INTRODUCTION:

The report is a prepared as pert of practical orientation of MBA program a description of all activities done by Pubali Bank, Principal Office. The report is lively narration of various banking activities like General Banking, loans and advance management and foreign trade financing and other ancillary services.

Significance of the study:

Federal and state laws have placed many new requirements concerning hiring and employment practices on employers. Jobs have also changed. They have become more technical and require employees with greater skills. Furthermore, job boundaries are becoming blurred. In the past, a worker performed a job in a specific department; working on particular job tasks with others who did similar jobs. Today’s workers are just as likely, however, to find them working on project teams with various people from across the organization. Others may do the majority of their work at home –and rarely see any of their coworkers. And, of course, global competition has increased the importance of organizations improving the productivity of their work force. This has resulted in the need for HRM specialists trained in psychology, sociology, organization and work design, and law. Federal legislation requires organizations to hire the best-qualified candidate without regard to race, religion, color, sex, disability, or national origin—and someone has to ensure that this is done. Employees need to be trained to function effectively within the organization—and again, someone has to Oversee this. Furthermore, once hired and trained, the organization has to provide for the continuing personal development of each employee. Practices are needed to ensure that these employees maintain their productive affiliation with the organization. The work environment must be structured to induce workers to say with the organization, while simultaneously attracting new applicants. Of course, the “someone’s” we refer to, those responsible for carrying out these activities, are human resource professionals. Today, professionals in the human resources area are important elements in the success of any organization. Their jobs require a new level of sophistication that is unprecedented in

human resource management. Not surprisingly, their status in the organization has also been elevated. Even the name has changed. Although the terms personal and human resource management are frequently used interchangeably, it is important to note that the two connote quite different aspects.

Once a single individual heading the personnel function, today the human resource department head may be a vice president sitting on executive boards, and participating in the development of the overall organizational strategy.

The real Benefited teams to this Human resource practice are as below

- Bank

- Students

- Researcher

- Country as a hole

For preparing this report that was assigned to the Pubali Bank Ltd.As an internee. During the internship period the collection of information from different sources.

I have used both qualitative and quantitative method for teaming up the data and information collected through primary and secondary sources. This study followed some methodology to find out the fact and feature of the Bank which are given as follows:

To conduct the study follows methodology were used

Such as : 01. Primary source and

02. Secondary source

Primary sources:

To collect the primary data were used a structured questionnaire and interview 30 officer 15excutive

Secondary sources:

It includes annual report, general report, investment manual, general, general banking manual, selected books, journals and other publication etc

Literature review

Morris (1986) reported that :

Management Strategy and Employee relations

The research is focused on the response of the Bank to changes in the financial sector which has been experiencing deregulation, increasing competition, technological innovation and an increasingly discriminating public. It examines both changing business and employee relations strategies and the links between the two. As greater diversity begins to exist amongst the retail banks the study explores the Banks attempt to find itself a niche or adopt a focus strategy. This paper is primarily concerned with Human Resource issues. Changes in the nature of banking clearly have a knock-on effect on employee relations as banks move towards being more market driven organizations with a culture consistent with that, and with staff being regarded more as a resource than a cost

Historically, it has been the case that employee relations have been regarded as a “second order” strategy, purely facilitative and not fully integrated into overall business strategy. Hence, there was little consideration of unrest was such that labor was seen as a problem, as for instance in the car industry. Although there has been a gradual rise in the number of personnel professionals at Board level, these are still a minority. Lack of serious consideration of employee relations has also been said to owe something to the dominance of financial control at this level and the lack of union influence. Certainly many would argue that while senior, management do think about human resource issues, the degree of unpredictability in this area pushes it fairly well downstream in corporate planning. However, there are dangers of looking at HR issues in this way. The importance of ensuring the active co-operations of employees in industry has been emphasized control to one of commitment and this can be even more significant for the service sector. Thus in retail banking, the banks do not yet provide significantly different products and hence consumer choice is heavily influenced by convenience and image, the latter partly created by contract with quality of service and staff quality. Yet, in banking traditionally staff have not been recruited or developed for customer contract skills but for technical and administrative ability.

Torrington (1994) says that:

The recent emphasis on the human resource management, Torrington suggests that not only is the management of labor being given more attention, but that the issues discussed are broader and more strategic as well as tactical define strategic human resource management as “those decisions and actions which concern the management of employees at all level in the business and which are related to the implementation of strategies directed towards creating and sustaining competitive advantage. Thus, unlike the traditional peripheral function of many personnel managers, the newer style of human resource managers attempts to:

“Relate personnel practices to beliefs, to link each and every process of the recruitment, induction, training, appraisal rewarding of individuals to an overall set of articulated beliefs of organization”

Human resource management is seen as part of the movement away from concentration on unions and collective bargaining, to an emphasis on staff as individuals. Behind all is a belief that it will release greater commitment from employees although one has to be careful to examine the extent tonew equal partnership between employers and employed, or are then really offering a convert from of employee manipulation dressed up as mutuality.

One must be wary of evaluating HRM simply by the range of activity being undertaken. HRM is about both new processes new outcomes. The existence of the former does not guarantee the latter. Many initiatives may be no more than ‘flavor of the month’ changes; other may be opportunistic rather than strategic, taking advantage of slack labor markets; in many uses the gap between the rhetoric and the reality may be wide.

Batstone (1984) reported that

The banking sector has been characterized by apparently harmonious industrial relations and has not suffered from the “British diseases” of industrial action and demarcation issues associated with parts of manufacturing industry. Banks have promoted unitary encouraging an ethos of teamwork, shared interest and loyalty, wanting commitment beyond

the cash nexus. While banks are generally seen as having a passive approach

to employee relations, paternalism did underpin the system and particularly important was the system of internal promotion supported by an unwritten

agreement between the major UK banks on no poaching. The internal labor market created two categories of employees; career and non-career which equated to a male/female divide.

