4.7 Necessary papers/documents for opening of an account:

Individual/Joint Account:

For any individual/joint account the following papers/documents are required:

a) Two copies of photograph of the accounts holder(s) who will operate A/C.

b) Introducer attested by current/savings account holder.

c) Service paper photocopy or nationality certificate by commissioner or photocopy of passport.

If the account is a joint account, then the joint account holder submit a declaration and operational instruction of the account along with their signature. The declaration is

“Any balance to the credit of the account is and shall be owned by us as joint depositor. Any liability whatsoever incurred in respect of this account shall be joint and several.”

Proprietorship Firm:

The following documents have to be submitted for preparing an account of a proprietorship firm:

a) Name of the firm.

b) Name of Proprietor

c) Copy of Trade license

d) Seal of Proprietorship Firm

e)

The following documents have to be submitted for preparing an account of a proprietorship firm:

a) Partnership deed.

- If the partnership firm is a registered one then one copy of registration forms.

- If not then a copy of certificate from the notary public.

b) Certified copy of valid trade license.

c) Trade seal.

d) Partnership account agreement (Draft enclosed)

Limited Company:

For the opening of an account of a limited company, following documents have to be submitted:

a) A copy of resolution of the company that the company decided to open an account in the NCCBL.

b) Certified true copy of the Memorandum & Articles of Association of the Company.

c) Certificate o Incorporation of the company for inspection and return along with a duly certified photocopy for bank’s records.

d) Certificate from the Register of Joint Stock Companies that the company is entitled to commence business (in case of Public Ltd. Co. for inspection and return) along with a duly certified photocopy for bank’s records.

e) Latest copy of balance sheet.

f) Extract of resolution of the board/general meeting of the company for opening the account and authorization for its operation duly certified by the Chairman/Managing director of the company.

g) List of Directors with address (a latest certified copy of Form-XII).

Club/Society:

Following documents have to be obtained in case of the account of the club or society:

a) Up to date list of office bearer.

b) Certified copy of Resolution for opening and operation of account.

c) Certified copy of Byelaw and Regulations/Constitution.

d) Copy of Government Approval (if registered).

Cooperative Society:

Following documents have to be obtained in case of the account of Cooperative Society:

a) Copy of Byelaw duly certified by the Cooperative Officer.

b) Up to date list of office bearers.

c) Resolution of the Executive Committee as regard of the account.

d) Certified copy of Certificate of Registration issued by the registrar, Cooperative societies.

Trustee Board:

Following documents have to be obtained in case of the account of trustee board:

a) Prior approval of the Head Office of PBL.

b) Certified copy of Deed of Trust, up to date list of members of the Trustee.

c) Board and certified copy of the Resolution of trustee Board to open and operate the account.

Minor’s Account:

Following documents have to be obtained in case of the account of minor:

a) Putting the word “MINOR” after the title of the account.

b) Recording of the special instruction of operation of the account.

c) The AOF is to be filled in and signed by either the parents or the legal guardian appointed by the court of law and not by the minor.

4.8 The Cash Counter Section

We know that a bank is the Dealer of Money; it receives money and pay money. Where cash counter should be the heart of any commercial bank’s branch office as it receives and pay cash every moment at its working time. Cash counter also does a very important work by managing the bank’s flow of Fund. All the money of any bank business enters & exits through the cash counter. This section is the major part of bank that works as the customer service oriented section. The efficiency of this section of a bank crates the good image of that bank to the all type of customers. If t he officials can serves at once the customer than it proves the strong human resources of that bank and increases customer satisfactions, which improve the overall position of that bank in the market. It must be mentioned that NCCBL has a very strong group of employees, especially in the Mirpur Branch, whom all the time serves the customers satisfactorily. Generally followings are some tasks done by the cash counter of Prime Bank:

ü Cash receive

ü Cash Payment

ü Receiving Current Bill, T&T & AKTEL Bill

ü Working as Agent at the time of issuing IPO of different companies.

ü Fund Management by maintaining sufficient amount of cash each day. Because if the amount of cash receives of any day is more than that of estimated, the bank has to pay more to the Insurance Company as premium of that excess amount. On the other hand if for any reason the amount of cash is less than the estimated amount, the bank can’t satisfy the customers’ demand.

ü Payment of ATM cards.

ü Payment of Money Gram.

ü Payment of Express Money.

4.9 The Account Department

This is the most confidential department of a bank. Recording all kinds of transactions of the branch, confirming their accuracy and preparing statements are the main job of this department. Now days under computerized banking system, the jobs of accounts department become very easy. Now the computer directly prepares the clean cash statement on party ledger vouchers. The function of the accounts department can be divided into two parts:

a) Daily function

b) Periodical functions

Daily Functions

The routine daily tasks of the accounts departments are as follows:

ü Record the daily transactions in the cash book.

ü Record the daily transactions in general and subsidiary ledger.

ü Prepare the daily position of the branch comprising of deposit and cash.

ü Prepare the daily statement of affairs showing all the assets and liability of the branch as per ledger and subsidiary ledger separately.

ü Pay all expenditure on behalf of the branch.

ü Make salary statement and pay salary.

ü Checking whether all the vouchers are correctly passed to ensure the conformity with the ‘Activity Report’; if otherwise making it correct by calling the respective official to rectify the voucher.

ü Records inter branch fund transfer and providing accounting treatment in this regard.

Periodical tasks

The routine periodicals tasked performed by the department are as follows:

ü Prepare the monthly salary statements for the employees.

ü Publish the basic data of the branch.

ü Prepare the weekly position for the branch, which is sent to the Head Office to maintain Cash Reserve Requirement.

ü Prepare the monthly position for the branch, which is sent to the Head Office to maintain liquidity requirement.

ü Prepare the weekly position for the branch comprising of the break up of sector-wise deposit, credit etc.

ü Prepare the weekly position for the branch comprising of the denomination wise statement of cash in tills.

4.10 Clearing Section

Clearing stands for mutual settlement of claims made in among member banks at an agreed time and place in respect of instruments drawn of each other. Clearing House is an arrangement under which member banks agree to meet, through their representatives, at the appointed time and place to deliver instruments drawn on the other and in exchange to receive instruments drawn from them. The nit amount payable or receivable as the case may be, is settled through an account kept with the controlling bank (Bangladesh Bank / Sonali Bank). In Clearing Section cheque, dividend warrants and other forms of financial instruments, which are easy for encashment, are received. The clearing department sends these instruments to the Clearing House of the Bangladesh Bank for collection. As soon as cash is received the amount is deposited in the client’s account. Collection of cheques, drafts etc. on behalf of its customers in one behalf of its customers in one of basic function of a commercial bank. Clearing stands for mutual settlement of claims made in between member banks at an agreed time and place in respect of instruments drawn on

each other. Negotiable instrument Law provides protection to a banker who collects s cheque or a draft if the banker fulfils the following conditions:

ü He collects the instrument for customer

ü The instrument be crossed

ü The banker acts in god faith and without negligence.

