Executive Summary

The development of a country depends up on the consolidate development of all infrastructures like-agricultural sector, industrial sector, financial sector, technological sector etc. But developing all these structures is not easy. A lot of troubles and threats always hinder and make difficulties to success. The most difficult problem is financial risk. So if it is feasible to provide financial protection then most of the structural development will be achievable with minimal efforts. And the most well known practical method for handling financial risk is insurance. Delta Life Insurance Company Limited was incorporated in November 10, 1986 and is mainly engaged in Ordinary Life (OL), Group Insurance (GI), Health Insurance (HI) business and non-traditional micro insurance business under the name of Gono-Grameen Bima (GN-GRB). The Company is a publicly traded Company and its shares are listed on the Dhaka Stock Exchange and Chittagong Stock Exchange. However, I have prepared this report on Delta Life Insurance Co. Ltd, which is one of the growing and prospective insurance companies in the insurance industry. The company is providing protection and financial security to the nation, whilst adding shareholders value thought customer service excellence. By the way of examining and evaluation the functions and performance of Delta Life Insurance Co. Ltd, I tried to illustrate a true scenario of insurance industry of Bangladesh. The most important part of this report is the findings and analysis that means what I have found out throughout my study.

My report topic is Overall Activities Delta Life Insurance Co. Lid´. So, to get an accurate realization about Delta Life Insurance Co. Ltd. I also made an effort to present some Suggestions for the better interest of the company. Basically, the major problems and facilities are similar for all insurance company as they are dealing with services. The difference can be made in one way, which is how well they are maintained their Accounts and dealing with their customer and most probably how efficiently and effectively they are operating their business.

Delta Life Insurance Company business started with the creation of product or service and ended with the attempt to sell it. Delta Life should start with the knowledge of the market. So, it is necessary to find out what is needed, what will be sold, only then should return the operation to create the product or service. Delta Life can take pride in moulding the saving habits of the lower and middle class people and transforming them into prospective policyholders. The potential is now so strongly perceived that all life insurance companies – old and new alike – operating in the country have started their own micro insurance products.

Introduction:

Origin:

As we are the student of business administration we have been authorized by our guide teacher to prepare a report on the activities of the general idea of lending’s of Delta Life Insurance Company given to the customers; analyze the methods of determining their risk assessment of lending’s. Along with, the way of offering the products of the company will be examined.

Purpose:

The purpose of this report is the writing purpose as well as to know about the activities of the companies, their activities, rates, performances.

Objectives:

Broad Objectives: A broad objective is to find out the overall activities of Delta Life Insurance Company ltd. Also about their services and rates which is different in different situation.

Specific Objectives:

- To find out the general activities of Delta Life InsuranceCompany

- To find out their services.

- To find out the different products.

- To find out the different types rates.

- To find out the different types condition

scopes:

To find out the overall activities & accounts department of Delta Life Insurance Company ltd.

Limitations:

In this short time, we have tried to give our maximum effort to provide the information about the total activities of Delta Life Insurance Company ltd. To prepare this report we face some limitations, like Privacy of the company

Methods and Sources:

Primary Sources: Primary sources will be collected from interview and questionnaires

Secondary sources: Secondary sources for data collection are given below:

1. Web site.

2. Leaflet.

3. Newspaper.

4. Annual report.

Contact Method:

Contact methods were personal interview

Company overview & its Activities:

Delta Life Insurance Company Limited was incorporated in November 10, 1986 and is mainly engaged in Ordinary Life (OL), Group Insurance (GI), Health Insurance (HI) business and non-traditional micro insurance business under the name of Gono-Grameen Bima (GN-GRB). The Company is a publicly traded Company and its shares are listed on the Dhaka Stock Exchange and Chittagong Stock Exchange.

Delta Life’s Present Workforce*:

Head office and ordinary life = 1200

Gono-Grameen Bima = 2121

Development = 21679

Total = 25000

Delta Life Insurance Co. Ltd. established mainly through the initiative of a group of Bangladeshi professionals then working abroad along with a few enthusiastic local entrepreneurs, started its operation in December, 1986 after the Government of Bangladesh allowed the private sector to operate in the insurance sector in 1984 to carryon the business of insurance in the Private Sector. It soon made a mark in the life insurance arena by not only being the leader among the private sector indigenous companies, but by undertaking and successfully implementing innovative and welfare oriented life insurance schemes. It introduced an array of conventional life and group insurance products – many of which were the first in Bangladesh. For the first time, health insurance products were also introduced by Delta Life. But more importantly, in fulfillment of the avowed commitment towards social development, Delta Life for the first time not only in Bangladesh but probably in the

World, devised and introduced micro-life insurance-cum-savings products specially suited to the needs and pockets of poor people of the country who constitute more than 80% of the people of Bangladesh.

Two projects of the company namely Grameen Bima for the rural people and Gono Bima for the poor and marginal savers of the urban areas were initiated to devote them selves exclusively to marketing and management of these innovative products.

We are happy to report that we have achieved a good measure of success although there is a long way to go. These schemes that we have introduced have created great stir and enthusiasm among the general mass who, before these projects started functioning, could not even dream of owning a policy that provides the much needed life insurance coverage along with facility of regular savings on a long-term basis. At a later stage i.e. in the year 2002, the projects were merged into a division of Delta Life, namely, Gono-Grameen Bima Division. The GNGRB Division has been growing at a first rate of more than 25% p.a. for the last couple of the years and is poised to maintain this growth rate at least in the next five years or so. Delta Life can take pride in moulding the saving habits of the lower and middle class people and transforming them into prospective policyholders. The potential is now so strongly perceived that all life insurance companies – old and new alike – operating in the country have started own micro insurance products.

