Business Operating Process of City Brokerage Limited

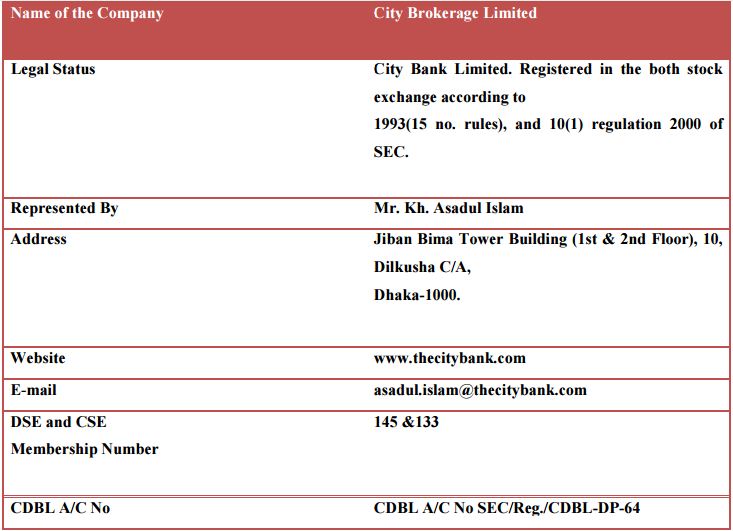

City Brokerage Limited had been set up in 2010 as a wholly owned subsidiary of The City Bank Limited to provide the capital market business requirements to the institutional and individual clients. City Brokerage Limited come to the market with full- fledged international standard brokerage service for retail, institutional and foreign clients. And before being a wholly owned subsidiary City Brokerage Limited had obtained membership in both Dhaka Stock Exchange and Chittagong Stock Exchange bearing member Id No. 145 and 133 in consecutively in 2009. Moreover an important thing about City Brokerage Limited is, it is a full service depository participant of Central Depository Bangladesh Limited bearing depository participant Id. No.45000 and the company is able to open BO account as requirement of clients. City Brokerage Limited has a bunch of dedicated and highly skilled professional with maintaining strong ethical standard to provide the best service to local and foreign investor. And it has established reputation in serving customer with maintaining strong compliance practices.

Vision, Mission and Values

Vision:

- The Financial Supermarket with a Winning Culture Offering Enjoyable Experiences

Mission:

- Offer wide array of products and services that differentiate and excite all customer segments

- Be the “Employer of choice” by offering an environment where people excel and leaders are created

- Continuously challenge processes and platforms to enhance effectiveness and efficiency

- Promote innovation and automation with a view to guaranteeing and enhancing excellence in service

- Ensure respect for community, good governance and compliance in everything we do

Values:

- Result Driven

- Accountable & Transparent

- Courageous & Respectful

- Engaged & Inspired

- Focused on Customer Delight

City Brokerage Limited at a glance:

Operating process of City Brokerage Limited:

It was a great opportunity for me to have a close look on the operating process of City Brokerage Limited as I had been done my Internship at Head office, Main branch of City Brokerage Limited. The functions of the brokerage house are divided into two parts, Front Office and Back Office. The operations of these two parts are equally important. Moreover, Front Office operations include all the customer management functions including new beneficiary account opening, liaison maintaining with existing and potential customers, acquiring buy and sell orders and executing them swiftly and accurately, co-ordinate with other departments. In addition, Front office maintains phone calls, arranges meetings and is also providing the available and current price sensitive news and other important news about the capital market of Bangladesh. Moreover, providing the daily portfolio to the clients is another job of front office. After trade hours, saving the trade report is also a part of front office operation, is performed at Head Office. Moreover, the back office operation of City brokerage Limited at Main branch performs data entry of cash and check receipt and payment, data entry of newly opened BO Account’s information in the back office and the data is also kept in the front office. Vouchers writing and documentation task is also performed by back office. In addition, Back office operation also includes daily data entry of trade confirmation note in a recognized form. Accounting and reconciliation, verification of deals, corrections, getting customer authorization and follow up with customer and payment and settlement services is also the part of back office job of the Main Branch. Maintaining different register including, client register, complaint register, attendance register with proper documentation process is also job of Head Office. There are some other jobs, is performed by city brokerage officials at Main branch. For an example, morning discussion often happens with the participation of officials at this branch. Furthermore, officials of this branch keep in touch with the customer and inform them their current status of their portfolio. Moreover, officials of this branch also coordinate with other Branch and sometimes they go to the other branch to check whether there is any problem or not. Moreover, other’s branch client checques are also cleared in this branch if any clients of other branch give checque to this branch. Nevertheless, any customer of Head Office faces negative equity on their portfolio, and then city brokerage officials pursue them to get the positive equity on their portfolio.

