5.2 Pricing

Pricing is one of the marketing mix tools that a company uses to achieve it marketing objectives. Global Beverage Company Limited (GBCL) decides its product pricing on the basis of Cost based pricing. Naturally they follow cot based pricing. This type of pricing added a standard mark-up to cost of certain product of virgin soft drinks.

In Cost plus pricing we consider two formulated steps:

1) Unit cost

2) Mark-up price

Formula:

1) Unit cost: Variable cost + (Fixed cost/Unit sales)

2) Mark-up: Unit cost / (1-Desired return on sales)

Can (250 ml):

Unit cost = Tk.10

Mark-up price = 10 / (1-0.187) = Tk. 12.3

Small pet bottle (500 ml):

Unit cost = Tk. 14

Mark-up price = 14 / (1-0.2) = Tk. 17.5

Medium pet bottle (1 liter):

Unit cost = Tk. 17

Mark-up = 17 / (1-0.2) = Tk. 21.25

Large pet bottle (1.5 liter):

Unit cost = Tk. 25

Mark-up price = 25 / (1-0.2) = Tk. 31.3

Diet can (250 ml):

Unit cost = 12

Mark-up price = 12 / (1-0.187) = Tk. 14.76

Pricing of producer to customer:

For ‘Can’:

Sizes | Promotion | Dealer | Retailer | Final consumer |

Can 250 ml | Tk. 12.30 | Tk. 12.30 | Tk. 13.5 | Tk. 15 |

Diet can 250 ml | Tk. 14.76 | Tk. 14.76 | Tk. 16.5 | Tk. 18 |

Small pet 500 ml | Tk. 17.50 | Tk. 17.50 | Tk. 18.5 | Tk. 20 |

Medium pet 1 liter | Tk. 21.25 | Tk. 21.25 | Tk. 23.0 | Tk. 25 |

Large pet 1.5 liter | Tk. 31.30 | Tk. 31.30 | Tk. 32.8 | Tk. 35 |

GBCL took steps to increase their sales promotion by providing discount facility on pet bottle (1 l. & 1.5 l.) only for previous Eid festival. In that time they earn much popularity and improved a lot of market share. So, GBCL management has decided they will continue their previous program. As a result, the price of pet bottle fixed at Tk. 25 for 1 liter and Tk. 35 for 1.5 liter.

5.3 Promotion

Promotion is one of the marketing tools that a company uses to achieve its marketing objectives. Each promotion tools has unique characteristics to improve their total sales.

Marketing promotion can be classified several steps-

5.3.1 Advertising:

Advertising is the way where massage could be delivered to the consumers mind. Massage can be delivered to the consumer by the sound, music, choreography, lighting, and performer appearance. Advertisement massage must be believable, meaningful and distinctive. Advertising can be used to buildup a long-term image for a product and also can trigger quick sales.

Advertising media:

a) TV channel

b) News paper

c) Magazine and Journal

d) Web site

e) Radio

f) Bill board

g) Neon board

h) Light box

i) Printed poster

Advertising time & located areas:

Virgin advertising is shown in TV channel from evening to midnight. The customers usually watch advertise in the evening. Almost every popular newspaper, magazine and journal is use for advertising. Advertising presented in the noon and afternoon session in Radio. Virgin Website shows attractive advertising in all time. Printed poster is naturally using all over the Bangladesh. Light box advertising usually found in retailer shops, super markets, and general stores spread all over the Bangladesh. Bill boards are shown in crowded areas such as at Mirpur, Farmgate, Jatrabari, Moghbazar, Gulshan-1, Tangi etc. Neon board is seen at Malibagh, Karwanbazar, Banani. Some retailers, customers, and dealers widely focus on the quality of advertisement. If GBCL served modernized advertising they have a better chance to improve their sales.

5.3.2 Personal selling:

Personal presentation by the firm sales force for the purpose of making sales and building customer relationship.

