Here the case study naming Blueprinting the Service Profit Chain is a clear demonstration to analyze the service of the operations management. The field of operations management has been criticized for the inadequacy of its theory. We suggest that this criticism may be too harsh and further, that many building blocks of theory are prevalent in the body of existing research. This paper has two goals. The first is to suggest that careful organization of our thinking can lead to useful, productive theories in operations management that demonstrate all the hallmarks of the familiar theories of natural science to the Chief Executive Officer of the bank. We discuss the nature of scientific inquiry in general terms, and examine the implications for what should be expected from theory in operations management. Our second goal is to illustrate through examples how such theories and their related laws might be developed (Banker et al, 1988). Two theories are proposed: the Theory of Swift, Even Flow, and the Theory of Performance Frontiers. The Theory of Swift, Even Flow addresses the phenomenon of cross-factory productivity differences. The Theory of Performance Frontiers addresses the multiple dimensions of factory performance and seeks to unify prior statements regarding cumulative capabilities and trade-offs. Implications drawn from the theories are discussed and concluding remarks suggest the advantages of future theory development and test. This report will demonstrate the case study of service profit chain from viewpoint of operations management perspective. The analysis is as follows.

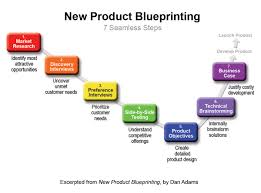

Understanding Service Blue Print

The service blueprint is a technique used for service innovation (Cross and Silvestro, 2000). The technique was first described by Lynn Shostack, a bank executive, in the Harverd Business Review in 1984. The blueprint shows processes within the bank, divided into different components which are separated by lines.

Building a blueprint

The process of structuring a blueprint involves six steps in our discussion. The continued growth of the mining sector in Western Australia, the Community Bank of Perth had experienced a strong growth in all areas of its business. So this structure should as follows to make a blueprint of a service bank. Here we will develop a blueprint considering the comments of the customers.

- The identification of the service process, that is supposed to be blueprinted

- The identification of the customer segment or the customers that are supposed to experience the service

- Picturing the service from the customer’s perspective

- Picturing the actions of the contact employee (onstage and backstage), and/or technology actions

- Linking the contact activities to the needed support functions

- Adding the evidence of service for every customer action step

Motivations for an Enhanced Blueprint for Community Bank of Perth

Traditionally, service blueprints have been done entirely with lines and text boxes to depict anything from user actions to support processes in Community Bank of Perth. Our research explores how to introduce new elements to the blueprint for capturing the meanings of new blueprint plan for the Bank service or emotional qualities that the customer experiences during key moments of the service. Our motivation is to augment the listing of customer-provider actions with some working form of a bellwether that could be used to temper the ups and downs of the customer’s relationship with the provider. Attending to this relationship is an important factor in maintaining and sustaining the customer base, as the customer’s emotional state during the service contributes to their overall perception of the service. The following facts will be considered to make a new service blueprint.

Customer Actions

This component contains all of the steps that customers take as part of the service delivery process of the loan and deposit. This element is always on top of the service blueprint.

Onstage / Visible Contact Employee Actions

This element is separated from the customer actions by a ‘line of interaction’. These actions are face-to-face actions between employees and customers.

Backstage / Invisible Contact Employee Actions

The ‘line of visibility’ separates the Onstage from the backstage actions. Everything that appears above the line of visibility can be seen by the customers, while everything under the line of visibility is invisible for the customers. A very good example of an action in this element is a telephone call; this is an action between an employee and a customer, but they don’t see each other in loan processing.

Support Processes

The ‘internal line of interaction’ separates the contact employees from the support processes. These are all the activities carried out by individuals and units within the bank who are not contact employees. These activities need to happen in order for the service to be delivered.

Physical Evidence

For each customer action, and every moment of truth, the physical evidence that customers come in contact with is described at the very top of the service blueprint. These are all the tangibles that customers are exposed to that can influence their quality perceptions in banking activities.

Understanding Operations Management

Operations management is an area of management concerned with overseeing, designing, controlling the process of production and redesigning commercial activities in the production of goods and/or services (Chun et al, 2009). It involves the responsibility of ensuring that business operations are efficient in terms of using as few resources as needed, and effective in terms of meeting customer requirements. It is concerned with managing the process that converts inputs (in the forms of materials, labor, and energy) into outputs (in the form of goods and/or services).