Main functions of City Brokerage Limited:

Since the establishment of the company as a wholly owned subsidiary of The City Bank Limited, City Brokerage Limited is engage in different functions to provide the promising services to its existing and potential clients and stakeholders. It has developed a disciplined approach toward providing capital market services, including beneficial owner accounts opening and maintaining, margin lone providing and with the research and publication. The main functions operated by City Brokerage Limited are as follows:

CDBL Services as full service Depository Participant:

- Bo (Beneficial Owner) accounts opening and maintenance

- Dematerialization and Re-materialization

- Transfers and multiple accounts movement

- Pledging, un-pledging and confiscation

- Lending and borrowing

- Corporate events announcement enquiry (Cash and non Cash).

Sales and Brokerage Services:

Brokerage services for Intuitional Clients :

- Foreign Fund Managers

- Insurance Companies

- Banks and Financial Institution

- Trust

- Corporation

- Brokerage Service for retail (Individual) Clients

- Provide Margin lone at competitive interest rate

- International and Domestic Placement of Securities

- Brokerage ServicesTrade Execution Dhaka and Chittagong Stock Exchange Limited

- Pre-IPO private placement opportunities through Merchant Banks

- Appointment of dedicated and skilled sales representative

- Opportunities for trading in different financial instruments

Custodial Services:

- City Brokerage Limited have an exclusive arrangement for clients to keep their shares in safe custody in our vault

- Safe Deepings of securities

Research and Publication:

- Daily price information Market Overview, Daily Fact Sheet

- Monthly report

- Industry/Corporate research report

- Industry/Corporate research report

- Free access to our company research reports through our web-site

- Half yearly political and economic update

Value Added Services:

- Daily portfolio services through email

- Daily trade confirmation through SMS service

- Web services for portfolio and report

SWOT ANALYSIS:

Every single business entity has some strength, weakness, opportunity and weakness. As other organization City Brokerage Limited also has some strength and opportunity and besides these the company has some weakness and threats. Anyway, strength and weakness are internal factor, which company can increases and decrease by implementing different plan of work. On the other hand opportunity and threats comes from external environment where organization doing their business. Though there is no role of company itself for facing these threats, or creating opportunity, but company has the chance to realize the opportunity comes from external factor and can take defensive actions to minimize the threats.

Strength:

- Skilled and knowledgeable employees of City Brokerage Limited.

- Realize the reputation of City Bank as wholly owned subsidiary of City Bank.

- Sophisticated tools and financial analysis.

- Highly complained operating system.

Weakness:

- Less number of branches.

- Lacking of manpower.

- Insufficient marketing effort.

- Not availability of online trading facility.

Opportunity:

- Increase the volume of trade by attracting foreign investor and remittance earners.

- Having a scope to expanding the market share.

- Investors are began to be sophisticated, now they are locking better service and take calculative judgment about the service of broker house.

- Provide the online trading service.

Threats:

- Low turnover in the capital market of Bangladesh.

- Political and social unrest in Bangladesh.

- Existing and upcoming broker houses in the market with attracting facilities.

- Frequent uncoordinated policy making by different regulatory bodies.

Investors’ Behavior Scenario:

The stock market or share market is a vital part of a country’s economy. People invest their money in the capital market to obtain economic prosperity for them, which also has positive effect on the country. However, if, for any reason like the stock market crash, this process of resource enlistment is threatened and as a result, investors become panic and begin seeking safe alternatives. Statistics shows around 3.3 million retail investors of Bangladesh engaged in the stock market during the market crash of 2010. In addition, they used to invest money from various sources such as savings in bank, idle money, and part of earnings or proceeds from selling their movable or immovable assets and so on. Unfortunately, after the crash they were left with nothing significant.

After the month March, 2014 BO account numbers stood at 60 thousand and the total number of the BO account holder increased at 29lakh 55 thousand and 731 which was before at 29lakh 4 thousand 832. Moreover, in February the men BO account holders were 21lakh 43thousand and 917 and this number is increased by 21 lakh 78thousand 305 that means after one month BO account of men increased at 34 thousand and 388.