Virgin uses personal selling in different stages of marketing and distribution. Company distributes their product among the dealers, resellers, retailers by maintaining excellent relationship.

5.3.3 Sales Promotion:

Sales promotion includes a wide way of tools that can attract consumer’s attraction, strong incentive of purchase, free gift, discount and several types of occasional program.

Consumer Promotion Tools: In consumer promotion tools GBCL provided some short- term attractive sales promotional tools. In Premium tools it followed – Eid dhamaka Tk. 5 discount for previous Eid festival and continuing still on. In Advertising Specialty they provided scratch card for various gift items such as- caps, T-shirts, bags, mugs and nice looking glasses conducted with Virgin brand name. In Contest & Sweepstakes they arranged exclusive travel ticket Dhaka to Singapore, and Dhaka to Cox’s Bazar.

Trade Promotion Tools: Here GBCL took steps to give special discounts, allowances, specialty advertising items, free goods, push money to the retailers and dealers. GBCL arranged conference every year among the dealers and also rewarded the first three dealers in terms of greater sales volume. GBCL can get such benefits by implementing trade promotional tools are given below-

º To carry the brand name.

º Give a brand shelf space.

º Promote brands in advertising.

º Push to the consumers.

Business Promotion Tools: GBCL rewarded its business market like as supermarket, departmental store, general store in terms of sales unit. They make advertising nameplate for business market by their own cost.

In survey we have seen that virgin needs to improve their sales promotion for raising their sales. Many consumers sited that if virgin provides more gift items they will encourage for buying it. So GBCL need to improve their selling by implementing some attractive sales promotion programs.

5.3.5 Promotion Mix Strategies:

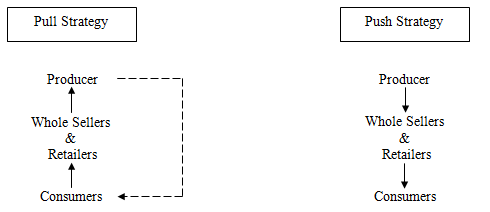

Marketers can choose basic two promotional marketing mix strategies these are given below:

Global Beverage Company Ltd. follows these two promotional mix strategies at a time. In pull strategy they influence consumers by advertising sales promotional programs. Then consumers make demand to retailers, about their choice. Again retailers make demand to Producer.

In push strategy producer wants to influence retailers and wholesalers by personal selling, trade promotional programs. Retailers are willing to motivate consumers by implementing personal selling advertising and sales promotional programs.

5.4 Place

Virgin is provided in the local area. Fast food shop, general store, departmental store, super market there is a place where virgin is available. Their manufacturing unit stands on Gazipur. Virgin’s head office is at Mirpur, Dhaka. Now they are exporting in Bhutan and trying to export their product in India.

6.0 Findings

Consumer (General)

Brand awareness

The brand on the top of the mind (TOM) of all irrespective of socio-economic class, age, and region was the same with the regared to total spontaneous awareness. However, considering total awareness (spontaneous plus prompted) RC was number one, closely followed by Coca-Cola.

Virgin was the fifth TOM brand among the SEC A and B, but sixth amongst all SEC. It was sixth and eighth in term of total spontaneous and total awareness respectively.

Consumption habits

Reasons for drinking CSD

- As a whole people drink CSD more to help with digestion of food than for any other reason, irrespective of age, SEC, sex, etc.

- Beats the heat (quenches thirst), removes fatigue, tastes good were the other major reasons cited for drinking CSD as can be seen from the following graph.

Brand preferences

- The two most preferred brands were Coca-Cola and RC.

- Coca-Cola was the men’s first choice while RC the wome’s.

- 7Up Was the third choice by both sexes.

- Coca-Cola was the first preference of SEC A and B consumers, while RC was SEC C’s

- Coca-Cola was the most preferred brand in the age group 20-39.

