HSBC is world’s second largest public company. They have 7500 offices in 87 countries. In Bangladesh they are doing business for a long time. They are making huge impact in our business by providing different financial services and helping business organizations by providing support in export and import activities. Each year huge amount of foreign currency is inwards and outwards in our economy for different purposes. HSBC plays a huge role in buying and selling foreign currencies from organizations and individuals.

Thus, they are making the money market of our country stable. HSBC Global Markets offers different spot, forward and option products to business people for the ease of these foreign exchange transactions. Moreover, the global markets offer different money market products in order to stabilize internal money market conditions like overnight call money, SWAP etc. In this project work the activities are elaborately discussed.

The Organization:

Introduction:

HSBC Holdings plc is a global banking and financial services company headquartered in Canary Wharf, London, United Kingdom. As of 2011 it is the world’s second-largest banking and financial services group and second-largest public company according to a composite measure by Forbes magazine. HSBC Group is one of the largest banking and financial services organizations in the world. It has around 7500 offices with presence in 87 countries. In

Bangladesh, Hong Kong and Shanghai Banking Corporation Ltd. opened its first branch in 1996. HSBC Bangladesh is a network of 13 offices, 39 ATM, 9 Customer service centers, an offshore banking unit, and offices in 7 EPZs. 1051 employees are there as of December 2010. In Bangladesh they have more than a 100,000 customer.

Product/service offerings

The business areas are:

1. Personal Finance Services

2. Commercial Banking

3. Corporate and Institutional Banking

4. Global Markets

5. Shariah Compliant Banking

Corporate and Institutional Banking

HSBC provides financial services to small, medium-sized and middle-market enterprises. The group has more than 3 million of such customers, including sole proprietors, partnerships, clubs and associations, incorporated businesses and publicly quoted companies. HSBC has relationship with almost all multinational in Bangladesh. Presently corporate banking department of HSBC is the largest among all the foreign banks operating in Bangladesh. HSBC has the appetite to grow further in corporate lending. Global network of HSBC is leveraging multinationals operating in different countries. They provide sizable single borrower limit to create customer financial needs. HSBC has industry wise segregated business team. The services:

1. Import Services:

a. Documentary credit: A letter from a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

b. Import Finance: Provide loans (increasing limit) to loyal customers in case of opening Letter of credit.

c. Shipping Guarantee

2. Export Services:

a. Pre-shipment FinancePage 4

b. Post-shipment Finance

c. Documentary credit Advising.

3. Corporate credit

a. Overdraft: An extension of credit from a lending institution when an account reaches zero. An overdraft allows the individual to continue withdrawing money even if the account has no funds in it. Basically the bank allows people to borrow a set amount of money.

b. Local Purchase

c. Term Loans

d. Guarantees and Bonds

4. Payment and Cash management

a. Integrated Delivery Channels

b. Account Management Services

c. Integrated Payment solutions (IPS)

d. Integrated Receivable Solutions (IRS)

Global Markets

Global Banking and Markets is the investment banking arm of HSBC. It provides investment banking and financing solutions for corporate and institutional clients, including corporate banking, investment banking, trade services, payments and cash management, and leveraged acquisition finance. It provides services in credit and rates, foreign exchange, money markets and securities services, in addition to asset management services.

1. Operating 87 treasury in more than 60 countries and territories

2. One of the largest and most sophisticated treasury centers in country

3. Offers almost all the treasury products under regulatory

4. The most active player in the forward markets

5. Offers customize products based on client requirements

Products and capabilities:

1. Competitive spot FX rate

2. Forward in FCY BDT currency pairs

3. Forward and zero cost option structures in FCY currency pairs

4. Capable to make big ticket size dividend/royalty payment

5. Daily FX rate sheet of all major currencies

6. Regular in-house research on local and international economies and currencies.

Project

1. Objective of the project

The objective of the report is to provide a brief idea about how the Global Markets department of HSBC, Bangladesh operates and what sort of FX products they are offering to our Bangladeshi foreign exchange market.

2. Methodology

The report has been made after a long observation of daily activity done by Global Market department of HSBC, Bangladesh. Moreover, lot of information has been taken by asking question from different aspects to the employees of the department. Help of internet and HSBC research materials has also taken.

