Economy is a part and parcel of each and every country. Banking industry is playing a vital role in the economy. With the passage of time this banking system has changed a lot. Initially banking system served mainly as depositors for funds, while now the more modern system has considered the supplying of credit their main job. Banks are financial institutions or financial intermediary that collect fund from people as deposit and lend this fund as loans and advances to the borrowers in different sectors of the economy in return they give or charge a certain amount of interest.

Banking industry is very important for both national and international trade. Now a day, no country can think their economy without international trade. Moreover, banking industry is providing some other non-traditional services like- factoring, issuing bank guarantees etc., which are very much supportive to modern national and international trades. The financial system of Bangladesh consists of Bangladesh Bank (BB) as the central bank, 04 nationalized commercial banks (NCB), 5 government owned specialized banks, 30 domestic private banks, 10 foreign banks and 28 non-bank financial institutions are existing in our country at present.

Premier Bank is What Premier Does:

Premier Bank believes that it really does premier for the customers. Real time online banking equipped with state of the art technology is the part and parcel of its service. Wherever in the country the customers will go they can bank with any of the branches as a premier customer. The bank offers optimum return on savings investments. Premier Bank is the first local bank to offer unique benefits on “premier 50 plus” and “premier genius” savings accounts designed for the senior citizen and students. Premier Bank was recognized by Visa International as the first local

bank to receive the principal membership of Visa International to issue and acquire Visa-Credit and Debit Cards in Bangladesh. The belief of Premier Bank Limited is that it excels in devising new products and services. In the variant choices of its clientele, its services are tailored and streamlines.

National and International Services of Premier Bank Limited:

- Islamic Banking Service: Islamic Banking system has now-a-days became a reality all over the world. It is widely accepted and liked not only by the Muslims but also NonMuslims. The Premier Bank Limited has launched Islamic Banking Operation through its two branches which are Islamic Banking Branch Mohakhali, Dhaka and Islamic Banking Branch, Laldighirpar, Sylhet.

- Evening Banking Service: A unique service of The Premier Bank Limited for receiving cash and documents beyond transaction hours till 8 o’ clock in the evening. This service is attractive for those like shopkeepers who accumulate cash as sales proceeds in the afternoon when counters of Bank Branches usually remain closed. The service is available at selective branches of the Bank.

- Remittance Service: Premier Bank‟s Remittance Payment procedure is very safe, simple and fast. The Bank has signed a good number of long term deals with a group of wellconnected remittance partners across the globe such as MoneyGram, Dolex, Xpress Money Services and Western Union etc. The Bank also has agreement with

GrameenPhone (1, 40,000 outlets) to use its mobile technology and wide distribution outlets around the country. - SME Service Centre: In order to facilitate the investors of Small and Medium Enterprise, Premier bank has opened several SME Service Centres at different locations – Banani SME Centre, Bangla Bazar SME Centre., Kawran Bazar SME Centre, Mohammadpur SME Centre , Malibagh SME Centre.

- Premier TC: “Premier TC” is prepaid foreign currency card denominated in US dollar available over the counter of the branches that makes customers foreign trip totally hassle-free and convenient. Customers can load this prepaid card with foreign currency in Bangladesh which gives them a 24-hours access to their money.

- Premier SMS: Customers can check their account balance from anywhere by using Premier SMS service.

- Debit/Credit Card and ATM: Premier Bank is offering Premier VISA and Master Card Debit/Credit Card Service as well as own Automated Teller Machine (ATM) facility to electronically debit money from customer‟s account. In addition to Premier Bank‟s own ATM Booth, customers can also use Premier VISA and Master Card Debit/Credit Card in other Bank‟s ATM where VISA and Master Card is accepted.

- Brokerage House: Get delight from the excellence services of Premier Bank Brokerage House. Share trading, BO account opening, margin loan facilities and more.