4.11 TYPES OF CLEARING:

Types of Clearing

- Outward Clearing: Outward clearing means when a particular branch receive instruments drawn on the other bank within the clearing zone and those instruments for collection through the clearing arrangement is considered as outward clearing for that particular branch.

- Inward Clearing: The bank provides the instruments to other banks through Clearing House which have been collected from different clients. It performs this kind of service for its clients without requiring any charge or the remittance.

OBC (Outward Bill for Collection)

If a party gives a check to a branch of NCCBL to collect money form a branch of another bank which is not situated in the clearing house then the NCCBL collect money through OBC. In case of OBC two ways exist to collect money from another bank.

ü In the first way, the receiving branch of NCCBL send the check with forwarding letter to the branch of another bank which name are included in the check. After receiving the check that branch of the bank send a D.D. to another branch of their bank which are situated in the same clearing house of payee’s branch of NCCBL. After that they issue pay order to the name of payee’s branch name and send the check to the clearing house and NCCBL collect this check through clearing h9use and credit the payee’s account.

ü In the second way, NCCBL payee’s branch sent the check to another branch of NCCBL which are situated in the same area of another bank’s branch (which

name are included in the check). Then the receiving branch of NCCBL collect the amount of check through outward clearing by clearing house of those areas and issue a credit advise to the payee’s branch. After that, payee’s branch credits the payee’s account.

4.12 Local Remittance Departments

Remittance is significant part of the general banking. The bank receives and transfers various types of bills through the remittance within the country. Obviously the bank charges commission on the basis of bills amount. NCCBL remittances are safe, swift, inexpensive and simple.

Types of Remittance

a) PO (Pay Order)

b) DD (Demand Draft)

c) TT (Telegraphic Transfer)

d) MT (Mail Transfer)

e) SP (Shanchaypotra)

a) Pay Order

Pay order is an instrument that contains an order for payment to the payee only in case of local payment whether on behalf of the bank or its constitution. Unlike checks, there is no possibility of dishonoring pay order. NCCBL charges different amount of commission on the basis of pay order amount.

b) Demand Draft

By DD any person can send money from one branch to another branch of NCC bank. To send the money he/she must fill up the NCCBL’s prescribed form of DD and paid charge

Commission and receive DD block. The following information is included in the DD Block:

ü Name of the sender branch

ü Name and account of the party who receive the money

ü For security purpose a confidential test number are included in the DD Block.

ü Amount of money to be transferred.

ü Name of receiver Branch.

The sender sends this block to the Receiver branch of DD. When this DD block receive by the receiver branch. The authorized officer of the receiver branch tests the DD confidential number and if the test is proved then he/she give the money to the payee.

c) Telegraphic Transfer

ü To send money urgently NCCBL may be requested for TT on payment of a nominal charge and telegram charges.

ü Any person urgently sends money from one branch to another branch within NCCBL through TT.

ü When a message of TT send through phone from one branch to another branch in that time the message received by the authorized officer who has a right of power of Attorney. After that, he/she fill up the TT form. Following things are included in the TT form:

- TT Number

- TT Test Number

- Name and Account number of the payee

- Power of attorney number of the sender and receiver of TT.

- The amount to be transferred.

ü After fill up of TT form he tests the Test number of TT. If he/she ensured through testing the test number then he credit the account of the payee. On the other hand, if the Test number is not proved then he/she callback to the sending branch of TT and request to send a new TT.

d) Mail Transfer

Money can be sent through mail transfers to anybody who has an account in any other branch of the same bank for this purpose the sender shall have to furnish details like:

ü The name of the beneficiary and his/her account number

ü The amount to be transferred

ü The name of the branch where the account is maintained.

4.9.2 Attractive Charges on remittances

Issuance of Pay Order

Amount | Commission |

| Up to Tk.1.00 lac | Tk.10/- & 15% VAT |

| Above Tk.1.00 lac to Tk.5.00 lac | Tk.20/- & 15% VAT |

| Above Tk.5.00 lac | Tk.30/- & 15% VAT |

Issuance of DD/TT/MT:

ü Commission ………………………………@ Tk.0.10%

ü Telephone/Telex charge…………………..@ Tk.30/-

4.13 Foreign Remittance:

These remittance services are provided for exchanging foreign currency. Those services are as follows:

Foreign Remittance

1. Foreign Demand Draft

2. Traveler’s Cheque

3. Money Gram

4. Habib Quarter

5. Dhaka Janata

Foreign Demand Draft:

NCCBL accepts the charges for TOFEL, SAT, GMAT etc through FDD. For that client has to open a student file to issue FDD maintaining the rule of BB. Before issuance of FDD, bank will ask the client to fill up the TM form, which contains the following particulars:

* Name of the student

* Address of the student

* Amount of FDD in foreign currency

* Purpose of remittance

* Address of the institution to which the FDD will be favored

* Country receiving payment

* Passport no of the student with date of issue

Traveler’s cheques are issued by banks to avoid the risk of loss or inconvenience in having to carry large amount of cash while traveling. The salient features of T.C. are:

ü The buyers of T.C. need not to be a client of NCCBL.

ü The buyer has to deposit money with the branch of NCCBL equivalent to the amount of the T.C. he wants to buy.

ü Each T.C. is signed by the buyer at place marked “when countersigned below with this signature”, before the NCCBL officer

ü T.C. is issued in single name. It is not issued in joint names or name of clubs, societies or companies.

ü There is no expiry period for the T.C.

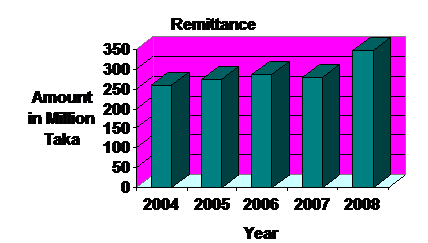

Remittance of NCC Bank Limited for last five years (2004-2008) is-

2004 | 2005 | 2006 | 2007 | 2008 |

259 | 275 | 287 | 279 | 348 |

Annual Report: 2004-2008

Money Gram

Money Gram

It is the new concept of transferring foreign remittance to Bangladesh. One person residing in the abroad can remit his money through the process of money gram. There are more that 22,000 money gram agents in over 100 countries are linked worldwide. Only NCCBL is authorized to do this kind of business. This kind of business is permitted by BB because of foreign remittance is coming to our country. For such transaction client doesn’t have to maintain any account in NCCBL. They will only take Tk. 0.07/$ as a commission.

There are some features of Money Gram:

ü Faster: When a person transfers money through money gram service his money gets there fast, usually in 10 minutes or less. Other services often take day or even weeks.

