Executive summary :Square Pharmaceuticals Ltd. was established as a partnership firm in 1958. In 1991 it was converted into a public limited company. Square Pharmaceuticals Limited is the largest pharmaceutical company in Bangladesh and it has been continuously in the 1st position among all national and multinational companies since 1985. Since 1987 Square has taken aggressive measures to explore new countries as potential export market. More & more countries are getting confidence in Square’s product every year. But it’s true that in the competitive global environment Square is still struggling to ensure firm footings in global market. Square is the flagship Pharma Company in Bangladesh, wants to be a global player. As recognition to its export contribution to national economy, Square received the National Export Trophy in 1997. To strengthen it’s global operation further, Square is planning to enter in Russian Pharma market considering market potentiality. Our project is focused on to decide entry mode of Square for Russia.

Russia is having a huge potential pharma market for a foreign company that is having competitive advantage. Domestic pharmaceutical producers of Russia supply only 35 percent of the total market and foreign companies control remaining 65% market. Imported pharmaceuticals have increased their presence in the Russian market in the last several years and continuously having positive growth in each year. In 2001 the imported pharma market growth was 36%. Due to high-unsatisfied demand for pharmaceuticals, decreased production capacity of Russian pharmaceuticals, increased prices of the domestic producers, drastically making them less competitive in comparison to imported ones.

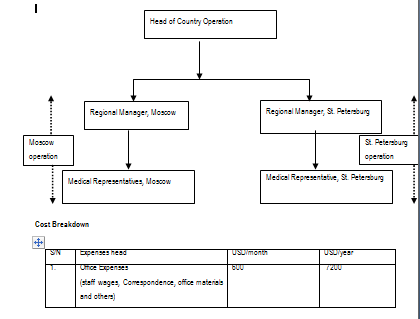

However considering the potential and opportunity, definitely Square can think to keep step in Russian Pharma market. The question is what will be the right entry mode & how to implement the business structure. I also analyzed all these issues in this project report. I made a thorough analysis of country profile, Russian market, target market, marketing mix and competitors’ profile. At last i have suggested the entry mode of “Exporting through distributor & office setup for marketing integration.”

I hope this project will help Square to find it’s own track in Russian Pharma market.

Part one: the organization Background

Square Pharmaceuticals Ltd. (SPL), the pharmaceutical giant in the country, is a trusted name in the industry of manufacturing quality medicines for more than four decade.

SQUARE today symbolizes a name – a state of mind. From the inception in 1958, it has today burgeoned into one of the top line conglomerates in Bangladesh. SQUARE Pharmaceuticals Ltd., the flagship company, is holding the strong leadership position in the pharmaceutical industry of Bangladesh since 1985 and is now on its way to becoming a high performance global player.

q FIRST to export antibiotics and other ethical drugs overseas.

q FIRST to manufacture and market Metronidazole, Ampicillin and Cotrimoxazole after the expiry of patents.

q FIRST to develop sustained release technology locally.

q FIRST to achieve an all time industry high record sales turnover of US$ 25 million.

q FIRST to locally produce high tech Metered dose Inhalation (MDI) formulations.

q FIRST to locally produce diclofenac sodium in the chemical division.

In addition to these FIRSTs, SQUARE Pharmaceuticals Limited (SPL) was always ahead in introducing new products in the market.

1.1 Profile of Square Pharmaceuticals Ltd.

Corporate Headquarters : SQUARE CENTRE

48, Mohakhali Commercial Area

Dhaka 1212, Bangladesh

Factory : Shalgaria, PabnaTown, Pabna

Established : 1958

Constitution : Public Limited Company

Chairman : Mr. Samson H. Chowdhury

Managing Director : Mr. Tapan Chowdhury

Details of Business : Pharmaceutical Products/ Bulk Chemicals/ AgroVet Products

Authorized Capital : Tk. 1000 million

Paid-up Capital : Tk. 496.8 million

No. of Employees : 2703

ProductRange : Pharma – 91 products in 185 dosage forms

Chemical Division – 7 products

AgroVet Division – 7 products

Name of the Banker : Janata Bank, 1, Dilkusha, Dhaka

CitiBank N.A., 122-124, Motijheel, Dhaka

Standard Chartered Bank, 18-20, Motijheel, Dhaka

Credit Agricole Indosuez, 47, Motijheel, Dhaka

Bank Asia Ltd., 113-116,Tejgaon, Dhaka

Manufacturing Units : 1. Pharmaceutical Division

2. AgroVet Division

3. Chemical Division

Square Pharmaceuticals Ltd. (SPL), the pharmaceutical giant in the country, is a trusted name in the industry of manufacturing quality medicines for more than four decade.

With a capital of Tk. 55,000, a floor space of 3000 sft, and a team of 12 persons, SPL made its humble debut as a partnership firm in 1958.

Within a span of only six years, under the farsighted vision of the management, and the dedicated efforts of the company, its turnover reached the mark of Taka one million. With the growth of turnover came the increase in number of employees, which in 1964stood to 50. At this point of time the partnership firm was transformed into Private Limited Company. In 1964, PL’s Authorized Capital was Tk. 5,00,000 and the Paid up Capital was 4,00,000.

During the mid-seventies (1975) SPL entered into a technical collaboration agreement with Janssen Pharmaceuticals, Belgium, which is a subsidiary of Johnson and Johnson International, USA. Since its inception SPL practices Good Manufacturing Practices (GMP), as recommended by the World Health Organization (WHO).

Another technical collaboration came under way, this time with F Hoffmann-La Roche Ltd., Switzerland, in 1982. But the fruits of this agreement could not be reaped on the account of the Drug Ordinance of 1982. Nevertheless, SPL’s growth was not being stunted. In 1982, turnover reached over Tk. 240 million, and the payroll increased 400 heads, and by 1988 SPL’s turnover exceeded half a billion taka., and the number of employees to 750.

A new factory built in 1987, with all the modern machinery, extensive development of the domestic market, and infiltration into foreign ones like UK and Singapore. Led to this phenomenal growth SPL is the first company in the country ever to export pharmaceuticals finished goods abroad. At present SPL is exporting its products to Nepal, Myanmar, Pakistan, Sri-Lanka, Combodia, and Russia.

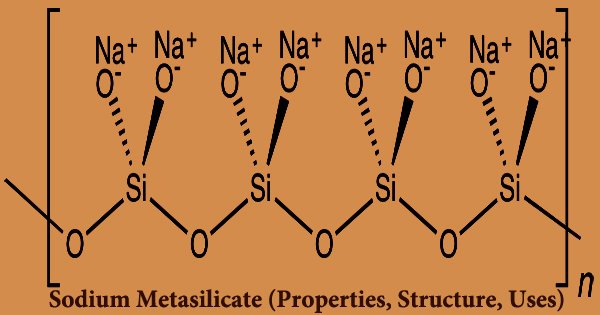

With its finished goods already dominating markets at home and abroad, SPL started production of pharmaceutical raw materials groom its new unit, christened as Square Chemical Division, in 1995. The items in production under this unit are Diclofennac Sodium, Amoxycillin, Cloxacillin and Paracetamol.

To sustain the changing environment SPL made convert itself into Public Limited Company in 1991. With a brilliant track record SPL became the first company in Bangladesh to cross the Billion Taka mark turnover in 1992. In 1994 SPL got its share listed in the Dhaka and Chittagong Stock Exchanges. Authorized Capital towered to billion taka and paid up capital by now is taka 250 million. Presently Square is family of 1321 members.

In 1996 an agreement was signed with M/s Tanvec, UK for the establishment of the second formulation unit (Pharma II) at Kaliakoir, Gazipur. This factory, which built with a view to get the approval of USFDA/MCA, is completed in the year 2000, and without doubt, help SPL continue to command its leadership through the next millennium as well.