- International Service: The International Division is looking after correspondent banking relationships, treasury back office and international trade settlement. In order to smooth global operation of international business Premier Bank has correspondent banking relationship with 430 foreign banks around the globe and maintain 19 Nostro accounts in 9 currencies to service the customers. Bank is providing the facility of letters of credit,

handling of import bills, issue of shipping guarantees, acceptance of bills, financing of imports. Advising of export letters of credit, confirmation of letters of credit, assistance in preparation of export documents, negotiation of letters of credit, handling export bills on collections, purchase or discount of export bills, pre-shipment facilities are extended for both domestic and foreign trade. The requirement of letters of guarantee, bid bonds, performance bonds, advance payment bonds for infrastructure projects in Bangladesh, participating in tenders or any other need basis, could be channeled through the Bank for speedy delivery at competitive tariffs. - Call Center: The Premier Bank Limited has setup its own “Call Center” at Head Office under the direct supervision of the Managing Director. If customers have any queries, suggestion or complain, they can talk to the Bank‟s Call Canter during business hour. Customers will also find complain and suggestion box at every branches for their valuable input. The Call Center is open from Sunday to Thursday to accept customer‟s call in working hours from 10:00 a.m. to 6:00 p.m. except on Saturday from 10:00 p.m. to 3:00 p.m. Dialing numbers are: 02-9887581-4.

Project

Introduction:

Today, banking sector is expanding and commercial banking is considered as a service industry. At the same time the banking process is becoming faster. As the demand for better services is increasing day by day, banks are coming up with different ideas and products. To survive in the banking sector and to become successful in own business a commercial bank must try to attract its customers. In the competitive economy it is expected that customer should consider some factors before selecting banks. If bank executives can know the factors that influence the customer‟s choice of selecting bank, they can try to improve those factors to make those more attractive.

Banking can be considered the business that really appreciates the value of building long-term relationships with customers. If a banker wants to attract depositors and borrowers, s/he must control the factors that influence the decision regarding choice of banks. Some of these factors are financial condition of banks, location, reputation of banks, personal relationship with bank‟s executives, behaviors of bank executives, ownership of banks, interest rate, physical facilities available in banks, security, promptness in giving services, ensure error free record and so on.

Origin of the report:

Internship Program of BRAC University is a Graduation requirement for the BBA students, which is also a partial requirement of the Internship program of BBA curriculum. The main purpose of internship is to get the student exposed to the job world. Being an intern the main challenge was to translate the theoretical concepts into real life experience.

The internship program and the study have following purposes:

- To get and organize detail knowledge on the job responsibility.

- To experience the real business world.

- To compare the real scenario with the lessons learned in the University

Objective of the Report:

The objective of the report can be viewed in two forms:

- Primary Objective

- Secondary Objective

Primary Objective:

The primary objective of my report is to evaluate the customer satisfaction level of Premier Bank Limited and fulfill the internship program requirements to complete the BBA program.

Secondary Objective:

This study entails the following secondary objectives:

- To give an overview of Premier Bank Limited and its product and services.

- To know the daily operations of general banking division of Premier Bank Limited.

- To provide some recommendations how to improve the customer satisfaction of Premier Bank Limited.

- To relate the academic knowledge with practical world.

Customer Satisfaction:

Customer satisfaction is really hard to define as many factors have a great influence on it. The most straight forward definition of customer satisfaction was provided by Philip Kotler “if the product matches expectation, the customer is satisfied; if it exceeds them, the customer is highly satisfied; if it falls short, the customer is dissatisfied.” The generally accepted the definition of customer satisfaction is “The extent to which a product perceived performance matches a buyer‟s expectation. If the product‟s performance falls short of expectations, the buyer is dissatisfied. If

performance matches or exceeds expectation, the buyer is satisfied or delighted”.

Customer Satisfaction = Expected Performance – Perceived Performance

When Customers are Satisfied?

Dissatisfaction: It occurs when the actual performances fail to meet its expectation.

Satisfaction: It occurs when the performance meets the expectation.

Delight: It occurs when the performance level exceed it expectation.