Industry overview:

A brief explanation as to the growth of life insurance business in Bangladesh is in order here. Bangladesh declared independence from the Pakistani rules on March 26, 1971 following which she had to witness a bloody liberation struggle with the occupation forces lasting for 9 months before they were defeated. Insurance business which was exclusively carried on in private sector before independence was nationalized after liberation in 1972 primarily to address the emerging situation of eroding public confidence in the industry that was left staggeringly short of resources in the face of huge losses caused by the war of liberation. After a series of experimentation, a state-owned body, namely Jiban Bima Corporation (JBC), established in May, 1973 for transacting the life insurance business, took over the assets and liabilities under life portfolios of all erstwhile private insurance companies and started business in its own name.

However, things did not improve; rather, in many respects became more exacerbating and the Government then thought it better to allow private sector participation in insurance business. Since inception, Delta Life set before itself a high standard of all round performance coextensive with professional soundness and proficiency.

Vision:

- We will be the premier life Insurance Company in Bangladesh

- “Adding value” will be the operative words of organization

- We will serve our customers with respects and will provide the best solution of their needs

- We will be a Company with qualified professional who will work together as a team and serve with dignity and the highest level of integrity. We believe an excellence and customers with service beyond their expectations

Goal:

- Provide financial security to our customers with insurance policies that aremost suitable for them

- Make life insurance an easy saving instrument and a profitable one withattractive bonus and improved customer service

- Collect small savings from the people of our country and invest theaccumulated savings in profitable nation building enterprises.

Values: TRUEST

Background of the Delta Life Insurance Company Limited At a glance

Facts and figures about Delta Life Insurance Company Ltd.

Year of establishment of the company : 1986

Founder Chairman and Managing Director : Late Shafat Ahmed Chowdhury

Present Chairman : Mr. SyedMoazzem Hussain

Present Managing Director : Mr. Das Deba Prashad

Present Deputy Managing Director : Mr. A B M Saiful Haque

First Policy Issued : December 17, 1986

Introduction of Grameen Bima : December 1988

Introduction of Gono Bima : October 08, 1993

Delta BRAC Housing : September 08, 1996

Delta Care Hospitalization Plan (Group) : October 19, 1996

Introduction of Health Insurance : December 04, 1999

Merging of Gono and Grameen Bima : January 04, 2003

Establishment of Delta Insurance Institute : March 07, 2006

The product of Delta Life Insurance Co. Ltd. Ordinary Life Insurance:

Delta Life offers a wide variety of ordinary life product/plans ranging from the most common endowment type to more modern and sophisticated plans like endowment with open term, pension plan with built in provision for increasing pension, increasing protection with provision for premium refund etc. The plans have been designed keeping in view the diverse and multifaceted needs of the insuring public belonging to different strata of the society. Some of the popular plans are briefly described below.

Some Popular Plans

I. Endowment plan with and without profits The most common and widely popular, this plan provides for a fixed sum at end of a particular term or at earlier death of the assured. The plan is available under both options i.e. with profit and without profit. This is a straightforward coverage allowing a person to plan his future needs for security and projected savings through means of insurance eds. for security and projected savings through means of insurance.

II. One-two-three endowment plan with profits provides for high security at earlier death of the assured before expiry of term (10 & 20 years) or the sum assured at expiry of the term. The plan provides for double the sum assured at premature death due to illness or treble the sum assured if death occurs directly as the result of an accident along with accrued bonuses till death or maturity as the case may be.

III. Installment payment plans with or without profit:

a) Three payments plan

Given for terms like 12, 15, 18, 21 years with or without profits this plan provides for one fourth of the sum assured upon expiry of each one third of the term and on death at anytime within the term the full sum assured – payment of one or all the installments notwithstanding. In case of survival to the end of the term remaining portion of the sum assured along with profits is paid after deducting the installments already paid.

b) Bi-annual payment plan

– is given for 10, 15 & 20 years’ term and provides for payment of a portion of sum assured bi-annually after expiry of the 4th year of the policy, if the policyholder is then living.

IV. Premium back term Insurance plan without profits These are comparatively low cost plans. These plans provide for payment of sum assured in case of premature death within the term or refund of all premiums paid at end of term, sum assured keeps on increasing at 8% p.a. on each successive policy anniversary and such increased sum is paid at death during the term. On survival up to the end of term, all premium paid during the term is paid.

A guaranteed profit equal to 10% of sum assured is paid along with full premium at end of term as survival benefit. On death before maturity, the sum assured is payable.

- Pension Plan Without profits. Under plan pensions are provided at quarterly intervals from an age designated by the policyholder for life, guaranteed for a minimum period of 10 years i.e. if the pensioner dies anytime within 10 years his designated nominee will get pension for remaining term of 10 years. Before pension starts, if the assured policyholder dies, 10 times the annual pension is paid as a lump-sum to his nominee and the policy is terminated upon such payment. There is another plan that while providing for full protection against premature death as described above, provides for pension from a designated age as elected by the policyholder at an increasing rate i.e. pension will increase @10% at intervals of two years. Payment of pension is guaranteed for at least ten years and thereafter as long as the pensioner lives. Both these pension plans provide for waiver of premium in case of permanent and totaldisability due to accident before commencement of pension.

- Child Educational Protection Plan with profits: Multiple benefits in the form of scholarship, monthly annuity etc. in addition to sum assured is available under these plans. Under one plan sum assured or a part thereof is also payable to the policyholder incase the child dies prematurely.

- VII. Tri-dimensional Policy: Built-in benefits for payment of 50% sum assured immediately if critical illness is diagnosed. Premium and the sum assured will there after be halved and the policy continues. Under this plan, a spouse may also be covered for major disease benefits.