Besides, women BO account holders are 7lakh 67thousand and 569 in March. On the other hand, in March the company BO accounts is 9thousand and 857. Now a chart is giving below which shows the two months comparison of BO accounts.

Reasons:

- Investors are influenced by other investors’ decisions.

- Individual investors invest most of their investment in the stock market without any research.

- Investors most of the time take decisions based on the rumor.

- They want to grab short term profit rather long term profit.

- Most of the investors think, behind the market there are some people who manipulate the market.

- Some people are giving false information so that they can take some advantages.

- Regulator bodies are failing to control the false information.

- Investors invest their money in the company’s shares without collect enough information about those companies. They just run after the profit and in the long run loss their money.

JOB SITE EXPERIENCE:

Internship is a way to gain practical job knowledge and it facilitates me to take a valuable experience regarding job. Besides, it introduces to me with a corporate culture. Punctuality, discipline and team work, these three facts are coming in my mind when I think about my experience of internship. Likewise, to reach a specific one goal, all the employees are working together by setting themselves different objectives.

Without co-operation with each other, it is difficult to reach projected goal. I did my internship in City Brokerage Limited at Head Office. It is a wholly owned subsidiary of City Bank Limited providing the brokerage services of local and foreign individual and institutional clients.

At the first day of my internship program I have been experience an orientation program at Head office of City Brokerage Limited. On that orientation program I had chance to get familiar with the different department of the office as well as it was my pleasure to be introduced with the brilliant and smart team of head office who are playing vital role for successfully run the organization. Moreover in this orientation program, there are an introducing part with CEO and Managing Director of the City Brokerage Limited, in terms of time frame it was a very short meeting, but the smart guy make the meeting very fruitful with his valuable speech, which inspire me lot and he give a brief idea about corporate world, his valuable guideline make me thrust to learn new things and keep some contribution to the society.

Through my thirteen week internship opportunity at City Brokerage I was gotten an opportunity to be experience with two types of job known as front office job and back office job and both are interrelated with each other. As I was working basically in Customer Service Department, I had to deal with customers.

Customer management, providing relevant information to the clients as requirement was some of job at front office done by me. Moreover, through the internship period I am continuously assist the officials of City Brokerage Limited to perform their day to day job. One of the frequently done jobs of me was giving portfolio statement to respective client. Furthermore, I was also mitigating the client’s query regarding the client’s account opening process. In this way I help the officials to open a new beneficiary owner account (BO) and fulfill the clients’ requirements.

On the other hand, I had learnt about preparing voucher, making requisition to withdraw balance from an account and process the delivering of cheque according to client’s requirement. Also, I had learnt the detail process of a new BO account.

Besides, I had a chance to learn buy and sell order execution at DSC using TESA software by the help of the Manager of Sales and Trading. It was really an exciting job for me.

A list of job performed by me at Head Office is given below:

Give information to the customer about necessary documents for open a B.O account:

As I was in Customer Department, I had to give necessary information to the customers for opening a B.O. account. This is one of the regular jobs for me. Besides, I had to very polite and helpful to the customers while giving information.

Open customer B.O account:

After providing all the required documents for opening a B.O account by the customers, I had to open B.O accounts for them. To open a B.O account I had to maintain some procedures. First of all check the documents and find whether there is any mismatch or not. If everything is fine, we collect opening fees and put customer name in a MS Excel file and also put client code as well as send the form to the settlement and they do the other procedures to open the account.

Give portfolio statement to the customer:

This is a regular job of Customer Service department. Everyday clients come from 10.00a.m to 5.30p.m to collect their portfolios. This is a bit challenging job because sometimes many clients come at a time and want their portfolios. On that time I had to listen very carefully and write down their codes. In addition, I had to give their portfolios very quickly and also had to carefully check whether they are real clients or not and I was giving the right portfolio at the right person. Moreover, on that time, senior officials also want their clients’ portfolios to me and I had to manage both the cases very carefully.

Receive cash deposit slip and cheque from customers:

Frequently customers come to give us cheques and deposit slips for further transactions. As customers sell and buy their stocks, they must have sufficient balance in their accounts. I had to receive all the cash deposit slips and cheques from the customers and after that I had to send it to the Accounts Department.

Pay cheque to the customer after verifying sign:

I had to perform the job very carefully. I had to verify customers’ signs to find out they were the right persons whom I was giving cheques. Moreover, I also checked the authorization form and verify the name and sign of the customer before providing the cheque.