The Customer Satisfaction Measurement Model:

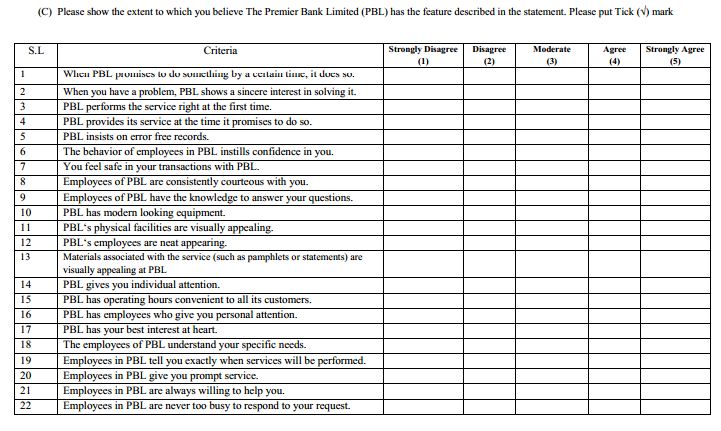

There are various models that are used in measuring the level of customers „satisfaction. I have calculated the Customer Satisfaction Index (CSI). Because, it looks pretty easier as it shows the satisfaction level as one number and this measure model considers various parameters and this is easy to calculate. The Customer Satisfaction Index represents the overall satisfaction level of that customer as one number, usually as a percentage. And SERVQUAL instrument has been used for calculating this index. The SERVQUAL instrument is the predominant method used to

measure consumers‟ perceptions of service quality. It has five common dimensions or factors of service quality that are stated as follows:

a. Reliability: Ability to perform the promised service dependably and accurately;

b. Assurance (including competence, courtesy, credibility and security): Knowledge and courtesy of employees and their ability to inspire trust and confidence;

c. Tangibles: Physical facilities, equipment and appearance of personnel;

d. Empathy (including access, communication, understanding the customer): Caring and Individualized attention that the firm provides to its customers;

e. Responsiveness: Willingness to help customers and provide prompt service.

a. Reliability:

- Act according to Promises

- Sincere Interest in Problem Solving

- Performs the Service Right the First Time

- Provides Services at the Time Promised

- Insists on Error Free Records

b. Assurance:

- Employees Behavior Instill Confidence in Customers

- Customers Feel Safe in Transaction

- Consistent Courtesy of Employees

- Employees have the Knowledge to Answer Customers’ Question

c. Tangibles:

- Modern Looking Equipment‟s

- Visually Appealing Physical Facilities

- Neat Appearance of Employees

- Appealing Appearance of Materials

d. Empathy:

- Gives Customers Individual Attention

- Has Convenient Operating Hours for Customers

- Has Employees to Give Customers Personal Attention

- Has Best Interest of Customers at Heart

- Employees Understand Specific Needs of Customers

e. Responsiveness:

- Informs exactly when Services will be provided

- Gives Prompt Services

- Employees are Always Willing to Help

- Never too Busy to Respond Customer Requests

Calculation of Customer Satisfaction Index (CSI):

The Customer Satisfaction Index represents the overall satisfaction level of that customer as one number, usually as a percentage. Plotting this Satisfaction Index of the customer against a time scale shows exactly how well the supplier is accomplishing the task of customer satisfaction over a period of time. Since the survey feedback comes from many respondents in one organization, the bias due to individual perception needs to be accounted for. This can be achieved by calculating the Satisfaction Index using an importance weighting based on an average of 1.

Calculate the average of all the weightings given by the customer. Divide the individual weightings by this average to arrive at the weighting on the basis of average of 1. Customer’s higher priorities are weighted more than 1 and lower priorities less than 1. The averages of the Customers Importance Scores are calculated and each individual score is expressed as a factor of that average. Thus Customer Satisfaction can be expressed as a single number that tells the

organization where it stands today.

To calculate the unweighted average SERVQUAL scores and the weighted average SERVQUAL scores, several steps are to be taken. The first step is to calculate the mean of each 22 perceptions. The next step is to calculate the gap score (Expectation- perception) of each of the 22 perception under the required dimensions. After that each of the 5 dimension‟s average score will be calculated. And after that the mean of the average will be calculated. The average

of the mean of the dimensions will be the unwieghted SERVQUAL score.

The Gap Score: Gap score is the difference between the Expectation and Perception. It indicates the reality gap from interviewer„s (my) perception.

Expectation: This part deals with my opinion on the bank on the basis of the point given to the specific dimension by customers. What I am interested in here is a number that best shows expectations about the Premier Bank Limited (Uttara branch).

Perception: This indicates the respondents „response on the statements taken under the SERVQUAL instrument.

