EXECUTIVE SUMMARY

The micro-credit is seen as the most effective development tool nowadays. The institutions in Bangladesh have a pioneering and leading in this sector worldwide and are recognized offering the most diverse product line. With the time many Income Generating Activities moved with the help of micro credit to the stage of entrepreneurship. Nonetheless there was years ago a big lack for those who have been released of micro credit. This is why MIDAS Financing Limited started in July 1993 its Micro Enterprise Development Initiative in short MIDI. The idea was to support graduated entrepreneurs with financing enabling them investing in their business and give them further perspectives. Additionally the training tools of MIDAS give their clients the ability to enhance their business skills.

By the time some leading NGOs and through the pressure of the government and for reaching a new client group, banks replicated or installed similar programs. More lending programs for a specific target group do not only mean a wider range of products and easier access to credit for enterprises but also implicates a change in the strategic position of MIDI on the market.

After introducing the topic and the objectives, methodology scope and limitations of the study, I tried to focus on the organizational overview, organogram and management, and different services offerings of MFL in chapter 2

In chapter 3, I tried to focus on the professional background of micro-credit and micro-enterprise financing itself. It is incessant to understand the basic concepts, historical development, importance and the perspectives of the micro financing.

In chapter 4, basic concepts, policies and strategies accompanied with background information of the MIDI Program are described. Also here I mentioned the General procedure of sanctioning a loan.

In chapter 5, marketing analysis of MIDI Program and MFL is evaluated. To conduct marketing analysis, I made a questionnaire, which is given in Appendix B.

A financial statement of MFL is evaluated using common size statement analysis and ratio analysis in chapter 6.

Chapter 7 tries to identify the strengths, weaknesses, opportunities and threats of the MIDI program. In chapter 8, some major findings and recommendations are mentioned in order to demonstrate necessary changes and possible strategies.

Some lists of acronyms are given in Appendix A, which are used in this report. The lending policy of MIDI Program of the company has been given in Appendix C.

Finally it can be said that MIDI has a strong performance and a good position on the market. Besides a lot of improvements have to be done for continuous success and to be able to compete with a good program packet in the future.

Introductory Part

MIDAS Financing Limited started the Micro Enterprise Development Initiative (MIDI) in 1993 with the intention to provide financial support to a neglected sector of enterprises up to that date. MFL was the first institution who recognized that there is a marginal group of enterprises not considered by the banking and NGO sector until this time. Giving financial access to this untouched niche in the financing sector led to that MFL is regarded as the pioneer of micro-enterprise financing in Bangladesh.

Very few other institutions recognized the incredible potential of the micro-enterprise sector. On the one hand the NGOs concentrated only on financing the hardcore poor and poor entrepreneurs and the commercial banks tried to make their business with the medium and large companies to reach incremental profit. The micro-enterprises who could graduate through micro-credit and standing on a self-sustainable basis had no objectives to get any financial support needed mainly as working capital. A further difficulty was for those entrepreneurs that there was no possibility to take smaller loans from commercial banks because collateral security has to be provided.

But during the last few years and also with the pressure of the government of the Republic of Bangladesh many banks started micro-enterprise financing schemes to extend their businesses and to reach new clients. Also the NGOs recognized that they cannot release their customers without giving them a perspective for the future. Therefore more and more NGOs decided to support them till the micro-enterprises can graduate to get loan from the banks.

Objective of the Study

The purpose of the report is to achieve knowledge about the micro credit and investment practices of the company. The main objective of this study is to prepare an internship report on the specified topic working within a company.

Certain objectives are essential for the conductive research. These are as follows-

- Presenting a brief overview and history of MFL company.

- Finding out and provide micro credit practices of MFL.

- Finding out the promotional activities of MFL.

- Finding out the problems regarding micro credit service.

- Understanding the cost efficiency of MIDI Projects.

- Understanding MFL activities and in special the MIDI program.

- Analyzing the situation of micro-enterprises and their future perspectives.

- Analyzing the policies, methods and practices of MIDI program.

- Pointing out the strengths, weaknesses opportunities and threats of the MIDI Program.

Importance of the Study

The main importance in any aspects of educational field is – “To gain knowledge through a scheduled process.” As an essential part of my assigned course, it is a necessity to go through all fields of knowledge, both theoretical & practical.

The internship program is assigned to all the BBA students to attain efficiency in various perspectives such as– micro credit, investment practice, accounting information systems, management, finance and banking, marketing, economics etc. It is very important to conduct an internship program, as academic knowledge is not sufficient enough to face future opportunities & threats. This program is valid for major reasons-

- To develop clear understanding about the organizational objectives.

- To know the structure of the organization.

- To analyze the activities of the organization.

- To assess the major strengths, weaknesses, opportunities and threats of the organization.

- To design promotional techniques for the organization.

- To identify the categories of the clients.

- To suggest appropriate steps taken to promote its services.

Scope of the Study

Basically this report is based on the present situation of micro credit in Bangladesh and MFL’s contribution in it. MIDAS Financing Limited (MFL) is one of the leading non banking financial institutions in Bangladesh. This report covers the organization’s background, structure, functions, management practices, services, micro credit, micro-enterprise financing, MIDI program and its market situation, and SWOT analysis of MIDAS Financing Limited.

Methodology of the Study

The report were conducted in number of subsequent steps that cover an integrated plan. These steps include:

- Collection of the relevant information,

- Collection of the necessary resources,

- Analysis and evaluation of the findings,

- Recommendation on the findings.

Sources of Data: Data used in the study were collected from both primary and secondary sources.

The Major sources of primary data are:

- Interview with the executives of different departments and MIDI department,

- Observing activities of the concerned Department.

- Discussion with knowledgeable persons.

The secondary sources of data are:

- Publication materials of MFL.

- Annual Reports of MFL.

- Use of brochures, published books, articles, journals, and research papers etc.

- Information collection from internet sources,

- Website.

- MFL Database.

Limitation of the Study

At the time of preparing my report I faced several problems. These limitations are as follows:

- Time is the main limitation for my study. Due to unavailability of sufficient time, it is not possible for me to provide all up to date information.

- Work load during the internship program at the work place was also a barrier to prepare this report.

- Due to lack of practical experience, some errors might be occurred during the study. Therefore maximum efforts have given to avoid mistakes.

- As a novice it was tough for me to make evaluation and finally draw recommendations. The allotted time is not enough to understand and evaluate this type of vast issue.

- Last but not the least; a good study requires the analysis of as much data as possible covering various aspects of the study. There may be some lacking and I hope to be excused for these.

- Current and adequate information is hard to collect.

Despite all these limitations, the study has hopefully fulfilled its objectives and indicates some important suggestions.

ORGANIZATION PROFILE

Historical Background of MIDAS Financing Limited

Micro Industries Development Assistance and services (MIDAS) was established in 1982 under the Societies Act with the initiative of United States Agency for International Development (USAID) to overcome the high rate of unemployment of Bangladesh which is also influenced by high population growth rate and stagnant per capital agricultural productivity.

MIDAS was also formally registered with the Department of Social Welfare, Government of the People’s Republic of Bangladesh as a non-profit voluntary organization with a view to generating employment opportunities. Before registration of MIDAS, a cooperative agreement was signed between USAID (under its Rural Industrial Project) and the Asia Foundation (as an intermediary) in 1981 to channel and administer USAID assistance to MIDAS.

