Prelude:

It is new dynamic millennium of 21st century. The business world is going more competitive to sustain their customers. Especially banks are directly engage to upgrade the social economy. It is well known that the bank is service-oriented and as a service-oriented organization Eastern Bank Limited is serving the customer through its different department. These are:

- General Banking Department

- Corporate Department

- Credit or Advance Department

- Foreign Exchange Department

Eastern bank Limited today has a strong motivated and dedicated management and stuff that are the pathfinders for introduction of sophisticated products. It is nearly in the offering to introduce soon mobile banking, Internet banking etc. and also more new products. These positive things shall broaden our customer base and enable the bank to have a competitive edge on other banks.

Objective of the study:

The objective of the study is to gather practical knowledge regarding general banking, foreign exchange, & credit system and its operations.

The study will cover the following specific points:

- To apply theoretical knowledge in the practical field.

- To know the organizational framework of EBL.

- To learn about banking operation system.

- To forecast the policy of EBL.

- To study about general banking system, crediting system & foreign exchange activities.

- To examine sectored allocation of deposits.

- To evaluate credit standard of EBL.

- To identify the employee’s satisfaction & as well as customer’s too.

- To highlight the difference of EBL with other public & private banks.

Methodology:

The report has been prepared on the basis of the experience gained during the period of the internship the significant features of the report is the use of the both primary and secondary data.

I have collected the primary data from the sample units by direct interview method. I have worked full time in the bank and observed customers service & dealing of all department.

The secondary data were collected from books, paper, magazine, bulleting, circular, memorandum, documents, and monthly transaction record book of the bank. The collected data and information have been tabulated, processed analyzed and graphically presented in order to make the study more informative, useful, and purposeful.

Limitation:

With a very short period of time it is not easy to complete all the aspects of banking clearly. But I have tried my best to fulfill all the shortcomings and try to gather necessary data’s so far as possible and try to prove IIUC’s graduate Masters Students are confident enough for facing every challenge.

Despite of my diligent efforts, there may have some lacking for less understanding.

The limitations are briefly pointed out below:

- Very short period of time to know everything.

- Short range of data analysis.

- The bank confidentially keeps their secret data.

- Lack of depth of analytical banking knowledge.

- Insufficient scrutinizes the activities of all departments.

- The responsible officers of the bank are passing a very busy time. So they could not give me enough time.

Historical Background:

Eastern Bank Limited incorporated on 16 August 1992 as a public limited company with the primary objective of carrying out all kinds of banking business in and outside Bangladesh. It was formed by taking over the business, assets, liabilities and losses if the erstwhile Bank of Credit and Commerce International (overseas) Limited (BCCI). Eastern Bank Commenced business with four branches and an authorized capital of Tk. 1,000 million divided into 10 million share of Tk. 100 each. Tk. 600 million has been subscribed and paid up by three different classes of shareholders, namely KA, KHA and Ga. The KA-type shares (1.2 million) are those, which are fully subscribed by the government of Bangladesh. The KHA-type shares (1.90 million) are fully subscribed by the financial institution and GA-types shares (2.9 million) are subscribed by the depositors of the erstwhile BCCI branches. The bank is listed with the Dhaka Stock Exchange.

Expect the 5 months of the first year of its operations (from 16 August to 31 December 1992), the bank had regularly earned profits up to December 2000. But it had to bear and offset a pre-takeover loss of Tk. 3,138.56 million since 1992. Gradual offsetting of that loss took a long time. Maintaining provision funds for the classified loans and advances accrued to the past in BCCI also seriously affected the overall profitability of the post-takeover Eastern Bank Limited.

The management of the bank is vested in a board of directors. In 2004, the bank had a total of 561 employees and 22 branches in different places in the country.

Values of EBL:

EBL’s value statement is “Simple math, the philosophy of easy banking”. Along with the statement EBL holds the following values:

- Strong customers focus and build relationships based on integrity, superior service and mutual benefits.