Methodology:

An appropriate methodology is required for a successful execution of a research work. It helps to get the objectives of the research work through a systematic process. The methodology and research design for preparing this study is given below:

Population and Sample:

Sample is the part of population. It represents the population. A sample is therefore subset of population. I have selected 50 account holders of uttara branch of Premier Bank Limited.

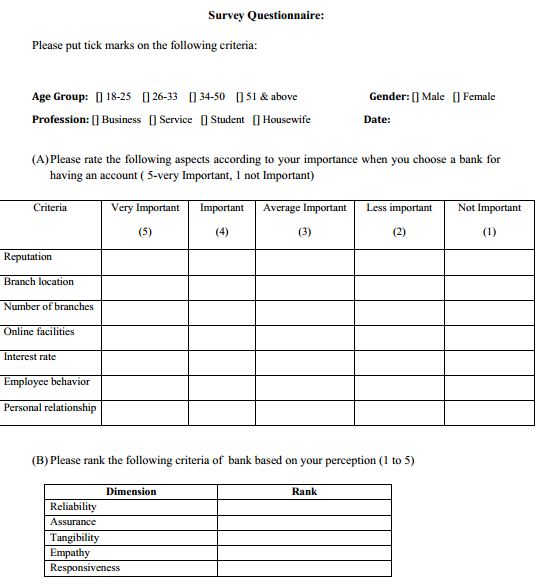

Questionnaire:

The most common procedure of generating data is questionnaire. To design questionnaire I have used SERVQUAL Instrument. To get data on customer satisfaction directly from customers with a view to measuring their level of satisfaction I‟ve taken interview of 50 account holders of uttara branch of Premier Bank Limited. The interviews have been conducted using a structured questionnaire containing 22 questions representing the five dimensions of customer satisfaction measurement. Customers„ responses have been recorded by using 5 point Likert Scale or Technique where the customer were asked to evaluate each statement to rate their degree of agreements or disagreements with each of 22 statements. These degrees of agreements or disagreements are plotted on the 5 point Likert Scale where point 1 indicates ―Strongly Disagree and point 5 indicates ―Strongly Agree with the statement.

Data Collection:

Primary Data Collection: After developing the questionnaire the required primary data have been collected through direct interview of the account holders of Premier Bank Limited of uttara branch.

Secondary Data: The secondary data have been collected from different books, journals, websites, company reports etc.

Statistical Tools: For analysis and interpretation I have used SPSS and Microsoft Excel.

Data Analysis:

All the quantitative data collected by surveying customers have been analyzed by using SPSS and Microsoft Excel. Using the program„s formula I„ve calculated mean, mode, standard deviation, average weight, number of respondents for each answer, etc. To achieve research objective I transformed the collected data into two categories- “Unsatisfactory” & “Satisfactory”.

If respondents „responses are – “Strongly Disagree”, “Disagree” & “Moderate” then these are treated as unsatisfactory for the organization and if respondents„ responses are “Agree” & “Strongly Agree” then these are treated as satisfactory for the organization. The collected data against the issue has been analyzed by using two statistical terms: “Mean” and “Standard Deviation”. Here the Variables have been analyzed in two standpoints: Expectation of Premier Bank Limited‟s customers and the Perception of the customers. Here each factor has been possessed two “Mean Scores”: one for the customers‟ expectations and another for the customers‟ perceptions. The more the mean score in perception, the better the satisfaction level for that certain variable. Thus, every variable has been analyzed toward the level of satisfaction. Another tool “Standard Deviation” has been expressed here the uniformity of responses. Between the response of customers: the lesser the standard deviation, the more the uniformity.

Findings

Quantitative Findings:

Demographic Description of the Sample:

50 account holders were surveyed as sample under the study to evaluate the satisfaction level in general banking customers of Premier Bank Limited (uttara Branch). The demographic information of samples is divided in 3 categories here like- gender, age and profession. Among the respondents 92% are male and 8% are female (see at appendix table no. 01). Here I divided the age group in to 4 categories like- 18 to 25, 26 to 33, 34 to 50 and 50 to above. So the respondents are accordingly 10%, 36%, 52% and 2% (see at appendix table no. 02). Lastly the respondents are from different professions like from business 68%, service 26%, student 2% and housewife 4% (see at appendix table no. 03). This is the demographic description of sample.