- VIII. Moving Term Plan: Policies under the plan are initially issued and is to be taken for a minimum term (6 to 10 years) as elected by policy holder. Any time within this minimum term if death occurs, full sum assured is payable. At the expiry of the minimum term, the policy may be surrendered for full refund of premiums paid. However, the policyholder need not terminate his policy at end of the minimum specified period. The policy will automatically continue till age 65 years of the policyholder unless heterminates it earlier. The survival benefit comprises of refund of all premiums paid along with bonuses. In case of premature death the nominee(s) is paid the sum assured plus all premiums paid till death, or all premiums paid with profit accrued till death whichever is greater.

- IX. Single Premium Multiple Security Plan: It is a single Premium Policy offering multiple security for five years term. It covers natural death, permanent and partial/total disability and seven major diseases. Premiums are based on the age of the proposed. This plan perfectly suits the needs of the executive class.

Policy Conditions

SurrenderValue:

After payment of two full years’ premium, the policy acquires cash surrender value which is quoted on request unless stated in the policy itself.

Loan:

At anytime after a cash surrender value is available under the policy and while the policy is in force, the policyholder may obtain, subject to the company’s existing rules, a loan on the policy up to 90% of the cash surrender value.

Age Proof:

Age of life assured as declared while applying for the policy has to be authenticated with an age proof document acceptable to the company. The company reserves the right to require proof of age of the life assured before paying any claim under the policy if not admitted earlier.

Settlement Option:

Payee may elect to receive the proceeds of the policy in installments instead of in a single sum, in such a manner as may be agreed upon with the company.

Suicide:

Should the life assured commit suicide, whether the assured be then sane or insane, within two years from the commencement date or from reinstatement of the policy, then the liability of the company shall be limited to the refund of all premiums paid under the policy less indebtedness, if any, at the time of such death.

Bonus:

DLIC pays attractive bonuses to its with-profit policies. The present rate of policy bonuses are as following:

a) A compound reversionary bonus @ 5% of paid up sum assured. This bonus is not paid on the installments withdrawn from the date of such withdrawal.

b) A simple reversionary bonus ranging from Tk. 10 to Tk. 15 per thousand sum assured per year depending on term.

c) A terminal bonus equal to 10% to 12% of sum assured at maturity of policy depending on terms if the policy would have been in force for at least 2/3rd of its term.

Average Rate of Bonus

On the basis of the three types of bonuses the Company now pays to its with profit policies, the average bonus earned by a Tk. 1, 00,000 sum assured endowment policy per thousand sum assured per year shall be as following:

Term of Policy Total bonus at maturity Average rate per thousand per S.A. year

10 years Tk. 52,000 Tk. 52

15 years Tk. 81,000 Tk. 54

20 years Tk. 1,15,000 Tk. 58

Delta Life first launched Micro-insurance product in 1988 through its Grameen Bima Project (GRB) to cater to the necessity of economic protection against premature death and of disability as well as providing a way for regular savings for the poor and low-income group of people living in villages. Later it started another project in 1994, namely, Gono Bima (GNB) for the urban poor and the low income class. These projects are now merged under the name of Gono-Grameen Bima Project (GN-GRB). The initial problems apart, the project started to yield impressive results right from the beginning by creating great interest among the target population who could not even perceive an institutional arrangement through which the ever present problems of insecurity of life could be addressed. To suit the needs and pockets of the target people, and for efficient management of these portfolios, some of the age-old traditional concepts of carrying on life insurance business had to be diluted and in some cases replaced by simple and straightforward practices. Yet, the results are so encouraging that Delta Life is now regarded far and wide as the undisputed leader espousing the cause of welfare of teeming millions and its experiences are now used to advantage not only by indigenous companies but also other micro-savings organizations abroad.

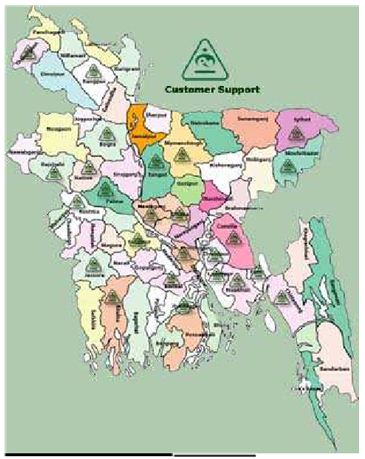

Coverage map:

Delta life insurance Company limited is one of the renowned insurance companies all over the country. It covers a huge area for its service. A coverage map is given bellow:

Target group and the product

In GNB/GRB the formalities are minimum. Insurance cover is given under Group Insurance concept. A person interested in a policy submits a simple two- page proposal form; it is signed or thumb-imprinted by him/her. There is no need for medical check-up. The person needs to be between 18 and 45 years of age, have a monthly income of Taka5,000/=(US $ 100.00) or less, be of good health and supply a Declaration of Good Health(DGH) at the time of submitting the Proposal form. Death through pregnancy complications within the first year of the policy and death through suicide in the first year of the policy are not covered under an “exclusion clause”. Simple endowment with profit policies are offered for 10 and 15 years term both with premium payment mode being weekly or monthly. Premium rate is the same irrespective of age at entry. Besides this plan new plans like three-payment plan with 12 and 15 years term and double protection endowment plan have recently been introduced.

Policy Documents and Micro Investment (Loan)

Upon acceptance of the proposal, a pass book is issued to the policyholder detailing all terms and conditions of the policy. The pass book serves as the purpose of recording of all payments made by him towards the policy. There is one group policy document for the policyholders of each Thana or Block. For individual policyholders the passbook serves as policy document.

