In April 2005NAISHARGIC PROPERTIES LTD. was established with the primary goal of providing first-grade quality service and takes a leadership role in the Real Estate market. Throughout the year their dedications to quality and diligence in remaining technically astute have been the key ingredients of their success in several clients’ engagements. We have thus been able to maintain long-term relationship with distinctions and pride.

While the trend in many businesses has been to diversify, this basic trend has guided NPL to diversify its activities. Their expertise lies in Real Estate; their only business is providing exceptional services, in an effort which encompasses land owners’ support, system design and administration.

In some instances, their sizable staff helps their clients to pick their peak workloads, allowing them to focus on the operation of their day-to-day business. They also emphasize their capabilities in undertaking large complex development projects, and share with their clients the commitment in meeting stringent deadlines and objectives. They pride their selves in being able to make the difference between a project that is delayed and a job that is well done within a reasonable time frame. They are a customer focus company and strive their best to make them smile.

1.1 Background of the Study:

Internship report is one of the very important and vital requirements, for business graduates. For this it is very important to gain practical knowledge on this subject that, why our honorable Chairman, Agricultural Economics & Rural Sociology, Md. MaqbulHossain assigned me to prepare a report on internship working period. For the fulfillment of his requirement I chose Naishargic Properties ltd. for my report.

1.2 Objective of the study:

Working or preparing report without objective is sailing without destination. Every report has an objective and in academic program there are basically two types of objectives one is primary and another is secondary objective.

- Primary objectiveis to makeastudyonthe overall financial performance ofselected real estate company (previously mentioned) and gathering knowledge about that real estate company’s projects.

- Thesecondary objectiveis to prepare this report to fulfill internship requirements.

1.3 Scope of the Study:

The scope of the report is to make a critical study regarding the project management of that above mentions corporatecompany in Bangladesh. We had to make heavy preoccupation in internship report. The results of this internship period are presented in this report.

1.4 Methodology:

1.4.1 Sources of Information:

To prepare this I generally use both the primary and secondary sources.

Primary sources:

I generally collect their data from the working in the company, company’s magazine, annual report, newspaper and also from the website of the company.

Secondary sources:

We collected information from their corporate office by discussing with the employees.

1.4.2 Data Collection Process:

- Face to face interview

- Discussion with the clients

1.4.3 Limitation:

There may some limitations behind this report. These are –

- Studyexclusivelydependsonthecompany’s internalfinancial data,soitissubjecttoalllimitationsthatareinherent inthecondensedinternalfinancialstatements.

- Thestudy coversaperiodofonlysevenyearsfrom2005-06to 2011-2012.Thedatacollected isonlyfortencompanies andthismightnotbetruerepresentation ofthe industry.Thisisamajorlimitationoftheresearch.

- 1. Preamble of REHAB:

Urbanization is an outcome of both population growth and rural-urban migration. As urbanization increases, more and more people are becoming city dwellers. Bangladesh is not any exception to that picture. The ever-increasing urban population is catering an increasing demand for shelter. The right of shelter is a fundamental right, which is ensured by both the declaration of United Nation (UN) and the constitution of Bangladesh. But it is very difficult on the part of the government of Bangladesh alone to ensure housing for all. Here comes the need of private sector real estate development.

It is a recognized fact that the health of the Real Estate Development Sector is the barometer of the National economy. In Bangladesh Real Estate Business started in Dhaka in late seventies. During 1970s there were fewer than 5 companies engaged in this business. In 1988 there were 42 such developers working in Dhaka and now in 2012 there are more than 650 companies engaged in this business.

2.1. Formation of REHAB:

With the number of companies increasing gradually, various problems concerning the housing sector cropped up requiring early solution. At this stage it was necessary to form a trade association of the Real Estate developers to protect the overall interests of the sector. To strengthen the role of real estate sector Real Estate & Housing Association of Bangladesh (REHAB) was formed with only 11 members in 1991. The objective of REHAB was to promote formal private sector Real Estate Development in Bangladesh.

2.2. Present Performance:

REHAB is the only trade organization of Real Estate Developers with a current membership of 422 Developers. All major institutionalized Developers are members of this organization. REHAB is also the “A Class” member of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI). In the recent years REHAB has played a very significant role in nation building through Real Estate Development by its members. The members of REHAB contribute a large amount of revenue to the Government exchequer in terms of Registration Cost, Income Tax and Utility Service Charges.

REHAB organizes its most colorful annual event REHAB Housing Fair each year in Bangladesh for the member developers, financial institutions and building material providers. It has already successfully completed eleven Housing Fairs during 2001 to 2011 at Different places in Dhaka City. To foster the growth of Real Estate Sector REHAB plans to organize Housing Fair abroad for the Bangladeshi individuals who are living different countries of the World to buy apartment, land and commercial spaces in their home country. Accordingly, the first – ever Housing Fair abroad organized by REHAB on August 2004 at Quality Hotel Hempstead, 80 Clinton Street, New York, USA.