Factors Influencing the Choice of Bank:

Criteria 1: Reputation of Bank

Reputation is important to attract the customers. When respondents were asked to rank the factors about 64% among them rank reputation as important and 36 % ranked it as average important factor.

Criteria 2: Branch Location

Branch location is another factor that influences the choice of bank for opening account. Many

people prefer bank located near to their residence. Thus 60% of respondents ranked branch

location as very important factor for opening of account, 36% said important and 4% of them

raked it as average important.

Criteria 3: Number of Branches

When respondents were asked to rank the number of branches among them 28% of the respondents considered number of branches as less important where as 42% of the respondents though it was average important and 30% of the respondents thought number of branches as important (see at appendix table no. 06). So for the majority of the respondent said number of branches is average important for selecting bank for opening account.

Criteria 4: Online Facilities

In this age of technology banks are trying to retain their customers by launching different convenient services. Increasing online facilities is one of them. From the survey it was found that 46% of the respondents thought online facilities as important for opening of account and 28% thought as average important. Survey result shows 26% of the respondents ranked online facilities as less important.

Criteria 5: Interest Rate

Interest rate is one of the major facilities through which banks try to convince its customer and to collect deposit from different sources. From the survey result it is found that 8% of the respondents consider interest rate as average important where as 62% of the respondents think interest rate is important for choosing a bank before opening of account and 30% of the respondents think interest rate as very important.

Criteria 6: Employee Behavior

Only having facilities is not enough. Employee behavior is also very important like 52% respondents ranked it as vary important and 48% ranked it as important. Thus it can be said that employee‟s behavior always attracts customer.

Criteria7: Personal Relationship

It is found from the survey result that 20% of the respondents consider personal relation is not important factor where as 40% of the respondents think personal relationship is less important and 22% of the respondents think it is average important factor and 18% think it is important for choosing a bank before opening of account. Majority of the respondents think it is less important factor.

Statement 1: ―When Premier Bank Limited promises to do something by a certain time, it does so.

Explanation: The above statement denotes the degree of keeping promises by the bank with a certain period of time. This statement is related to the cheque book or debit card delivery by Premier Bank Limited. When account holder gives cheque book or debit card requisition they are told to come in a certain date to receive that cheque book or debit card. The survey result shows that the mean value is 4.34 (see at appendix table no. 11). That means customers are satisfied with the performance against the promises made by Premier Bank Limited (uttara branch). The mode value (5) represents that most of the respondents are strongly agree with the above statement. So, on this point of fulfilling promises customers are seemed to be satisfied.

Statement 2: ―When you have a problem, Premier Bank Limited shows a sincere interest in solving it.

Explanation: The above statement refers to the degree of sincerity of the bank concerning the interest in solving the problems of customers. This statement deals with the happening of certain events such as loss of cheque leaves, deposit books, deposit slips and debit cards. When customers face this kind of happening they come for the help in bank. The survey shows that the mean value is 4.30. That means customers are satisfied with the banks sincerity in solving their problem. The mode value (4) represents that most of the respondents are agreed with the above statement. So, on this point of bank‟s sincerity in problem solving the customers are seemed to be satisfied.

Statement 3: ―Premier Bank Limited performs the service right at the first time.

Explanation: The statement means the degree of performing service correctly by the bank at the first time it performs for an individual. When accountholders of Premier Bank Limited (uttara branch) were asked to show the perception 42% of them were strongly agreed with the statement. Thus the mean value 4.02 shows that customers are satisfied. Though 20% of the respondents disagree with the statement since sometimes new employees are

employed who are not experienced with delivering the service. Thus they are not able to perform service correctly.

Statement 4: ―Premier Bank Limited provides its service at the time it promises to do so.

Explanation: The above statement refers to the degree of delivering Just In Time (JIT) service by the bank according to its promise. This statement is related to the delivery of the account statement, knowing account balance required by the account holders. The mean result 4.28 of the statement shows that customers of Premier Bank Limited (uttara branch) are satisfied.

Statement 5: ―Premier Bank Limited insists on error free records.