- Work as a team to serve the best interest of the group.

- Relentless in pursuit of business innovation and improvement.

- Value and respect people and make decisions based on profit.

- Recognition and rewards based on performance.

- Responsible, trustworthy and law-abiding in every activity.

Business philosophy of EBL:

The philosophy of EBL is to develop the bank into and ideal and unique banking institution. The perception is that EBL should be quit different from other privately owned and managed commercial bank operating in Bangladesh. EBL is to grow as a leader in the industry rather than a follower. The leadership will be in the area of service, constant effort being made to add new dimension so that client can get “Additional” in the matter of services to commensurate with the needs and requirement of the country’s growing society and developing economy.

The present management has turned the bank into new business philosophy. Till 2003, EBL operating in a Geographical Matrix where the business of the bank was concentrated on 22 branches divided into zones. But in 2004, the new dynamic management if EBL led by the managing director Mr. K. Mahmood Sattar has changed the business philosophy into business matrix. The three main businesses that the bank is currently structured in are:

- Corporate

- Consumer

- Treasury

The branches of the bank are now termed as “Sales & ServicesCenter” which are solely concentrated providing service to the corporate and consumer clients and maintain relationship with them.

Management aspects of EBL:

Like any other business organization, the top management makes all the major decisions in EBL. The board of directors being at the highest level of organizational structure plays an important role on the policy formulation. The board of directors is not directly concern with the day-to-day operation of bank. They have delegated their authority to its management committee. The board established the objectives and policies of the bank there are three committee of the board for different purpose.

- Executive committee comprising of 7 members of the board.

- Committee of the board for administrative matter.

- Committee to examine bad loan cases.

Then the Chief Executive Officer (CEO), who is assisted by 3 Executive Vice president (EVP), looks after day-to-day affairs of the bank, Human Resources Department, MDs Secretarial and Audit and Compliance Department are under direct control of the CEO. The three EVPs control the affair of different departments through respective departmental head.

Mid and lower level employee get the direction and instruction from the top executives about the duties and tasks they have to perform. Management of Eastern Bank Limited assumes that employees are members of the team, who actively participate in accomplishing the organization goal. The chief executive provides the guideline and board direction to the managers and employees but delegate’s responsibility for determining how task and goals are to be accomplished.

Operational aspects of EBL:

EBL is operating through 22 branches located in Dhaka, Chittagong, Khulna, Rajshahi, Sylhet, Moulvibazar, Bogura & jess ore in these branches, along with the principal branch in Dhaka, EBL is offering % types of services. These are:

Retail Banking:

The Retail banking division comprises the domestic branch network with the specialized customer credit, real estate finance. Retail banking deals with the banking services to the individuals. Eastern Bank Retail banking strategy is aimed at keeping, as closely in tune with their customers’ needs as possible and further improving the quality of advisory services. As a result, EBL offers different product ranges to different target groups. It includes the following:

- Deposit services: individuals may open Current, Savings, Std, Fixed deposit accounts.

- Wage earners services: EBL offer a few innovative schemes to Bangladeshi wage earners working overseas.

Institutional Banking:

Eastern bank offers different services to foreign mission, NGOs, and voluntary organization, consultants, airlines, shipping lines, colleges, universities, donor agencies and consultants. Product ranges to different target groups. The service includes the following:

- Deposit service.

- Current accounts in both taka & major foreign currencies.

- Convertible taka account.

- Local and foreign currency remittances.

- Various types of financing to cater the banking requirements of multinational clients.

Corporate Banking:

A professional account management team caters to the needs to corporate client and provides a comprehensive range of financial service to national and multinational companies. It services including following:

- Corporate deposit accounts.

- Projects finance investments, constancy and other finances.

- Syndicate loans.

- Local and international treasury product.

- Bonds and guarantees.

- Skills and responsive attention to varying lending needs.

Commercial Banking:

Being a commercial bank EBL provides comprehensive banking services to all types commercial concerns. Some of the services are:

- Trade finance.