2.3. REAL ESTATE HOUSING ASSOCIATION OF BANGLADESH (REHAB)

AT A GLANCE

Year of Establishment: 1991

No of Member in 1991: 11

No of Member in 2012 (October): 422

No of Apt. units Delivered by the Developer in last 20 year: 68000 (Approx.)

No of Apt. units Delivered by the Developer per year (2008): 5500-6000 units

No of Plot units Delivered by the Developer per year: 5000-6000 units.

Approx. turnover per year: 1,550 Crore Taka (Tk. 15.50 billion)

Contribution revenue to Government: 100 Crore Taka (Tk. 1.00 billion)

Contribution to GDP: 12-14 %

Direct Employment:

a. Architects : 400 nos

b. Graduate Engineer : 2000 nos

c. Diploma Engineer : 8000 nos

d. Management Official : 14000 nos

d. Direct Labour Skilled & unskilled : 1.5 million (15 Lacs ).

2.4. Building Materials used by the members of REHAB:

Aluminum Cement

Bricks Tiles & Sanitary

Paints Woods

C.I. Sheet Ceramic & Mosaic

Electric Hardware

Lighting Sand & Stone

Glass

2.5. Real Estate Business at a Glance:

To develop a land, A Real Estate Company needs to go through some process. The sequence form the beginning from the land procurement to sales and all the promotional activities are enlisted below:

1. Land Procurement: –

a) Joint Venture (Develop vs. landowner).

b) Location / Size or land.

c) Ratio/Profit Sharing.

d) By ownership

2. Legal Activities: –

a) Document Searching.

b) Deed of Agreement.

c) Power of Attorney.

3. At Present in- house as well as external advisors is providing this service: –

a) Architectural (Engineering survey of land).

b) Structural (Soil test).

c) Electromechanical (Different consultants).

4. Brochures and Leaflet: –

a) Perspective (by other firms).

b) Brochure design & printing etc.

5. Advertising: –

a) Ad preparation.

b) Insertion in Press Medias.

c) Animation etc.

d) Printing.

6. RAJUK Clearance: –

a) RAJUK Sheet Preparation.

b) Submissions.

c) Clearance from different authorities.

7. Construction: –

a) Layout.

b) Starting construction of structure (pilling/foundation).

c) Civil work.

d) Finishing

8. Procurement of Materials: –

a) Purchase of quality materials.

b) Sourcing at reasonable price and in time.

c) Managing inventory.

9. Accounting & Finance

a) Souring fund.

b) Maintenance of Account.

10. Sales: –

a) Clients call in response to ad and hoarding.

b) Sales materialization after demonstration.

11. After Sales: –

a) Recovery of installments.

b) Meeting client demand/desire.

c) Loan Processing.

d) Optional works handling.

12. Quality Control: –

a) Purchased materials are tested through BUET Laboratory.

b) Professional in house personnel are involved in quality control during the whole process of construction.

13. Promotional Activities: –

a) Different Souvenirs are published.

b) Gift Items.

c) Sponsorship.

d) Participation in Fairs.

e) Write up Press Medias

14. Advertisement: –

a) Advertisement in different Daily Newspapers

b) Advertisement in different Weekly Magazines

c) Advertisement in different Bangla Newspapers/Magazines published in other countries

d) Different National & International Magazines

e) Advertisement from personal known circle

f) Advertisement on electric media/different TV channel.

15. Registration Process: –

a) Registration of Apartment/Shop/Office Space.

b) Free hold land.

c) Lease holds land.

d) VAT.

e) Income Tax etc.

16. Hand Over: –

a) Landowner after finishing to both L/O & Clients.

b) Forming Cooperative Society.

c) Transfer of cooperative fund.

d) Ensuring after sales service for one year at least after hand over of Project.

17. Broker: –

a) Land Broker

b) Apartment Sales Broker.

18. Involvement with other Organizations: –

a) RAJUK.

b) DESA.

c) WASA.

d) TGTDCL.

e) DOE.

f) CAAB, BAF.

g) BB &Treasury.

h) Different Banks.

i) HBFC, IDLC, DBH, etc.

j) Different suppliers (Lift &Generator etc.).

k) Papers.

l) Magazines (Home & Abroad).

m) Architects.

n) Engineers.

- o) Institutions like DCCI, FBCCI, and MCCI etc.

p) REHAB.

q) Clubs.

r) Police.

s) Muscleman.

t) Contractors.

u) BUET & other Universities.

20. Market Survey/ Research: –

a) Survey of different projects in Dhaka.

b) Survey on clients for demand analysis.

c) And so many other seasons.