Give cheque requisition form, authorization form, tax requisition form to the customer:

Another day to day job of my department was to give cheque requisition form, authorization form, tax requisition form to the customer. To withdraw money and collect cheque, customer must take those forms and I had to give them proper direction to fill it properly.

Give ledger to the customer:

Often many customers need their ledger details or financial transactions. I had given them the ledgers according to their needs and I had to do this task in software, Blue- Chip. Every day I had to open the software and had to provide portfolios and ledgers with the help of the software.

Receiving customer calls and forwarding them to respective officer:

Every day I received many customers’ calls and gave answers to their queries. If I did not know any answer, transferred the call to respective officer or informed my supervisor. Sometimes customers gave call and wanted officers for some official purposes and at that time I had to forwarding the call to the respective officers. Besides, some important calls had come for the CEO and other senior officers and I responded those calls very nicely and transferred them to high official management.

Auditing whole B.O accounting books:

To audit the whole B.O account is another day to day job. I had to create an Excel Sheet and had to keep record on that file. Every day I checked more than 20 books to find out whether there are any mistake or not. Moreover, if I found any mistake, had to keep record on that file and inform my supervisor about it.

There are some other jobs which I performed at City Brokerage, Head Office are given below:

- Check B.O account form according KYC

- Receiving various e mails and letter.

- Correspondence with customers

- Attend customers and fixed appointment to high official management.

- Give tax certificate to the customer after verifying sign.

- Receive account opening fee from customer

RECOMMENDATIONS:

- City Brokerage Limited should develop a well organized website to make them more accessible to their existing and potential clients. In addition they should introduce online trading facilities for their clients.

- City Brokerage Limited can introduce investor awareness program, should take the initiative to produce wise and educated investor. In this way both the clients and house will be benefitted.

- City Brokerage Limited should give more emphasize on the research and publications. And it should be ensured that research and publications are available to the clients.

- Branch offices should more closely monitored by the management of the City Brokerage and there can be sudden visit to the branch office to have a look on the office.

- There should be a way to get the feedback from the clients. They should take effective initiative to make the all employees up to date about necessary rules and regulation about the capital market of Bangladesh.

- City Brokerage Limited can arrange seminar and workshop with the different stakeholder of this organization about the investment of capital market.

- Conclusion:

- In the above study, we have observed the reasons and scenario behind the market crash 2010-2011 and also found out the investors’ behavior and how they are investing their money in the stock market. However, now we should find out some remedy so that in future investors can invest their money in capital market without any fearing or they can invest in this sector with honesty and make a good return of their investment. On the other hand, we can see that investors in general show irrational excitement in times of stock market bubble and undue doubt after the bust of the bubble. Both behavioral patterns cause stock prices to move away from their fundamental values. To avoid this kind of behavior, investors should assess long run profitability of companies.

- If they observe a sudden jump in EPSs, investors must identify reasons of the jump and evaluate its long-run sustainability. The EPSs and NAVs are thus not always a good guide. Investors should therefore examine earnings persistency, not just the one period ahead forecast of EPSs. Besides, SEC can formulate laws so that investors can obtain financial analyst services and make informed investment decisions. Stock exchanges can also educate investors as to help them make sensible investment decisions. They can organize training programs on technical and fundamental analysis of securities. Press and electronic media can also play a great role to this end. Moreover, steps are needed to motivate institutional investors to be more active in the share market. To do so, it would essentially require that money market is stabilized and interest rate declines to a reasonable level.

- That would also require that inflation declines to a reasonable level. Besides, City Brokerage Limited is a brokerage house under the city Bank. They have a well reputation for satisfying their customer through providing good services; since they have been starting their journey 2009. Along with other brokerage house, they use modern technology to give better services to their customers. Moreover, City Brokerage limited is dedicated to providing a high level of professional and personalized services to its domestic and international clients and that’s why its office is decorated in such way to give better services to their clients. In addition, we can see many of the Brokerage houses serve their clients in one big room but in City Brokerage LTD, there are several rooms for serving their clients. In addition, the company aims to offer high quality product and service at a competitive rate to all clients. After the 2010, capital market had been passing a tough time. During this tough period, City Brokerage Limited has tried best to give better services to their clients as possible. Also, they have ensured the customer satisfaction through their services. However, for sustainable growth, by implementing innovation they have to walk with the time. In this purpose, they must look on their strength and need to recover their weak sides. At the same time they must look after the opportunity and threats as well as.