Upon registration as non-profit voluntary organization, the management of MIDAS was vested in a board of directors who were society’s member representing the voluntary agencies, private organizations, the government of Bangladesh and donor agencies. The Board Members are elected for a term of two years.

An amendment to the cooperative agreement with USAID was made in 1985 that include a scheme of granting loan and equity fund to the potentially profitable and innovative business ventures as it believed that there is a large opportunity for the development of micro and small labor intensive enterprises in the services, construction and manufacturing sub sectors rather than in the public and large manufacturing sectors.

Through a high degree of specialization and experience together with prudent traditional values, MIDAS activities are increasingly become commercial in nature and have demonstrated its ability and commitment to the development of small enterprises in Bangladesh. Therefore the government of Bangladesh has advised to operate MIDAS as an industrial promotion company rather than a non-profit voluntary organization. Understanding this Board of MIDAS reviews the proposition and decided to convert MIDAS into a company limited by guarantee under the Company Act 1993.

USAID supported MIDAS till September 1993 and after that MIDAS has not received any assistance from any quarters.

The goal of MIDAS is not only to provide financial assistance to micro and small enterprises but also to become a financially self-reliant organization. In this respect it applied to Bangladesh Bank for license under the Financial Act, 1993 to operate as a regular Non-Banking Financial Institution and have access to short-term credit from international organization and multinational agencies lick ADB, IFAD etc.

With license from Bangladesh Bank to operate as a non-bank financial institution under the financial act, 1993, MIDAS set up “MIDAS Financing Limited” which is an offshoot, a spin-off MIDAS with the primary objective of taking over the enterprise financing role of MIDAS and performing it in a better way and on a larger scale.

MIDAS and MFL both are companies incorporated by the register of joint stock companies and firms under the companies act. But where MIDAS is a company limited by guarantee and MFL is a public company limited by shares.

MFL having license from MIDAS has inherited a corps of devoted and qualified professionals with vast experience in enterprise promotion and financing. It will also be underpinned by the backup services of MIDAS that will continue to play its developmental role with full vim and vigor.

Objectives

MFL strongly believes that a positive contribution can be made to the development of the economy through creating new employment opportunities and developing new base of entrepreneurship in the country. Therefore it aims at-

- To enhance the capability of micro, small and medium enterprises through providing financial assistance.

- To develop entrepreneurship and enabling entrepreneurs to exploit new business opportunities.

- To identify exceptionally promising micro, small and medium enterprises for providing financial, managerial and technical assistance.

- To promote women entrepreneurship.

- To discriminate information on micro, small and medium enterprises.

- To offer consultancy services.

- To carryout study and research services.

- To develop its institutional capabilities for attaining self- reliance.

- To expand their presence in the area of trade and business and investment of our country.

- To serve as a catalyst force for the growth of sustainable micro and small enterprises in our country.

The Strategy

MIDAS strongly believes that micro and small enterprises provide an excellent room for creation of new employment opportunities and development of new base of entrepreneurship in the country. Its enterprise development program aims at strengthening the strategic position of micro and small enterprises between large scale , capital intensive and sophisticated firms and very small scale, informal and less sophisticated enterprises.

Values

MFL abides by a set of core values. Some can be classified as traditional values such as security, trustworthiness, integrity, and confidentiality. MFL holds the following values also-

- To work as a team to serve the best interest of the customer.

- To have strong customer focus and build relationship based on integrity, superior service, and manual benefits.

- To be relentless in pursuit of entrepreneurship development and improvement.

- To value and respect people and made decisions based on merits.

- To strive for profit and sound growth.

Mission

MFL is a non-banking financial institution with a vision of excellence. It aim to be an outstanding non-banking financial institution providing a broad range of services to the full range of customers, delivered nationally and differentiate from its competitors by quality and efficiency of services. MIDAS Financing Limited connects the mission into specific performance objectives-

- MFL wishes to achieve the top position in the country and sustain thereafter.

- MFL develops strategic plan (Long term, intermediate, and short term) to attain its objectives.

Vision

MFL will be renowned as the top performing non- banking financial institutions serving in Bangladesh. They are relative to their competitors:

Provide the greatest return to the shareholder by achieving sound profitable growth. Be perceived by customers and staff as the best whatever they operate. Have staff of the high-test caliber.

Management of MFL

There are 10 members in the management of MFL. The Board of Directors including Managing Director look after the day-to-day affairs of the company. Management of MIDAS Financing Ltd every year performs Annual General Meeting (AGM). The management of MIDAS Financing Ltd has already started and has planned to undertake a number of new programs in order to diversify its activities and expand business, which are as follows:

- Housing loan scheme.

- Investment in capital market.

- Merchant banking operation.

- Factoring.

- Computerization and Automation.

- Enlistment with CDBL.

Professional and Functional Specialization

Trained manpower is an important asset of any company. MFL implements its programs with the help of its own team of qualified professional specialized in various financial incentives and socio-economics. MFL has in house professional with their qualifications, experience and expertise in various fields such as Business Administration, Economics, Finance, Management, Marketing, Accounting and Computer Science etc. A number of officers of the company participated in different training courses and workshops organized by reputed training institutions including BIBM.

Networking

MIDAS maintains an excellent networking with similar institutions both within and outside Bangladesh.

Publications

MIDAS publishes a quarterly newsletter named “MIDAS News”. Its circulation is about 3,000 copies and is distributed to selected organizations of many countries of all the 6 continents of the world.

MIDAS also publishes an annual report, which presents the organization’s overall activities and achievements during the year. There are also brochures on different programs of MIDAS which are updated from time to time.

Evaluation

MIDAS performance of first 10 years had been reviewed by two leading US based consultancy houses namely, Development Alternatives, Inc., and the Nathan Associates Inc., Washington, D.C., appointed by USAID. The main areas of evaluation were– MIDAS’s organizational strength and its management system and self-sustainability. MIDAS financial management system was evaluated by the Coopers and Lybrand, Singapore, appointed by the Regional Inspector General of Audit, USAID/Singapore, a non-federal audit office of USAID.

In one of the evaluation reports, the evaluators recorded MIDAS as a “highly visible and highly regarded show-case of private enterprise initiative in developing countries”.

Branch Offices

MFL has 12 Branches situated at different in commercial places across the country to provide multidimensional financial services to the people. There is a plane to add 8 new branches in 2010-2011. Every Branch office has its own Library and Information center, computer and other modern communication facilities.

SERVICES MIX OF MFL

Presented below are the different services provided by MFL for development and promotion of micro, small and medium scale enterprises and other institutions/organizations in Bangladesh.

Small Enterprise Development (SED)

MFL adopted SED program to create employment on self-sustainable basis for small and medium enterprises and to explore new products, production process, marketing strategies and financial arranges etc. Under this program MFL provides loan for Fixed Capital and Working Capital.

Characteristics SED Program

- Maximum loan size of SED is Tk. 100 million.

- The debt equity ratio must be 70:30

- The loan repayment period is 5 years (maximum).

- Mode of repayment may be monthly, quarterly or half yearly.

- Service charge is 17% per annum (simple) and project appraisal fee is @ 0.5% of the total project cost.

- Personal guarantee, third party guarantee, demand promissory note, hypothecation of the project assets are required as security. Collateral security / bank guarantee/ insurance guarantee for loans above Tk. 7.5 lac.

