Strategies for Effective Bank Marketing in Bangladesh

Since the inception of globalization in Bangladesh, banking sector has undergone various changes. Introduction of asset classification and prudential accounting norms, deregulation of interest rate and opening up of the financial sector made Bangladeshi banking sector competitive. Encouragement to foreign banks and private sector banks increased competition for all operators in banking sector. The protective regime by the authority is over. Bangladeshi banks are exposed to global competition. Even competition within the country has increased manifold. The almost monopoly position enjoyed by the public sector banks of Bangladesh is no more existence. Under this development Bangladeshi banks needs to reinvent the marketing strategy for growth.

The spread of the bank in Bangladeh rural and semi urban areas are highly different from state to state and region to region. Many devision have fewer networks of bank branches in the rural areas. Under such scenario different marketing approach for different areas is required. If the bank follows the same marketing strategy for all areas the success would be difficult.

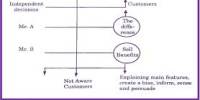

Marketing approach for urban area: The urban areas of Bangldesh are developed taking into account all parameters of development. The level of income of the people, the literacy rate and level of education as well as awareness of the people about rights of the customer are higher than that of the rural and even semi urban areas. Thus here for effective bank marketing different approach is necessary than that of rural areas.

The marketing strategy should be based on customer service and the use of modern technology in banking. Under competitive environment for the success of the business, better customers and retaining existing customers is possible only with customer service. Use of modern technology in urban areas will also go long way for marketing of banking services. Technology based service like credit card, debit card, ATM, anywhere banking, internet banking, and mobile banking are necessary for urban areas. This is because it enables customers to perform banking transactions at their convenience. Business hours of a bank are also an important factor for urban banking. India many private sector banks, especially co-operative banks and now even some of the public sector banks have also started this practice and they find it successful. To attract business and wholesale customers, banks need to adopt technology based product and service which is suitable to such class of customer. For instance RTGS, collection of out station cheques, issuing the cheques at par at any branch in the country, cash management facility, DD butiques etc. are necessary.

Marketing approach for rural areas:

Banks need t develop some scheme which would attract them to bank with. For loans and advances products which are suitable to tarmers, small traders, small scale agro based rural industries are already in existence. Banks need to see the how value addition can be mad to these existing scheme. Banks also needs to tie up with Non Government Organisations and various Self Help Group for different types of loans, micro financing etc. This will help the bank for building good image and reputation in the rural areas over and above the business. Another potential area which can be explored by the banks in the rural area is retail banking. With the steady increase in the income of the rural people there is ample scope for retail loan products like housing loans and loan for consumer durables.

Marketing through customer services in rural areas is different from that of urban areas. Here personalized banking is the success mantra for banks. Because of high level of illiteracy people prefer to undertake banking transaction themselves. They hesitate to depend upon technology based service. For effective marketing in rural areas bank should have staff with right soft skill like concern for customers’ problem, positive attitude, good communication and negotiation skill. At every level of dealing with the customer bank need to educate them for banking activates and process. To attract the customers from the unorganized sector most important factor is to provide. The borrower the required finance of right amount at right time.