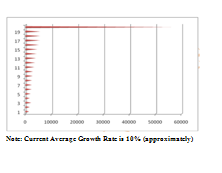

2.6. Apartment Units Delivered In The Last 20 Years:

Year | No. of Apartment | Growth Rate |

1990 | 840 | 27 |

1991 | 1275 | 51 |

1992 | 1540 | 21 |

1993 | 2140 | 39 |

1994 | 1530 | 28 |

1995 | 1850 | 20 |

1996 | 2298 | 24 |

1997 | 2320 | 01 |

1998 | 2430 | 05 |

1999 | 2684 | 10 |

2000 | 2840 | 06 |

2001 | 3298 | 16 |

2002 | 3620 | 10 |

2003 | 3930 | 09 |

2004 | 4172 | 06 |

2005 | 4465 | 07 |

2006 | 5074 | 14 |

2007 | 5480 | 10 |

2008 | 5897 | 12 |

2009 | 7234 | 14 |

2010 | 8777 | 16 |

Total | 73694

| – |

3.0 Organization

3.1 Company Profile

Registering Name:

Naishargic Properties Ltd

Incorporation Date:

The Company started its operation from April 2005 as a public limited company, under the company act of 1994.

Company Registration No: C-49030 (1014)/2005, April 2005

Company’s TIN NO: 142 200 8445/CO.15 TEX AREA-5, DHAKA.

Dhaka City Corporation’s (DCC) Trade License No.: 157190

Company Vat No- 9131051985

3.2 History

Naishargic Properties Ltd (NPL) has taken birth just in the year 2005 with a bunch of young professionals in real estate industry in Bangladesh.

The company vision allows the members to serve the nation ultimately in a different angle very smartly. NPL believes to cater the need of house of the people as a whole is not a difficult job.

It’s just a matter of long term planning on any environment friendly geographical location. Of course it involves so many factors in deciding about that. It has taken twelve projects in different locations in Dhaka (till August 2012). More than ten are in the pipe line also for presentation to the prospects within the year 2012. NPL is little a bit slow but steady in persuasion of its goal. The Management Personnel, Professionals, Managers, Executives, Architects, Engineers and Staffs Members are serving for the enhancement of efficiency of the company so that the company serves the prospects and clients better, always. Departmentalization is specially taken care for systematic and coordinated operation of the company activities. A panel of Advisors, Consultants and Patrons are also continuously working for its enrichment of products and services.

3.3. Key Features of NPL:

NAISHARGIC PROPERTIES LTD. is a team of resource full skilled human Asset in the Complex aspect of Real estate Business.

NPL is a team … with demonstrative capabilities for clients who seek special, outside skills for particularly large or urgent needs. Capable of quickly mobilizing technical talent in order to react quickly to deadlines and to offer methods which have proven successful in providing solution to current-day problems.

NPL is a team… with a proven track record in most industries wherever the challenges of business depend upon computer technology.

NPL is a team … that brings a quality revolution to its customers by achieving service equivalent of defect-free status.

NPL is a team … with a number of full time technicians committed to providing the high quality responsive service that has been the cornerstone of their success and which has accounted for recurring business with their customers. Professionals empowered with a clear mission, superior talent and unerring integrity.

… With a proven track record in most industries;

Wherever the challenges of business depend upon Computer technology.

3.4. Competitive advantage:

Five major attributes make the cornerstone of their success:

The standards which set for their selves and which govern their engagements constantly reinforce their goal of bringing the highest level of professionalism to all their engagements. We exists to serve their clients are directed to meet this commitments.

We exist to serve their clients and their clients are directed to meet this commitment.

… Senior executives, who are personally involved in quality related activities…

Naishargic properties ltd. (NPL)Reflects this commitment to quality through the activities of its senior executives, who are personally involved in quality related activities such as planning, goal-setting, employee recognition, progress reviews and meeting with customers. They project and reinforce the Company’s quality values in a consistent manner and engage all levels of management to co-operate in this effort.

Their senior management is responsible for reinforcing the firm’s vitality by infusing each assignment with integrity and excellence of effort. As a result of this attention to quality of naishargic properties ltd.(NPL) is a substantial co-operation since April 2005 and has served a number of customers. Consistency in meeting user objectives with a shared sense of concern accounts for their reputation of excellence and reliability.

Teamwork within naishargic properties ltd. (NPL) Occurs when people work in a community of shared technical, personal and economic interests. To successfully carry out their missions their employees are assigned to projects where their technical disciplines complement one another in achieving the customer’s business objectives. But there is more. We maintain just first class interpersonal relationship within their office & beyond.

Within the workplace there is a sense enthusiasm and eagerness to demonstrate technical proficiency by working together to produce the best results possible. It involves logic through processes and creativity, which is fostered by an environment, where individuals may exercise their own initiative. Naishargic properties ltd.fosters a team spirit and the founders of the firm have this idea of close co-operation in mind at the very beginning.

Their professionals are directly involved in each project. Every assignment is important. If customer has a problem, they make it their problem. They know customers want a timely and accurate resolution; you want to be sure. Their customers bank on them& value their trust & confidence very highly. They know customer is their boss.