Micro Enterprise Development Initiative (MIDI)

The MIDI program was introduced in the year 1993 under MIDAS. After that in the year 2000, it became one of the important schemes of MFL. The main objectives of MIDI are to create employment opportunities and develop entrepreneurial skills among small entrepreneurs. Short-term and medium-term loans ranging from Tk.50,000/- to Tk.1,000,000/- are provided to micro enterprises on very soft terms. Special features of MIDI loans are:

- Loans up to Tk.750,000/- are collateral free.

- Simple and quick processing.

- Special cash incentive is offered on timely repayment.

- Provision for special loans to meet seasonal demand.

- Special reduced interest rate for women entrepreneurs.

- No fees for documentation.

For security of the loan, MIDI takes Personal Guarantee of the Sponsor and Third Party Guarantee from a person acceptable to MFL. There is no collateral security needed up to Tk. 750,000. So guarantor is very important and visit to the guarantor is also necessary. If the sponsor does not repay money then after 3 months they (MIDI) has to send notice.

Women Enterprise Development (WED)

The WED cell is established with the objective of increasing women participation in activities by way of their employment or self-employment in MIDAS supported programs. A designated female Board member of MIDAS supervises the cell. It offers a wide variety of managerial and technical support services to them. Under the WED program investment counseling, tech-market information, technical assistance, managerial assistance, market promotion, organizing women’s forums, organizing MIDAS MINI MART is provided to women entrepreneurs. MFL arranges discussion meetings with women entrepreneur on the 3rd Thursday of every month at the head office to inspire and assist them to start business and establish as a successful entrepreneur.

Lease Finance

MFL extends lease finance facility to micro, small and medium enterprises and corporate business units in the manufacturing and service sectors and also to individuals and institutions for acquisition of machinery, equipment, vehicles and other fixed assets. After obtaining license as non-bank financial institution in October 1999 it started its commercial operation from January 2000 but it actually started leasing operation from July 2001.

Under this scheme, they give loan to Capital machinery, Heavy construction equipment, Generator, Transformer, Lift and Boiler, Air-Conditioning and Refrigeration equipment, Medical equipment, Vehicles, and Agricultural equipment.

- Lease amount: minimum Tk. 300,000 and maximum Tk. 100 million.

- Lease Period is 2-5 years.

- Installment is monthly or bi-monthly.

- Implementation period is 3 months (maximum).

- MFL takes two rental installments as Lease/Security Deposit.

- Terminal Value is 1% of lease amount.

- Appraisal Fee is 0.2% of lease amount or Tk. 2,000 (min) to Tk. 20,000 (max).

- Rental charge is 18% (reducing balance method).

- Lease period is maximum 5 years.

For security of the loan, lease finance takes Personal Guarantee of the sponsor and Third Party Guarantee/Corporate Guarantee, Bank/Insurance Guarantee, Mortgage of Land and Building, Lien of Marketable Securities, and Lien of TDR.

Housing Loan

MFL has launched Housing Loan Scheme in the year 2004 to fulfill the dream of the limited income people by extending financial support in the form of term loan. Under this scheme, they give loan for construction or renovation of a house / apartment, and purchasing a readymade house / apartment / commercial space / shop.

- Any Bangladeshi citizen within the age bracket of 30-55 years with recognized sources of income can apply for loan under this scheme.

- The amount of loan shall be from Tk. 3 lac to Tk. 50 lac but not exceeding 50% of the construction cost or purchase price of the property.

- The loan along with the interest is repayable in equal monthly installments over a period from 3 to 15 years for residential purpose and 3 to 8 years for commercial space.

- The interest rate is 15.50% to 16% depending on the period of loan. For example- if the loan period is 3-7 years then interest rate is 15.50%, if the loan period is 8-10 years then interest rate is 15.75%, and if the loan period is 11-15 years then interest rate is 16%.

Under Housing Loan Scheme they do not take personal guarantee. They take third party guarantee.

Consumer Credit Scheme (CCS)

MIDAS Financing Limited (MFL) launched its Consumers Credit Scheme (CCS) in August 2001 to provide financial assistance to acquire household items and others consumer durables to the consumers of limited and fixed income of the society in order to improve their standard of living.

- Interest Rate is 12% (Flat) per annum.

- Amount of loan is Tk. 10,000/- to Tk. 200,000/-

- The loan will be amortized over a period of 1 to 3 years.

Loan against Lien of Securities (LLS)

As a leading non-bank financing institution, MFL plays an important role in the development of capital market. To broaden the base of capital market by facilitating participation of small investors, MFL launched a special credit scheme to provide loans to the investors/traders of capital market and broker houses against lien of securities/shares of publicly traded companies. Special features of LLS scheme are:

– Loans ranging from Tk.100,000 to Tk.10,000,000

– No additional security.

– Simple and quick processing.

– Flexible disbursement and repayment.

MFL started LLS scheme in 22nd December 2005. MFL LLS scheme is a fully risk less scheme and now it is becoming very popular day by day.

Term Deposit

Under the guideline of Bangladesh Bank, MFL receives term deposit from individuals and institutions at attractive rates of interest. The rapidly growing MFL offers an excellent opportunity of secure investment with superior return to individual and organizational investors under its investment scheme. MFL started this scheme to solve liquidity problem. Anyone has surplus fund and are interested in secure investment with superior return, he / she can easily invest his / her fund under this scheme in MFL.

Main features of this scheme are:

- Fund received under an agreement.

- Period of investment is 1 year for an individual and 6 year in case of institution (automatically renewable).

- Rate of return at 13% per annum.

- Payment of return- Half yearly and instant on the due date.

Investment in Securities

As part of diversification of its operation MFL has decided to operate in the capital market by investing in shares and securities both in the Primary market and Secondary market. This investment will help develop capital market as well as Increase Company’s earning and profitability.

Objectives of Investment in Capital Market: MFL should decide upon capital investment objectives before buying securities. Different organizations have different objectives to invest in capital market. For the organizational investors, perhaps one goal should be not to get rich, but rather to make a sensible return investment. There may be other objectives as well. The following are possible investment objectives of the investor: Liquidity, Income or yield, Capital gains, Security or principal, and Hedging inflation.

MICRO CREDIT AND INVESTMENT PRACTICE

What is Micro Credit

“Micro credit” is the name given to extremely small loans made to poor borrowers. A typical micro credit scheme involves the extension of an unsecured, commercial-type loan at interest to a poverty stricken borrower. The definition of poverty stricken varies with the situation, but in Bangladesh the typical definition is a borrower who owns less than 0.5 acres of land and relies on wages for all income. Loans are disbursed in a group setting to poor borrowers, with some amount of non-credit assistance also being made available. The non-credit assistance typically ranges from skills training to marketing assistance to lessons in social empowerment. (Khander, 1998).

Extremely small business ventures, such as those financed with micro credit loans, are known as micro enterprises. Micro enterprise clusters are simply groups of micro enterprises located in close proximity to one another and engaging in similar business activities. Clustering can either arise spontaneously, or as a result of outside encouragement from government or NGO’s.

According to Oxfam, micro credit consists of “very small scale financial services, including savings, loans for emergencies, day-to-day living, and investment in productive activities”. Credit is usually provided to groups of individuals or village organizations that use joint-liability to enforce loan repayment. The word “micro credit” did not exist before the seventies. Now it has become a buzz-word among the development practitioners.