ü Convenient: There are more than 22,000 money gram agents over 100 countries. Therefore, a person can easily transfer his fund.

ü Secured: People use the money gram service thousands of time a day all over the world. It is a trusted guaranteed and reliable thoroughly personal way to transfer money.

ü Easy: Just one simple form and computerized money transfer network will speed a person’s funds to destination throughout the world quickly.

Money Gram processing:

ü Sender will go to money gram agent to transfer his/her money to any country (suppose Bangladesh)

ü Sender gets receipt and notifies recipients of the transaction reference number.

ü Recipients go to the money gram agent (NCCBL) in Bangladesh, fill the “Receive form” to request funds and shows proper identification.

ü Receiving agents contract the money gram transaction center (Head office on NCCBL) to obtain authorization to pay recipient.

ü Eventually receiver will get the money

SWIFT (Society for Worldwide Inter Bank Financial Telecommunication)

NCC Bank ia a member of the society of interbank financial telecommunication. Through this fast, secure, global communication NCC bank has gained 24 hours connectivity with 7000 financial institution in 200 countries for transmission of LCs, Guarantees, funs transfers, payment etc. SWIFT is a bank owned nonprofit cooperative based in Belgium servicing the financial community worldwide. It ensures secure messaging having a global reach of 6,495 Banks and Financial Institutions in 178 countries, 24 hours a day. SWIFT global network carries an average 4 million message daily and estimated average value of payment messages is USD 2 trillion.

SWIFT is a highly secured messaging network enables banks to send and receive Fund Transfer, L/C related and other free format messages to and from any banks active in the network.

Having SWIFT facility, bank will be able to serve its customers more profitable by providing L/C, payment and other messages efficiently and with utmost security. Especially it will be of great help for our clients dealing with Imports, exports and Remittances etc.

5.1The Internship Position and Responsibilities

I have worked mainly of the General banking Section. Sometimes I have worked in the foreign exchange, money gram, Loan and advances department and cash counter. Mainly general banking section I worked account opening, deals with the clients about to open a new account, Forms of Deposit. Actually in our country the bank deposits take three different forms.

- Current or Demand Deposit.

- Saving Deposit

- Fixed Deposit

Fill up the Form

The person desiring to open a current account with the bank has to make application in the prescribed form. This form must be properly filled up and signed by the applicants.

My suggestion

Sometimes I suggested to the customers how to operations of the account, according to the NCCBL rules to opening and operating the account. After the above formalities are over, the banker opens an account in the name of applicant. Generally the minimum amount to be deposited initially is taka one thousand for opening a saving account and taka five thousand for current account.

Deposit Book

With a view to facilitate the receipt of credit items paid in by a customer, the bank will provide him /her pay-in- slip either loose or in book forms. The customer has to fill up the pay in slip at the time of depositing the money with the bank. The cashier with his/her initials and stamps will return the counterfoil to the customer on the receipt of the money.

Chequebook

To facilitate withdrawals and payments to third parties by the customer, the bank will also provide a chequebook to the customer. But it is noted that to get a chequebook, the customer has to dully fill up the cheque requisition slip to the banker.

Some days I was worked in Loan and advanced department. Mainly loan and advanced department worked deals with client about the loan conditions of the NCCBL.

5.2 A bank officer’s contribution to improve the customer service

In this modern era of banking the bank officers needs to be more efficient and should work effectively in order providing quality service to the customer. But on the other hand it is a matter of fact that bank officers often busy with so many things that sometimes they fail to satisfy the customer. I have worked in different division and department of NCCBL. As a marketing major student I can make some possible solution on how should a bank officer make contribution to improve the quality or satisfying the customer service.

What is Customer Service?

Customer service is meeting the needs and expectations of the customer as defined by the customer.

‘Meeting the needs and expectations of the customer’ means bankers know what their customers want, what they expect, and bank is providing that to them on a consistent basis. And to know what the customers want, bank officers have to ask them!

‘As defined by the customer ’ is the key phrase because it says if the customer does not perceive bankers as offering good customer service, then they are not. The customer is the judge here; no matter how good the internal records claim officers are, the customer is the only voice worth listening to. So in order to have an effective customer service

initiative, bankers must know what their customers want, provide it to them on a consistent basis, and ask them how bank officers are doing.

5.3 BENEFITS OF AN EFFECTIVE CUSTOMER SERVICE INITIATIVE

Bank officers and their organization can benefit from customer service in the following ways:

ü Minimize stress: If bank officers are dealing with customers directly, especially unhappy ones there will be a certain amount of stress with each episode. It can be reduced if they have a systematic way for dealing with the customers.

ü Higher efficiencies: when bankers focus their efforts on the areas that directly affect customer satisfaction, they can utilize their resources more efficiently. An effective customer service programs provides a plan for working on those areas most important to the customers and reduces the deviation which may distract them and the organization from focusing on these areas.

ü Increased morale and satisfaction: when bankers are working on those areas that mean the most to the customers and to the success of the organization, then they might share a common vision and meaning with the entire organization.

ü Survival: effective customer service becomes the cause of the bankers staying in business. With growing competition, there are plenty of suppliers eager for business and the opportunity to satisfy customers. If they are not part of it, then they may not stay in business for a long.

ü Cost Effective: According to an authentic survey, it costs five times more to gain a new customer. Some survey also proves the fact that with just a 5% increase in

customer retention, a firm can raise its profitability by 25% and in some cases as much as 85%. Similar studies also show the longer a company keeps a customer, the more money it will make. This happens because consumers spend slowly at first, but with succeeding years of good experiences, they will spend increasingly more.

Why effective customer service important?

Because of customers are important for banking sectors. Banking business is standing on the basis of customer’s deposits and loans.

Why important?

Bankers have to have their customers to earn money. If bankers do not give them good services they will not come to the organization again and they will persuade others not to come to the bank. So by giving bad service they will lose their customers and also future customers, but by giving good service they can get new customers and never lose any customer. (Ref: Soroosh Karimi. info@sorooshk.com)

It is a matter of fact that… it costs 5 times as much to bring in a new customer, than to keep an existing one. When people become customer, they want to be loyal. So, why do they leave? Most of the time, they leave because of small oversights and lack of attention to plain and old customer service. (By Adrian Miller)

Customer Service as a Competitive Advantage

Fierce competition demands more and more innovations to differentiate organizations from one another. With technology available to virtually all organizations today, traditional feature and cost-benefit advantages no longer offer for a sustainable competitive advantage. More and more companies are turning to quality of service to make themselves prominent from their competitors. They are talking to their customers to determine what is most important to them and how they can further add value to them.

