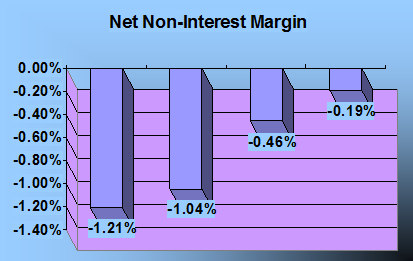

Net Non-Interest Margin

The non-interest margin, I contrast, measures the amount of non-interest revenues stemming from deposit service changes and other service fees the bank has been able to collect (called fee income) relative to the amount of non-interest costs incurred (including salaries and wages, repair and maintenance costs on bank facilities, and loan-loss expenses). For most banks, the non-interest margin is negative: non-interest costs generally outstrip fee income; through bank fee income has been rising rapidly in recent years as a percentage of all revenues.

For most bank the non-interest margin is negative and that the normal. But in case of ABBL the positive thing is that the spread between the non-interest income and the expenses is become less day by day. In the above figure we see that in year 2002 the non-interest margin was -1.21% but in year 2005 it was only -0.19% which proves that the bank generating more income which is not related to the loan or interest than it did before. And in future it could be in positive figure.

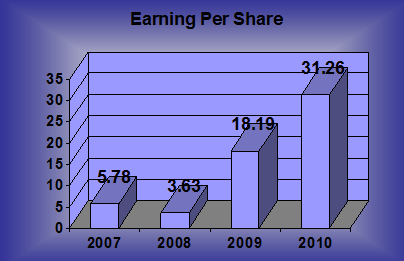

Earning Per Share

Earning per share is the ratio of bank’s net – income after tax divided by the total common equity share outstanding which means how much profit will get the shareholder on their owned share. Earning per share is the main indicator of an organization’s wealth. If the EPS is increasing year by year then we can say that the organization is doing well.

Here in the above graph we see that the EPS of ABBL in year 2005 is increased by 10 times than the year 2003 when ABBL went through a bad time. But now they are in a position which is more than the satisfactory level.

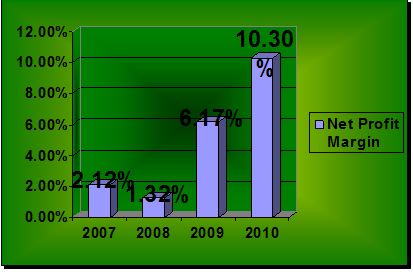

Net Profit Margin

The Net Profit Margin (NPM), or the ration of the net income to total revenues, is subject to some degree of management control and direction. It reflects the effectiveness of expense management (cost control) and service pricing policies. It reminds us that banks can increase their earnings and their return to their stockholders by successfully controlling expenses and maximizing revenues.

Where the net profit margin shown the efficiency of the management control and direction we can say that the management of ABBL is doing well in the recent time than the before. If we see the net profit margin in year 2002 and year 2003 it was 2.12% and 1.32% respectively but in last year the net profit margin was 10.30%. Which shows the management’s control over the expense and the strong but reasonable pricing policies of their service, which they offer to their customer?

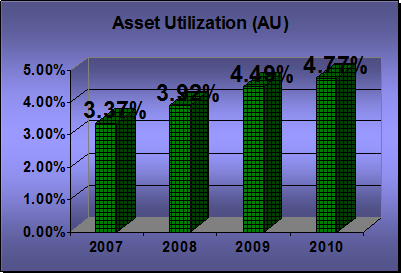

Assets Utilization (AU)

Assets Utilization (AU) ratio is the product of Total Operating Income divided by the Total Assets that means how much income bank generate by using a single unite of assets. This ratio reflects portfolio management policies, especially the mix and yield on the bank’s assets. By carefully allocating the bank’s assets to the highest-yielding loans and investments while avoiding excessive risk, management can raise the bank’s average yield on its assets.

Assets Utilization ratio shows that how efficiently the bank use their assets to generate revenue. In above graph we see that ABBL develop their assets utilization ration by a contentious basis. Which reveal their strong management team, who made the careful and the effective decision about portfolio investment and by avoiding risk as much as possible.