- RC was the young ones’ first choice being preferred most in the age group 12-19

- Virgin Cola was the fifth choice among CSDs, being more popular with SEC A and B and female consumers. There was some preference for only this variant of Virgin while there seemed to be little interest in the others. The age group 35-39 did not seem to care much about any variant of Virgin .

Brand purchase

- The most purchased brands were RC and Coca-Cola followed far behind by 7-Up and Virgin.

Substituted brands

- In the absence of the preferred brand at the outlet, Coca-Cola came out to be the number one substitute brand followed by RC, Sprite, Pepsi, up and Virgin in that order.

Place of consumption and Pack preference

- CSD is consumed most at home, mentioned by 92% of the respondents, lager pack being more popular. At work/ school and while traveling are the other important place of consumption. Popular packs at different place of consumption can be seen from the following matrix :

| Place of consumption | Response frequency | Popular Packs |

| At home | 92% | 1 lit,1.5 lit, pet and 1 glass (Figure??) |

| At work | 26% | 1 lit, pet, 250 ml glass and pet, 500 ml pet Can |

| While traveling | 22% | Can |

| At school /college | 33% | Can, 250 ml glass, 1 lit pet and glass |

| At play | 12% | Can , 1 lit pet, 250 glass and pet |

Time of consumption

- CSD consumption seemed to be the most during mid afternoon (after lunch and before evening), irrespective, of SEC, age sex and area. They only peculiarity seemed to be in Khulna and Rajshahi where more than 50% of consumers seemed to drink CSds at night w ith approximately a third of the total having a drink late at night before retiring.

- Women appeared to drink CSDs at lunch more than men while larger number of men seemed drink CSDs during mid morning than women (in between breakfast and lunch)

- Almost 50% of the consumers appeared to drink CSDs during lunch

- Overall the tendency to drink CSDs at night ( at dinner or after seemed to be relatively low

CSD purchase habits

Brand switching and the reasons for the same

Brand switch between brands purchased most in the last one month to brands purchased last was not noticed much. However, whatever switch took place was mainly due to the non-availability of the most purchased brand. Some switching took place also to try out new brands.

- The tendency to switch for trying out a new brand seemed to be more among the SECA A and B consumers.

- It second that more men would switch to try out a new brand than women would.

- Among the different age groups only those between 16 and 19 had switched more to try out a new brand than for any others reason.

Purchase frequency

- It seemed by and large that most consumers of soft drinks would buy the drinks about 2-3 times a week.

- The only exception was among the SEC C consumers. Most in this class would buy the drinks once in every fifteen days.

- Men appeared to buy soft drinks more frequently that women.

- As perhaps expected urban consumers would buy soft drinks more frequency than semi urban/semi rural consumers.

- More people in Dhaka seemed to buy soft drinks about 2-3 times a week than anywhere class in the country.

- Most consumers of Chittagong and Rajshahi seemed to buy soft drinks once in a week.

Purchase frequency | Total | By SEC | ||

| Base | 1000 | SEC A | SEC B | SEC C |

| 2/3 times per week | 28.9 | 136 | 136 | 402 |

| Once per week | 23.0 | 32.2 | 34.7 | 23.5 |

| Once per 15 days | 18.7 | 23.8 | 22.0 | 22.5 |

| 4/5 times per week | 15.4 | 14.9 | 16.3 | 23.6 |

| Once a month | 8.7 | 17.0 | 12.5 | 14.9 |

| Everday | 4.2 | 6.7 | 9.4 | 10.4 |

| Less than one month | 1.0 | 4.9 | 5.2 | 3.2 |

| Total | 100.00 | 0.5 | – | 1.9 |

| Mean score | 3.67 | 100.0 | 100.00 | 100.0 |

Place of purchase

- Overwhelmingly the usual place of purchase of CSDS was a small localized retail shop more commonly known as a general store. This was the was the case in both urban and semi urban/semi rural areas of the country, among all SECs and age groups.