- Issuing of import L/Cs.

- Advising and confirming export L/Cs.

- Bonds and guarantees.

- Investments advice

- Project finance opportunity for import substitution and export oriented project.

Corresponding Banking:

Service to corresponding banks includes following:

- Current accounts service where seen is necessary.

- Issue bonds and guarantees in support of their customer business

- Advice letter of credit and negotiation of documents.

- Market intelligence and status report.

Products & Services offered by EBL:

Eastern Bank Limited has verity of products offered for the retail customers as well as for corporate client are given below:

Product for retail client:

The existing products that are offered by EBL are:

- High performance account (HPA),

- Monthly income plan,

- Monthly deposit plan,

- Fast cash,

- Fast loan,

- Fixed deposit,

- Auto loan,

- Consumer loan,

- Loans for professional,

- Festi-loan,

- Executive’s loan.

Service for retail clients:

Services for retail clients are:

1. Sale of Bangladesh sanchaya patra, pratirakkya patra, ICB certificate etc.

2. Encashment of different sanchaya patra, ICB certificate etc.

3. EBL Q-cash ATM card.

4. Equity services bill collection.

5. Tuition fees.

6. Student file.

Product for Corporate Clients:

- Payment against document (PAD).

- Loan against trust receipt (LTR).

- Acceptance against ULC.

- Local bill purchase documentary (LBPD).

- Foreign bill purchase documentary (FBPD).

- Sight letter of credit (SLC).

- Letter of guarantee (LG).

- Secured overdraft (SOD).

- Demand loan.

- Time loan.

- Term loan.

Competitive situation:

Now in the competitive market it’s very difficult to survive without taking advantages from other banks. In the competitive situation the organization have to one step ahead from the relative competitors. Now in the banking sector in Bangladesh competition is extreme position. Everybody wants to the market leader by his or her products and services. Now in the local banking sector is facing competition not only each other but also the foreign banks. So the competition becomes war. In this situation every bank is very conscious about the market and the demand create from the market and try to provide the product and services at the very fast before anyone fulfills the demand. So competition is increasing day by day and it will go on in its way.

Comparison according to total assets, deposits, loans and advances and investment of four private banks with EBL.

| Banks | Total Assets | Total Deposits | Total Loans & Advances | Investment |

| Prime Bank | 31,175,253,120 | 25,965,451,365 | 21,256,148,120 | 8,650,125,950 |

| Bank Asia | 17,810,533,529 | 13,470,981,849 | 11,681,169,196 | 3,240,516,524 |

| Mercantile Bank | 24,705,000,000 | 22,385,200,000 | 17,669,300,000 | 5,560,570,000 |

| Eastern Bank | 19,176,000,000 | 13,661,000,000 | 11,861,196,196 | 5,331,354,100 |

| One Bank | 13,419,000,000 | 10,915,000,000 | 9,613,000,000 | 1,229,000,000 |

Sources: Annual Reports

Loans and Advances of EBL:

EBL revised structure and strategies to meet the challenges of rapidly evolving technology based banking services, growing competition in the financial service industry, changes in customer’s need. These changes are designed to promote growth, enhance customer services, enrich asset quality, arrange low cost funds and maximize banks earnings.

EBL made concrete plans to restructure the entire gamut of Eastern Bank Ltd’s banking standards and its transaction viz corporate, consumer, treasury, trade services etc. This enables the bank to operate with greater efficiency in all respects thus resulting the better revenue generation compared to past years.

In 2002 EBL made significant progress in upgrading our asset portfolio by booking high quality accounts (blue chip local corporate and multinational). The effort was ongoing EBL also introducing new monitoring standards, credit approval guidance and initiated the process to establish a separate credit administration unit to ensure greater control. This brought better management of asset relationships.

The loans and advance of the bank stood at tk 11,861 million indicating an increase of 3.65% as against tk 11,288 million of preceding year.

