In 21st century, we have entered in to a new age of business world. We have seen how business organizations have changed from profit centric to more customers centric. There is no business organization that can survive in market without satisfying its customers. Quality service is a precursor of customer satisfaction. Only purchasing product does not satisfy customers, rather they may weigh convenience, availability, reliability. In banking industry where almost all the products are indistinguishable, with nominal difference in charges set by market, service quality can be key differentiator. BRAC bank is offering wide arrays of products to its customers. Sales centers of BRAC bank are propelling these products to the customers. It is interesting to see how these service centers are operating, what is customer’s perception towards their service.

I took, “Evaluation of customer satisfaction level at Graphics Building Branch: BRAC Bank LTD” as my intern topic, given that my Internship experience in BRAC bank helped me to conduct this research. During my internship, I came to realize dealing with customers, pleasing them is requires special skills and a deep understanding of customer’s mind.

BRAC bank has set some code & conducts for all its employees to follow. Bank is committed to make customers leave bank with a hassel free, contented experience. While conducting my research I came to know about customer’s complaints, suggestions and satisfaction. There are number of issues Graphics building branch should improve. They need to employ adequate staffs in some places to speed up the service. Server system in this branch is little slow sometime which sometimes becomes reason of customer’s infuriation. Graphics building branch is very concerned about their honored customers and always ready to help them. Customers are also happy about credit service. Some of them expressed their disappointment how bank is taking too long to disburse their loan. Similarly, there are some other issues customers think bank should improve.

BRAC bank is a financial institution, which may not have been in market for long time, but they have been showing impressive growth over the years. Their quality service and diverse range of products already have left good impression on customer’s mind. They have a legacy for contribution in economical reformation and development of human capital. To be a market leader in long run they need to keep improving in all aspects of their service.

Purpose of the study

Unlike other institutions, a bank has to focus both on its product and on service. In the age of globalization and free market, there is severe competition in banking industry. All the banks try to pull customers into their organizations by offering diverse products and services. But only providing wide range of products are not responsible alone to attract customers attention.

Banking is not like other products that customers just visit outlet buy the products. To enjoy banking facilities wholly customers have to go through some services given by bank outlets. Quality service is an intangible thing that customers experience rather than physically buying it. A favorable customer experience may turn a new customer in to a loyal customer. That is the prime intention of all the business organization turning its customer into loyal customers as if they repeatedly come back to bank and buy new offers. To survive in a competitive market there is no way of underestimating clients. Today almost all the banking organizations putting emphasize on retention of existing customers, besides making of new customers.

Since quality service has become an important parameter of successful banking business, so banking organizations need to evaluate its customer’s perception annually. It gives them an idea what customer demand from bank. In this report, I intend to explore customer’s perception on service quality of a bank outlet. I have used different research procedures to analysis customer’s opinion about service quality, areas of weakness in service and how to improve service.

Objectives

Broad objectives:

Broad objective of this report is to analyze satisfaction level of customers in Graphics building branch of BRAC bank irrespective of service taken who visit this branch for different purposes.

Specific Objective:

Specific objectives of the study are-

- To basic understanding of the activities customer service unit of BRAC bank.

- To classify key service features of a bank outlet.

- To analyze customer satisfaction level at Graphics Building Branch.

- To come up with some suggestions that can upgrade current service quality.

Methodology

To conduct a research work it is very important to obtain sufficient volume of data. I have questionnaire to conduct this survey. I have distributed this questionnaire to randomly chosen customers visit the bank every day. To get sufficient informations I also interviewed key bank staffs.

Sources of Information:

Primary sources:

- Direct conversation with the customers.

- Personal observation over the internee period.

- By interviewing bank staffs.

Secondary sources:

- Website of BRAC bank.

- Annual Report of BRAC bank.

- Different types of Brochures.

- Through attending 3 days BRAC bank orientation program.

Products & Service Information

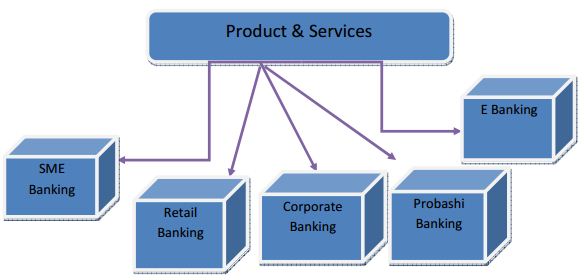

BRAC bank has five different wings of their business activities. These are-

SME banking:

Initially, BRAC bank started their journey to carter SME business. BRAC bank believes in empowering huge human resource in the country. After liberation war, most of the commercial banks were providing large amount of loan to large industries and big corporations. No was doing anything for small and medium entrepreneurs, no one was thinking their potentiality. This group was defined as “Missing middle”. This missing middle had the potentiality but due to shortage of fund, they could not contribute to the national economy. With a view to providing them, a firm ground under their feet BRAC bank is providing SME loan service to this missing middle. 50% of BRAC bank’s total portfolio.

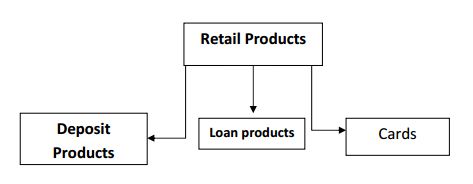

Retail Products:

BRAC bank has divided its retail products in to three categories-

Corporate Banking:

There are three categories of corporate products-

- Loan Products

- Trade Finance

- Corporate Cash Management

Probashi banking:

BRAC bank is providing probashi banking to facilitate demand for remittance. These services are described below Probashi Current account:

This account offers for those who have objection to earn interest due to religious reason.

Probashi Savings Account:

It is a regular savings account maintained in local currency for non-residents Bangladeshis who want to utilize this account in future when they come back to Bangladesh.

• Probashi Fixed Deposit:

A fixed deposit account which allows non-resident Bangladeshis to deposit their money for a fixed period of time. Interest is paid at the maturity at an attractive rate.