1.2 Chronology since inception

Year Events

1958 : | Debut of Square Pharma as a Partnership Firm. |

1964 : | Converted into a Private Limited Company. |

1974 : | Technical Collaboration with Janssen Pharmaceutica, Belgium, a subsidiary of Johnson and Johnson International, USA. |

1982 : | Licensing Agreement signed with F. Hoffmann-La Roche Ltd., Switzerland. |

1985 : | Achieved first position in the Pharmaceutical Market of Bangladesh among all national and multinational companies. |

1987 : | Pioneer in pharmaceutical export from Bangladesh. |

1991 : | Converted in to a Public Limited Company |

1994 : | Initial Public Offering of Square Pharmaceutical Shares. |

1995 : | Chemical Division of Square Pharmaceuticals Ltd. starts production of pharmaceutical bulk products (API). |

1997 : | Won the National Export trophy for exporting pharmaceuticals. |

1998 : | Agro-chemicals & Veterinary Products Division of Square Pharma starts its operation. |

2001 : | US FDA/UK MCA standard new Pharmaceutical factory goes into operation built under the supervision of Bovis Lend Lease, UK. |

2004 : | Signing of agreement with ROVIPHARM, Vietnam to manufacture and market SQUARE products under license in Vietnam. |

| Secured the top position for the best published accounts and report for 2003 in the manufacturing category for transparency and excellence in corporate reporting. |

2005 | New State-of- the-Art Square Cephlosporins Ltd. goes into operation; built under the supervision of TELSTAR S.A. of Spain as per US FDA/ UK MHRA requirements. |

1.3 Global Operations of SPL

SQUARE has extended its range of services towards the highway of global market. It pioneered exports of medicines from Bangladesh in 1987. Through its extended marketing operations, SQUARE is now selling its finished goods in many countries of Asia and Europe including:

- Cambodia

- Myanmar

- Nepal

- Pakistan

- ØRussia

- ØSri Lanka

- ØUkraine

- ØYemen

In addition, registration of many of SQUARE’s finished goods in other countries of Asia, Europe, and Africa is now under process.

1.3.1 Partnership and agreement with different world players

1974 : Technical Collaboration with Janssen Pharmaceutical, Belgium, a subsidiary of Johnson & Johnson International, USA

1982 : Agreement signed with F. Hoffmann-La Roche Ltd., Switzerland

1999 : Agreement with Bayer AG, Germany

1999 : Agreement with Eisai Co. Ltd., Japan

1999 : Technical know-how transfer to foreign pharmaceutical company

2000 : Establishment of Square Spinnings Limited.

2001 : Operation of new factory with a view to get USFDA/MCA approval and production support for expanding export operations.

2002 : Establishment of Square – Fashions Limited and Square – Knit fabrics Limited.

2003 : Turnover crosses Four Billion Taka mark.

Overview of Square Pharmaceuticals Ltd.

2.1 Manufacturing Facilities

SQUARE is committed to ensure strict compliance with CGMP norms and regulatory requirements in every phase of manufacturing, quality assurance, and distribution of medicines. To comply with CGMP SQUARE has state-of-the-art technology in production and quality control. In addition, USFDA/MCA standard new plant is now at the completion stage.

Documented Quality Management System (QMS) is integral part of all of SPL operations. People at all levels are committed to adopt advanced technology for continuous development. Being confident with the sophisticated manufacturing and quality assurance technology of SQUARE, multinationals from industrialized countries now have agreements with Square for having their products manufactured in Bangladesh.

2.2 Product Mix

SQUARE has latest technologies for production of a wide varieties of dosage forms including Tablet, Sustained Release formulation, Capsule, Metered Dose Inhaler (MDI), Injectable, Syrup (liquid and dry), Suspension (liquid and dry), Pediatric Drops, Nasal & Ophthalmic formulations, Topical Gel/Ointment/Cream, and oral care formulations.

Current product mix of Square Pharmaceuticals Ltd. comprised of products from the following types of Drug Delivery Systems:

- Tablets

- Non-coated (Vaginal, Dispersible, Chewable, Plain)

- Coated (Sugar coated, Film coated, Enteric coated)

- Sustained released (coated/non-coated)

- Capsules

- Injectables

- Vials containing dry powder for injections

- Small volume parenterals

- Liquids

- Oral (suspension, syrup, drops, and stomatologicals)

- Topical solutions

- Nasal drops

- Dry powders

- Oral (for reconstitution to make suspension, syrup and drops)

- Topical

- Semisolids (creams, ointments and gels)

- Solid suppository formulations

- Metered Dose Inhalers (MDIs)

- Dry Powder Inhalers (DPIs)

- Sterile Ophthalmic Formulations (drops)

Therapeutic Range (Formulation)

| Analgesics/AntipyreticsAnthelmintics Antiallergics Antidepressants Antidiabetics Antidiarrheals Antiemetics/Gastroprokinetics Antifungal Systemic Antigout Antihistaminics Antihypertensive / Antianginal Antiinfectives/Antibacterial Antimalarial Antiprotozoals Antiseptics/Disinfectants Antispasmodics Antiulcerants | AntiviralsBone resorption preparations Dermatologicals Enzymes Expectorants/Antitussives Hematinics Lipid modifiers/Antiobesity Nootropics NSAIDs Ophthalmic preparations Sedatives/Tranquilizers/Muscle Relaxants Bronchodilators/Antiasthmatic Vitamin and mineral preparations Androgen suppressants Anti-migraine Laxatives Neurological |

2.3 Quality

SQUARE is committed to ensure better life through quality medicine. SPL has defined its Quality Policy to fulfill this commitment. To achieve and maintain a steady quality, a range of sophisticated state-of-the-art technology is engaged in operation. SQUARE has adopted the latest quality philosophy by organizing a well-equipped Quality Assurance Department in the plant in addition to Quality Control Department. Above all highly qualified, well-trained, experienced and dedicated professionals are most valuable assets of Square Pharmaceuticals Ltd.

2.4 Research and Development

SPL’s Research and Development is devoted to improve the health care facility of people. Square Pharmaceuticals Ltd. has brought in advanced technology for its Research and Development works. Research & Development includes the bibliographic search aided by a resourceful library, design and selection of process that maximizes efficiency and minimizes the environmental impact, accelerated and long term stability testing, product quality optimization and translation of new scientific insights into the products. R&D Department is also devoted to extensive research and development work in synthesizing bulk chemicals for Chemicals Division. Having started as an importer of technology, R&D Dept. from 1999 has started to export technology to SQUARE’s global customers. To support Research and Development work latest Information Technology (IT) is available with us and SQUARE is now fully prepared to meet the challenge of twenty-first century.

2.5 Chemicals Division for Bulk Drug Manufacturing

In 1995, SQUARE has established a separate division for the manufacturing of bulk drugs. Currently this division is producing the following bulk chemicals for the domestic pharmaceutical companies:

v Paracetamol BP/USP

v Diclofenac sodium BP

v Diclofenac free acid INN

v Diclofenac diethylamine

v Diclofenac potassium INN

v Flucloxacillin sodium BP

v Amoxicillin trihydrate BP/USP (compacted and micronized)

v Cloxacillin sodium BP/USP (compacted and micronized)

v Ampicillin trihydrate BP/USP (compacted and micronized)

v Cephalexin monohydrate BP/USP (compacted and micronized)

2.6 Distribution Network

SQUARE is committed to ensure better life through quality medicine. The ultimate motto is to ensure customer satisfaction by exceeding their level of expectations. SPL has 14 Sales and Distribution offices in the following places in Bangladesh:

Depot | Address | Phone |

| Dhaka | 355-356, Tejgaon Industrial Area, Dhaka-1208. | (880-2) 8828775 |

| Pabna | Hospital Road, Salgaria, Pabna. | (880-731) 66580 |

| Bogra | 877/A, MS Road, Bakshi Bazar, Malati Nagar, Bogra | (880-051) 64747 |

| Rangpur | House # 36, Road # 2, R K Road, Islambag , Rangpur. | (880-0521) 63588 |

| Khulna | Alhamdulillah, 25 Usufe Road, Mirzapur, Khulna-9100 | (880-041) 732330, 724654 |

| Barisal | 502/532 South Alekanda, 1 No. C & B Pool, C & B Road, Barisal. | (880-0531) 53661, 56778 |

| Comilla | 400/363, Shishu Mangol Road, Kandirper Comilla. | (880-081) 72320 |

| Mymensingh | 5/A/04 & 5/A/05, Shaheb Quarter, Kachijuli, Mymensingh | (880-091) 55143 |

| Chittagong | House No-1/C, Baijid Bostami Road, East Nasirabad, Chittagong-4000. | (880-031) 654423 |

| Maizdee | 234/B, Hospital Road, Maizdee Court, Noakhali. | (880-0321) 61683 |

| Sylhet | Sabina Mohal, 44, Payra, Darshandewry, Dorga Mohalla, Sylhet. | (880-0821) 725298 |

| Tangail | Biswas Betka, Dhaka Road, Tangail | (880-0921) 53488 |

| Rajshahi | 106, Ambagan, Senanibas Sarak, Rajshahi | (880-0721) 760877 |

| Faridpur | Mission Road, Christian Mission, Police Line, Faridpur | (880- 0631) 63561 |

The extensive marketing network comprising of latest technical and logistic support along with 887 skilled and qualified field staffs is a key to succeed in achieving customer satisfaction level beyond their expectation. The modern warehousing and completely computerized invoicing facilities of SQUARE ensures just-in-time delivery and high customers’ satisfaction.

