Compensation :

Compensation is a systematic approach to providing monetary value to employees in exchange for work performed. Compensation may achieve several purposes assisting in recruitment, job performance, and job satisfaction.

Compensation the methods and practices of maintaining balance between interests of operating the company within the fiscal budget and attracting, developing, retaining, and rewarding high quality staff through wages and salaries which are competitive with the prevailing rates for similar employment in the labor markets.

Today’s compensation systems have come from a long way. With the changing organizational structures workers’ need and compensation systems have also been changing. From the bureaucratic organizations to the participative organizations, employees have started asking for their rights and appropriate compensations. The higher education standards and higher skills required for the jobs have made the organizations provide competitive compensations to their employees.

Compensation strategy is derived from the business strategy. The business goals and objectives are aligned with the HR strategies. Then the compensation committee or the concerned authority formulates the Compensation strategy. It depends on both internal and external factors as well as the life cycle of an organization.

Traditional Compensation Systems

In the traditional organizational structures, employees were expected to work hard and obey the bosses’ orders. In return they were provided with job security, salary increments and promotions annually. The salary was determined on the basis of the job work and the years of experience the employee is holding. Some of the organizations provided for retirement benefits such as, pension plans, for the employees. It was assumed that humans work for money, there was no space for other psychological and social needs of workers.

Change in Compensation Systems

With the behavioral science theories and evolution of labor and trade unions, employees started asking for their rights. Maslow brought in the need hierarchy for the rights of the employees. He stated that employees do not work only for money but there are other needs too which they want to satisfy from their job, i.e. social needs, psychological needs, safety needs, self-actualization, etc. Now the employees were being treated as human resource.

Their performance was being measured and appraised based on the organizational and individual performance. Competition among employees existed. Employees were expected to work hard to have the job security. The compensation system was designed on the basis of job work and related proficiency of the employee.

Today’s Modern Compensation Systems

Today the compensation systems are designed aligned to the business goals and strategies. The employees are expected to work and take their own decisions. Authority is being delegated. Employees feel secured and valued in the organization. Organizations offer monetary and non-monetary benefits to attract and retain the best talents in the competitive environment. Some of the benefits are special allowances like mobile, company’s vehicle; House rent allowances; statutory leaves, etc.

Labor therefore expects to have fair share in the business/production process. Therefore a fair compensation system is a must for every business organization. The fair compensation system will help in the following:

- An ideal compensation system will have positive impact on the efficiency and results produced by employees. It will encourage the employees to perform better and achieve the standards fixed.

- It will enhance the process of job evaluation. It will also help in setting up an ideal job evaluation and the set standards would be more realistic and achievable.

- Such a system should be well defined and uniform. It will be apply to all the levels of the organization as a general system.

- The system should be simple and flexible so that every employee would be able to compute his own compensation receivable.

- It should be easy to implement, should not result in exploitation of workers.

- It will raise the morale, efficiency and cooperation among the workers. It, being just and fair would provide satisfaction to the workers.

- Such system would help management in complying with the various labor acts.

- Such system should also solve disputes between the employee union and management.

- The system should follow the management principle of equal pay.

- It should motivate and encouragement those who perform better and should provide Opportunities for those who wish to excel.

- Sound Compensation/Reward System brings peace in the relationship of employer and employees.

- It aims at creating a healthy competition among them and encourages employees to work hard and efficiently.

- The system provides growth and advancement opportunities to the deserving employees.

- The perfect compensation system provides platform for happy and satisfied workforce. This minimizes the labor turnover. The organization enjoys the stability.

- The organization is able to retain the best talent by providing them adequate compensation thereby stopping them from switching over to another job.

- The business organization can think of expansion and growth if it has the support of skillful, talented and happy workforce.

The sound compensation system is hallmark of organization’s success and prosperity. The success and stability of organization is measured with pay-package it provides to its employees.

Purpose or use of compensation:

Compensation is a tool used by management for a variety of purposes to further the existence of the company. Compensation may be adjusted according the business needs, goals, and available resources.

Compensation may be used to:

- Recruit and retain qualified employees.

- Increase or maintain morale/satisfaction.

- Reward and encourage peak performance.

- Achieve internal and external equity.

- Reduce turnover and encourage company loyalty.

- Modify (through negotiations) practices of unions.