Micro Investment (Loan)

GN-GRB gives small project loans to its policyholders on group liability basis. No collateral is required. There is 20% service charge on the loans, which is calculated at a flat rate and added to the principal amount. The loan, together with the service charge, is repayable in 12 equal monthly installments. The repayments are collected from door to door by the organizers. Recently a decision has been taken to establish small collection booths in the villages. A person must be a policyholder and pay premiums for at least one year before being eligible for a loan. The maximum loan given is Taka 5,000/=(US$ 100.00) per policyholder. The loans are for income generating activities (IGA) only. Policyholders form a committee of 5 to 7 members. 3 policyholders selected by the committee are given the first loan. After recovery of 3 installments from each of the first three borrowers, the next 3 are given their loans and so on. As a general rule, 60% of the premium income of an area and 40% of the repaid loan of an area are available for loan in that area. Also 100% of premium collection of a committee is available for loan to that committee.

Group Life Insurance

immediate financial support to an insured member and/or his family in case of devastating events like-death, disability, disease as well as retirement. Group Insurance has already established its importance as a component of ³Employee Benefit Package´ in Bangladesh. Exclusive features of Group Insurance are: Insurance coverage to a number of individuals under a single contract

Group Insurance is an instrument for providing life insurance coverage (protection) to an umber of individuals under a single contract (policy) who are associated together for a common interest other than insurance. It is the most cost effective means to provide

- Simple insurable conditions

- Easy administrative procedure

- Prompt claim settlement

- Affordable premium

- Tax exemption on premium

Delta Life offers a host of Group-Life Insurance schemes from which an organization/employer may choose for benefits of its members/employees, as may best serve their interest according to organizational setup.

To be treated as a group, the following criteria need to be fulfilled.

- A ‘Group’ Should comprise of at least 15 members

- It should be a legitimately organized body

Group clients of Delta Life Insurance Company Limited include:

- Semi-Government organization, autonomous bodies

- Private, Non-Government Organizations (NGO’s)

- Educational & Financial Institutions

- Public Limited Companies

- Associations, Business organizations etc

Group Life Insurance Schemes offered by Delta Life are of two types:

- Traditional Schemes: for insurance coverage of members/employees of a group

- Exclusive Schemes: for insurance coverage of clients of financial institutions

Traditional Scheme:

These are the commonly offered ³Group-Life Insurance´ schemes and are also known as

Basic Schemes: These are:

- Group Term Life Insurance Scheme (GT):————————–} Short Term Contract

- Group Term Life with Premium Refund Scheme (GTR)——}

- Group Endowment Life Insurance Scheme (GEN)————-} Long Term Contract

- Group Pension Scheme (GP)———————————–}

There are several variants of Basic Schemes. Examples of two variants of GTR are:

GTR-100/10: Group Term Life with 100% Premium Refund after 10 years

GTR-50/10 : Group Term Life with 50% Premium Refund after 10 years

Salient features of the Basic Schemes

| Group Term Life (GT) |

|

| Group Term Life Insurance with Premium Refund (GTR) |

|

Features & Benefits | Basic Schemes | ||

Group Term Life (GT) | Group Term Life with Premium Refund (GTR) | Group Endowment Scheme(GEN) | |

Age Limit for Insurance Coverage | 18 years to 60 Years | 18 years to 60 Years | 18 yrs. to the age of retirement (max. 60 yrs) |

| Duration of Contract | 3 years in each spell | 10 years or 15 years in each spell | Continuous Contract, if not terminated |

Scope for Inclusion & Exclusion | Yes | Yes | Yes |

Scope for Inclusion& Exclusion | Yes | Yes | Yes |

Scope for Alteration of Sum Assured | Yes | Yes | Yes |

Premium Rate | Single & Fixed (irrespective of age Low} | Single & Fixed (irrespective of age) | Variable; age dependant premium rate |

| Benefits: | |||

Death (payment of Insured amount on death) | Yes | Yes | Yes |

Maturity Benefit | None | None | Payment of Sum Assured as per contract during retirement |

Premium Refund | None | Refund of Premium as per contract on retirement or completion of term. Payment of surrender value in case of non completion of term | None |

Profit Share | Provided to large groups only | None | None |

Supplementary Covers:

To provide insurance protection against few devastating conditions other than death, and to enhance insurance benefit in case of sudden accidental death, several Supplementary Covers are offered along with basic schemes. Supplementary covers include:

- Accidental Death Benefit (ADB): Provides for double sum assured in case of accidental death.

- Permanent and Total Disability Benefit (PTD): Provides for full sum assured on happening of defined risks.

- Permanent & Partial Disability Benefit (PPD): Provides for certain percentage of the sum assured as per schedule on happening of the defined risks.

- Dismemberment Benefit (DB): Provides for a certain percentage of Sum Assured as per schedule on happening of the defined risks. It is only offered with ADB.

- Major Disease Benefit (MDB): Provides for 25% or 50% of S.A. upon diagnosis of a few specific life threatening diseases

Exclusive Schemes:

These are schemes, especially designed for financial institutions, in order to secure their investment and adorn the product to make it attractive to customers as well as to protect interest of the client. Few examples are:

Home Loan Insurance:

Scheme for ‘Home Loan Borrowers of Delta BracHousing

Depositor’s Insurance:

Scheme for ‘Smart Plant’ Depositors of Dhaka Bank Ltd

Premium:

For traditional schemes: Premiums are usually payable annually in advance before commencement of insurance.

For exclusive schemes: A single premium is payable for the whole period of coverage before commencement of insurance.

How to get a Group Life Insurance Proposal?

For Proposal: fill in the Proposal Request Form and send it to us at our contract address For Quotation: fill in the ³Proposal Request Form´ and send it to us at our contract address accompanied by the list of members to be insured with following details.

| Sl. No. | .Name | Designation | Date of Birth | *Sum Assured |

Health Insurance

Health Insurance is now considered indispensable in developed countries. In the present financial-social perspective of Bangladesh as well, Health Insurance has now become inessential, dependable, acceptable and the most cost effective means to make the modern treatment facilities affordable to all socio-economic classes of people, especially the fixed income group. As pioneer of Health Insurance in Bangladesh, Delta Life Insurance Company offers several Health Insurance schemes, which are as follows:

Hospitalization (In-patient) treatment coverage plans

- Hospitalization Insurance Plan (Group) – offered to Members of a group and their dependants (if desired)

- Hospitalization Insurance Plan (Individual): offered to an Individual and/ or his/her dependant family members also known as ‘Delta Care Hospitalization Plan’

Delta Life offers a wide variety of ordinary life product/plans ranging from the most common endowment type to more modern and sophisticated plans like endowment with open term, pension plan with built in provision for increasing pension, increasing protection with provision for premium refund etc. The plans have been designed keeping in view the diverse and multifaceted needs of the insuring public belonging to different strata of the society. Some of the popular plans are briefly described below.

Expenses Covered under Hospitalization Insurance Plans:

- Hospital Accommodation

- Consultation Fee

- Medicine & Accessories

- Medical Investigations

- Surgical Operation and

- Ancillary Services like Blood Transfusion, Ambulance Service, Dressing etc.

General Features of the Scheme

- No need for preliminary Medical Examination during enrolment.

- Treatment coverage round the clock inclusive of Accidents and Emergencies

- Coverage offered to Bangladesh National as well as resident foreigner.

- Treatment at any renowned hospital or clinic by consultant of own choice

- Preferential service at Designated Hospital

- Direct payment of treatment expenses by the company at Designated Hospital

- Reimbursement of expenses for treatment at non-designated hospital.

- Membership ID Card for each insured to facilitate preferential services.

- Option for Maternity Benefit and Overseas Treatment coverage.

- Provision for inclusion of Spouse & Children under the plan.

- Provision for inclusion of new member under the plan.

- Coverage up to 65 years under Group HI & 60 years under Individual HI plan.

- Two types of plans with several benefit grades to choose from. Option to choose more than one grade according to status of the members of agroup. Option to alter benefit grade during renewal.

Exclusion from Coverage

Major Exclusions include: –

- Congenital infirmity.

- Pre-existing condition for certain period.

- Psychiatric disorders and narcotic addiction.

- Attempted suicide and self-inflicted injury.

- Dental treatment Pre or post hospitalization expenses and out patient treatment expenses.

- War risk, civil commotion or violence

- Routine health checkup

- Treatment for family planning purpose, contraception and infertility

Group Hospitalization Insurance Plans

Types of plan offered:

Standard Plan ± Distinctive Hospitalization Insurance Plan of Delta Life

Customized Plan ± Tailored to the need and desire of the client.

Standard Plan: –

Five Grades of benefits are offered under standard plan to choose from

| Benefit Grade | Master care | Super care | Deluxe care | Exclusive care | Royal care |

Max. Benefit each insured per year | Tk. 25,000 | Tk.45,000 | Tk. 75,000 | Tk. 1,00,000 | Tk.1,40,000 |

Customized Plan:-

Benefit Schedule & Premium Rate

- Benefits desired has to be provided by the client

- A “fixed premium rate” irrespective of age is offered on receipt of the list of members to be insured.

How to get a Group Hospitalization Insurance Proposal?

For Proposal: fill in the Proposal Request Form and send it to us at our contract address

For Quotation: fill in the ³Proposal Request Form´ and send it to us at our contract address accompanied by the list of members to be insured with following details.

Sl. No. | Name | Date of Birth | *Status | Benefit Grade |

* Status means rank of an employee or his relationship with dependant (spouse/children).

Individual Hospitalization Insurance Plan

Bengali Leaflet

Proposal Form

Overseas Mediclaim Policy

This is a distinctive Health Insurance Policy issued to travelers only. It is also a pre-requisite for Visa application of developed countries. The Policy is issued to Bangladeshi Nationals and Foreigners resident in Bangladesh

OMP issued by Delta Life is universally accepted by all foreign Embassies in Bangladesh.

Types of Policy

Plan-A: for visiting any Country of the World (except USA & Canada)

Plan -B: for visiting all Countries of the World

Coverage under both Plan ±A & Plan ±B exceeds EURO 30,000Key Features of the Policy

Age Limit: Policy issued to Individuals from the age of 6 months to 65 years.

Nationality: Policy issued to Bangladeshi and Foreigner Resident in Bangladesh.

Covered Expenses: Treatment expenses incurred for sudden and unexpected illness or accident while on tour abroad.

Maximum Benefit:

Plan-A US$ 50,000

Plan-B US$ 1, 00,000

How to take out an OverseasMediclaim Policy´

Fill in a Proposal Form

Attach Photocopy of the first five pages of the passport

Enclose requisite premium (Cash) as per Rate Chart

Send those these to Health Insurance Department at the Head office of Delta Life.

* Physical presence or Photograph of proposer is not required.

* Only about 30 minutes time is needed to issue a Policy

* ³Proposal Form is also available at Head Office and Agency Offices of Delta Life

³Premium Rate Chart

Bonus:

DLIC pays attractive bonuses to its with-profit policies. The present rate of policy bonuses are as following:

a) A compound reversionary bonus @ 5% of paid up sum assured. This bonus is not paidon the installments withdrawn from the date of such withdrawal.

b) A simple reversionary bonus ranging from Tk. 10 to Tk. 15 per thousand sum assured per year depending on term.

c) A terminal bonus equal to 10% to 12% of sum assured at maturity of policy dependingon terms if the policy would have been in force for at least 2/3rd of its term.

Average Rate of Bonus

On the basis of the three types of bonuses the Company now pays to its with profit policies, the average bonus earned by a Tk. 1,00,000 sum assured endowment policy (except Table No. 03, 04) per thousand sum assured per year shall be as following:

Term of Policy | Total bonus atmaturity | Average rate per thousand per S.A. year |

10 Years | Tk. 52,000 | Tk . 52 |

15 Years | Tk. 81,000 | Tk. 54 |

20 Years | Tk. 1,15,000 | Tk. 58 |

Cash Payment: There are some expenses made by Delta life Insurance company limited for doing its activities. By using account code they made a statement to maintain these expenses daily. These expenses are given bellow:

- Agency Commission

1) 1styear

2) I.C balance

- U.C Commission

1) 1st year

2) I.C balance

- A.M Commission

1) 1st year

2) I.C balance

- A.M & Above Commission

1) 1st year

2) I.C balance

- Agency Balance

- Arrear Commission

- Outstanding Commission

- Medical fee

- Travel & tour

- Conveyance

- Office tea & entertainment

- Stationery

- Office maintenance

- Wages

- Electric bill

- Water bill

- Gas bill

- News paper expenses

- Photostat

- Postage bill

- Revenue stamp

- Telephone bills

- Office rent

- Staff salary

- Salary A Scheme

- Salary b Scheme

- Intensive Bonus (dev)

- Intensive Bonus (stt)

- Car maintain (Fuel)

- Car maintain (repair)

- Car maintain (others)

List of return: There are different types of return based on time these are:

Returns | Sending time |

| DCS | Daily |

| DES | Daily |

| Cheque encashment advice | Regularly |

| FPR statement | Weekly |

| Weekly BM statement | Weekly |

| Bank balance statement | After 15 days |

| Monthly bank statement of related accounts | Monthly |

| Motor cycle loan received statement | Monthly |

| Early received commission schedule | After 3 months |

| Tax deducted statement | After 3 months |

| Agent commission bill | After 3 months to the central commission |

| Furniture & ficture yearly Stock report | Yearly |

There are different types of Income source of Delta life insurance Company limited. Thisare:

Premium:

- 1st year premium

- Renewal premium

Others:

- Assets sales income

- Investment income

- Late fee

- Change fee

- Advance receipt

- Arrear receipt

- Others

The Income sources of Delta Life Insurance Company limited are given bellow:

- Income Sources

- 1st year premium

- Renewal premium

- Home loan premium

- Interest on home loan

- Late fee

- Alteration fee

- Re-writing fee

- Policy stamp fee

- Loan bond fee

- Policy loan recovery

- Interest on policy loan

- Motor cycle loan recovery

- Interest on Motor cycle loan

- By-cycle loan recovery

- Interest on By-cycle loan

- Linces fee

- Proposal form

- Calendar

- Dairy

- Telephone Index

- Visiting Card

- Rate book

- Delta barta

- Uttaron

- Application fee for home loan

- Application fee for Delta care hospitalization

- Premium

Accounts control: There are two types of account control system for maintaining the accounts of Delta life Insurance Company limited.

Accounts Control———————1) Cash system

2) Crual system

Cash system: Cash system is a system which is used by Delta life Insurance Company limited to maintain the cash received and payment only based on daily basis. Use some documents and bank memorandum or vouchers. Without cash basis others accounts are not included here.

Crual system: Here only those payments are included which are payable in future or could be earn in future. No cash payments are included here. This is used for future transaction.

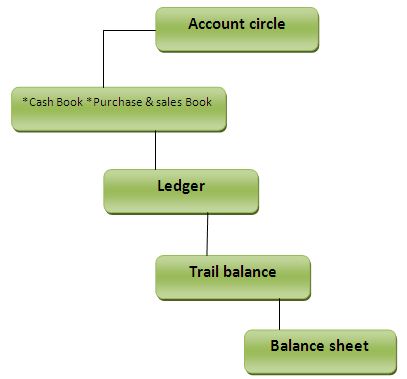

Account circle: There is a account circle maintain by the Delta Life insurance Company Limited. This is given below:

The main service of Delta Life insurance company limited is Ordinary Life insurance.This Ordinary Life insurance uses three types of documents for its procedures. These are

- P.R (present receipt)

- Daily receiving statement

- Check credit advise

These three types of documents used by the company to make easier transaction and early settlement. In present receipt used for collecting present documents. In daily receiving statement it has Date, Amount, branch name, bima number in the chart. Check credit service is used specially for early settlement.

In Ordinary life insurance there are some expenses for the company. These are

- Agency commission

- U.C commission

- A.C commission

All these have three types of payments. These are:

- 1st year commission

- I.C commission

- Renewal commission

Accounts book & register: There are different types of accounts book and register maintained by Delta Life Insurance Company limited these are:

- Cash book

- Cheque issue register

- Cheque receive register

- Agent office petty expense register

- Claim payment register (Head wise)

- Premium payment register

- BM collection register

- BM summery register

- Fund receive register

- Fund transfer register

- PM stock register

- BM stock register

- Motor cycle loan recovery register

- Office rent and advance rent register

- Furniture stock register

- Stationary stock register

- Key stock register

- Bank account register

- Car maintenance register (Folio wise)

- Petrol register (Company’s vehicles)

- Telephone register (office & resident)

- Revenue stamp purchase register

- Furniture purchase register

- Stationary purchase register

- Office maintenance register

- Legal expense register

- Postage expense register

Audit: There are two types of audit maintain by every company .Delta life insurance company limited also use two types of auditing system.

1) Internal audit

- Pre audit

- Post audit

- Inspection audit

2) External audit

- Commercial audit: appointed by the share holders

- Government audit: appointed by the controller of insurance

- Special audit: Particulars

- Special audit: Control by director

Queries: There are different types of queries made by Delta life insurance Companylimited for better performance these are:

1) Verification

- Cash

- Stamp

- Stock

2) Premium collection & banking

- Late deposit

- Mis-Serial of Present receipt

- Bank reconditions

- Cheque honor

- Cheque dishonor

- Advice

3) Cash book balance

4) Payment

5) Voucher

6) Purchase

7) Proper head of accounts code

8) Commission related payment

- License

- Approval

- Signature verification

- Double payment

- Stamp act

Related sector with service centre: There is some related centre with the service centre. This helps to complete the activitiesof service centre. These are:

1)Accounts Section

- General accounts

- Receipt and payments

- Commission

2) Service section

- General

- Renewal premium adjustment

- Alteration

- Docket

- Photocopy

3) Underwriting section

- Underwriting

- New business

4) Policy issue

Last 5 years performance:

A) Life Fund:

(Tk in Crore) | Remarks | |||||

2003 | 2004 | 2005 | 2006 | 2007 | ||

| Life Fund | 541.21 | 680.83 | 849.40 | 1042.11 | 1206.36 | |

B) Investment :

(Tk in Crore) | Remarks | |||||

2003 | 2004 | 2005 | 2006 | 2007 | ||

370.36 | 486.25 | 605.30 | 799.85 | 996.11 | ||

C) Premium Income :

(Tk in Crore) | |||||||

Division | Type | 2003 | 2004 | 2005 | 2006 | 2007 | Remarks |

Ordinary life | 110.00 | 125.45 | 145.53 | 164.52 | 186.02 | ||

Gono Grameen | 61.56 | 76.26 | 103.17 | 127.94 | 141.27 | ||

Group & Health Insurance | 8.01 | 8.51 | 8.86 | 10.98 | 13.89 | ||

Gross Premium | 179.57 | 210.25 | 257.51 | 303.44 | 341.18 | ||

D) Investment Income :

(Tk in Crore) | ||||||

2003 | 2004 | 2005 | 2006 | 2007 | Remarks | |

Investment Income | 40.02 | 56.22 | 60.67 | 89.58 | 112.56 | |

Business Growth:

2004 | 2003 | 2002 | 2001 | 2000 | |

Premium (in %) | 17.09 | 13.25 | 13.25 | 10.25 | 7.89 |

Asset (in %) | 23.11 | 23.832 | 23.65 | 25.36 | 24.70 |

Life Fund (in %) | 25.11 | 24.60 | 26.48 | 28.58 | 29.45 |

3.Present Premium Collection through Banks as follows:

ORDINARY LIFE

Name of Banks | No. of Branches | Amount (Tk in Crore) 2007 | Amount (Tk in Crore) 2006 |

Pubali Bank Ltd. | 180 | 17.92 | 17.56 |

Bangladesh Krishi Bank | 300 | 23.17 | 22.70 |

Rajshahi Krishi Bank | 124 | 7.15 | 6.58 |

Agrani Bank Ltd. | 33 | .09 | .09 |

4. Present Collection Procedure:

ORDINARY LIFE

We open an account with Bank and send a BM (Bank Memorandum) book to therespective Bank for premium collection from our policyholders with the following standing instructions:

Standing Instructions:

1. All day to day receipts through BM will be accepted in this “Current Account”

2. Our BM will be issued by the bank only for collection of premium and other deposits in cash to the credit of our STD/Current-cum-BM Collection Account

3. In case of Cheque deposit no BM will be issued before cheque encashment.BM will be issued only after encashment of the cheque against credited amount.

4. Since the BM is treated as cash receipt of money, therefore, BM can only be issued by the authorized officer/staff of the bank and BM book not to be handled by anybody else other than authorized persons of bank. Once a BM is issued by the bank it will be treated as cash deposit to our account.

5. Each bank Memorandum book contains 100 receipts in five copies and while issuing a receipt against a collection, the copies shall be distributed as under.

(i) 1st Copy: To be delivered to the depositor.

(ii) 2nd Copy: To be sent to our central office at Uttara Bank Bhaban (11th floor)90

Motijheel C/A, Dhaka at the end of each week. (BM issued against NEW BUSINESS may be handed over to the depositor in a closed envelope on his/her request taking his/her signature, name and code number.

(iii) 3rd Copy: To be sent to our Central office at “Uttara Bank Bhaban (11thfloor) 90

Motijheel C/A. Dhaka” with your monthly bank statement including all debit and credit advice in original by the 1st week of the following month. Please note that BM number should be mentioned in the “particular” column of the bank statement.

(iv) 4th Copy: To be attached with bank voucher by your branch.

(v) 5th Copy: To be retained in the receipt book at your branch.

6 Bank Memorandum (BM) should be issued serially according to book number (when more than one book will be supplied) and page number. No BM should be issued dating back. If any BM is canceled for any reason whatsoever, the first three copies of the canceled BM including the original one should be sent to the aforementioned address.

- Levy if any is to be deducted by the branch as per Govt. direction from the deposit of this account.

8. The amount accumulated in this STD/Current account for a month be transferred automatically to the “Delta Life Insurance Company Limited Main STD Collection Account positively by the 7th day of the following month under intimation to us.

9. No prescribed form and other formalities will be necessary to open this account. Our application in company’s letterhead will serve the purpose.

10. No Cheque book is required and generally no withdrawal should be entertained on this account except usual transfer as advised.

11. Initially no cash deposit is required to open a Current-cum-BM Collection account. Our collection through BM will serve this purpose.

12 In no case cash deposit be refused even if proposal/policy number is not mentioned by the depositor. The name of the depositor will serve our purpose.

