Introduction

Accounting is considered as the major helping hand to form a successive management which needs to report and analyse the business transactions. Accounting is a pathway of measuring success through the designing projects as measuring the outcomes of the projects in line with the target goal of the organisations (Elliot, Barry & Elliot, Jamie, 2004). Organisations maintain their financial reports with the help of accounting theories and policies. The international financial reporting standards also help to keep the accounting practice effectively, efficiently, and correctly. The efficient management will be built if the organisation follows the international reporting standards accurately. As a mandatory course unit of myself I need to prove my understanding about the financial systems and auditing through this report. I will gradually demonstrate my understanding on the purpose, use, importance of accounting records, accounting systems, computerised accounting system, manual accounting systems, business risk, audit risk, internal and external control systems, importance of auditing, and planning audit assignment as well as preparing audit report in the body part of my report.

Task One

Purpose and Use of Different Accounting Records

Accounting records represents the management of all source of information in different records books. These records are ledger, journals, bank statements, adjusting journals, statement verification, invoice, brochure, and etc. The purpose and use of different accounting record in the following.

Purpose

To illustrate the purpose of accounting records we chose main two types of accounting record. These are journal and ledger. The journal represents the original entry. The purpose of journal entry is given below.

- Knowing the date of transaction

- Determining the accounting effect

- Recording the right amount of money

- Identifying the transaction type

Ledger is the summery of all financial activities. The final entry is recorded in the ledger. The purpose of ledger is given below.

- Sourcing data for preparing financial statements

- Identifying debtor and creditor

- Summarising of all types of information

- Controlling accounts

Use

Accounting practice basically depends upon journal and ledger. To make financial reports like balance sheet, income statements, profit and loss accounts and etc the journal and ledger are must. When a transaction occurs then it immediately recorded in the journal through identifying debtor and creditor. All transactions are reported in the ledger as an individual accounts which identify the amount of money to be gain or to be given or to be incorporated as profit. These records are used to make the organisation’s financial statements which use in the financial decision making. So the use accounting records is related from beginning of the financial transaction to the financial decision making.

Importance and Meaning of Five Fundamental Accounting Concepts

The financial statements need to follow some theories. The five accounting concepts are followed by the all organisation in maintaining accounting concepts. These are not principle, these concepts agree the rules. The meanings of five accounting concepts are as follows.

Meaning

Going Concern Concept: In this concept it is considered that an organisation or corporation will be operated for no ending date. It will not be operated for specific period. It will run for undefined time (Cardarelli, Elekdag, and Lall, 2009).

Time Period Concepts: The specific period will be considered to measure the profit of the organisation. It may be 3 months or six months, or 1 year.

Monetary Unit Concepts: this concepts says that, an organisation need to select one money unit to record its transactions and operations like US $.

Entity Unit Assumption: The business and the owner are separated from each other. The business organisation is considered as a person in this concept.

Consistency Concepts: In this concept, organisations follow the same technique to measure any functions. Organisation gets the positive output to measure the accounting decisions.

Importance

The importance of accounting records for the following outcomes.

- Save time.

- Save energy

- Provide effective decision

- Easy to understand

- Separated from owners

- Measuring actual decisions

The Factors of Influence in Accounting Systems

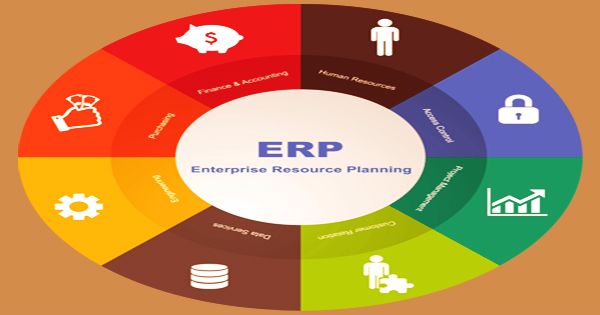

Organisations can maintain its accounting systems through the manual based accounting systems and compute based accounting systems. In this case it influenced by different factors which is discussed in the following.

Manual Based Accounting Systems

In manual based accounting systems the ledger contains the basic accounts which are found in the source of transaction. To prepare ledger in manual based accounting systems accountants mostly follow the “T” account table, which contain the columns including the running balance, running debtors and creditors, remaining balance of debit or credit columns (Chinn and Ito, 2008). This format has no influence on beginning balance of the accounts.

Computer Based Accounting Systems

The computer based accounting systems is updated and modern practice of accounting systems. In this system the beginning balance of every account need to include this represents the months-to-date total of all transaction (Davies and Drexler, 2010). The individual accounts for every fiscal period is recorded. The beginning and running balances are adjusted to bring the ending balance for the period. The computer based accounting systems is easier to find out any information in the accounting records as well as time saving.