5.4 STEPS TO A CUSTOMER SERVICE INITIATIVE

Each organization’s customer service plan must be customized to suit its own needs, but, more importantly, it must satisfy the needs of its customers. There is no hard and fast rule for an effective customer service programe; each one will have its own distinct differences. However, there are some common steps that we need to consider when setting up our programe.

STAFF RESPONSES TO EXAMPLES OF GOOD CUSTOMER SERVICE:

Following up if they were able to get what they wanted make them aware that we care.

10 (Ten) tips for customer services:

- Hire people who have a service attitude. Some people simply enjoy serving others, their organizations, and even their communities. The spirit of service dominates their personality. This attitude of service has nothing to do with money or background, and people who have this attitude are not necessarily the most outgoing or bubbly. This type of person will move our business forward. These people make the best salespeople as well.

- Treat each customer as an experience while dealing with them. But bankers have a few short moments with customers. Bankers do not have time to complain about anything else. Ask bankers, “How to be better experienced?” Is it a better option to treat customer by name and how can bankers ask without being too aggressive? How to control the environment in this company? How it is affecting their 5 senses? Exceed their expectations just a little with their senses and with bankers attitude to serve and please and it might create a memorable and compelling experience.

- Regularly inform all the employees about what’s going on in the company. Employees need to know what’s happening. What new products are we offering? When will they be available? What kind of advertising will take place in the next month? Will any physical changes be happening in

offices? Will new branches be added?

- Make every decision with the customer in mind. Employees need to know some questions such as, “Do the customers like what they are doing?” and “Would the customers like different type of promotion”

- Make the customers an agenda item at every staff meeting. Present their point of view and ask these questions: What would the customer think of this? Would this move be fair to them? How to serve the customers better or differently?

- Empower the employees to do the right thing. And try not to hold it against them if the situation doesn’t turn out perfectly. That means giving employees the power to do whatever has to be done to make a customer’s experience a WOW experience.

- Continually ask employees how to improve and add value. If they do not keep asking and pushing, it may start to slip behind the competition. Customers have more than one choice and the competition is aggressively marketing to them. They know what is being offered by others. Be ahead of the curve by asking what can be done to add value to the customer’s experience with the company.

- Create an atmosphere of excellence. Let it be known that everything company employees do has to be the best. One thing to remember that winning organizations are always raising the bar. If it is pushing to do better than yesterday, everything will be left in the dust of the competition.

- Continually do the unexpected. Have the reputation for doing the unexpected, and customers will always expect something different and exciting from the company. This doesn’t mean that bankers have to have dancing clowns in the lobby, but having the same lollipops that everyone else gives out is not at all unexpected. Do something different. These are the things that customers talk about.

- Never let an untrained employee have customer contact. Employees representing the company, and the brand. Working with customers is the most important thing they will do. Give them the tools necessary by giving them adequate training to handle customers.

PERSON SPECIFICATION

PRINCIPAL CUSTOMER SERVICES OFFICER

| SKILLS | KNOWLEDGE | ATTAINMENT | ATTITUDE |

| ESSENTIAL | ESSENTIAL | ESSENTIAL | ESSENTIAL |

| Three years experience in a customer service role at a managerial level utilizing CRM technologies | ‘Can Do’ Flexible Customer Focused Self-starter Promote positive and professional image of the Service. Commitment to quality | |

| DESIRABLE | DESIRABLE | DESIRABLE | DESIRABLE |

| Practitioner Coaching Skills Budget Management | Community, cultural and social issues | Bangladeshi Computer Driving Management Qualification People | Pioneer leadership containing better quality full service |

5.5 UNDERSTANDING CUSTOMER REQUIREMENTS

Sources of customer information -Often organizations claim to know their customers’ requirements, yet they’ve never taken the time to do a real thorough analysis. Sure, they probably know their customers’ general requirements, but do they know what is really important to their customers, how they measure up relative to the important factors and how they compare to the competition in the areas most important to the customer? In most cases they don’t and won’t unless they collect this information in a formal, systematic manner.

Own organization – Without looking too far, employees will be able to uncover potential areas of customer dissatisfaction by reviewing the key operational data. Check on the status of backlogs or stock outs. Chances are if these are significant where some customers that are not happy with the delivery cycle time.

Another place to look is the internal reject or yield rates. If number of rejects is high or the yields low, they can bet that some bad product (deposit scheme) is leaking out to the customer. Even if the inspection of the product done before shipping it to the customer, tests have shown that inspection isn’t 100% reliable–some bad product will sneak out.

Now consider a service company–maybe even some local private bank company. Customers are typically concerned with the turnaround time for performance of service. The telephone company could review its internal records for the average turnaround time. If it is excessive they probably have some unhappy customers. Another measurement to look carefully that is the number of times they must re-do a service.

Review the internal data to pinpoint potential problem areas for customers. Also, gather all employees together and get their inputs on the customers’ satisfaction level. Assemble a list of strengths and weaknesses, but do not get bogged down in the details.

Surveys and focus groups are two of the most popular methods for gathering information on customer needs. Surveys are written questions given to individual customers; focus groups are oral questions administered to groups of customers. Both must have clear and specific goals up front in order to be successful.

A broad questionnaire or focus group session provides lot of information, but it is usually too general to be of any value. Objectives must be clear and questions specific if they are to provide results that can be acted upon. Although focus groups and surveys are similar in what they want to accomplish, one may be more suitable than the other, depending on the application. Surveys are relatively simple and economical to administer and can reach large amounts of customers, but the information can sometimes be limited since it is a one-way exchange of information.

On the other hand, focus groups take more time and effort, are often more expensive to administer and may not be as far- reaching as surveys, but their interactive nature may produce clearer feedback. The best results are found when combinations of both techniques are used to identify customer requirements and expectations.

5.6 CREATING CUSTOMER VISION AND SERVICE POLICIES

The vision–In order to transform the company into one that values customer satisfaction, company must establish a customer-entered vision. So what is a vision, exactly? According to Richard Whitely of the Forum Corporation, a vision is … a vivid picture of an ambitious, desirable future state that is connected to the customer and better in some important way than the current state.

In other words, vision is what employees want their organization to become, what they want is “to grow up to be.” And a client-centered vision is one which takes its direction from the customer.

A vision has two critical functions that it performs. First, it serves as a source of inspiration that rallies the organization around a single unifying purpose, which in this case is the customer.

The second duty a vision performs is that it guides decision-making and aligns an organization so that all functions work towards a single goal. In the business world, there are rarely black and white decisions to make, but there is an awful lot of Gray.

With a vision that spells out what the organization wants to become, it provides direction needed to make better decisions. After all, as a bank employee who knows where the business wants to head is more likely to make decisions that reinforce that goal.

So how does a banker create a vision? It’s really quite easy. Vision statements need not be elaborate. For instance, first world countries banking service are “Quality, Service, and flexible customer service.” so as a banker Keep the vision short and concise so that other organization is clear on the meaning.