Resources

| ||||||

| ||||||

| ||||||

|

2.7 New Plant of SPL

SQUARE is now on it’s way to becoming a high performance global company. To this end SQUARE has built a new plant that went into operations by the end of 2001. This plant is the first of its kind in Bangladesh with its MCA of UK and USFDA standard manufacturing and quality assurance facilities.

The implementation of Pharma Unit at Dhaka (Kaliakoir) is carried out under the supervision of M/s. Tanvec Ltd. of UK. In view of the complex and complicated design and high quality standard required for USFDA/EU/MCA specifications the progress of implementation has to be slower. It may be noted that during the year under review total investment increased by Tk. 463,667,368 from Tk. 317,321,566 as on 31-03-98 to 780,988,934 as on 31-03-99 on various heads as shown below:

Square Dhaka Unit Project work was started from October 1996. After technical review and in the best interest of the project in order to achieve quality work as State-of-the-art facility to meet the requirement of the USFDA/MCA Good Manufacturing Practice the original project completion schedule had to be extended.

The Dhaka Unit New Pharmaceuticals Production Facility at Kaliakoir is one of its kind in the country to face the challenge of free world market in the beginning of new millennium.

The State-of-Art Facility incorporated certain basic requirement in the area of Purified Water System. Floor Construction, HVAC System Process Equipment and Validation/ Qualification Documentation as stipulated by USA, EU and other developed countries.

2.8 Export market

In an effort to expand the market for the pharmaceutical products beyond the border, the company has been successful in exporting to several countries at an increasing ratio of its turnover as indicated below:

(Taka in ‘000)

| Year | Turnover (Gross) | Exports | % age of GT |

| 2001-2002 | 2,422,785 | 44,361 | 1.83% |

| 2000-2001 | 2,055,418 | 15,082 | 0.73% |

| 1999-2000 | 1,827,983 | 11,503 | 0.63% |

| 1998-1999 | 1,595,590 | 163 | 0.01% |

The company has so far been able to enter into the markets of Russia, Pakistan, Sri Lanka, Myanmar, Nepal, and Cambodia. It is expected that after the Dhaka Unit goes into production the company will succeed in entering the markets of developed countries with expanded share of exports.

2.9 Corporate Financial Highlights

Head Amount

Authorized Capital Tk. 1000 Million

Issued, Subscribed and Paid-up Capital Tk. 496.8 Million

Reserve/Surplus (Retained Earnings) Tk. 872 Million

Share Premium Tk. 800 Million

Long Term Loan Tk. 210 Million

2.10Marketing Performance

2.10.1 Product

Square’s product is viewed among the most quality products in the country. This quality image has increased its credibility among the doctors. It is also pioneer in introducing many new products sought by the doctors. Introducing new products is one of the important objectives of the company. But there are some complaints regarding packaging of the products. But the company has now concentrated in this area and working hard to bring attractive and good packaging

2.10.2 Pricing

Government fixes Price of most of the essential drugs. The number is 118 products. The company can fix price of other products but needs to take approval of government. In pricing a product, Square Pharmaceuticals Ltd. usually follows target pricing. Premium prices cannot be charged, as all the competitor products are similar and not much distinguishable from each other. But prices of some products are still higher than the competitors. But since Square Pharmaceuticals Ltd. does not compromise with the quality, sometimes they have to charge higher to ensure the highest quality possible.

2.10.3 Promotion

Personal selling is the main weapon in pharmaceutical industry. Medical representatives of the company go to the doctors to promote the products. The quality of medical reps is assumed to be the best in Square Pharmaceuticals Ltd. They are selected after a careful scrutiny and are sent to market after some extensive training. This helps Square Pharmaceuticals Ltd. to maintain the quality of its medical reps. Advertising can be given only in magazines related to health profession. Square also utilizes every opportunity to explore this area

2.10.4 Distribution

square distributes its products all over the country using its own distribution channel. It has a large number of vehicles and sales depots to ensure coverage of the whole country. Its coverage is the best in the country.

Corporate Profile of SQUARE

Chapter-3

Although Square started its operation in pharmaceutical sector and leader in the field, it is today a synonym of quality toiletries, health products, textile products and AgroVet products. It has also expanded its business in real estate, engineering construction, hospitals, electronic media and other trade & services. SQUARE is now one of the fastest growing and fastest diversifying conglomerate in Bangladesh.

3.1 Square Family

Square family is currently comprised of following companies:

| Square Pharmaceuticals Ltd. | |

| Square Textiles Ltd. | |

| Square Spinnings Ltd. | |

| Square Toiletries Ltd. | |

| Square Consumer Products Ltd. | |

| Square Informatix Ltd. | |

| Square Health Products Ltd. | |

| Square Agro Ltd. | |

| Mediacom Ltd. |

3.2 Associated Companies

As part of vast diversification, SQUARE has the following associated companies:

| Sheltech | |

| Pioneer Insurance Company Ltd. | |

| Mutual Trust Bank Ltd. | |

| National Housing Finance And Investment Ltd. | |

| Aegis Services Ltd. | |

| Maasranga Productions |

3.3 Corporate Headquarters:

Corporate Headquarters of SQUARE is now located at the following address:

‘SQUARE CENTRE’

48, Mohakhali Commercial Area, Dhaka-1212, Bangladesh

Tel. : (880)-2-8827729 (10 lines); Fax : (880)-2-8828608, 8828609

Email: square@bangla.net, Web: http://www.square-bd.com

3.4 Board of Directors

| Mr. Samson H. Chowdhury | Chairman |

| Mr. Tapan Chowdhury | Managing Director |

| Dr. Kazi Harunar Rashid | Director |

| Mr. Samuel S. Chowdhury | Director |

| Mr. Anjan Chowdhury | Director |

| Mr. Kazi Iqbal Harun | Director |

| Mrs. Jahanara Chowdhury | Director |

3.5 Human resources

In its efforts for human resources development in all spheres of its activities the company offered various courses of training. The company conducted in-house courses of different duration for upgrading skill of 395 employees during the financial year of 1998-1999. 22 employees were sent to various local institutes for training on different topics, 7 employees were sent abroad for training/attending seminars/symposiums on various subjects including general management, 3 expatriates were also invited for holding various discussion forums for officers/staff of the company.

The Breakdown of HR

Job Location | Manager and above | Executive | Non Executive | Total |

Corporate Headquarters | 46 | 123 | 123 | 292 |

Chemicals Division | 2 | 12 | 64 | 78 |

Pabna Plant | 19 | 59 | 459 | 537 |

Dhaka Unit | 14 | 61 | 168 | 243 |

Distribution | 3 | 17 | 174 | 194 |

Field Force(SPL) | 942 | |||

Field Force(Agrovet) | 70 | |||

Field Force(Pesticide) | 25 | |||

Total HR | 84 | 272 | 988 | 2381 |

The Supervision Ratio

Criteria | Manager | Executive | Span of Supervision |

Supervision | 84 | 272 | 1 : 3 |

Executive | Non Executive | ||

272 | 988 | 1 : 4 |

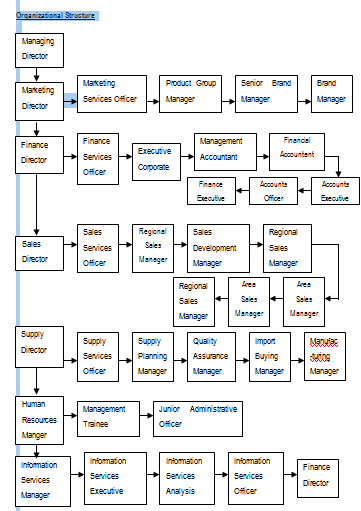

3.6 Activities of Key Functional Departments in SPL

As per the latest organogram SPL had 20 (twenty) functional departments for its operation. The names of the departments are as follows:

- Information Technology (IT) Department

- Medical Services Department (MSD)

- Product Management Department (PMD)

- Sales Department

- Distribution Department

- International Marketing Department

- Market Research and Planning Cell

- Quality Management and Audit Dept.

- Production Planning and Inventory Cell

- Engineering Department

- Production Department

- Commercial Department

- Personnel and Administration Department

- Technical Services Department

- Human Resource Training and Development Department

- Quality Control Department

- Quality Assurance Department

- AgroVet Department

- Accounts and Finance Department

- Accounts (New Venture) Department

Organizational Structure

The following departments manage domestic marketing operation:

- Product Management Department (PMD)

- Sales Department

- Medical Services Department (MSD)

- Distribution Department

- Market Research and Planning Cell

The following paragraphs describe the key functions of the above-mentioned Departments:

Information Technology (IT) Department

The main functions of IT Department are as follows:

- Provide computer and other related accessories supports to all the user

- Maintenance of server and ensure smooth LAN operation

- Provide up to date technical and software support to all the sectors of SQUARE

- Development and maintenance of centralized databases and provide routine and ad hoc reports for management decision making.

