Customer Satisfaction Level of Standard Bank

Standard Bank had been widely acclaimed by the business community, from small entrepreneur to large traders and industrial conglomerates, including the top rated corporate borrowers for forward-looking business outlook and innovative financing solutions. Thus within this very short period of time it has been able to create an image for itself and has earned significant reputation in the country’s banking sector as setting a new standard in banking. The various programs undertaken by the Bank to enrich the quality of human resource are mainly aimed at increasing professional knowledge and skill levels of employees through training and development, in order form a well-equipped work force for providing superlative services to the customers.

In preparation of this digest both secondary and primary data sources have been used. The primary data were mainly collected while conducting the survey on customer satisfaction. The secondary data sources were the company website, the annualreports and other publicized documents of the company as well as from other books.

The report will mainly focus on what criteria Standard Bank Limited of Bangladesh is maintaining for satisfying the customers in different sectors like investment, deposit scheme, loan sanction, remittance etc.

OBJECTIVES OF THE REPORT

The objective of this report is to gather practical knowledge and experience about the Standard Bank Limited and its operations in different fields and its customer satisfaction level.

More Specific Objectives:

- To find out how its present strategy is working.

- To analyze the bank‟s performance in some key areas.

- To find out existing problems of the bank.

- To find out the customers satisfaction in services and products.

- To formulate alternative strategies for solving the problems.

THE BANK

Standard Bank Limited is a scheduled Bank under private sector established under the ambit of bank Company Act, 1991 and incorporated as a Public Limited Company under Companies Act, 1994. The Bank started commercial banking operations effective from June 06, 1999. During this short span of time the Bank had been successful to position itself as a progressive and dynamic financial institution in the country. The Bank had been widely acclaimed by the business community, from small entrepreneur to large traders and industrial conglomerates, including the top rated corporate borrowers for forward-looking business outlook and innovative financing solutions. Thus within this very short period of time it has been able to create an image for itself and has earned significant reputation in the country‟s banking sector as setting a new standard in banking. Presently it has eighty seven with two Islami window branches in operation.

The emergence of Standard Bank Limited at the junction of liberation of global economic activities, after the WTO has been an important event in the financial sector of Bangladesh.The experience of the prosperous economies of Asian countries and in particular of South Asia has been the driving force and the strategies behind operational policy option of the Bank. The Company Philosophy – “Setting a New Standard in Banking” has been preciously the essence of the legend of bank‟s success.

Standard Bank Limited has been licensed by the Government of Bangladesh as a Scheduled Bank in the private sector in pursuance of the policy of liberalization of banking and financial services and facilities in Bangladesh. In view of the above, the Bank within a period of 16 years of its operation achieved a remarkable success and met up capital adequacy requirement of Bangladesh Bank.

ASSETS VISION OF STANDARD BANK LIMITED

Industrial Credit – Term Loan

One of the vital and prerequisites of country‟s development is its industrial growth. The bank has rightly identified and carefully extended industrial Term Loan. Out of the total credit portfolio of Tk. 74049.89 million in 2013. Tk. 35737.98 million has been deployed for large and medium scale industries.

The Bank has given concentration to disburse loan in the urban area. Only Tk 1405 million (1.89%) loans have been disbursed in the rural area.

Guarantee Business

The Bank has been assisting different business houses by providing non-funded banking facilities in the form of Bank Guarantee which is most lucrative and remunerating. The total Bank Guarantee business reached around Tk.5126.10 million during 2013 which is 26.66% higher than that of the previous year.

Consumer Credit Scheme

The Bank also extends its credit to the employee against to help increasing their living standard. Around Tk. 153.23 million has been extended under the scheme under easy terms in 2013.

Commercial Lending / Working Capital

The Bank has been continuously providing working capital / commercial lending support to the small and medium entrepreneurs / business and as well as large industries. Around Tk. 5708.8 million i.e. 34.65% of the present credit portfolio has been extended in this area.