Many companies make the mistake of trying to create journalistic masterpieces. The only problem is that they tend to be so long, no one in the organization really knows what it means. The hard part in creating a vision is deciding what employees want the organization to be in the future.

DEALING EFFECTIVELY WITH CUSTOMERS:

Now, once it has established the customer-centered vision and created customer-friendly policies, bankers become ready to sharpen their skills necessary to deal effectively with the customers. These skills can be segregated into two areas–communication skills and problem-solving skills.

Communication skills–How to communicate to the customers is just as important as what is to communicate. Following I will find some behavioral skills that will communicate to the customer that I am an organization that values their business

Greet the customers–”Put them at ease and make them feel comfortable!” When the customer or prospective customer first walks in or telephones with an inquiry or order, make him feel welcomed. This sets the tone for the rest of the transaction. If this is the first time with this customer, this is when first impressions can help or hurt, depending on how well it makes the customer feel within those first critical moments.

Value customers–”Let we know that we think we are important!” Customers want to feel special, and to make them feel special the attitude and behavior must say, “You’re the customer–you pay my salary. You make my job possible.” When it is time to value customers, sincerity makes them feel good about the organization. A customer-focused organization is not in business to deliver a product or service, but, instead, is there to enable people to enjoy the benefits of its product or service. The difference is demonstrated by the temporary employment agency that is in business not to fill in job vacancies with temporary personnel, but rather to help their customers enjoy the benefits that their service provides–immediate placement of highly skilled individuals. The difference is subtle, but the effect is not!

Listen to customers–”Please listen to me and understand me!” Listen totally–to the customer’s words, their tone, their body language. According to a UCLA study on communication, 7% of our communication is verbal, 38% is tone of voice, and 55% is nonverbal. Listening totally will enhance my understanding of what customer really needs as well as make them feel valued.

Help customers–”Help me get what we want!” Customers do not go for any services for what they are, but, instead, they using their Account for the benefits that the services offer. That is why bankers must be customer-focused rather than product- or service-focused. Do not waste the time explaining the service features. Explain how the service benefits them–how it satisfies a need, solves their problems, or gives them extra value.

Problem-solving skills —- Problems will always occur, but taking responsibility for these problems can turn a negative customer into a positive one. Studies show that if a problem is resolved quickly, 98% of our customers will open account again and even tell colleagues that they had a positive experience! However, the longer the problem drags on, the more frustrated a customer becomes, and the less likely he is to be satisfied.

Finally, I want to tell that customer service is really interesting and enjoyable. In this way we can meet with a lot of people. A customer service officer has a lot of job responsibility. He has to motivate the customer in the same time he has to describe his organization product and service policy, has to settle the customer all kind of problems. It is a busy and most concentrated job. In this way he has to achieve his branch target as well. Now a day’s whole world faces the credit crunch problem. Comparatively the situation of Bangladesh is good situation than other 1st world countries. Because of banking is product and service policy. In first world now a day banking account open is a great achievement matter. In 1st world countries bank account is most important for the people very steps of life. 1st world banking and Bangladeshi banking policy and services are totally different.

CHAPTE SIX

Loans & Advance

6.1 Loans and Advance

The main business of Bank is to settle loan & advance. Bank collects deposits of saving from one kind of people of society and invests these deposits as loan, subject to conditions, to other kind of people. Bank not sanction cash loan but also credit its good reputation, coincidence faith etc. To settle loan by the bank is called credit or loan and advance. It can be mentioned that banks do business by savings or deposits collected from local people. So before settle loan the band must ensure about the security of the disbursed amount (loan) and he also ensures about the repayment of the loan.

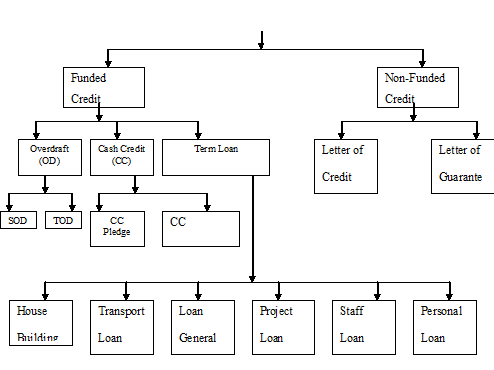

Different Advances Offered by NCCBL

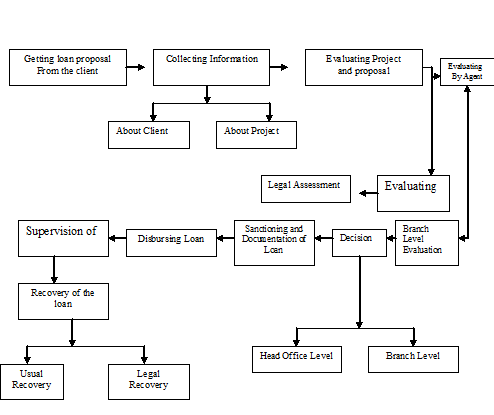

Process of handling loans:

6.2 Types of Loan

The Loan and Advances made by the NCCBL can broadly be classified by following categories-

ü Continuous Loan

ü Demand Loan

ü Term Loan

ü Other Special Scheme

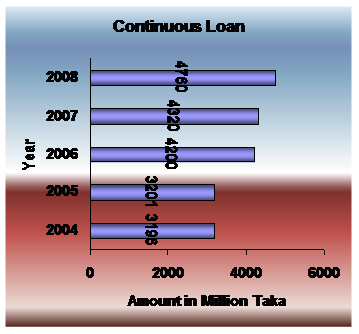

Continuous Loan

These are those advances which do not have any set schedule for drawing or disbursement but usually have a terminal date of full adjustment or repayment. Example: Cash credit (CC), Over Draft (OD).

Continuous Loan of NCCBL for last five years (2004-2008) is-

2004 | 2005 | 2006 | 2007 | 2008 |

3196 | 3201 | 4200 | 4320 | 4760 |

Annual Report: 2004-2008

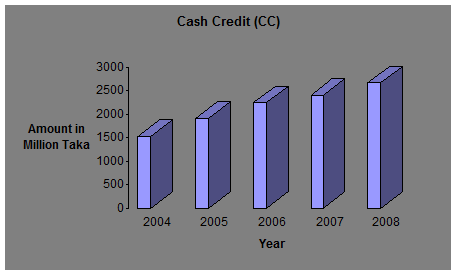

Cash credit (CC)

A Cash Credit (CC) is an arrangement by which the customer is allowed to borrow money up to a limit. This is a permanent arrangement and the customer need not draw the sanctioned amount at once, but draw the amount as and when required. They can put back any surplus amount, which they may find with them. Thus Cash Credit (CC) is an active and running account, which deposits and with drawls may be affected frequently. Interest is charged only for the amount withdrawn and not for the whole amount charged. If the customer does not use the Cash Credit (CC) limit to the full extent, a commitment charge is made by the bank. This charge is imposed on the unutilized portion of Cash Credit (CC) only.