- A lot of purchase of CSDs took place in confectionerise (It is possible that some respondents termed the general stores as “ confectioneries” since in most general stores one would get confectionery items like bread, biscuits, cakes and savories.

- Quite a bit of CSD purchase to0ok place at fast food/coffee shops.

Consumer perception and attitudes

Brand perception

As a whole, Coca-Cola and RC received higher association with majority of the attributes, indicating better overall perception, as can be seen from the graph overleaf. However, brand wise specific perceptions are as follows:

- Coca-Cola and Pepsi were perceived to be brands which were available everywhere. Coca-Cola was also perceived by many as a drink for “outgoing people” and a good quality drink.

- RC, Virgin and Uro were mostly linked to entertaining advertisements

- RC was also considered as being available everywhere and being a drink for outgoing people.

- Virgin also was named as a brand available everywhere and was recognized as being a new drink.

- Regarding quality consumers perceived a strong relationship with Coca-Cola and RC. The perception was rather low with Virgin.

- A large number of respondents found Coca-Cola and RC to be “refreshing” drinks along with Pepsi, Sprite and 7 up.

- Uro, Virgin, Mirinda, Fanta and RC were thought be drinks for children by about a quarter of the consumers.

- Approximately half of the respondents thought Coca-Cola and RC were drinks for people like them

- Nearly a third of the people thought Coca-Cola and RC were drinks with a difference only 20% felt that way about virgin and Uro

| Perception | Brand | Perceived by |

| Available everywhere | Coca-Cola, Pepsi, RC, Virgin, Fanta, Mirinda. | All age groups, both sexes |

| For outgoing people | Coca-Cola, RC | All age groups, both sexes |

| Refreshing drink | Sprite 7 up, Coca-Cola, Pepsi, RC | All age groups, More men than women |

| Good quality drink | Coca-Cola, RC | All age groups, both sexes |

| Good quality drink | RC, Virgin, Uro | All age groups, both sexes |

| Has an entertaining ad |

However, brand wise specific perceptions are as follows:

Image | Brands | Perceived by |

| Fun | Coca-Cola, Pepsi, 7 Up, RC Virgin (low) | All age groups, both sexes |

| Trendy | RC, Coca-ColaVirgin Uro, Pepsi, 7 up (all low) | All age groups, both sexes |

| Modern | Virgin, Uro, RC | All age groups, both sexes |

| Cool | Virgin | 16-24 and 30-34 (more from these age groups than women) |

| American | Coca-Cola | All age groups, both sexes |

| Boring | Fanta, Mirinda | All age groups, both sexes |

| Chidish | Fanta, MirindaVirgin, Uro, RC Virgin, Uro, RC | 12-15,20-39 age groups MenWomen |

- Most people associated almost all the good images to Coca-Cola and RC

- Though by significantly lesser number of people almost all the good images were also associated to virgin and Uro.

Consumer (Virgin specific)

Past and present consumers

Top of mind awareness of variant

The variant on the top of the mind of all Virgin consumers (past and present) was Virgin Cola, followed by Virgin lemon and Virgin orange. The picture was the same with the regard to total awareness (total spontaneous plus prompted). The only exception with regard to top of the mind variant was in the age group 30-34 where Cola was followed by orange and then lemon.

Prompted awareness of variant and Total Awarness

- When prompted the highest was with the orange variant followed by lemon and diet cola.

- However, total awareness of Virgin cola was the highest closely followed by Lemon and orange. Virgin Diet Diet Cola total awareness much lower than the other variants.

Present consumers

Variant preference

By and large the most preferred various were similar in the following order:

- Cola

- Lemon

- Orange

- Diet

- Coca-Cola was the first choice for both sexes.

- Orange was the second and lemon the third choice in the age group 30-34.

- Orange was the second and lemon the third choice in Rajshahi. There was no other regional peculiarity/ bias.

