Banking Overview of Dutch Bangla Bank Limited

Dutch-Bangla Bank Limited is a scheduled commercial bank. The Bank was established under the Bank Companies Act 1991 and incorporated as a public limited company under the Companies Act 1994 in Bangladesh with the primary objective to carry on all kinds of banking business in Bangladesh. The Bank is listed with Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited. DBBL- a Bangladesh European private joint venture scheduled commercial bank commenced formal operation from June 3, 1996. The head office of the Bank is located at Senakalyan Bhaban (4th floor), 195, Motijheel C/A, Dhaka, Bangladesh. The Bank commenced its banking business with one branch on 4 July 1996.

Dutch Bangla Bank Limited (DBBL) a public company limited by shares, incorporated in Bangladesh in the year 1995 under companies Act 1994. With 30% equity holding, the Netherlands Development Finance company (FMO) of the Netherlands is the international cosponsor of the Bank. Out of the rest 70%, 60% equity has been provided by prominent local entrepreneurs and industrialists & the rest 10% shares is the public issue. During the initial operating year (1996-1997) the bank received skill augmentation technical assistance from ABN Amro Bank of the Netherlands.

DBBL’s focus is to provide one counter service to clients covering: Commercial Banking (Deposit Accounts), Consumer Banking (Retail Baking) – Traveler Cheques- Foreign & Inland Remittances, Financial Services, Corporate Banking, Asset & liability management, Liquidity & capital Resources Management, Information technology, Human Resources. DBBL Internet banking enables customer to access his/her personal or business accounts anytime anywhere from home, office or when traveling. Internet Banking gives customer the freedom to choose his/her own banking hours. It can save time, money and effort. It’s fast, easy, secure and best of all.

DBBL, since its inception was active in various social activities, which increased manifold over the period of time and its growth. It is one of the fast growing leading online banks in private sector. The emergence of Dutch-Bangla Bank Ltd. in the private sector is an important event in the banking area of Bangladesh. The Netherlands Development Finance Company (FMO) of the Netherlands is the international sponsor of the Bank. The FMO is the Dutch development bank of the Netherlands specialized in the financing of private enterprises in Asia, Africa, Latin America and Eastern Europe. Dutch-Bangla Bank Ltd. came into existence with joint venture as a public limited company incorporated in Bangladesh on June 26, 1995 with the primary objectives to carry on all kinds of banking business in and outside of Bangladesh. DBBL has started its business with foreign bank. DBBL commenced its business as scheduled bank with effect from July 04, 1995 with one branch-Motijheel Branch, Dhaka, with a motto to grow as a leader in the banking arena of Bangladesh through better counseling and effect service to clients and thus to revitalize the economy of the country. All the branches are currently providing truly On-Line banking facility. DBBL resumed its operational activities initially with an authorized capital of Tk.400 million and paid up capital of Tk.202.14 million.

An overview of DBBL

Dutch-Bangla Bank is a second generation commercial private Bank. During the period of its operation, this bank creates a milestone of success in banking sector. This bank holds an experienced team of banking professional. They achieve this success because of their experienced banking professional team, proper management & so on. Dutch-Bangla Bank Limited is a Bangladesh–Netherlands joint venture scheduled commercial bank established in Bangladesh with the primary objective to carry on all kinds of banking business in and outside of Bangladesh.

Starting with one Branch in 1996, DBBL has expanded to thirty nine (39) branches including nine Branches outside of the capital. To provide client services all over Bangladesh it has established a wide correspondent banking relationship with a number of local banks. To facilitate international trade transactions, it has arranged correspondent relationship with large number of international banks which are active across the globe.

In addition to its banking activities, Dutch-Bangla Bank Limited takes part in different national activities promoting sports, culture, social awareness, etc. Participation in these activities as sponsors is part of its business development policy.

