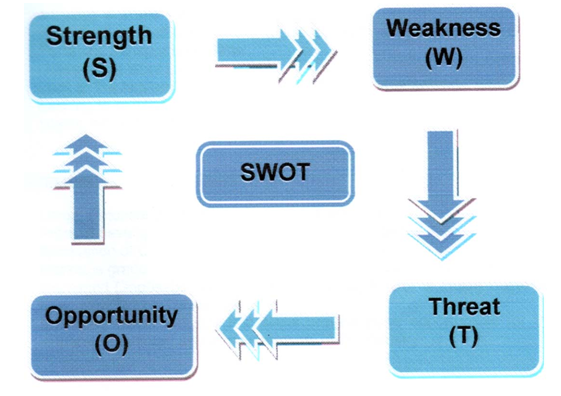

SWOT Analysis

SWOT analysis enables an organization to have a comprehensive insight about its current position in the industry compared to the competitors. It provides the organization a scope to improve strategically its position in the market. Here, the internal strengths and weaknesses of Prime Bank Limited as well as the external opportunities and threats are discussed.

Strengths:

- Good Customer Service: Prime Bank Limited provides quality services to the clients compared to its other contemporary competitors. The bank has a very good relationship with its customers. The bank believes in maintaining personal relationship with the customers. One of the major goals of this bank is to build long-term relationship with the customers and to create value for them.

- Innovative Products: Prime Bank Limited has offered various kinds of deposit schemes by which people have opportunity to save their small money and bank is able to earn more for themselves for their clients. Comparatively Prime Bank Limited offers more number of deposit schemes to customers.

- Efficient Administration: Prime Bank Limited has an efficient administration. The work is done in a timely and systematic manner for which the efficient administration is responsible. There is close relationship between the employees and management though the chain of command is maintained strictly. Overall, there is a good balance between the administration and the employees.

- Capital Adequacy: Prime Bank Limited is maintaining a strong capital base. By the end of December 2007, the capital adequacy ratio was 11.50%. The bank has now increased its authorized capital to 4000 million for its expansion program.

Weakness:

- Technology: One of the major weaknesses of Prime Bank Limited is the technology used by the bank. With the change of time, technological advancement is essential to survive in the competition.

- Promotion: When an employee gets a promotion to the next level, he/she gets more compensation. Prime Bank Limited is regular in giving promotion but the employees get later effect of this promotion.

- Training: Prime Bank Limited has its own training institute PBTI (Prime Bank Training Institute) to strengthen the capabilities of human resources. However, there is a lack of specific training for specific jobs. As a result, the employees have to learn things from the job by doing it practically.

Opportunity:

- Branch Expansion: Prime Bank Limited is growing quickly all over the country. Besides expanding in the urban areas, Prime Bank Limited has prospects to open more branches that will eventually enhance the government’s effort at receiving the rural economy as well as reaching more people by better service.

- Training Facility: Prime Bank Training Institute (PBTI) is supporting the bank by offering in house training courses, workshops and seminars. As the bank has its own training institute to enhance the capability of human resources, Prime bank Limited can use this opportunity to train their employees in specific areas and create specialized and expert people for the bank.

- Banking Software: Quality service providing is a major goals of Prime bank limited. Though Prime Bank limited is still lagging behind in upgrading their software system, the bank has the prospect to select high quality banking software, which will make the banking operations easier and smooth.

Threats:

- Level of Competition: Competition is always a major threat for any organization. In recent years, the number of private bank is increasing. These banks always pose a threat for others by coming up with new product line, innovative technology, quality services, etc. Thus, the level of competition rises and creates threats for Prime Bank Limited.

- Technological Advancement: With time, technology is getting advancement and most of the private banks are upgrading their operating system to survive in the industry. Prime bank Limited is lagging behind in this department and still mostly dependent on manual work rather than technology. Advancement of technology is posing great threat for Prime bank Limited.