Explanation: This statement refers the degree of maintaining and providing error free records of transactions and other banking documents by the bank. The mean (4.38) value of this statement shows that customers believe that Premier Bank Limited (uttara branch) insists on error free records.

Statement 6: ―The behavior of employees in Premier Bank Limited instills confidence in you.

Explanation: This statement depicts the increase in the level of confidence of the customers due to the behavior of the employees of the bank. The survey result shows that the mean value is 3.84 that means customers are not at proper satisfied with the employee‟s behavior in instilling confidence in them (see at appendix table no. 16). The mode value (4) represents that most of the respondents are agreed with the above statement though the mean is indicating a lower value. So, on this point of employees‟ behavior in installing confidence in customers the clients are appeared to be laid on a less-satisfied zone which is below the acceptable point.

Statement 7: ―You feel safe in your transactions with Premier Bank Limited.

Explanation: The statement means the degree of safety that the customer feels by maintaining account and transacting with the bank. The mean value of this statement is 4.56 that means customers are well satisfied in maintaining transactions with the bank (see at appendix table no. 17). The mode value (5) represents that most of the respondents are strongly agreed with the above statement. So, on this point of customers feel safe in transactions with the bank the clients are appeared to be well satisfied.

Statement 8: ―Employees of Premier Bank Limited are consistently courteous with you.

Explanation: Premier Bank Limited always gives emphasis on the techniques to attract the customers. The survey result shows that 54% of the accountholders strongly agree with the statement (see at appendix table no. 18). The mean value 4.52 also represents that employees of Premier Bank Limited (uttara branch) are courteous.

Statement 9: ―Employees of Premier Bank Limited have the knowledge to answer your questions.

Explanation: It is mandatory for the employees to have the knowledge about different services that banks can perform for its customers for the purpose of delivering service correctly. The accountholders of Premier Bank Limited (uttara branch) believes that the employees of this bank have the proper knowledge and they can provide the service with the enough information. Thus the mean value 4.08 shows that degree of agreement with the statement.

Statement 10: ―Premier Bank Limited has modern looking equipment.

Explanation: Modern looking equipment is necessary for providing better service to the customers. When account holders of Premier Bank Limited (uttara branch) were asked to show their perception abot this statement 70% of them were strongly agreed with this. The mean value 4.66 also shows that customers are satisfied with the equipment of Premier Bank Limited (uttara branch).

Statement 11: ―Premier Bank Limited„s physical facilities are visually appealing.

Explanation: The above statement means the degree that Premier Bank Limited (uttara branch) has appealing physical facilities. Survey result shows that the mean value is 4.72 that means customers are well satisfied with the visually appealing physical facility of the bank (see at appendix table no. 21). The mode value (5) represents that most of the respondents are strongly agree with the above statement. So, on this point of the clients are appeared to be satisfied enough.

Statement 12: ―Premier Bank Limited„s employees are neat appearing.

Explanation: Every organization has its dress code and Premier Bank Limited (uttara branch) is not exception to it. It emphasizes on the appearance of employees. 62% of the account holders think that PBL‟s employees are neat appearing (see at appendix table no. 22). The means value 4.54 expresses that customers are satisfied with the neat appearing.

Statement 13: ―Materials associated with the service (such as pamphlets or statements) are visually appealing at Premier Bank Limited.

Explanation: A single envelope can attract a customer towards the organization. Premier Bank Limited (uttara branch) tries to design its materials visually appealing. It provides such materials (statement, thanks letter, offer letter) to the account holders. When account holders were asked to show their perceptions, 52% were strongly agreed with the statement that Premier Bank Limited (uttara branch)‟s materials are visually appealing. Here mean value 4.38 represent that customers are strongly agree with it.

Statement 14: ―Premier Bank Limited gives you individual attention.

Explanation: Top customers always get appreciation and require individual attention. Sometimes providing individual attention may not be possible during busy hour. The mean value 3.88 represents that customers are not that much satisfied with the attention given by the employees.

Statement 15: ―Premier Bank Limited has operating hours convenient to all its customers.