Cash Credit (CC) provides an elastic form of borrowing since the limit fluctuates according to the needs of the business. Cash Credit (CC) is the most favorite mode of borrowing by large commercial and industrial concerns in our country.

Cash Credit (CC) arrangements are usually made against the security of commodities hypothecated or pledged with the bank.

a) Cash Credit (Hypothecation):

This type of credit is allowed to the traders and industrial borrowers for promoting trade and commerce and industries. In case of hypothecation the possession of goods is not given to the bank. The goods remain at the disposal and in the go downs of the borrower. This is given access to goods whenever it so desires. The borrower furnishes periodical return of stock with the bank.

b) Cash Credit (Pledge):

Allowed for promoting trade, commerce and industries of the country against pledge of stock in trade under Bank’s control. In case of the pledge, the goods are placed in custody of the bank with its name on the go down where they are stored. The borrower has no right to deal with them.

Cash Credit (CC) of NCCBL for last five years (2004-2008) is:

2004 | 2005 | 2006 | 2007 | 2008 |

1532 | 1910 | 2243 | 2407 | 2663 |

Annual Report: 2004-2008

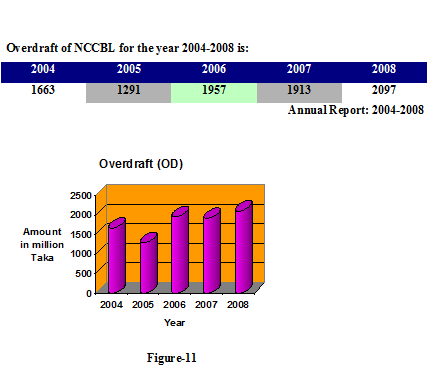

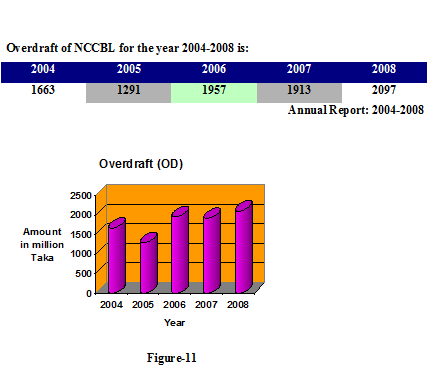

Overdraft:

Overdraft (OD) is an arrangement between a banker and its customer by which the latter is allowed to withdraw over his credit balance in the current account up to an agreed limit. This is only a temporary accommodation usually granted against securities. The borrower is permitted to draw and repay any number of times, provided the total amount overdrawn does not exceed the agreed limit. The interest is charged only for the amount drawn and not for the whole amount sanctioned.

There are two kinds of overdraft.

a) Secured overdraft

b) Unsecured overdraft

a) Secured overdraft: Secured overdrafts are loans which have collateral attached to them in the form of a lien. A lien is a monetary claim against a property to be fulfilled before repeat ownership can take place.

Secured overdrafts divided into two forms. There are- (i) Secured overdrafts financial obligation (SOD-FO) (ii) Secured overdrafts general (SOD General).

- SOD (FO): Allowed against financial obligation (Like- FDR, SSS etc.) for promotion of economic and business activities.

- SOD (General): Generally allowed t9o the traders for business promotion and economic activities. In case of SOD (General), bank keeps the land as collateral.

b)Unsecured overdraft: Banks, sometimes grant unsecured overdraft for small amount to customers having current account with them. Such customers may be government employees with fixed income or traders. Unsecured overdrafts are permitted only where reliable source of funds are available to a borrower for repayment.

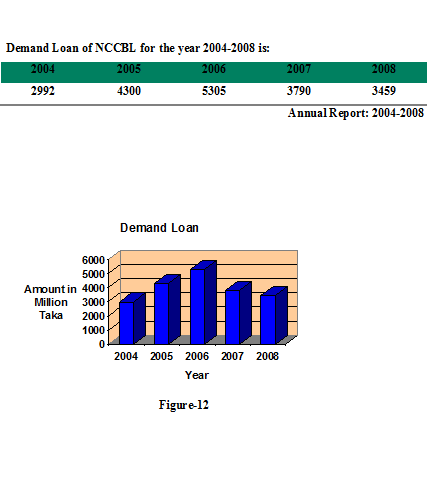

Demand Loan:

The loan which become payable after serving demand notice by the bank concerned are termed as Demand Loan.

Example: LIM, LTR, PAD, Loan against Packing Credit, Loan against Investment etc.

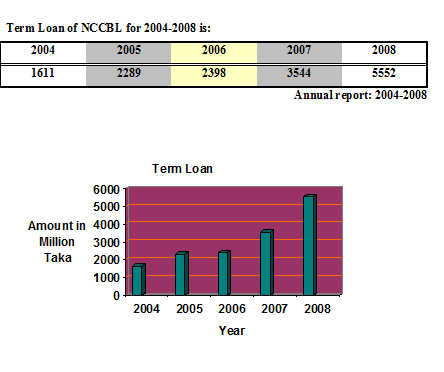

Term Loan:

These are loans which have a specific term for repayment as specified in the loan agreement. Example: Loan (General), Transport Loan, Project Loan, Lease Financing, small Business Loan, Personal Loan, House Building Loan and Other Loan etc.

Loan (General):

In case of loan general, the banker advances a lump sum for a certain period at an agreed rate of interest. The entire amount is paid on an occasion either in cash or by credit in his/her current account which he/she can draw at any time. The interest is charged for the full amount sanctioned whether he/she withdraws the money from his/her account or not. The loan may be repaid in monthly installments or at the expiry of a certain period.

Higher the loan amount higher the income of the bank. In this sense, NCCBL is doing well. In the year 2000 this loan general was Tk.927 million, but in 2003 it was Tk.2697 million. This picture indicates that NCCBL is aggressive to earn interest income. By doing this job management maximize the profit of the bank and maximize the wealth also.

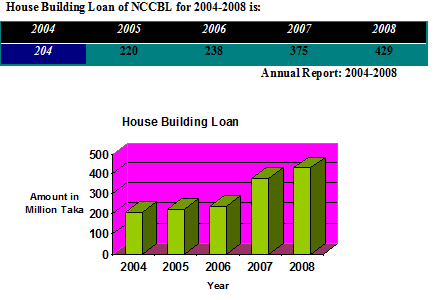

Housing Loan

A large amount of money needed to construct a house or purchase a apartment. It is not possible to of all people to construct a house by only own income sources. Especially this problem largely faces by middle level and fixed income people. To solve this problem, NCCBL’s offer Housing Loan with easy repayment condition and less interest rate.