Probashi Abiram:

Another fixed deposit facility which allows NRB’s to get return every month.

Probshi Biniyug:

Probshi biniyug is a product by which a non resident can invest in capital market in bangladesh by opening BO account.

E Banking:

E-Commerce:

BRAC bank is providing e-commerce service to all VISA & Mastercard holders. It is a convinient way of making transaction right from the web.

24 hour call center:

BRAC bank is providing 24 hour call center service to ease customer’s transation. For any banking purpose they can call into 16221 for receving following service-

• Accounts detail

• Balance Query

• Inter-city charge query

• Debit/ Credit card activation

• Cheque book request

Project

“Evaluation of Customer satisfaction level at BRAC Bank”

Research Background:

Customer Satisfaction, most echoed term in business world, is a measurement of the extent to which quality of goods or service of a company meets or surpasses customer expectation. Alternatively, in a more plain word customer satisfaction is the measurement of how acceptable a product or service of a company to the customer. It is not possible to make a concrete definition of customer satisfaction since it is highly personal assessment, which varies from person to person. Still there is a certain standard, which is expected, below which no one will be satisfied.

In banking industry, customer satisfaction is the key performance indicator. When almost all banks provide identical products, there is only way to distinguish is quality. All the banks are providing same product and there is only little difference in interest rate charge. Therefore, bank management plays vital role to differentiate itself from other banks through adjusting its service quality to the customer’s expectation. In most cases, it is reported that customers switch banks because of poor service. Banks success largely depends on its outlets dedicated to render service.

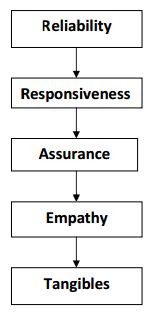

It is reported from various research that cost of acquiring new customer is huge then retaining existing customer. Therefore, successful organizations always take special care about existing customers by incorporating rigid service management into their objective in an attempt to turn existing customer into loyal customer. Customer satisfaction has been a constant subject of numerous researches to find out how customers perceive quality service. There are number of models to draw customer’s perspective on service quality. One of such model is “SERVQUAL” or “Rater”, a service quality framework developed by Zeithaml, Parasuraman & Berry. This framework is an instrument of assessing customer’s perception of service quality especially in service and retail businesses. According to SERVQUAL customer’s perception in this regard can be described through five dimensions. If these five dimensions can be ensured customers will be converted into royal customers of the organization. However, not all the dimensions are equal; they usually vary from customer to customer.

The five SERVQAL dimensions are

- Reliability: Reliability means service provider’s ability to provide services the way it was promised, accurately and dependably. So it should be service provider’s utmost effort to make service reliable.

- Responsiveness: Responsiveness means how cordial service providers towards customer’s problem and ability to provide prompt service. Service providers are expected to responsive to customers request. Besides, delay in providing service makes for disappointing experience for customers.

- Assurance: Clients trust service providers thinking that they are seasoned in delivering service; it is definite from customer’s side. But if service provider’s aptitude does not become visible to customers, their assessment on overall service will be negative because service providers are the person they deal face to face. Therefore, service provider’s approach should instill faith into customers.

- Empathy: Customers tend to feel being cared by the service employee. Service employee should make customers feel that they are taken important individually. If customers feel that service employees only care about them during service delivery, they are not available after that then customer will develop a negative assessment about service quality.

- Tangibles: A dimension sometime considered least important among the model, may not be least important in all places, in all context. It refers attractiveness of physical facilities, availability of technology, personal communication etc. Issues like employees uniform, equipment, office environment may appear to be source of customer’s dissatisfaction.

While working in BRAC bank I found there three factors those should be weighed more than anything else to define customer satisfaction- 1) satisfaction with client-bank staff interaction, if it is in person, or by phone or mail. 2) Precision of the service and 3) timeliness of the service. In banking industry, quality service is very often synonymous to good relationship between bank staff and customer. Customer always expect friendly behavior from bank stuffs, they also expect bank stuffs are able to solve their problems. Precision of service means providing customers with adequate informations about product so as to avert any future conflict which may cause dissatisfaction and executing service in line with rules and regulations of bank as well as law stipulated by Bangladesh bank. Timeliness refers branch being able to render quick service, not keeping people waiting for long time for any service.

Project Description:

In the course of my internship at BRAC bank branch, I received an opportunity to know about banking service, customer’s problems and their response towards the service. Therefore, I decided to do my project on customer satisfaction of BRAC bank Graphics building branch.

Research Subject:

“My Research subject is to evaluate or analyze if customer satisfaction level at Graphics Building Branch in different aspects of service higher or lower than average level.”

Method & Data:

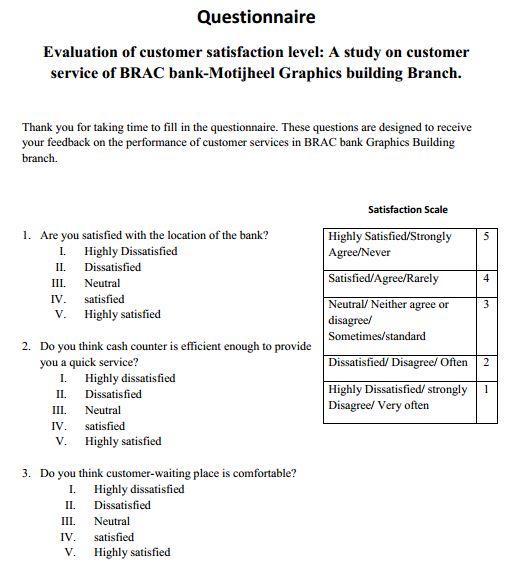

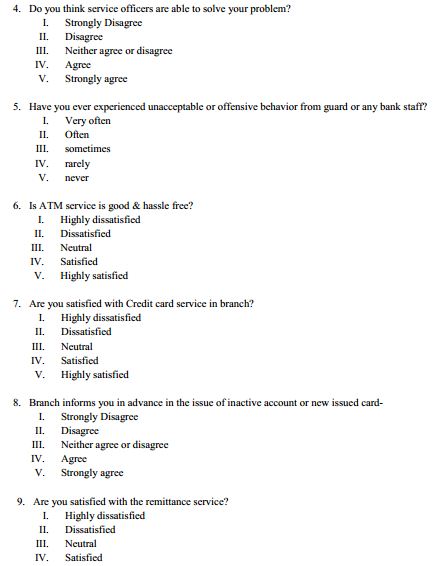

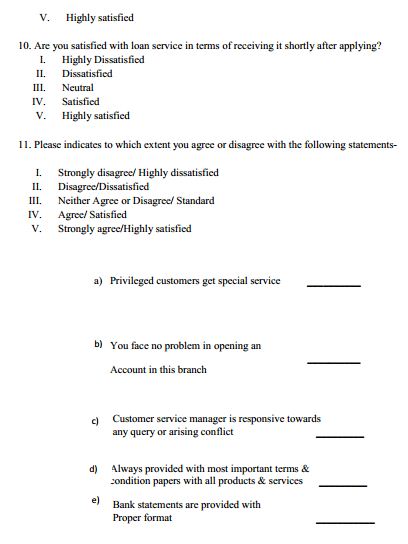

My research has been conducted by questionnaire. Population of this research is all the customers of BRAC bank Graphics building branch. In view of the fact that there is not precise data recorded on exactly how many customers visit this branch everyday so I have taken all the customer as population. I have selected a sample size of 100 customers. All the questionnaire respondents are active with bank service and visit this branch at least twice a month. I have distributed questionnaire randomly to the customers irrespective of their gender, occupation, location etc. I have not taken into account of these factors because I thought these factors do not add any value to the research and all the customers have their own opinion about service.

Research Method:

To conduct this research I have used research software SPSS. I have used likert scale; a psychometric rating scale widely recognized scaling used in survey research. To testify my hypothesis test I have used two-taliled sample t-test.

Hypothesis test:

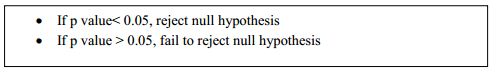

For hypothesis testing, I have chosen a significance level of 0.05. so to conclude if null hypothesis will be rejected or not I set my hypothesis assumption-

Decision process:

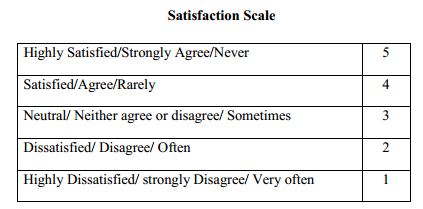

Now here I have done a hypothesis test to investigate customer’s satisfaction about bank’s employee’s service. I have put my sample data into SPSS software and come up with the result. I have used my questionnaire as a tool of measure (see Appendix). For measuring, I have used a hypothetical satisfaction scale with the attribution of likert scale.

For analyzing sample data I computed the satisfaction rate from the above table= 15/5= 3. This average rank means that satisfaction level is not extremely positive or negative, rather tossup between these two. So I will compare this average satisfaction rank to the sample result to see if there is significant difference between a particular aspect of service to the average satisfaction level of customers. If there is significant deviation between two variables, I have tested frequency test to analyze frequencies of the answers.

Basic Ideas about respondents:

Before conducting the survey, it is important to know some basic informations about sample. It gives us clear view about customers, their expectations and their demand. Along with my survey on various aspect of service I randomly chose 70 customers and asked them about their association with this branch, kind of services they usually take, their monthly visit in this branch.

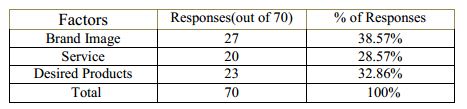

Customer’s association with BRAC Bank:

All customers have some certain reasons to choose a bank. My survey shows that brand image is the key factor for choosing BRAC bank owns a very positive image on customers mind, which motivate them to choose this bank. BRAC bank’s wide range of products also another determining factor. Only little above 28% thinks they prefer BRAC bank for its service.

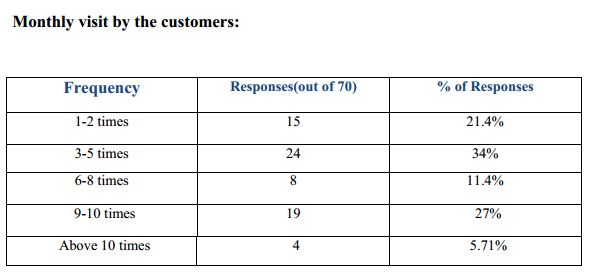

Frequency of Visiting the Branch:

During conducting the survey, I thought It is important to know the frequency of visiting this branch by customers, which would assist evaluating their response. So i asked them how often they visit this branch in a month.

Since Graphics, building branch provides retail banking services most of the customers visit for individual purpose. 34% visit this branch 3-5 times and 21.4% visit couple of times. Most of these customers visit branch to withdraw money, to collect new issued card, to deposit or come with other problems. Those who visit this branch for nine to ten times or more than ten times are mostly businesspersons. Out of business necessity, they have to visit this branch so often.