The Credit facilities of Eastern Bank Limited:

Eastern Bank Limited offered its customer both consumer credit and corporate credit according to their demand. EBL equally emphasize on both categories. At the beginning EBL emphasize on corporate credit. But recently, EBL can understand the importance of consumer credit in the banking industry. Now they have very strong department for the consumer.

The credit facilities that offered by EBL are:

- Cash credit (hypo)

- Cash credit scheme

- Lease financing

- Hire purchase

- Staff loan

- Fast loan

- Auto car loan

- Loans for professional

- Flexi loan

- Executive loan

- Loan against trust receipt (LTR)

- Sight of letter of credit

- Demand loan

- Time loan

- Term loan etc.

Growth of Loans and Advances of EBL:

| Year | Amount (Tk in million) |

| 2000 | 8,141 |

| 2001 | 9,946 |

| 2002 | 10,891 |

| 2003 | 11,288 |

| 2004 | 11,861 |

Source: Annual report

Sector-wise loans &advances

Source: Annual report

Maturity grouping of loans and advances of EBL:

| On demand | 2004 (Taka) |

| Less than three months | 2,153,884,084 |

| More than three months but less than one year | 1,769,655,079 |

| More than one year but less than five years | 5,517,480,281 |

| More than five years | 2,036,092,399 |

| Total | 384,084,253 |

Maturity-type wise loans & advances

Source: Annual Report

Bank credit:

The principle reason banks is chartered is to make loans to their customers, banks are expected to support their local communities with an adequate supply of credit for all legitimate business and customer financial needs and to price that credit reasonably in line with competitively determine interest rates. Indeed, making loan is the principle economic function of the banks-to fund consumption and investment spending by businesses, individuals and units of government. How well a bank performs its lending function has a great deal to do with the economic health of its region, because bank loan support the growth of new business and jobs within the bank’s trade territory and promote economic vitality. Moreover, bank loans often seem to convey positive information to the marketplace about a borrower’s credit quality, enabling a borrower to obtain more and perhaps somewhat cheaper funds from the sources.

Types of loan made by banks:

Bank loans may be divided into seven broad categories of loans, delineated by their purposes:

- Real Estate loan: REL, which are secured by real property-land, buildings and other structures and which includes short term loans for construction and land development and longer term loans to finance the purpose of farmland, homes, apartments, commercial structure and foreign properties.

- Financial institution loans: FIL includes credit to bank, insurance companies, finance companies and other financial institution..

- Agricultural loans:AL extended to farm and ranch operation to assist in planting and harvesting crops and to support the feeding and care of livestock.

- Commercial and industrial loans: C & IL granted to business to cover such expenses as purchasing inventories, paying taxes and meeting payrolls.

- Loans to individuals: Loans to individuals, including credit to finance the purchase of automobiles, mobile homes, appliances and other retail to repair and modernize homes, cover the cost the medical care and other personal expenses, either extended directly to individuals or indirectly through retail dealers.

- Miscellaneous loans: ML, which includes all those loans not classified here, including securities’ loan.

- Lease financing receivables, where the bank buys equipment of vehicles and lease them to its customers.

Factors determining the growth and mix of bank loans:

Characteristics of the market area: One of the key factors in shaping an individual bank’s loan portfolio is the profile of characteristics of the market area it serves. Each bank must respond to the particular demands for credit rising from customer in its own market. A bank serving a suburban community with large number of single family home and small retail stores will normally have mainly residential real estate loans, automobile loans, and credit for the purchase of home appliances and for meeting household expenses. In contrast, a bank situated in a central city surrounded by office buildings, department stores and manufacturing establishments will typically devote the bulk of its loan portfolio to business loan designed to stock shelves with inventory, purchase equipment and meet payrolls. Of course, banks are not totally depending on the local areas they serve for all the loans they acquire. They can purchase whole loans or prices of loans from other banks, shares in loans with other banks (known as participants) or even use credit derivatives to offset the economic volatility inherent in loans for their trade territory. These steps can help to reduce the risk of loss if the local areas served by the bank incur severe economic problems.