Retail banking is a highly labour intensive retail banking is a highly industry labour costs forming 70% of total operting expenditure and “involment in funds transmission meant that majority of clerical staff have not been used as a means of marketing the banks’ products nor directly for increasing business but to process existing accounts. They have accordingly been regarded as an overhead rather than a resource”(Morris,1986,p.22). until the 1980s competition between banks has been limited,banks operating as an oligopoly and government’s concern with maintaining economic stability with limits to lending, to the management of staff as national wage bargaining minimized competition for labour. However ,deregulation led to the collapse of the national system and a questioning of old employment practices.

Background:

The co-operative Bank is a wholly owned subsidiary of the co-operative Whole sale Society (CWS).the bank has a network of 90 branches and some 4,000 in-store banking points in co-operative stores. it has seen itself as an alternative force in uk banking and has a reputation for innovation. In banking products. While the history of the bank shows development away from the CWS(25years ago 90%of deposit came from movement and 10 % from other sources: the reverse is now the case) it remains the banker to the co-operative movement and as it’s chief Executive stated in the 1986 Annual Report,” our co-operative philosophy dictates that we approach the bank market in a fundamentally different way”.(see Wilkinson,1991).

The development of the bank’s policy on the management of people illustrates the move from the narrower re

structure of the study:

The research divided in chapter as follow:

1st chapter includes:

Introduction

Objective of the study

Significant of the study

Methodology of the study

Literature review

Structure of the study

2nd chapter includes:

Conceptual frame work

Introduction

Human Resources management

3rd chapter includes

An overview of Pubali bank

4th chapter includes

Findings & Analysis

5th chapter includes

Recommendation and conclusion

6th chapter includes

References

7th chapter includes

Appendix

Chapter 2

Conceptual frame work

Introduction:

In formulating the Human resource management, HR managers must address three basic challenges; the need support corporate productivity and performance improvement efforts; the fact that employees play an expanded role in the employer’s performance improvement efforts; and the fact that HR must be more involved in designing not just executing the company’s strategic plan.

There are six basic steps in the strategic management process ; Define the business and its mission perform an external and internal audits translate the mission into strategic goals; formulate a strategy to achieve the strategic goals; implement the strategy and evaluate the performance.

A strategy is a course of action. It shows how the enterprise will move from the business it is in now to the business it wants to be in, given its opportunities and threats and its internal strengths and weaknesses.

Strategic human resources management means formulating and executing HR systems that produce the employees competencies and behaviors the company requires to achieve its strategic aims

The high performance work system is designed to maximize the overall quality of human capital throughout the organization, and provides a set of benchmarks against which today’s HR manager can compare the structure, content, and efficiency and effectiveness of his or her HR system.

Human Resources Management:

Human Resources (HR):

Human resources (HR) are the people who are ready, willing, and able to contribute to an organizations success.

Human resources (HR): Hiring activities, including recruitment, interviewing, training, layoff planning, including out placement, and counseling.

Human resources (HR) segment contains the full set of capabilities needed to manager, schedule. Pay, and hire the people who make a company run. It includes payroll, benefits and administration, applicant data administration, personal development planning, workforce planning, schedule and shift planning, time management, and travel expense accounting.

Human Resources Management:

Human resources management is concerned with the people dimension in management. Every organization is made up of people acquiring their services developing their skills motivating them to high levels of performance and ensuring right people right time and right place.

Definition of Human Resource management:

(Randall s. schuter)

Different terms are used to describe the people who work in an organization employees, associates (Wal-Mart, for instance), personnel, human resources (HR).The term HR has gained widespread acceptance over the last decade because it expresses the belief that workers are a valuable and irreplaceable resources/asset

In simple term, Human Resource Management is about managing people in organizations.

Wright and McMahan says (1999)

“The pattern of planned human resource activities intended to enable an organization to achieve its goals”

Again, Miles and Snow says (1984)

“A human resource system that is tailored to the demands of the business strategy”

So, Human resource management is the process of acquiring, training, appraising, and compensating employees, and attending to their labor relations, health and safety, and fairness concerns.

A set of activities directed at an organization’s resources with the aim of achieving organizational goals in efficient and effective manner.

Functions of Human resource:

Human Resource Management is a process consisting of four functions, these are Staffing, Training & Development, Motivation, Maintenance .For a HR manager for maintaining an effective workforce it is necessary to know these functions.

Staffing: concerned with sourcing & hiring qualified employees.

The key areas of staffing are:

- Strategic Human Resource Planning: HRP help the organization to achieve the corporate goals by adopting and adjusting with changing situations for example rapid technological change

- Recruiting: The process of discovering potential job candidates by external & internal sources.

- Selection: Choosing the best incumbent for the organization.

Training & Development: concerned with assisting employees to develop up-to- date skills, knowledge & ability.

The major area of Training & Development is:

- Orientation: The activities involved in introducing new employees to the organization & their work units.

- Effective Training

- Employee Development: Future oriented training focusing on the personal growth of the employees.

- Carrier Development: The sequence of positions that a person has held over his/her life.

Motivation: Helping employees exert high energy level.

Some important factors of Motivation are:

- Motivational Theory & job Design.

- Performance Appraisal

- Rewards & Compensation

- Employee Benefits

- Discipline

Maintenance: maintaining employee’s commitment & loyalty to the organization.

Maintenance consist of

- Safety & Health

- Employee/Labor Relations

- Communication

Feature of the HRM:

The activities that a company dopes to manage their human resources include—

Understanding the Environment internal environment; structure, size, business, strategy, technologies etc.