Recruitment and retention of qualified employees is a common goal shared by many employers. To some extent, the availability and cost of qualified applicants for open positions is determined by market factors beyond the control of the employer. While an employer may set compensation levels for new hires and advertize those salary ranges, it does so in the context of other employers seeking to hire from the same applicant pool.

Morale and job satisfaction are affected by compensation. Often there is a balance (equity) that must be reached between the monetary value the employer is willing to pay and the sentiments of worth felt be the employee. In an attempt to save money, employers may opt to freeze salaries or salary levels at the expense of satisfaction and morale. Conversely, an employer wishing to reduce employee turnover may seek to increase salaries and salary levels.

Compensation may also be used as a reward for exceptional job performance. Examples of such plans include: bonuses, commissions, stock, and profit sharing, gain sharing.

Components of a compensation system:

Compensation will be perceived by employees as fair if based on systematic components. Various compensation systems have developed to determine the value of positions. These systems utilize many similar components including job descriptions, salary ranges/structures, and written procedures. Job analysis is a systematic approach to defining the job role, description, requirements, responsibilities, evaluation, etc. It helps in finding out required level of education, skills, knowledge, training, etc for the job position. It also depicts the job worth i.e. measurable effectiveness of the job and contribution of job to the organization. Thus, it effectively contributes to setting up the compensation package for the job position.

The components of a compensation system include:

- Job Descriptions A critical component of both compensation and selection systems, job descriptions define in writing the responsibilities, requirements, functions, duties, location, environment, conditions, and other aspects of jobs. Descriptions may be developed for jobs individually or for entire job families.

- Job Analysis: The process of analyzing jobs from which job descriptions are developed. Job analysis techniques include the use of interviews, questionnaires, and observation.

Importance of Job Analysis

Job analysis helps in analyzing the resources and establishing the strategies to accomplish the business goals and strategic objectives. It forms the basis for demand-supply analysis, recruitments, compensation management, and training need assessment and performance appraisal.

Components of Job Analysis

Job analysis: It is a systematic procedure to analyze the requirements for the job role and job profile. Job analysis can be further categorized into following sub components.

Job Position

Job position refers to the designation of the job and employee in the organization. Job position forms an important part of the compensation strategy as it determines the level of the job in the organization. For example management level employees receive greater pay scale than non-managerial employees. The non-monetary benefits offered to two different levels in the organization also vary.

Job Description

Job description refers the requirements an organization looks for a particular job position. It states the key skill requirements, the level of experience needed, level of education required, etc. It also describes the roles and responsibilities attached with the job position. The roles and responsibilities are key determinant factor in estimating the level of experience, education, skill, etc required for the job. It also helps in benchmarking the performance standards.

Job worth

Job Worth refers to estimating the job worthiness i.e. how much the job contributes to the organization. It is also known as job evaluation. Job description is used to analyze the job worthiness. It is also known as job evaluation. Roles and responsibilities helps in determining the outcome from the job profile. Once it is determined that how much the job is worth, it becomes easy to define the compensation strategy for the position.

Therefore, job analysis forms an integral part in the formulation of compensation strategy of an organization. Organizations should conduct the job analysis in a systematic at regular intervals. Job analysis can be used for setting up the compensation packages, for reviewing employees’ performance with the standard level of performance, determining the training needs for employees who are lacking certain skills.

- Salary Surveys: Collections of salary and market data. May include average salaries, inflation indicators, cost of living indicators, salary budget averages. Companies may purchase results of surveys conducted by survey vendors or may conduct their own salary surveys. When purchasing the results of salary surveys conducted by other vendors, note that surveys may be conducted within a specific industry or across industries as well as within one geographical region or across different geographical regions. Know which industry or geographic location the salary results pertain to before comparing the results to your company.

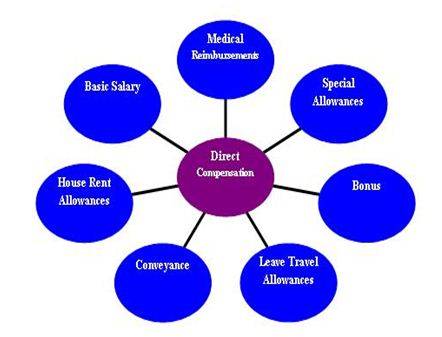

Direct Compensation

Direct compensation refers to monetary benefits offered and provided to employees in return of the services they provide to the organization. The monetary benefits include basic salary, house rent allowance, conveyance, leave travel allowance, medical reimbursements, special allowances, bonus, Pf/Gratuity, etc. They are given at a regular interval at a definite time.