If you have any problem makes it their problem.

You are the center of their enterprise…………………

……….Only by understanding the customers’ needs can the Company deliver the superior service…

They satisfy these needs by remaining constantly available to their customers and allocating the kind of their customers may need & they provide the best solution in a timely manner. Customers are the center of their enterprise and they will take necessary action to support customers’ success every time. They believe that only by understanding the customers’ needs a company can deliver superior service and stay ahead of competitors.

NPL believes that the best way to improve productivity is to give its people the opportunity to learn, contribute to the process and develop each individual’s own sense of achievement.

It is their demand for excellence that the enthusiasm they bring to consulting, which has contributed to the company’s success.

…The best way to improve productivity is to give its

People the opportunity to learn, contribute to the process…

Long-term success can only be assured by cultivating new ideas. That is the way of naishargic properties ltd.Its people to be creative give them the means to see their ideas realized.

The office of the NPL is situated in the 2nd floor of a commercial building in the Uttara commercial Area. The building is easily approachable by all types of vehicles like cars, trucks, van, rickshaw etc. The office space id about 4000 square feet furnishes adequately and appropriately.

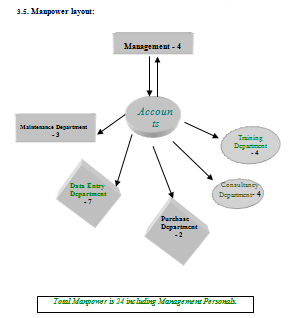

Staff Pattern (as per diagrammatic approach)

Management — 4 persons

Training Department —4 persons

Marketing Department –3 persons

Accounts Department–3 persons

Maintenance Department — 3persons

Data Entry Department — 7persons

Purchase/procurement Department — 2 persons

Consultancy Department — 4persons

Part-Time Consultants

There are several part time consultants in NPL from different professional organizations and are contributing significantly in the growth of the company.

3.6. Vision of Naishargic Properties Ltd:

Quality professionalism and commitment makes success in real estate business that is the thing which Naishargic Properties Ltd. believes. After started its journey in 2005, it now has become highly acclaimed and widely accepted name in real estate business it has got in house skilled professionals having experience for long days who are able to provide the most efficient space utilization and architectural aesthetic solution Naishargic Properties Ltd. cordially welcomes its potential buyers to visit its office of the project side before taking any decision. Naishargic Properties Ltd. would like to express its deep gratitude to all related to the company for their continued support.

NPL Developers Ensures the followings:

Naishargic Properties Ltd. is very sensitive to fulfill their commitment.

They use high quality construction equipment.

They always try to satisfy their customers.

All of the directors, Managers, Executives and other employees of Naishargic Properties Ltd. are very experienced and professional.

Naishargic Properties Ltd. ensures their customers that they are tension free about the quality of their apartments.

They provide maximum benefit to their customers.

3.7. GENERAL TERMS & CONDITIONS FOR THE BUYER/CLIENTS:

Application: Interested buyer shall submit application on the prescribed form duly signed by him/her/them along with earnest money. Naishargic properties ltd. serves the right to accept or reject any application without assigning any reason.

Allotment:Allotment will be made on first come first served basis. On acceptance of application & earnest money, Naishargic properties ltd. will issue an allotment letter to the applicant on receipt of which he/she shall start making payments as per the schedule of payments in the brochure. Buyers willing to make a onetime payment will be entertained with substantial discount. Until the full payment of installments, buyer shall have no right to transfer the allotment to the third party.

Payment: All payments shall be made by A/C Payee Cheque or Bank Draft or Pay-order in favor of “Naishargic properties ltd.” Bangladeshis residing abroad may remit payments by TT or DD. Buyer must strictly follow the payment schedule.Naishargic properties ltd. may issue reminders to the buyer for delay in payment beyond due date. The buyer is liable to pay a delay charge @ 0.1% per day on the amount of payment delayed. If the payment is delayedbeyond 30 days naishargic properties ltd.shall have the right to cancel the allotment. In such an event the amount paid by buyer shall be refunded after deducting 5% of the total price after resale of the Apartment.

Company’s Right: The Company may take minor changes in the design both Architectural & Structural of the project should these become necessary. Limited changes in the specification and facilities may be made by Naishargic properties ltd. for overall interest of the project.

Hand Over: The possession of the apartment will be handed over within 24 months from the date of commencement of construction work except for reasons beyond control of Naishargic properties Ltd. such as force majeure, natural calamities, political disturbances, strikes, Acts of God or economic conditions, etc. This hand over will only be made after the full payment of installments.

Utility Connection: Connection fee, security deposit for water, Gas & Electricity and incidental costs relating to these are not included in the price of apartment. Buyer will make these payments directly to the authorities concerned. Should expenditure on these accounts be incurred by Naishargic properties Ltd.buyer will reimburse the same to the company proportionate to his/ her share.