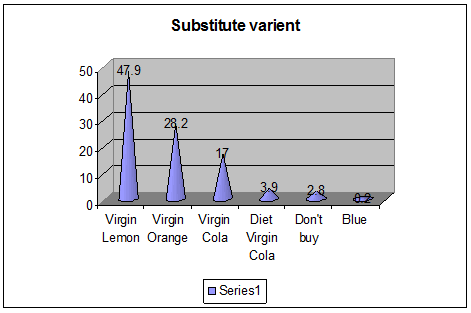

Substitued variants

Lemon came out to be the number one substitute variant followed by Orange, Cola, and Diet in that order

Purchase frequency

- It seemed by and large that most consumers of Virgin would buy the drink less than once a month.

- The exceptions were among the SEC and female consumers, and in the age groups 12,15,20-24,30-39. Most in these groups would buy the drinks once month.

- Wome appeared to buy Virgin drinks more frequently than men.

- While urban consumers would buy Virgin drinks more frequently than semi urban/semi rural consumers, it appeared that those in Dhaka and Rajshahi Division purchased more frequently than those in the other areas.

Pack preference

- It appeared that overall the 1.5 lit pet bottle was the most popular Virgin pack followed by Can, 2 lit pet, 250 ml pet and 500 ml pet in that order.

- The can was more preferred by women and the consumers in SEC B, as well as among the age groups 12-24

Attributes (ranked)

- There was reasonably strong agreement with all the following statements with regard to Virgin drinks. The statements were ranked on 5 point scale and are listed here in descending order:

a) “Available in Various flavours”

b) A well known brand

c) A brand for young people

d) An international brand

e) An innovative brand

New Variants sought

- Various unusal suggestions for new variants, such as “hot/spicy”, “chocolate flavour”, “coffee flavour” have been put forward, By far the maximum recommendations have come for various fruit flavorus. The drinks/flavorus which the Virgin consumers would like to see most in future:

- Mango flavour

- More fizzay variant

- Lichy flavoru

- Chocolate flavour

- Pineapple flavour

- Grape flavour

Past consumers

Reasons for discontinuing Virgin

- Overwhelming by the main reason cited for discontinuing Virgin brands was “DID NOT TASTE GOOD”.

This was the reasponse across all SECs, age groups, sexes and areas. No other response in the whole study has been so unanimous.

- The next important reason was “high price” which seemed to matter more to the consumers belonging to SEC B and semi urban/semi rural areas, age groups 12-24 and 30-34 and to the women.

- “Non availability” of the product was another important reason cited for not continuing with the brand

| Reasons | Total | By SEC | |||

| SEC-A | SEC-B | SEC-C | |||

| Base | 64.8 | 323 | 93 | 232 | |

| Doesn’t taste good | 40.9 | 43.2 | 43.0 | 37.3 | |

| High price | 12.8 | 8.8 | 19.2 | 15.1 | |

| Not available in every shop | 10.1 | 13.7 | 8.7 | 6.4 | |

| Others don’t like it | 9.8 | 6.2 | 4.2 | 16.2 | |

| Quality has deteriorated | 8.0 | 8.6 | 4.4 | 8.7 | |

| Doesn’t satisfy | 7.5 | 8.7 | 8.8 | 5.5 | |

| Less pungent | 7.0 | 5.2 | 10.3 | 7.7 | |

Aware but never tried

Reasons for not ever trying Virgin

Reasons | Total | By SEC | ||||

SEC-A | SEC-B | SEC-C | ||||

Base | 648 | 323 | 93 | 232 | ||

It doesn’t taste good | 25.2 | 21.7 | 36.2 | 25.2 | ||

Don’t want to shift brand | 23.2 | 30.2 | 15.5 | 19.5 | ||

Not available everywhere | 15.3 | 20.6 | 6.9 | 13.1 | ||

Nobody brings it home | 12.8 | 11.3 | 13.7 | 13.7 | ||

High price | 12.7 | 8.2 | 13.1 | 16.3 | ||

Table: Reasons for not ever trying Virgin

About 18% of those who were aware of the Virgin brand appear not ever having tried the drinks. The reasons cited for this were:

1. “Heard that it did not taste good” : Seemed important to

SEC “B” and “C” age groups 16-24 and 30-39, and to women relatively more than men

2. Did not wish to switch brands : Was the views of SEC

“A” consumers and those in age group 16-19, and 25-29

3. Was not available everywhere : Seemed to be of

concern more to age groups 16-24 and 35-39 and to SEC “A” consumers

4. Nobody brought it home : to those in age group 12-15 this was the most important reason for not ever getting to try the brand.

5. High price : “C” consumers and the age groups 16-19 and 25-29, and those in the semi urban/semi rural areas. Interestingly, this also seemed to be a problem with men.

Bangla Virgin logo

Majority reacted positively to the suggested Bangla logo. However, a large number of respondents did not like it much.

CSD ads seen

- Advertisements of RC was recalled by almost all (96%) respondents belonging to all age groups, sexes, socio-economic classes, and areas. Ads of Coke, Uro, Pepsi and Viging were also highly recalled.

- Most had reported seeing advertisements of all CSds on television followed by signage’s, print media, posters and billboards. There was hardly any difference in this pattern with regard to sex, SEC, age, and are.

Media habitIncidence of watching TV

- As is clear from the above pie chart more than 90% of the respondents watch television.

- Viewer ship of TV is relatively more in SEC “A” and “B”, in the age groups 12-15 and 35-39, and among the women.

- As is expected more people in the urban areas watch TV than in the semi-urban/rural areas.

- Going by region TV viewership was greater in Dhaka and Khulan regions compared to the other parts of the country

- As can be seen in the graph below 100% of the consumers of Virgin watch TV. As RC, Coke and Pepsi are more widely available, including in semi-urban and rural areas, there is a section of its consumers who do not watch TV.

TV viewing time

- By and large bulk of the viewing takes place between 7 pm and 10 pm

- A significant number of the CSD consumers seemto watch TV even after 10 pm

- Interestingly about a quarter of the women respondents reported watching TV beyond 1 am

- Looking at the TV viewing habit of the CSD consumers by brand there is hardly any difference in the picture

TV channels watched

- Despite the influx of satellite channels BTV (terrestrial and non-satellite) remains the most watched channel among the CSD consumers. This has more to do with the reach of the satellite channels than with programme preferences. For the same reason perhaps BTV is watched more in the semi-urban/rural areas (81%) than in the urban areas (69%).

- Channel is the next most watched channel followed by ATN and Star Plus

- More men than women seem to watch Channel I, and more women than men watch ATN.

- There is hardly and difference in the picture looking at it by CSD brands

Programmers watched regularly

- Drama appeared to be the most popular TV programmer followed Bengali Cinema. News and Magazine programmer. Strangely even children as young as 12- 15 years old watched TV drama more any other programmer

- News is watched more by the older segment of the population – approximately 50% of the 30- 39 years age group.

- While significantly lager number of women (39%) the men (25%)watch Bengali cinema, significantly lager number on men (37%) than women (26%)watch the news programmes.

- The ratio of watching Bengali cinema is more in the semi – urban / rural areas (40%)than in the urban (29%).

- The percentage of Begali cinema viewers is significantly larger in Chittagong, Khulna, Rajshahi areas (over 35%) than in Dhaka (28%).

- Similarly significantly larger number of people in Dhaka (37%) watch the News than in the other parts of the country (between 23% 27%).

- Relatively a larger number or pepole in Chittagong and Khulan (over 35%) watch the magazine programmes (app. Such programmes do not appear to have much appeal in the Rajshahi area)

- Going by CSD brands whiled the greater segment of all consumers of all brands watch TV drams more than any other programmed, it seems that larger number of the Coke, Sprite, Uro and virgin consumers watch News more than Bengali cinema.