Definitions differ, of course, from country to country. Some of the defining criteria used include-

- size- loans are micro, or very small in size

- target users- micro entrepreneurs and low-income households

- utilization– the use of funds – for income generation, and enterprise development, but also for community use (health/education) etc.

- terms and conditions– most terms and conditions for micro credit loans are flexible and easy to understand, and suited to the local conditions of the community.

Micro credit has proven an effective and popular measure in the ongoing struggle against poverty, enabling those without access to lending institutions to borrow at bank rates, and start small business.

The key implications of micro credit are in its name itself: ‘micro’. A number of issues come to mind when ‘micro’ is considered: The small size of the loans made, small size of savings made, the smaller frequency of loans, shorter repayment periods and amounts, the micro/local level of activities, the community-based immediacy of micro credit etc. Hence micro credit is not the solution, but is a menu of options and ennoblement, that has to be put together based on local conditions and needs.

Essential Features of Micro Credit are:

- It promotes credit as a human right.

- Its mission is to help the poor families to help themselves to overcome poverty. It is targeted to the poor, particularly poor women.

- It is offered for creating self-employment for income-generating activities and housing for the poor, as opposed to consumption.

- It was initiated as a challenge to the conventional banking which rejected the poor by classifying them to be “not creditworthy”. As a result it rejected the basic methodology of the conventional banking and created its own methodology.

- Loans can be received in a continuous sequence. New loan becomes available to a borrower if her previous loan is repaid.

- All loans are to be paid back in installments.

- Simultaneously more than one loan can be received by a borrower.

- It comes with both obligatory and voluntary savings program for the borrowers.

In the Context of Microfinance

In 1998 the number of people around the globe having a daily income of US $1 reached 1.2 billion. A year later 4.5 billion people (nearly 75% of the world population) have been living in countries with low income. Out of them 2.4 billion had an average per capita income of US $410 and further 2.1 billion men has been living in countries with a per capita income of US $1200.

In developing countries the majority of the people have a lack on capital and savings what results in the impossibility to get self-employed and make productive activities. To close this gap micro finance has been installed to support those poor people and enabling them to get access to capital and to get more independent. Especially those small and micro-entrepreneurs constitutes a significant percentage of economic activities, particularly in those countries where the agricultural sector is important and is the main income resource.

Bangladesh is probably the country with highest population density where job opportunity is very small. Unemployment rate is approximately 40%. Population living below the poverty line is 36%. Therefore, it is the prime concern for the nation to generate income through creation of job opportunity and employment. Creation of job opportunity at large scale is not possible. A tool for helping the people to get self-employed can be financial support. Many small and medium entrepreneurs in the country have innovative ideas, spirit and potentiality to do something productive for local consumers as well as to export abroad.

The definition of microfinance often includes both financial intermediation and social intermediation. Micro-finance is not simply banking but it is a development tool. Micro-financing activities usually involve:

- Small loans, typically for working capital.

- Informal appraisal of borrowers and investments.

- Collateral substitutes, such as group guarantees or compulsory savings.

- Access to repeat and larger loans, based on repayment performance.

- Streamlined loan disbursement and monitoring.

- Secure saving products.

Compulsory savings are useful

- to demonstrate the saving value to the borrowers,

- to serve as an additional guarantee mechanism to ensure the repayment of loans,

- to demonstrate the ability of clients to manage cash flow and make periodic contributions (is important for loan repayment) and

- to build up the asset base of clients.

Referring to the World Bank the collection of savings is an important part of the credit operation. “By reducing daily consumption and controlling unnecessary expenses whatever amount can be saved for future investment is called savings.” Furthermore during long time observation it is proven that “credit operation has shown that savings regularly tend to be disciplined in credit and others activities” and following is “an important indicator of the ability to pay back loans”. Savings can enable the borrower a special kind of life security and are an additional asset what can also used for further investment.

Micro Financing Institutions (MFI)

MFI’s are usually NGOs, credit unions, private commercial banks, state-owned banks, etc. who offer financial services to the poor. Their clients are self-employed entrepreneurs with low income in rural and urban areas like traders, street vendors, small farmers, hairdressers, etc. with a stable but low income.

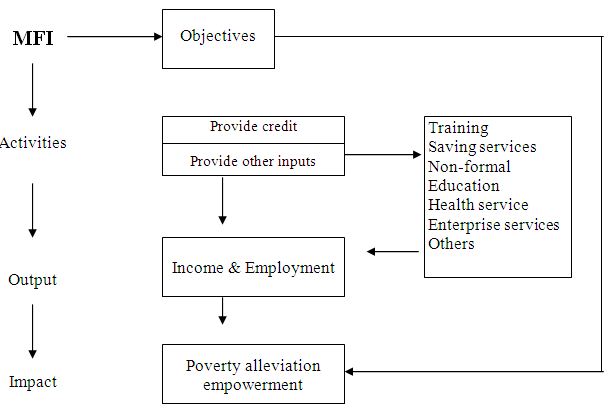

The circle of micro-finance: Below a simple diagram represents the circle of micro-finance. The main objectives of MFI’s are without doubt the poverty alleviation and the empowerment of the people. The activities and tools to achieve that is the provision of micro-credit. However, those inputs only define the product microfinance. More insurance, enhanced personal skills and entrepreneur development result in higher business success. Finally, the enterprise receives more income and can employ more people. If the policy and strategy including the service of the MFI works well, the impact should coincide with the objectives namely reaching the aim of poverty alleviation. Besides the positive effects for the enterprise, the MFI can have further profits like taking subsequent loan by the entrepreneur or good recommendations, etc.

Diagram 2: The links of objectives, activities and impact of micro financing institutions

The Impact of Microfinance in General

There is a significant difference between the increase of income and reduction of poverty. Poverty is neither linear nor static. A not so poor person today can easily belong to the group of very poor people tomorrow. The reverse case is also possible.

In the year 1997 Hulme and Mosley wrote:

“There is clear evidence that the impact of a loan on a borrower’s income is related to the level of income….This finding should not unexpected given that these with higher income have a greater range of investment opportunities, more information about market conditions and can take more risk than the poorest households without threatening their minimum needs for survival.”

The Evolution of Micro Credit in Bangladesh

After liberation of Bangladesh in 1971 a high number of landless households without asset had little or no access to formal credit for self-employment. For that reason there was a demand of a strategic shift in the development policy of the country. In March 1976 the government of Bangladesh undertook a project to provide collateral free credit to small farmers and landless labourers through Janata Bank. This initiation came into progress under the name “Action-cum-Research Project on Small Farmers and Landless Labourers” what turned later on into the Small Farmers Development Project (SFDP) which was supported by UNDP through FAO.

Later on was “The Grameen Bank Project (GBP) taken up for experimentation based on the Zobra village experiences of Prof. Yunus on a limited scale by involving the NCBs for financing the landless poor by organizing them into groups for certain Income Generation Activities. The operation started in 1979 in 2 thanas namely Chittagong and in Tangail district. Through its success, the project was expanded to ten Swanirvar thanas under the supervision of GBP office of the Bangladesh Bank. In 1983 Grameen Bank was established under an ordinance passed in parliament.

With the time, many large NGOs introduced similar loan programs all over the country. Small NGO’s got supported by domestic and foreign donor agencies to be capable offering the package as well. With the growing success of micro-finance in Bangladesh many foreign institutions have overtaken the approach in their programs.