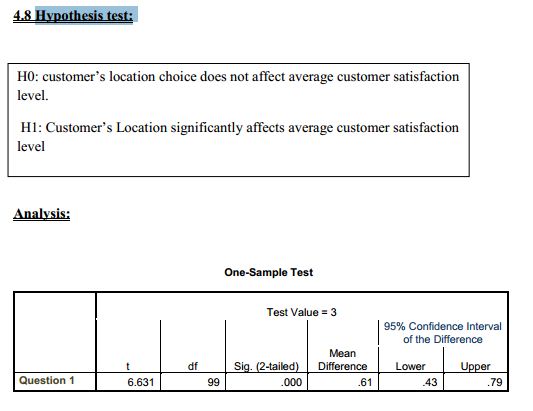

Hypothesis test:

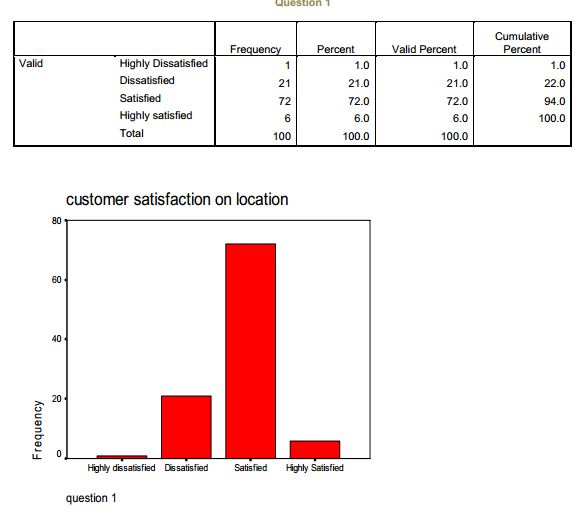

From the above sample test, we have a positive t value with significant mean difference. T value represents mean difference between two variables. Positive mean difference means sample mean is .61 higher than average mean. Two tailed p value is – .000< .05, therefore null hypothesis (H0) is rejected. There is significant deviation from the average satisfaction level. So we can deduce customer’s satisfaction about location of this bank is above average.

Now I have done a frequency test of respondents reply to their satisfaction to the location of the branch-

Analysis:

From the above frequency table it has been founded that 72% respondents are satisfied with the location of the branch. Since we have already come to know most of the customers chose this branch either because it is near to their home or workplace, so it is natural of them being satisfied with the location. Besides another advantage of this location is it can be traced because it resides just next to Dhaka Stock Exchange building. This branch is on the main road so customers do not have to go for searching this branch. 21% are dissatisfied with the location. These respondents usually come from far place because of official work. On top of that, sometimes this area gets unsafe because of the outrage of shareholders on share market issue.

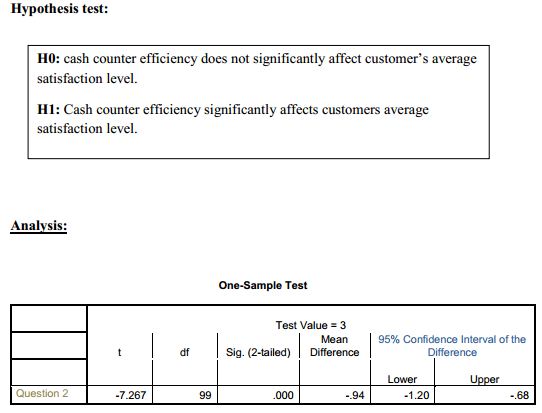

Opinions about cash counter efficiency:

Cash counter management one of the vital factors of quality service. It is quite improbable not seeing long line up of customers in a bank. Customers expect staffs working in cash are efficient enough to give them a quick service. Customers come to branch to withdraw money from their account or remittance money and to deposit their money. Tellers should be very skilled to speed up the transaction and do it accurately.

From the above table we can see there is negative t value, mean difference is negative which means sample mean is .94 less than average mean. Here p value is .000< .05, therefore null hypothesis is rejected. There is significant deviation in average satisfaction level.

New here is the result of customer’s perception of efficacy of cash counter

From the above frequency test, it is seen that customers are by no means satisfied about cash counter service. A huge portion of 45% has given their verdict that they are highly dissatisfied with the cash counter service. Another 31% are dissatisfied about the way this service is given.

Only 11% are satisfied and 8% are highly satisfied with service.

Observation:

During my internship, I tried to find out what is problem with cash counter. Couple of times I got opportunities to work inside cash counter. There were some inefficiencies caught my attention-

1. Inadequate tellers:

In the cash counter, there should be sufficient teller to facilitate customers. But I noticed there were not adequate tellers to provide service. They have a head teller, under him there are other tellers work. There are total seven counters and six tellers including head teller. Head teller generally does not take part in regular transaction. He usually does cheque deposit, cheque return processing, and supervision of volt. Only if there is huge row he gets involved. Out of the rest five tellers, there is another one who only provides service for remittance and special customers. Therefore, four tellers are not sufficient to serve regular account holders.

2. New teller:

During my internship, I have seen changes in cash counter of employees. Some of them got shifted to another branch or some became were sick. I have seen some female tellers in cash that were pregnant. So eventually, they will take maternity live, which will cause new staff to be employed. Although, new employees are trained to work in cash counter but still they need time to settle down to the system of the branch, which slows down service in the cash counter in the process.

Opinion about customer waiting place:

Customers do not only come to branch to deposit or withdraw cash, they also come to open account, to know about product, to receive remittance service or to get solution regarding any banking related problem. Our sales officers are there to listen to customers problem, try to solve their problems. Given that not all the customers can get service at once, they need to take token and wait for their call. So customers waiting place should be comfortable, there should be enough space for sitting. Thus, a comfortable waiting place is also included in quality service. For that reason, I asked my respondents about what is their opinion about branch’s waiting place through the questionnaire.

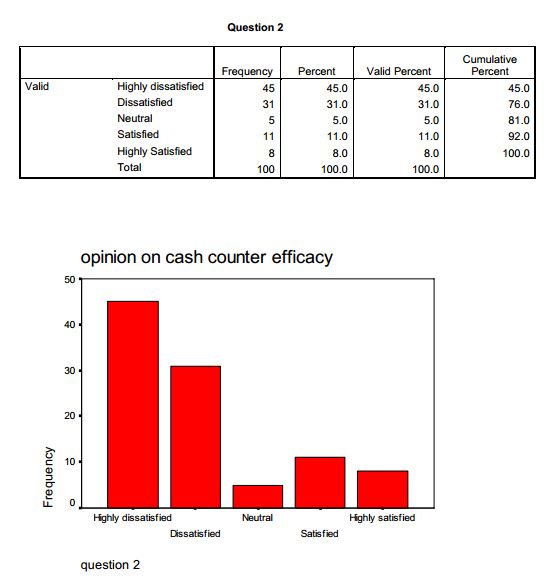

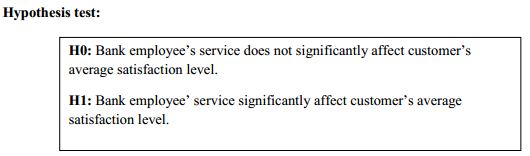

Customer’s opinion about employee’s services:

Branch sales & service officers play key role in serving customers. Service officer should be very resourceful and proficient in terms of providing service. Customers come to branch with their problems knowing that service officer is capable of solving their problems.