- The extent of magazine programmes viewing is more or less the same by all consumers.

Incidence of radio listening

- Only 14% of the respondents reported listening to the radio with the incidence being higher in the semi-urban/rural areas (20%) than in the urban (10%)

- Relatively more people in Dhaka and Rajshahi (16%-17%) listen to the radio than in the other parts of the country (approximately 8%)

- The highest radio listening is among the 7 Up, RC, and Coke consumers (15%-17%) Radio listening is rather low by the Virgin consumers (10%).

- Which most of the listening is done between 12 pm, men listen to the radio more in the morning (6am-9am).

- Dhaka-Kha is the more preferred radio station.

Newspapers read

- Out of the 21 Daily news pares mentioned as being more or less regularly read only one The Dialy Star is in English. All others are Bengali. Only 0.2% of the total respondents reported reading The Daily Star regularly.

- Virtually across all levels and in all areas Protho Alo followed by Jugantor, Ittefaq, Jonokontho and Inqilab are the most regularly read newspapers. For some reason the difference is in the age group 25-29 where Prothome alo is followed by Ittefaq, Jugantor, Inqilab and Jonokontho.

- Newspapers are read more by men than women and more in the urban than semi-urban/rural areas.

- While Prothom Alo is the most regularly read Daily by consumers of all brands it seems that Virgin consumers read the Ittefaq more regularly than Jugantor.

Periodicals and magazine read

- The study has revealed that the readership of periodicals and magazines (weeklies/fortnightlies’/monthlies) are rather low.

- The most regularly read periodicals/magazines are:

Alpin, Bicchu, Jai Jai Din, Sanonda, Anondo Lok, PurnimaOutdoor ads/shop facials noticed

- The above graph represents the overall picture across almost all levels, and sexes, However, it seems that the outdoor ads and shop facias are noticed by a relatively lesser number of people (approximately 55%) in Chittagong and Rajshahi.

- The consumers of RC also seem to have noticed such material less than the consumers of other brands (65% vs over 70%)

Incidence of watching movies at cinema halls

- More 90% of the people across levels, categories and areas do not go to cinema halls to watch movies

- Relatively more men (11%) go to cinema halls if at all than women (01%)

- Cinema hall goers are relatively more in urban than in semi-urban/rural areas

- Almost 100% of those in Chittagong do not seem to go to cinema halls

- Cinema hall going seems to be relatively more among the Mirinda and Virgin consumers

- Among those who do go to cinema hall most (about 63%) do so on an average once in a month

- About 26% of those who go to cinema halls do so more than once in a month

- Looking at the picture by CSD brand consumers among the virgin consumer 78% of the cinema goers go once a month a month to the cinema halls. This is higher than the frequencies observed in all other brand consumers.

Trade (General)Brands (usually) available at shop

- Coca-Cola and RC at more than 90% of the shops

- Sprite and 7Up at more than 80% to 90% shops

- Pepsi, Uro Cola and Virgincola at less than 80% of the shops

- More than 95% of the shops would have the I lit pet bottle of the CSDs

- The 1 lit pet bottels of Coca-Cola, Pepsi, RC Cola, RC Lime, virgin cola would (usually) be available at more than 90% of the shops

Brands stocked/available at shop

- At time of the survey more than 50% of the shops had Coca-Cola in their stock most of it being in Dhaka

- RC Cola was available at 24% of the shops most of which were in Dhaka Rc Cola was available in more semi urbas semi rural shops than in urban RC and Coca-Cola seemed to be available in the same number of shops in Chittagong

- 7 Up and Pepsi were available at less than 10% of the shops

- Only 2% of the shops had Virgin Cola most of which were in the urban areas. It appeared that relatively more shops in Chittgong Stocked the brand than in Dhaka

Reasons for stocking

- The single most important reason for stocking a brand would be its demand in the market. Clearly quick turnover was more important than anything else.