The World Bank estimates that there is a potential market for micro-enterprise credit at a state of 100 million clients worldwide. Out of all those markets around the globe the microfinance sector in Bangladesh is maybe the most diverse sector. The four largest MFI’s are Grameen Bank, BRAC, ASA and PROSHIKA.

The Transition from Micro Credit to Micro Enterprise Financing

Income Generating Activities belong to the informal sector being usually not self-sustainable. The other sector players like small and medium enterprises but also the large-scale industries are mainly profit-orientated and concentrate on maximizing their profit and expanding their business. The micro-enterprise itself belongs not really to the informal but also not to the formal sector. It is more or less on the jump to the formal sector through graduating from the informal sector especially through getting micro-credit in former years. When they reached the self-sustainable level and need more money to expand their business, there was in the last year a lack of financial support.

Mainstream financial institutions (the commercial banks) are incapable of servicing the micro enterprise at a cost only covered by the interest charge, and with confidence in the intent and ability of the borrower to repay. The classical methods employed by the commercial banks are clearly too expensive to make loans of such small amounts and of such short duration, commercially viable.

They can generate income and contribute to the GDP. They may also provide employment to other people. Development and growth of Small and Medium Enterprises is vital for national financial support because they have no access to institutional credit facilities, as they cannot provide collateral security as demanded for such credit facility.

Micro Enterprise Financing

Norma1ly, no general definition is available for this type of enterprises. It varies from country to country but also between the different financing institutions.

Definition

Whatever in the last years was said, from all different views crystallized some key points of describing a micro enterprise

1) 10 or less employees; often family members

2) Some capital assets, often under USD 1,000

3) Often located in the home or yard

4) Predominant activities: Retail, services, processing and manufacturing; usually the operational sectors are traditional ones.

5) Where total bank investment is limited to Tk. 600,000.

6) Location: Both rural and urban.

7) Characteristics:

• Limited equity & some collateral

• Some technical skills

• Very limited access to credit (especially formal)

• Some machinery and equipment

• Limited use of power

• No modern management

• Weak marketing, which is usually oriented to the local markets

• Low value added

• Labor intensive

• Obtains its products locally

• No paper recording system

8) Over 75% of the micro enterprises are under individual ownership. Of the others most are under family ownership and very few are under partnerships or limited companies.

9) Local areas are the most important markets for the products of micro enterprise, followed by neighbouring areas and urban markets.

10) Does not follow labor laws like minimum wage and good working conditions (sometimes also employs children).

A problem for the micro-enterprise is that it belongs neither to the non-formal nor to the formal sector. On the one side the commercial banks concentrating only on the medium and large sized industry and on the other side the NGOs supporting only the poor and hardcore poor. Between these two sectors the informal and the formal there is still a gap in financing even when the situation is improving in Bangladesh.

Micro-enterprise programs go to predictable stages of growths from initial introduction, to expansion and ultimately to sustainable operations. Those programs are designed to provide credit and non-financial services to large segments of a market that is currently not served by the formal banking system.

Problems for Micro Enterprises

Collateral is technically not effective but psychologically important. Technically collateral is for lower amount ranges of micro-enterprise financing counterproductive because if the borrower is unable or unwilling to repay his duties then the necessity for the MFI arises to go to court. It is practically proved that open a lawsuit can end in a long process over years at the court what satisfies none of the two parties and is accompanied by lot of costs. Furthermore, the lower courts in Bangladesh are after the police the second highest corrupted institution. Surveys have shown that 73% if such courts charge bribe.

More important of demanding collateral is the fact that it is very time consuming for the entrepreneur to prepare all necessary documents and for the MFI to collect, control and review them. When collateral is asked then it takes 2-3 additional months whereas without the process can be done within some days.

In short, it should be mentioned that graduated enterprises also often have problems to bring their products, which are not produced anymore only for the daily purpose, to the markets especially when the enterprises are located on the countryside. Those people have a further problem caused by missing infrastructure and the lack of transport facilities. We can refer this to a geographical gap. That let think the bigger NGO’s and banks to open a branch in such locations.

Development in Bangladesh

MIDAS financing limited started the Micro Enterprise Development Initiative (MIDI) in July 1993 with the pioneer role in micro enterprise financing for a specific group of entrepreneurs who has neither financial access to NGOs nor to banks. Some other programs followed by the big NGO’s like BRAC and PROSHIKA. Recently the banks establish more and more programs to attract these target groups. The one reason is that the government of the Republic of Bangladesh puts pressure on the banks and besides there is a high competition on the banking sector for medium and large enterprises that is why banks have to diversify and extend their product line.

Other NGOs like Resource Integration Centre (RIC) or Shakti Foundation now established micro enterprise cells in order to be capable to give further support to their members. Also new banks will enter this finance sector. For instance Southeast Bank Limited has planed to launch with begin of July 2003 a micro enterprise financing program. Through the upcoming expansion to the countryside of the bank with new subsidiaries, the focus of this program will concentrate on the rural and the agro-processing areas.

MIDI PROGRAM

MIDI is a special credit program of MFL. Under this program short-term and medium term loans are provided for establishment / expansion of small and micro enterprises on easy terms.

Mission

To generate sustainable employment opportunities by promoting the development of small and micro enterprises.

Objectives

- Promote entrepreneurship development.

- Finance micro enterprise.

- Develop entrepreneurial skills and assist business growth.

- Encourage entrepreneurs to set up new business venture.

- Serve or retain the existing work force or micro enterprises.

- Create new employment opportunities.

- Develop entrepreneurial skills among women entrepreneurs and encourage them to set up new ventures.

Terms and conditions of the loan are:

- The loan size is Tk. 50,000 to Tk. 1,000,000.

- Total Project Cost is Tk. 10 million (maximum).

- Debt- Equity ratio is 80:20 (maximum).

- Service Charge is 16.78% per annum (simple) on the basis of reducing balance method.

- Rebate for timely repayment of loan is 5% of service charge.

- Loan repayment period is 1 to 4 years.

- Project implementation period is 3 months (maximum).

- Loan processing time is 15-30 days.

- Mode of repayment: monthly installments.

- Project appraisal fee is 1% of the loan amount for new loans and 0.5% for repeat loans.

- Provision of loan for- Working capital and Fixed capital.

- Loan application fee is Tk.100 (non refundable).

Security

- Personal guarantee of the sponsor

- Third Party guarantee from a person acceptable to MFL.

- No collateral security is needed upto Tk. 750,000

Loan Processing Costs

| Application fee | Tk. 100 (non refundable) |

| Loan Application Fee | 1st loan: 1%, Repeat loan: 0.5%, Additional loan: 1% of sanctioned loan. |

| Legal Fee | NIL |

| Documentation Fee | NIL |

Eligibility for Credit Facilities

| Age of the entrepreneur | 25-60 years |

| Educational background of loanee | Ability to sign |

| Experience of loanee | N/A |

| Existence of business | At least 2 year |

| No. of engaged employees | N/A |

| Net annual income | N/A |

| Type of clients | Individuals |

| Type of enterprise | Existing enterprises |

| Provision of subsequent loan by |

|

| Other requirements of selection | List of clients |

Statistical Facts:

At the start of the program, the women rate of entrepreneurs under the umbrella of the MIDI program was only at the rate of 3%. During the time the rate climbed up to 14% with further increasing tendency.

| Women rate of loanees | 14% |

| Recovery rate | 95% |

| Legal status of enterprise: Proprietorship Partnership | 99% 1% |

| Operating places: Urban | 100% |

MIDI is a very popular scheme of MFL. Most of the clients of MIDI are women entrepreneurs who are the owners of different innovative enterprises.