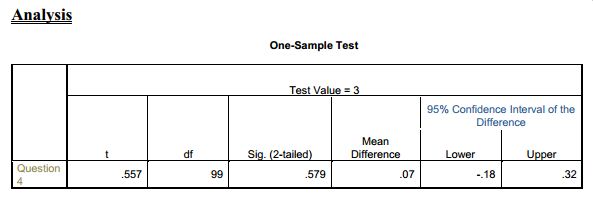

From the above tables we can see for hundred respondents mean is 3.07, which is greter than test value (average satisfaction rate). T value is positive here because sample mean is larger than test value. The significance value (p value) is 0.579, which is larger than threshold value of 0.05, so fail to reject null hypothesis that employee’s service does not significantly affect average satisfaction level of customers.

Observation:

There are six counters for service officers. One of them is only dedicated for credit card related service. One of these counter remains empty, it is only used for western union service. Rests of the four service officers give all other services except credit card. What I have observed there those who have been working here for quite a long time are very efficient in rendering service.

They are well versed in all the problems customers usually face and help them with proper solution. Service officers seem to be well aware of rules and regulations. Even those who are new in work are trying hard to give optimum service. Nevertheless, I found some service glitch-

1. New employees seem to be less trained for their work and know less about software use. Because of that, they tend to provide slow service. Their lack of knowledge in finacle software makes them ask his/her senior repeatedly. It impedes other officers while servicing.

2. Along with limited knowledge about software, new employees sometime know less about product, which makes for providing wrong information, which causes future discontentment from customer’s side. I think number of officer is less than enough. When one officer go for lunch or absent for some reasons, it becomes difficult to manage customers.

Customer’s view on staff’s behavior:

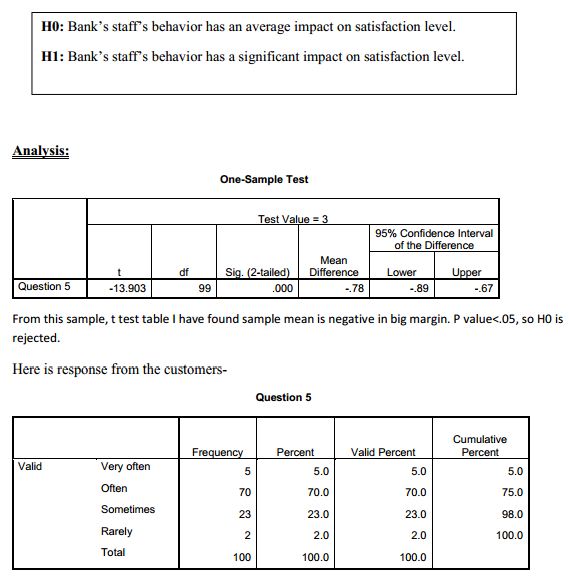

Customers expect that bank staffs will do their utmost to help them. Any negative response from staffs may adversely affect customers. If they are not happy about the standard of courtesy of bank’s employees, it may accelerate their decision to switch the bank. So I have kept these question in my questionnaire that-‘Have they ever experienced any unacceptable behavior from any bank staffs?’

What we can see from this table is not good news for bank. Out of total, 70%, believe that they have often experienced negative behavior from employees. 23% of them think sometime they have met with bed response from bank staffs. 5% of respondents think very often employees are less helpful to them and 2% rarely experienced such behavior. Not that every one of them experienced it but while staying at branch they saw it happened which gave them a bed impression about this bank.

Observation:

There are handfuls of reasons for these disappointing responses from customers. I describe them below-

1. Lack of supervision and training: Guards and bank staffs should be trained how to behave with customers properly. Here I should bring an example I saw during my internship- one of the guards who were calling people to customer care when it came their turn. He saw a client was talking very loudly over phone. So he went up to that person and told him very loudly to keep his voice down. That customer got very angry and a scene was created. That guard could have asked him politely instead of showing anger. While doing intern I found that customer service manager or general manager did not properly supervise this sort of events. They would only step in when there was a problem. But they did not take any effective action against staffs who did it.

2. Bad example from service officers:

Sometimes while giving service, service officers seemed to lose their temper. Especially it happened in cash counter. Very often specially after lunch hour people started gathering in branch resulted in huge line up. Having stood for a long time, customers started objecting, and then sometimes heat words were exchanged between customers and

employees in cash counter. In the question number two and four where I asked about cash counter and service officer’s efficacy, those who gave negative response to these questions gave negative answers this question. They think service officers are not sympathetic to their problems and only say what bank’s policy is.

Customer’s opinion about ATM service:

ATM service is an important extension of banking service. Customers like to get ATM service from branch as if they can easily collect their money. There are two Automated teller machines in graphics building branch. Here I set my hypothesis about ATM service –

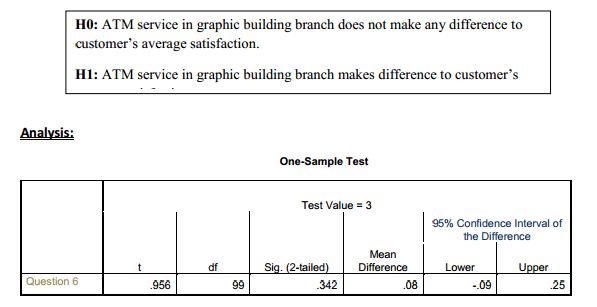

So for question number 6 we have a t value of .956 with 99 degree of freedoms and a mean difference between sample mean and satisfaction mean is .08. T value is positive because sample mean is greater than satisfaction average. We significance value of .342 which is greater than 0.05, as a result we fail to reject null hypothesis. Therefore, satisfaction on ATM service is not highly positive or negative.