- Among the other far less important reasons for stocking a brand the following were of some significance:

- Refrigerators provided for showeasing/keeping the brand

- Good quality

- Alwasy available

- Sales incentive (two bottles free with each case)

Seasonality of StockingMostly between April and September.Brands sold mostThe picture was almost similar to that of “brands stocked”.

- Coca-Cola was the highest selling brand followed by RC Cola, 7 Up, and Pepsi.

- Sales of Virgin Cola, Uro Cola, was reported to be very low.

Reasons for selling most1. Good taste : Coca-Cola, RC Cola2. High demand : RC Cola, Coca-Col, Sprite, Pepsi, virgin3. Good quality : RC Cola, Pepsi Coca, 7 UP Most profitable brand

- Coca-Cola

- RC Cola

- 7 Up

- Pepsi

- Uro Cola

- Virgin Cola

Reasons for being profitable

- Fast moving (quick turnover)

- More cornmission/bonuse

- Price to trade is low

Tendency to promote septic brands

- More than 60% reported that would not promote a specific brand on their own

- Approximately 36% suggested they would promote a spefic brand under the following circumstances:

- If the brand asked for by the customer was not available

- If a brand was more profitable

- Availability for sample stocking

Are sales promotion programmers by companies effective and how?

- Nearly 90% felt that salse promotion schemes by companies were effectives as those resulted in:

- Increased sales

- Attacted consumers to the brand

Most effective sales schemes/suggestions for new schemes(Table 30)

- Search cards for consumers

- Prizes for volume purchases by consumers

- More free bottles/per case for traders

- Free gifts/bottle

7.1 conclusionsGlobal Beverage Company limited introduced VIRGIN drinks in 1999. Now Virgin takes step in 6th year. When Virgin came advertising was the strong path to influence people about the new product. In that time GBCL followed a smooth marketing strategy. Virgin formed can at a cheap rate for the first time in Bangladesh. Someone has sited their opinion that Virgin’s advertising, quality, distribution, packaging was better than the others.Now Virgin overall takes the position in 4th place. But in terms of cola flavor it takes 3rd place. At a time it takes also better position in consumer mind by its quality, attractive flavor, nice looking packaging.GBCL newly introduces 6 flavors with 500 ml. its main buyers are children. Those products introduce for improving their current market share. GBCL has a future plan to introduce 250 ml with plastic bottle and fountain pack.We gather some essential information from our survey. At first they need to maintain their standard quality level, advertising should be more attractive, need to upgrade known famous character for advertising that influence people very quickly. Some one has said packaging need no change. But new form could be better way to influence people. GBCL must create better relationship among the dealers, resellers, retailers. Need to take steps for various programs of sales promotion.Report on marketing analysis is the part of our credit course of BBA program. We learn so many things from this report about Virgin Company, its product nature, its distributors, retailers, consumers, and its overall marketing condition in beverage industry. Though BBA is a job related programs, in future we will face so many problems from making any sort of report in the organization. This report will assist us to build up a better career in the job section.7.2 RecommendationsSpecific Recommendations

- Virgin has no fountain pack.

- Virgin is recently introduced in Bangladesh in 1999 that’s why they didn’t captured big market.

- GBCL doesn’t follow societal marketing concept.

- There is a better chance to create market demand in Bangladesh.

- Virgin can focus customers mind by implementing more modernized advertising.

- Fountain pack and 250 ml with plastic container can increase more customers.

- Virgin can taken short-term program for pet bottle.

- Virgin needed to reduce its price for improving its sales without changing quality level.

- Has a big chance to entrance into international market by exporting neighborhood countries.

- GBCL follows Government regulation but some competitors do not.

- Other competitors reduce their price that can hamper the sale of Virgin.