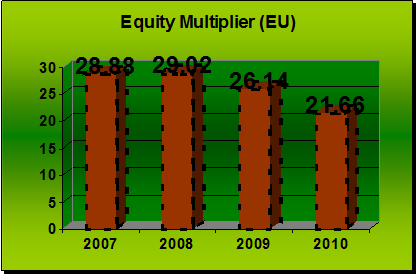

Equity Multiplier

The Equity Multiplier (EM), or assets-to-equity-capital ratio, is normally the largest, averaging about 15* or larger for most bank. The biggest banks in the industry often operate with multipliers of 20* or more. The multiplier is a direct measure of the bank’s degrees of financial leverage–how many portion of assets must be supported by each amount of equity capital and how much of the bank’s resources therefore must rest on debt. Because equity must absorb losses on the bank’s assets, the larger the multiplier, the more exposed to failure risk the bank is. However, the larger the multiplier, the greater the bank’s potential for high returns for it’s stockholders.

The multiplier ratio tells us that the higher the multiplier is higher the income and also it lead high risk of bank’s failure. In the above graph we see that the multiplier is decreasing by the time which means that the risk of ABBL is decreasing by the time but the income to the shareholder may decrease with the time.

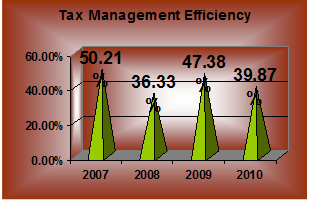

Tax Management Efficiency

Tax Management Efficiency ratio reflects the bank’s use security gains or losses and other tax-management tools (like buying tax-exempted bonds) to minimize its tax exposure.

In the above graph we see that the Tax management efficiency was not in a stable level. Some time it was up and some time it was down so we can’t say that the ABBL manage their tax over their earning very efficiently as their expectation.

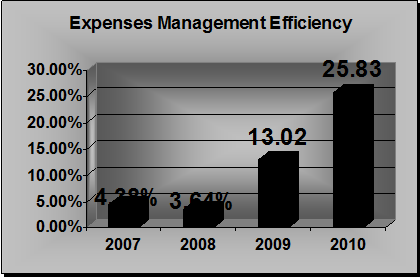

Expenses Management Efficiency

Expenses Management Efficiency ratio is the ratio to before-tax income to total revenue as an indicator of how many Taka of revenue survives after operating expenses are removed expense management efficiency measurement is a measure of operating efficiency and expenses control.

If we see to the above graph we could realize that the operating expenses of the ABBL were well managed by the last two years. Where we see that in year 2002 and 2003 the expense management efficiency was only 4.38% and 3.64% respectively but in year 2005

it become 25.83%. That shows a strong management control over the expenses.

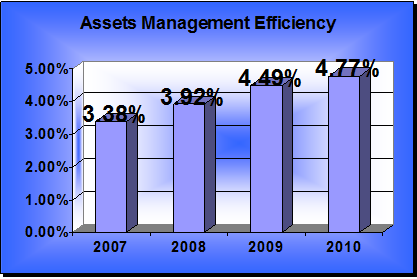

Assets Management Efficiency

Assets Management Efficiency ratio is the product of Total Operating Income divided by the Total Assets that means how much income bank generate by using a single unite of assets. This ratio reflects portfolio management policies, especially the mix and yield on the bank’s assets. By carefully allocating the bank’s assets t the highest-yielding loans and investments while avoiding excessive risk, management can raise the bank’s average yield on its assets.

Asset management efficiency is same as the asset utilization. Asset management efficiency shows that how efficiently the bank uses their assets to generate revenue. In above graph we see that ABBL develop their Asset management efficiency by a contentious basis. Which reveal their strong management team, who made the careful and the effective decision about portfolio investment and by avoiding risk as much as possible.