Medical Services Department (MSD)

The main functions of MSD are as follows:

Arranging clinical meeting with the physicians on different products

Provide answers to different queries of the physicians through mail or telephone

Arranging education programs for the rural medical practitioners

Publishing of medical journals

Arranging of special promotional campaign of different products

Product Management Department (PMD)

PMD is the core and centralized department for managing the total marketing effort. Basically PMD performs the all planning, implementation of plans as part of marketing management functions. The two key functions of PMD are as follows:

1.Introduction of new product into the market

2.Manage the existing portfolio to achieve the marketing objectives.

To this end PMD undertakes all relevant activities including the following:

- Preparation of Marketing Plan.

- Designing and development of promotional materials

- Training of field forces

- Feasibility study of new products

- Management of regulatory affairs with Drugs Administration

- Preparation of printed promotional material (literature/pad/brochure/show card etc.).

- All relevant coordination works with supplier/factory and procurement department concerning machinery and raw materials that will be used to manufacture the concerned brands.

Sales Department

- Pay regular visit to the doctors; show the benefits of new existing products with the help of promotional tools.

- Monitor the competitors’ activities.

- Handles initial product queries from doctors and product complain from the market.

- Receive sales order from the retailers /drug stores.

- Coordination among different markets

- Market rearrangement

- Handling different problems of field forces

Distribution Department

Ensure smooth distribution of products to all over the country

Collection of payments from the customers

Performs functions as the representative of SPL at the depot level.

Maintenance of vehicles and depots

International Marketing Department

Exploration of new markets all over the world

Operating of export business in the different countries

Provide training to field forces in overseas countries

Provide all types of documents for registration of SPL’s products in overseas countries.

Market Research and Planning Cell

Performing market survey on the Bangladesh Pharmaceutical Market

Regular prescription share analysis and report generation for SPL market share analysis.

Performing different market research work on different issues

Provide all kinds of support to Field Colleagues in effective planning in the market level.

Quality Management and Audit

Ensure the practices of Quality Management System (QMS) at every stage of operations of SPL in full compliance with ISO 9001.

To monitor the activities to ensure compliance with defined quality policy at every stage of business.

Develop process and instructions for continuous development of operations to increase productivity.

Production Planning and Inventory Cell (PPIC)

Prepare the monthly production schedule of different products

Maintain the inventory status of different raw materials and packaging materials

Technical Services Department (TSD)

- Provide technical support to QC, QA, Production and other departments with regards to any kind of technical issues.

- To procure new Raw Material and production and quality facilities in coordination with Commercial Dept.

- Development of formulation of new products

- Selection of machinery and equipment including spare parts.

- Coordination and follow-up of the designing and implementation of the Master Plan of the factory. All matters related to development of factory facilities.

- Handling various forms of product complaints from market, field forces, and different departments.

- Recipe development and necessary changes in formulations, product improvement.

Current performance of SPL.

4.1 Corporate financial highlights

As on March 31, 2006 the corporate financial position of SQUARE was as follows:

| 1. Authorized Capital | Tk. | 1000 Million |

| 2. Issued, Subscribed and Paid up Capital | Tk. | 436.8Million |

| 3. Reserve/Surplus (Retained Earnings) | Tk. | 872 Million |

| 4. Share Premium | Tk. | 800 Million |

| 5. Long Term Loans | Tk. | 210 Million |

| 6. Number of Shareholders (2006) | 13,206 |

4.2 Corporate operational results

The following three years financial data proves that SPL is operating through maximizing the shareholders’ benefits.

(Figures in thousands)

2003-2004 (12 months) | 2004-2005 (12 months) | 2005-2006 (12 months) | ||

1 | Turnover (Gross) | 3451523 | 4234244 | 4729743 |

2 | Value Added Tax | 450577 | 563433 | 663892 |

3 | Turnover (Net) | 3000946 | 3670811 | 4065851 |

4 | Gross Profit | 1081340 | 1435655 | 1466282 |

5 | Net Profit before Tax | 691636 | 905736 | 929604 |

6 | Net Profit after Tax | 573677 | 759448 | 764885 |

7 | Paid-up Capital | 300,000 | 300,000 | 300,000 |

8 | Earning per Share | 229.47 | 253.15 | 254.96 |

9 | Dividend per Share | 70.00 | 75.00 | 70.00 |

4.3 Output/Capacity utilization

The actual production of the various categories of products (except inhalers) including chemicals increased substantially leading to higher capacity utilization as summarized below:

Product Categories | Units | Production (‘000) | % age increase / (Decrease) | Capital Utilization | |||

2005-2006 | 2004-2005 | 2005-2006 | 2004-2005 | ||||

1 | Tablets | Pcs | 1829089 | 1736561 | 5% | 105% | 231% |

2 | Capsules | Pcs | 295234 | 286350 | 3% | 96% | 119% |

3 | Liquids | Bottles | 21210 | 16105 | 32% | 118% | 153% |

4 | Injectables | Pcs | 13325 | 23075 | (42%) | 74% | 90% |

5 | ENT Preparations | Phials | 8651 | 10778 | (20%) | 192% | 207% |

6 | Opthal Preparations | Phials | 1083 | 966 | 12% | 181% | 116% |

7 | Dry Syrup | Bottles | 4048 | 2634 | 54% | 169% | 88% |

8 | Inhalers | Can | 298 | 148 | 101% | 50% | – |

9 | Basic Chemicals | Kg | 219 | 201 | 9% | 64% | 59% |

10 | Tablets-AgroVet | Pcs | 1262 | 1697 | (26%) | 67% | 99% |

11 | Powder-AgroVet | Gm | 34911 | 15252 | 129% | 189% | 127% |

The capacity utilization rate in some areas of production decreased due to strategic changes in favor of increased production of higher value added products in each category resulting in higher turnover in value.

4.4 Dhaka Expansion

Despite numerous oddities and complex artifices usually associated with a state-of-art plant, the management is in the final phase of implementation of the project with the planning, supervisory and technical support form the consultants e.g. M/s Bovis Lendles and Tanvec of UK and KUPPA collaboration of Thailand, though the target of commissioning had to be revise / shifted a few times in the past. It may be appreciated that the project in hand is only of its kind in the region with USFDA and EU pharmaceutical manufacturing standards requiring highly rigid and unquestionable quality of materials, workmanship, and performance. The process of implementation has often suffered from various hazards of communication, transports, movements and planned accomplishments was not achieved fully due to malfunctioning of ports, airports, airlines, shipping services, etc. Due to carious reasons as are rampant in the country since the project was taken in hand. Considering all these factors and the technical complexities of such a project as well as non-availability of requir5ed man-machine-material in Bangladesh, the delay in implementation of the project would not be termed unusual and abnormal. It may also be mentioned that the consultants also had often failed to identify and consider every possible situation in Bangladesh. In spite of these the unit is scheduled to start functioning by end 2001.

During the year 2005-2006, an amount of Tk. 807,016,104 has been invested on various heads as detailed below:

| Particulars | As on 31-03-05 | As on 31-03-06 | Increase | |

| 1 | Land & Land Development | 86,725,346 | 107,550,519 | 20,825,173 |

| 2 | Building/Civil Work | 318,783,360 | 812,111,406 | 493,328,043 |

| 3 | Imported Plant & Machinery | 348,897,963 | 576,923,068 | 228,025,105 |

| 4 | Other Assets | 6,315,634 | 19,954,395 | 13,638,761 |

| 5 | Interest during Construction Period | 5,577,622 | 47,501,489 | 41,923,867 |

| 6 | Unallocated Expenditures | 14,689,009 | 23,964,161 | 9,275,152 |

| Total Tk. | 780,988,934 | 1,588,005,038 | 807,016,104 |

The remaining implementation work is expected to be now completed by end of 2004 at an estimated final cost of Tk. 1,830 million and commence production thereafter.

Square Dhaka Unit Project work was started from October 1996, which completed by end of March 2000. After technical review and in the best interest of the project in order to achieve quality work as State-of-the-art facility to meet the requirement of the USFDA/MCA Good Manufacturing Practice the original project completion schedule had to be extended.

The Dhaka Unit New Pharmaceuticals Production Facility at Kaliakoir is going to be one of its kind in the country to face the challenge of free world market in the beginning of new millennium.

