good sources of employee and must be chosen carefully by employers and job seeking alike. A preliminary interview is conducted for the applicants. Unfortunately some agencies are more concerned with placing employees quickly than in effecting a good match between the employee and the organization. The discrepancy can be reduced if the HR managers give detailed and specific requirements.

The internet and the WWW

One of the fastest growing recruitment methods is the internet and the WWW.Companies who does use the internet as a recruiting source appears to be happy with the process and the results. It allows access to broader set of people and hence broader setoff expertise and skills. It is also faster and convenient. However it may not be accessible to all.

Alternatives to recruitment

Another strategic business decision can be made is not to recruit. Instead they can rely on alternative staffing options.

Common alternative staffing options

- Traditional temporary help

A potential employee is recruited, tested, screened and employed by a temporary staffing agency. They assign qualified individuals to work at a clients site, generally to support or supplement the current work force.

- Long term temporary assignments

It is becoming increasing popular for an organization to staff part of its work force with temporary workers on an ongoing basis. These individuals are not considered short-term replacements, but more a part of the regular work force.

- Part time employees

Workers who work less than 40 hours a week are considered part time employees. They can be organization’s pay roll or assigned via a temporary agency.

- Employee leasing

A Company will transfer some of its employees to a leasing firm. The leasing firm then leases back the workers to perform the same job they did for the Client Company. However the leasing firm is now responsible for cost and work associated with the typical HR functions such as Payroll, benefits and recordkeeping.

- Independent contractors

Independent contractors are self-employed individuals who market a specific skill they posses to a variety of companies. A Company will hire them for a specific project or contract. Payment is usually based on the time and effort the individuals put forth on the project and expenses are frequently reimbursed

Selection

: Standard Chartered selects employee based on knowledge, skills and talent. They are committed to providing equality of opportunity to all employees, regardless of gender, race, nationality, age, disability, ethnic origin, or marital status. They are committed not jus to providing equality of opportunity to all employee, but also identifying what unique strengths each individual brings to the roles they carry out and the development of these strengths.

The Process of Selection

- Conducting a well structured and effective selection

- interview

- Making hiring decision

- Reference checking

- Making the offer

Key Elements of an Effective Selection Interview

- interviewing principles

- The “do” and “don’ts” of the interviewer

- The structure of the interview

- The interviewer competencies

- Identifying issues to be avoided such as questions

- Relating to discrimination

The Selection Interview

- Preparing for the interview

- Physical preparation

- Interviewer’s preparation

- Conducting the interview

- Opening and structuring

- Building rapport

- Gathering essential information by asking

- appropriate questions

- Telling information that candidate would value

- Closing

- Assessing the interview

- Evaluating and making the selection decision

Competency Based Selection

- The objectives and the benefits

- The approach and the questions to be asked in

- getting meaningful information for validation and

- evaluation

Comparison between SCBL and NBL (Recruitment and selection process)

Comparison between banks

| Contents | SCBL | NBL |

| Internal recruiting methods: |

1.Encourage Job posting

yes

No

2.Referralsyesno

3. Skills inventoryyesyes4.Job biddingyesnoExternal recruiting methods:

1. use of job boards

(bdjobs.com; prothomalojobs.net 😉

yes

no2.More emphasize on external recruitmentno yes3.Others external recruitment(campus recruiting; job fair)yesno4.Job specification & job description are well definedyesno5.Call the applicantsyesno6.Contact point verificationyesno7.Applicant’s are to go for a medical test

no

yes

Findings of National Bank Limited

National Bank Limited should sorts the best according to the CGPA obtained and the university ranking at the initial screening step.

National Bank Limited does not call the applicants. They only mail the invitation cards..

The conditional job offer obtainers go for the medical test where the cost is borne by the applicant.

The 5 years bond for is a great impediment for many of best applicants. They do not to stick themselves into any bounding.

In case of recruitment, National Bank gives more emphasize on external recruitment. External recruitment is expensive and time consuming

National Bank discourages the employee referral source for recruitment. Some studies have found that new workers recruited through current employee referrals have longer tenure with organizations than those from other recruiting sources. Beside a large pool of qualified applicants can be generated at a lower cost

National Bank does not use the job boards for recruitments. Job boards are the websites which provide places for the employers to post jobs or search for candidates. Now lots of large employers in Bangladesh are using job boards, such as, bdjobs.com, prothom-alojobs.net, etc.

There are lots of other external recruitment sources rather than newspaper and internet advertisements, which National Bank does not consider for attracting candidates. Thus National Bank is not fully utilizing the benefits of external recruitment. Campus recruiting, job fairs, employment agencies are such external recruitment sources which can be very effective in terms of Bangladesh.