MARKET ANALYSIS

Business Performance

Table 3: Business performance of MIDAS Financing Limited

Particulars | Unit | Year | ||||

2005 | 2006 | 2007 | 2008 | 2009 | ||

| Loan/ Lease/ Investment Portfolio | No. | 2415 | 2587 | 2345 | 2290 | 2549 |

| Million/Tk. | 627.72 | 1026.41 | 1272.62 | 2020.31 | 2388.63 | |

| Amount Disbursed | Million/Tk. | 423.38 | 706.93 | 744.59 | 1272.43 | 1128.45 |

| Amount Recovered | Million/Tk. | 315.57 | 424.13 | 545.55 | 729.87 | 1117.04 |

| Deposit Received | Million/Tk. | 171.63 | 175.70 | 321.00 | 297.85 | 33.85 |

Explanation: The above diagram is showing the business performance of MIDAS Financing Limited. We can see that the company’s business performance is good in all areas. Its Loan/ Lease/ Investment portfolio is increasing at a rapid rate. Amount of disbursement is decreased in 2009 and recovery shows increasing trend over the periods, which is a good sign of managing their portfolio. Although collection of deposit was increasing from 2005 to 2008, it decreased in 2009

Business Performance of MIDI Program

Table 4: Business performance of MIDI Program

Taka in Million

Particulars | Year | ||||

2006 | 2007 | 2008 | 2009 | 2010 | |

| Portfolio | 132.77 | 128.60 | 149.50 | 294.60 | 516.28 |

| Disbursement | 82.35 | 66.60 | 97.15 | 248.94 | 497.00 |

| Recovery | 75.08 | 94.00 | 92.98 | 130.00 | 261.88 |

Explanation: The above diagram is showing the business performance under MIDI Program of MIDAS Financing Limited. Its investment portfolio is increasing over years, although decreased in 2007. Although amount of disbursement is fluctuating over years, it is highest in 2009. Amount o recovery is increasing over years under MIDI program.

Project Analysis of MIDI Program

Table 5: Performance report of MIDI Program for year 2009 and 2010

Sl | Particulars | Year | Increase (Decrease) in % | ||

2009 | 2010 | ||||

1 | Application Form Sold (No.) | 1198 | 1520 | 78.82% | |

2 | Application Form Received (No.) | 971 | 1380 | 70.36% | |

3 | Application Fees Received (Tk.) | 119,800 | 152,000 | 78.82% | |

4 | Project Developed (No.) | 787 | 1210 | 65.04% | |

5 | Project Approved (No.) | 738 | 1150 | 64.17% | |

6 | Appraisal Fees Received (Tk.) | 2,660,000 | 3,240,000 | 98.52% | |

7 | Loan Sanctioned (Tk.) | 259,550,000 | 312,000,000 | 83.19% | |

8 | Fund Disbursed (Tk.) | 248,940,000 | 497,000,000 | 50.09% | |

9 | Project Financed (No.) | 677 | 1,100 | 61.55% | |

10 | Loan Recovery | ||||

| a) Principal (Tk.) | 98,470,000 | 200,600,000 | 49.09% | ||

| b) Service Charge (Tk.) | 31,530,000 | 61,280,000 | 51.45% | ||

| Total (Tk.) [a+b] | 130,000,000 | 261,880,000 | 49.64% | ||

11 | Total Income (Tk.) [3+6+10b] | 34,740,000 | 64,672,000 | 53.71% | |

12 | Portfolio Amount | 294,600,000 | 512,852,625 | 57.44% | |

Explanation: The above table compares last two years performance of MIDI Program. The company sold 1198 application form in 2009 and 1520 application form in 2010. So number of application form sold increased by 78.82% than previous year. As higher number of application form sold in 2010, company received higher application fees in 2010; and application fees increased by 78.82%. In 2009, company developed 787 projects and approved 738 projects. In 2010, company developed 1210 projects and approved 1150 projects. Amount of appraisal fees received, loan sanctioned, fund disbursed increased. Company recovered 130.74 million taka in 209 and 261.88 million taka in 2010. Total income under MIDI Program is increased by 53.71% in 2008. Company’s investment portfolio is increased by 57.44%.

Sub-Sector Wise Distribution of MIDI Projects

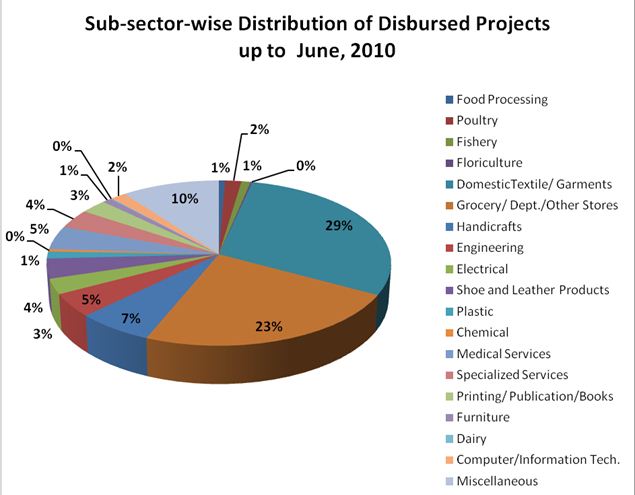

Table 6: Sub-sector-wise Distribution of Disbursed Projects up to June, 2010

Sl.No. | Sub-Sector | No. of Projects | % of Total | No. of Classified Project | % of Classified Projects | Clasified Projects as% of Total Projects | |

1 | Food Processing | 31 | 0.64% | 4 | 2% | 0.08% | |

2 | Poultry | 83 | 1.71% | 1 | 0% | 0.02% | |

3 | Fishery | 46 | 0.95% | 0 | 0% | 0.00% | |

4 | Floriculture | 9 | 0.19% | 0 | 0% | 0.00% | |

5 | DomesticTextile/ Garments | 1427 | 29.40% | 61 | 25% | 1.26% | |

6 | Grocery/ Dept./Other Stores | 1132 | 23.33% | 68 | 28% | 1.40% | |

7 | Handicrafts | 317 | 6.53% | 16 | 7% | 0% | |

8 | Engineering | 221 | 4.55% | 11 | 5% | 0.23% | |

9 | Electrical | 145 | 2.99% | 5 | 2% | 0% | |

10 | Shoe and Leather Products | 188 | 3.87% | 9 | 4% | 0.19% | |

11 | Plastic | 66 | 1.36% | 3 | 1% | 0% | |

12 | Chemical | 24 | 0.49% | 6 | 2% | 0.12% | |

13 | Medical Services | 223 | 4.60% | 8 | 3% | 0.16% | |

14 | Specialized Services | 182 | 3.75% | 18 | 7% | 0.37% | |

15 | Printing/ Publication/Books | 132 | 2.72% | 5 | 2% | 0% | |

16 | Furniture | 47 | 0.97% | 1 | 0% | 0.02% | |

17 | Dairy | 7 | 0.14% | 0 | 0% | 0% | |

18 | Computer/Information Tech. | 78 | 1.61% | 7 | 3% | 0.14% | |

19 | Miscellaneous | 495 | 10.20% | 21 | 9% | 0.43% | |

| Total | 4853 | 100% | 244 | 100% | 0.52% |

Figure 3: Sub-sector-wise Distribution of Disbursed Projects up to June, 2010

Explanation: Table 6 is showing the number of approved projects in different sub-sector under MIDI Program up to June 2010. It also shows the percentage of total approved projects in different sub-sector.