Task Two

Business Risk and Audit Risk

The risk occurs in the business in every operation. The consequences of risk have adverse effect on the global business. Organisation makes risk management to recover the possible risks by identifying business risk and audit risk. The components of business risks as follows.

Components of Business Risks

The business risk has strong influence on the business. The components of business risks include the following risks.

- Underestimating Cash Flow

- Poor cash collection

- Risk of execution

- Risk of financing

- Risk of market

- Risk of Product

Audit Risk Vs Business Risks

| Audit Risks | Business Risks |

| Audit risks involved with transactions. | Business risks involved with operations. |

| It refers to the unqualified reports. | It refers to inefficiency in business. |

| It has three types of risks. | It has many types of risks. |

| It arises from the auditors. | It arises from the owners and others stakeholders. |

| It generates fraud. | It generates business loss. |

Table 1: Audit Vs Business Risks

Four Approaches of Managing Business Risks

The four approaches of managing risk management are risk avoidance, risk reduction, risk sharing, and risk retention. These are briefly explained in the following (Edison, Levine, Ricci, and Slok, 2002).

Risk Avoidance: This approach represents to eliminate or withdraw or not become involved with any risky activities of business.

Risk Reduction: This approach used to mitigate or optimise the risk through effective planning.

Risk Sharing: Making insurance or transferring or outsourcing the risky activities with another party.

Risk Retention: This approach means accepting the outcomes of the risks whether it positive or negative.

Control Systems

Internal control considered as a process of influencing organisation structure, its work, organisation’s flows, people of the organisation, and MIS (Management Information Systems) (Oldroyd, David & Dobie, Alisdair, 2008). It is a way of reducing fraud in the organisation that makes the audit report suspicious. It is a process of detecting and protecting the wrong doings.

Risks of Fraud

In the organisation, the company may create its fraud. If a company makes any unlawful works with its financial records then it will be considered as fraud. It is an intentional unlawful work which is also considered as crime (Friedlob, Thomas & Plewa, James, 1996). The intentional unlawful works will be detected if the auditors are efficient to its activities. The activities of auditors are the risks of fraud. As a manager will be higher efficient the risks of fraud will be greater. The characteristics of efficient auditors and the risks of fraud are as follows.

- The individual Authorization,

- Exact Book Keeping,

- Having Authority of Transaction,

- Retaining Records,

- Operating Supervision,

- Monitoring Auditors,

- Information Technology Security

- Top Level Security.

- Controlling over IT processing.

Task Three

Planning Audit with Referencing Scope, Materiality, and Risk

The importance of planning audit with the engagement of the internal audit is given below in line with the outlining the similarities and differences between internal and external audit report.

Importance of Planning Audit

The efficient audit planning has positive outcomes to the business (Porta et al, 1997). The auditor is responsible to engage the internal audit department for the following importance.

- Performing client relationship engagement

- Specific audit engagement

- Evaluating ethical requirements

- Ensuring independence

- Establishing the terms of engagement

Internal Audit Vs External Audit

The following table represents the difference between internal audit and external audit.

| Internal Audit | External Audit |

| It is integrated with the company entity. | It is integrated with the public entity. |

| Internal audit perform auditing on the company. | External auditing performs auditing on the internal auditing report. |

| The beneficiaries of internal control are management at all levels. | The beneficiaries of external control are shareholders, boards, and administrators. |

| It is used to make the recommendations and conclusions (Levine, 1999). | It is used for assess the internal report. |

| It has scope of assessing the all segments. | It has the scope of assessing the public entity. |

Table 2: Internal Vs External Control

Identifying Use of Appropriate Audit Tests

The appropriate audit reports and tests meet the organisation’s regulations, compliances, and legitimate requirements to the stake holder of the organisation. The appropriate audit tests are used for evaluation of the following activities (Andrianova, Demetriades, and Shortland, 2006).

Tests of Control

The auditor is required to perform tests of controls when the internal controls are operating effectively or when substantive procedures alone do not provide sufficient appropriate audit evidence at the assertion level. Tests of controls comprise of testing three things.

- Ensuring internal controls are appropriately designed.

- Implementing internal control operation.

- Measuring efficiency of internal control.

Substantive Testing

Substantive procedures are performed in order to detect material misstatements at the assertion level, and include tests of details of classes of transactions, account balances and disclosures and substantive analytical procedures.

- Financial statement agreement with accounting records.

- It examines the material journal entries which is based on the financial statements.