Refund: For any reason beyond the control of Nairshargic properties Ltd. like force majeure, natural calamities, political disturbances, strikes, Acts of God or economic conditions, etc., the company may be bound to abandon the Project. In such an event the buyer will be entitled to refund of all installments along with the earnest money already paid by him/ her.

Transfer of Ownership: Proportionate share of undivided &demarcated land will be registered in favor of each allocate as per the current rules & regulations of Ministry of Works.

Transfer Cost: All costs relating to transfer of ownership of the proportionate share of land will be borne by the allottee on actual basis.

Management: The buyer must undertake to become a member of the Owners’ Cooperative Society that will be formed by the owners of the apartments for the management of common services such as lift, pumps, security, compound, etc. Each allocate must initially deposit Tk. 25000.00 (twenty five thousand) only in the Reserve Fund of the Association or Company for maintaining management expenses of the complex.

- SWOT ANALYSIS OF NAISHARGIC PROPERTIES LTD:

4.1.Strengths:

- Experienced Management.

- Efficient and dedicated employees.

- Good understanding between employees.

- Good relationship with existing clients.

- Locations of the Projects are good enough.

- High standard of construction quality.

4.2. Weaknesses:

- As a company it is new in Real Estate sector.

- Many prospective clients don’t have any idea about its construction quality.

- Comparatively product’s prices are higher than many companies.

- Lack of promotional activities or advertisements.

- No specific policy following by the employees.

4.3. Opportunities:

- The upcoming Projects are in demandable locations.

- Those who know about NPL, they normally consider as a good developer.

- Motivation of the sales persons to encourage them for more effective in sell.

- Offer the prospective clients to visit the existing projects to make positive impression.

4.4.Threats:

- Huge numbers of developers means huge numbers of competitors are in the race.

- Land procurement cost becoming higher and higher day by day.

- Asking prices of many companies in the same location are lower than NPL.

5.0 RESULTS AND ANALYSIS

Financial analysts oftenassessthefirm’sliquidity, solvency,efficiency, profitability,operatingefficiency andfinancialstabilityinbothshort-termandlong-term. Ratioanalysisprovidesrelativemeasures ofthe company’sperformance andcanindicatecluestothe underlying financialposition.Formeasuring financial positionandfinancialefficiency,appropriate levelof financialperformanceindicatorsarerequiredwithwhom comparison canbemade.Generallyliquidratio,debt- equityratio,interestcoverage ratio,inventory turnover ratio,returnoninvestment ratioanddebttonetworth ratioarehighly useful indeterminingfinancialposition, financialperformance andthefinancialstabilityor otherwiseofsuch management.

5.1. Liquidity ratios:

- Liquid ratio:Itistheratioofliquidassetstocurrent liabilities. Liquidratioismorerigoroustestofliquidity thanthecurrentratiobecauseiteliminatesinventoriesand prepaidexpenses asapartofcurrentassets.Usuallya highliquidratioanindicationthatthefirmisliquidand hastheabilitytomeetitscurrentorliquidliabilities in timeandontheotherhandalowliquidityratiorepresents thatthefirm’sliquiditypositionisnotgood.Table1show thatliquidratioissatisfactoryinthecaseofNPL because theratioismorethanindustry average. NPL havebeenabletomeettheirmatured current obligations underthestudyperiod.Coefficient of variationofliquidratioofNPLis16.16%whichshowslessconsistency duringthestudyperiodbecausecoefficientofvariationof industryasawholeis8.74%.Greatervariability inthe liquidratioindicatesimproperorinefficientmanagement offundinasmuch.

- Debt/equity ratio:Thedebt-to-equity ratio(D/E)isa financialratioindicating therelativeproportion of shareholders’equityanddebtusedtofinanceacompany’s assets.Thetwocomponents areoftentakenfromthe firm’sbalancesheetorstatementoffinancialposition,but theratiomayalsobecalculatedusingmarket valuesfor both,ifthecompany’sdebtandequityarepubliclytraded, orusingacombinationofbookvaluefordebtandmarket valueforequityfinancially. Ahighdebt/equity ratio generallymeansthatacompanyhasbeenaggressive in financingitsgrowthwithdebt.This canresultinvolatileearningsasaresultoftheadditional interestexpense.Alowdebt/equity ratiousuallymeans thatacompanyhasbeenfriendlyinfinancingitsgrowth withdebtandmoreaggressive infinancingitsgrowth withequity.Table 1 also showsthat debt-equityratio.Ahigh debt-equity ratioisobservedincaseofNPLwithan averageof0.72,whichmeansthecompany hasbeen aggressiveinfinancingits growthwithdebt.Coefficient ofvariationofdebt-equityratio of NPLis 48.61% whichshowsmore consistencyduringthestudyperiodbecausecoefficientof variation ofindustryasawholeis8.57%.Lower variabilityinthedebt-equity ratioindicatesproperor efficientmanagementofdebt-equity.