Observation:

I have already mentioned that there are two automated teller machines in the branch. It aids customers remarkably. Nevertheless, I have seen some problems with this service-

– Out of these two ATM machines, one of them had been inactive for most of the time of my internship. So literally only one of them was out of function for customers for most of the time. Besides, there was a constant complain from few customers that their card got captured when they inserted card into it due to the machine’s problem. So because of that ATM machine they have to come to the branch to retrieve their card which was quite embarrassing for branch. This ATM service is very less obtrusive, if one do not enter into this branch will not notice it. So many BRAC bank customers get deprived from ATM service.

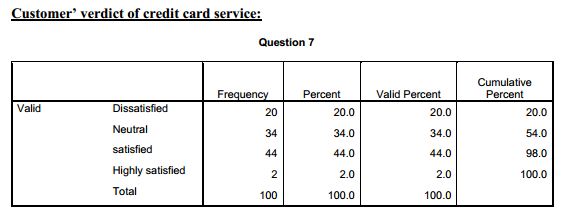

Satisfaction of credit card service of the branch:

Customers often visit branch to receive credit card related services. They have usually query about credit card service, they also come here to pay credit card bill, to give new credit card order or even to know credit card transaction details. As a very important part of service, I asked my respondents about their response towards this service.

Based on their response I have made my hypothesis:

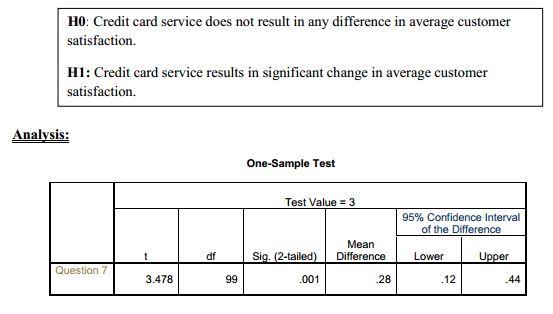

From the above one sample test for question, no 7 we can see there is a mean difference of .28 Here p value is lower than significance level (0.001<0.05), therefore we can reject the null hypothesis. Credit card service does make difference in average customer satisfaction.

From the table above we can see 44% customers are satisfied about credit card service. Here I would like to mention that credit card customer is less compared to other customers. So service provider does not have to hurry for their service. Out of 100 respondents 34% are neutral, most of these 34% do not use credit card. 20% respondents are dissatisfied with the service. Most of them complained that they were not informed timely when their ordered card was issued or they had to wait in line for a long time in row to pay their bill.

Observation:

Since customers of credit card are fewer compared to other customers, it is possible for one person to provide this service. But I noticed that other sales & service officer’s do not know about credit card facilities. As a result, when they need some informations about credit cards they need to go to sales officer who serve this part. However, I think other service officers should know about this service better. If this only sale officer are not present a single day, no one is there to provide this service, because no one can operate this software. Therefore, they have to inform it to head office to send someone for an interim period. But in between this sometimes we have to turn down customers request and ask them to wait or visit us other day.

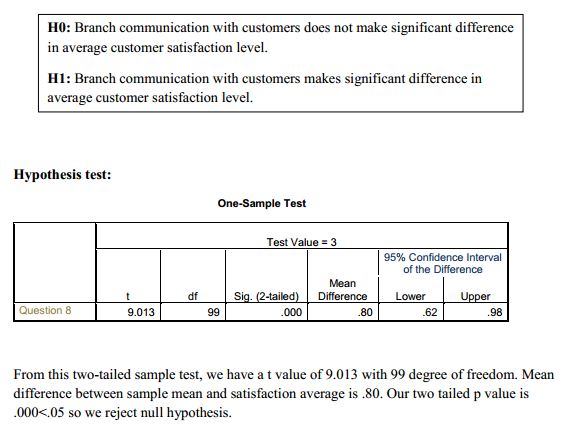

Customer’s satisfaction on branch communication:

Customers expect that they will be informed in advance if their card has reached to branch, which he/she has ordered before, if bank has retrieved their capture card or will be updated with their account information. When it does not happen, they become upset.

Hypothesis testing:

Observation:

When a new card is issued, it is not immediately informed to customers. While filling the card request form, customers are told they will have to collect it after three working days. Usually customer come after three days to collect their card or if within three months customer do not come they are phoned from branch requesting to collect it. Problem is sometimes customers account becomes inactive due to lack of transaction. Though they are sent transaction informations in their address sometimes, they forget that. Once account remains inactive it is a lengthy process to active it again. Very often customers change their cell number so it becomes difficult to inform them.

Customer’s opinion on remittance service:

BRAC bank is facilitating its customers by channeling remittance money from abroad to country. There are different mediums of remittance service available for customers such as – western union money transfer, Money gram, remit2home, express money; exchange houses etc. customers always demand quick remittance service from branch.