Main body of the project report:

Treasury management includes management of a bank’s holdings, with the ultimate goal of maximizing the firm’s liquidity and mitigating its operational, financial and reputational risk. Treasury Management includes a firm’s collections, disbursements, concentration, investment and funding activities. In larger banks, it may also include trading in bonds, currencies, financial derivatives and the associated financial risk management. A Bank

Treasuries may have the following departments:

a. A Fixed Income or Money Market desk that is devoted to buying and selling interest bearing securities

b. A Foreign exchange or “FX” desk that buys and sells currencies

c. A Capital Markets or Equities desk that deals in shares listed on the stock market.

Treasury Management for Bank

1. Cash Management

a. Managing cash flows

b. Payment management (interest rate, debt, and FX)

c. Sourcing the better price

2. Hedging foreign exchange risks

a. FX FWD or Option or bespoke

3. Hedging Interest rate risks

a. Vanilla IRS, Cap, Floor, Collar bespoke

4. Evaluation choices of hedging

5. Limit management

a. Allocating proper limit authorities and mandates to relevant staff

b. Ensuring availability of bank limits

HSBC has only Money market desk and Foreign exchange desk. They do not have any capital market desk as they are not involved with Dhaka Stock Exchange or Chittagong Stock Exchange. The functions of HSBC treasury are:

1. Manage the bank’s Asset and Liabilities (ALM): In banking, asset and liability management means managing risks that arise due to mismatches between the assets and liabilities (debts and assets) of the bank. Banks face several risks such as the

a. liquidity risk,

b. interest rate risk,

c. credit risk and

d. Operational risk.

Asset Liability management (ALM) is a strategic management tool to manage interest rate risk and liquidity risk faced by banks. Banks manage the risks of Asset liability mismatch by matching the assets and liabilities according to the maturity pattern or the matching the duration, by hedging and by securitization.

2. Promote and sell treasury products

a. Manages the bank’s excess/short foreign exchange: According to daily demand and supply of foreign currencies the bank gets a daily position of long or short position of fund. According to daily position they decide where to lend or from where to borrow. The corporate desk (foreign exchange desk) deals with clients and sell/buy foreign currency and the interbank desk (Money market desk) run the bank’s position according to daily demand and supply through deciding where to invest or from where to borrow.

• Manages and originate fixed income products to generate revenue: Managing fixed income product is the responsibility of interbank desk which are:

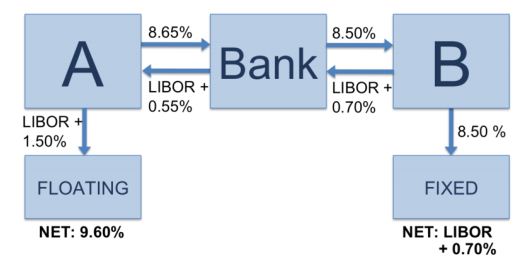

a. IRS (interest rate swap): An interest rate swap is a derivative in which one party exchanges a stream of interest payments for another party’s stream of cash flows. Interest rate swaps can be used by hedgers to manage their fixed or floating assets and liabilities.

b. Currency Swap: A currency swap is a foreign-exchange agreement between two parties to exchange aspects (namely the principal and/or interest payments) of a loan in one currency for equivalent aspects of an equal in net present value loan in another currency.

c. Forex swap (FX Swap): is a simultaneous purchase and sale of identical amounts of one currency for another with two different value dates (normally spot to forward).

• Design and promote new products as per customer requirement

• Build and maintain relationship with customer: Make new client according to prospect and maintain a good relationship with existing clients through arranging events like picnic, comedy shows, cricket match live show or iftar distribution on Ramadan.

• Build and maintain relationship with regulators: Build and maintain sound relationship with regulatory body like Bangladesh Bank, Board of Investment etc.

• Forecast market direction and write markets commentary for customers for their betterment.

Aim of ALM

• To manage the bank’s regulatory requirements

a. SLR is 18% of Total D/L + T/L

b. CRR is 27.8% of SLR (i.e. 5% of Total D/L + T/L)

c. Remaining 72.2% of the SLR can be maintained by:

i. Local currency (non-interest bearing)

ii. Foreign currency (non-interest bearing)

iii. T-Bills

iv. Reverse repo with Bangladesh Bank

v. Government approved bonds & securities

• To manage the market risks of the bank: There is constant fluctuation of currency rate in international market. So there is always market risk present for the one who runs the position of bank. If market of a specific currency falls then the interbank trader faces the risk of his current holdings of that particular currency. Depending on market the trader make the decision whether he have to hedge or un-hedge his current position.