Bank size: Bank size is also a key factor shaping the composition of the bank’s capital, which determines its legal lending limit to single borrowing customer. Larger banks typically are wholesale lenders, devoting the bulk of their credit portfolio to large domination loans to corporations and other business firms. Smaller loans, on the other hand, tend to emphasize retail credit; in the form of smaller-denomination personal cash and investment loans and homes mortgage loans extended to individuals and families, as well as smaller business loans to firms and ranches. The smaller banks are more heavily committed to real estate and a agricultural loans compared to the largest banking firms, which are more heavily committed to commercial loans.

Experience and expertise of management: The experience and expertise of management in making different types of loans also shape a bank’s loan portfolio mix, as does the bank’s official loan policy, which prohibits its loan officers from making certain kinds of loans.

Expected yield: Loan mix at any particular bank depends heavily as well as upon the expected yield to the bank that each loan offers compared t6o the yields on all other asset s the bank could acquire. Other factors held equal, a bank would generally prefer to make loans bearing the highest expected returns after all expenses and the risk of loan losses are taken into account. One way banker can assess this yield versus cost factor is to set up a cost accounting system that considers all expected revenues along with the direct and indirect cost of making each type of loan. As a general rule, a bank should make those type of loans for which it is the most efficient producer.

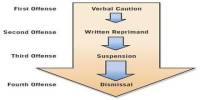

Establishing a written policy of bank loan:

One of the most important ways a bank makes sure its loans meet regulatory standards and are profitable is to establish a written loan policy. Such a policy gives loan officers and the bank’s management specific guidelines in making individual loan decisions and in shaping the bank’s overall loan portfolio. The actual makeup of a bank’s portfolio should reflect what its loan policy says. Otherwise the loan policy is not functioning effectively and should be either revised or more strongly enforced by senior management.

The most important elements of a good “bank loan policy” include:

- A global statement for the bank’s loan portfolio (i.e. statement of the characteristics of a good loan portfolio for the bank in terms of types, maturities, sizes and quality of loans).

- Specification of the lending authority given to each loan officer and loan committee (measuring the maximum amount and types of loan that each person and committee can approve and what signature are required).

- Lines of responsibility in making assignments and reporting information within the loan department.

- Operating procedures for soliciting, reviewing, evaluating and making decisions on customer loan applications.

- The required documentation that is to accompany each loan application and what must be kept in the bank’s credit files (required financial statements, security agreements etc).

- Guidelines for talking, evaluating and perfecting loan collateral.

- Lines of authority within the bank, detailing who is the responsible for maintaining and reviewing the bank’s credit files.

- A presentation of policies and procedures for setting loan interest rates and fees and the terms for repayment of loans.

- A statement of quality standards applicable to all loans.

- A statement of the preferred upper limits for total loans outstanding (i.e. the maximum ratio of total loans total assets allowed).

- 29A decision of the preferred procedures for detecting, analyzing and working out problem loan situations.

The advantages of written loan policy are that, it communicates to employees working in the loan department, what procedures they must follow and what their responsibilities are. It helps the bank move toward a loan portfolio that can successfully blend multiple objectives, such as promoting the bank’s portfolio, controlling its risk exposure and satisfying regulatory requirements. While any written loan policy must be flexible due to continuing changes in economic conditions and regulations, violations of a bank’s loan policy should be infrequent events.

Credit analysis: What makes a good loan?

The division of the bank responsible for analyzing and making recommendations on the fate of most loan applications is the credit department. Experience has shown that this department must satisfactorily answer three major questions regarding each loan application:

- Is the borrower credit worthy? How do you know?

- Can the agreement be properly structured and documented so that the bank and its depositors are adequately protected and the customer has a high probability of being able to service the loan without excessive strain?

- Can the bank perfect its claim against the assets or earnings of the customer so that, in the event of default, bank funds can be recovered rapidly at low cost and with low risk?