Philosophy of DBBL

The objectives of Dutch-Bangla Bank Limited remains to offer modern & innovative products & services to its clients in Bangladesh the partnership with FMO is optimistically scene to offer scopes opportunities to draw on modern tools & techniques of Banking from western world which could be blended with the currently prevalent local customs & practice. The Bank is committed to being a sophisticated prominent and professional institution, providing a one window service to its customers. During the first five years Dutch Bangla Bank’s strategy was focused on continuing in provident of internal procedures and operating structures, to have a greater control on the quality of our business and to provide better management direction. After five years of working on the Banks structure, its culture and controls, the management is confident that the Bank can move forward on a rapid growth path. The DBBL’s corporate philosophy is to build its nonfunded fees and commission income stream, thus reducing its reliance on interest income alone.

Core objective of DBBL

Dutch-Bangla Bank believes in its uncompromising commitment to fulfill its customer needs and satisfaction and to become their first choice in banking. Taking cue from its pool esteemed clientele, Dutch-Bangla Bank intends to pave the way for a new era in banking that uphold and epitomize its vaunted marquees “Your Trusted Partner”

Focus of DBBL

DBBL’s focus is to provide one counter service to our clients covering:

- Commercial Banking (Deposit Accounts)

- Consumer Banking (Retail Baking)-

- Traveler Cheques

- Foreign & Inland Remittances

- Financial Services

- Corporate Banking

- Asset & liability management

- Liquidity & capital Resources Management

- Information technology

- Human Resources

Mission

Each business unit needs to define its specific mission within the broader company mission. Dutch-Bangla Bank engineers enterprise and creativity in business and industry with a commitment to social responsibility. “Profits alone” do not hold a central focus in the Bank’s operation; because “man does not live by bread and butter alone”. Mission statements are at their best when they are guided by a vision.

Vision

“To become a leading banking institution and play a pivotal role in the development of the country”

Vision, a compelling view of a future yet to be, creates meaning and purpose which catapults both individuals and organizations to high levels of achievement. Dutch-Bangla Bank dreams of better Bangladesh, where arts and letters, sports and athletics, music and entertainment, science and education, health and hygiene, clean and pollution free environment and above all a society based on morality and ethics make all our lives worth living. DBBL’s essence and ethos rest on a cosmos of creativity and the marvel-magic of a charmed life that abounds with spirit of life and adventures that contributes towards human development.

Strategies of DBBL

The strategies are as follows:

- To manage and operate the Bank in the most efficient manner to enhance financial performance and to control cost of fund

- To strive for customer satisfaction through quality control and delivery of timely services

- To identify customers’ credit and other banking needs and monitor their perception towards our performance in meeting those requirements.

- To review and update policies, procedures and practices to enhance the ability to extend better service to customers.

- To train and develop all employees and provide them adequate resources so that customers’ need can be reasonably addressed.

- To promote organizational effectiveness by openly communicating company plans, policies, practices and procedures to employees in a timely fashion

- To diversify portfolio both in the retail and wholesale market

- To increase direct contact with customers in order to cultivate a closer relationship between the bank and its customers.

Objectives of DBBL

- To earn and maintain CAMEL Rating ‘Strong’

- To establish relationship banking and improve service quality through development of Strategic Marketing Plans.

- To remain one of the best banks in Bangladesh in terms of profitability and assets quality.

- To introduce fully automated systems through integration of information technology.

- To ensure an adequate rate of return on investment

- To keep risk position at an acceptable range (including any off balance sheet risk)

Departments of DBBL

Human Resources Department

Success of any organization largely depends on the efficiency & competence of its manpower. The organization provides a comprehensive range of human resources services to staff and managers and all prospective employees. A full list of staff and their relevant areas of responsibility are conduct here. This includes Senior Management, Operations group – including HR Advisors, Staff Development, and Job Evaluation & Systems & Management Information group.

Our vision is to be a department that leads on and delivers the University’s Staff Experience Strategy, works as a business partner within the organization and leads by example in relation to university values.

Services provided under this department:

We provide the following range of services:-

- Strategic planning and organizational development

- faculty and departmental operational advice, support and services

- staff development

- projects and information management

Equality and Diversity

The organization is committed to the support and implementation of the equality and diversity agenda as laid out in our policy.

