Introduction to the Organization

AB Bank Limited, the first private sector bank was incorporated in Bangladesh on 31st December 1981 as Arab Bangladesh Bank Limited and started its operation with effect from April 12, 1982.

AB Bank is known as one of leading bank of the country since its commencement 27 years ago. It continues to remain updated with the latest products and services, considering consumer and client perspectives. AB Bank has thus been able to keep their consumer’s and client’s trust while upholding their reliability, across time.

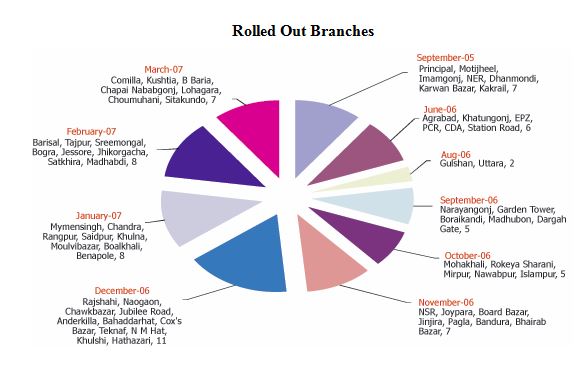

During the last 27 years, AB Bank Limited has opened 77 Branches in different Business Centres of the country, one foreign Branch in Mumbai, India and also established a wholly owned Subsidiary Finance Company in Hong Kong in the name of AB International Finance Limited. To facilitate cross border trade and payment related services, the Bank has correspondent relationship with over 220 international banks of repute across 58 countries of the World.

In spite of adverse market conditions, AB Bank Limited which turned 27 this year, concluded the 2008 financial year with good results. The Bank’s consolidated profit after taxes amounted to Taka 230 cr which is 21% higher than that of 2007. The asset base of AB grew by 32% from 2007 to stand at over Tk 8,400 cr as at the end of 2008.

The Bank showed strong growth in loans and deposits. Deposit of the Bank rose by Tk. 1518 cr ie., 28.45% while the diversified Loan Portfolio grew by over 30% during the year and recorded a Tk 1579 cr increase. Foreign Trade Business handled was Tk 9,898 cr indicating a growth of over 40% in 2008

The Bank maintained its sound credit rating in 2008 to that of the previous year. The Credit Rating Agency of Bangladesh Limited (CRAB) awarded the Bank an A1 rating in the long term and ST-2 rating in the short Term.

AB Bank believes in modernization. The bank took a conscious decision to rejuvenate its past identity – an identity that the bank carried as Arab Bangladesh Bank Limited for twenty five long years. As a result of this decision, the bank chose to rename itself as AB Bank Limited and the Bangladesh Bank put its affirmative stamp on November 14, 2007.

The Bank decided to change its traditional color and logo to bring about a fresh approach in the financial world; an approach, which like its new logo is based on bonding, and trust. The bank has developed its logo considering the contemporary time. The new logo represents their cultural “Sheetal pati” as it reflects the bonding with its clientele and fulfilling their every need. Thus the new spirit of AB is “Bonding”. The Logo of the bank is primarily “red”, as red represents velocity of speed and purity. Our new logo innovates, bonding of affiliates that generate changes considering its customer demand. AB Bank launched the new Logo on its.25th..Anniversary year.

AB Bank commits to nation to take a lead in the Banking sector through not only its strong financial position, but also through innovation of products and services. It also ensures creating higher value for its respected customers and shareholders. The bank has focused to bring services at the doorstep of its customers, and to bring millions into banking channels those who are outside the mainstream banking arena. Innovative products and services were introduced in the field of Small and Medium Enterprise (SME) credit, Women’s Entrepreneur, Consumer Loans, Debit and Credit Cards (Local & International), ATMs, Internet and SMS Banking, Remittance Services, Treasury Products and Services, Structured Finance for Corporate, strengthening and expanding its Islamic Banking activities, Investment Banking, specialized products and services for NRBs, Priority Banking, and Customer Care. The Bank has successfully completed its automation project in mid 2008. It envisages enabling customers to get banking services within the comfort of their homes and offices.