The Environment: External, Specific and General Environment

External environment-Outside institutions or forces that potentially affect an organization performance. It has two components- Specific and general

Enduring advantage will come from making better used people.

Specific environment- includes those external forces that have a direct and immediate impact on manager decisions and actions and directly relevant to the achievement of organizational goals. The main ones are customers, suppliers, competitors and pressure groups (like environmentalists, green parties, students unions etc.)

Managing Organizational and Human Resource changes: Such changes may include bending the culture of two newly merged companies, or successfully managing downsizing efforts

Staffing the organization: Staffing activities may include- analyzing the job, recruiting job candidates, selecting, selecting the most appropriate one.

Workforce Diversity: (varied backgrounds of employees) : managing people was considerably simpler fifty-years before because workforce was more or less homogenous (within as well as outside the national boundary). After 1960s minority and female workers started to rise in USA and accommodating their demands and needs have become vital responsibilities for managers. Until very recently, organizations took a melting-pot approach to differences in organizations. It was assumed that people who were different would somehow automatically want to assimilate. But today’s manager have found that employees do not set aside their cultural values and lifestyle preferences when they come to work. The challenge for the managers therefore, is to make concerted efforts to attract and maintain a diversified workforce, not only in USA but all over the world.

Evidence involves four factors:

- The person belong to a protected class

- The person applied for, and was qualified for, a job the employer was trying to fill

- The person was rejected despite being qualified

- The position remained open and the employer continued to seek applicants as qualified as the person rejected

More clearly, disparate impact occurs when the standard is applied to all applicants or employees, but that standard affects a protected class more negatively.

CHAPTER 3

overview of Pubali bank

Bank Profile:

History of Pubali Bank Limited

After liberation the Eastern mercantile bank was converted into Pubali Bank and was taken under the government management because the government policy was nationalized of all financial institutions. The objective was strengthening the rural economy. The result of the policy was a mixed one. In late 70s when the government wanted to establish a market oriented economy with less public sector role. As pert of the privatization and liberalization process this bank was denationalized in the year 1983. it started function as a public limited company Limited and registered as Pubali Bank Limited. All liabilities and asset of the bank is transferred to the limited company.

The bank was incorporated under the Companies Act (Act VII) of 1913 as a limited company having its Head Office in Dhaka. The Bank started functioning with the approval of Bangladesh Bank under the guidelines, rules and regulations given for scheduled commercial banks in Bangladesh.

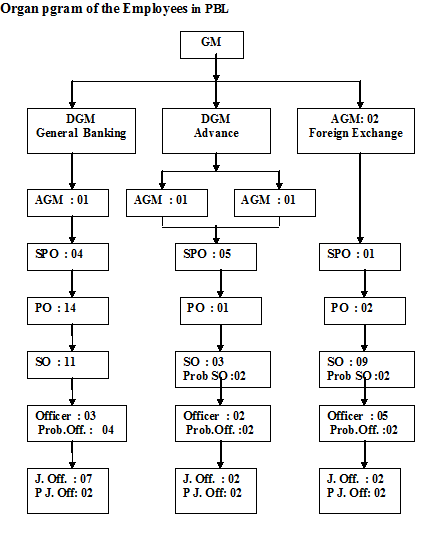

Organization Structure of PBL:

Pubali Bank Ltd expanded as a largest commercial bank in the country. Its operational networks cover almost every part of the country including the major cities, rural townships, which are prospective business centers in Bangladesh.

The bank was established primarily as private bank. After liberation it was nationalized and it remained so for quite a long period. Though it has been denationalized again and has gone back to its private norm it could not get rid of all the rules and norms of nationalized bank. The bank is run by an excellent management team under the direct supervision of a competent board of directors. The board of directors comprises total fourteen members headed by the chairman. Mr.E.A.Chaudhury is the present chairman of the board. The Managing Director (MD) heads management team. Under him a General Manager (GM) heads each department of the bank. Mr. Khondkar Ibrahim Khaled is the present MD of PBL. There are total twelve divisions in the Head Office of PBL. List of various divisions of PBL is given below:

Boards of Directors:

Mr. E. A. Chaudhury

Mr. Moniruddin Ahmed

Mr. Sk. Wahidur Rahman

Mr. Monzurur Rahman

Mr. Giashuddin Ahamed

Mr. M. A. Raquib

Mr. Syed Moazzem Hussain

Mr. Ahmed Shafi Chowdhury

Mr. Fahim Ahmed Faruk Chowdhury

Mr. Habibur Rahman

Mr. Manir Ahmed

Mr. Mohammed Yaqub

Mr. Muhammad Faizur Rahman

Divisions of Head Office

| Sl# | Division | Functions |

| 1. | Board & MD’s Secretariat Division | Deals with Shares |

| 2. | Human Resource Division | Recruitment, promotion, training, Disciplinary action, dismiss, discharge, retirement, pay and allowances, career plan, trade union etc. |

| 3. | Establishment division | Engineering, transport, telephone, telex, fax, security system, real estate etc. |

| 4. | Credit Division | All sorts of credit, its allocation, estimation, sanction, etc. |

| 5. | Credit Monitor and recovery Division | Monitoring of credit, classification, evaluation and recovery of credit etc. |

| 6. | International Division | All types of works with foreign banks or organizations. |

| 7. | Central Accounts Division | Correct accounts, financial evaluation and forecast of future financial events of the bank. |

| 8. | Branch Operation Division | Management of branches, control, monitoring and evaluation of performance of branches of the bank. |

| 9. | General Services & Develop Division | Looks for improvement services, sets strategy for business promotion and development of the bank. |

| 10. | Audit Division | Conduct internal audits of the branches. |

| 11. | Information Technology Division | Mainly looks after the computer system, provides necessary support to the branches in regards to computer and electronic equipments. |

| 12. | Lease Financing & Law Division | Deal with the lease financing and help the bank to move with its legal aspects. |

Divisions Of Head Office ( Organizational Structure ) | ||||||||||||||||||||||||||

|

Registered Head Office:

Pubali Bank Bhaban

26, Dilkusha Commercial Area

Dhaka – 1000, Bangladesh

Post Box No. 853

Cable: pubalipeak, Dhaka.