The State-of-Art Facility incorporated certain basic requirement in the area of Purified Water System. Floor Construction, HVAC System Process Equipment and Validation/ Qualification Documentation as stipulated by USA, EU and other developed countries.

4.5 Export market

The company’s export drive is being continued with great stress. However, there are number of problems in exports of medicines from Bangladesh. As a result, the value of exports in Taka declined by 9.1%. To counter this in future, registration process of products for export purposes has been initiated in few more countries. The company expects to make a break through in exports when the Dhaka Unit is commissioned. (Taka in ‘000)

| Year | Turnover (Gross) | Exports | % age of gross turnover |

| 2005-2006 | 2,655,952 | 40,324 | 1.52% |

| 2004-2005 | 2,422,785 | 44,361 | 1.83% |

| 2003-2004 | 2,055,418 | 15,082 | 0.73% |

The company has so far been able to enter into the markets of Russia, Pakistan, Sri Lanka, Myanmar, Nepal, Combodia. It is expected that after the Dhaka Unit goes into production the company will succeed in entering the markets of developed countries with expanded share of exports.

4.6 Financial results

The operating financial results of the company for the year under report as compared to the previous year are as follows:

Figure in thousand : BDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

4.7 Concluding comments

Square Pharmaceuticals Ltd. has a very good working environment where the employees get enough opportunity to show their ability and creativeness. Its communication channel is superb. Informal channel of communication is very active. Many interdepartmental issues are solved in informal meetings, often over a cup of tea. Introduction of LAN has smoothened the process.

Every member of Square Pharmaceuticals Ltd. feels like he or she is a member of the Square family. This family feeling is a big asset for this company. Most of the employees are dedicated and motivated to work. Since good performance is always highlighted and creative ideas welcomed people are eager to contribute their best.

Square Pharmaceuticals Ltd. believes in honesty in every phase of business. The management promotes this idea to its workers. The image of the company is also good all over the country. Customers all over the country recognize Square as a quality company and an honest company.

SWOT ANALYSIS

Chapter:5

Strengths

Nationwide & worldwide recognition.

Big multinational clients.

Quality assurance.

Providing quality research.

Client satisfaction.

Continuous innovation and investment on core categories and new business initiatives.

Constant focus on effective and innovative ways of consumer communication.

Qualified employees.

Reliable & trusted employees.

ISO certified.

Learning economy.

Weakness

Employee turnover (as it reveals the secrets of the company).

Unnecessary permanent employees almost in every department.

Excess workload on employees.

Too much importance attached to the role of top management.

High production cost.

High marketing expenses affect their margin significantly.

Opportunities

Big unserved but potential international market.

Entering into new foreign pharma markets.

Threats

Too many competitors.

Frequent change in government rules & regulations.

Unstable political situation.

Regular devaluation of money increasing the cost of exports.

Part Two: The Project

Introduction

Today’s Pharmaceutical industry is very much competitive with more than 200 companies operating nationwide. Though only few of them are operating in national scale, the market is very competitive. The national players are fighting aggressively for grabbing some market share. In addition of the local share, some of the major pharmaceuticals are also trying to find market of their products in foreign markets.

Furthermore, after implementation of WTO agreement, as the local market will see many foreign players, there will be scope to export medicines to other countries as well. To get a firm foothold then, Square and other companies need to enter some foreign markets from now.

Different countries have different environment that includes social, cultural, legal, infra-structural, political environments. Depending on these environments, entry strategy to each country must be customized. So, it is essential to set specific entry strategy for each country a company wants to enter.

1.1 Title of the Report

Title of the report is “Deciding Entry Mode for Square Pharmaceuticals Ltd. for its export operations in Russian Pharmaceutical Market”.

1.2 Objective of the Study

Major objective of the study is to help SPL to draw an entry strategy for Russian Pharmaceutical Market. Specific objectives include:

To get an overview of Square’s global operation

To develop a country profile of Russia

To get an in-depth view of the Russian pharmaceutical market

To set an entry strategy based on the above information

To discuss some implementation issues

1.3 Scope of the Study

The study will concentrate on Russian Pharmaceuticals Ltd. market only.

1.4 Methodology

Source of Information:

The report is primarily based on secondary data on Russian market. Books and journals were consulted for theoretical material. Previous studies made regarding this market have also been used to get an insight.

Some documents of Square Pharmaceutical’s International Marketing Department were used. Managers related to international operation of Square were interviewed for information and clarifications.

1.5 Limitations

The primary limitation of the report is that it will be based on facts, accumulated from word of mouth, while consulting secondary data. Some information presented in the report may be biased, as the companies may be reluctant to provide all the information.

Square’s Global Operation

Square extended its horizon by exporting and marketing its products abroad. Square is now strengthening its export operations on its way to becoming a high performance global competitor by supplying quality pharmaceuticals at most competitive price. Starting its first export to UK and Singapore in 1987, it is now exporting to several countries of Europe and Asia, which includes Russia, Sri Lanka, Pakistan, Myanmar, Kosova, Nepal and Yemen. As recognition to its export contribution to national economy, Square received the National Export Trophy in 1997.

2.1 Sales earnings from Global Operations

| Company | 2003(Million-Taka) | 2004(Million-Taka) | 2005(Million-Taka) | 2006(Million-Taka) |

| Square | 44 | 41 | 41.5 | 49 |

2.2 Countrywide breakdown (2005)

Pakistan…… 15 Million Taka

Sri Lanka……15 Million Taka

Myanmar….. 10 Million Taka

Nepal……….0.8 Million Taka

Yemen…….. 0.4 Million Taka

Kosova……. 0.3 Million Taka

…………………………………………….

Total = 41.5 million taka

2.3 Mode of entry strategy adopted in different countries

Pakistan…… Export

Sri Lanka……Export

Myanmar….. Export

Nepal……….Export

Yemen……..Export

Kosova……. Export

RUSSIA: COUNTRY PROFILE

3.1 Russia…Geography & Others

Country name:

Conventional long form: Russian Federation

Conventional short form: Russia

Local long form: Rossiyskaya Federatsiya

Local short form: Rossiya

Former: Russian Empire, RussianSovietFederativeSocialistRepublic

Location: Northern Asia (that part west of the Urals is sometimes included with Europe), bordering the Arctic Ocean, between Europe and the North Pacific Ocean.

Area: 17,075,200 sq km

Land: 16,995,800 sq km

Water: 79,400 sq km

Area – comparative: slightly less than 1.8 times the size of the US.

Land boundaries: 19,961 km

Coastline: 37,653 km

Maritime claims: continental shelf: 200-m depth or to the depth of exploitation.

Exclusive economic zone: 200 NM, territorial sea: 12 NM

Climate: Ranges from steppes in the south through humid continental in much of European Russia; Sub-arctic in Siberia to tundra climate in the polar north; winters vary from cool along Black Sea coast to frigid in Siberia; summers vary from warm in the steppes to cool along Arctic coast.

Land use: arable land: 8%, permanent crops: 0%, permanent pastures: 4%, forests and woodland: 46%

other: 42% (1993 est.)

Irrigated land: 40,000 sq km (1993 est.)

Natural hazards: Permafrost over much of Siberia is a major impediment to development; volcanic activity in the Kuril Islands; volcanoes and earthquakes on the KamchatkaPeninsula

Geography:

Largest country in the world in terms of area but unfavorably located in relation to major sea lanes of the world; despite its size, much of the country lacks proper soils and climates (either too cold or too dry) for agriculture; Mount Elbrus is Europe’s tallest peak

3.2 Russia…People

Population: 145,470,197 (July 2001 est.)

Age structure:

0-14 years: 17.41% (male 12,915,026; female 12,405,341)

15-64 years: 69.78% (male 49,183,000; female 52,320,962)

65 years and over: 12.81% (male 5,941,944; female 12,703,924) (2001 est.)

Population growth rate: -0.35% (2001 est.)

Birth rate: 9.35-births/1,000 population (2001 est.)

Death rate: 13.85-deaths/1,000 population (2001 est.)

Net migration rate: 0.98 migrant(s)/1,000 population (2001 est.)

Sex ratio:

At birth: 1.05 male(s)/female, under 15 years: 1.04 male(s)/female, 15-64 years: 0.94 male(s)/female

65 years and over: 0.47 male(s)/female, total population: 0.88 male(s)/female (2001 est.)

Infant mortality rate: 20.05 deaths/1,000 live births (2001 est.)

Life expectancy at birth:

Total population: 67.34 years

male: 62.12 years, female: 72.83 years (2001 est.)

Total fertility rate: 1.27 children born/woman (2001 est.)