Table 1: Selected Liquidity Ratios

| Year | Liquid Ratios | Debt-Equity Ratios | ||

| NPL | Industry Average | NPL | Industry Average | |

| 2005-2006 | 1.06 | 0.82 | 0.42 | 0.73 |

| 2006-2007 | 1.04 | 0.74 | 0.55 | 0.70 |

| 2007-2008 | 1.04 | 0.70 | 0.43 | 0.66 |

| 2008-2009 | 1.16 | 0.78 | 0.41 | 0.72 |

| 2009-2010 | 1.13 | 0.84 | 0.64 | 0.75 |

| 2010-2011 | 0.71 | 0.90 | 0.31 | 0.63 |

| 2011-2012 | 1.01 | 0.70 | 1.12 | 0.78 |

| Mean | o.99 | 0.78 | 0.72 | 0.70 |

| S.D | 0.16 | 0.07 | 0.35 | 0.06 |

| C.V (%) | 16.16 | 8.74 | 48.61 | 8.57 |

5.2. Profitability ratios:

- Return on investment ratio:Returnoninvestmentratio isusedbyfinancial analyststoascertainthebest investment plans.Itisalsoanimportanttoolusedby investors,while makinginvestment decisions.ReturnonInvestment ratioforacompany showshowmuchprofitacompanyismakingagainstthe investmentsmadeby the shareholdersandtheinvestors. Return on Investmentratio isalsousedtocomparedifferentinvestmentoptionsbyaninvestmentadvisor.An investment withahigherROIratioismorelucrative optionascomparedtoaninvestment withalowerROI ratio.AninvestmentwithanegativeorlowerROIratiois mostlikelytobediscontinuedbytheinvestors.Table2 exemplifies thatreturnoninvestmentratioofNPLis veryhigherasitsaverage is16.92 thangrandindustry averagesof12.77. Itindicatesmorewealthfortheinvestors ofNPL.Coefficientofvariationofreturnoninvestment ratioofNPL is32.51%,which showslessconsistency duringthestudyperiodbecausecoefficientofvariationof industryasawholeis15.51%.Lesservariability inthereturnoninvestment ratio indicatesproperorefficientmanagementofwealth.

- Debt to net worth ratio:Debttonetworth Ratio measuresisusedintheanalysisoffinancialstatementsto showtheamountofprotectionavailabletocreditors.The ratioequalstotalliabilitiesdividedbytotalstockholders’ equity; alsocalleddebttonetworthratio.Ahighratio usuallyindicatesthatthebusinesshasalotofriskbecause itmustmeetprincipal andinterestonitsobligations. Potentialcreditorsarereluctanttogivefinancingtoa company withahighdebtposition.However, the magnitudeof debtdependson thetypeof business. Usually,bookvalueis usedtomeasurea firm’sdebtand equitysecuritiesincalculating theratio.Marketvalue maybeamorerealisticmeasure, however, becauseit takesintoaccountcurrentmarketconditions. Table2 exemplifies thatdebttonetworthratioofNPLduringtheperiodofstudyishigherasits averages0.70than0.57,grand industryaverage,whichisinuseasstandard. Itisan indication ofmore riskabout debtobligations ofthosecompanies.Coefficientofvariationofdebttonet worthratioofNPL is45.71% whichshowslessconsistencyduringthe study periodbecause coefficientofvariationofindustry asawholeis28.07%.Greatervariabilityinthedebttonet worthratioindicatesimproperorinefficientmanagement offinancialrisk.