Telex: 675844 Pub BJ/632240 UCBL- H- O- BJ

Fax: 880-2-9564009

PABX: 9551614

Financial Analysis of Information

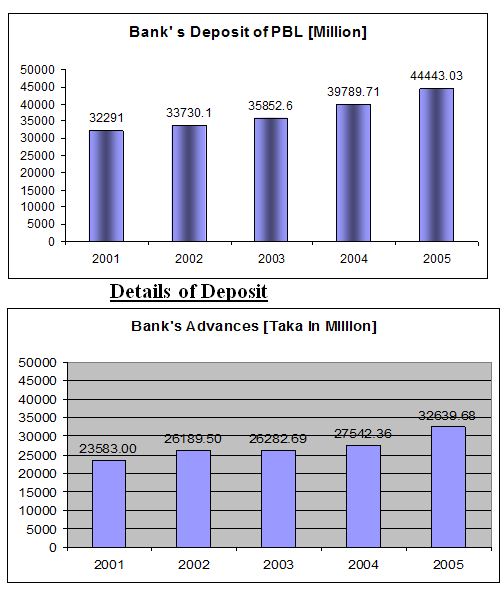

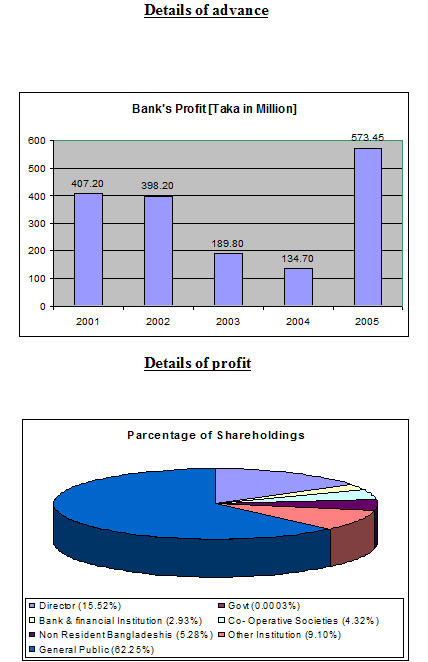

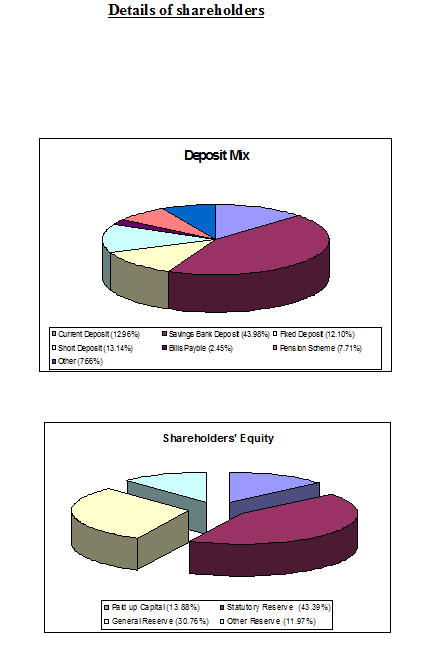

As at 31st December (In million taka) | |||||

2003 | 2004 | 2005 | 2006 | 2007 | |

| Authorized Capital | 5000.00 | 5000.00 | 5000.00 | 5000.00 | 5000.00 |

| Paid-up Capital | 200.00 | 200.00 | 200.00 | 200.00 | 400.00 |

| Reserve Fund & other Reserve | 1338.29 | 1740.8 | 1931.76 | 2107.76 | 2481.21 |

| Deposits | 32291.00 | 33730.10 | 35852.60 | 39789.71 | 44443.03 |

| Advance | 23583.00 | 26189.50 | 26282.69 | 27542.33 | 32639.68 |

| Investments | 4165.80 | 4400.80 | 4938.86 | 5742.12 | 5536.84 |

| Import Business | 12573.00 | 10500.00 | 12141.30 | 18024.30 | 26033.80 |

| Export Business | 11228.00 | 10214.00 | 11684.20 | 13670.50 | 15721.10 |

| Bridge Finance | 8.40 | 8.30 | 7.90 | 7.80 | 7.29 |

| Total Income | 3660.20 | 3823.50 | 3569.30 | 3455.32 | 4435.90 |

| Total Expenditure | 2488.70 | 2575.70 | 2704.10 | 2830.41 | 3063.27 |

| Pre-tax Profit | 626.50 | 724.00 | 345.20 | 244.90 | 1042.63 |

| Net Profit | 407.20 | 398.20 | 189.80 | 134.70 | 573.45 |

| Total Assets | 39086.30 | 41895.90 | 43502.25 | 46593.28 | 52671.44 |

| Foxed Assets | 565.60 | 591.30 | 582.60 | 545.40 | 546.48 |

5088

Number of Shareholders6601350

Branch Profile:

Location of Principal Branch :

Principal Branch of Pubali Bank is situated in the ground floor of Pubali Bank Bhaban, 26 , Dilkusha C/A , Dhaka-1000, Bangladesh.. The office is highly decorated and it is the most important and busy branch maintaining all types of banking transactions. There 96 employees are working in this branch.