Nationality: noun: Russian(s) , adjective: Russian

Ethnic groups: Russian 81.5%, Tatar 3.8%, Ukrainian 3%, Chuvash 1.2%, Bashkir 0.9%, Byelorussian 0.8%, Moldavian 0.7%, other 8.1%

Religions: Russian Orthodox, Muslim, other

Languages: Russian, other

Literacy:

Definition: age 15 and over can read and write

Total population: 98%, male: 100%, female: 97% (1989 est.)

3.3 Russia…Economy

Economy:

A decade after the implosion of the Soviet Union in 1991, Russia is still struggling to establish a modern market economy and achieve strong economic growth. In contrast to its trading partners in Central Europe, which were able to overcome the initial production declines that accompanied the market reforms within three to five years. Russia saw its economy contract for five years, as the executive and legislature dithered over the implementation of many of the basic foundations of a market economy. Russia achieved a slight recovery in 1997, but the government’s stubborn budget deficits and the country’s poor business climate made it vulnerable when the global financial crisis swept through in 1998. The crisis culminated in the August depreciation of the ruble, a debt default by the government, and a sharp deterioration in living standards for most of the population. The economy rebounded in 1999 and 2000, buoyed by the competitive boost from the weak ruble and a surging trade surplus fueled by rising world oil prices. This recovery, along with a renewed government effort in 2000 to advance lagging structural reforms, have raised business and investor confidence over Russia’s prospects in its second decade of transition. Yet serious problems persist. Russia remains heavily dependent on exports of commodities, particularly oil, natural gas, metals, and timber, which account for over 80% of exports, leaving the country vulnerable to swings in world prices. Russia’s agricultural sector remains beset by uncertainty over land ownership rights, which has discouraged needed investment and restructuring. Another threat is negative demographic trends, fueled by low birth rates and a deteriorating health situation – including an alarming rise in AIDS cases – that have contributed to a nearly 2% drop in the population since 1992. Russia’s industrial base is increasingly dilapidated and must be replaced or modernized if the country is to achieve sustainable economic growth. Other problems include widespread corruption, capital flight, and brain drain.

GDP:

Purchasing power parity – $1.12 trillion (2005 est.)

GDP – real growth rate: 6.3% (2005 est.)

GDP – per capita: purchasing power parity – $7,700 (2005 est.)

GDP – composition by sector:

Agriculture: 7%, industry: 34%, services: 59% (2005 est.)

Population below poverty line: 40% (2005 est.)

Household income or consumption by percentage share: lowest 10%: 1.7%, highest 10%: 38.7% (2004)

Inflation rate (consumer prices): 20.6% (2005 est.)

Labor force: 66 million (2005)

Labor force – by occupation: agriculture 15%, industry 30%, services 55% (2004 est.)

Unemployment rate: 10.5% (2000 est.), plus considerable underemployment

Budget: revenues: $40 billion, expenditures: $33.7 billion, including capital expenditures of $NA (2004 est.)

Industries: Complete range of mining and extractive industries producing coal, oil, gas, chemicals, and metals. All forms of machine building from rolling mills to high-performance aircraft and space vehicles; shipbuilding; road and rail transportation equipment; communications equipment; agricultural machinery, tractors, and construction equipment; electric power generating and transmitting equipment; medical and scientific instruments; consumer durables, textiles, foodstuffs, handicrafts

Industrial production growth rate: 8.8% (2004 est.)

Electricity

Production: 798.065 billion kWh

Consumption: 728.2 billion kWh

Exports: 20 billion kWh

Imports: 6 billion kWh

Agriculture – products: grain, sugar beets, sunflower seed, vegetables, fruits; beef, milk

Exports: $105.1 billion (2005 est.)

Commodities: petroleum and petroleum products, natural gas, wood and wood products, metals, chemicals, and a wide variety of civilian and military manufactures

Partners:US 8.8%, Germany 8.5%, Ukraine 6.5%, Belarus 5.1%, Italy 5%, Netherlands 4.8% (2004)

Imports: $44.2 billion (2005 est.)

Commodities: machinery and equipment, consumer goods, medicines, meat, grain, sugar, semi finished metal products

Partners:Germany 13.8%, Belarus 10.7%, Ukraine 8.3%, US 7.9%, Kazakhstan 4.6%, Italy 3.8% (1999)

Debt – external: $163 billion (2005 est.)

Economic aid – recipient: $8.523 billion (2003)

Currency: Russian ruble (RUR)

Exchange rates: Russian rubles per US dollar – 28.3592 (January 2001), 28.1292 (2000), 24.6199 (1999)

3.4 Russia…. Communications

Telephones

Main lines in use: 30 million (1998)

Mobile cellular: 2.5 million (October 2000)

Radios: 61.5 million (1997)

Televisions: 60.5 million (1997)

Internet country code: .ru

Internet Service Providers (ISPs): 35 (2000)

Internet users: 9.2 million (2000)

3.5 Russia…Transportation

Railways: 149,000 km

Highways: total: 952,000 km

Waterways: 95,900 km (total routes in general use)

Ports and harbors:

Arkhangel’sk, Astrakhan’, Kaliningrad, Kazan’, Khabarovsk, Kholmsk, Krasnoyarsk, Moscow, Murmansk, Nakhodka, Nevel’sk, Novorossiysk, Petropavlovsk-Kamchatskiy, Saint Petersburg, Rostov, Sochi, Tuapse, Vladivostok, Volgograd, Vostochnyy, Vyborg

Merchant marine: total: 878 ships (1,000 GRT or over) totaling 4,314,485 GRT/5,344,958 DWT

Ships by type: barge carrier 1, bulk 20, cargo 543, chemical tanker 4, combination bulk 21, combination ore/oil 7, container 31, multi-functional large-load carrier 1, passenger 35, passenger/cargo 3, petroleum tanker 164, refrigerated cargo 24, roll on/roll off 17, short-sea passenger 7

Airports: 2,743 (2000 est.)

PHARMA MARKET, RUSSIA, AN IN-DEPTH ANALYSIS

4.1 Overviews of Health care system:

Russia is one of the largest countries in the world, with a population of 148 million. Currently Russia is facing, among other problems, a deep crisis of its health care system revealed in low health care indicators, poor condition of health care facilities, return of certain diseases (such as diphtheria, cholera, and tuberculosis) which have been forgotten for decades.

Experts cite the collapse of the Russian state-run health care system and declining living standards induced by economic reform as the fundamental causes of these problems. The current difficulties are principally due to lack of funding and the low political priority placed on health care by the Russian government. The federal budget allocation for health care in 1997 accounted for only 1.53 percent of the total budgetary expenses and 0.31 percent of the Gross Domestic Product. Current spending practices in the Russian health care sector cause further concern for foreign investors.

Because Russian health care spending has for years been inefficient, resulting in large purchase of medicines and medical equipment with low clinical effect, Russia represents a promising market for foreign companies. In fact, buyers are too often ready to spend money and do not demand high quality in the goods they buy. The Ministry of Health is trying to improve procurement practices, and has established Public Council on pharmaceutical supplies composed of representatives of Russian pharmaceutical enterprises. At the same time, government policy, according to the former Minister of Health Ms. Dmitrieva, has attempted to provide maximum support for local producers of pharmaceuticals and medical equipment through tax benefits and other measures. The Ministry prefers to promote foreign investment in the medical industry as an alternative to imports of Western medical goods.

4.2 Market Highlights & Best Prospects

4.2.1 Market Profile

The pharmaceutical sector has undergone significant change in the past several years. Despite progress in decentralization of production and distribution of pharmaceuticals and relative saturation of the market, many important issues remain on the table of the policy makers and industry participants. A long-standing deficit in pharmaceutical supply continues to hamper effective health care. Another factor that aggravates the current pharmaceutical market difficulties is low funding. Only 9 percent of the total funds spent on health care in Russia go into the purchases of pharmaceuticals. Government financing of pharmaceutical purchases is very low. Individual patients pay for more than 70 percent of all pharmaceutical purchases, the rest of the purchases are paid by local and federal budgets. Despite the fact that the Russian population is larger than the population of Japan or Germany, the pharmaceutical market in Russia is several times smaller than in Japan or Germany.

4.2.2 Domestic market

Over the last three years the production of pharmaceuticals has plunged by almost 65 percent in volume terms and the range of available products has shrunk drastically. Over the same period, production of cardiovascular, anti-tumor and psychotherapeutic drugs has declined by 30 to 40 percent. In spite of the collapse in volume, producers have raised prices to international levels to the extent where total domestic output measured in US dollars has actually increased by over 150 percent over the last four years.