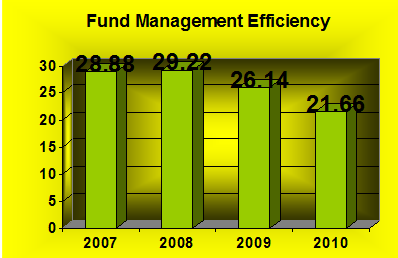

Fund Management Efficiency

The Fund Management Efficiency, or assets-to-equity-capital ratio, or Equity Multiplier is normally the largest, averaging about 15* or larger for most bank. The biggest banks in the industry often operate with multipliers of 20* or more. The multiplier is a direct measure of the bank’s degrees of financial leverage–how many portion of assets must be supported by each amount of equity capital and how much of the bank’s resources therefore must rest on debt. Because equity must absorb losses on the bank’s assets, the larger the multiplier, the more exposed to failure risk the bank is. However, the larger the multiplier, the greater the bank’s potential for high returns for it’s stockholders.

The fund management ratio is same to the Equity Multiplier ratio; the multiplier ratio tells us that the higher the multiplier is higher the income and also it lead high risk of bank’s failure. In the above graph we see that the multiplier is decreasing by the time which means that the risk of ABBL is decreasing by the time but the income to the shareholder also decreasing by the time.

By analyzing the performance of ABBL we see that this bank really doing well last two years. In year 2004 their net profit margin was 6.17% and year 2005 it become 10.30% which shows their strong management efficiency and the strong control over the operating expenses. Now a day’s people want batter product and service at reasonable price. And AB Bank provides that batter product and service at reasonable price which attract more customer loyalty. The ultimate goal of a business organization is to maximize their wealth not the profit, and the indicator of wealth maximization is increase in share price. In case of AB we see that in year 2004 the Earning per Share was 18.19 and in year 2005 it become 31.26 it was almost doubled as compare to the previous year. That influences the investor to invest their money in the AB Bank Limited share because the return on those shares will increase year by year. Existence of an organization depends upon mainly two things one is, Are they generate sufficient amount of profit and another things is the loyalty of customer and the investor regarding that organization. Here we see that the profit of AB Bank Limited become almost doubled in year 2005 than the previous year and the investor will more attractive when they see that the return on share also become doubled in last year. So we can say that, AB Bank Limited has good enough potentials in the money market of Bangladesh.

Product’s of AB Bank Limited

Unsecured Loans

| Product Name | Personal Loan |

| Target Customer | Employees of reputed Local Corporate, MNCs, NGOs, Airlines, Private Universities, Schools and Colleges, International Aid Agencies and UN bodies, Government Employees, Self-employed Professionals (Doctors, Engineers, Chartered Accountants, Architects, Consultants), Businessmen. |

| Purpose | Marriages in the family, Purchase of office equipment / accessories, Purchase of miscellaneous household appliances, Purchase of Personal Computers, Purchase of audio-video equipment, Purchase of furniture. |

| Loan Amount | Minimum Tk. 25,000.00 Maximum Tk. 5,00,000.00 |

| Charges | Application fee: Tk. 500.00 Processing fee: 1% on the approved loan amount or Tk. 2000.00 whichever is higher |

| Tenor | Min 12 months Max 36 months |

| Rate of Interest | 14.50% p.a. – 17.50% p.a. |

| Security | Hypothecation of the product to be purchased. Two personal guarantees (as per our list of eligible guarantors) |

| Product Name | Auto Loan |

| Target Customer | Employees of reputed Local Corporate, MNCs, NGOs, Airlines, PrivateUniversities, Schools and Colleges, International Aid Agencies and UN bodies, Government Employees, Self-employed Professionals (Doctors, Engineers, Chartered Accountants, Architects, Consultants), Businessmen |

| Purpose | To purchase Brand new vehicle, non-registered reconditioned vehicle |

| Loan Amount | 70% for the brand new car 60% for the reconditioned car but must not exceed BDT 10,00,000.00 |

| Charges | Application fee: Tk. 500.00 Processing fee: 1% on the approved loan amount or Tk. 5000.00 whichever is higher |