• To identify and manage the bank’s balance sheet gaps

• To manage the bank’s liquidity risk and review the liquidity contingency plan: liquidity risk is the risk that a given security or asset cannot be traded quickly enough in the market to prevent a loss (or make the required profit). Bank faces liquidity risk when they do not have certain reserve for the particular currency to satisfy an order/deal. On that

time inter-bank desk manages the reserve by fixed income products.

• To monitor and manage various FIN ratios ( liquidity ratio, A-D ratio, R WA etc)

• To help determine deposit and lending rates of the bank

Limits, Basel II and Misc.

• Issuance of various market risk limits

• Includes interest rate, FX and other product based limits of the bank

• Issuance of counterparty credit limits

• FX limits (risk weighted)

• Settlement limits (full or net-of)

• Money Market limits (100%)

• Issuance of limit mandates to Head of GM, and dealers

• Manages R WA and third party assets (Nostro a/c)

• Operational risks – identify , understand and manage

• Ensuring compliance with, not only the letter but also the spirit of the law.

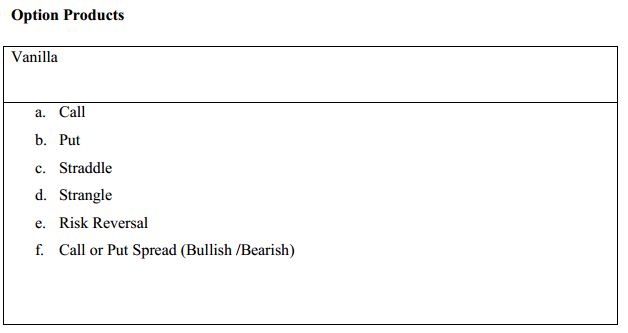

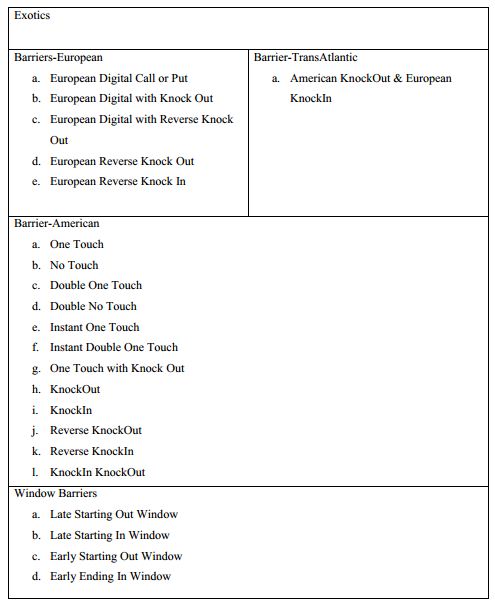

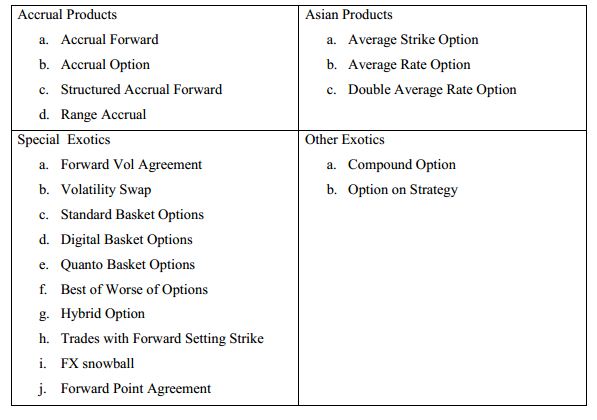

Typical global markets products

• Spot foreign exchange

• Forward foreign exchange

• Money markets: overnight and term deposits

• Repo & reverse repo: repurchase / sell-buy transactions

• Swaps: a) currency b) interest rate & c) structured

• Option: a) plain vanilla & b) exotic

• Derivative: a) plain vanilla & b) structured

• Securities: a) T-Bills and T-Bonds b) FRNS

The FX market and spot:

• A spot FX transaction is an agreement between two parties

• To exchange a specific amount of one currency

• For a specified amount of another currency

• On the second business day

• If the FX transaction is to be settles beyond SPOT date then it is a FWD FX transaction

FX Forward:

A contact where:

Two parties agree to buy/sell a currency against another at an agreed exchange rate at an agreed future date. Forward are generally used by both Exporters and Importers to hedge against future exchange rate volatility.