Explanation: Premier Bank Limited (uttara branch) follows the banking hour (open at 10am and close at 4pm) in proper manner. Though its closing time is 4.00pm it tries to serve customer in urgent need even if it is 4.30 pm. The mean value 4.08 thus shows that customers are satisfied with the service.

RATER Score of the Analysis:

This has 5 parameters and the score of the parameters are given below.

a. Ability of Employees to Perform Promised Service Dependently and Accurately: According to customers„ response, performance of all the dimensions listed under ―Reliability head (acting according to promises, sincerity in problem solving, performing the service right at the first time, providing service at the promised time & insistence on error free record) are quite satisfactory and the overall SERVQUAL score in this area is 4.26. So, the employees are able to perform promised services dependently and accurately.

b. Assurance of Competency, Courtesy, Credibility and Security: From customers „point of view, employees behaviour instills enough confidence in customers. All other dimensions listed under ―Assurance head (safe felling in transactions, consistent good courtesy of employees & having decent knowledge of employees in answering customers queries) are quite satisfactory. Though one dimension is not satisfactory but the satisfactory position of all other dimensions under ―Assurance head leads this to a satisfactory position and the overall SERVQUAL score is 4.25. So, on average the customers are assured enough by competence, courtesy, credibility and security of the employees and the bank.

c. Tangible Appearances in Satisfying Customers: Customers of the bank are satisfied with tangible appearances (equipment‟s, materials, physical facilities & employees) inside the bank. Average ―Tangibles SERVQUAL score of 4.54.

d. Performance in Personal Care, Understanding Customers & Offered Banking Hour: The survey result proved that the bank is offering its customers convenient banking hours and the employees have the best interest of customers in their heart. Beside these two satisfactory points there are some unsatisfactory items also. On weighted average customers think that they are not getting proper individual attention, there is lacking of employees who will give them personal attention and employees do not understand their personal needs. These disappointing factors are

forming average ―Empathy weighted score to 4.02.

e. Response & Willingness of Employees in Providing Service: The study shows that the employees are always willing to help customers but there are lacking in providing prompt services, informing exactly when service will be actually provided and responding customers when the employees have works in hand. These negative points are shaping the average ―Responsiveness SERVQUAL score to 4.24.

f. Overall Evaluation of Customer Satisfaction: The overall unweighted SERVQUAL score is 4.27 (see at appendix table no. 38) which is indicating a satisfactory stage in the level of customer satisfaction. The weighted SERVQUAL score or the Customer Satisfaction Index (CSI) is 4.25. This figure is also indicating an acceptable level of customer satisfaction. So, from the quantitative analysis it is found that although in some dimensions customers are not

properly satisfied, the overall result is pointing to a satisfactory level of customers „satisfaction at Premier Bank Limited (uttara branch). There are some points where it needs to improve performance to increase the level of customer satisfaction. These are- providing customers individual attention, understanding special needs of customers, providing information exactly when service will be provided, providing quick service, response timely to customers, etc.

Qualitative Findings:

The key informants believe that the customers can be made more satisfied by providing them quick service. They also think that most of the customers deal with lower level officers of General Banking Department. Customers of the bank are increasing day by day. It will not be possible to serve customers then as they serve today. To make provide them prompt service without creating any queue more employees are needed under General Banking department. This will help them to carry on every day time consuming works like voucher sorting properly and thus there will be no pending works. They also believe that a better core banking software will help them to deal with their works more accurately. These will save their valuable time and thus they will be able to offer this extra saved time to the customers to meet their wants timely. A conventional query desk or reception booth or information booth can serve customers who make a phone or come at bank for simple query and this can reduce customers„ rush to the officers

desk. Students appointed under internship program may help in many day to day simple works like account opening, voucher sorting, mail management, providing information to customers, etc. It is also advantageous because it costs a little no comparing to full time appointed employees.

Developing customer satisfaction is not just about carrying out a survey. Surveys provide the reading that shows where attention is required but in many respects, this is the easy part. Very often, major long lasting improvements need a fundamental transformation in the organization, probably involving training of the staff, possibly involving cultural change. The result should be financially beneficial with less customer churn, higher market shares, premium prices, stronger brands and reputation, and happier staff. However, there is a price to pay for these improvements. Costs will be incurred in the research surveys are made. Time will be spent working out an action plan and in implementation of development process. Training may well be required to improve the customer service. The implications of customer satisfaction surveys go far beyond the survey itself and will only be successful if fully supported by the echelons of senior management.