Detail information of Housing Loan:

ü Purpose of Loan:

a) To help service holders, self-employed persons, businessmen, professionals and also those who have the capability to repay loan for purchase of flats/house/construct buildings and thereby improve their quality of life.

b) To contribute to the reduction of acute housing problems of the country.

c) To help the prospective clients get housing loans on easy terms and without any hardies.

d) To strengthen NCCBL.

e) To contribute towards improvement of socio economic condition of the society.

ü Housing Loan Product of NCC Bank Limited:

a) Flat purchase

b) Own Construction

c) House Extension

d) Readymade house purchase

ü Target Group: People of all sections of the society who are desirous of purchasing flats/house/constructing buildings/flats on land owned through registered purchase/lease from the government/any other government approved authority and who have the capacity to repay the loans within the validity period of the loan out of the income generated by the flats/house and also their other sources of income, may be the ideal customers.

ü Designated Branches:

a) Gulsan Branch.

b) Dhanmondi Branch.

c) Mirpur Branch.

d) Uttara Branch.

ü Maximum size of loan: Loan for amount exceeding Tk.5.00 lac to the maximum of Tk.50.00 lac may be considered under the Housing Loan Scheme.

Necessary Document for Housing Loan:

The following papers are to be submitted while applying for loan:

ü For Employed-

- i. Employment certificate/contract paper.

- ii. Pay slip for last 3 months (showing all deduction).

- iii. Bio-Data (income-earner).

- iv. Bank statement for the last 12 months.

- v. If applicant has any other income, proof of that may be given (e.g. Rental agreement).

- vi. TIN Certificate.

- vii. Letter of Consent from the guarantor (if required).

ü For Self Employed-

- i. Statement of business, detail such as product/clients etc.

- ii. Income Tax assessment orders/returns for 3 years.

- iii. Audited Profit & loss Account and Balance Sheet for last 3 years.

- iv. Self-assessed Profit & loss Account for last 3 years (for Proprietorship Firm).

- v. Bank Statement of self and business for last 1 year.

- vi. Bio-Data.

- vii. If applicant has any other income, proof of that may be given (e.g. Rental agreement).

- viii. TIN Certificate.

ü For Private Land-

- i. Ownership deed (original).

- ii. Baya deed (original/certified/photocopy).

- iii. Recent Survey Report (i.e. Math parcha duly attested).

- iv. CS/RSSA Parcha.

- v. Mutation ParchaKhatian.

- vi. Up to date “Non-Encumbrance Certificate” for 13 years.

- vii. Approved plan and approval letter of Rajuk Authority.

- viii. Detailed estimate of the cost of construction prepared by a qualified Engineer/Architect at current market rates.

- ix. Photograph of the project.

Project Loan:

NCC Bank Ltd has their project loan scheme. Though they do not invest in project loan extensively but now they are planning on project loan. Because project loan is huge investment and it completely depends on success of the project for that reason bank always keeps eye some major factor before invest on project loan. Before invest on project loan bank always who is the people involves in the project security standard of the borrower. Then bank looks for the feasibility report of the project. Borrower has to completely show the feasibility report to the Head Office. In the feasibility report borrower has to show them what the mission of the project, who are the target customer, comparative analysis of the project with other same project, how the project meets the demand of the target customer, for which purpose the loan is asking for, detail information of the project operation, detail price list of the equipment, approximate repayment planning by the borrower. Branches do not have any authority to sanction any amount of loan for project loan. Branch can only assess the project feasibility, evaluate the client check the necessary papers and collect it from the client. After getting the entire necessary papers branch makes a proposal for the loan and send it to the head office. Head Office then re-evaluates the proposal with necessary papers. Then head office aging inspects the project.

Detail information of project Loan:

ü Name and address of the client.

ü Particulars of the directors (Directors percentage of the share in the project).

ü Detail of the approved facility.

ü Nature of the facility-Term loan.

ü Amount of sanctioned loan.

ü Purpose of the loan-for which specific reason client wants the loan for purchasing machinery.

ü Rate of interest-16% p.a. at quarterly rest, subject to change from time to time.

ü Grace Period- after disbursement installment will not count from the following month. After completing the project installment period will be count from that month in which month the project is complete and start its operation.

ü Validity of the loan means how long it will take to repay the loan.

ü Mode of adjustment-usually for project loan installment count quarterly, because of bulk of installment. According to the loan amount bank calculates how many installments needed for the repayment of the loan amount and how many years take for the repayment, including the grace period.

Necessary Documents for the Project Loan:

ü Tax Identification Number (TIN) Certificate.

ü CIB (Customer Information Beauro) response form.

ü Party’s application

ü Credit proposal and approval form

ü List of collateral securities

ü Feasibility report

ü Trade license

ü Memorandum & articles of the association

ü Resolution

ü Net worth calculation of business & individual

ü Legal opinion

ü Valuation assessment

ü Quotation

ü Deed of lease agreement

ü CIB inquiry form 1, 2 and 3.

This is also an important instrument of term loan. This scheme covers the following areas- Plastic Industry, Medical service provider etc.

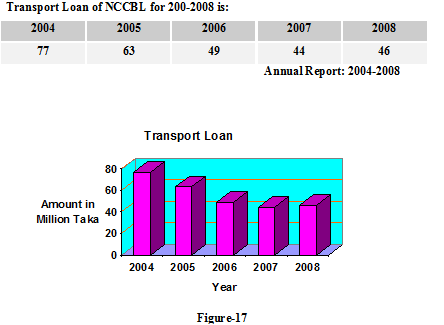

Transport Loan:

NCC bank Ltd was an investment company before the conversion in a bank. So they have good idea about lease financing. Transport loan is fallen under lease financing, though it is called transport loan but it is actually fallen under leasing term and condition. NCC Bank Ltd does not have any car loan scheme for individual clients, they had this scheme but the scheme is completely stopped for the time being.

Detail Information of Transport Loan:

ü Name and address of the borrower & company

ü Nature of limit- Loan (Transport)

ü Purpose of the Loan- To procure vehicle for industrial or local transport.

ü Nature of business of the borrower- Transport business.

ü Amount of the limit- the loan amount

ü Margin- 50% cash against each vehicle

ü Debt-Equity ratio- 50:50 (Bank cash 50% and Party cash 50%)

ü Validity- No of months (Calculated by the bank how many months it will take to repay the loan against each vehicle) from the date of disbursement against each vehicle.

ü Rate of interest- 16% p.a. at quarterly rest, subject to change according to market situation.

ü Mode of disbursement- The loan to be preferably disbursed after getting of vehicle. If advance payment is considered as sine-qua-non the payment to be made direct to respective seller through payment order after realizing party’s full equity with instruction to deliver the vehicle to the bank’s representative. All other costs insurance premium, route permit etc. to be borne by the borrower. Sale receipt to be issued in the name of bank account party.