Loans to Leasing / Housing Finance Companies / Micro Finance Agencies

Standard Bank Limited has also opened up the window of financing the leasing /

Housing Finance Companies / Micro finance agencies on short, medium and long term basis for on lending / re-lending to their customers. Almost all the leasing companies have been enjoying this financing which presently amounts to around Tk. 1539.19 million and the leasing business is found to be visibly vibrant.

HUMAN RESOURCE MANAGEMENT OF STANDARD BANK LIMITED

Human resource development and management has been proved as one of the most critical aspects of attaining organizational effectiveness. Human Resource management (HRM) is concerned with the “people dimension in management.

Standard Bank Limited, since its inception, has placed equal emphasis on all the four key functions of the process of HRM- acquisition, development, motivation and retention. The various programs undertaken by the Bank to enrich the quality of human resource are mainly aimed at increasing professional knowledge and skill levels of employees through training and development, in order form a well-equipped work force for providing superlative services to the customers. The reinforcement and enhancement of motivational aspects of the employees, at the same time, have remained one of the major concerns, as we all know that “success of an organization lies in getting employees to give them little bit extra.”

Standard Bank Limited has arranged professional training programs for newly recruited probationary officers. The Bank has so far sent a number of executives for attending training for 6 countries and workshops in China, United States of America, Hong Kong, Singapore, Malaysia and India.

The Bank has developed its own training centre with both in-house and visiting faculties and resource person. To further strengthen its efficient work force has recruited fresh business graduates of reputed universities as Probationary Officer. The recruited personnel joined the mainstream of banking which would surely enrich the quality of human resources and eventually contribute towards the Bank‟s operational effectiveness and long term sustainable results.

Human resources objective of Standard Bank

Human resource objective of Standard Bank is to provide the organization‟s requirements on human resource demand on its various sectors. HR functions in Standard Bank refer to policies and practices to carry out personnel aspects of the organization. These practices and policies are the followings:

- Conducting job analysis (determining nature of each employee‟s job)

- Planning employee needs

- Selecting and recruiting job candidates

- Orienting and training new employees

- Managing wages and salaries

- Providing incentives and benefits

- Appraising performance

- Counseling and disciplining

- Training and developing

- Building employee commitment

Recruitment

There is no alternative to skilled and trained manpower in service Industry. Bearing this in mind the well-educated, promising and honest workers are being appointed and trained. Standard bank has given top priority for developing skilled manpower and introducing them with modern technologies with the purpose to develop quality customer services. Standard bank recruit experienced bankers as well as fresh university graduates. In general, the board of directors determines the recruitment policy of the bank from time to time. The minimum entry-level qualification for any official position other than supportive management is a Bachelor degree. However, informally the management prefers a minimum master‟s degree for the appointment of Probationary Officers / Management Trainee in the Executive Officer position. The recruitment for entry-level positions begins with a formal written test, which is conducted and supervised by the Institute of Business Administration, University of Dhaka. After successful completion of the written test, a personal interview is conducted for the successful candidates by a panel of experts comprising of renowned bureaucrats and prominent bankers of the country.

Training

The Bank gives utmost importance to impart training to build up quality manpower at every level and focuses on motivational devices for appropriate career progression of the employees. The Bank regularly organizes various training courses at its own Training Institute in Head Office, Bangladesh Institute of Bank Management (BIBM) and the Institute of Bankers. Apart from imparting training, officials / executives of the Bank often participate in various seminars and symposiums outside the country to acquaint them with global banking environment.

In the year 213, 72 employees were sent to BIBM for training on different Banking policies and strategies while 114 employees were also sent for foundation training at BIBM. 62 employees were sent to the different Institutions in the country for participating in workshops, symposiums etc. Besides on invitation of Foreign Banks and Organizations, 21 employees were sent in the different part of globe to attend seminars, workshop and symposiums, which made themselves aware of the latest knowledge and techniques of Modern banking.

Customer Satisfaction level Of Standard Bank Ltd.