International Division

Internal trade means foreign currency and includes all deposits, credit and balances payable in foreign currency as well as all foreign currency instruments, such as, Drafts, Travelers Cheques, Bills of Exchange, and Promissory Notes payable in any foreign country.

Anything that conveys a right to wealth in another country is Foreign Exchange.

DBBL provides premium quality service for repatriation and collection of remittance with the help of its first class correspondents and trained personnel. By introducing on-line banking service and becoming a SWIFT Alliance Access Member, which enable its branches to send and receive payment instruction directly, which helps provide premium services.

Credit department

Risk is an integral part of business & the main role of our risk management principle is to find the optimal balance of risk & return. Bangladesh bank has undertaken a project to install a core risk management system in every bank. DBBL Bank Ltd installing the same system in respect to Asset liability management, Foreign exchange management, internal control & compliance, Anti money laundering. The bank prudently controls asset allocation through limiting exposure to industry sector & setting client limit. Moreover, the bank approved a new organization structure to accommodate core risk management perspective.

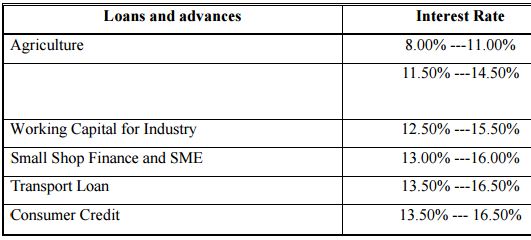

Loans and Advances

IT department

Dutch-Bangla Bank Limited (DBBL) undertook a project with BASIS (Bangladesh Association of Software and Information Services) to award the best IT uses by Bangladeshi companies. DBBL and BASIS organized IT award-giving ceremony in this regard. The award Ceremony was held on 30th November 2005, which was the day before last day of BASIS SOFfEXP02005 (November 27-December 01, 2005). This was a gala evening (with dinner and cultural program) attended by around 700 dignitaries including government high officials & policy makers, corporate heads, representatives from development agencies, IT policy makers, academicians and the IT industry members. In this regards, DBBL’s contribution in supporting this event was 50% of the estimated cost with Tk.6.25 Lac.

PRODUCTS AND SERVICES

Products and services offered by DBBL

- Retail Banking

- Remittance and collection

- Import and export handling and financing

- Corporate Banking

- Project Finance

- Investment Banking

- Consumer credit

- Agriculture Loan

- Real time any branch banking

- 24 Hours Banking through ATM

- DBBL-NEXUS ATM & Debit card

- DBBL-Maestro/Cirrus ATM & Debit card

- DBBL Credit card

- Internet Banking

- SMS Banking

- On line Banking through all Branches

Banking Products

Various deposits:

- Savings Deposit Account

- Current Deposit Account

- Short Term Deposit Account

- Resident Foreign Currency Deposit

- Foreign Currency Deposit

- Convertible Taka Account

- Non-Convertible Taka Account

- Exporter’s FC Deposit(FBPAR)

- Current Deposit Account-Bank

- Short Term Deposit Account-Bank

Loan & Advances

- Loan against Trust Receipt

- Transport Loan

- Consumer Credit Scheme

- Real Estate Loan (Res. & Comm.)

- Loan Against Accepted Bill

- Industrial Term Loan

- Agricultural Term Loan

- Lease Finance

- Other Term Loan

- FMO Local currency Loan for SME

- FMO Foreign currency Loan

- Cash Credit (Hypothecation)

- Small Shop Financing Scheme

ATM Services

We can find DBBL ATMs beside our home, in our office premise, nearby market, university, college & school premises, Airport, Railway stations etc., throughout the country. Using any of the DBBL ATM pools any where in the country, you can perform the following:

- Account balance enquiry

- Cash withdrawal – 24 hours a day, 7 days a week, 365 days a year

- Cash deposit to a certain number of ATMs any time

- Mini statement printing

- PIN (Personal Identification Number) change

Treasury

DBBL is well equipped for treasury operation through subscribing Reuters’s terminal and operating in SWIFT network. It is also well equipped with competent human resources for efficient dealing.