AB Bank has continuously invests into its biggest asset, the human resource to drive forward with its mission “to be the best performing bank in the country.” The bank has introduced Dress Code for its employees. Male employees wear designed ties and females wear Sharee or Salwar Kamiz, all the dresses are consisted with the unique AB Bank logo. AB is recognized as the people’s choice, catering to the satisfaction of its cliental. Their satisfaction is AB’s success

Organization Overview

Business Automation

Being the first private sector Bank of the country, this Bank has prided itself in the quality of the banking services it provides by taking conscious decision to employ the best available banking technology to serve the customers which now stands over 200,000 in all. Core Banking System Kapiti was employed alongside the manual banking operations ever since 1984. Later on in the year 2004, Misys core banking solution was selected for implementation to take AB in to super highway of real time online banking of today. Beginning, 2005 Misys implementation was taken-up and in the 1st Phase seven (7) Branches were upgraded to the new core banking system.

For the year 2006, in line with the growth strategy, service quality improvement and availability were put into focus whereupon coverage of remaining Branches under Misys became all the more important. Bank took up a massive Project of migration, connectivity, and standardization of processes and hardware throughout. A CORE TEAM was formed. The theme was YES WE CAN. We made it possible.

Software products from Misys PLC (Running)

- Core Banking Software: Equation Banking System

- Front End Software: Equation Branch Automation

- Reporting Software: Webform

Software products from Misys PLC (Implementation Phase)

- Trade Finance Software: Trade Innovation

- Internet Banking Software: Integrated Financial Module

Operating :

Over the years, AB Bank has contributed in many ways towards development of the private sector banking in the country. Many of the big industries in different fields of the economy has ABBL’s name attached and this Bank remains a proud development partner of these industrial houses over the years. ABBL thrived on customer service and relationship banking which brought new dimensions to this particular service sector and many more new entrants to banking sector followed ABBL.……………………………………………………………………………….

ABBL’s Sponsors set a vision for the Bank which reads: “To be the Trendsetter for innovative banking with excellence and perfection“. Throughout these 27 years this bank raised the bar for itself through services, initiatives, products, customer support and performance towards that visionary path.…………………………………………………………………………

At the beginning of the year 2005, Board took the mission for the year as “a year of consolidation and growth”. In line with that, year 2006 was identified to be the year of “financial re-structuring and growth“. Sponsors of the Bank remain committed to take AB into next higher level of banking on a strong financial footing and with appropriate systems and processes in place.………………………………………………………………………………………………….

Being a financial institution, this bank is exposed to the entire gamut of economic developments and activities both within and outside the country