Satisfaction is a person‟s feelings of pleasure or disappointment resulting from comparing a product‟s perceived performance (or outcome) in relation to his or her expectations. Whether the buyer is satisfied after purchase depends on the offer‟s performance in relation to the buyer‟s expectations. If the performance falls short of the expectations, the customer is dissatisfied. If the performance matches the expectations, the customer is satisfied. If the performance exceeds expectations the customer is highly satisfied or delighted. A company would be wise to measure customer satisfaction regularly because one key to customer retention is customer satisfaction. A highly satisfied customer generally stays loyal longer, buys more as the company introduces new products and upgrades existing products, talks favourably about the company and its products, pays less attention to competing brands and is less sensitive to price, offers product or service ideas to the company, and costs less to serve than new customers because transactions are routine.

One of the vital and prerequisites of country‟s development is its industrial growth. The bank has rightly identified and carefully extended industrial Term Loan. Out of the total credit portfolio of Tk. 4364.33 million in 2013. Tk. 1298.23 million has been deployed for large and medium scale industries.

The Bank has been assisting different business houses by providing non-funded banking facilities in the form of Bank Guarantee which is most lucrative and remunerating. The total Bank Guarantee business reached around Tk.436.3 million during 2013 which is 38% higher than that of the previous year.

The Bank also extends its credit to the employee against to help increasing their living standard. Around Tk. 16.00 million has been extended under the scheme under easy terms in 2013.

Graphical Analysis

The data collected with the help of questionnaires is tabulated and analyzed.

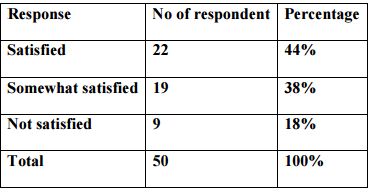

Is Branch location convenient?

Analysis

From the above we can clearly see that most of the people from the sample size are quite happy with branch location of SBL but it is not total satisfaction. Some of them also think that the location of branch should be more convenient for the customers to do their daily activities. It should be very near of their business centers or homes.

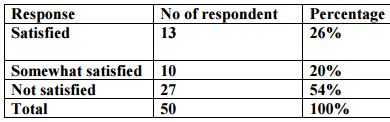

Facilities (such as ATM, Credit card, and debit card) are sufficient.

Analysis

As from the table we can see that majority 54% people are not satisfied with the facilities like ATM or Debit/ Credit card. This delivers the message that the bank has not in a satisfactory service position in terms of its facility services.

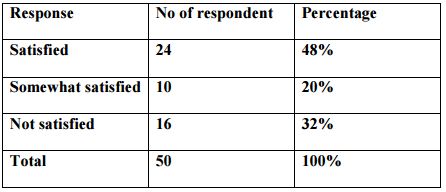

Do you think Comparing to other banks, services are efficient and satisfactory?

Analysis

From the above survey result we can say that the service comparing to other banks are quite satisfied with 48% and in between of it is 20% and the not satisfied people are also not so small. So SBL has to work really hard to get something good in near future or to be sure that they stays in the market. They have to employ good quality people in their service wings and make things faster than present.

Do you think Employees are accurate and consistent?

Analysis

The accuracy of the employees providing services is also a very important factor for any Bank. From the above we can see that response from the customers are quite satisfactory in this manner, at least 56% of the customers surveyed think that the employees are good at their job and not satisfied people are small in number. So SBL is making a good job in dealing with their customers.

Are Service charges low enough comparing to other banks?

Analysis

Service charges are one of the most important factors in customer satisfaction and from the above table we can clearly say that SBL has maintained a minimum service charge for their customers & 54% of the customers surveyed think that its charges are quite acceptable comparing to the charges of others. Somewhat are not satisfied but the portion of unsatisfied customers are regularly normal for the bank.

Are Islamic banking facilities available & satisfactory?

Analysis

Islami banking facility is one of the newest introductions of services of Standard Bank Limited. About 42% of the customer rates this service as not satisfactory because of its availability and small array of product range. There are only two Islami Banking wing in SBL so customers from other branches are not so aware of this and rates it as like.16-25% is also satisfied with its availability. SBL has to distribute these services to all of its branches to gather a good satisfaction from the customers.

Do you think Employees treat customers with proper respect?