Distribution of Employees:

| DESIGNATION | NO |

| General Manager | 01 |

| Deputy General Manager (DGM) | 02 |

| Assistant General Manger (AGM) | 05 |

| Senior Principal Officer (SPO) | 10 |

| Principal Officer (PO) | 17 |

| Senior Officer (SO) | 23 |

| Officer | 10 |

| Junior Officer | 11 |

| Prob. Senior Officer | 04 |

| Prob. Officer | 08 |

| Prob. Junior Officer | 06 |

Branch Financial Position as on Date 27th October, 2008

PARTICULARS | AMOUNT IN TK. |

| Cash & Bank Balance | 337,30,85,825.99 |

| Loans and Advances | 850,51,24,720.18 |

| Deposit | 254,59,07,560.17 |

| Bills Payable | 4,59,40,870.48 |

| Bills Discounted & Purchase | 5,78,44,600.50 |

| Fixed Asset | 2,19,30,264.90 |

| Other Asset | 14,12,02,956.30 |

| Income | 82,89,01,879.59 |

General Banking of PBL

Introduction:

General banking is the starting point of all the banking operations. It is the department, which provides day-to-day services to the customers. Everyday it receives deposits from the customers and meets their demand for cash by honoring cheques. It opens new accounts, remit funds, issues bank drafts and pay orders etc. Since bank is confined to provide the services everyday, general banking is also known as ‘retail banking’.

According to World Bank, the general people understand the depositing and withdrawal of money and credit financing. But Bank performs numerous types of services. To deal these services bank has to maintain many register/ ledger and documents. Some different jobs that waive the General banking has shown in the following diagram

Token Issue:

The token issue department uses a register book and different types of tokens decorated with different letters for different types of accounts. There are two types of tokens. One is for savings A/C and another is current / other accounts.

Procedure:

The client will encash money from his account will show his cheque to the respective officer of the desk. The officer will give him a token with particular number after being sure of his two signatures on the back of the cheque. The officer will give him a token with a particular number on the back of the cheque. The client will then proceed on for encashment. The officer then gives an entry about the token number, account name and the amount in the column of the register book.

The token will be checked by the responsible officer for maintaining at the end of each business day. Tokens are then handed over to the supervising official concern to keep them in a locked box. Tokens are checked once a month by the supervising officer in charge wheather tokens is ok or not. When a token is lost it is informed to the head office for a matter of precaution.

Maintenance of the subsidiary register for receipt of cheques, drafts :

At the counter every cheque, demand draft and other credit instrument tender for the credit of the customers account will be delivered. Deposits received by post will sent by the receiving officer to the bills department against acknowledgment of the dealing officer. The dealing officer is concerned here about four types entries. They are

- Local Clearing

- IBC (Inter Branch Collection )

- SC (Short Collection )

- BT (Bank Transfer)

In case of local clearing one bank sends money by cheque or DD which will be collected in the name of the account holder of this branch. This cheque or DD will be taken to the clearing house where agents of all banks exchange these instruments. Important thing is that the paying Bank must be in the local area (Dhaka). In case of IBC the branches must be of the same banks for short collection, the paying banker is in the area other than Dhaka whereas bank transfer will be between two accounts of the same branch.

The dealing officer of this desk should be aware of the following things about instruments:

Name of the account is very clearly written on the deposit slip.

Full particulars of the deposit instruments such as cheque numbers, name of bank, etc are properly recorded on the paying slip as required.

The pay in slip has been signed by the depositor.

Full particulars of the railway receipts and instruments of title goods, bills of exchange, invoice etc. associated with an inland documentary bill received from the depositors direct at the counter or by post from other branches/ banks endorsement thereon.

All cheques, bills and other instruments are crossed with crossing seal .

After categorizing all the instruments and checked out the preliminary mandatory things, the dealing officer gives entries in the appropriate column of subsidiary ledger for crediting the accounts.

Account Opening Section:

When a customer want to open a deposit account in bank, he/she will have to go the A/C opening section to know the rules and regulations for opening account and to have the set of documents required. Since PBL is an authorized dealer it can open deposit A/Cs denominated both in Taka and approved foreign currencies.

Deposits are like raw materials out of which credits are created. Deposit accounts are one of the important sources of funds. In order to attract customers the banks offer different facilities to various types of account holders. Competition in accepting deposits takes two forms:

(a) Improvement in customer service

(b) Offer a higher rate of interest.

In our country PCBs and foreign banks are appreciated to attract deposit because of their superior customer services. PBL principal office branch with its traditions customer service approaches faces difficulties to draw attention of new customers.

Main functions of account opening are given below:

- To give answers to the queries regarding account opening

- To supply the appropriate type of account opening form

- To put a/c number from a computerized sheet on advice of new account

- To input date into computer from a/c opening form.

- To maintain and update the a/c opening file for different types of accounts.

- To maintain a register for cash type of recording details of a/c opening

- To supply deposit slip books and cheque book on requisition

- To act on request for closing and transferring of deposit a/c

- To act on request for closing and transferring of deposit a/c

Classification of Customer:

a) Individual (personal)

b) Proprietorship (Sole traders)

c) Partnership firms (Register or Unregistered)

d) Joint Stock Companies ( Private Limited and Public Limited )

e) Municipalities/Municipal Corporations/Local Bodies etc.

f) Clubs / Societies / Associations /School / Colleges / Universities etc.

g) Executors /Administrators

h) Trustees

i) Illiterate persons

j) Constituted Attorney

k) Wage Earners

Different types of A/C of PBL Principal Office:

- Current A/C : Interest free and generously withdraw able.