Findings of Standard Chartered Bank Limited

Bank follow manpower planning in a very systematic way but being systematic they have to follow various steps & it is found to be very time consuming.

- Bank has been successful in removing the surplus manpower.

- Job specification and job description are well defined to all employees and they know what is expected of them. Everything is.

- There is no fix percentage of employees that are to be recruited for each source every year.

- Representation of candidates belonging to minority class communities is included in the selection committee, taking care of interest of minorities

Recommendations of National Bank Limited

Based on the above study I have some points to focus which will help the bank to improve the efficiency as well as the quality of work. The points are as follows:

National Bank Limited can perform initial screening step in their selection process because it’ll save time for the organization to select the best suitable applicant.

National Bank Limited should sorts the best according to the CGPA obtained and the university ranking at the initial screening step.

National Bank Limited does not call the applicants. They only mail the invitation cards. Sometimes mailing needs more time in our country. So they should start ‘Call the Applicants’ system along with mailing the invitation cards.

The conditional job offer obtainers go for the medical test where the cost is borne by the applicant. But it should be borne by the bank so that it can increase the bank’s reputation.

The 5 years bond for is a great impediment for many of best applicants. They do not to stick themselves into any bounding. So the bank should lessen the time period of bonding or call off the bond signing.

Management should set properly planning for it’s operations of each and every work for the whole bank as well as branches of NBL.

Management must design the job on priority basis.

It’s necessary to assign required qualified manpower for every job.

- Employees should be involved in decisions affecting them

- Total quality approach should be used

- Creation of enhanced performance appraisal system

- Job rotation and job enrichment for employees

- Improve communication skills

- Aggressive marketing strategy in banking

- Institutionalization of HRM

- Research and development facilities must be improved

- New Talent/ professionals should be hired

- To increase the employee retention, National Bank can use employee referral for recruitment

Using more external sources, such as, job boards, campus recruiting, job fairs, and employment agencies will provide National Bank with a wider range of options for selection.

Adapting more selection tests, such as, personality, honesty/integrity tests beside the ability test will help National Bank to select the candidates who are not only fit for the job but also fit for the organization

Recommendations of Standard Chartered Bank Limited

Standard Chartered Bank should continue using redeployment, retrenchment and instruments like VRS in order to reduce effectively its staff in areas of surplus.

Recruitment activities in Standard Chartered Bank could be combined with other such PSUs for the purpose of cutting on advertisement costs and cost involved in holding of interviews plus outside help could taken for organizing interviews.

Summer trainees should be allowed to avail various welfare facilities like travel free in company buses, subsidized food etc. so as to attract them to apply for job in Standard Chartered Bank.

The internal candidates though given relaxation during the selection procedure are not given preference over external candidates since Standard Chartered Bank adopts50:50 formula. I think it should get away with this formula and encourage the present employees to opt for higher levels within Standard Chartered Bank.

Although Compensation has not been analyzed in this research to find out whether it had any significant relation with perceived organizational performance, it seemed to be another important factor for Standard Chartered Bank, as per personal interviews. Overall not a single respondent of the interviews had a negative view on questions regarding compensation. This could be because they believed that compensation played a strong role in improving the organizational performance. Therefore, Standard Chartered Bank should put focus on it and try to give precise remuneration to each level employee.

Conclusion

Recruitment and selection are getting very much importance these days in the banking sector. It is very critical thing to evaluate the human resources. It is a systematic procedure that involves many activities. The process includes the step like HR planning attracting applicant and screening them. It is very important activity as it provides right people in right place at right time. It is not an easy task as bank’s future is depends on this activity. If suitable employees are selected which are beneficial to the bank it is at safe side but if decision goes wrong it can be dangerous to the bank. So it is an activity for which HR department gets very much importance. Recruitment and selection procedure and its policies changed as per the banking activities. Its importance also gets changed as the bank’s changed.

Finally, reviewing the current recruitment and selection polices will lead to a competent future for National Bank as the objective of recruitment and selection is to pick up the right candidates who meet the requirements of the job and the organization best. Any mismatch in this regard can cost an organization a great deal of money, time and energy, which will ultimately affect the employee retention and organizational performance.

Effective recruitment is important in achieving high organizational performance and minimizing labor turnover. As of now Standard Chartered Bank Limited has a team of effective human resource which is efficiently managing the organization at its best. Though the recruitment process adopted by the organization needs to be improved, challenges are ahead for the HR Department to recruit people after the effect of recession. In the present competitive & dynamic environment, it has become essential for organization to build and sustainable.