Table 2: Selected Profitability Ratios

| Year | Return on Investment Ratios | Debt to Net Worth Ratios | ||

| NPL | Industry Average | NPL | Industry Average | |

| 2005-2006 | 17.21 | 11.62 | 0.48 | 0.74 |

| 2006-2007 | 25.51 | 13.38 | 0.55 | 0.73 |

| 2007-2008 | 14.12 | 13.99 | 0.43 | 0.52 |

| 2008-2009 | 6.66 | 12.51 | 0.41 | 0.46 |

| 2009-2010 | 19.47 | 13.07 | 0.64 | 0.58 |

| 2010-2011 | 15.43 | 13.21 | 0.81 | 0.59 |

| 2011-2012 | 20.32 | 8.77 | 0.94 | 0.70 |

| Mean | 16.92 | 12.77 | 0.70 | 0.57 |

| S.D | 5.44 | 1.98 | 0.32 | 0.16 |

| C.V (%) | 32.51 | 15.51 | 45.71 | 28.07 |

Tale 3: Selected Solvency Ratios

| Year | Interest Coverage Ratios | Inventory Turnover Ratios | ||

| NPL | Industry Average | NPL | Industry Average | |

| 2005-2006 | 1.98 | 1.18 | 9.44 | 3.89 |

| 2006-2007 | 0.55 | 1.35 | 8.04 | 3.02 |

| 2007-2008 | 8.93 | 1.63 | 7.03 | 3.87 |

| 2008-2009 | 0.64 | 0.97 | 6.22 | 4.11 |

| 2009-2010 | 0.81 | 1.34 | 12.29 | 3.59 |

| 2010-2011 | 4.96 | 1.56 | 7.41 | 3.63 |

| 2011-2012 | 3.66 | 1.51 | 12.86 | 3.98 |

| Mean | 3.26 | 1.44 | 9.30 | 3.85 |

| S.D | 2.89 | 0.31 | 2.52 | 0.48 |

| C.V (%) | 88.65 | 21.53 | 27.10 | 12.53 |

5.3. Solvency ratios:

Interest coverage ratio:Aratiousedtodeterminehow easilyacompanycanpayinterestonoutstanding debt. Theinterestcoverageratioiscalculated bydividinga company’sEarningsbeforeInterestandTaxes(EBIT)of oneperiodbythecompany’sinterestexpensesofthesame period.Thelowertheratio,themorethecompany is burdenedbydebtexpense. Whenacompany’s interest coverage ratioislower,itsabilitytomeetinterest expensesmaybequestionable anditindicatesthatthe companyisnotgenerating sufficient revenuestosatisfy interestexpenses.

Theinterestcoverage ratioisameasureofthe numberoftimesacompany couldmaketheinterest paymentsonitsdebtwithitsearningsbeforeinterestand taxes,alsoknown asEBIT. Thelowertheinterest coverageratio,thehigheristhecompany’s debtburden andthegreaterthepossibilityofbankruptcyordefault.

Forbondholders,theinterestcoverageratioissupposed toactasasafetygauge.Itgivesyouasenseofhowfara company’searningscanfallbeforeitwillstartdefaulting on itsbond payments.For stockholders,the interestcoverageratioisimportantbecauseitgivesaclearpicture oftheshort-termfinancialhealthofabusiness.Table3 showsthatinterestcoverage ratioinof NPLis morethanindustryaveragesas its averages3.26.Thisisan indicationof debt burdenandthegreaterthepossibility ofbankruptcy. Coefficientof variationof interestcoverageratioof NPLis88.65whichshowlessconsistency duringthestudyperiod becausecoefficientofvariationofindustryasawholeis 21.53%.Greatervariabilityintheinterestcoverageratio indicatesimproperorinefficientmanagement ofdebt- fund.

Inventory turnover ratio:Theinventory-turnoverratio givesageneralviewontheinventoriesofacompany.In ordertocalculate ityoushoulddividetheannual sales/costofsalesofthecompanybyitsinventory.Ifthe value of theinventory-turnoverratio islow, thenit indicatesthatthemanagement teamdoesn’tdoitsjob properlyinmanaginginventories. Thisratioshouldbe comparedagainstindustryaverages.A low turnover impliespoorsalesand,therefore, excessinventory. A highratioimplieseitherstrongsalesorineffectivebuying. Highinventory levelsareunhealthy becausethey representaninvestment witharateofreturnofzero.It alsoopensthecompanyuptotroubleshouldpricesbegin tofall.Table3showsthatinventory-turnover ratioof NPL during theperiod ofstudyisvery satisfactoryasitsaverage9.30 whichismuchhigherthan3.85,grandindustryaverage, whichistakenasstandard.Thisisasignofstrongsales. Coefficientofvariationofinventory-turnover ratioof NPLis27.10%,whichshowslessconsistency during thestudyperiodbecausecoefficient ofvariationof industryasawholeis12.53%.Greatervariabilityinthe inventory-turnoverratioindicatesimproperorinefficient management ofinventory.

5.4. Multiple regressions:

Financialperformancethroughmultipleregressions: Inthissection anattempthasbeenmadetoexamine compositeimpactoffinancialperformanceindicatorson profitabilitythroughthesophisticated statistical techniques.Accordingly,multipleregressiontechniques havebeenappliedtostudythejointinfluence ofthe selectedratiosindicatingcompany’sfinancialpositionand performance ontheprofitabilityandtheregression coefficients havebeentestedwiththehelpofthemost popular ‘t’test.Inthisstudy,LR,DER,ICR,ITRand DNWRhavebeentakenastheexplanatoryvariablesand ROIRhasbeenusedasthedependent variable.The regressionmodelusedinthisanalysisisROIR=£+ß1LR+ß2DER+ß3ICR+ß4ITR+ß5DNWRRwhere £,ß1, ß2,ß3,ß4,ß5,aretheparametersoftheROIRline.