Audit Process

The constructive relationship of external audit with internal audit makes an interactive working environment for the auditing (Arteta, 2003). The audit projects are unique and the process of auditing some distinctive stages. These stages analysed in the following discussion.

Narrative Notes

Narrative notes provide a step-by-step description of the audited entity’s major systems or operations. The primary purpose of preparing narrative notes is to identify key control activities. Information for preparing narrative notes is obtained from interviewing personnel and reviewing procedures manuals and other system documentation.

Working Papers

The working papers ensure the efficient audit management through the use of auto audit management automation software. The working papers prepare annual audit plan and risk assessment, management reports, audit findings, audit assignment.

Flowcharts

The flowcharts in the audit process represent the graphical presentation of works through the flow of activities. It helps to visualise the audit process which is facilitation of the operation. Flowcharts help to analyse the operation, identifying inefficiencies, control of weakness. It is considered as the value able documentation which helps to process documents

Internal Control Questionnaire

A list of questions on a particular area or function may be developed to obtain information relating to the audit objective. The questionnaire for the internal control should be designed as the following way.

- Avoiding Ambiguities or confusion

- Narrative responsible for the response

- No requirement of obvious response

Task Four

Preparing Audit Reports

Management Letters Relating with A Statutory Audit Report

The letter of auditor to the management considered as the management letter. This letter contains the auditor’s conclusion regarding the company of the organisation. The management should have the following procedures to analyse it (Goldsmith, 1969).

- Conclusion of public accountant

- Having the policies and procedures of accounting,

- Measuring operation management

- Measuring internal control

- Pointing the problem areas

- Recommendations for improvements

Conclusion

The overall report has been designed to focus my understanding on the whole course material of financial systems and auditing. The task one is designed on the basis of understanding different accounting records, the fundamental accounting concepts, the factors of influence in the accounting systems. The components of business risk make me able to analyse the business of a one country. The fraud within the business risk makes the company unprofitable or may influence to go behind. The control and audit basically supports the accounting standards and principles. The accounting principles and concepts are used in making financial reports and statements. Organisation need to follow the accounting principle in line with the accounting standards (IMF, 2011). The audit report is made on the basis of the auditing standards of the organisation. Finally this report has focused on the basic principles, concepts, of accounting which finds the way to evaluate the financial statements through the audit report in line with the audit standards which are followed by organisations or corporations within a country.

References

Elliot, B. & Elliot, J. (2004), Financial accounting and reporting, Prentice Hall, London, p. 3.

Thomas, F. G. and Plewa, F. J. (1996), Understanding balance sheets, John Wiley & Sons, NYC.

Oldroyd, D. and Dobie, A. (2008), Themes in the history of bookkeeping, The Routledge Companion to Accounting History, London.

Andrianova, S., Demetriades, P. and Shortland, A. (2006). “Government Ownership of Banks, Institutions, and Financial Development.” WEF Working Paper 0011. London: ESRC World Economy and Finance Research Programme, Birkbeck, University of London.

Arteta, C. O. (2003). “Are Financially Dollarized Countries More Prone to Costly Crises?” International Finance Discussion Paper 763. Board of Governors of the Federal Reserve System (US).

Cardarelli, R., Elekdag, E. and Lall, S. (2009), “Financial Stress, Downturns, and Recoveries.” IMF Working Paper WP/09/100. Washington DC: IMF.

Chinn, M. S. and H. Ito. (2008). “A New Measure of Financial Openness.” Journal of Comparative Policy Analysis 10 (3): 309–22.

Edison, H. J., Levine, R., Ricci, L. and Slok, T. (2002). “International Financial Integration and Economic Growth.” Journal of International Money and Finance 21 (6): 749–76.

Levine, R. (1999). “Law, Finance, and Economic Growth.” Journal of Financial Intermediation 8 (1/2): 8–36.

Goldsmith, R. W. (1969). Financial Structure and Development. London and New Haven: Yale University Press.

Merton, R. and Bodie, Z. (1995). “A Conceptual Framework for Analyzing the Financial System.” A paper is based on chapters 1 and 8 of The Global Financial System: A Functional Perspective, Harvard Business School Press.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A. and Vishny, R. W. (1997). 1998a. “Law and Finance.” Journal of Political Economy 106: 1113–55.

Davies, H. and Drexler, M. (2010). “Financial Development, Capital Flows, and Capital Controls.” In The Financial Development Report 2010. Geneva and New York: World Economic Forum. 31–47.

IMF (International Monetary Fund), (2011). “Recent Experiences in Managing Capital Inflows—Cross-Cutting Themes and Possible Policy Framework.” Available at http://www.imf.org/external/pp/ longres.aspx?id=4542