- Saving Bank A/C: Interest bearing and checkable with some restriction

- Short Term deposit: Usually interest bearing and with draw able on short notice.

- Fixed deposit: Interest bearing and definite period like one year or six month.

- Non Resident foreign currency deposit: All non residents of Bangladesh can open this interest bearing account in the form of term deposit with a minimum amount of $1000 or equivalent.

- Private Foreign Currency A/C: Bangladeshi National residing abroad or foreign nationals may open this a/c with deposit mode from inward.

- Convertible Take Amount: A type of non-interest bearing current a/c designed specially for foreigners living here.

- Private foreign Currency A/C: Bangladeshi nationals residing abroad or foreign nationals may open this a/c with deposit mode from inward.

Documents required for opening new account:

- Documents Common for all types of Account & Customers

- Advise of New Account

- Specimen signature cards

- Account Opening Agreement Form

- Photographs of Account Holder

- Deposit Slips Book

- Cheque book Requisition slips

- Letter of mandate is required where necessary.

Account opening procedure:

- Applying in a printed application in a certain stipulated form printed by the bank itself.

- Supply a set of printed forms required for opening the account which will normally include

i) Advise of new Account

ii) Specimen Signature Cards

iii) Account Agreement

iv) Deposit slip Book

v) Cheque Book Requisition slip

- The account should properly introduced by any one of the following

i) An existing Current Account holder of the bank

ii) Officials of the Bank not below the rank of an Assistant officer

iii) A respectable person of the locality well known to the Manager or Sub- Manger of the Branch concerned.

- A number of photographs which must be duly attested by the introducer in front of the manager or responsible officer. The signature of the introducer must be attested. After being scrutinize the application and the manager or authorized officer may give his consent to open the account.

- A package with deposit book, cheque book with a unique A/C No. given to the Customer maintaining the A/C opening register book.

Precautionary Measures of A/C Opening:

- Soon after the opening of a new Account a letter of Thanks should be sent to the introducer.

- A letter of thanks as per prescribed should also be sent to the account holder immediately upon opening the account, under registered post with a/c for verification of postal address as well as genuineness of the Account holder.

- In case of a new account is opened a proprietorship / partnership firm, having local business address, a responsible officer of the branch will inform the firm to obtain the confidential report on the firm.

Formalities for opening Current A/C and STD A/C:

These accounts are meant for business firms and corporate bodies. Initial deposit requirement is Tk 5000 in addition to common documents required to open a saving a/c following additional documents will be required for depending upon the nature of the organization.

Joint Account of two or more persons:

Mandate for Operation of Account: A clear authority by all the joint A/C holders containing instructions as to who will operate the account and how the account is to be operated should be obtained. The mandate should mention the name of the persons authorized to draw check. In case of death, insanity, insolvency of one or more of the joint a/c holders, the authority will cease to operate:

For sole traders:

i) Trade license

ii) A certificate with tax identification number from income tax authority

iii) Seal

iv) In case of current account an agreement to accept all responsibilities for all over draws, interest cost and expenditures

For Partnership firms:

i) Trade license

ii) Notarized deed of partnership

iii) A mended in agreement form regarding operation of the account signed by the entire partnership firm

iv) Sale/ Stump of the firms

v) 2 copy photo of all partners

For Private and Public Limited Companies:

i) Memorandum and Articles of association

ii) Certificate of incorporation

iii) Certificate of commencement of business if it’s Public limited

iv) Copy of board resolution to open a/c certificate by the chairman and secretary

v) Power of attorney to operate a/c in favor of any one or more of directors.

vi) Balance sheet and income statement

vii) List of Directors and their address and chairman certificate.

Formalities for opening Private foreign currency A/C:

Foreign Currency account may be opened in US dollar, Pound Sterling, Douche Mark and Japanese Yen. Credit may be made to this A/C against inward remittance from abroad. Usually this a/c operated like a current a/c but no checkbook are issued against his a/c. Withdrawals may be made through withdrawals slips. Interest may be paid on this a/c if it is maintained in the form of term deposit for a minimum of 90 Day’s Bangladeshis’ living abroad can open even without initial deposit. A nominee can be appointed.

Documents required: When an eligible person is interested to open an F/C account his passport is to be checked and signature verified. When he is staying abroad his signature is to be verified and attested by –

i) Bangladeshi embassy on that country

ii) His banker in this country

iii) Notary public of that country

Following documents are needed to:

i) Photocopy of 1st 4 pages of passport

ii) Photocopy of visa and work permit

iii) Nominees photo and account no.

iv) Declaration of source of income

Issue of Duplicate cheque book:

Duplicate cheque book in lieu of lost one should be issued only when A/C holder personally approaches the bank with an application. Fresh Cheque Book in lieu of lost one should be issued after verification of the signature of the Account holder from the Specimen signature card and on realization of required excise duty only with prior approval of manager of the branch. Cheque series number of the new cheque book should be recorded in ledger card signature card as usual. Series number of lost cheque book should be recorded in the stop payment register and caution should be exercised to guard against fraudulent payment.

Closing of Account:

Upon the request a customer an account can be closed. After received an application from the customer to close an Account, the following procedure are followed by a Banker.

The customer should be asked to draw the final cheque for amount standing to the credit of his a/c by deducting the amount of closing and other incidental charges.

In case of joint a/c the application for closing the a/c should be signed by all the joint holder.