Table 4: Multiple Regression Coefficients (a) of NPL

| Model | Unstandardized Coefficient | Standardized Coefficient | |||

| B | SE | Beta | t | Sig. | |

| (Constant) | 5.085 | 10.431 | 0.488 | 0.711 | |

| LR | 9.681 | 10.422 | 1.122 | 0.929 | 0.523 |

| DER | 16.205 | 41.225 | 3.658 | 0.393 | 0.762 |

| ICR | -0.108 | 0.312 | -0.228 | -0.347 | 0.787 |

| ITR | -0.770 | 0.689 | -1.164 | -1.118 | 0.465 |

| DNWR | -9.992 | 44.327 | -2.213 | -0.225 | 0.859 |

- Dependent Variable

5.5. Performance indicators:

Joint impact of performance indicators on profitability of NPL: MultipleregressionanalysisofNPLhasbeen tabulated inTable4.Table4provesthepowerof relationship betweenthedependentvariable,ROIRand all the independentvariablestaken togetherand the impactoftheseindependentvariablesontheprofitability. Itwasobserved thatforoneunitincreaseinLR,the profitability ofthecompanyincreasedby9.681units, whichwasstatisticallysignificantat1%level.However, when DER increasedby oneunit, theROIR of the companyincreasedby16.205unitsthoughtheinfluence ofDERonROIRwasverysignificant. Foroneunit increaseinICR,theprofitability ofthecompany decreased by0.108units.Again,ITRincreased byone unit,ROIRdecreasedby0.770whichwasstatisticallyat 1%level.However,whenDNWRincreasedbyoneunit, theROIRof thecompanydecreasedby9.992units though the influenceof DNWRon ROIRwasvery noteworthy.

Model Summary

| Model | R | Adjusted | SE of the Estimate | |

| 1 | 0.829 | 0.688 | -o.874 | 2.02696 |

Themultiplecorrelation coefficients betweenthe dependentvariableROIRandtheindependentvariables LR,DER,ICR,ITRandDNWRtakentogetherwere82.9. Itindicatesthattheprofitabilitywasperfectlyinfluenced byitsindependent variables.Itisalsoevidentfromthe valueofR2that68.8%ofvariation inROIRwas accounted bythejointvariationinalltheindependent variables. Coefficient ofdeterminationisnegatively 87.4%variedindicatesthattheregression linepartially fitsthedata.Standard errorofestimate isflawlessly associated withregression analysis.Suchasignificant variation couldbejustifiedastheimpactofmanyother financialperformance indicators,whichhavenottaken intothe study, in additionto the effectof the usedin the study.

5.6. Findings:

Fromthestudyofthefinancialperformance ofthe selected Real Estate itcanbeconcludedthat

The liquiditypositionwas sopoorofNPLtherebyreflectingtheabilityof thecompaniestopayshort-termobligationsonduedates.

Long-termsolvencyincaseofNPLislowerwhich showsthatcompanies reliedmoreonexternalfundsin termsoflong-termborrowingstherebyprovidingalower degreeofprotectiontothecreditors.

Financial stability ratiosintheveinofdebttonet worthratioincaseofNPLhaveshowed adownward trendandconsequently thefinancialstabilityhasbeen decreasingat anintenserate.

TheBangladeshi Real Estateindustrywillwitnessan increaseinthemarketshare.Thesectorispoisednotonly totakenewchallenge buttosustainthegrowth momentumofthepastdecade.

6. CONCLUSION AND RECOMMENDATION:

CONCLUSION

After analyzing the business of whole Real Estate sector in Bangladesh it is very clear that the number of competitors for Naishargic properties Ltd. are huge. That’s why it is not very easy for the company to make the business financially and profitably stable without extra efforts in business promotion and extra ordinary features and services. The offer from Naishargic Properties Ltd. should be extra ordinary and something new. Definitely there need to have specific advantages for the buyers. So that they will find Naishargic properties Ltd. better than others. Service is important specially to make the references strong. Clients will bring clients. This should be the theme of the business. And it can be possible by giving better services. If the clients are happy, they will tell others. It is very effective for long term business. Still the future of Naishargic properties Ltd.is very bright. If they able to improve their lacking and weaknesses, they will be able increase their sell more. Naishargic properties Ltd. have different projects in its hand in different locations for different levels of buyers. Just Need to go for aggressive promotion with attractive offer to reach to the buyers. I strongly believe that time is not a far away for NPL to have its position on the top.

RECOMMENDATION

Not only Naishargic properties Ltd. also every business organization is looking for a vision that is profit. Because without profit a company will not be able to run. Once upon a time it will be wordless & unsuccessful. The continuation of achieving the vision is a very important thing which is the central target and maintains and organizes the company’s whole staffs & officials. But it is not a very easy task for the companies. The top Real Estate and Multinational companies running in our country are doing a lot to achieve their goals. As a new company Naishargic Properties Ltd. May study those. Some common activities of different organizations may be a sort recommendation as listed below to follow:

- Regular advertisement in the major daily Newspapers, Magazines etc.

- Regular monitoring of all types of works including construction.

- Maintain good construction quality.

- Maintain good relation with existing clients.

- Regular feedback from the existing clients.

- Promote after sell service.

- Regular evaluation of the employees.

- Effective motivation policy for the employees.

- Extra/surprised reward for the dedicated and good working employees.