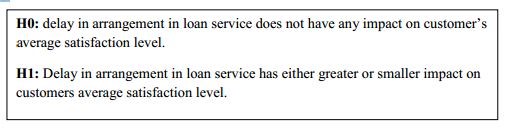

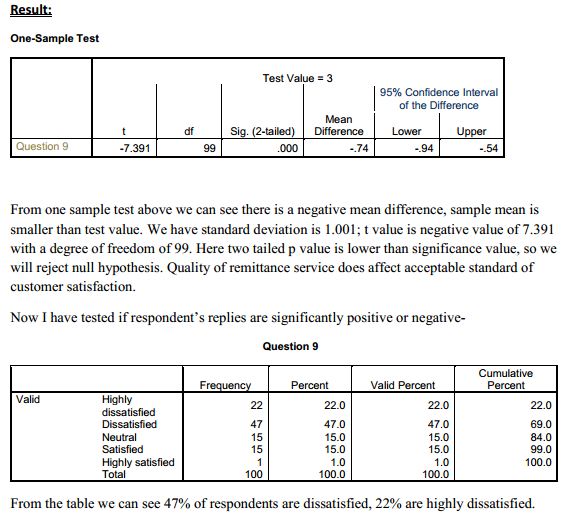

Now I want to test if remittance service in branch significantly affects Customer satisfaction on quick loan disposing:

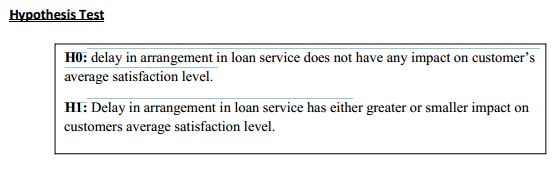

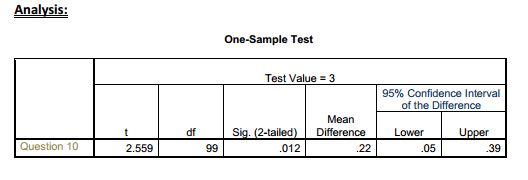

BRAC bank retail outlets are providing wide range of loan products such as – salary loan, Quick loan, Auto loan, Home loan and Secured loan. Customers expect bank will arrange their loan soon after submitting the application for loan. Yet, BRAC bank has a very centralized system. It takes quite a long time to receive approval from head office. By the time, it goes through all the processing customers become impatient about it. Now I will test if delay in disposal of loan has a significant effect on customer’s satisfaction level.

Observation:

The reason of customers being so dissatisfied about remittance service is slow processing. In that area a cable repair work was underway, this made the remittance service unbearably slow. Apart from western union service, all other remittance service mediums were having this problem. Another thing is there was a computer in customer end, only used for western union purpose because it has western union link. Other computers do not have western union link. Therefore, to complete western union processing BSSO has to leave his/her own sit and go to that computer.

Western union customer is very frequent compared to other remittance mediums. Since there is only one computer to use for western union it keeps customers waiting for long.

Customer satisfaction on quick loan disposing:

BRAC bank retail outlets are providing wide range of loan products such as – salary loan, Quick loan, Auto loan, Home loan and Secured loan. Customers expect bank will arrange their loan soon after submitting the application for loan. Yet, BRAC bank has a very centralized system. It takes quite a long time to receive approval from head office. By the time, it goes through all the processing customers become impatient about it. Now I will test if delay in disposal of loan has a significant effect on customer’s satisfaction level.

Here t value is 2.559 with a degree of freedom of 99. There is a positive mean difference of .22. Since two tailed p value is .012< .05 so we fail to reject null hypothesis. There is not much difference between sample mean and satisfaction average.

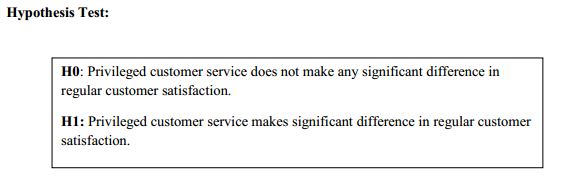

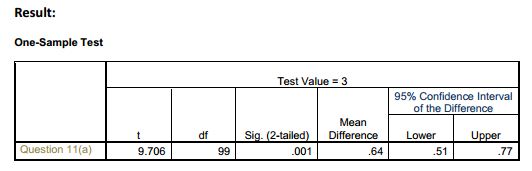

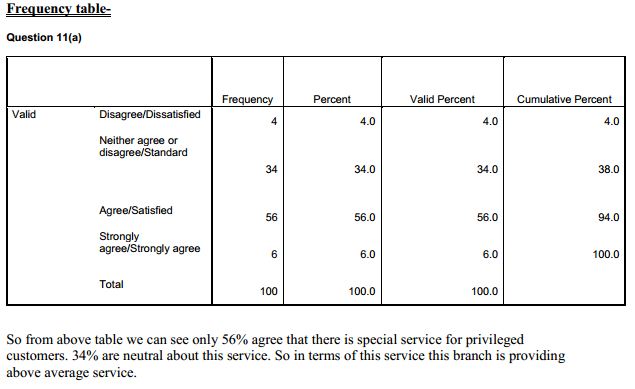

Service for privilege customer:

BRAC bank has categorized its honored customer based on some criteria. Privilege customers are promised to get special facilities. But there was no isolated counter for special customers. Usually customer service manager serve them. Usually customer service manager facilitates privileged customer. But sometimes customer manager interrupt BSSO in the middle of their service by ordering them to serve the special customer. So a general customer who has been waiting for long for service gets annoyed.

Now I set hypothesis to know if privileged customer service makes any difference to acceptable service quality

We can see there is considerable mean difference. T value is 9.706 with degree of freedom of 99. With 95% confidence interval of the difference p value is lower than level of significance (.001<.05), so according to statistical condition we reject null hypothesis.

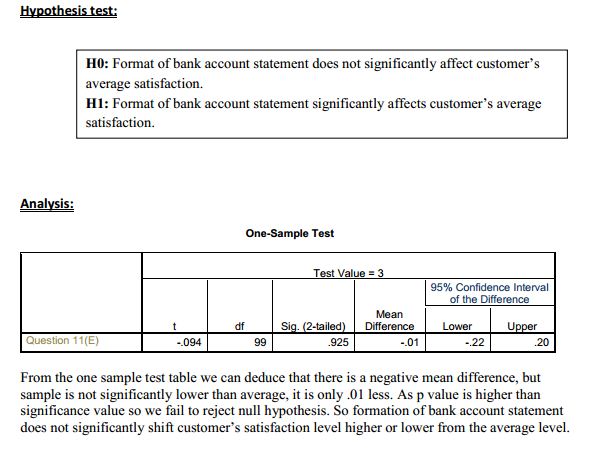

Customer’s opinion about bank statements:

Bank account statement is the summery of bank transaction of a customer for given period. Every day number of customers who have account in this branch come to this branch to receive printed copy of bank account statement. Bank account statements are required for receiving loan, bill payment of credit card or utilities, for checking salary account. Customers expect this bank statement will be provided with proper format. Therefore, I will do hypothesis test if this service causes any impact on customer’s average satisfaction.