Over the last five years the production of substances has declined by 60 percent. The domestic producers raised the prices of substances drastically making them less competitive in comparison to imported ones. As imported substances are generally much cheaper than those produced locally, many factories prefer to buy them abroad, especially in India and China. Ninety-three percent of pharmaceuticals manufactured in Russia are made from foreign chemicals.

The production of vaccines has fallen even more dramatically. Russian Health Minister Tatyana Dmitrieva has stated that Russia’s production of vaccines and serums – the country’s only protection from infectious diseases – is at a standstill. The government owes vaccine and serum producers $40 million.

In 1997 Russian pharmaceuticals production showed some improvement. According to investment bank Alfa Capital, Russian pharmaceuticals production increased 15 percent in the first nine months of 1997, compared with less than 2 percent for industrial production as a whole. The top 50 Russian companies’ profit margins vary from 25 to 45 percent, nearly twice that of comparable companies in the West. According to the Alfa Capital’s research, the expected sector’s annual growth rates for the next few years are estimated at 15 percent. Higher rates are projected for such companies as ICN, Moskhimpharmpreparaty, Akrikhin, and Bryntsalov.

Six years ago about 70 percent of medications were produced locally and one third imported; the ratio has now reversed: only one third of pharmaceuticals is produced locally, while 65 percent is imported.

4.2.3 Import market

Domestic pharmaceutical producers supply about 35 percent of the total market while the ratio of imported drugs in the market is 65 percent. Imported pharmaceuticals have increased their presence in the Russian market in the last several years thanks to a number of factors, including high unsatisfied demand for pharmaceuticals, intensive advertising by foreign companies, and Russian health care authorities’ actions toward streamlining the registration procedures for foreign pharmaceuticals. Pharmaceutical imports were up 15 percent in 1996 compared with 1995. In 1997 they were up 35 percent in comparison to 1996.

Although many types of pharmaceuticals have become more available recently, on average only 60 percent of the population’s drug requirements are being met, with the situation considerably worse in some regions. At the same time, the ability of patients in need to gain access to high quality medicines is severely limited.

With a low rate of consumption and a high rate of population, the Russian pharmaceutical market offers enormous potential to pharmaceutical manufacturers. The report on the Russian pharmaceutical market done by the Russian investment bank Alfa Capital confirms that in 1996 per capita pharmaceutical consumption in Russia was only 33 percent of that of Germany and 20 percent of that of the United States.

The biggest advantage for the industry is the 30 percent gap that exists between demand and available supply. Market demand will continue to expand as government health care allocations and real wages begin to increase.

4.2.4 Best selling therapeutic Classes:

Local production does not meet the demand for many types of drugs needed for treatment. Pharmaceutical imports help solve the problem, but there is still large unsatisfied demand for many types of medicines. According to local market surveys, the best sales prospects in the Russian pharmaceutical market include cardiovascular drugs (18.2 percent of the total demand), analgesics, antiseptics & anti-inflammatory drugs (16.7 percent), antibiotics (14.3 percent), vitamins (9.8 percent), tranquilizers, psychotherapeutic medicines & central nervous system stimulants (7.5 percent), antivirus drugs (5.8 percent), antihistaminic preparations (4.2 percent), purgatives (3.3 percent), ferments (3.0 percent), and other pharmaceuticals (17 percent of total demand).

According to the American Chamber of Commerce, the area of OTC drugs deserves additional attention. For the growing pharmaceutical industry, OTCs represent perhaps the most attractive market to pursue. Whereas prescription drug markets rely heavily on limited state funds, the consumer market for OTC drugs is growing rapidly. From the viewpoint of the Russian Health Care Reform, appropriate self-medication may play a positive role in reducing demand on primary health care facilities. A wide spectrum of regulatory issues faces policy makers in trying to ensure safety and proper education concerning self-medication practices. In this and other areas of pharmaceutical regulation, Russia has the opportunity to build on experience of other countries in order to reach the most effective policy decisions.

Research done by the Russian Investment Bank Alfa Capital estimates that by the year 2000, sales of painkillers are expected to increase by 25 percent from 1995 levels. The research adds that sales of gastric medicines are expected to increase by 20 percent over the same period while sales of non-prescription cough and cold medicines may jump by 60 percent. Vitamins are predicted to grow even larger – by 80 percent.

Alfa Capital’s research emphasizes the potential growth in the vitamin market. In 1993 the only vitamin B-1 production facility in Russia was closed. Three years later, Russia’s Nutrition Institute of the Academy of Sciences reported that consumption of some essential vitamins was barely 50 percent of recommended levels. In 1996 the Russian vitamin market was estimated at 90 million dollars, or 0.61 dollar per capita. Imports accounted for 86 percent of total vitamin production, covering 37 different types. The rapid expansion of vitamin imports is evidently at great expense of domestic market share. Considerable potential in this area remains for both foreign and domestic producers, as Russian consumers spend approximately the same amount on all pharmaceuticals as Western consumers spend on vitamins. Many Russian consumers have begun to prefer foreign-made vitamins to Russian-made ones. Alfa Capital researcher maintains though that Russian consumers perceive domestically produced vitamins as superior to imported brands and that Russian medical professionals, often, continue to recommend the domestic variety.

4.3 Customer analysis

The major end-users of pharmaceuticals are federal, regional and local authorities, clinics, hospitals and polyclinics, pharmacies, and private consumers.

As centralized purchases of pharmaceuticals from the federal budget decline, regional governments, hospitals, pharmaceutical wholesalers and pharmacies have become major buyers of pharmaceuticals. Final end-users of pharmaceuticals are, of course, individuals who pay for 70 percent of all pharmaceutical purchases. Despite declining living standards of the Russian population, purchases of pharmaceuticals by citizens of Russia have been growing.

The federal government is still a significant buyer of pharmaceutical products in Russia. In 1996, different bodies of federal government spent about 132 million dollars on drugs consumed by the military, medical research centers, ministry of emergencies. Federal government purchases pharmaceuticals to execute nation-wide programs in the health care area, such as Diabetes Program, Vaccination and Prevention Program, Mother and Child Care Program, Anti-AIDS Program, etc.

Since early 1990 when the central drug purchasing system ceased to exist, territories have formed their own procurement practices. Any regional budget has a health care section to finance such items as administrative costs of regional health department or fixed capital expenditures of medical institutions in its territory. This money is available to the institutions and distributed by lobbying capabilities and political weight of clinics’ chief physicians.

Operating costs of clinics (including pharmaceuticals) are covered by regional Mandatory Health Insurance Funds. In most regions, those funds contract local Pharmacias (government drug procurement agencies which among other functions supply municipal chains of pharmacies and clinics) to supply local hospitals with basic drugs. Thus, obtain a certain economies of scale as compared to the situation when each hospital would run its own supply department and buy products in smaller quantities. Russia is now trying to reform the system of drug purchases. Particular emphasis is placed on the elimination of direct purchases by hospitals and the requirement of tenders for the purchase of all reimbursed medicines.

There are several factors that influence the actual demand for pharmaceuticals. First, a large portion (46%) of the population is chronically ill or disabled. There are between 33 and 44 million cases of infectious diseases annually. About 85 percent of the population lives in areas where air quality does not correspond to the norms set by the Ministry of Health (mainly due to pollution from cars and industry).

Second, Russia has a high proportion of retirees (19%of the population) and a sharply worsening mortality rate, which in 1996 was 14.4 per 10,000 people, versus 10.5 in the European Union. From 1991 to 1995 the general mortality rate rose 31.6 percent, the average life expectancy fell by four years, reaching 65 years in 1995, and mortality in the most active segment of the population rose to 60 percent.

The actual demand differs from the solvent demand. The actual demand is based on the needs of the public for medicines, but cannot be satisfied due to the inability of the state or population to buy them. In reality the size of the market is determined by the solvent demand, which is based on the purchasing power of the population and is significantly lower than the actual demand.

4.4 Disease Prevalence

In recent years in Russia social stratification is taking place with an accelerated differentiation population in their financial positions. It is very important to establish peculiarities in health and health problems in different groups of population.The survey was conducted in 1999 (sample of population – 4017 people in 4 regions of Russia), using the questionnaires.

The prevalence of main diseases is established in different population groups in connection with the social status of patients. The obtained outcomes show higher prevalence the cardiovascular diseases, diabetes, chronic lung diseases in poor families. So the prevalence of hypertensive disease was 21.6% among people indicated the gross deterioration of their financial positions, in the solvent group with improved them –8.5% in the same age. The prevalence of diabetes in groups of population of middle level of material conditions – 2.4%, in poor families –7.7%. None of the diabetics indicated the material well-being of their family as rich. Almost 60% of the people with lower level material conditions indicate a disadvantage in their nutrition; almost 25% patients have no opportunity to buy necessary medicines.