1. Basic Salary

Salary is the amount received by the employee in lieu of the work done by him/her for a certain period say a day, a week, a month, etc. It is the money an employee receives from his/her employer by rendering his/her services

2. House Rent Allowance

Organizations either provide accommodations to its employees who are from different state or country or they provide house rent allowances to its employees. This is done to provide them social security and motivate them to work.

3. Conveyance

Organizations provide for cab facilities to their employees. Few organizations also provide vehicles and petrol allowances to their employees to motivate them.

4. Leave Travel Allowance

These allowances are provided to retain the best talent in the organization. The employees are given allowances to visit any place they wish with their families. The allowances are scaled as per the position of employee in the organization.

5. Medical Reimbursement

Organizations also look after the health conditions of their employees. The employees are provided with medi-claims for them and their family members. These medi-claims include health-insurances and treatment bills reimbursements.

6. Bonus

Bonus is paid to the employees during festive seasons to motivate them and provide them the social security. The bonus amount usually amounts to one month’s salary of the employee.

7. Special Allowance

Special allowance such as overtime, mobile allowances, meals, commissions, travel expenses, reduced interest loans; insurance, club memberships, etc are provided to employees to provide them social security and motivate them which improve the organizational productivity.

INDIRECT COMPENSATION

Indirect compensation refers to non-monetary benefits offered and provided to employees in lieu of the services provided by them to the organization. They include Leave Policy, Overtime Policy, Car policy, Hospitalization, Insurance, Leave travel Assistance Limits, Retirement Benefits, Holiday Homes.

1. Leave Policy

It is the right of employee to get adequate number of leave while working with the organization. The organizations provide for paid leaves such as, casual leaves, medical leaves (sick leave), and maternity leaves, statutory pay, etc.

2. Overtime Policy

Employees should be provided with the adequate allowances and facilities during their overtime, if they happened to do so, such as transport facilities, overtime pay, etc.

3. Hospitalization

The employees should be provided allowances to get their regular check-ups, say at an interval of one year. Even their dependents should be eligible for the midi-claims that provide them emotional and social security.

4. Insurance

Organizations also provide for accidental insurance and life insurance for employees. This gives them the emotional security and they feel themselves valued in the organization.

5. Leave Travel

The employees are provided with leaves and travel allowances to go for holiday with their families. Some organizations arrange for a tour for the employees of the organization. This is usually done to make the employees stress free.

6. Retirement Benefits

Organizations provide for pension plans and other benefits for their employees which benefits them after they retire from the organization at the prescribed age.

7. Holiday Homes

Organizations provide for holiday homes and guest house for their employees at different locations. These holiday homes are usually located in hill station and other most wanted holiday spots. The organizations make sure that the employees do not face any kind of difficulties during their stay in the guest house.

8. Flexible Timings

Organizations provide for flexible timings to the employees who cannot come to work during normal shifts due to their personal problems and valid reasons.

Compensation Plans

Develop a program outline.

- Set an objective for the program.

- Establish target dates for implementation and completion.

- Determine a budget.

Designate an individual to oversee designing the compensation program.

- Determine whether this position will be permanent or temporary.

- Determine who will oversee the program once it is established.

- Determine the cost of going outside versus looking inside.

- Determine the cost of a consultant’s review.

Develop a compensation philosophy.

- Form a compensation committee (presumably consisting of officers or at least including one officer of the company).

- Decide what, if any, differences should exist in pay structures for executives, professional employees, sales employees, and so on (e.g., hourly versus salaried rates, incentive-based versus no contingent pay).

- Determine whether the company should set salaries at, above, or below market.

- Decide the extent to which employee benefits should replace or supplement cash compensation.

Conduct a job analysis of all positions.

- Conduct a general task analysis by major departments. What tasks must be accomplished by whom?

- Get input from senior vice presidents of marketing, finance, sales, administration, production, and other appropriate departments to determine the organizational structure and primary functions of each.

- Interview department managers and key employees, as necessary, to determine their specific job functions.

- Decide which job classifications should be exempt and which should be nonexempt.

- Develop model job descriptions for exempt and nonexempt positions and distribute the models to incumbents for review and comment; adjust job descriptions if necessary.

- Develop a final draft of job descriptions.

- Meet with department managers, as necessary, to review job descriptions.