From the above graph, it is observed that Domestic Textile/Garments sector takes the major position in the portfolio of MIDI projects, which possesses 29.40% of the total portfolio. The reason behind this position is higher demand and good repayment performance of this sector. After Garments sector, Grocery/Departmental/Other Stores consist 23.33% of the total portfolio as most of the small entrepreneurs in Bangladesh are engaged in retailing and wholesaling business. Floriculture sector posses the lowest percentage (0.19%) of portfolio in the MIDI projects. The reason might be that MIDI’s loan portfolio targets the urban sector but most of the agro-based industries are located at rural areas.

Investment

Table 7: Investment Practice of last two year

Taka in Million

Sl# | Schemes | 2009 | 2010 | % Increase (Decrease) |

1 | Term Finance | 1311.77 | 2255.88 | 58.15% |

2 | Lease | 450.87 | 739.92 | 60.93% |

3 | CCS | 5.64 | 5.41 | -4.08% |

4 | Housing | 280.54 | 397.82 | 70.52% |

5 | LLS | 84.85 | 266.62 | 31.82% |

6 | Investment in Securities | 146.10 | 274.35 | 53.25% |

Total Taka | 2279.77 | 3940 | 70.89% | |

During the year under report, the Company achieved remarkable progress in its operation compared to the previous year. Investment under Term loan, Lease, Housing loan, LLS and Securities are increased. But CCS schemes decreased.

FINANCIAL STATEMENT ANALYSIS

Basis of Accounting

The Financial Statements have been prepared in accordance with the Companies Act 1994, Bangladesh Accounting Standard (BAS), the Financial Institution Act 1993, Securities and Exchange Commission Rules 1987 and all other relevant rules & laws applicable for the Company. The accounting policies have been consistently applied for preparation of the Financial Statements.

Financial Performance- At a Glance

Table 8: Financial performance of MIDAS Financing Limited of five years

Financial Performance | Year | ||||

2006 | 2007 | 2008 | 2009 | 2010 | |

| Shareholders Equity | 322.12 | 372.11 | 439.80 | 494.63 | 657.30 |

| Paid-up capital | 258.68 | 284.55 | 313.00 | 352.13 | 404.63 |

| Total Assets | 1,104.82 | 1,468.93 | 2,238.72 | 2,648.30 | 4,127.16 |

| Income | 135.14 | 185.80 | 325.13 | 335.78 | 513.88 |

| Expenditure | 100.38 | 98.52 | 213.02 | 227.66 | 285.00 |

| Net Profit Before Tax | 36.04 | 93.03 | 125.32 | 108.12 | 228.89 |

| Net Profit After Tax | 35.36 | 55.16 | 81.92 | 70.48 | 171.47 |

| Net Asset value per Share | 125.00 | 131.00 | 141.00 | 141.00 | 162.32 |

| Earning Per Share (EPS) | 13.67 | 19.39 | 26.17 | 20.02 | 42.34 |

| Dividend (%) | 12.00 | 15.00 | 17.50 | 17.5 | 35 |

Common Size Statement Analysis

Common Size Statements are used to standardize financial statement components by expressing them as a percentage of relevant bases. For example, balance sheet components can be shown as a percentage of total assets, and revenues and expenses can be computed as a percentage of total sales or revenues. Table 9 and Table 10 shows the actual balance sheet and common size balance sheet of the company of last five years, and Table 11 and Table 12 shows the actual income statements and common size income statements of the company of last five years. The scaling factors are total assets for the balance sheet and operating revenue for the income statements.

Table 9: Five Years Balance Sheet of MIDAS Financing Limited

Comparative Balance Sheet | Amount in Taka | ||||

Particulars | 2006 | 2007 | 2008 | 2009 | 2010 |

| Current Assets: |

|

|

|

|

|

| Cash and Cash Equivalents | 160,553,245 | 42,592,111 | 99,411,029 | 63,141,914 | 42,182,187 |

| Marketable Securities | 41,881,091 | 60,240,372 | 70,337,799 | 141,796,624 | 145,100,160 |

| Accounts Receivables | 27,781,698 | 36,878,996 | 101,747,911 | 161,317,101 | 184,973,217 |

| Advance, Deposit and Prepayment | 7,488,500 | 4,443,952 | 6,786,602 | 16,347,184 | 108,852,171 |

| Stock of Stationery & Office Materials | 136,289 | 52,157 | 89,532 | 54,673 | 159,473 |

| Current Portion of Lease Assets | 13,184,360 | 15,005,132 | 218,645,073 | 204,379,024 | 157,149,227 |

| Current Portion of Loan | 0 | 154,323,111 | 123,497,155 | 278,499,367 | 433,653,727 |

Total Current Assets | 251,025,183 | 313,535,831 | 620,515,101 | 865,535,887 | 1,072,070,162 |

| Application of Funds: | |||||

| Fixed Assets | 13,830,616 | 15,474,928 | 64,164,169 | 87,044,417 | 105,513,370 |

| Investments | 584,658,621 | 775,812,726 | 784,246,710 | 1,286,135,077 | 14,69,442,797 |

Total Fixed Assets | 598,489,237 | 791,287,654 | 848,410,879 | 1,373,179,494 | 1,574,956,167 |

Total Assets | 849,514,420 | 1,104,823,485 | 1,468,925,980 | 2,238,715,381 | 2,647,026,329 |

| Current Liabilities & Provisions: | |||||

| Call Loan | 0 | 0 | 70,000,000 | 0 | 100,000,000 |

| Accounts Payable | 7,450,788 | 6,593,812 | 12,038,109 | 29,571,400 | 10,880303 |

| Currents Portion of Loans | 20,788,211 | 166,798,535 | 212,040,158 | 356,630,286 | 458,845,797 |

| Advance, Deposit and Prepayment | 34,532,618 | 41,715,833 | 42,564,852 | 32,268,684 | 28,742,136 |

| Provision for Taxation | 4,100,000 | 4,782,000 | 40,309,234 | 83,709,234 | 121,350,471 |

| Provision for Other Finance | 10,486,294 | 46,057,490 | 53,342,524 | 103,232,319 | 125,381,067 |

| Provision for Income Suspense | 0 | 7,116,898 | 15,746,199 | 28,584,540 | 36,679,437 |

Total Current Liabilities | 77,357,911 | 273,064,568 | 446,041,076 | 633,996,463 | 881,879,211 |

| Long Term Loan & Term Deposit: | |||||

| Loan Fund | 309,059,018 | 333,933,757 | 329,766,756 | 546,058,840 | 685,511,976 |

| Term Deposit | 171,630,000 | 175,703,000 | 321,005,500 | 618,854,274 | 585,001,266 |

Total Long Term Liabilities | 480,689,018 | 509,636,757 | 650,772,256 | 1,164,913,114 | 1270,513,242 |

Total Liabilities | 558,046,929 | 782,701,325 | 1,096,813,332 | 1,798,909,577 | 2,152,392,453 |

| Shareholders Equity: | |||||

| Share Capital | 235,162,400 | 258,678,600 | 284,546,500 | 313,001,100 | 352,126,200 |

| Statutory Reserve | 22,337,589 | 29,409,172 | 40,441,984 | 56,826,080 | 70,921,705 |

| Proposed Dividend | 28,219,488 | 31,041,432 | 42,681,975 | 54,775,192 | 61,622,122 |

| Retained Earnings | 5,748,014 | 2,992,956 | 4,442,189 | 15,203,432 | 9,962,848 |

Shareholders Equity | 291,467,491 | 322,122,160 | 372,112,648 | 439,805,804 | 494,633,876 |

Total Liabilities & Equities | 849,514,420 | 1,104,823,485 | 1,468,925,980 | 2,238,715,381 | 2,647,026,329 |

SWOT ANALYSIS

It is evitable for a company to analyze the strength & weakness of its products and its position on the market. Furthermore it is also important to analyze the company’s structure itself. Here I tried to list these points demonstrating strengths, weaknesses, opportunities and threats of MIDI and MFL at the current time.