Necessary Documents for Transport Loan:

ü CIB (Customer Information Beauro) response form.

ü Party’s application

ü CIB inquiry form 1, 2 and 3.

ü D.P. Note

ü Letter of arrangement

ü Letter of disbursement

ü Letter of authority

ü Letter of hypothecation

ü Letter of lien

Other Special Scheme

Consumer Scheme

The Scheme aims at improving the standard of living of the fixed income group. Under the scheme the clients may secure loan facilities at easy installments to procure household amenities.

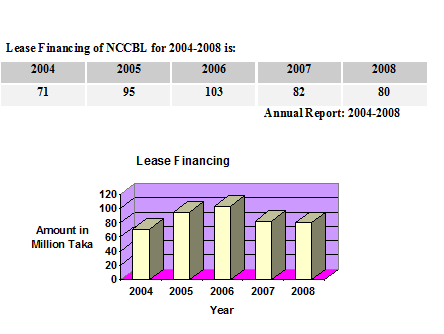

Lease Finance

An entrepreneur, under this scheme, may avail of the lease facilities to procure industrial machinery (without having to purchase it by down payment) with easy repayment schedule. The clients also get special rebate in their income tax payment under the scheme.

Lease financing is one of the most convenient long term sources of acquiring capital machinery and equipment. It is a very popular scheme whereby a client is given the opportunity to have an exclusive right to use an asset, usually for an agreed period of time, against payment of rent. Of late, the lease finance has become very popular in almost all the countries of the world. An obvious advantage of the lease is to use an asset without having to buy it. The lessee is obligated to make lease payments until the expiration of the lease agreement which corresponds to the useful life of the assets. In a capital scarce economy like ours. Lease financing is suitable for firms to acquire capital, Machinery, Equipments, medical Instruments and Automobiles etc. And thereby employ

their own resources more advantageously in some other investments. Lease financing also helps a firm to reap significant economic benefit through tax saving and by reducing the risk of the equipments becoming obsolete due to the technological advancement.

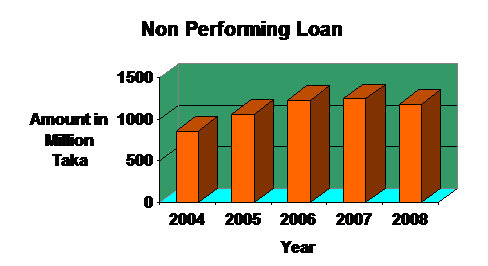

Non Performing Loan:

Loans are designated as none performing when they are placed on nonaccrual status or when the terms are substantially altered in a restructuring. Nonaccrual means that banks deduct all interest on the loans that was recorded but not actually collected. Banks have traditionally stopped acquiring interest when debt payments were more than 90 days past due by the end of the reporting period. This permitted borrowers to make late partial payments and the banks to report all interest as accrued, even it was not collected. On occasion, banks would lend the borrower the funds that were used to make the late payment.

Volume of nonperforming loan of NCCBL for the year 2004-2008 as bellow:

2004 | 2005 | 2006 | 2007 | 2008 |

865.11 | 1067.06 | 1234.14 | 1253.35 | 1188.40 |

Annual Report: 200-2008

From the above figure we can see that NCCBL’s non performing loan amount increased day by day. But it doesn’t show the real picture. Because, the total loan and advances increased then non performing loan also increased over the preceding year.

6.3: Rate of Different Loan & Advances:

SL. No. | Particulars | Rate |

| A. | Continuous Loan | |

| 01. | Cash Credit a. CC (Pledge) b. CC (Hypothecation) | 16% 16% |

| 02. | Overdraft (OD) a. SOD (FO) i. SOD (FO) against FDR SOD (FO) against NCCBL’s FDR SOD (FO) against other Bank’s FDR ii. SOD (FO) against SDS iii. SOD (FO) against SSS b. SOD (G) |

FDR Rate+3% 15% 15% 15% 16% |

| B. | Term Loan | |

| 01. | Small Loan a) Small Business Loan b) Personal Loan c) House Renovation Loan | 16% 16% 16% |

| 02. | Consumer Finance Scheme | 16% |

| 03. | Loan (G) against (P.F) | 16% |

| 04. | HouseBuilding Loan | 13% |

| 05. | Transport Loan | 16% |

| 06. | Project Loan | 16% |

Basis for loan classification: All loans and advances are classified on the basis of two criteria:

Objective criteria

Qualitative judgment criteria

| Objective Criteria | |||

| Status | Type of loans | Definition | |

| 1 Unclassified | All | Current loans with required! adequate eligible securities | |

| 2 Sub- standard | Continuous | Overdue is more than 3 months but less than 6 months | |

| Demand | Overdue is more than 3 months but less than 6 months from the date of serving notice! creation of forced loans | ||

| Term (less than 5 years) | If the defaulted amount of installment is equal to installment! installments payable in 6 months | ||

| Term (More than 5 years) | If the defaulted amount of installment is equal to installment! installments payable in 12 months | ||

| Short term agriculture! micro | Overdue is more than 12 months but less than 36 months | ||

| Doubtful | Continuous | Overdue is more than 6 months but less than 12 months | |

| Doubtful | Demand | Overdue is more than 6 months but less than 12 months from the date of serving notice! creation of forced loans | |

| Term (Up to 5 years) | If the defaulted amount of installment is equal to installment! installments payable in 12 months | ||

| Term (More than 5 years) | If the defaulted amount of installment is equal to installment/ installments payable in 18 months | ||

| Short term /micro | Overdue is more than 36 months but less than 60 months | ||

| Bad/ loss | Continuous | Overdue is more than 12 months | |

| Demand | Overdue is more than 12 months from the date of serving notice! creation of forced loans | ||

| Demand | Overdue is more than 12 months from the date of serving notice! creation of forced loans | ||

| Term (Up to 5 years) | If the defaulted amount of installment is equal to installment! installments payable in 18 months | ||

| Term (More than 5 years) | If the defaulted amount of installment payable in 24 months | ||

| Short term/ micro | Overdue is more than 60 months | ||

| Qualitative Judgment Criteria

| ||

| Status | Type of loans | Definition

|

| Sub- standard | All | A loan is considered “Sub-standard” when the degree of risk of non-payable is so high and there is reasonable prospect that the loans condition can be improved

|

| Doubtful | Chance of recovery is uncertain

| |

| Bad/ loss | All | No security held. Borrower not traceable. Time barred loan cases. No hope of recovery. |

![Internship report on National credit and commerce bank Ltd [part-2]](https://assignmentpoint.com/wp-content/uploads/2013/03/ncc-bank.jpg)