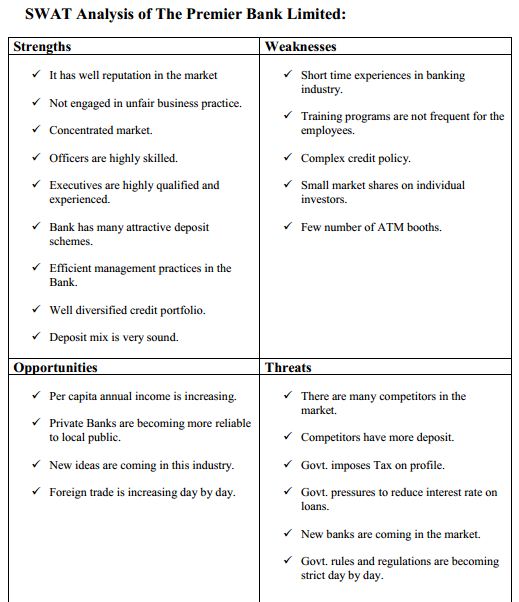

Recommendations:

In the fast evolving world, it is very necessary for each and every organization to build a strong presence in the market by maximizing profit margin by satisfying their customers as much possible. As a bank, the manager has to identify the strategies that align, fit or match the banks‟ resources and capabilities to the demands of the environment in order to exploit opportunities and counter threat and to correct company weakness building on the strength. It is like a process containing corporate planning, performance analysis, program or service delivery, and evaluation and review.

After completing my internship program with Premier Bank Limited (uttara branch), I think the following recommendations will help them to improve the level of customer satisfaction.

- Deposit book should be provided to the regular account holder such as current account and MSS account holder. Some customers want a full book of deposit slip. By discussing with them it comes to know that they are the current account holder and MSS account holder. They have to come to the bank daily or twice a week. So it becomes tough to them to come in the bank to put the signature on deposit slip. If they get that slip as book, it will be helpful for them as they can send bearer to deposit the money.

- Debit card should be given to the new account holder with in short period of time and itshould be activated as early as possible. Sometime customers open bank account for their early and fast service in the case of carrying debit card but it is reached on customers hand after 10 or 12 days later. So they claimed that the card service of Premier Bank Limited should be upgraded. So management should think of it.

- ATM boths of Premier Bank Limited are very few not only for Dhaka city but also for the country. Number of booth should be increased to fill up customer demand and increase the market share.

- Premier Bank Limited has the facility of locker service for the customer in urrata branch. But the locker numbers are few and demand is high. So Premier Bank Limited should take steps for increase the locker number.

- Premier Bank Limited should create business opportunities for themselves. Nowadays there is an intense competition between the banks. All the banks are expanding with aggressive approach. So Premier bank needs to open more branches to capture the market and it should be nearer to the customer address. So they can do banking easily with Premier Bank Limited.

- Cheque authorization Process should be developed to save the time of customer. Here customers have to wait for long time to take the authorization of cheque from other branch.

- Premier Bank Limited should give more emphasize on their marketing effort and try to increase their sales force. Model Banks like Citibank, HSBC Bank, Standard Chartered Bank are using media very effectively to increase the business of banks. So Premier Bank Limited should need to use electronic media for its business developments.

Conclusion:

Premier Bank Limited is one of the leading private banks in the country with commendable performance directed by mission. It is providing a wide range of banking services. It has achieved success within a short period of time among its peer competitors. It has dynamic professional, dedicated team management having long experience and expertise in modern banking. Premier Bank Limited has adequate technology and efficient management to satisfy its present clients. With all of its resources management of Premier Bank Limited believes that the bank would be able to face all the challenges coming in the future. I have the opportunity to complete my internship in this reputed bank. As an intern I have worked in general banking division and learnt to do tasks like account opening, closing of accounts and scheme, maintaining register, issue cheque, issue pay order, making voucher and other several tasks instructed by

different officers. These leanings will help me to sharpen my future career. At last I wish a very successful future for Premier Bank Limited according to its vision and Goals.