- Finalize and document all job descriptions.

Evaluate jobs.

- Rank the jobs within each senior vice presidents and manager’s department, and then rank jobs between and among departments.

- Verify ranking by comparing it to industry market data concerning the ranking, and adjust if necessary.

- Prepare a matrix organizational review.

- On the basis of required tasks and forecasted business plans, develop a matrix of jobs crossing lines and departments.

- Compare the matrix with data from both the company structure and the industry wide market.

- Prepare flow charts of all ranks for each department for ease of interpretation and assessment.

- Present data and charts to the compensation committee for review and adjustment.

Determine grades.

- Establish the num

- ber of levels – senior, junior, intermediate, and beginner – for each job family and assign a grade to each level.

- Determine the number of pay grades, or monetary range of a position at a particular level, within each department.

Establish grade pricing and salary range.

- Establish benchmark (key) jobs.

- Review the market price of benchmark jobs within the industry.

- Establish a trend line in accordance with company philosophy (i.e., where the company wants to be in relation to salary ranges in the industry).

Determine an appropriate salary structure.

- Determine the difference between each salary step.

- Determine a minimum and a maximum percent spread.

- Slot the remaining jobs.

- Review job descriptions.

- Verify the purpose, necessity, or other reasons for maintaining a position.

- Meet with the compensation committee for review, adjustments, and approval.

Develop a salary administration policy.

- Develop and document the general company policy.

- Develop and document specific policies for selected groups.

- Develop and document a strategy for merit raises and other pay increases, such as cost-of-living adjustments, bonuses, annual reviews, and promotions.

- Develop and document procedures to justify the policy (e.g., performance appraisal forms, a merit raise schedule).

- Meet with the compensation committee for review, adjustments, and approval.

Obtain top executives’ approval of the basic salary program.

- Develop and present cost impact studies that project the expense of bringing the present staff up to the proposed levels.

- Present data to the compensation committee for review, adjustment, and approval.

- Present data to the executive operating committee (senior managers and officers) for review and approval.

Communicate the final program to employees and managers.

Present the plan to the compensation committee for feedback, adjustments, review, and approval.

- Make a presentation to executive staff managers for approval or change, and incorporate necessary changes.

- Develop a plan for communicating the new program to employees, using slide shows or movies, literature, handouts, etc.

- Make presentations to managers and employees. Implement the program.

- Design and develop detailed systems, procedures, and forms.

- Work with HR information systems staff to establish effective implementation procedures, to develop appropriate data input forms, and to create effective monitoring reports for senior managers.

- Have the necessary forms printed.

- Develop and determine format specifications for all reports.

- Execute test runs on the human resources information system.

- Execute the program.

BASIC COMPONENTS OF COMPENSATION PROGRAMS

A pay program may include the following four components: base pay, wage and salary add-ons, incentive payments, and benefits and services. Base pay refers to the cash that an employer pays for the work performed. This base pay can be further delineated as either a wage or a salary. Wages are hourly rates of pay regulated by the Fair Labor Standards Act of 1938. This federal legislation formed the foundation of minimum wage, overtime pay, child labor, gender equality, and record keeping requirements for U.S. businesses. Employees who are subject to the Fair Labor Standards Act are known in compensation management parlance as “nonexempt.” Salaries, which are usually paid to managers and professionals, are annual or monthly calculations of pay that usually have less relation to hours worked. Most (but not all) salaried workers are “exempt” from the Fair Labor Standards Act of 1938.

Wage and salary add-ons include cost-of-living adjustments (or COLAs), overtime, holiday and other premium wages, travel and apparel expenses, and a host of related forms of premiums and reimbursements. Wage and salary add-ons are used to compensate employees for work above and beyond their normal work schedules or to reimburse them for expenses related to their jobs. COLAs are usually across-the-board contractual increases tied to an economic indicator, such as the consumer price index, that reports an increase in the cost of living.

Incentive payments refer to funds employees receive for meeting performance or output goals as well as to seniority and merit pay. Companies provide these forms of compensation to influence employee behavior, improve productivity, and reward employees for their years of service or their strong job performance.

Finally, benefits and services include paid time off, health insurance, deferred income such as pension and profit sharing programs, company cars, fitness club memberships, child care services, and tuition reimbursement. Social Security, workers’ compensation, and unemployment compensation are three legally required benefits. Since its initial passage in 1935, the Social Security Act has been amended and expanded to protect workers and their families from losses due to retirement, disability, and/or death.