FX Forward: An example:

A customer requires USD 1 mln 3 month forward SPOT: 69.35

FWD PTS: 1.6389

FWD RATE: 70.9889 (at ‘premium’ more expensive)

WHY???

We buy USD spot @ 69.35

We place (lend) USD @2.00% for 3 months

We borrow BDT @ 11.50% for 3 month

9.50% Difference added to the spot price in the form of premium

This is an example of regular FX forward. There are many kinds of forward which are discussed below:

Outright Forward

• A contract where:

Two parties agree to buy/sell a currency against another at an agreed exchange rate at an agreed future date. Forward are used to hedge against future exchange rate volatility.

• Main advantages are:

• Hedge exchange risk exposure and reduce exchange losses

• Advance knowledge of transaction price helps in forecast balance sheet

• Main disadvantages are:

• Contract must be closed out at or before maturity date

• Market rate must be against forward rate at maturity of the forward Par forward

A series forward contract at the same agreed exchange rate with different maturity date in future. Par forwards are generally used to hedge a stream of the future cash-flows Example:

A six month USD/BDT forward contract which matures at the beginning of each month

Deal date:

Advantage:

• Hedge exchange risk exposure

• Avoid price fluctuation

• Gain advantage of significantly high premium

• Advantage knowledge of transaction price helps in forecasting balance sheet

Disadvantage:

• Spot market rate may be better than the forward rate at maturity

• Contract must be closed out at or before maturity date

Floating forward

A series outright forward contracts with fixed term done continuously after a certain interval from the previous one.

Advantage:

• hedge exchange risk exposure

• Flexibility to gain on favorable spot movement

• Gain advantage of significantly higher premium

Disadvantage:

• Spot market rate may be better than the forward rate at maturity

• Contract must be closed out at or before maturity date

Correlated forward

A fixed/option forward purchase contract linked to the spot/near leg deals in the sale side. This product is useful for the FCY hedges and suitable for clients who have buy and sell exposure at different dates.

Example: client to settle an outward remittance at value spot. Side by side, it will receive inward remittance that will be en-cashed during next 6-months. Under the correlated forward deal, client can sell HSBC US dollar forward for 6 month and buy it at spot (at HSBC board rate) and receive the advantage of forward premiums.

Indicative quotation is as follows:

- For spot client purchase (HSBC Sale): 73.65 (Board rate)

- For 6 month client correlation forward scale (HSBC buy): 73.52

- Exchange gain from the inward remittance transaction is maximized by entering into correlatedforward

- Deal structure: In this case, HSBC sell USD spot at 73.65 and enter into six separate forward purchase agreement at 73.52 with the client. Each forward purchase amount will be one-sixth the spot sale amount.

Main advantages are:

• Hedge exchange risk exposure and reduce exchange losses

• Advance knowledge of transaction price helps in forecast balance sheet

• At present sell/buy preference is provided only for same date transactions. With this product, client will gain advantage of narrower spread despite having mismatched flows.

Disadvantage:

• Spot market rate may be better than the forward rate at maturity

• Contract must be closed out at or before maturity date

Range forward:

A zero combination of a call option and put options which protects against unfavorable rate movements but limits the profits which can be made from favorable price movement.

• If client is an importer then he buys a call and sell a put for the same amount and same expiry with different strike rate.

• If client is an exporter then he buys a put and sells a call for the same amount and same expiry rates.

Advantage:

• Fully hedged at cap (importer)/ floor(exporter)

• No upfront premium

Disadvantage

- No hedged in between two strikes

- Gain is limited to floor (importer)/Cap (exporter)

- Seagull

A three-legged option strategy, often, used in forex, that can provide a hedge against the desired movement of an underlying asset. A seagull option is structured through the purchase of a call spread and the sale of a put option (or vice versa)

The option contracts must be in equal amounts and are normally prices to produce a zero premium.

Advantage:

1. Provides more flexibility than range forward

Disadvantage:

Client fully protected beyond a certain extend

FX Option:

European call

Market conditions on 05 Feb 2008

USD/BDT: 69.50

Description:

1. HSBC is selling a CALL option to Co. XYZ to buy USD against BDT

2. C. XYZ is the buyer of the call option. That means Co. XYZ possess the right to buy USD at maturity (but not an obligation).