Analysis

From the above table it reveals that 42% people are moderately & 36% people are satisfied enough with behavior of the employees. Employees should be 100% respectful to their customers and employees of this Bank are on the way to achieve it.

Though some people are not satisfied with the present situations & they think that employees should behave more respectably with their customers.

Do you think Confidentiality of Customer information is maintained?

Analysis

The high percentage of the table represents that confidentiality of the customers information is maintained with great care in the Bank. They are very much confident that bank will show respect to them by keeping safe of their confidential information. But some people are not totally confident with the bank keeping their information. They think that it would be quite risky for them to share such kind of confidential information with the bank. But this percentage is very low.

Do you think E-Banking facilities are up to the mark?

Analysis

The above table reveals that most of the people are satisfied & do agree with the quality of the E-banking facilities provided by the bank. Some think that they should do more quality service than present to satisfy all type of customers. They think banks present system is not clear & up to the mark & it should be analyzed so that mass people can interact more with the bank.

Do you think Bank Provides prompt service to customers?

Analysis

In every sector of a bank it is extremely important to perform prompt service to the customers. Performing the service immediately eliminates the chance of making errors in the first time. They have to think that customers are not annoyed with their service quality.

From the above we can clearly see that most of the people think that the bank can provide prompt service & they are quite satisfied with this effort and the number of people disagrees with this are very small in number.

Overall customer rating on Standard Bank limited.

Analysis

I have asked personally to customers what is their opinion for the overall rating for the Standard Bank limited & they gave me their direct answer to that which are shown in the table. Representing 70% of people are happy with the hank & its services but others think that they need to work really hard to make a better position in this competitive market.

Comparative Analysis

Standard Bank, in addition to contributing to economic growth, wants to achieve significant change in the communities. Standard Bank tries to improve community relations to cultivate understanding and credibility. The Bank is internally devoted to maintain Corporate Social Responsibility in numerous ways. It has excellent track record of support for charitable causes. In 2013, Standard Bank has spentTk.78.89 million as donations for education, healthcare, community development, infrastructure development, relief operations etc. We keep ourselves accountable for the social, environmental and economic impact of our operations. We design our policies and business practices to reflect the highest standards of corporate governance, transparency and social and religious ethics. The Bank raised its statutory reserve from Tk. 2489 million to Tk. 2912 million during the year 2013 which is quite significant compared to the position of the previous year Comparative Analysis.

According to the annual report on bank performance Standard Bank is the 17th most profitable Bank in the year 2013, where Janat, Agrani bank, Iaslami, IBBL and Prime Bank holds the first five positions respectively. Among the Islami Principle based banks Standard Bank stands after IBBL and AL-Aarafah Bank. Dutch Bangla Bank has highest number of accounts, ATM cards and ATM booths. SCB has highest number of organizational accounts. Foreign commercial banks like HSBC, Citibank NA and SCB get largest share of foreign exchange via L/C and other foreign exchange business. IBBL get the highest amount of foreign remittance form abroad.

INDUSTRY ANALYSIS

Industry analysis builds on customer & competitor analysis to make more strategic judgment about a market & its dynamics. One primary objective of industry analysis is to determine the attractiveness of a market to current & potential participants. A second objective of a market analysis is to understand the dynamics of the market.

The need is to identify the key emerging factors, trends & threats, opportunities, & strategic uncertainties that can guide information gathering & analysis. Porter‟s approach can be applied to an industry, but it can also be applied to a market or submarket within the industry. The basic idea is that the attractiveness of an industry or market as measured by the long-term return investment of the average firm depends largely on five factors.

A complete understanding of the competitive area helps to guide strategy design & implementation.

Rivalry among Existing Competitors

The rivalry among the competitors and the growth in the industry depends upon the intensity of competition. A high intensity of competition is observed in the banking sector of Bangladesh. There are more than 50 commercial banks in Bangladesh that fight for their own share of the market. The national banks have the highest banking network in Bangladesh. They compete against the banks with their low cost of operation and government support. Again, Standard Chartered Bank is the largest multinational banking network in Bangladesh that has its network in many metropolitans of Bangladesh. There are other international banks that also take part in the competition and aggressive in nature. This high intensity of competition makes companies difficult to sustain in the long run.

Threat of New Entrants

The next force highlights the possibility of new competitors entering the market. Existing firms may try to discourage new completion by aggressive expansion & other types of entry barriers. The banking sector of Bangladesh seriously faces the threat of new entrants. However the threat comes from two directions. The first threat comes with the arrival of the multinational banks and their branch expansion particularly due to the booming energy sector. Secondly, the continuous entries of local banks with lower cost structure also possess a severe threat to this industry.

In the context of SBL the various new & upcoming Banks pose a significant threat, being new entrants in the banking sector of Bangladesh. But SBL is aware of these potential competitors. So it is trying to expand countrywide to make the sector unattractive & to create entry barrier.

Threat of Substitute Products

This force considers the potential impact of substitutes. New products that satisfy the same customer needs are important sources of competition including alternative products in the definition of product market structure identify substitute forms of competition.

SBL continuously faces the threat of various substitute products launched by its strong competitors in the market place. For example, the launch of premier banking by SCB poses a strong threat on SBL‟s premium customer group and SBL is at a condition where it should launch an even better product. Moreover the various consumer credit schemes offered by various local banks with lower interest rates and cost also poses a strong threat on the SBL‟s personal banking products. Again the lower service charges at national banks also discourage a wide group of customers to hold account in SBL. So these are some of the threats posed by substitute products in the market place.

COMPETITIVE FORCES ANALYSIS

Michael Porter‟s Five Forces Model is an effective way to analyze the nature of competition in an industry. The model suggests the following five forces that make up the state of competition:

Rivalry among Competing Sellers

In banking industry, rivalry among competing sellers (banks) is moderate to high. Because of the following reasons:

- Major rivals are equal or „close to‟ in size and capability (revenue and volume).

- Slow market growth due to the sluggish economy.

- Exit barriers are higher.

- New private banks are snatching NCBs and each other customers by providing extra benefits.

- Depositors cost of switching banks are low.

Substitute products

There are substitute financial institutions that do many of the activities and transactions of a bank In the leasing field Industrial Leasing and Development Company Ltd.(IDLC), Industrial Promotion and Development Corporation (IPDC), United Leasing Company are the key players. They provide industrial leasing to many companies in the country. Vanik Bangladesh Ltd. (Lanka Bangla Finance Co.), a merchant bank, provides investment counseling and credit services among its other financial activities. But some of the operations of the banks like exporting/importing have no substitutes.

Threat of Potential Entry

Threat of potential entry is not that much strong, because it is a highly regulated industry. After a long time, in 1999 nine new banks started their operations and it made the industry more competitive. Some more local and foreign banks are expected to enter the market in Bangladesh within the near future to avail of the opportunities in a developing economy like Bangladesh.

In Banking industry, nationalized commercial banks are the market leaders. But due to their poor service quality their image are quite low. On the other hand though foreign banks have very little market share and limited geographic coverage, they are highly known for their quality service. Private commercial banks fall between these groups. Among the private banks, Islami Bank is comparatively in good position.

Bargaining power of customer

The bargaining power of the customer is not much of a headache here because all the rates and interests bank is receiving from the customers are duly appointed and properly monitored by the Bangladesh Bank regulatory authority. So there is no scope for any misrepresentation of data or any kind of fraud and forgery.

Bargaining power of the supplier

In banking industry, bank itself is the main supplier of its products and services, so there is no point of bargaining with the other outside suppliers.

SWOT ANALYSIS

SWOT Analysis is an important tool for evaluating the company‟s Strengths, Weaknesses, Opportunities and Threats. It helps the organization to identify how to evaluate its performance and scan the macro environment, which in turn would help the organization to navigate in the turbulent ocean of competition.

STRENGTHS

- Company Reputation in the banking industry of the country particularly among the new comers.

- The sponsor directors belong to large industrial conglomerates of the country. The Board of Directors headed by its Chairman Mr. KaziAkramUddin has earned the reputation of being a successful businessman.