4.5 Distribution Pattern

Russia’s existing system of pharmaceutical distribution exhibits a large degree of fragmentation. Likewise, the system of retail pharmacies remains undeveloped. There are about 4,000 pharmaceutical wholesalers in Russia. Of these, fewer than 30 offer what may be considered nationwide coverage. About 10 percent of pharmaceutical wholesalers are direct importers with remaining 90 percent either dealing with exclusively domestic products or reselling drugs imported by bigger competitors. Private distributors now handle over 90 percent of local pharmaceutical distribution.

While most of Russian wholesalers are small to medium size companies operating only within their regions, some distributors are big nation-wide networks or vertically integrated structures. They buy directly from manufacturers and often possess their own manufacturing capabilities in Russia and/or other CIS republics as well as pharmacy network in major cities.

All wholesale distributors can be divided into several categories. The first category is Pharmacies which are state-controlled bodies to supply their regions with drugs for the public sector. Old-time state employees who made their careers during Soviet times of central purchasing often manage pharmacies. Their motivations and business practices often differ from those of the managers of private companies.

In the second category are companies transformed from former state-owned suppliers in the process of privatization in 1993-1995. Old-time state employees who made their careers during Soviet times of central purchasing also manage them. Their motivations and business practices often differ from those of the managers/owners of private companies.

The evolution of entrepreneurial private companies has taken place during last 3-5 years. Profit-driven, those companies have been more successful than their state-controlled competitors. Practically in every region, the major players in the local market are new private companies. Some of them became nation-wide vertically integrated structures with manufacturing, distribution and retail network components (like Vremya); others aggressively expand in the regions by creating new franchise-type units (Ecohelp). The largest private distributors report monthly sales in excess of 20 million dollars.

And finally, the last group of distributors is composed of international companies that were brave enough to step into the Russian market and establish their Western-style operations here. While their retail clients do typically not appreciate their prices, terms, and styles, Western manufacturers prefer to deal with these companies due to cultural similarities, business practices, and transferability of risk and commitments to distributor’s parent companies in the West. Many of these distributors run their own pharmacy networks (Multi-Pharma, Suramed). Like representative offices of the manufacturers operating in Russia, all these distributors are based in Moscow.

There are 18,000 pharmacies in Russia, 23 percent of which belong to regional governments, 60 percent to municipal authorities, and 17 percent are private. In addition to pharmacies there are 50 thousand small pharmaceutical kiosks.

Russia has only about 10 pharmacies per 10,000 of people, compared to 14 in Poland and 30 or more in Western Europe. The number of pharmacies may be a key area of growth in the near future.

Western firms typically enter the Russian market by initially working through local distributors and buyers and, if this goes smoothly, possibly broadening their activities to include joint production agreements with local partners. Some companies start by opening representative offices to market their products in Russia. If they wish to, they can later form a Russian legal entity having the right to directly buy and sell within Russia.

Some doctors have started to work as distributors of pharmaceuticals and medical goods, especially vitamins and food additives. Mark-ups by doctor-distributors seem typically to be between 20 and 30 percent. Doctors often agree to become distributors because they are underpaid at their primary place of work. U.S. companies may note that working with and promoting their product through Russian doctors has already proven an effective marketing approach.

Pharmaceutical products are subject to mark-up limitations imposed with the purpose of holding retail prices. These limitations specify the percentage of allowable mark-up for both wholesalers and retailers and vary from region to region. For imported pharmaceuticals, mark-up limitations do not apply to the first importer, which gives advantages to the companies importing directly from abroad. At the same time, by various contractual mechanisms agents further down the distribution ladder may also avoid mark-up limitations. As a result mark-ups in some cases vary from 120 to 200 percent.

The Moscow government has recently introduced a new regulation that provides that a consolidated wholesaler plus retailer margin in pharmaceutical products sold in Moscow cannot exceed 25 percent of the original manufacturer’s price (down from 30 percent before). The declared purpose of this action is to make survive only those wholesalers who work directly with manufacturing companies and thus can offer the lowest prices to retailers. This action will definitely result in a wave of mergers, acquisitions and bankruptcies in the Moscow pharmaceutical market as well as to stronger trend towards vertical integration between wholesalers and retailers. However, since Russian taxes do not allow any company to operate with such a low gross margin, many retail and wholesale companies will be subject to increased pressure from regulatory authorities with more corruption as a result.

4.6 Financing

There are two major government sources of funding for medical purchases: budget allocations from federal and local budgets, and the federal and regional Obligatory Medical Insurance (OBI) funds. In Russia, payroll contributions to the OBI account represent 3.6 percent of earnings. In Western Europe, payroll contributions to analogous funds range from 8 to 12 percent of earnings. Actual collections of regional OBI funds are only 60 to 90 percent of budgeted revenues; in addition, OBI money is often used for items other than health care.

The Federal Medical Obligatory Fund disposes of approximately 30 percent of all resources devoted to health care in the Russian Federation. Local governments pay for 93 percent of state pharmaceutical purchases, while the federal government accounts for only 7 percent of such purchases

4.7 Regulations

4.7.1 Import Climate

Current Russian legislation does not erect significant barriers to importers of pharmaceuticals. Before July 1995 all pharmaceuticals were exempt from customs duties. On July 1, 1995, the government introduced 10 percent customs duty for a significant number of pharmaceuticals, and starting April 11, 1996, the Government of Russia increased customs duties for pharmaceuticals. Customs duties now range from 5 to 30 percent. Experience shows that higher import duties are passed on in the form of higher end-user prices. Imported registered pharmaceuticals are generally exempt from VAT.

4.7.2 Registration of Pharmaceuticals

According to Russian law, all drugs and biological products must be registered with the Ministry of Health of the Russian Federation in the name of the manufacturer and/or an authorized representative. In addition, the pharmaceutical or substance must be registered and listed with the Food and Drug Administration (FDA) by the manufacturer.

The Russian Ministry of Health’s Bureau of Registration of New Pharmaceuticals and Medical Equipment is responsible for drug registration. Documents required include an application, a product description, and certification/approval papers obtained in the United States. Trading companies seeking product registration must present a letter from the manufacturer authorizing them to do so.

The current registration fee is $15,000, and is valid for five years. All documents should be submitted to the Bureau of Registration of New Pharmaceuticals and Medical Equipment, which issue the registration certificate.

4.7.3 Certification of Pharmaceuticals

Besides registration, an importer must obtain a Russian quality certificate. Gosstandart authorizes a number of organizations to certify pharmaceuticals, though many drug companies prefer to act through the Inspectorate of Quality Control of Drugs and Medical Equipment of the Ministry of Health. The Inspectorate also can provide information on testing laboratories that can provide certificates of conformity for drugs.

Since certification and registration procedures are similar, an applicant may present copies of tests and analysis carried out during registration to the certification body. This information is normally sufficient for certification without any additional testing, or reduces testing to a minimum.

Vitamins and biologically active additives in the majority of cases are registered and certified the same way as ordinary drugs. In some cases, when the contents of micronutrient of mineral salts in biologically active additives does not exceed daily requirement by six times, registration is not needed. At the same time, imports of such vitamins and biologically active additives to Russia should be accompanied by a certificate of hygiene which can be issued by the Institute of Nutrition of the RussianAcademy of Medical Sciences. The hygiene certificate is valid for three years.

One area of regulatory concern regards the distinction between OTC drugs and dietary supplements. Because no clear criteria have been established to distinguish OTCs and dietary supplements, several cases of dual registration have been observed. In several observed cases, companies, having first registered their product with the Institute of Nutrition as a dietary supplement, have obtained a second product registration through the Ministry of Health. Companies may deem a second registration profitable because products registered as pharmaceuticals carry no VAT obligation. Lack of clarity may benefit some manufacturers through tax reduction, while on the other hand such a system of dual registration may benefit regulatory agencies by increasing assessed fees. In the end, however, such system will trickle down to consumers in the form of increased prices.

4.7.4 Marking and Labeling Requirement

On May 17, 1997 the Russian government adopted a decree “On Marking of Goods and Products Within the Territory of the Russian Federation with Marks of Conformity which are protected from Falsification”. A mark of conformity is a duly registered mark confirming that the goods or products labeled with it comply with the standards and requirements adopted for the relevant types of product, including pharmaceuticals. The decree states that such marks shall be placed on all goods produced on the territory of Russia, imported into the country or confiscated by customs and later offered in the consumer market. Currently Russian authorities require that labels for imported pharmaceuticals be in Russian. Pharmaceuticals also should be marked with EAN or UPC standard bar codes.

4.7.5 Import licenses