DBBL’s treasury quotes competitive exchange rate for major currencies:

- Spot Sale/Purchase

- Forward Sale/Purchase

- Money market Inter bank & Corporate

- SWAPS

Account Service

DBBL provides all the accounts services as prescribed by the guidelines of Central Bank (Bangladesh Bank). DBBL offers competitive interest rate and provides premium quality services for the accounts. Account services are:

- Foreign Currency Account

- Non-Resident Foreign Currency Deposit Account (NFCD)

- Resident Foreign Currency Deposit Account (RFCD)

- Convertible and Non-Convertible Taka Account

Foreign Trade

DBBL extends finance to the importers in the form of:

- Opening of L/C (Foreign/Local)

- Credit against Trust Receipt for retirement of import bills.

- Short term & medium term loans for installation of imported

Foreign Remittance

DBBL provides premium quality service for repatriation and collection of remittance with the help of its first class correspondents and trained personnel. By introducing on-line banking service and becoming a SWIFT Alliance Access Member, which enable its branches to send and receive payment instruction directly, which helps provide premium services. Remittance services provided by DBBL are:

- Inward Remittance: Draft, TT

- Outward Remittance: FDD, TT, TC and Cash (FC)

Western Union

Western Union Financial Services Inc. U.S.A. is the number one and reliable money transfer company in the world. This modern Electronic Technology based money transfer company has earned world wide reputation in transferring money from one country to another country within the shortest possible time. Dutch-Bangla Bank Limited has set up a Representation Agreement with Western Union Financial Services Inc. U.S.A. as on 14th February 2006.

DBBL Internet Banking

DBBL Internet banking enables customer to access his/her personal or business accounts anytime anywhere from home, office or when traveling. Internet Banking gives customer the freedom to choose his/her own banking hours. It can save time, money and effort. It’s fast, easy, secure and best of all.

Using any of the DBBL ATM pools any where in the country, you can perform the following:

- Securities with DBBL Internet Banking

- A/c Opening & Accessing Internet Banking

- Internet Banking Features

- Terms & Conditions of Internet Banking

SWOT Analysis

Strengths

- Largest banking service provider in the commercial bank and operate near about 1000 corporate client.

- Qualified, hard working & dedicated human resources

- Gets advantage for ATM card

Weaknesses

- Low deposit rate and minimum balances are too high.

- Non functioning ATM machines, delay for providing cards.

- Poor coordination & communication between Head offices and branches

Opportunities

- If reducing its current fees & charges and positioning attractively , so DBBL can attract more corporate client

- By offering more attractive interest rates, and lowering the minimum balances eligible for interest, the bank can attract a lot of the old customers

Threats

- At present Trust Bank, EBL and BRAC Corp are posing significant threats to DBBL regarding retail and business banking respectively.

- Furthermore, the new comers in private banking sector are also coming up with very competitive products.

Conclusion

Dutch-Bangla Bank Limited is one of the most potential Banks in the banking sector. It has a large portfolio with huge assets to meet up its liabilities and management of this bank is equipped with the export bankers and managers in all level of management. So it is not an easy job to find out the drawbacks of this branch.

It has been observed that DBBL started its banking services with a view to minimize the customer’s needs by offering different products and services which are easy and affordable for all level of customers. To that extent, DBBL always emphasizes its customer services, product development, resource management, branch networking and the contribution to the economic development of the country. The bank also provides social services through DBBF as their social responsibility.

The success of a bank depends on the quality of the services it offers. All the commercial banks, therefore, try to provide quality services with competitive interest rates. DBBL is not an exception. Life line package has been developed with the same purpose. Although, the comparative analysis shows that DBBL is in better position, but there are some obstacles it faces to sustain the position. However, the continuous improvement of the services will certainly place the bank in the best position in one decade.