- Top management the CEO and DMD the top management of the bank is also a major strength for the SBL and has contributed heavily towards the growth and development of the bank.

- Market share profitability of SBL has established a fin-n footing among the new comers in the banking industry of Bangladesh. They have already achieved a high growth rate accompanied by an impressive profit growth rate in 2009.

- Standard Bank Limited has strong financial resources to run the banking business. In the year 2009 the capital fund of the bank including paid up capital, reserves, retained earnings stood at around Tk. 2644.00 million.

- SBL has adequate physical facilities and equipment‟s to provide better service to the customers. The bank has computerized banking operations under the software called STEALER.

- SBL has earned a reputation in the banking sector for establishing impressive branches. The Gulshan Branch, Dhanmondi Branch, Uttara Branch , Agrabad Branch and the Jubilee Road Branch are the most lavish and impressive branches of SBL.

- SBL has an interactive corporate culture. Unlike other local organization, SBL‟s working environment is very friendly, interactive and informal.

- At SBL‟s mid-level and lower level management, there are often team works. Many jobs are performed in-groups of two or three in order to reduce the burden of the workload and enhance the process of completion of the job.

- Relatively less intervention from the Board of Directors compared to other banks.

WEAKNESSES

- The greatest irony is that despite claiming to be “Setting a new standard in Banking” which is used as its advertising platform and mission statement, the bank as of today has failed to develop a prescribed set of vision as it embarks in to the cyber age of twenty first century.

- Advertising and Promotionis a major set-back for SBL and one of its weakest areas. SBL does not pursue an aggressive marketing campaign.

- SBL has not recruited competent people in filling up its lower and some mid-level positions.

- Reference appointmentis one of the set-backs of SBL and will have a long-term repercussion on the quality of Human Resource.

- Disguised Employment, Currently there are “Too many heads but few hands.” Again this is related to the problem of reference appointment.

- Low remuneration package for the entry and the mid-level management is considerably low.

- Human Resources department is another weak area of SBL.

- Centralized Decision-Making,the CEO. DMD and other top management officials craft policies and strategies and then they are cascaded down.

- Noise Pollution has become another major problem SBL.

- Lack of qualified system operators and computer operators.

- Few staff meetings and departmental meetings at the branch level. This is not a good management practice.

- STEALER is modern and comprehensive banking software but it does not provide adequate support in providing the services.

OPPORTUNITIES

- SBL can pursue a diversification strategy in expanding its current line of business.

- There are several opportunities for SBL to expand its product line.

- Credit Cards and Tele banking.

- Introduction of SBL‟s own savings scheme.

- Introduction of corporate scheme.

- Separate schemes for service holders.

THREATS

- The emergence of the multinational banks and their rapid expansion poses a potential threat to the new PCB‟s.

- The upcoming private local banks can also pose a threat to the existing PCB‟S

- Contemporary Banks of SBL such as EXIM Bank, Premier Bank, Bank Asia, and Mercantile Bank are its major rivals.

- No new deposit creation is a problem and a threat faced by the whole banking sector of Bangladesh.

- As SBL is a very new organization the problem of non-performing loans is very minimum or insignificant.

Conclusion

The importance of sustaining and improving bank performance is increasing day by day. Particularly in an environment which is characterized by rapidly flourishing technology and its growing application to banking, tremendous competition, product development, shift in marketing strategy, deregulation & globalization on the one hand, and escalation in the number of bank failures accompanied by mergers and mega mergers on the contrary. In order to keep abreast with the prevailing market scenario Standard Bank limited has already strengthen its position in the industry. The Bank has grown well in its 14th year of business, expanded its coverage of financial products and customer segments and enhanced its service capabilities across multiple channels. The result achieved by the Bank reflects that it claimed to even higher operational height despite stiff competition.

To be a leading private sector bank, Standard Bank Ltd. has to apply some new dimensions in its customer satisfaction level & its products and services. Otherwise, it would be quite hard for them to keep their business position in competitive market industry. Because of without pure satisfaction from the customers no one can last longer in the market. Existing customers hope better future of Standard Bank Limited by providing best services.