| Tenor | For Reconditioned Car: Max 36 months For Brand new Car: Max 60 months |

| Rate of Interest | 14.50% p.a. – 17.50% p.a. |

| Security | Hypothecation of the vehicle to be purchased. Two personal guarantees (as per our list of eligible guarantors) |

| Product Name | Easy Loan (For Executives) |

| Target Customer | The loan is specially designed for salaried people who are employed in different reputed companies |

| Purpose | Marriages in the family, Purchase of office equipment / accessories, Purchase of miscellaneous household appliances, Purchase of Personal Computers, Purchase of audio-video equipment, Purchase of furniture, Advance rental payment, Trips abroad, Admission/Education fee of Children etc. |

| Loan Amount | Minimum Tk. 50,000.00, Maximum Tk. 3,00,000.00 |

| Charges | Application fee: Tk. 500.00 Processing fee: 1% on the approved loan amount or Tk. 1000.00 whichever is higher |

| Tenor | Min 12 months, Max 36 months |

| Rate of Interest | 16.00% p.a. |

| Security | Letter of confirmation from the employer. One personal guarantee (as per our list of eligible guarantors) |

| Product Name | Gold Grace – Jewellery Loan |

| Target Customer | Both female & male employees may apply viz. employees of reputed Banks & Leasing companies, reputed Local Corporate, MNCs, NGOs, Airlines, Private Universities, Schools and Colleges, International Aid Agencies and UN bodies. Government Employees. Self-employed Professionals (Doctors, Engineers, Chartered Accountants, Architects, Consultants). Businessmen with a reliable regular source of income. |

| Purpose | To purchase ornaments/Jewellery for personal use |

| Loan Amount | Minimum Tk. 50,000.00, Maximum Tk. 3,00,000.00 |

| Charges | Application fee: Tk. 500.00, Processing fee: 1% on the approved loan amount or Tk. 1000.00 whichever is higher |

| Tenor | Min 12 months, Max 36 months |

| Rate of Interest | 16.00% p.a. |

| Security | Letter of confirmation from the employer. Personal guarantee from the parents and spouse (if married) |

| Product Name | House/Office Furnishing/Renovation Loan |

| Target Customer | Expatriate Bangladeshi nationals who are in business or service holders. Employees of reputed Banks & Leasing companies, reputed Local Corporate, MNCs, NGOs, Airlines, PrivateUniversities, Schools and Colleges, International Aid Agencies and UN bodies. Government Employees. Self-employed Professionals (Doctors, Engineers, Chartered Accountants, Architects, Consultants). Reputed and highly respectable Businessmen with a reliable source of income |

| Purpose | House/Office Furnishing/ Renovation, For interior decoration / Titles Stones, Electrical fittings, wooden cabinets / Overall furnishing and all types of House/Office Renovation, purchase/furnishing of apartments etc. |

| Loan Amount | Minimum Tk. 1,00,000.00, Maximum Tk. 10,00,000.00 |

| Charges | Application fee: Tk. 500.00, Processing fee: 1% on the approved loan amount or Tk. 2000.00 whichever is higher |

| Tenor | Min 12 months, Max 48 months |

| Rate of Interest | 16.50% p.a. |

| Security | Title deed of the House/Office to be furnished/renovated along with memorandum of deposit of title deed duly supported by a notarized power of attorney to be kept by the bank as a matter of comfort. Two personal guarantees (as per our list of eligible guarantors). Registered mortgaged of the property if the loan amount is more than Tk. 5.00 lack |

| Product Name | Staff Loan |

| Target Customer | All permanent employees of ABBL |

| Purpose | Marriages in the family, Purchase of office equipment / accessories, Purchase of miscellaneous household appliances, Purchase of Personal Computers, Purchase of audio-video equipment, Purchase of furniture |