Strength

- Big loan range is an asset.

- Most of the clients of MFL are repeat borrowers which is an indication of customer’s satisfaction.

- Maximum amount of first loan is attractive for new entrepreneurs coming from other financial institutions.

- High rebate on interest that ensures and enforces the loanees to show a good repayment performance and is also an asset of promotion.

- Special focus on women.

- Excellent recovery rate.

- Incentive for good repayment performance.

- Loan process of MIDI is very easy and consumes little time.

- MFL is self sufficient and not dependent on any other organization. Self reliant MFIs are better able to maintain theirs identity, autonomy and mission.

- Excellent interpersonal relationships of MFL staffs.

- Excellent training for low fee for the clients.

Weakness

- Low and old technical facilities.

- Low number of staff what makes it difficult to expand new markets and supervises an increasing number of clients.

- Growth rate of financial project is very low in MIDI.

- MIDAS is even not known or well known by every bank (or their officers).

- Rate of women entrepreneurs is not satisfactory.

- The MIDI program has no special futures. Most of the banks have various credit programs with sector or area concentrated futures and priorities for their target groups.

Opportunity

- SME sector is a flourishing sector in our country. The size of SME sector is increasing at a rapid rate which reveals the future potential demand of this sector.

- Government is adopting favorable MSME policy to boost up this sector. For instance, EEF is being provided to agro based and IT sectors. MFL also enjoys the benefit of refinancing for providing loan to the MSME sector.

- Default culture is lower in MSME than that of corporate and industrial loan although most of the micro enterprise financing is collateral free.

- MFL is managing collateral free loan portfolio very effectively which would ultimately attract the new clients to be a prospective loanee of MFL.

Threat

- Banks are concentrating in SME sector realizing the potentiality of this sector which evokes massive competition in this sector.

- Local co-operative institutes are also very much active in this sector.

- Central bank is not aware of informal loan information. For this reason, the current status of borrowers can not be properly assessed.

- As bank, non bank and other co-operative institutions are competing among others through extending the disbursement of loan, it wound increase default culture.

- Complexity in legal procedure creates difficulties in solving the dispute as the loan is completely collateral free.

FINDINGS

Major Findings

Here, I have summarized the findings of this report in pointing out what can or has to be by the MIDI program of MIDAS Financing Limited.

- MFL is a public limited company.

- MFL has a remarkable reputation in the market.

- MFL has a wide distribution channel all over the country.

- Environment is customer friendly.

- MFL does not go for aggressive in sales and marketing strategy.

- MFL do not have separate sales forces to approach the potential customers.

- MFL does not have a marketing plan in a broad aspect.

- Most of its customers are referred by the current customer.

- Brochure of MIDI program is out dated.

- MFL yet approach most of the corporate customer.

- Advertisement and media communication are hardly seen to communicate the offer of MFL.

- There is no separate marketing department.

- Management is efficient, experienced and highly qualified.

- Business growth is high.

- Advertisement and media communication are hardly seen.

- Brand name of MIDAS provides some extra value to MFL.

- Cost of fund is high in NBFI in compare with bank.

RECOMMENDATION

Recommendations

I would like to recommend the following points-

The program

- Cost & time can be saved through using advanced management information system.

- No necessity to go down with the minimum ceiling.

- Incentive system for Extension officers: providing bonuses for maintaining high repayment rates and new client growth. Give loanee feeling that you care about him personally, not only as client.

- Improve the selection process. This is the most essential point in having clients with excellent repayment performance in the future.

- Expanding MIDI Program in other areas, the focus should be set to urban and sub-urban areas (like Sylhet or Rajsahi). When MFL is located primarily in several big and smaller cities, at the same time it also covers some of the rural areas. In near future the rural will be more effective but it needs time to have those areas developed gradually (mostly those entrepreneurs take micro-credit). But it is too risky to expand rural areas at a time.

- Of course the concentration should lie on the biggest growing areas and the potential enterprise development. It should not be forgotten at which areas the competitors are located.

- Attract the clients to make voluntary savings. That gives them the possibility to have investment capital at the end of the repayment phase.

- Prepare a questionnaire for the loanees for beneficiaries to evaluate the whole MID1 loan process at the end of the repayment phase. Usable may be given which enables MFL to understand easier the problems and obstacles for the entrepreneurs. Besides during meetings with the clients also it can be talked about program related problems or improvements. Extend the target group to other sectors; also new programs can be initiated through which new target groups can be reached. The MIDI program can also be divided into sub-programs.

- New programs can be started depending on the location.

- Diversification of the product should be a must as well as the expansion to other places because as we have seen the micro-enterprise sector attracts more interest by government, World Bank, foreign institutions, banks and NGOs, Commercial banks have the advantage of a wide branch network and that the credit scheme is one of many.

- More detailed analysis should be done by the MIS (Management Information System) in order to study more detailed the developments, strengths and weaknesses of the lending performance. For examples: percentage of borrowers concerned to the amount of loan, percentage of the location of the borrower enterprises, percentage of the sick projects or overdue products related to the loan range.

- Organize awareness through workshops

Promoting Organizing events

- Organizing interesting or unusual activities— fairs, public information desk by big public events.

- Intensify the promotion for women through women’s organizations (like WEA or WEB)

- Intensify the cooperation with newspapers, radio, television, etc.

- Strong personal contact with the client and good experiences of the borrower with the MIDI program will lead the clients to recommend the program.

- When a client is a new borrower of MIDI then s/he should be asked how s/he got informed about MFL. (Can I really broach the target group with my advertisements? Which promotion techniques are more effective?).

Conclusion

Before seventies Bangladesh was suffering from the curse of poverty. People were not conscious for the education and health. After the liberation war, when the micro credit was introduced by some NGOs then the poverty level was reduced successfully. Micro credit is increasingly promoted not only as a positive rural development intervention, but in some instances as a rural development panacea. The rise of new-liberalism has facilitated a distorted perspective of the prospects and possibilities of micro finance as a rural development intervention. The promotion of micro enterprise financing as a rural development intervention has tied in neatly with new development ideology. It develops new markets and promotes a culture of entrepreneurship. The provision of micro credit is necessary but not sufficient factor in ensuring the success of micro enterprise. Sufficient infrastructure, skilled entrepreneurs, access to information and culture conductive to micro enterprise are necessary conditions for the success of micro enterprise.