3. Tenor 3 months

Pricing:

1. Strike price: 70.00 (in the money). Co. XYZ has to pay premium (say) of .75%

Situation one: if the market is above 70.00. for example at 71 co. XYZ will exercise option and take the gain of 1 taka.

2. Situation two: If market is below 70. for example at 68 co. XYZ will not exercise the option and buy USD at market rate.

Strike price can be changed according to Co. XYZ’s view and desire. Premium will change accordingly. Premium or price of an option is a function of volatility, difference of strike price from spot, and interest rate of the two currencies (swap points).

FX products (more option varieties)

Call and term MM

1. Money lent between banks and financial institutions for overnight is termed Call Money

a. Maturity next day with option to roll over the lending/borrowing at the pre-existing rate for another day.

b. Most liquid in our market but volatile

2. Money lent between banks and financial institution for a fixed term

a. Fixed maturity, but mostly 3-months

b. Less liquid, but rates are stable (not as volatile as call-money)

1. Money lent between banks or financial institution with T-bills (securities) as collateral

2. sell/buy and buy/sell transaction

3. Mostly the tenor is overnight, some 7 days

4. With BB, it was auction based (BB can reject the bid)

5. BB uses these two products to manage market liquidity as per monetary policy.

IRS: Interest rate SWAP:

1. SWAP floating interest rate payables with fixed or vice versa

2. Hedges customer against rising/falling int. rate environment

3. Possibilities for Bangladesh:

a. USD interest rates may bottom out soon

b. Customers would be interested to move from floating to fixed

c. BDT IRS for customers with floating BDT debt

1. BDT interest rates may rise (given high inflation)

2. Customers would be interested to move from floating to fix.

IRS – Hedging US $ interest rate exposure

Example:

1. XYZ has borrowed 3- year USD term loan, paying Libor interest

2. Company’s view is for rates to rise

3. Keen to hedge against rising interest rates

IRS – Gain from declining BDT interest rate

Example:

1. XYZ has borrowed 3-year BDT term loan at 13% fixed

2. Company’s view is for interest rate to decline

3. Company is keen to take advantage of the declining interest rates.

Basics of Dealings

Foreign exchange in Bangladesh

- SPOT: Sale or purchase of specified currency at a fixed rate for delivery after 2 working days

- TOM (tomorrow): for delivery on the next working day.

- TDY (Today): For delivary on the same date

- FWD (Beyond Spot): For delivary beyond 2 working days

1. FWD is a contract to sell and buy a currency at a future date

2. Used for hedging against fluctuation exchange rate

3. This is also a derivative in the sense that it is derived from spot rate and interest rates

Direct and Indirect Quotes

There are two types’ quotes. Direct and Indirect

$1 = CHF 1.1655/60

$1 = JPY 98.30/35

$1 = SGD 1.5145/55

$1 = BDT 69.00/05

$1 = AED 3.6700/50

These are “Direct Quotes”, because these currencies are quoted per dollar. In other words, dollar is the “unit currency” [also known as BASE currency] while the other currency is the “variable currency” [also known as PRICING currency].

A few examples:

GBP 1 = USD 1.4590/95

EUR 1 = USD 1.3445/50

AUD 1 = USD 0.7010/15

NZD 1 = USD 100.67/78

These are “indirect quotes”, because these currencies are not quoted per dollar. Here the dollar is the “variable currency” [BASE currency] while the other currency is the “unit currency” [PRICING currency].

A few examples:

GBP 1 = JPY 136.90/95

EUR 1 = GBP 0.8845/48

AUD 1 = BDT 48.37/44

GBP 1 = BDT 100.67/78

These are called “Cross currencies”. The dollar has been calculated “out” of these rates. The “variable currency” and the “unit currency” in the cross-currency quotations is determined by convention.

Quoting/Dealing conventions:

1. The entity quoting the rate or price is the “Market Maker”

2. The entity asking for the price is the “Market Taker”

3. Market Maker decides on the spread between the Bid and Ask/Offer

4. Market Taker is subjected to the spread, i.e. Market Taker has to buy at Market Maker’s offer and sell at Market maker’s Bid

5. Market Maker takes the risk of quoting 2-way price not knowing which side the Market Taker will ‘hit’.

6. Market taker may or may not deal or hit on the rate q.