Risk factors of Loans & Advances:

Before loan settlement the bank must carefully remember the risk factors. The following situation and circumstances may tell upon the company’s performance. The bank can consider the factors before settle of loan.

a) Unforeseen situations and circumstances leading to bad investment.

b) Sudden change in social economic environment.

c) Continued political unrests leading to disruption in banking business.

d) Banking sector particularly nationalized commercial bank have 40% bad loan but in private sector bank this rate comparatively lower at present. In this event if investment turns bad this percentage go up therefore bear risk.

e) The bank should not encourage any hi-tech project or in any such project which involves technological risk.

f) In the event of introduction of any new laws or regulations by any regulatory body of the country may leads to risk.

g) Potential changes in global or national policy may impose risk.

Bank’s sources of credit information:

- 1. Personal interview

- 2. Financial statement

- 3. Bank’s own record

- 4. Market report

- 5. Credit information bureau

- Other sources

Factors influencing the commercial bank’s credit policy:

- Capital position of the bank

- Earning requirements

- Stability of deposits

- Experience and efficiency of the bank personnel

- Credit needs of the area served.

Features of good securities:

- Acceptability

- Ability

- Marketability

- Liability free

- Transferability

- Stability of price

- Liquidity

- Quality of the assets.

A few usual securities against banker’s advances:

- Immoveable properties

- Personal securities

- Goods and products as securities

- Marketable securities

- Documents:

- i. The main deed or the certificate copy with receipt of the land/property.

- ii. C.S, S.A, R.S khatiyan.

- iii. Non-encumbrances certificate.

- iv. Approval plan of the building that will establish on the land.

- v. Evaluation certificate of the property from the related authority.

- vi. Memorandum of deposit or title deeds.

- vii. Confirmation letter of ownership of the property from “appointed lawyer” of the bank.

- viii. Valuable goods.

- ix. Others.

Limitation on the creation of credit of commercial bank:

- Lack of available cash

- Lack of deposits

- Tendency of protect in cash

- Decrease in public savings

- Habit of customer

- Amount of initial deposits

- Credit control policy of central bank

- Condition of the business

- Influence of bad debts

- Special situations.

Handling loan problem situations:

Inevitably, despite the safeguards most bank build into there lending programs, some loans on a bank’s books will become problem loans. Usually this means the borrower has missed one or more promised payments or the collateral pledge behind a loan has declined significantly in value. Which each problem loan situation is somewhat different, several features common to most such situation should warn a banker that troubles have set in:

- Unusual or unexplained delays in receiving promised financial reports and payments or in communicating with bank personnel.

- For business loans, any sudden change in methods used by the borrowing firm to account for depreciation, make pension plan contributions, values inventories, account for taxes or recognized income.

- For business loans, restructuring outstanding debt or eliminating dividends, or experiencing a change in the customer’s credit rating.

- Adverse changes in the price of a borrowing customer’s stock.

- Net earnings losses in one or more years, especially as measured by returns on the borrower’s assets (ROA), or equity capital (ROE), or earnings before interest and taxes (EBIT).

- Averse changes in the borrower’s capital structure (equity/debt ratio), liquidity (current ratio) or activity levels (e.g., the ratio of sales to inventory).

- Deviations of actual sales or cash flow from those projected when the loan was requested.

- Sudden, unexpected, and unexplained changes in deposit balances maintained by the customer.

The processes of recovering the bank’s fund from a problem loan situation:

- Bankers must always keep the goal of loan workouts firmly in mind: to maximize the bank’s chances for the full recover of its funds.

- The rapid detection and reporting of any problems with a loan are essential; delay often worsens a problem loan situation.

- The loan workout responsibility should be separate from the lending function to avoid possible conflicts of interest for the loan officer.

- Estimate what resources are available to collect the trouble loan, including the estimated liquidation values of assets and deposits.

- Loan workout personnel should conduct a tax and litigation search to see the borrower has other unpaid obligations.