Million Taka | |||||

| December 31 | 2008 | 2007 | % Change | ||

| Gross Interest Income | 7,366.85 | 5,269.90 | 39.79 | ||

| Net Interest Income | 2,030.69 | 1,439.28 | 41.09 | ||

| Operating Profit (PBP & T) | 4,298.39 | 3,325.29 | 29.26 | ||

| Net Operating Profit (PBT) | 3,600.62 | 2,817.99 | 27.77 | ||

| Profit after Tax (PAT) | 2,300.62 | 1,903.49 | 20.86 | ||

| Deposits | 68,560.47 | 53,375.35 | 28.45 | ||

| Loans & Advances | 56,708.77 | 40,915.35 | 38.60 | ||

| Total assets | 84,053.61 | 63,549.86 | 32.26 | ||

| Shareholders’ Equity | 6,722.51 | 4,511.59 | 49.01 | ||

| NIM% | 2.75 | 2.58 | |||

| Non Interest Income to Operating Income (%) | 66.98 | 69.09 | |||

| Cost Income Ratio | 62.57 | 28.59 | |||

| Return on Equity – ROE (%) | 40.96 | 42.19 | |||

| Return on Assets – ROA (%) | 3.12 | 3.41 | |||

| Advance Deposit Ratio (%) | 82.71 | 76.66 | |||

| Capital Adequacy Ratio | 12.84 | 10.75 | |||

| NPL as % of Advances | 2.99 | 4.31 | |||

| Earnings per Share (Tk.) | 103.18 | 85.37 | |||

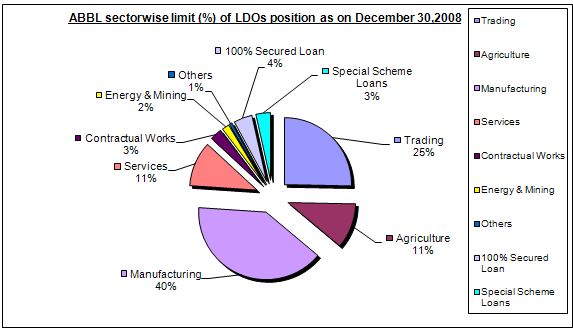

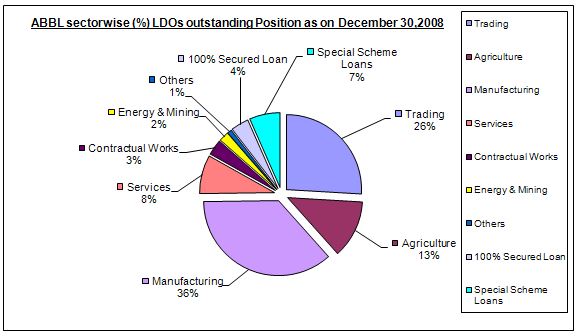

Industrial sector | SIC Code | Limit | % | Outstanding | % | A/C |

| Trading | 1000 | 15,064,919 | 25% | 12,130,869 | 25% | 3323 |

| Agriculture | 2000 | 6,444,920 | 11% | 5,477,990 | 11% | 393 |

| Manufacturing | 3000 | 23,816,061 | 40% | 18,695,354 | 38% | 1491 |

| Services | 4000 | 6,427,150 | 11% | 5,376,696 | 11% | 235 |

| Contractual Works | 5000 | 1,693,475 | 3% | 1,108,986 | 2% | 227 |

| Energy & Mining | 6000 | 1,016,647 | 2% | 945,776 | 2% | 51 |

| Others | 7000 | 393,408 | 1% | 350,843 | 1% | 42 |

| 100% Secured Loan | 8000 | 2,633,006 | 4% | 2,098,487 | 4% | 1118 |

| Special Scheme Loans | 9000 | 2,095,618 | 4% | 2,730,863 | 6% | 174 |

59,585,204 | 100% | 48,915,864 | 100% | 7054 |

Products & Services

Retail Banking

Unsecured Loans

| Product Name | Personal Loan |

| Loan Amount | Minimum Tk. 25,000.00 Maximum Tk. 5,00,000.00 |

| Tenor | Min 12 months Max 36 months |

| Rate of Interest | 14.50% p.a. – 17.50% p.a. |

| Security | Hypothecation of the product to be purchased. Two personal guarantees (as per our list of eligible guarantors) |

| Product Name | Auto Loan |

| Loan Amount | 70% for the brand new car 60% for the reconditioned car but must not exceed BDT 10,00,000.00 |

| Tenor | For Reconditioned Car: Max 36 months For Brand new Car: Max 60 months |

| Rate of Interest | 14.50% p.a. – 17.50% p.a. |

| Security | Hypothecation of the vehicle to be purchased. Two personal guarantees (as per our list of eligible guarantors) |

| Product Name | Easy Loan (For Executives) |

| Loan Amount | Minimum Tk. 50,000.00 Maximum Tk. 3,00,000.00 |

| Tenor | Min 12 months Max 36 months |

| Rate of Interest | 16.00% p.a. |

| Security | Letter of confirmation from the employer. One personal guarantee (as per our list of eligible guarantors) |

| Product Name | Gold Grace – Jewellery Loan |

| Loan Amount | Minimum Tk. 50,000.00 Maximum Tk. 3,00,000.00 |

| Tenor | Min 12 months Max 36 months |

| Rate of Interest | 16.00% p.a. |

| Security | Letter of confirmation from the employer. Personal guarantee from the parents and spouse (if married) |

| Product Name | House/Office Furnishing/Renovation Loan |

| Loan Amount | Minimum Tk. 1,00,000.00 Maximum Tk. 10,00,000.00 |

| Tenor | Min 12 months Max 48 months |

| Rate of Interest | 16.50% p.a. |

| Security | Title deed of the House/Office to be furnished/renovated along with memorandum of deposit of title deed duly supported by a notarized power of attorney to be kept by the bank as a matter of comfort. Two personal guarantees (as per our list of eligible guarantors). Registered mortgaged of the property if the loan amount is more than Tk. 5.00 lac |

| Product Name | Staff Loan |

| Loan Amount | According to the debt burden ration and other criteria |

| Tenor | Min 12 months Max 36 months |

| Rate of Interest | 15.50% p.a. |

| Security | Hypothecation of the product to be purchased |

| Product Name | Education Loan |

| Loan Amount | Minimum Tk. 50,000.00 Maximum Tk. 3,00,000.00 |

| Tenor | Min 12 months Max 36 months |

| Rate of Interest | 14.50% p.a. – 16.00% p.a. |

| Security | One personal guarantees (as per our list of eligible guarantors) |

Secured Loans

| Product Name | Personal Loan |

| Loan Amount | Maximum 95% of the present value of the security |

| Tenor | Min 12 months Max 36 months |

| Rate of Interest | 13.50% p.a. – 16.50% p.a. (subject to type of the security). 2% spread must be maintained in case of own bank FDR |