The relationship of operations management to top management in commercial contexts can be compared to the relationship of line officers to highest-level senior officers in military science. The highest-level officers shape the tactics and revise it over time, while the line officers make technical decisions in support of carrying out the strategy. In business as in military affairs, the boundaries between levels are not always distinct; tactical information dynamically informs strategy, and individual people often move between roles over time. The operations management will focus on the following tactics which is as follows.

Customer Care

Customer care has been identified as a vital component of success of Community Bank of Perth and “a commercial must” (McAtersney, 1999). Effective customer support and care is an important aspect of businesses irrespective of whether a bank is related to the manufacturing or services sector (El Sawy and Bowles, 1997). Researchers have found that banks are giving increasing importance to their customers and are looking for more ways to create value for them with the intention of changing their relationship with customers from “one of selling and order taking” “into one of solution finding and partnering” with the intention of facilitating long term customer relationships through customer care, support and services with the bank (El Sawy and Bowles, 1997).

Kaizen

Kaizen refers to “continuous improvement” of employees and organizations, and is the foundation “for all lean initiatives” in which the primary objective is to facilitate productive changes in workplaces with the help of “solid planning and smart implementation to the bank (Ortiz, 2006). We will focus on Kaizen, which focuses at commencing transformation by bringing about improvements which could sometimes be minute and unobvious but aim at having clean and organized workplaces.

We will initiate a kaizen program is initiated to make certain changes in the bank processes for an increase in profitability by eliminating anything that is waste and unnecessary. The Kaizen approach is similar to customer care which is also based on commencing enhancement at the workplace by valuing customers as potential sources of information which serve to enable managers to bring about improvements. Both, Kaizen and customer care seek improvements of the workplace and employees but the former approach involves the elimination of all kinds of wastes and facilitating change through lean, whereas in the case of customer care, change takes place with the help of relationship building with clients which are the ultimate resources for change.

Just-in-Time

Just-in-Time refers to the philosophy which was first originated in Japan with regard to management and has been popularly used in Japanese organizations since the early part of 1970 (Cheng et al., 1996). The community bank of Perth need to initiate Just-in-Time philosophy was initiated and utilized by Toyota owner Taiichi Ohno, who is the initiator of this approach and has ever since been used a successful model of business in organizations in Japan and worldwide.

Just-in-Time philosophy was originally invented and put into practice for meeting the needs and demands of customers of Toyota without causing any kind of delays or inconveniences to them (Goddard, 1986). This approach implies several requirements including having the precise items necessary in accurate quantities appropriate to a particular given time, so that there is elimination of all wastes and focus on lean manufacturing.

Total Quality Management in Banking Operation

Total Quality Management (TQM) refers to a philosophy in management which aims to improve the performances of businesses so that they can gain advantage over their competitors through a strategic approach of fulfilling the needs and requirements of all customers (Agus, 2005; Pino, 2008). Total Quality management focuses on the quality of goods and services being offered to customers, thereby directly improving the performance of the bank. As such, the primary objective of quality management practices “is to produce improvement in operative and business performance”, where operative performance relates to “customer satisfaction or the optimal quality of products and services while business performance is enhanced by improved financial results (Pino, 2008). By adopting the TQM philosophy or approach, organizations seek to undertake fundamental changes and paradigm shifts in the manner in which they conduct business and several alterations are made with regard to the business being managed as a complete system rather than separate processes.

Service Profit Chain

The service-profit chain establishes relationships between profitability, loyalty of customer, and, satisfaction of employee, loyalty, and productivity. The links in the chain (which should be regarded as propositions) are as follows:

Profit and growth are stimulated primarily by customer loyalty in loan payment setup. Loyalty is a direct result of customer satisfaction. Satisfaction is largely influenced by the value of services provided to customers (Reichheld et la, 1990). Value is created by satisfied, loyal, and productive employees. Employee satisfaction, in turn, results primarily from high-quality support services and policies that enable employees to deliver results to customers. The service-profit chain is also defined by a special kind of leadership that emphasizes the importance of each employee and customer. here we need to look over the Harvard University research.