Interest rate on deposit:

Interest rate different types of deposit as prescribed by PBL head office from time to time irrespective of size of deposit

Type of Deposits | Interest rates |

| a. Saving deposit | 8.00% |

| b. Special notice deposit | 6.50% |

| c. Fixed Deposit | |

| 3 Months | 7.50% |

| 6 months | 8.00% |

| 1year | 8.5% |

| 2 or 3 year | 9.% |

Clearing Section:

The Cheque Clearing Section of PBL principal office branch sends Inter Branch Debit Advice (IBDA) to the Head office on the receiving day of the instruments. The main Branch takes those instruments to the Clearing House on the following day. If the instrument is dishonored, Head office of PBL, sends IBDA to the PBL, Principal Office branch. The total procedure takes three days if everything goes orderly.

The Cheque Clearing Section of PBL, Principal Office branch sends Outward Bills for Collection (OBC) to the concerned Paying Bank to get Inter Branch Credit Advice (IBCA) from the paying Bank. If the instruments are dishonored by the Paying Bank, the Paying Bank returns it to the PBL, Local Officer Branch describing why the instruments are dishonored. The procedure takes around a week.

The Cheque Clearing Section of PBL, Principal office branch sends Outward Bills for Collection (OBC) to the concerned paying Branch to get Inter Branch Credit Advice (IBCA) from the paying returns it to the PBL, Local Office branch describing why the instrument is dishonored.

Local Remittance Section:

Local Remittance is used to transfer of funds denominated in Bangladesh Taka between banks within the country. It is an order from the Issuing branch to the Drawee Bank/ Branch for payment of a certain sum of money to the beneficiary. The payment instruction is sent by Telex / Telegram and funds are paid to the beneficiary through his account maintained with the Drawee branch or through a pay order if no a/c is maintained with the drawee branch. The cash department does remittance of cash. Instruments of local remittances at PBL branches are follows

Local Remittance

Telegraphic transfer TT | Demand Draft DD | Pay Order | |||

Pay Order:

- Pay order issue process

For issuing a pay order the client is to submit an Application to the Remittance Department in the prescribed form (in triplicate) properly filled up and duly signed by application. The processing of the pay order Application form, despot of cash/cheque at the Teller’s country and finally issuing a order etc, are similar to those of processing of L.D Application.

As in case of L.D each branch should use a running control serial number of their own for issuance of a pay order. This control serial number should be introduced at the beginning of each year which will continue till the end of the year. A fresh number should be introduced at the beginning of the next calendar year and so on.

- Charges

For issuing each pay Order commission at the rate prescribed by Head Office is realized from the client and credited to Income A/c as usual.

- Entries

Dr. Teller’s Cash/client’s a/c

Cr pays Order a/c

Cr commission a/c

- P.O issue Register

The remittance Department will issue the pay Order’s duly crossed “A/c payee” and will enter the particulars of the P.O Issued in the prescribed P.O Register duly authenticated.

- Payment of pay orders

As the P. Os crossed A/c payee, the same are presented to the Issuing branch for payment either through clearing of for credit to the client’s A/c. Os when presented for payment are processed in the Remittance Department. On making payment, the relative entry in the P.O Register is marked of by entering the date of payment in the P.O Register duly authenticated. The paid instrument is treated as Debit Ticket.

- Refund of Pay Order

The following procedure should be followed for refund of pay order by cancellation

- The purchase should submit a written request for refund of pay order by cancellation attaching therewith the original pay order

- The signature of the purchaser will have to be verified from the original application form on record.

- Manager/Sub-manager’s prior permission is to be obtained before refunding the amount of pay order cancellation.

- Prescribed cancellation charge is to be recovered from the application and only the amount of the pay order less cancellation charge should be refunded.

- The pay order should be affixed with a stamps “ cancelled” under should also be canceled with RED ink but in no case should be torn. The canceled pay order should be kept with the relevant Ticket.

- The original entries are to be reversed with proper narrations.

- Cancellation of the pay Order should also be recorded in the pay order Issue register #Issue and payment of Pay-order:

Strictly speaking pay-order is not meant for remittance. Because it is payable by the issuing branch. A order is issued to facilitate fund transfer within a clearing area.

Dr. tellers cash/Client A/c

Cr. Manages cheque

Cr. Commission

Up to Tk.1000 Tk. 10

Tk.1001-100000 Tk. 25

Tk.100, 001-500000 Tk. 50

Above Tk.500000 Tk. 100

When paying against pay-order following entries are passed

Dr. Manager’s cheque

Cr Cash/Client A/c

Loans and Advances:

Introduction:

Major source of income of a bank is the earning from credit. Borrower selection is the main and prime task of this department. Advancing loans is the primary function of the commercial banks. Without loans country’s industrial and commercial development is not possible. Therefore, smooth loan system in banking sector is a catalyst for economic development of a country.

Manager’s Concern:

In the process of loan Manager has to ensure three things:

1) How to locate purpose

2) How to locate security

3) How to locate borrower

How to locate purpose:

Manger has to ensure that the loan will generate adequate cash. For that matter the loan should be engaged in productive activities. Such an employment will increase economic activities, promote trade and commerce, create employment avenues and increase movement of goods and flow of cash. This flow of cash is known in the banking concept as cash generation. If there is enough cash generation, funds will automatically flow into the borrowers accounts with the bank and will show a satisfactory turnover in accounts which the lending bank always demands. This is why the manager’s speculation should be making the highest cash through the employment of the advances.