| Loan Amount | According to the debt burden ration and other criteria |

| Charges | Processing fee: 1% on the approved loan amount |

| Tenor | Min 12 months, Max 36 months |

| Rate of Interest | 15.50% p.a. |

| Security | Hypothecation of the product to be purchased |

| Product Name | Education Loan |

| Target Customer | Students Criteria: • Students of reputed Educational Institutes, such as Public & Private Universities, Medical Colleges & Engineering Institute. • Undergraduate & Post graduate Level • Professionals degrees (Chartered Accountants (CA), Cost & management Accountants (CMA), Marine, MBM, MBA) • Doctorate degree (PhD), FCPS etc. • Occupation: Student • Minimum Age: 17 years • Maximum Age: 40 years • Educational Qualification: Minimum HSC/A-Level Pass. Parents Criteria: Service Holder: • Individuals with ranks equivalent to Senior Assistant Secretary or higher would qualify guarantor • Bank officials (Equivalent to Senior Principal Officer of NCBs, AVP / Branch Manager of Local and Foreign banks) and Department Head of Multinational Company or established Local Corporate. Guarantors must be accepted by the Branch Manager / Head Office. Businessman: • Well reputed and widely respected Self-employed professionals |

| Purpose | To Financially Assist The Parents: Admission/Education Fees, Semester Fees, Study abroad |

| Loan Amount | Minimum Tk. 50,000.00, Maximum Tk. 3,00,000.00 |

| Charges | Application fee: Tk. 500.00, Processing fee: 1% on the approved loan amount or Tk. 1000.00 whichever is higher |

| Tenor | Min 12 months, Max 36 months |

| Rate of Interest | 14.50% p.a. – 16.00% p.a. |

| Security | One personal guarantees (as per our list of eligible guarantors) |

Secured Loans

| Product Name | Personal Loan |

| Target Customer | All Clients of ABBL |

| Purpose | To meet personal requirement of fund |

| Loan Amount | Maximum 95% of the present value of the security |

| Charges | Processing fee: Tk. 1000.00 |

| Tenor | Min 12 months, Max 36 months |

| Rate of Interest | 13.50% p.a. – 16.50% p.a. (subject to type of the security). 2% spread must be maintained in case of own bank FDR |

| Security | Lien over FDR, BSP, ICB Unit Certificate, RFCD, NFCD, CD account(s) etc. One personal guarantee in case of third party cash collateral (as per our list of eligible guarantors) |

| Product Name | Personal Overdraft |

| Target Customer | All Clients of ABBL |

| Purpose | To meet personal requirement of fund |

| Loan Amount | Maximum 95% of the present value of the security |

| Charges | Processing fee: Tk. 1000.00 |

| Tenor | Revolving with annual review |

| Rate of Interest | 13.50% p.a. – 16.50% p.a. (subject to type of the security). 2% spread must be maintained in case of own bank FDR |

| Security | Lien over FDR, BSP, ICB Unit Certificate, RFCD, NFCD, CD account(s) etc. One personal guarantee in case of third party cash collateral (as per our list of eligible guarantors) |

At AB Bank we provide complete range of solutions to meet Corporate Customers’ requirement. Our Corporate Banking solutions include a broad spectrum of products and services backed by proven, modern technologies.

Corporate Lending

Our specialist teams offer a comprehensive service providing finance to large and medium-sized businesses based in Bangladesh. For more information as to how we might best meet your corporate debt needs, please contact us at our Corporate Head Office.

Structured Finance

We have a specialist Structured Finance Team who arrange and underwrite finance solutions including Debt and Equity Syndication for financial sponsors, management teams and corporates. Also we provide corporate advisory services.

We aim to provide tailored financing solutions with a dedicated team who can rapidly respond to client needs.

Following are some of the products and financial tools of Corporate Banking:

- Project Finance

- Working Capital Finance

- Trade Finance

- Cash Management

- Syndicated Finance, both onshore & off-shore

- Equity Finance, both onshore & off-shore

- Corporate Advisory Services

Some more parts-

Report On Marketing Analysis Of Product Of AB Bank Limited (Part-1)

Report On Marketing Analysis Of Product Of AB Bank Limited (Part-2)

Report On Marketing Analysis Of Product Of AB Bank Limited (Part-3)