| Security | Lien over FDR, BSP, ICB Unit Certificate, RFCD, NFCD, CD account(s) etc. One personal guarantee in case of third party cash collateral (as per our list of eligible guarantors) |

| Product Name | Personal Overdraft |

| Loan Amount | Maximum 95% of the present value of the security |

| Tenor | Revolving with annual review |

| Rate of Interest | 13.50% p.a. – 16.50% p.a. (subject to type of the security). 2% spread must be maintained in case of own bank FDR |

| Security | Lien over FDR, BSP, ICB Unit Certificate, RFCD, NFCD, CD account(s) etc. One personal guarantee in case of third party cash collateral (as per our list of eligible guarantors) |

| Corporate Banking |

| At AB Bank provide complete range of solutions to meet Corporate Customers’ requirement. Corporate Banking solutions include a broad spectrum of products and services backed by proven, modern technologies………………………………………………………………………………………… |

Corporate.Lending

Ttheir specialist teams offer a comprehensive service providing finance to large and medium-sized businesses based in Bangladesh…………………………………………………………………………….

Following are some of the products and financial tools of Corporate Banking:

- Project Finance

- Working Capital Finance

- Trade Finance

- Cash Management

- Syndicated Finance, both onshore & off-shore

- Equity Finance, both onshore & off-shore

- Corporate Advisory Services

| SME Banking | |

| SME.Loan Considering the volume, role and contribution of the SMEs, in the last two decades AB Bank has been patronizing this sector by extending credit facilities of different types and tenor. As of now 54% of the bank’s total loan portfolio is segmented to the SMEs which deserve all out attention in our plans, projections and forecasting……………………………………………………………. | |

As such the bank has emphasized on the following issues:

- To provide the best services to the SME sector

- To increase the SME portfolio of ABBL significantly

- To improve the quality of ABBL’s portfolio

SME Sectors in which AB Bank has participated so far:

- Agro machinery

- Poultry

- Animal Feed

- Dairy Product

- Fruit Preservation

- Hotel & Restaurants

- Garments Accessories

- Leather products

- Plastic product

- Furniture : Wooden & Metal

- Ink

- Paint

- Printing & Packaging

- Wire & Cable

- Aluminum

- Cement and Lime Plaster

- Clinics and Hospitals

- Engineering & Scientific Instruments

Safe Deposit LockerLocated at select branches in cities all over the country, lockers ensure the safe keeping of valuables.

Advantages / Key Benefits:

- Wide Availability.

- Lockers available in various sizes. i.e. Small, Medium and Large with varying rents.

- Lockers are rented out for a minimum period of one year. Rent is payable in advance.

- The rent may be conveniently paid from your deposit account with us.

- Direct debits for locker rentals from customers account rid them of the hassles in writing out cheques.

Our main focus in this report is to know about the technologies used by AB Bank and about their operating performance. Through our findings we came to know that this bank uses management information system in every department like:

- IT

- marketing

- customer service

- Treasury

- Merchant baking

They use various types of modern software to run their operations. These soft wares include:

Core Banking Software: Equation Banking System

Misys Equation is a fully integrated, real-time, multi-currency retail banking solution that helps organizations deliver competitive products and excellent service to customers. It supports consumer and corporate banking as well as treasury operations on a single platform.

Software products from Misys PLC (Running)

Core.Banking.Software:.Equation.Banking.System

Misys Equation is a fully integrated, real-time, multi-currency retail banking solution that helps organisations deliver competitive products and excellent service to customers. It supports consumer and corporate banking as well as treasury operations on a single platform.

Front End Software: Equation Branch Automation

Equation Branch Automation is designed to support customer-facing staff within a retail branch banking environment. The Equation Branch Automation system is already tightly integrated with the Equation core banking server, and provides ready-to-run functionality to support cashiers, personal bankers and relationship managers.

Equation Branch Automation allows online, real-time transaction processing for the Equation Banking Server, with immediate access to account and transaction information and verification of availability of funds.