- Foe business borrowers, bank loan personnel must evaluate the quality, competence and integrity of current management and visit the site to assess the borrower’s property and operations.

- Bank workout professionals must consider all reasonable alternatives for cleaning up the trouble loan, including making a new, temporary agreement if loan problem appear to be short term in nature or finding a way to help the customer strengthen cash flow (such as reducing expenses or entering new markets) or to infuse new capital into the business. Other possibilities include finding additional collateral, securing endorsement or guarantees, recognizing, merging or liquidating the firm or filing a bankruptcy petition.

Findings of EBL

However the satisfaction level of EBL is good enough. But some customers have expressed their dissatisfaction about the EBL in various aspects. It has a profound effect on the overall satisfaction level of EBL.

- Customer’s dissatisfaction with the incremental hidden charges and service charges while dealing with ‘EBL’.

- Customer’s loose temper because of taking long time for serving their purpose. Sometime it happens because of the insincerity of the ‘EBL’ officers.

- EBL officers sometime can’t provide services within the given time to the customers because of the dependency on other department. Personnel of related department do not realize the emergency.

- Communication gap with the clients while dealing with EBL.

- Officers very occasionally show lack of enthusiasm in dealing with the customer.

- Facing a huge competition in case of introducing new product in the market.

- The employees are not professionally trained and skilled enough.

- The great problem of EBL is the absence of credit card.

- EBL does not provide evening banking.

- Lack of promotional activity is another problem that is responsible for the decline of the customer’s satisfaction of EBL.

- Service charges of EBL are comparatively higher than other bank.

Therefore, from the above findings it has been identified that the Eastern Bank Limited has some problems. The task of this research is to identify the problems that are responsible for the decline of the credit level of EBL. The problem can be solved easily through proper steps and management needs to rethink and change the strategy.

Recommendation

I have to make some recommendation based in the findings that I have got from research. The recommendation will help the bank to take necessary steps in order to increase efficiency of EBL. The following are some recommendation for the company.

- EBL should withdraw the incremental hidden charges while dealing with customer.

- EBL officers should not take so many times for their services. They should be very sincere about their services.

- The inter-departmental responsiveness should be very fast and one department should realize the emergency of other department.

- EBL should communicate with the clients regularly either by phone or postal services.

- The officers should show the enthusiasm in dealing with the customer regularly because customer is the heart of a bank.

- EBL should introduce new produce new produces and services before any one introduce it in the market.

- The EBL management should appoint the trained and skilled employee or arrange a training program for the unskilled employee.

- EBL launched the credit card because it the modern age’s demand and the bank should consider time and its demand.

- EBL should open the evening banking because some banks already stared this banking facility and taking advantages.

- EBL should emphasize on promotional activities because in the modern world promotion is one strong media to touch the people and to reach the people.

- EBL should decline the charges on different services because now rivalry is extreme in the banking sector and every bank declining the charges as much as possible to take the advantages.

Conclusion

The banking sector plays an important role in modern society and private banks have made more competitive, diversified and dynamic compare to traditional banking system. Everyday new competitors appear into the industry with better innovative ideas, products and services. In banking sector Eastern Bank Limited is a name of trust, now it is an icon of best services.

Working as an intern in the EBL, I got practical experiences of the demands of the customers and also the bank’s effort to meet them. In understanding a project, I found and evaluate the factors that are responsible for the decline of the credit level of customers of EBL. The success of a financial organization is largely dependent on the service quality promotional activity, personnel effort and distribution. From my research, it has been found that there are some problems in EBL and based on these problems I suggest some recommendations for EBL.

The reliability of the customers on EBL is increased promptly day by day. In EBL all the staffs are performing sands serving the customers untiringly. EBL keeps itself busy to serve the society, to imp rove the lifestyle of the people, to develop the business environment. EbL has been performing since 1992 but before that, it was known as BCCI and still performing well. Day by day its idea of serving is increased all over the country through setting up new branches at new places.