Observation:

Statement of account includes account holder’s name, account number, address, MICR code, transaction informations for a given period. BRAC bank provide all these informations in the bank statement. But very often we came across complaints from customers that printed bank account statements are not readable with inappropriate font size. Sometimes because of malfunction in printing machine customers, have to wait for long time.

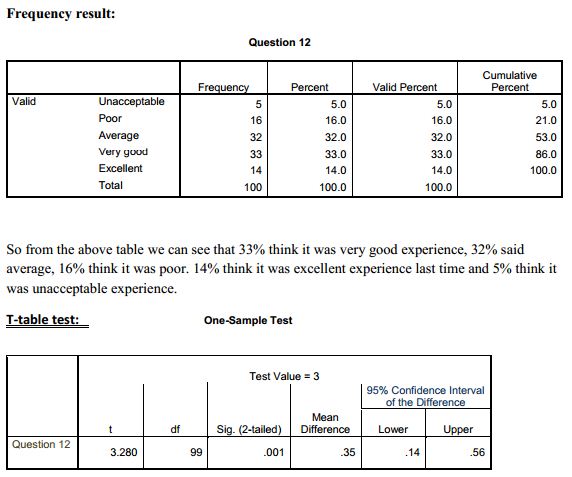

Customer’s recent experience:

To know how I my respondents recent experience of visiting our branch I put this question in questionnaire. Because I thought, current experience will be responsible for customer’s verdict on my questionnaire.

From the one sample test, I can conclude that since there is a significant mean difference and p value .001<.05 so we can say recent experience of customers in this branch is above average.

Some Major Problems:

- There is not adequate teller in cash counter.

- Lack of proper line management for customers while depositing or withdrawing money.

- Server system of BRAC bank is too slow which impedes natural pace of service and makes customers waiting for a simple service. On top of that, network problem in remittance service which was supposed to be a temporary problem has been lasting for nearly two months.

- Sometimes there are confusions over tracking documents and files caused by courier.

- Too lengthy loan disbursement process

- There is no special service for senior citizens and handicapped people.

- Air conditioning system in branch is a major source of discontentment for customers

Recommendations:

Based on customer’s suggestions and my observations, I made some recommendations that may help to improve customer care of BRAC bank Graphics building branch-

- Graphics building branch need to fix their server problems related to remittance service as soon as possible. Although it is up to back office to fix this problem, so they need to keep reminding about this problem. I have seen customers who came to withdraw remittance money at morning, but left branch when it was almost afternoon. This sort of service is very disappointing. Another thing is, i saw that there was one computer, which was dedicated to give western union service. Western union service is more frequent than other remittance service. It is not good BSSO change their seat repeatedly again just to give this service. If western union link is installed in every single computer, this waste of time can be saved.

- Sufficient tellers should be appointed in cash counter. I have seen there is enough space at the backside of the cash counter. A seating place accompanied with computer and important documents should be arranged for head teller. So when he is not serving customers, another teller can take his place to serve customer. Row for account holder seems to be most crowded, when there is more tellers, this row can be split into three or four rows whereby they can speed up transaction process. Guards will assist customers to line up properly.

- When a new sales executive is appointed, it should make sure he/she know all aspects of service he /she is assigned to provide. Although, all the BRAC outlets use same software, uniform documents, but still, when new sales executive is appointed, initially they face problems to get along with new environment. Therefore, before being hired, sales executives should be educated about all features of product and policies as if he/she does not pass any wrong information to the customer. Besides, it will not annoy other sales executives in the middle of their service to teach new sales executive, thus prevents service being slowed down.

- Branch should have their own courier system to send important documents to head office and customers. It will increase transparency over courier system and incidents like document lost; problem of tracking files will be reduced.

- Customers waiting place should be comfortable and sufficient sitting place should be there.

- Bank should maintain a complaint register in a proper format for customer to express their grievances in it. Regional manager or any representative from head office should examine this register book when they pay visit to the branch.

Conclusion:

At present world, commercial bank is emerging as a driving factor for economic development of a country. It is said that if there is an efficient banking system in a country it contributes rapid growth in many sectors in economy. Since its inception, BRAC bank has been working according to its 3p agenda- Planet, people and profit. From the beginning, BRAC bank has been working to ensure best use of human capital. As a member of GABV (Global Alliance for banking on values), BRAC bank put emphasis on sustainable banking by making sure utmost service for people and economy.

In this cutthroat world, there is huge competition. Banking industry is no different. All banks try to make a strong presence to market by rendering best possible solutions and supreme service quality. Nevertheless, satisfaction is highly personal opinion; definition of satisfaction differs from person to person. Satisfaction is something perhaps beyond adequacy, beyond expectation that put a positive impression on customer’s mind. Since there is no fixed definition of customer’s satisfaction in banking, I made this report by making an effort to question customers with whom I got opportunity to get close in the course of my internship. I tried to know from them what they think would make them satisfied about service.

Working in customer care of a branch has given me an opportunity to have an idea of front office operation of a branch. There was not much confidentiality that could hinder my research work. Though I have limited access to the important documents but there was no obstruction like interviewing customers and bank staffs. It is a grand experience, and I like to convey that I am honored to be part of the fastest growing bank in Bangladesh for three months. I hope opportunity of working here would help me a lot ahead in my career.

Appendix: