Executive Summary : Libra Infusions Ltd is playing a vital role in medicine sector of Bangladesh. I have discussed about the general marketing performance of Libra Infusions Ltd, Mirpur , Dhaka. It committed manufacturing world class Quality Products using modern technology. It maintaining Quality Management System (QMS) through documentation of all activities of the Company complying with International standard requirement of ISO 9001 through developing employees at all levels by regular training participation.

It highly committed customer satisfaction through service up to their level of expectation. Libra reviews activities and performance of its operation to ensure compliance with commitment.

Chapter 1

Introduction

Internship program is the practical aspect of our theoretical learning. It makes a bridge between the gap of class room learning and practical learning. In this view, Internship plays a pivotal role for each professional degree like BBA. The study will help formulate suitable policies taking into consideration different ideas, suggestions and feelings of the customer and producer. Further more, it may note that Libra Infusions Ltd executives who are really executing the policies undertaken by the top management will have a chance to communicate their interaction and necessary feedback. Pharmaceutical companies are very much essential for all the people of the country especially for the patient. And the medicines of Libra Infusions Ltd are plying like a new life to a patient.

Origin of the Report

Now we are living in the age of competition at anything in any place. From that tendency recently education is also in the age of competition. So the procedures and standards of teaching are upgraded by different universities and institutions in our country. In respect to that, internship is mandatory for our BBA program offered by NationalUniversity. This program is partial fulfillment of our BBA curriculum. To do so I decided to complete my internship in Libra Infusions Ltd. In connecting, HRD of Libra Infusions Ltd sent me to the Sylhet Branch and assined to prepare this report.

So, the report entitled “Marketing Management of Libra Infusions Ltd” has been prepared as a partial fulfillment of BBA program authorized by the Director of BBA program, Department of BBA, MohammadpurKendriyaCollege.

Rationale of the study

Due to the increased competition of the increased number of medicine industry and growing economy, the expectations of the customers have also increased than ever before

Realizing the present condition, pharmaceutical companies are trying to elevate their medicine service as much as reachable to their customers. So it is the duty of the top management of the medicine sector to work with the situation.

Benefits to the Institution through the Report

The Company will get an overall picture on marketing management of the company through this report. It may take steps to overcome shortage or weakness; at the same time it may explore the opportunities it does have.

Special Objectives of the report

Objectives regarding this study are as follows:

(a) To fulfill academic requirement.

(b) To gain practical knowledge in Marketing Management.

(c) To compare Libra Infusions Ltd with others ISO certified Medicine Company.

(d) To make a general evaluation of this company’s marketing activities among different professionals.

(e) To find out the real picture of Libra Infusions Ltd production, distribution and

Marketing.

(f) To get an overview of the Medicine company in our country.

(g) To identify major strength and weakness of Libra Infusions Ltd. In respect to other medicine company.

(h) To analyze the demand and quality of different type of medicine of Libra

Infusions Ltd.

(i) To assess and evaluate the growth trends on Libra Infusions Ltd among other

Medicine Company.

(j) To recommend ways and means to solve problems regarding marketing

Management.

Duration

The duration of the study was a very short span of time. It was three month long internship program (20th December 2010 to 18th March 2011). It was very much hard to complete a report as well as assigned task by the medicine Company. So I hade to complete this study facing very much time pressure.

Scope of the study

Libra Infusions Ltd is one of the largest Medicine Company in Bangladesh. This company operates through 20 branches in the country. I am assigned to learn practical

Knowledge from Libra Infusions Ltd, Sylhet Branch. In this study I would try to concentrate on the theoretical aspect of Marketing Management. I would analyze the data on the company and various marketing strategies.

So, this report covers only “Marketing Management of Libra Infusions Ltd” Especially this report emphasizes on the product Planning, Branding, Pricing, Sales promotion, Advertising, Channels of distribution etc.

Methodology of the Report

The report is descriptive in nature. To fulfill the objectives of this report total methodology has divided into two major parts:

SOURCE OF DATA

PRIMARY DATA SECONDARY DATA

Data Collection Procedure: In order to make the report more meaningful and presentable, two sources of data and information have been used widely. Both primary

and secondary data sources were to generate the report.

The “Primary Sources” are as follows:-

- I have made questionnaire survey of both the assistant general managers and others officers of the branch and the various pharmacies.

- Relevant file study as provided by the officers concerned.

The “secondary Sources” are as follows:-

- Office files and documents

- Web sites

- Study related books and journals.

(b) Data processing & analysis:

Collected information then processed and compiled with the aid of MS Word and other related computer software. Necessary tables have been prepared on the basis of collected data and various statistical techniques have been applied to analysis on the basis classified information. Detail explanation and analysis have also been incorporated in the report.

Limitations of the Study

To prepare a report on the topic like this is an short duration is not easy task. In preparing this report some problems and limitations have encountered which are as follows:

(a) The main constraint of the study was insufficiency of information, which was required for the study. There are various information the employee cannot provide due to security and other corporate obligations.

(b) As the data in most cases are not in organized way, the company failed to provide all information.

(c) Due to time limitation, many of the aspects could not be discussed in the present report.

(d) Since the company personnel were very busy, they could not pay enough time.

(e) Lack of opportunity to access to internal data.

(f) I had to base on the secondary data for preparing this report.

(g) Legal action related information was not available

(h) All of them are not eager to give me any kind of legal action related information.

(i) All the clients whom I interviewed did not want to provide necessary information.

Libra Infusions Ltd at a Glance:

Company Profile

There was always a scarcity of Intravenous (I.V.) Fluid in the market as Govt. could not manufacture enough to fulfill the local demand. Before 1985, the major portion of the local demand was being covered by the imported I.V. Fluid. To overcome this situation LIBRA made its debut in February 1985 under the strong leadership of Dr. Roushon Alam with a view to provide quality products. The company is situated on approx. 2 acres of land at Mirpur I/E, Dhaka. The factory is housed in a centrally Air Conditioning modern building having all necessary facilities. I.V. Fluid, the product of the company is a life saving and a basic medical necessity used in all medical situations involving diarrhoeal disease, surgical operation, loss of blood, weakness and hospitalization in general. LIBRA’s I.V. Fluid being a quality product has a tremendous demand in the market.

The technology has been supplied by M/S Vifor S.A., Geneva, Switzerland under a Technical Collaboration Agreement. In addition, implementation of ISO 9001 Quality Management System has ensured customer satisfaction by guaranteeing good design, reliable product quality, safe performance, prompt delivery and efficient service. LIBRA employed a team of highly qualified and motivated staff. Since LIBRA came first in this segment of pharmaceuticals, the company had to struggle with a lot of adverse situations.

But today, LIBRA is known to the medical profession and general public as the best and largest manufacturer of I.V. Fluid in Bangladesh.

Quality Policy

We at “LIBRA” are committed to provide total customer satisfaction for all products formulated & processed. This is achieved by:

• Implementing defined quality management system

• Continuous upgradation of technology

• Creating quality awareness &active participation of employees at all levels

Manufacturing Technology

Libra always uses modern technology for manufacturing I.V. Fluid a life saving product. The production is based on imported raw & packing materials our Quality Assurance System ensure full quality control testing in accordance with product requirements Technical support including LAL test, validation and stability studies are available as a part of our commitment to quality.

Human Resource

Libra has a experienced dedicated staff members which included pharmacists, chemists, doctors, engineers, accountants and other professionals. Libra’s success depends on sincerity, hard labor and team efforts of employees at all levels. Libra invests in personal and professional development of its employees through training and workshop.

PRODUCTS

Name & Details | Pack Size | Trade | VAT (Tk) | TP+VAT (Tk) | MRP(TK) | |

| • LIBOTT 5% Dextrose For rehydration at the time of Water deficit, General weakness and Post surgical intervention. Available in 500 ml & 100 ml pack size. | 500 ml | 36.64 | 6.05 | 42.69 | 48.55 | |

| 1000 ml | 46.55 | 7.68 | 54.23 | 61.70 | ||

| • LIBOTT-10 1% Dextrose For the treatment of Jaundice, General weakness, Eclampsia, Pre-eclampsia, During pregnancy & after delivery and post surgical intervention. Available in 500 ml &1000 ml pack size | 500 ml | 42.50 | 7.01 | 49.51 | 56.32 | |

| 1000 ml | 58.24 | 9.61 | 67.85 | 77.16 | ||

| • LIBOTT-25 25% Dextrose It is used in emergency treatment of Severe hypoglycaemia. To reduce cerebro-spinal pressure and energy malnutrition. It is the most extensively used injection in hospital practice. Available in 100 ml & 250 ml pack size | 100 ml | 27.00 | 4.46 | 31.46 | 35.41 | |

| 250 ml | 44.27 | 7.30 | 51.57 | 58.67 | ||

| • LIBOTT-S 5% Dextrose + 0.9% Sodium Chloride For rehydration during general weakness, Water deficiency along with sodium, Diuresis, Intoxication and post surgical intervention. Available in 500 ml &1000 ml pack size | 500 ml | 36.64 | 6.05 | 42.69 | 48.55 | |

| 1000 ml | 47.33 | 7.81 | 55.14 | 62.71 | ||

| • LIBOTT-S JR 5% Dextrose + 0.45% Sodium Chloride It fulfills water deficit along with low deficiency of NaCl, simultaneously it supplies energy for growing children. It also excludes the risk of hypernatreamia in adult where less NaCl deficiency occur. Available in 500 ml pack size | 500 ml | 42.62 | 7.03 | 49.65 | 56.47 | |

| • NORMASOL 0.9% Sodium Chloride This solution is used for correction of serious sodium deficit. It’s use is essential for haemodialysis procedure. It can be used topically for irrigation of wounds and body cavities. Available in 500 ml &1000 ml pack size | 500 ml | 35.01 | 5.78 | 40.79 | 46.39 | |

| 1000 ml | 43.38 | 7.16 | 50.54 | 57.48 | ||

| • BABY SALINE 5% Dextrose + 0.225% Sodium Chloride It fulfills both water deficit along with low deficiency of NaCl, simultaneously it supplies energy for neonates & infants. It also excludes the risk of hypernatreamia in adult where less NaCl deficiency occur. Available in 250 ml & 500 ml pack size | 500 ml | 38.05 | 6.28 | 44.33 | 50.42 | |

| 250 ml | 39.69 | 6.55 | 46.24 | 52.60 | ||

| • DIASOL 0.5% Sodium Chloride + 0.652% Sodium Acetate, 3H2O + 0.10% Potassium Chloride. It is used in dehydration during Diarrhoea, Cholera, Vomiting and Profuse sweating. Available in 500 ml &1000 ml pack size | 500 ml | 39.69 | 6.55 | 46.24 | 52.60 | |

| 1000 ml | 49.62 | 8.19 | 57.81 | 65.74 | ||

| • HARTSOL 0.6% Sodium Chloride + 0.040% Potassium Chloride + 0.027% Calcium Chloride, 2H2O +0.65% Sodium Lactate 50% Soln. Mainly used as a fluid and electrolyte replenisher in hypovolaemia caused by trauma, surgery, haemorrage and burn. Available in 500 ml &1000 ml pack size | 500 ml | 39.58 | 6.53 | 46.11 | 52.44 | |

| 1000 ml | 45.67 | 7.54 | 53.21 | 60.51 | ||

| • LIBRAZOL 0.5% Metronidazole The most effective antimicrobial agent for the treatment of anaerobic infection. Available in 100 ml pack size | 100 ml | 37.85 | 6.25 | 44.10 | 49.57 | |

| • LIBRACIN 0.2% Ciprofloxacin The most active and potent fluoroquinolone for the treatment of both gram positive and gram negative bacteria including mixed infections. Available in 100 ml pack size | 100 ml | 80.20 | 13.23 | 93.43 | 106.25 | |

| • LIBOTT-M 4.3% Dextrose + 0.18% Sodium Chloride Isotonic dextrose saline LIBOTT-M, the possible maintenance fluid throughout the pre & post operative fluid regime. Available in 500 ml &1000 ml pack size | 500 ml | 35.88 | 5.92 | 41.80 | 47.54 | |

| 1000 ml | 46.56 | 7.68 | 54.24 | 61.70 | ||

| • LIBRACIN-400 Ciprofloxacine Lactate USP 508 eq to Ciprofloxacine USP 400mg Injection | 100 ml | 1110.00 | 18.15 | 128.15 | 145.75 | |

| • LIBRET Ranitidine HCL 50mg I.V. Injection USP | 100 ml | 41.51 | 6.85 | 48.36 | 55.00 |

| 5 Year’s Financial Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| «•» Highlights On Major Items | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Board of Directors:

| • Begum Shamsun Nahar Ahsanullah – Chairperson |

| • Dr. Roushon Alam – Director & Founder |

| • Begum Ayesha Alam – Managing Director |

| • Saira Mariam Alam – Director |

| • Monami Alam – Director |

Company Secretary :

| • M.A. Rashid |

Auditors:

| M/s. Muhammad Shaheeddullah & Co. |

| Chartered Accountants |

| 19 Bangabandhu Avenue |

| Dhaka House (2nd Floor) |

| Dhaka-1000. |

| Bankers: |

| Agrani Bank |

| Amin Court Branch |

| 62-63 Motijheel C/A, |

| Dhaka-1000.

|

Contact Address Registred Office:

| I/7, Mirpur Industrial Estate, Rupnagar Section-2, Dhaka-1216, Bangladesh . Tel: 9001179, 9004770-1, 8012534, 8012536 Fax: (880-2) 8015833, E-mail:libra@libragroupbd.com |

Factory & Corporate Head Quarter:

| I/7, Mirpur Industrial Estate, Rupnagar Section-2, Dhaka-1216, Bangladesh . Tel: 9001179, 9004770-1, 8012534, 8012536 Fax: (880-2) 8015833, E-mail: |

VISION

All of our activities should benefit the society to take health care. We strongly believe that in the final analysis we are accountable to our employees, our customers, citizen of our country and shareholders.

MISSION

To attain Vision will devote its resources to manufacture world class products using modern technology.

Financial Position for the Half year ended on 31 December 2010

Sl. No | Particulars | Jul 2010 to Dec 2010 Taka |

1 | Turnover | 18,30,07,026.00 |

2 | Net profit after tax | 43,99,541.00 |

3 | Earning per share (of Tk. 100.00 each) | 35.15 |

4 | Net assets value | 196,28,82,650.00 |

5 | Net Operating cash flow per share | (205.61) |

MARKETING

Organization of marketing department of “Libra Infusions Ltd”

Vice President of Marketing

Director of Product Director of Marketing

Marketing Communication

Product Planning

Product planning is a process used to identify and develop new products. The purpose of planning is to make choices about which product ideas a company should invest in. Companies can approach product planning from a number of different perspectives. Having a system in place before planning begins is important as it helps to avoid wasted time and creates a framework for decision making. Consultants who specialize in marketing and corporate decision making can be involved in the development of a product planning system for a company, which will accommodate the company’s approach to business while helping it avoid expensive dead ends.

At any given time, a company should have numerous ideas for new products and services circulating. These ideas come from customers, distributors, people within the company, and research conducted by the company. This research can include surveys, research on competitors, and study of the market to identify emerging needs. A company must be able to act quickly on time-sensitive product ideas while also stopping bad ideas in their tracks.

The Product Planning Process Of Libra

The product planning process is one of the most controversial within any company. Everyone wants a hand in new product definition and almost everyone will have contributions that will make a new product successful. With all these interested parties, you are going to need a system to help you through the product planning process and a way to decide which ideas have the most merit. This system also needs to incorporate customer feedback, assure that important new product ideas are approved, and that development of them initiated immediately. What follows is a product planning system that works well for most companies.

The above diagram outlines the phases in the product planning cycle. In any given company, these steps may be condensed or combined. For example, some companies may use a single document to cover both the Market Requirements Document and the Functional Specification.

The steps are important because they allow you to gather input from all possible resources, evaluate the potential of each idea and gather input from all involved parties about which ideas will work and their ease of implementation.

Input

There should be no shortage of new product ideas. If you are doing regular customer councils and customer surveys, you should have a long list. (Please see Chapter 2 for more information on gathering regular input from customers and your sales channels.) You will also have ideas from sales, engineering, technical support, and management. The biggest job is narrowing down the list. A regular poll of sales, tech support, engineering, and customers for product ideas may help you prioritize. Be sure everyone in your company knows to feed product ideas to you. Often times the tech support organization has a unique insight to customer requirements because they are in contact with customers who need help daily, but no one ever bothers to ask them. When you need to narrow the list further, run it by your customer council. You can ask them to vote on the product ideas they think are most valuable.

You should also understand your current products, what is selling, what isn’t, and why. Finance should be able to provide you with a breakdown of sales by product. A couple of phone calls to key sales people should provide you with an earful of information on why certain products are selling well and why others are not. Product managers are also called upon to do customer presentations to major accounts. These presentations should be open communication sessions. It is an excellent opportunity to learn first-hand what the customer needs and how they are using your product. (For more information please see Chapter 2, “Customer Presentations”)

Competitive analysis is also an important part of product planning. Your customers, sales channels, and prospects evaluating your product will tell you where you fall short competitively. Additionally you may want to take an existing strength that you have over your competitors and lengthen your lead with improvements to that strength. Remember that a competitor won’t release a feature that is just on par with your product, they will be trying to exceed your strength. Also understand where your competitors are going and what products they have in the works. You won’t get this information directly from them, but you may hear rumors or see press on their strategic directions. Additionally listen to your prospects when they are asking you about your product features and directions. Often times they are parroting back information that your competitor’s have given them. The World Wide Web is also an excellent place to gather competitive information. Often times competitors will publish their strategic directions and, for software companies, actually have beta versions of their new software releases available.

Market analysis is also important. Trends in the industry need to be factored into your product plans. Professional market analysts can help you with this if you want a third-party perspective. Your engineering group will also provide some good ideas in this area; they are generally on top of many of the new technologies.

Don’t forget the possibility of discontinuing a current product. Discontinuing a product is a tough decision, but many companies have failed because they have spent too much of their resource trying to maintain a product with old, difficult technology. (Please see the product discontinuation section for more information on when to discontinue a product.)

Narrow down the list to a handful of ideas that you want to investigate further. Remember that the most important criteria for your company is return on investment. The top ideas that you select must either have broad market appeal (within your current market) or enable you tap a new market.

Product Ideas Refined

After narrowing down the list of potential new products or features enhancements for an existing product, you will want to refine some of the more promising ideas. Before a product idea is funded, some basic information needs to be gathered about who is going to buy the product, how much they will buy, and how much it will cost to develop it. This is the information that will eventually be expanded upon in the MRD (Market Requirements Document) but should be gathered and presented in summarized form to seek product approval. Here is the type of information you will need:

- Product Description – You need enough information so that the product can be easily described in one or two sentences to customers or other people within the company. Also position the product. Who buys the product? Why is the product of value to the buyer? Why is it better than the competition? One over-used, but effective measurement of your description is the “elevator test”. Can you sell the product idea to potential customer in the short time that you would have them as a captive audience on an elevator.

- Market Justification – Why should the company build this product? Who needs it? How much will they buy? Including market numbers and real sales projections will help you determine the size and the viability of the market. These will initially be very rough estimates until you have time to determine competing products’ marketshare.

- Resource Projection – Work with the engineering organization to get an initial very rough estimate on what it will take to build the product in terms of people-years. You will probably meet some resistance with this. No engineering manager wants to sign up to a schedule for a product that is not well defined. You will need to assure the engineering manager that no product will be defined until management can be assured of the return on investment and you can’t figure out ROI without having an estimation of the investment. Be sure to use these schedule numbers with the caveat that they are rough estimates and real schedules will be defined after the product is specified.

Products Approved

Once you have gathered the above information for you product proposals, you need to get the project approved. I recommend using a product planning meeting for this because it allows you to present all the appropriate information to everyone at once. It is also a great forum for discussion of the merits of the product. (See “Running an Effective Product Planning Meeting” below for more information.)

In some companies, you may need a full market requirements document before the project is approved. This is not the most effective method of product planning for the following reasons:

- At this point, the product manager’s time is best used looking at the broad picture and narrowing down the most promising product ideas. To do the research work required for a full MRD wastes time before the project is approved.

- Projects are better refined by all parties involved. There should be an open discussion of the project’s viability before a detailed MRD is generated.

The company should have an “Approved Projects List” (some companies call this a Plan of Record or POR) that is either published regularly or located centrally where everyone can access it. If your company doesn’t have one, then create one. This is a list of all projects that are approved and currently being developed in the company or division. Having one central list will provide a point of focus and clarify the priorities for all involved. Ideally the list should be updated regularly and posted in a central location. When a project is added to the list, it should be funded with development resources.

Market Requirements Refined

Once the product is approved you can refine the market requirements, adding more detail on the desired features of the product and how the customers will use the product. (See the “Market Requirements Document” section of this chapter for more information.) There will be two types of MRDs, one for new products and a second for new releases of a current product. The new product MRD will require

Development Initiated

Once the MRD is complete, the developers can start to work on a functional specification and prototypes. Some companies combine the MRD and Functional Specification into one document to help them decrease time to market. To do this, you must work very closely with engineering to make sure that the functional design of the product will indeed meet customer requirements. (Please see Chapter 4 – The Product Development Cycle for more information on working the Product through the development cycle

Running a Successful Product Planning Meeting

Why have a product planning meeting? Everyone hates meetings and adding one more won’t be popular. You need a meeting because time-to-market is the key to success in the high-tech industry. Anything that delays your time-to-market hurts your company. If you can gather everyone in a room and get them to agree that a new product must be funded and development started immediately, you have decreased your time-to-market.

The meeting gives you a forum to formally add and remove products and projects to the approved projects list and to make sure that everyone involved is clear on the priorities. It also gives them visibility to why the priorities are what they are.

I initially started product planning meetings when I was working in a CEO-driven company. This particular CEO would wander over engineering and together with a couple key engineers they would come up with a great idea and suddenly we had a new product that was funded. The problem was that the product was not necessarily something our customers wanted and the products our customers wanted most, didn’t have the resources assigned to them. I put the product planning meeting in place so that all ideas were researched, discussed, and approved or rejected at this meeting with everyone’s input.

This process may seem like a lot of work, and frankly it is. By comparison, you wouldn’t just start writing code on a software product without doing the structure and design work first. When you compare the effort of product planning to spending hundreds of man-hours of development resource for a product that sales can’t sell and customers won’t buy, the planning work is nominal.

How often you run product planning meetings depends upon the size of your engineering group and the dynamics of your market. Once every six weeks to once every quarter, should be often enough to reset priorities. Although the market may change overnight, product development can’t and shouldn’t be asked to. Changes to development plans, schedules and priorities need to be carefully measured.

Attendees

The objective of the meeting is to obtain product approval, so you need to invite everyone who has a say in such things including the President, CEO, VP of Marketing, VP of Engineering, VP of Finance, and VP of Manufacturing. You also want to invite anyone who will provide lively but productive discussions. (It is also your job to keep these discussions under control and not let the meeting get side-tracked.) Invite as much of engineering as you can get away with. You don’t want the meeting to become unwieldy, but at the same time you don’t want someone coming back later saying that the product should not have been approved or rejected without their input.

Meeting Format

Everyone should be notified well in advance of the meeting about which potential products or features are to be discussed. This will allow concerned parties to give you their input well in advance of the meeting. The idea is not to “spring” new product ideas in the meeting, but give people time to think about the new ideas and how it will affect their aspect of the business. Here is a sample agenda.

- Overview of the market and significant changes in the market since the last product planning meeting or within the last quarter. This is done so that the audience has complete exposure to all the changes and trends in the market. It will allow them to be better prepared to make product decisions.

- Review of company direction. A very quick review of the company’s long term goals will help everyone keep the strategy in mind when making product decisions.

- Review of the current approved products and schedules, preferably by the VP of Engineering. This lets the audience understand the current workload and how time is already allocated. If current projects are slipping it makes no sense to add new projects without removing some.

- Discussion of new project proposals or changes. Each product should be given 45 minutes to an hour for presentation and discussion, so you should only try to do four to six products in a single meeting. You will probably need to run the meeting through lunch and ideally have it off-site where there are no interruptions.

It is important to drive the meeting to conclusion. This should be your primary purpose in the meeting. The meeting should end with a review of all projects and which were approved, rejected, or need further investigation. Also included should be a list of proposed projects for the next meeting.

Product planning meeting minutes should be published immediately following the meeting. Meeting minutes are painful and it is always easy to put them off, however for this meeting the decisions are so critical to every aspect of the business that I would recommend getting the minutes out the night of the meeting.

For projects that are approved, work should commence on a Market Requirements Document

The Preparation

The outline below shows you what information should be included on the product planning slides for each product.

You need to prepare all the slides in advance of the meeting. You will want to schedule some time with engineering to review the slides before they are finalized. This is necessary for the following reasons:

- Engineering needs to provide resource estimates.

- Engineers may have great ideas on a particular implementation of a product or even a good target market for the product.

- Engineers may have strong opinions on a given project. It is best to understand those before trying to get the project approved.

For the meeting you will want to have the room set up in a round table format to encourage discussion. Have copies of the slides and back-up documentation for everyone involved. New products are controversial and anything you can do to make the meeting run smoother is important to the overall objective of the company working on projects with the best return on investment.

Outline of Presentation

I recommend using only one or two slides per product. You can hand out any back-up material. A simple standard format will allow anyone to look back at the slides and recommendations without becoming lost.

Sample Presentation

Project Name– Come up with a name for the project that is easy to identify, but don’t spend a lot of time on it, this isn’t the final product name.

Product Description – Give a brief bulleted description of the product and its positioning (why it is of value to the customers and why it is better than anything else on the market).

Recommedation – Most people would want the recommendation last, but I have worked with plenty of unruly groups who would get sidetracked long before the product manger could talk about their recommendation. So I put it as far up to the top as possible. If you are working with a more civilized group of people, you can put it at the end.

The recommendation should be one of three things: Add the project to the approved projects list and fund it, reject the project (removing it if it was on the list), or hold for further investigation. If a project is a fairly new idea and you haven’t had the opportunity to run it by your customers, you may want to recommend that you spend some more time on the market justification before it is approved. The only other statement that may be made here is the recommendation to discontinue a current product. If this is a recommendation then there should also be a discussion of the replacement product.

Market Justification – Why should the company build this product? Who needs it? How much will they buy? Include market size numbers here and real sales projections. Just remember that the VP of Sales isn’t going to sign up to these preliminary numbers!

Resource Projection – This should be a rough estimate from engineering on what it will take to build the product.

The Decision

Getting a decision from the meeting is crucial, even if the decision is that more information is needed. The ultimate decision generally falls into one of four categories:

- Approved – If there is sufficient information to approve a product, then it is added to the list of approved products and the next step, whether it is writing a market requirements document, or writing a functional specification, is started.

- Canceled – If there is not sufficient justification for a product, or it does not fit into the company strategy then it should be canceled and removed from the list of approved projects (if it was there to begin with).

- Hold pending further investigation – No matter how much research you do on a project, questions may come up that you don’t have ready answers for. Sometimes a decision will need to be delayed pending further market research information or an investigation from development. In any case, the additional information should be gathered and the project should be discussed at the next product planning meeting.

- Hold for future – If the product fits into the company strategy, but the resources are unavailable to work on it, it may be a good idea to put it on hold until some determined future time.

The decision should take into account the following criteria:

- Does the project fit into the company’s long term strategy?

- Does the target market for the project align with the company strategy?

- Will there be sufficient revenue from the product to justify the work required?

- If there is not sufficient revenue, are there other highly compelling reasons to justify the work?

- Are the resources available to do the work?

- If the resources are not available, should this project take precedence over another?

The person who ultimately makes the decision should be determined in advance of the meeting. This is generally the CEO, President, or CTO of the company. The forum should allow adequate discussion before the decision is reached.

Market Requirements Document (MRD)

Please see my MRD binder for good variety of resources on how to write a market requirements document.

Product Line and Mix of Libra

Product Line

A product line is a group of products that are closely related because they function in a similar manner, are sold to the same customer groups, are marketed through the same types of outlets, or fall within given price ranges. For example, Nike produces several lines of athletic shoes, Motorola produces several lines of telecommunications products, and AT&T offers several lines of long-distance telephone services.

Product Mix

A product mix (or product assortment) consists of all the product lines and items that a particular seller offers for sale. Avon’s product mix consists of four major product lines: cosmetics, jewelry, fashions, and household items. Each product line consists of several sublines.

Libra’s product mix has four important dimensions: width, length, depth, and consistency. Product mix width refers to the number of different product lines the company carries. For example, Procter & Gamble markets a fairly wide product mix consisting of many product lines, including paper, food, household cleaning, medicinal, cosmetics, and personal care products. Product mix length refers to the total number of items the company carries within its product lines. Procter & Gamble typically carries many brands within each line. For example, it sells eleven laundry detergents, eight hand soaps, six shampoos, and four dishwashing detergents.

Product line depth refers to the number of versions offered of each product in the line. Thus, Procter & Gamble’s Crest toothpaste comes in three sizes and two formulations (paste and gel). Finally, the consistency of the product mix refers to how closely related the various product lines are in end use, production requirements, distribution channels, or some other way. Procter & Gamble’s product lines are consistent insofar as they are consumer products that go through the same distribution channels. The lines are less consistent insofar as they perform different functions for buyers.

Product decisions

Marketing starts with the product since it is what an organization has to offer its target market. As we’ve stressed many times in this tutorial, organizations attempt to provide solutions to a target market’s problems. These solutions include tangible or intangible (or both) product offerings marketed by an organization.

In addition to satisfying the target market’s needs, the product is important because it is how organizations generate revenue. It is the “thing” that for-profit companies sell in order to realize profits and satisfy stakeholders and what non-profit organizations use to generate funds needed to sustain itself. Without a well-developed product strategy that includes input from the target market, a marketing organization will not have long-term success.

In this part of the Principles of Marketing Tutorials we take a close look at the key concepts all marketers should consider when faced with product decisions. In the Managing Products tutorial we will extend the discussion to look at the key issues in managing product decisions.

Key Product Decisions

The actual product is designed to provide the core benefits sought by the target market. The marketer offers these benefits through a combination of factors that make up the actual product.

Below we discuss in detail four key factors that together help shape the actual product. These factors include:

- Consumable Product Features

- Branding

- Packaging

- Labeling

Branding

Branding involves decisions that establish an identity for a product with the goal of distinguishing it from competitors’ offerings. In markets where competition is fierce and where customers may select from among many competitive products, creating an identity through branding is essential. It is particularly important in helping position the product (see discussion of product position) in the minds of the product’s target market.

While consumer products companies have long recognized the value of branding, it has only been within the last 10-15 years that organizations selling component products in the business-to-business market have begun to focus on brand building strategies. The most well-known company to brand components is Intel with its now famous “Intel Inside” slogan. Intel’s success has led many other b-to-b companies and even non-profits to incorporate branding within their overall marketing strategy.

Packaging

Nearly all tangible products (i.e., goods) are sold to customers within a container or package that, as we will discuss, serves many purposes including protecting the product during shipment. In a few cases, such as with certain produce items, the final customer may purchase the product without a package but the produce marketer still faces packaging decisions when it comes to shipping to the store. Thus, for many products there are two packaging decisions:

- Final Customer Package

- Distribution Channel Package

Labeling

Most packages, whether final customer packaging or distribution packaging, are imprinted with information intended to assist the customer. For consumer products, labeling decisions are extremely important for the following reasons.

- Labels serve to capture the attention of shoppers. The use of catchy words may cause strolling customers to stop and evaluate the product.

- The label is likely to be the first thing a new customer sees and thus offers their first impression of the product.

- The label provides customers with product information to aid their purchase decision or help improve the customer’s experience when using the product (e.g., recipes).

- Labels generally include a universal product codes (UPC) and, in some cases, radio frequency identification (RFID) tags, that make it easy for resellers, such as retailers, to checkout customers and manage inventory.

- For companies serving international markets or diverse cultures within a single country, bilingual or multilingual labels may be needed.

- In some countries many products, including food and pharmaceuticals, are required by law to contain certain labels such as listing ingredients, providing nutritional information or including usage warning information.

Libra’s New Product Development Strategy

- New Product Development Strategy

- You can download this presentation at: www.studyMarketing.org Visit www.studyMarketing.org for more presentations on Marketing, Strategy, Innovation, and Branding

- Key Steps in New Product Development

- Key Steps in New Product Development Idea Generation Product Screening Concept Testing Business & Financial Analysis Product Development Test Marketing Commercialization

- Idea Generation Idea generation is a continuous, systematic search for new product opportunities. It involves delineating sources of new ideas and methods for generating them.

- Methods for Generating Ideas Dimensional Analysis lists all of the physical characteristics of a product type. Having obtained such a list, creativity can be triggered by asking questions such as: "Why is the product this way?“, "How could the product be changed?" or "’What would happen if one or more of the characteristics were removed?"

- Problem Analysis is a need-assessment technique designed to develop an inventory of consumer problems in a particular product or service category and to serve as a basis for new product or service ideas.

- Benefit Structure Analysis determines what specific benefits and characteristics are desired by consumers within a particular product or service category and identifies perceived deficiencies in what is currently provided.

- Scenario Analysis identifies opportunities by capitalizing on projected future environments and associated consumer needs.

- Product Screening After the firm identifies potential products, it must screen them. In product screening, poor, unsuitable, or otherwise unattractive ideas are weeded out from further actions.

- Today, many companies use a new-product screening checklist for preliminary evaluation.

- In it, firms list the new-product attributes considered most important and compare each idea with those attributes.

- The checklist is standardized and allows ideas to be compared.

- Concept testing presents the consumer with a proposed product and measures attitudes and intentions at this early stage of development. Concept Testing

- Concept testing is a quick and inexpensive way of measuring consumer enthusiasm. It asks potential consumers to react to a picture, written statement, or oral description of a product. This enables a firm to determine initial attitudes prior to expensive, time-consuming prototype development.

- Business and financial analysis for the remaining product concepts is much more detailed than product screening. Business & Financial Analysis

- Factors considered in business analysis stage :

- Demand projections

- Cost projections

- Competition

- Required investment

- Profitability

- Product development converts a product idea into a physical form and identifies a basic marketing strategy. Product Development

- It involves product construction, packaging, branding, product positioning, and usage testing.

- Test marketing involves placing a product for sale in one or more selected areas and observing its actual performance under the proposed marketing plan. Test Marketing

- The purpose is to evaluate the product and pretest marketing efforts in a real setting prior to a full-scale introduction.

- Rather than inquire about intentions, test marketing allows actual consumer behavior to be observed. The firm can also learn about competitive reactions and the response of channel members.

- After testing is completed, the firm is ready to introduce the product to its full target market. This is commercialization and corresponds to the introductory stage of the product life cycle.

- Commercialization involves implementing a total marketing plan and full production.

- Key Success Factors in New Product Development

- An investigation of new product practices in 700 firms by Booz-Allen & Hamilton identified the existence of common characteristics in companies that were successful at product innovation

- Successful companies are more committed to growth through new products developed internally. 1. Operating Philosophy

- They are more likely to have had a formal new product process in place for a longer period of time than unsuccessful companies. They are more likely to have a strategic plan that includes a certain portion of company growth from new products.

- Successful companies are more likely to house the new product organization in R&D or engineering and are more likely to allow the marketing and R&D functions to have greater influence on the new product process. 2. Organizational Structure

- Experience in introducing new products enables companies to improve new product performance. 3. The Experience Effect

- New product development costs conform to the experience curve: The more you do something, the more efficient you become at doing it. This experience advantage stems from the acquisition of a knowledge of the market and of the steps required to develop a new product.

- Successful companies appear not only to select a management style appropriate to immediate new product development needs but also to revise and tailor that approach to changing new product opportunities 4. Management Style

- An empirical research by Robert Cooper found three key factors that distinguish winning projects from the losers

- Factor 1: A High-Quality New Product Process Factor 2: A Clear and Well-Communicated New Product Strategy for the Business Factor 3: Adequate Resources for New Products three key factors three key factors for effective product development:

- Factor 1: A High-Quality New Product Process

- Some of these success factors that top performers build into their new product processes include:

- emphasizing the up-front predevelopment homework;

- building in the voice of the customer throughout

- Some of these success factors that top performers build into their new product processes include:

- Factor 1: A High-Quality New Product Process

- demanding sharp, early product definition

- having tough Go/Kill decision points where projects really do get killed

- and highlighting quality of execution throughout

- there are clear goals or objectives for the business’s total new product effort; for example, what percentage of sales or profits new products will contribute to the business

Factor 2: A Clear and Well-Communicated New Product Strategy for the Business

- there are clearly defined arenas—specified areas of strategic focus, such as products, markets, or technologies—to give direction to the business’s total new product effort

- the role of new products in achieving the business’s goals and the new product strategy for the business are clearly communicated to all who need to know

- In top-performing businesses, senior management has devoted the necessary resources—people and money, marketing and technical—to achieve the business’s new product objectives

Factor 3: Adequate Resources for New Products

- R&D budgets are adequate—judged to be sufficient in light of the business’s new product objectives

- the necessary people are in place and have their time freed up for new products.

- Source of Reference: Robert Cooper, Winning at New Products: Accelerating the Process from Idea to Launch, Perseus Books Group.

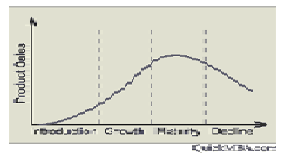

The Product Life Cycle

A new product progresses through a sequence of stages from introduction to growth, maturity, and decline. This sequence is known as the product life cycle and is associated with changes in the marketing situation, thus impacting the marketing strategy and the marketing mix.

The product revenue and profits can be plotted as a function of the life-cycle stages as shown in the graph below:

Product Life Cycle Diagram

Introduction Stage

In the introduction stage, the firm seeks to build product awareness and develop a market for the product. The impact on the marketing mix is as follows:

- Product branding and quality level is established and intellectual property protection such as patents and trademarks are obtained.

- Pricing may be low penetration pricing to build market share rapidly, or high skim pricing to recover development costs.

- Distribution is selective until consumers show acceptance of the product.

- Promotion is aimed at innovators and early adopters. Marketing communications seeks to build product awareness and to educate potential consumers about the product.

Growth Stage

In the growth stage, the firm seeks to build brand preference and increase market share.

- Product quality is maintained and additional features and support services may be added.

- Pricing is maintained as the firm enjoys increasing demand with little competition.

- Distribution channels are added as demand increases and customers accept the product.

- Promotion is aimed at a broader audience.

Maturity Stage

At maturity, the strong growth in sales diminishes. Competition may appear with similar products. The primary objective at this point is to defend market share while maximizing profit.

- Product features may be enhanced to differentiate the product from that of competitors.

- Pricing may be lower because of the new competition.

- Distribution becomes more intensive and incentives may be offered to encourage preference over competing products.

- Promotion emphasizes product differentiation.

Decline Stage

As sales decline, the firm has several options:

- Maintain the product, possibly rejuvenating it by adding new features and finding new uses.

- Harvest the product – reduce costs and continue to offer it, possibly to a loyal niche segment.

- Discontinue the product, liquidating remaining inventory or selling it to another firm that is willing to continue the product.

The marketing mix decisions in the decline phase will depend on the selected strategy. For example, the product may be changed if it is being rejuvenated, or left unchanged if it is being harvested or liquidated. The price may be maintained if the product is harvested, or reduced drastically if liquidated.

Planning with the Product Life Cycle

As we saw in the Managing External Forces and Marketing Planning and Strategy tutorials, there are many components, both internal and external, that must be considered within the marketing planning process. In fact, for many marketers creating the Marketing Plan represents one of the most challenging and burdensome tasks they face. Fortunately, over the years marketing academics and professionals have put forth theories, models and other tools that aid planning. Possibly the most widely used planning tool within marketing is the Product Life Cycle (PLC) concept. The basic premise of the PLC is that products go through several stages of “life” with each stage presenting the marketer with different challenges that must be met with different marketing approaches. By understanding a product’s position in the PLC, the marketer may be able to develop more effective plans.

There have been several attempts over the years to define the stages that make up the PLC. Unfortunately, the PLC may be different for different products, different markets and different market conditions (e.g., economic forces). Consequently, there is not a one-model-fits-all PLC. Yet there is enough evidence to suggest that most products experience patterns of activity that divide the evolution of the product into five distinct stages. These stages are:

- Development – Occurs before the product is released to the market and is principally a time for honing the product offering and preparing the market for product introduction.

- Introduction – Product is released to the market and sales begin though often gradually as the market becomes aware of the product.

- Growth – If the product is accepted it may reach a stage of rapid growth in sales and in profits.

- Maturity –At some point sales of a product may stabilize. For some products the maturity phase can be the longest stage as the product is repeatedly purchased by loyal customers. However, while overall sales may grow year-over-year, percentage sales increases may be small.

- Decline – All products eventually see demand decline as customers no longer see value in purchasing the product.

Target Markets and Market Segmentation

The market selected by a company as the target for their marketing efforts (i.e., target market) is critical since all subsequent marketing decisions will be directed toward satisfying the needs of these customers. But what approach should be taken to select markets the company will target?

One approach is to target at a very broad level by identifying the market as consisting of qualified customers who have a basic need that must be satisfied. For example, one could consider the beverage market as consisting of all customers that want to purchase liquid refreshment products to solve a thirst need. While this may be the largest possible market a company could hope for (it would seem to contain just about everyone in the world!) in reality there are no commercial products that would appeal to everyone in the world since individual nutritional needs, tastes, purchase situations, economic conditions, and many other issues lead to differences in what people seek to satisfy their thirst needs.

Because people are different and seek different ways to satisfy their needs, nearly all organizations, whether for-profits or not-for-profits, industrial or consumer, domestic or international, must use a Market Segmentation approach to target marketing. This approach divides broad markets, consisting of customers possessing different characteristics, into smaller market segments in which customers are grouped by characteristic shared by others in the segment.

To successfully target markets using a segmentation approach, organizations should engage in the following three-step process.

- Identify segments within the overall market

- Choose the segment(s) that fits best with the organization’s objectives and goals

- Develop a marketing strategy that appeals to the selected target market(s)

Market Pricing: Price Lining Method

As we have discussed many times throughout the Principles of Marketing Tutorials, marketers must appeal to the needs of a wide variety of customers tutorial . The difference in the “needs-set” between customers often leads marketers to realization that the overall market is really made up of a collection smaller market segments. These segments may seek similar products but with different sets of product features, which are presented in the form of different models (e.g., different quality of basketball sneakers) or service options (e.g., different hotel room options).

Price lining or product line pricing is a method that primarily uses price to create the separation between the different models. With this approach, even if customers possess little knowledge about a set of products, customers may perceive they are different based on price alone. The key is whether the prices for all products in the group are perceived as representing distinct price points (i.e., enough separation between each). For instance, a marketer may sell a base model, an upgraded model and a deluxe model each at a different price. If the differences in features for each model is not readily apparent to a customer, such as differences that are inside the product and not easily viewed (e.g., difference between laptop computers), then price lining will help the customer recognize that differences do exist as long as the prices are noticeably different.

Price lining can also be effective as a method for increasing profitability. In many cases the cost to the marketer for adding different features to create different models or service options does not alone justify a big price difference. For instance, an upgraded model may cost 10% more to produce than a base model but using the price lining method the upgraded product price may be 20% higher and thus more profitable than the base model. The increase in profitability offered by price lining is one reason marketers introduce multiple models, since it allows the company to not only satisfy the needs of different segments but also presents an option for a customer to “buy up” to a higher priced and more profitable model.

Steps in the Price Setting Process

We view price setting as a series of decisions the marketer makes in order to determine the price direct and indirect customers pay to acquire the product. Direct customers are those who purchase products directly from the marketer. For example, consider the direct pricing decisions that take place when a new novel is sold:

- Publisher of the book must decide at what price they will charge their immediate customers in the channel of distribution such as online booksellers (e.g., Amazon.com).

- Booksellers must decide at what price they will sell the book to their immediate customers which are typically final consumers (e.g., website shopper).

As we see with the bookseller example, many companies also sell indirectly to the final customer through a network of resellers such as retailers. For marketers selling through resellers the pricing decision is complicated by resellers’ need to earn a profit and the marketer’s need to have some control over the product’s price to the final customer. In these cases setting price involves more than only worrying about what the direct customer is willing pay since the marketer must also evaluate pricing to indirect customers (e.g., resellers’ customers). Clearly sales can be dramatically different than what the marketer forecasts if the selling price to the final customer differs significantly from what the marketer expects. For instance, if the marketing organization has forecasted to sell 1,000,000 novels if the price to the final customer is one price and resellers decide to raise the price 25% higher than that price the marketer’s sales may be much lower then forecasted.

With an understanding that marketers must consider many factors (see the Pricing Decisions tutorial) when setting price, we now turn to the process by which price is set. We present this as a five-step approach. As we noted earlier, while not all marketers follow these steps, what is presented does cover the methods used by many marketers.

The steps we cover include:

1. Examine Company and Marketing Objectives

2. Determine an Initial Price

3. Set Standard Price Adjustments

4. Determine Promotional Pricing

5. State Payment Options

Cost Pricing: Markup Method

This pricing method, often utilized by resellers who acquire products from suppliers, uses a percentage increase on top of product cost to arrive at an initial price. A major general retailer, such as Walmart, may apply a set percentage for each product category (e.g., womens’ clothing, automotive, garden supplies, etc.) making the pricing consistent for all like-products. Alternatively, the predetermined percentage may be a number that is identified with the marketing objectives (e.g., required 20% ROI).

For resellers that purchase thousands of products (e.g., retailers) the simplicity inherent in markup pricing makes it a more attractive pricing option than more time-consuming methods. However, the advantage of ease of use is sometimes offset by the disadvantage that products may not always be optimally priced resulting in products that are priced too high or too low given the demand for the product.

Resellers differ in how they use markup pricing with some using the Markup-on-Cost method and others using the Markup-on-Selling-Price method. In the next two sections we cover each option. We will demonstrate each using an item that costs a reseller (US) $50 to purchase from a supplier and sells to customers for (US) $65.

Markup-on-Selling-Price Pricing Method

Many resellers, and in particular retailers, discuss their markup not in terms of Markup-on-Cost but as a reflection of price. That is, the markup is viewed as a percentage of the selling price and not as a percentage of cost as it is with the Markup-on-Cost method. For example, using the same information as was used in the Markup-on-Cost, the Markup-on-Selling-Price is reflected in this formula:

Markup Amount = Markup Percentage

Selling Price

$15 = 23%

$65

The calculation for setting initial price using Markup-on-Selling-Price is:

Item Cost = Price

(1.00 – Markup Percentage)

$50 = $65

(1.00 – .23)

Market Pricing: Psychological Method

For many years researchers have investigated customers’ response to product pricing. Some of the results point to several interesting psychological effects price may have on customers’ buying behavior and on their perception of individual products. We stress that certain pricing tactics “may” have a psychological effect since the results of some studies have suggested otherwise. But enough studies have shown an effect that this topic is worthy of discussion.

Odd-Even Pricing

One effect dubbed “odd-even” pricing relates to whole number pricing where customers may perceive a significant difference in product price when pricing is slightly below a whole number value. For example, a product priced at (US) $299.95 may be perceived as offering more value than a product priced at $300.00. This effect can also be used to influence potential customers who receive product information from others. Many times a buyer will pass along the price as being lower than it is either because they recall it being lower than the even number or they want to impress others with their success in obtaining a good value. For instance, in our example a buyer who pays $299.95 may tell a friend they paid “a little more than $200” for the product when in fact it was much closer to $300.

Prestige Pricing

Another psychological effect, called prestige pricing, points to a strong correlation between perceived product quality and price. The higher the price the more likely customers are to perceive it has being higher quality compared to a lower priced product. (Although there is point at which customers will begin to question the value of the product if the price is too high.) In fact, the less a customer knows about a product the more likely they are to judge the product as being of higher quality based on only knowing the price. Prestige pricing can also work with odd-even pricing as marketers, looking to present an image of high quality, may choose to price products at even levels (e.g., $10 rather than $9.99).

Channels of Distribution

In the Business Buying Behavior Tutorial, we describe a supply chain as consisting of all parties and their supplied activities that help a marketer create and deliver products to the final customer. For marketers, the distribution decision is primarily concerned with the supply chain’s front-end or channels of distribution that are designed to move the product (goods or services) from the hands of the company to the hands of the customer. Obviously when we talk about intangible services the use of the word “hands” is a figurative way to describe the exchange that takes place. But the idea is the same as with tangible goods. All activities and organizations helping with the exchange are part of the marketer’s channels of distribution.

Activities involved in the channel are wide and varied though the basic activities revolve around these general tasks:

- Ordering

- Handling and shipping

- Storage

- Display

- Promotion

- Selling

- Information feedback

Type of Channel Members

Channel activities may be carried out by the marketer or the marketer may seek specialist organizations to assist with certain functions. We can classify specialist organizations into two broad categories: resellers and specialty service firms.

Resellers

These organizations, also known within some industries as intermediaries, distributors or dealers, generally purchase or take ownership of products from the marketing company with the intention of selling to others. If a marketer utilizes multiple resellers within its distribution channel strategy the collection of resellers is termed a Reseller Network. These organizations can be classified into several sub-categories including:

- Retailers – Organizations that sell products directly to final consumers.

- Wholesalers – Organizations that purchase products from suppliers, such as manufacturers or other wholesalers, and in turn sell these to other resellers, such as retailers or other wholesalers.

- Industrial Distributors – Firms that work mainly in the business-to-business market selling products obtained from industrial suppliers.

Specialty Service Firms

These are organizations that provide additional services to help with the exchange of products but generally do not purchase the product (i.e., do not take ownership of the product):

- Agents and Brokers – Organizations that mainly work to bring suppliers and buyers together in exchange for a fee.

- Distribution Service Firms – Offer services aiding in the movement of products such as assistance with transportation, storage, and order processing.

- Others – This category includes firms that provide additional services to aid in the distribution process such as insurance companies and firms offering transportation routing assistance.

Channel Arrangements

The distribution channel consists of many parties each seeking to meet their own business objectives. Clearly for the channel to work well, relationships between channel members must be strong with each member understanding and trusting others on whom they depend for product distribution to flow smoothly.

For instance, a small sporting goods retailer that purchases products from a wholesaler trusts the wholesaler to deliver required items on-time in order to meet customer demand, while the wholesaler counts on the retailer to place regular orders and to make on-time payments.

Relationships in a channel are in large part a function of the arrangement that occurs between the members. These arrangements can be divided in two main categories:

- Independent Channel Arrangements

- Dependent Channel Arrangement

Marketing Issues in Channels

Distribution strategy can be shaped by how decisions are made in other marketing areas.

Product Issues

The nature of the product often dictates the distribution options available especially if the product requires special handling. For instance, companies selling delicate or fragile products, such as flowers, look for shipping arrangements that are different than those sought for companies selling extremely tough or durable products, such as steel beams.

Promotion Issues

Besides issues related to physical handling of products, distribution decisions are affected by the type of promotional activities needed to sell the product to customers. For products needing extensive salesperson-to-customer contact (e.g., automobile purchases) the distribution options are different than for products where customers typically require no sales assistance (i.e., bread purchases).

Pricing Issues

The desired price at which a marketer seeks to sell their product can impact how they choose to distribute. As previously mentioned, the inclusion of resellers in a marketer’s distribution strategy may affect a product’s pricing since each member of the channel seeks to make a profit for their contribution to the sale of the product. If too many channel members are involved the eventual selling price may be too high to meet sales targets in which case the marketer may explore other distribution options.

Target Market Issues

A distribution system is only effective if customers can obtain the product. Consequently, a key decision in setting up a channel arrangement is for the marketer to choose the approach that reaches customers in the most effective way possible. The most important decision with regard to reaching the target market is to determine the level of distribution coverage needed to effectively meet customer’s needs. Distribution coverage is measured in terms of the intensity by which the product is made available and is discussed in detail in the next section.

Distribution Systems: Direct

With a direct distribution system the marketer reaches the intended final user of their product by distributing the product directly to the customer. That is, there are no other parties involved in the distribution process that take ownership of the product. The direct system can be further divided by the method of communication that takes place when a sale occurs. These methods are:

- Direct Marketing Systems – With this system the customer places the order either through information gained from non-personal contact with the marketer, such as by visiting the marketer’s website or ordering from the marketer’s catalog, or through personal communication with a customer representative who is not a salesperson, such as through toll-free telephone ordering.

- Direct Retail Systems – This type of system exists when a product marketer also operates their own retail outlets. As previously discussed, Starbucks would fall into this category.

- Personal Selling Systems – The key to this direct distribution system is that a person whose main responsibility involves creating and managing sales (e.g., salesperson) is involved in the distribution process, generally by persuading the buyer to place an order. While the order itself may not be handled by the salesperson (e.g., buyer physically places the order online or by phone) the salesperson plays a role in generating the sales.

- Assisted Marketing Systems – Under the assisted marketing system, the marketer relies on others to help communicate the marketer’s products but handles distribution directly to the customer. The classic example of assisted marketing systems is eBay which helps bring buyers and sellers together for a fee. Other agents and brokers would also fall into this category.

Distribution Channels

How do you sell to your end-users? Do you use a direct sales team? Resellers? A catalog or website?

Distribution channels are the pathways that companies use to sell their products to end-users. B2B companies can sell through a single channel or through multiple channels that may include

- Direct/sales team: One or more sales teams that you employ directly. You may use multiple teams that specialize in different products or customer segments.

- Direct/internet: Selling through your own e-commerce website.

- Direct/catalog: Selling through your own catalog.

- Wholesaler/distributor: A company that buys products in bulk from many manufacturers and then re-sells smaller volumes to resellers or retailers.

- Value-added reseller (VAR): A VAR works with end-users to provide custom solutions that may include multiple products and services from different manufacturers.

- Consultant: A consultant develops relationships with companies and provides either specific or very broad services; they may recommend a manufacturer’s product or simply purchase it to deliver a solution for the customer.

- Dealer: A company or person who buys inventory from either a manufacturer or distributor, then re-sells to an end-user.

- Retail: Retailers sell directly to end-users via a physical store, website or catalog.

- Sales agent/manufacturer’s rep: You can outsource your sales function to a company that sells different manufacturers’ products to a group of similar customers in a specific territory.

Distribution is one of the classic “4 Ps” of marketing (product, promotion, price, placement a.k.a. distribution). It’s a key element in your entire marketing strategy — it helps you expand your reach and grow revenue.

Here are three distribution examples:

DIRECT TO END USERS | SELL THROUGH A DEALER NETWORK | SELL THROUGH A VAR (VALUE-ADDED RESELLER) |

You have a sales team that sells directly to Fortune 100 companies. You have a second product line for small businesses. Instead of using your sales team, you sell this line directly to end-users through your website and marketing campaigns. | You have two markets and two distribution channels. You sell a product through a geographical network of dealers who sell to end-users in their areas. The dealers may service the product as well. Your dealers are essentially your customers, and you have a strong program to train and support them with marketing campaigns and materials. | You sell a product to a company who bundles it with services or other products and re-sells it. That company is called a Value Added Reseller (VAR) because it adds value to your product. A VAR may work with an end-user to determine the right products and configurations, then implement a system that includes your product. |

To create a good distribution program, focus on the needs of your end-users.

- If they need personalized service, you can utilize a local dealer network or reseller program to provide that service.

- If your users prefer to buy online, you can create an e-commerce website and fulfillment system and sell direct; you can also sell to another online retailer or a distributor to offer your product on their own sites.

- You can build your own specialized sales team to prospect and close deals directly with customers.

Wholesalers, resellers, retailers, consultants and agents already have resources and relationships to quickly bring your product to market. If you sell through these groups instead of (or in addition to) selling direct, treat the entire channel as a group of customers – and they are, since they’re buying your product and re-selling it. Understand their needs and deliver strong marketing programs; you’ll maximize everyone’s revenue in the process.

Best Case | Neutral Case | Worst Case |

You’ve used one or more distribution channels to grow your revenue and market share more quickly than you would have otherwise. Your end-users get the information and service they need before and after the sale. If you reach your end-user through wholesalers, VARs or other channel partners, you’ve created many successful marketing programs to drive revenue through your channel and you’re committed to their success. | You’re using one or more distribution channels with average success. You may not have as many channel partners as you’d like, but your current system is working moderately well. You devote resources to the program, but you wonder whether you’d be better off building an alternative distribution method — one that could help you grow more aggressively than you are now. | You probably aren’t hitting your revenue goals because your distribution strategy is in trouble. With your current system, you may not be effectively reaching your end-users; your prospects probably aren’t getting the information and service they need to buy your product. Your current system may also be difficult to manage. For example, channel members may not sell at your suggested price; they don’t follow up on leads you deliver; they don’t service the product very well and you’re taking calls from angry customers. |

Key concepts & steps