How to locate security:

As soon as the evaluation of purpose is done manager will examine and evaluate in the following manner the securities offered by the prospective borrower:

a) Security is the source of information on the prospective borrower. If offered are valuable properties like land, building, shares of stocks or pledged goods, these will offer adequate information about the borrower as to his financial position.

b) If securities are hypothecated stocks of raw materials for production, these will offer adequate information about the borrower as to his ability or capacity to utilities

c) Securities (tangible or intangible) offer a yardstick for measuring the extent of involvement of the borrower himself. The lending bank’s investment of funds is a joint venture of the banker and the borrower. The securities offered are the borrower’s portion of involvement i.e. his equity or capital. Thus the greater is his involvement, the better for the banks. The borrower in that case will think twice that if the business goes wrong, it is who will suffer most. Thus it will be in his own interest that he will avail and utilize the loan as per agreed stipulations. Thus the best way to safeguard the lending banks interest is, as far as possible to maximize the banks commitment.

d) The branch Manager’s responsibility as to security is also to see how much control he will be in a position to exercise on the entire stocks of the borrower.

How to locate borrower:

In appraising a loan process, the selection of the prospective borrower is the most vital point. The borrower is the real actor and must be in position to achieve the purpose for which the loan has been requested. In selecting ideal borrower, the branch manager thus assumes the greatest responsibility. Capital is another point to indicate the borrower’s position. He should be given loan in proportion to this own investment as working capital. As a general rule a bank should not sanction loan more than the investment of the borrower.

Then the consideration of borrower’s capacity – whether the borrower can utilize the funds or not.

Of all the qualifications of a prospective borrower, character is undoubtedly the greatest. While the capacity and capital are the factors upon which depends his ability to repay the money advanced, the character of the borrower indicates his intention to repay the loan.

To select the ideal borrower the following points have to consider:

a) Branch records: The manager may have first hand information on a prospective borrower by a reference to his records, if the banks with him. The turnover of his financial dealings is reflected in the ledger folios of his branch.

b) Borrower’s Record: The prospective borrower may be advised to submit his books of accounts balance sheet etc. for examination by the manager. These financial tools reflect the position of his assets and liabilities and a fair idea about the capital and capacity of the borrower.

c) Personal Enquires: As an individual the borrower must be a desirable person in the society. He must have integrity. There are some factors such as the sobriety, the promptness of payment goods habits personality, the ability and the willingness to carry a project

Advance Secured and Unsecured:

- Secured Advance: Secured advance are those advance which are secured by tangible securities of adequate value over which the bank has either absolute or constructive control in addition to the personal guarantee of the customer.

- Unsecured Advance: The advances which are granted to a constituent of undoubted standing and reliability and only in exceptional circumstances and for short period without any tangible security are called unsecured advances.

Types of Loan:

Pubali Bank Principal Branch has the following loan schemes

- Continuous Loan

Demand Loa

- Loan

- Term Loan

- Cash Credit (CC)

- Overdraft (OD)

- Bank Guarantee

- Staff Loan(PBL)

Continuous Loan: The limited loans with expiry date of loan payment, which can be transacted without any particular payment schedule, are termed as continuous loan. Following are the various categories :

- Small Enterprise Financing (SEF)

- Consumer Financing (CF)

- Other than SEF and CF

Demand Loan:

The loans, which become eligible for payment when demanded by the bank, are termed as demand loan. If contingent or any other debt becomes forced loan, then those are also termed as demand loan.

Following are the various categories :

- Small Enterprise Financing (SEF)

- Consumer Financing (CF)

- Other than SEF and CF

Term Loan:

The loans which are to be paid within limited term with a particular payment schedule are known as term loan.

Following are the various categories :

(a) Term loans up to 5 years

- Small Enterprise Financing (SEF)

2. Consumer Financing (Other than HF & LP)

3. Housing Finance (HF)

4. Loans for Professionals to setup business. (LP)

5. Others

(b) Term loan over 5 years

- Small Enterprise Financing (SEF)

2. Consumer Financing (Other than HF & LP)

3. Housing Finance (HF)

4. Loans for Professionals to setup business. (LP)

5. Others

Short term Agri and Micro Credit:

The short-term loans which are listed in yearly loan disbursement schedule served by the loan department of Bangladesh Bank, are termed as short-term agricultural loan and micro-credit. The loan given to the agricultural sector for less than 12 months is also included in this category. By short-term loan we mean the loan below Tk 10,000 to be paid within 12 months.

Loan classification and provision of 2006 as on date 30th September.

(Figures in Thousands)

| Sector | Total |

| 1.Continuous Loan | 1999150 |

| 2.Demand Loan | 485543 |

| 3.Term Loan up to 5 Years | 2424010 |

| 4.Term Loan Over 5 years | 2435267 |

| 5.Short term Agri & micro credit | ———- |

| 6.Staff loan | 426682 |

| Total | 7770652 |

Cash Credit (CC):

| |

CC (hypothecation) | CC (pledge) |

| |

Over Draft (OD):

| |

| Secured Overdraft – SOD | Loan General – LG |

| |

OD and CC amount as on 27th October, 2006

- Over Draft 141,77,69,177.12

- Cash Credit 47,24,41,768.59

Bank Guarantee:

| |

| Bid Bond | Generally issued while dropping tender for work. |

| Performance Bond | It is issued when customer gets a specific work-order. Here bank guarantees that his customer is willing and able to complete the required work, and bank takes the responsibility of completing the contracted work. |

Staff Loan:

- 1. Staff House Building Loan – SHBL

- 120 times of the basic salary is provided as SHBL

- Bank Rate + 1%, interest is charged to the employee

- Repayment is adjusted from their monthly salary

- Repayment is made at equal monthly installment

- 10% of basic is contributed by employee in every month

- 10% of basic is also contributed to the PF by the Bank

- Repayment is adjusted from their monthly salary

- Maximum Sanction from PF

Process of Loan:

| Heads | Characteristics |

| Application | Applicant applies for the loan in the prescribed form of the bank describing the types and purpose of loan. |

| Sanction |

|

| Documentation |

|

State of Classification and Provision for 5 Years of PBL:

<p align=”center”%3