Reporting software: WebForm

Webform applies the latest web-based technology to the Equation banking system. Reports are automatically captured and delivered to users as web pages over the bank’s internal network, removing the need to print and distribute paper versions of reports. Report data is available as web pages, as Excel spreadsheets, and for analysis using multi-dimensional PivotTables. Reports can also be distributed automatically as emails, enabling people who do not have direct access to the system to be kept informed with the latest data.

Webform will capture existing reports, run and deliver user-defined reports, and provide an enquiry system for any previous business date, making it an invaluable management-reporting tool. Using the PivotTables built from Equation reports and associated databases, users can filter and manipulate the data to isolate key elements of information for analysis purposes. Once they have generated the required view of the data, users can drill down to see details of the underlying accounts.

Software products from Misys PLC (Implementation Phase)

Trade.Finance.Software:Trade.Innovation

TI has been designed with advanced workflow management to streamline the entire transaction lifecycle and the overall workflow of the trade finance operation. TI allows the bank to define service level agreements (SLAs) for each customer. The bank can apply either customer groupings (e.g. gold, silver, bronze) or bi-lateral agreements for individual customers. The factoring capability in TI is optimised for trade receivables financing available. Finance is calculated on the agreed, discounted total of eligible receivables available on any one day. Drawings are processed at the express request of the customer.

Internet.Banking.Software:.Integrated.Financial.Module

Equation IFM offers powerful features for business customers. Customers can administer their own user communities, with different levels of access to customer and account information and transactions. Each user can have a pre-defined authorisation limit, simplifying control and reducing risk.

These technologies help ABBL to become one of the leading banking organizations in Bangladesh. Though they think they are lacking the Anti Money Laundering system which is an enterprise solution that takes a risk-focused approach to the critical task of monitoring for suspicious activity. The solution applies advanced analytics and scenarios against customer and transactional data from all areas of the enterprise to automatically identify, classify and surface suspicious behavior. Once identified, a seamless workflow enables the investigative function to proceed with increased effectiveness and efficiency. But they are trying to get this software as soon as possible. Other wise they think their service is an on going process which is yet to be developed.

Now a days AB Bank is using modern information technology in case of providing services. To know the systems of Management information of AB Bank we tried to get the below information.

What are the available information technologies?

- Misys core banking solution.

- Mail server

- Website

- Core Banking Software: Equation Banking System

- Front End Software: Equation Branch Automation

- Reporting software: WebForm

In which sectors management information technology has been used?

- IT

- marketing

- customer service

- Treasury

- Merchant baking

- Every department

Is there any information systems department available?

Ans. Yes, We have IT department.

Who is the provider of available information system?

- Microsoft

- Mysis, UK

What are the non uses information technologies?

Ans. There is not AML (Anti Money Laundering) SYSTEM yet.

How they can get the unavailable information system?

Ans. We are trying to get this software as soon as possible.

Is the company follows the E-BUSINESS, E-COMMERCE, and E-GOVERNMENT or not?

Ans. We have official website of AB Bank. Our E-banking service is on going process not yet done.

Find out the problem AB Bank facing for not using the management information technology.

Ans. As far I think AB Bank is not facing any problem right now.

Is AB Bank use information system incase of competitors and satisfaction customer?

SMS banking

AB bank is very well known bank in Bangladesh. There management information system is quict good. There technological system is on satisfied level. But as their customers we can recommend. Some of our recommendation given below:

- AB should Expand ATM both.

- They should think about E-Banking.

- They should reduce their transaction cost on ATM both.

- They should upgrade their networking system.

- AB bank can recruit more experts on IT sector.

- They can start on line transaction.

- They can start SMS banking

As a first private Bank in Bangladesh AB Bank has proved that they believe in modern Information technology system. We can see that AB Bank uses many kinds of technology like core Banking software, Front end software, Reporting software, Trade finance software, Internet banking software, global economy etc. In order to operate Banking system, it must deal with many different pieces of information about suppliers, customers’ employees, invoices and payments, and their services. AB Bank start SME loan system for helping the customer like businessman.

AB Bank organize work activities that use the information to operate efficiently and enhance the over all performance of the bank. Information systems make it possible for AB Bank to manage all their information, make better decisions, and improve the execution of their business processes.

Using information technology AB Bank started electron debit card. Using modern information system AB Bank uses safe deposit locker, money transfer-Western Union, Foreign remittance through exchange house.

It is important to pay close attention to business processes and information system. And by looking over well it has prove that AB Bank is such a great sector which is using information technology and make a place for themselves in modern technology system.