Harvard University Research for Banking Operation

The Service-Profit Chain is a theory and business model evolved by a group of researchers from Harvard University in the nineties. In their subsequent book The Service Profit Chain – How Leading Banks Link Profit and Growth to Loyalty, Satisfaction and Value they prove there is a direct link between superior service experiences, customer loyalty, and financial performance (profit and growth). In an article in the Strategic Management Journal she argues that they haven’t found any hard data supporting the concept (Heskett et al, 1994) .

The framework for Retail Banking

The Community Bank of Perth need to develop the The framework of the service-profit chain for retail banking consists of the following elements:

1 Profitability and Revenue Growth – Most banks strive towards profit and growth

2 Customer loyalty – Banks with profit and growth are characterized by a large number of loyal customers and that execute well against the 3 Rs: retention, repeat business, and referrals

3 Customer satisfaction – Loyal customers result from satisfied customers by having service designed and delivered to meet targeted customer needs

4 External Service Value – Satisfaction depends on the bank’s ability to create value for the customer through a well defined service concept

5 Employee retention – Value is created by loyal employees

6 Employee productivity – Satisfied and loyal employees are far more productive

7 Employee satisfaction – Employee loyalty is driven by employee satisfaction

8 Internal service quality – To engage employees and ensure employee satisfaction the bank has to build up the best possible internal quality through effective workplace design, job design, employee selection and development, employee rewards and recognition, and tools for serving customers.

Linking the Service-Profit Chain

Customer loyalty drives Profit and Growth

The service-profit chain research suggests that customer loyalty is the key determinant of profitability “Zero Defections: Quality Comes to Services.” HBR September-October 1990). This same research suggested that a 5% improvement in customer loyalty results in a 25-85% improvement in profits.

Customer satisfaction drives Customer Loyalty

There are two things about loyalty which are important to notice. A satisfied customer is not automatically a loyal customer. It’s only the super satisfied customers who become loyal. That is why ‘satisfied’ is not enough in a world of abundance which is the situation for many banks today. Add to that the tough reality that what we considered fantastic last year is what we expect this year. The expectations of the customer change all the time. If a bank wants to maintain the loyalty it has to get better and better (Hurley and Estelami, 2007).

The Community Bank of Perth found that customers that rated those 5 (on a 1-5 customer satisfaction ranking) were six times more likely to repurchase Xerox equipment versus those at the 4 rating level. The Community Bank of Perth coined the term apostles to characterize the customers that rated them a 5. Just as important is to avoid creating terrorists: customers that become so upset the make it a point to speak out about the poor service they received at every opportunity.

Loyal customers are more likely to tell others about their loyalty than just satisfied customers. So we need to increase the loyal customer for our expansion of our business. Excited customers tell other people about their experiences and create ambassadors for the bank. They become loyal customers and they keep returning.

Value drives Customer Satisfaction

The primary determinant of customer satisfaction is perceived value – which the customer has gained more from the product than he or she thinks it is worth. Value often has an emotional aspect that makes an experience particularly memorable for the customer. The key to create value is the ability to bond emotionally with the customers and create emotional wow experiences. By Underlying this is being very clear about the targeted service concept for the targeted customers.

Employee Productivity drives Value

Value is a direct result from having engaged productive employees in the Community Bank of Pert. In this case value has to do with the employee’s ability to act on the wishes and needs of the customers and find solutions that work within the framework of the bank. Productive employees also have a high degree of product knowledge and customer knowledge. This is why employees who have served quite a few years in the bank usually are much more productive than new employees.

Employee Loyalty drives Productivity

Employee loyalty is driven by enthusiasm and satisfaction. To be able to create excited customers and contribute to memorable experiences you need to be excited as an employee as well. This implies that the employees must be happy with their jobs to have what it takes to effectively engage the customer in this way they treat the customer. In this case loyal refers to considerate employees who have longer tenure with the bank and have great knowledge of customers, processes and the culture within the bank. It is also important to understand the negative: the real cost of employee turnover, and not managing retention, is the loss of productivity and decreased customer satisfaction.

Employee Satisfaction drives Loyalty

The research behind the service-profit chain shows that low employee turnover can be linked to high customer satisfaction.

Internal Quality drives Employee Satisfaction

Employee satisfaction is rather easy to achieve. To achieve real excitement is far more difficult and much more complex. In the service-profit chain employee satisfaction is a result of ‘internal quality’ which is measured by the feelings that employees have toward their jobs, colleagues, and banks. This is related to a number of elements that have to be present to ensure employee satisfaction such as workplace design, job design, employee selection, training and development, rewards and recognition, and tools for serving customers.

Internal quality ensures the employee’s motivation. It’s important to underline that motivation has to do with both job context and job content. The job context is the external conditions such as fringe benefits and wages. However, this is not the most important aspect of motivation. The context merely prevents demotivation. The determining factor for motivation and employee satisfaction is the job content. The moment we contribute with something meaningful it gives us a high degree of motivation.

Leadership Underlies the Chain’s Success

A service-profit chain leader develops and maintains a culture that is focused on service to customers and fellow employees in the banking activities. They are also effective listeners with both the ability and willingness to listen. These are high engagement leaders that spend time with their employees and customers, test their service delivery processes, and actively seek employee suggestions for improvement. In addition, they demonstrate real care and concern for employees as demonstrated by how they select them, tracking and guide their development, and proactively recognize them to the organization.

Conclusion

The personnel estimates are use to level the workload. This is accomplished by moving tasks so each day, week, and month has the proper number of work hours assigned. To accommodate changes in seasonal flow, vacations, and maintenance requirements it may be necessary to schedule more or less work on a specific week or month. With the continued growth of the mining sector in Western Australia, the Community Bank of Perth had experienced a strong growth in all areas of its business. One area that seemed to be booming was the refinancing of home loans. Prospective and current customers were searching for more economical loans, and the applications for refinancing were being received in ever-increasing numbers. In order to handle the increased volume, the bank developed a new loans approval process. Most banking operations are stochastic because of uncertainty in the timing of customer orders or the receipt of purchased material and because of variability in the processing and set-up times caused by various disruptions (Luthans & Peterson, 2001). All this increases congestion and consequently inflates lead times and creates excess inventories. In a time based production environment that’s exactly what we want to avoid. So the basic question is how to handle congestion, how to take advantage of the trade-offs between various performance measures such as work-in-process, lead-times and investment in capacity. Insights from queuing theory are of great help here.

Reference

Heskett, James L., Jones, Thomas O., Loveman, Gary W., Sasser, W. Earl, and Schelsinger, Leonard A (1994). “Putting the Service Profit Chain to Work”, Harvard Business Review, (March-April 1994) 164-174

Heskett, James L., Sasser, W. Earl Jr., and Schlesinger, Leonard A. The Service Profit Chain: How Leading Companies Link Profit and Growth to Loyalty, Satisfaction, and Value. The Free Press, New York, 1997.

Chun, Rosa, Davies, Gary, and Kamins, Michael, (2009) A. Reputation gaps and the performance of service organizations. Strategic Management Journal, 2009.

Reichheld, Fredrick and Sasser, W. Earl Jr(1990). “Zero Defections: Quality Comes to Services.” HBR September-October 1990

Banker, R., Datar, S. and Kekre. S., 1988, Relevant Costs, Congestion and Stochasticity in Production Environments, .Toz~nlnlo fAccour~rii~ngrz d Ecoiionzics, 10, 171-197.

Icarmarkar, U,, 1987; Lot Sizes. Lead Times and In-Process Inventories. Mnnugemer~l Sciem

ce, 33(3). 409-423.

Kim, T, 1993, Reducing Inventory and Improving Productivity: Evidence from the PIMS Data, (Working paper University of California. San Diego).

Craig, S. (2009, January 29). Merrill Bonus Case Widens as Deal Struggles. Wall Street Journal

Kotter, John P. & Dan S. Cohen. (2002). The Heart of Change. Boston: Harvard Business School Publishing.

Luthans, F & Peterson, S.J, (2001), ‘Employee engagement and manager self-efficacy: Implications for managerial effectiveness and development’, Journal of Management Development, Vol. 21, no. 5, pp. 376-387

Hurley, R.F., Estelami, H, (2007), ‘An exploratory study of employee turnover indicators as predictors of customer satisfaction’ Journal of Services Marketing, Vol. 21, no.3, pp. 186-199

Cross, S & Silvestro, R, (2000), ‘Applying the service profit chain in a retail environment: Challenging the satisfaction mirror’, International Journal of Service Industry Management, Vol. 11, no. 3, pp. 244- 268