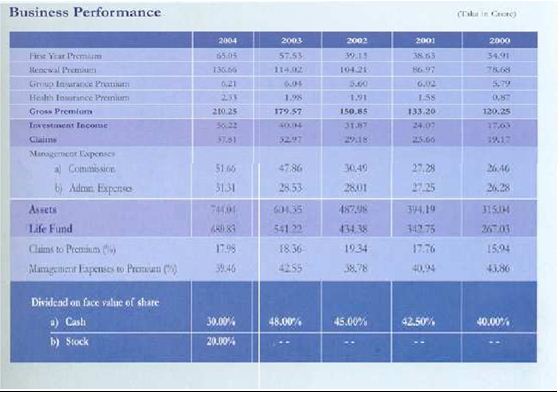

Business performance: The performance of Delta Life insurance Company Limited is getting better day by day. One of the figures of the performance of Delta life Insurance is given bellow:

Challenge of the DLICL

Delta Life Insurance Company business started with the creation of product or service and ended with the attempt to sell it. Delta Life should start with the knowledge of the market. So, it is necessary to find out what is needed, what will be sold, only then should return the operation to create the product or service. Today, Life Insurance Company is considered as a service organization. For the process of conducting its own activities to achieve its own goal i.e. making and assuring benefit, a fast growing leading insurance company considered services the following ways:

- Solving all customer services and conservation related problems.

- Ensure the policy should be under write.

- Deposit the premiums.

- Ensure all kinds of claim benefits.

The normal function of insurance company to selling their product as basis of their customer’s life risk. Here risk is defined as the opening the policy, company will give all the benefits including the risk coverage. Thus in the course of its activities, an Insurance company contract with different groups of people on the basis on some: and criteria they also called our respective client’s. So, the better consideration of the successful in Insurance business to achieve the selling products, but it is too much important to ensure the customer service accordingly. It is observed that better performance of Insurance to conducting and performs better service for reputation of the clients. It is possible to improve those factors or take remedial actions in relation to Insurance companies in order to make their company attractive.

SWOT ANALYSIS

Not surprisingly, in the competitive arena of marketing era SWOT analysis is a must based on product, price, place and promotion of a financial institute.. From the SWOT analysis we can figure out ongoing scenario of the bank. So to have a better view of the present

SWOT Analysis

1) Internal factor

(a) Strength

(b) Weakness

2) External factor

(a) Opportunity

(b) Threats

SRTENGTH:

- Quality of the Delta Life management

- Location of the Delta Life sales & Agency Office

- Good banker-customer relationship.

- Financial condition of DLICL

- Environmental constraint

- Personal relationship with the DLICL employees

WEAK NESS:

- Some times it takes longer to meet claims

- Have not the same position in all the branches.

- Sometimes it could not get its target in service center.

OPPORTUNITY:

- Huge business area.

- Introducing on line system all over the country in insurance business.

- Growth of sales volume.

- Introducing more branches.

- Develop relations and correspondence with foreign Insurance companies.

- Could make contacts with more banks

THREATS:

- Other Insurance Companies in Bangladesh.

- Different classic service of other Insurance Companies.

- Political unrest and Economic recession.

- Illegal business operation by the some clients.

- New entrance

Findings & Analysis:

The subject matter of this study includes the facto’s influencing the choice Delta Life, Thus the analysis of results and findings will be related with this topic.

Factors influence the choice of Delta Life Types of clients and factors influence the choice of Delta Life

Although respondents have been given 11 factors to rank in order of preference, it is observed that they ranked on the average only four to six factor¶s, it is also found that:

- Quality of the Delta Life management.

- Location of the Delta Life sales & Agency Office.

- Reputation of Delta Life.

- Personal relationship with Delta Life s employees are normally considered by most of the respondents. So for the analysis of this study only these four factors have been taken into accounts.

Recommendations:

It is an auspicious for Delta Life as a well reputed leading insurance company of Bangladesh. This has been able to attract customer. Delta Life facing extensive competition from the new entrants and the other insurance company. So, to increase market share and to retain customers it should take proper policy and strategies that can play vital role on the present competitive situation in the insurance sector. The following measures should be under taken to improve more the insurance business of Delta Life.

- The findings of this study observed that the executives of DLICL, have little judgment (idea) about their customers. So in this case, training program should be under taken to develop the interpersonal dealings of the DLICL employees.

- As both clients and beneficiaries are influenced by most of the same factors. So DLICL should give importance or priorities to allure customers by developing or formulating the same strategies or policies for clients and beneficiaries.

- As the bank choice of customers (both clients and beneficiaries) are related with the customers satisfaction, so it should improved the performance of promises in time, personal attention to the clients, tangible Insurance facilities and courteous and knowledge of insurance employees.

- “Quality of the DLICL management”, “Reputation of DLICL”; “personal relationship with the employees” and “Location of DLICL office” implies the implicit cause of insurance choice such as perceived risk by customer. So the management of DLICL should take the corrective measures to reduce the financial risk, performance risk, physical risk, social risk and psychological risk perceived by customers.

- The choice factors of bank implicate the customers perceptions of value including two sides total customer value and total customer cost. Total customer value included product value, service value, personnel value, and image value whereas total customer cost includes monetary cost, time cost, and energy const and psychic cost. So the management of DLICL should try to equalize the value between the two sides.

Conclusion:

Delta Life insurance Company is one of the leading insurance Company in Bangladesh. The performance of Delta life Insurance company is getting better day by day. Its premium, assets, claims meeting, utilization of income is getting better in last five years. The study is about the activities of delta Life Insurance Company limited, its cash payments, claims meeting, premium collection, service offered, products etc. The study also has showed that the factors are related with the customer perceived risk and customer’s value and cost furthermore, the study has identified that the DLICL customer (both Clients and beneficiaries) are influenced by most of the same factors. Here Delta life insurance company limited could improve its marketing strategy for customer satisfaction. Overall we can see that Delta life insurance Company limited is one of the progressive Insurance Company in Bangladesh for its servicing and its better performance.

![Report on Overall Banking Practice of National credit and commerce bank [Part-2]](https://assignmentpoint.com/wp-content/uploads/2013/05/images-11-200x79.jpg)

![Report on One Bank LTD [PART-2]](https://assignmentpoint.com/wp-content/uploads/2013/03/one-bank1-200x58.jpg)