COMPENSATION ADMINISTRATION MODEL

A general model of compensation administration encompasses the creation and management of a pay system based on four basic, interrelated policy decisions: internal consistency, external competitiveness, employee contributions, and administration of the compensation program. Compensation professionals work with these policy decisions according to individual corporations’ needs, keeping in mind the ultimate objectives of compensation administration—efficiency, equity, and compliance. Companies develop their individual compensation strategies by placing varying degrees of emphasis on these four policy decisions. This model of compensation administration shows how companies consider most of the 13 factors previously presented that influence pay rates.

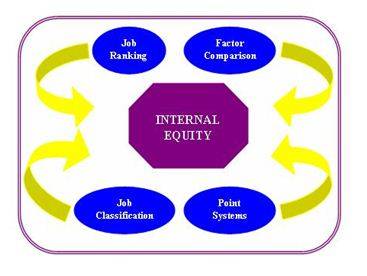

INTERNAL CONSISTENCY:

Compensation managers seek to achieve internal equity and consistency—rationalizing pay within a single organization from the chief executive officer on down—through the analysis, description, evaluation, and structure of jobs. This policy requires compensation managers to compare jobs or skill levels to determine the contributions employees with different job titles or skill levels make toward accomplishing company goals. Compensation managers, therefore, should consider internal consistency when determining pay rates for employees who do the same work and employees who do different work. The objective of internal consistency is for compensation managers to determine equitable rates of pay by considering the similarities and differences in work content or job skills as well as the different contributions employees with different jobs and skill levels make to a company’s goals. The different values companies have for employees with different jobs reflect the perceived importance of the various jobs or skill levels to achieving company goals.

Internal consistency depends on how a company is structured—i.e., its hierarchy. Companies traditionally maintained larger hierarchies with several levels, but the corporate restructuring and reorganizing trend of the 1990s has resulted in flatter corporate structures with just a few levels. The pay structure of a company is its range of pay rates for different jobs and skill levels within the organization. In other words, pay structures reflect corporate structures. For example, a company may have three organizational levels: executive, managerial, and professional. Each of these levels may correspond to different pay rates. Hence, employees may have salaries of $60,000 in the executive level, $45,000 in the management level, and $30,000 in the professional level. The differences in pay among the various levels are called pay differentials, so the differential between executives and managers is $15,000 and the differential between executives and professionals is $30,000.

An emphasis on internal consistency forces employers to allocate pay fairly across a company’s levels. Consequently, a company with the pay and corporate structure outlined above would have deemed it fair that executives earn twice as much as professionals, which seems reasonable in that some companies pay their highest-paid employees 10 to 200 times as much as their lowest-paid employees.

The number of levels and the degree of pay differentials are based on three general criteria: the value of a job and a job’s responsibilities, the skills and knowledge needed, and job performance and productivity. Employers can use these criteria to modify employee behavior by indicating what kinds of responsibilities, performance, productivity, skills, and knowledge employees need to move into a different level and receive a higher pay rate.

More specifically, six primary but interrelated factors can shape a company’s pay structure:

- Social Customs: Beginning in the thirteenth century, employees began demanding a “just” wage. This idea evolved into the current notion of a federally mandated minimum wage. Hence, economic forces do not determine wages alone.

- Economic Conditions: Demand for labor influences employee wages. Employers pay wages based on the relative contributions employees make to production goals. In addition, supply and demand for knowledge and skills helps determine wages.

- Company Factors: Pay structures depend on the kind of technology a company has and on whether a company uses pay as an incentive to motivate employees to improve job performance and to accept more responsibilities.

- Job Requirements: Some jobs may require greater skills, knowledge, or experience than others and hence fetch a higher pay rate.

- Employee Knowledge and Skills: Likewise, employees bring different levels of skills and knowledge to companies and hence they are qualified to work at different levels of a company hierarchy and receive different rates of pay as a result.

- Employee Acceptance: Employees expect fair pay rates and determine if they receive fair wages by comparing their wages with their coworkers’ and supervisors’ rates of pay. If employees consider their pay rates unfair, they may seek employment elsewhere, put forth little effort in their jobs, or file lawsuits.

EXTERNAL COMPETITIVENESS:

Achieving external competitiveness in the area of compensation means balancing the need to keep operating costs (including labor costs) low with the need to attract and retain quality workers. External competitiveness is how a company’s rates of pay compare to those of its competitors.

Compensation managers achieve external competitiveness by comparing wage levels within their industry, examining their companies’ resources and goals, and establishing their own pay levels accordingly. In general, companies can set their pay levels to lead, match, or follow competitors’ pay practices. Contemporary compensation policies include “variable pay,” where pay levels reflect the fluctuation of the firms’ success or decline, and positioning as “employer of choice.” “Employer of choice” emphasizes the total compensation package, and may include employment security, educational opportunities, and the promise of intellectual challenges or latitude. In practice, some employers use different policies for different units and/or job groups.

Job surveys have also been developed by professional human resource groups over the decades. The New York-based American Management Association’s “Executive Compensation Service” has compiled and published information on compensation and related subjects since 1950. This publication provides a means for measuring a company’s compensation packages against those of other companies.

Establishing the pay level balances a company’s profit requirements with competition for competent employees. Factors determining pay level include:

- Competition in the labor market: the supply and demand for employees with various qualifications.

- Product market conditions: the degree of demand for specific products and the level of industry competition.

- Organizational characteristics: industry, management philosophy, size, and technology.

Weighing all these considerations, firms can choose to pay more than the industry average, and therefore favor attracting and retaining quality employees, or pay less than their competitors’ average hoping to attract and retain employees through no compensation means such as recognition events, achievement celebrations, and working in a pleasant environment. A competitive pay level—one that balances all considerations—can help contain labor costs, enlarge the pool of qualified applicants, increase quality and experience, reduce voluntary turnover, discourage unionization, and abate pay-related work stoppages. Once a company has determined its pay level relative to its competitors, compensation managers must determine the best compensation package for each occupation.

EMPLOYEE CONTRIBUTIONS:

This policy area involves the weight companies choose to place on employee performance in determining a compensation program. Some companies may choose to pay all employees the same wage, while others decide to reward employees for seniority and productivity. Companies that choose the latter route tend to emphasize incentive and merit aspects of compensation programs. This approach enables companies to give their employees a measure of control over their compensation and ideally thereby influence their performance. This policy assumes that employees are significantly motivated by pay, which studies fail to confirm or refute conclusively. Nevertheless, pay studies suggest that pay is one of several important employee motivators, just not the consummate one. Compensation based on employee contributions generally is distributed on the basis of employee evaluations.

In order to carry out evaluations perceived as being fair by employees, companies must establish performance standards. To do so, companies should maintain a list of updated job descriptions that indicate what aspects of employee performance will be measured for each job. The aspects of employee performance to be measured should be reasonably attainable. Furthermore, employees should participate in establishing standards and they should know the standards at the beginning of the review period.

A performance evaluation may include objective and/or subjective measurements. Objective assessments (such as number of pieces produced per hour, number of words typed per minute) are clearly reliable and fair, although they may be more difficult to establish for some jobs. Subjective measurement are problematic because of the potential for bias and because inaccurate measurement can lead to employee frustration and apathy. Some objective methods of compensation for performance have become very popular incentives in the late 20th century.

Perhaps the most common examples are sales commissions and piecework, but creative additions to these staples have been added recently. Gain-sharing programs tie incentives to increased productivity, quality improvements, and or cost savings. Profit sharing links pay to increases in company profits, and employee stock option plans base increased compensation on a company’s stock performance. These programs are geared toward making each employee’s vested interest in the company clearer and more immediate through his or her paycheck. These concepts also help control labor costs, because employees do not receive the rewards unless the company performs well.

ADMINISTRATION:

The administrative policy refers to the tasks of compensation managers in designing and implementing a pay program. Taking into consideration the previous three policies, compensation managers must choose the components that they will include in a company’s compensation program—that is, which kinds of base pay, wage and salary add-ons, incentives, and benefits they will offer employees with different jobs and skill levels. Administration also involves determining whether the pay program will attract and retain needed employees successfully, whether employees consider the pay program fair, how competitors pay their employees and if competitors are more or less productive.

Compensation also must reinforce the organization’s strategic conditions. Intensifying competition in many industries has brought about shifts in overall corporate strategies and changes in compensation. For example, Ford Motor Co. decided to emphasize customer service in the 1990s as part of its marketing strategy. In order to encourage dealerships to shift their focus as well, Ford had to change its incentive program. Whereas incentives had previously been based strictly on sales, they began to relate to more customer-service-oriented goals.