INTRODUCTION:

Loans comprise the most important asset as well as the primary source of earning for the banking financial institutions. On the other hand, this (loan) is also the major source of risk for the bank management. A prudent bank management should always try to make an appropriate balance between its return and risk involved with the loan portfolio. An unregulated banking financial institution might be fraught with unmanageable risks for the purpose of maximizing its potential return. In such a situation, the banking financial institutions might find itself in serious financial distress instead of improving its financial health. Consequently, not only the depositors but also the general shareholders will be deprived of their money from the bank. The deterioration of loan quality will also affect the intermediation efficiency of the financial institutions and thus the economic growth process of the country. This establishes the fact that banks should provide increasing emphasis on various analytical tools and techniques for screening proposals and loan decision taking. Credit Worthiness Analysis is one of the most important activities before sanctioning any credit to a new borrower as well as existing borrower to avoid any default risk and for improving the operational efficiency of nationalized and private sector commercial banks.

Rationale of the study:

The principal function of the bank is to lend. Lending comprises a very large portion of a bank’s total activities. Sound lending practice therefore, is very important for profitability and success of a bank. Like other financial intermediary, commercial banks also intermediate between the savers and borrower to mobilize the financial surplus of the savers and allocate these savings to the creditworthy borrowers of different sectors of the economy. In this way they not only help in financial development of a country, but also facilitate its economic development. For the sake of sound lending, it is necessary to develop a sound policy and modern lending techniques to ensure that loans/ advances are safe and the money will come back within the time set for repayment. For this purpose, proper and prior analysis of credit proposals is required to assess the credit worthiness for avoiding risk. Risk is inherent and absolutely unavoidable in banking. Lending itself is risky and the very purpose of analyzing the credit worthiness is to determine whether a particular loan applicant is credit worthy or not. While deciding a loan proposal we should judge the degree of credit worthiness of individual potential borrower, risk in a given situation. Lending is a judgment which depends upon ones ability to assess the shortcomings in the proposals and to identify the risk. Ability in taking prior measures to minimize the risk is very much important. In the background of the above things, the issue “Credit Worthiness Analysis” has been undertaken as a comprehensive research topic, which will serve the BBA program

Objective:

Objective of a particular report depicts the idea and the reasons behind preparing a report. This objective can be staged into two distinctive way first general objective and second Project objective. My objectives behind preparing this report on general Banking Operation of IFIC Bank Limited by IFIC are discussed below:

General Objectives:

The partial fulfillment of the requirement for the award of the degree of Bachelor of Business Administration (BBA)

To gain practical job experiences and view the application of theoretical knowledge in the real life situation.

Project Objectives:

- To know about IFIC Bank Limited and it’s general banking system.

- To know about the IFIC Bank Limited’s business process.

- To know about IFIC Bank Limited’s Credit Collection Department by using bank’s current online services

- To know overall marketing of the Bank product.

- To identify the customer servicing systems of the Bank.

- To detect the employees capability to provide quality service.

- To know existing customers satisfaction.

- To find out the customer attitudes and response to the service provided by the Bank.

- To understand and classify the customer’s nature and behavior.

- Sales strategies of credit collection department.

- To find out the customers recommendation for improving the Banking service.

Methodology:

Methodology of this report includes the following:

1. Theoretical Framework

2. Sources (Primary & Secondary)

3. Selected Type of the Study.

4. Data Preparation Method.

Theoretical Framework:

Literary, a theory is a conceptual scheme based on foundational statements called axioms, which are assumed to be true. In case of this report I designed my theoretical framework by the help of “foreign Exchange Regulations Act Volume1”, of several manuals or brochures published by IFIC.

Sources:

Source refers to the origin from where we have collected all the information. The reliability of the report depends on the source of the information. Both primary and secondary source of the report writing is discussed below:

Primary Sources:

The method that was used to collect the primary data is as follows:

Discussion with officials of IFIC. (The discussion was conducted with 3 officials of IFIC and information was collected through direct conversation and discussion suing some predetermined questions and instant solutions that rose from instant problem.)

Practical work Experiences in the different desks of the department of the branch covered. Relevant file study as provided by the offers concerned.

Face to Face conversation with the clients (Conducted 7 face to face conversation with clients as there was ample chance of communication with the customers during the working hour.)

Discussion with my supervising teacher and manager.

Secondary Source:

The method that was used to collect the Secondary data is as follows:

Information regarding the background history of IFIC and its services that are currently taking place in our country are collected form the IFIC’s website.

Annual report of IFIC Bank. Ltd.

Various books, articles regarding general banking function foreign Exchange operation and credit police.

Different procedure mutual published by IFIC.

Different circular sent by head office of IFIC and Bangladesh Bank.

Selected Type of the Study:

As this report is based on the description of the various aspects of over all Banking operation provided by the IFIC Dhanmondi Branch Dhanmondi, I selected to go on with a descriptive study as this will include the functions IFIC in the overall section.

Data Preparation Method:

During the preparation of this report MS Word report writing software has been used as this software is easy to use and is one of the highly accepted software for professional report writing.

Limitations:

As by nature all the elements and study have its recompense as well as limitations. Here the limitations of the study of this report are few but it would have been better work if we could have over come those limitations.

Time Limitations:

As I have to submit this report within a certain time limit, I couldn’t get or use a proficient way of collecting information. If I have more time to prepare this report the report would have been more reach with information.

Centralized service system by IFIC:

As I am an intern in the IFIC Dhanmondi Branch Dhanmondi which includes few particular services regarding the foreign exchange, I wasn’t able to collect all the information relating to foreign exchange especially Import, Export and LC. That is why I have discussed a few parts of foreign exchange services provided by IFIC.

Inadequate Discussion with Officials:

To prepare a high-quality report I felt the urgency of discussion with the high officials in IFIC but as I was an intern and took considerable time to get use to the environment, was not able to communicate with the High Level Officials.

Limited Disclosure:

Interns are not allowed in every section of IFIC, that is why, and access to the information was limited.

The study has many dimensions and covers a broad spectrum. The report limits its scope to IFIC Bank Limited only. Hence the working area of my internship was only Customer Service in Dhanmondi Branch of the bank. Actually this study does not show the existing all but a portion customer of the IFIC Bank Ltd. The data requires for sufficient analysis for report writing could not be collected due to excessive workload

PROFILE OF THE ORGANIZATION:

Prolegomenon

About IFIC Bank

Function of IFIC

Mission of IFIC

Vision of IFIC

Management Aspect of IFIC

Organizational Structure of IFIC

IFIC”s Core Values

Teamwork

Joint Ventures Abroad

Performance of IFIC

CAMEL Rating

SWOT Analysis of IFIC Bank

Organizational Background :

Prolegomenon:

The word ‘bank’ is derived from the word ‘Banco’ or ‘Banque’. Banco or Banque means a bench. The early bankers transacted their money leading activities sitting on the benches in a market place. According to others, the word ‘Bank’ is originally derived from the German word ‘Back’ meaning a joint stock fund. However, the term ‘Bank’ has been use from the Middle Ages in connection with the business of money lending.

Originally, ‘Banker’ or ‘Bank’ was defined as a person who carried on business of receiving money, collecting of drafts, honoring cheques drawn upon it. Over the years the banking business has undergone many changes

and now it covers a wide range of activities. According to modern concept, banking is a business, which deals with borrowings, lending and remittances of funds as well as many ancillary businesses connected thereto.

According to Imperial Dictionary –

“A Bank is an establishment which trades in money; an establishment for deposit, custody and issue of money and also for granting loans, discounting bills and facilitating transmission of remittances from one place to another.”

According to Oxford English Dictionary –

“Banking is the business of a banker, the keeping or management of a bank.”

About IFIC Bank:

Introduction:

IFIC bank is regarded as the pioneer in the private sector banking of Bangladesh. IFIC Bank is stated its journey with the noble vision of diversifying banking activates into different areas of client services.

The bank stated its operation way back from 23rd March, 1983. Since then for 20 years this bank is operating its activities though out the country in order to strengthen the economy of the country. In every sector of banking activities IFIC is become the success bank. Good customer service, investment and t50he industries employees make it possible for IFIC to be one of the leading banking companies of the country.

The board of directors of the bank consists if the finest intellects of the country’s business and extensive experience acquires over the years guided IFIC to a great success and fresher altitude.

The success of IFIC is largely credited to its friendly, cooperative approach, understanding the social banking needs of each and every client and concern for the benefit and welfare. From the beginning, the prime objective of IFIC was to increase capitalization, to maintain disciplined growth and high corporate ethics standard and enhance the health of shareholders.

Now IFIC is operating i0ts activities over the country with 110 branches. This branch is situated in most business points of the country. IFIC is the leading investors in garment sectors of Bangladesh. This helped the people to employ. The country also gets a lot of foreign currency from foreign countries. In 1996 IFIC acquired equity and management of Nepal Arab Bank Ltd. And in 1997 IFIC opened a representative office in Dubai.

With a strong sense of all business area of commercial banking, IFIC could foresee tremendous growth in home bound remittance from Bangladeshi expatriates in USA, UK, and Meddle East and in different countries of the world.

Banking is not only a profit-oriented commercial institution but it has a public base and social commitment. Admitting this true IFIC is going on with its diversified banking activities. IFIC introduced monthly saving Scheme, Special Deposit Scheme, Consumer’s credit scheme and savings Insurance Scheme etc. to combine the people of lower and middle-income group.

A term of highly qualified and experienced professionals headed by the managing director of the bank who has vast banking experience operates bank and at the top there is an efficient board of directors for making policies.

Function of IFIC:

The main task of the IFIC is to accept deposited from various customers though various accounts.

Provide loans on east term and condition.

It creates loan deposit.

The bank invest it fund into profitable sector.

It transfer money by Demand Draft (DD), pay order (PO), and telegraphic transfer. Etc.

The bank is doing the transaction of bill of exchange, cheque etc. On behalf of the client.

Assists in the foreign exchange by issuing letter of credit.

The bank insures the securities of valuable documents of the client

It brings the increasing power of dimension of transaction.

Above all IFIC helps the business man financially by giving discount facility for bill of exchange and by providing the facility of letter of guarantee.

Mission of IFIC:

- Give the clients and shareholders the highest facilities.

- Broaden the business sectors.

- By increasing working capacity and capability, the utmost use of employees.

- Increment of investment to get the market economy running

- To build a strong base of capital for the country.

- To invent the technique of getting proper increment.

- To create friendly environment to give better customer service.

- To broaden the activities of bank both international and local sectors to help the country’s economic development.

- Highest use of data Technology and proper planning of future banking activities.

- Investment in proper sector.

Vision of IFIC:

- Giving economic service in social and business sectors to be the leader of the banking sectors and develop it.

Management Aspect of IFIC:

Like any other business organization, the top management makes all the major decisions in IFIC. The board of directors being at the highest level of organization structure plays in important role on the policy formation. The board directors are not directly concern with the day to day operation of bank. They have delegate there authority to its management committee. The board established the objective and polices of the bank.

The bank has in its management a combination of highly skilled and eminent bankers of country of varied experience and expertise successfully led by Mr. Md. Abdur Rahaman Shaker a dynamic banker, as its managing directors and well educated energetic and delegated officer. Mid and lower level employees get the direction and instruction from top executives about the duties and tasks they have to perform. Management of IFIC Bank Ltd. assumes that employees are members of the team, who actively participate in accomplishing the organizational goal. The chief executive provides the guide line and board direction to the managers and employees but delegates responsibility for determine how tasks and goals are to be accomplished.

Organizational Structure of IFIC:

The management committee consists of the managing directors and head office executives. They discuss about the progress on portfolio functions. Different ideas and decisions, guidelines regarding deposits, lending and management of human and material resources are the main concern of this committee.

All these committees meet on a regular basis for discussing various issues and proposals submitted for decisions.

A layout of management structure and legitimate hierarchy of management, of IFIC are presented in the following:

Figure: Layout of Management Structure

IFIC’s Core Values:

IFIC’s core values consist of 6 key elements. These values bind they are people together with an emphasis that they are people are essential to everything being done in the Bank.

Integrity:

IFIC protects and safeguards all customer information

IFIC treats everyone in an equitable and consistent manner

IFIC creates an environment, which earns and maintains consumer trust

Open Communication:

IFIC builds customer relationships based on integrity and respect.

IFIC offers a full line of products and excellent service.

IFIC is committed to the prosperity of the customers and shareholders.

Performance Driven:

In IFIC customers and employees are judged in terms of their performance

Continuous Self Improvement:

Continuous learning, self-challenge and strive make ways for self improvement of workforce at IFIC.

Quality

IFIC offers hassle free better service timely

IFIC builds-up quality assets in the portfolio.

Teamwork:

Interaction, open communication, and maintaining a positive attitude reflect IFIC’s commitment to a supportive environment based on teamwork.

Corporate Information:

| Incorporation of the bank | 15.03.1983 |

| Certificate of Commencement of Business | 20.03.1983 |

| License Issued by Bangladesh Bank | 22.02.1983 |

| License issued for opening the first branch, Dilkusha Branch | 22.03.1983 |

| Formal launching of the bank | 23.03.1983 |

| Commencement of Business of Dilkusha Branch | 23.03.1983 |

| Listed with Dhaka Stock Exchange Ltd. | 20.12.1984 |

| Publication of Prospectus | 30.12.1984 |

| Date of first public subscription (IPO) | 14.01.1985 |

| Trading of Shares in DSE | 21.04.1985 |

| Association with Gulf Exchange Pte Ltd | 26.11.1985 |

| Signing of agreement with Western Union Money Transfer | 16.05.1993 |

| Listed with Chittagong Stock Exchange Ltd | 06.11.1995 |

| Trading of share in CSE | 06.11.1995 |

| Listed with CDBL | 29.09.2004 |

| Inauguration of Balaka Exchange Pte Ltd | 08.07.2007 |

| Registration Certificate as Stock Broker | 24.10.2007 |

Joint ventures abroad:

Bank of Maldives Limited:

IFIC is the first among the banks in the private sector to have operations abroad. In 1983, the Bank set up a joint venture bank in Maldives known as ‘Bank of Maldives Limited’ (BML) at the request of the Government of the Republic of Maldives. This is the only national bank in that country having branches throughout that country. IFIC Bank managed the affairs of BML from 1983 to 1992. IFIC Bank sold its shares in 1992 to the Government of the Republic of Maldives and handed over the Management of BML to Maldives Government.

NIB Bank Ltd., Pakistan:

IFIC Bank had two branches in Pakistan, one in Karachi and the other in Lahore. Karachi Branch was opened on 26th April 1987, while Lahore Branch was opened on 23rd December 1993.

To meet the Minimum Capital Requirement (MCR) of the State Bank of Pakistan, the Overseas Branches in Pakistan have been amalgamated with a reputed leasing company in Pakistan named National Development Leasing Corporation Ltd. Therefore, the existence of our above Overseas Branches has ceased w.e.f. 2nd October 2003 and a new joint venture bank entitled NDLC – IFIC Bank Ltd. emerged in Pakistan w.e.f. 3rd October 2003. The Bank was subsequently renamed as NIB Bank Ltd. IFIC Bank presently holds 7.31% equity in the Bank.

Nepal Bangladesh Bank Ltd. (NB Bank):

Nepal Bangladesh Bank Ltd. (NB Bank), a joint venture commercial bank between IFIC Bank Ltd. and Nepal nationals, started operation with effect from June 06, 1994 in Nepal with 50% equity from IFIC Bank Ltd.

The Bank has so far opened 17 (seventeen) branches at different important locations in Nepal. IFIC Bank presently holds 25% shares in NB Bank.

Nepal Bangladesh Finance & Leasing Limited (NB Finance):

NepalBangladesh Finance & Leasing Co. Ltd. (subsequently renamed as Nepal Bangladesh Finance & Leasing Ltd.), another joint venture leasing company between IFIC Bank Ltd. and Nepali Nationals, started its operation on April 18, 1999 in Nepal. IFIC Bank presently holds 15% share in the company.

Oman International Exchange LLC (OIE):

Oman International Exchange LLC (OIE), a joint venture between IFIC Bank Limited and Oman nationals, was established in 1985 to facilitate remittance by Bangladeshi wage earners in Oman. IFIC Bank holds 25% shares, and the balance 75% is held by the Omani sponsors. The exchange company has a network of 10 branches covering all the major cities/towns of Oman. The operations of the branches are fully computerized having online system.

The affairs and business of the company is run and managed by the Bank under a Management Contract.

Performance of IFIC:

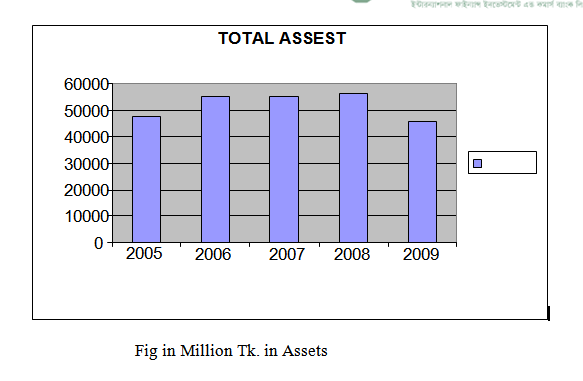

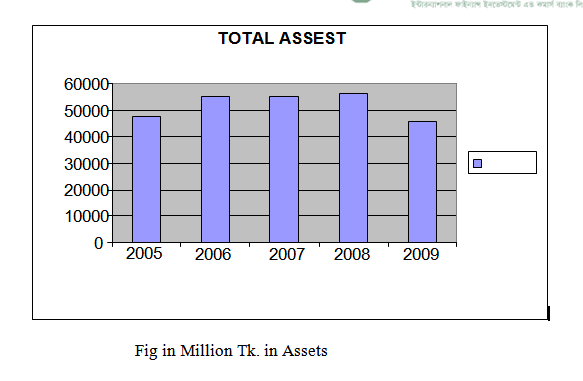

IFIC bank limited recorded a good operating result in 2007. In spite of the sluggish economic performance, the bank could maintain the continuity of its march towards progress in profit, deposit, credit, foreign exchange and foreign trade business. It maintained its lead as the major financier to ready-made garments sector. The bank also financed in other sector, such as leather,

tea, shrimp culture, etc. The bank remained as sound as before with an asset of Tk. 56520.70 million as on 31.12.2007.

Total Assets of IFIC for the year 2005-2009

| Year | 2005 | 2006 | 2007 | 2008 | 2009 |

| Amount | 48024.96 | 55046.13 | 55125.65 | 56520.70 | 45729.47 |

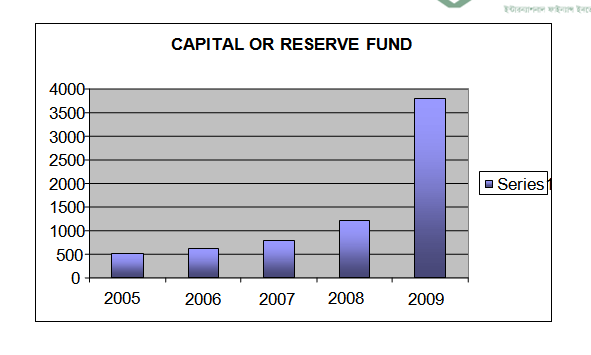

Capital and Reserve fund:

The authorized capital of the bank was enhanced to Tk. 2450.00 million in the year 2007. Reserve of the bank stood at Tk. 1,208.20 million in December 2007 as against Tk. 2468.79 million in show 2006 showing an increase of 57.13%.

Fig in Million Tk. (Paid up Capital)

| Year | 2005 | 2006 | 2007 | 2008 | 2009 |

| Amount | 516.33 | 619.59 | 805.47 | 1208.20 | 3793.04 |

Advances:

The bank continue to extend credit facilities to trade and commerce, export, import, leather, shrimp culture, real estate, and other productive and priority sectors within the policy guidelines of the bank and also Bangladesh bank. The total amount of credit of the bank stood at Tk. 36,475.74 million as on December 31, 2007 as against Tk. 32,709.68 million as on December 31, 2006.

| Year | 2005 | 2006 | 2007 | 2008 | 2009 |

| Amount | 23129.65 | 27020.21 | 32709.68 | 36475.74 | 33018.39 |

Fig in Million Tk. Advances

CAMEL Rating:

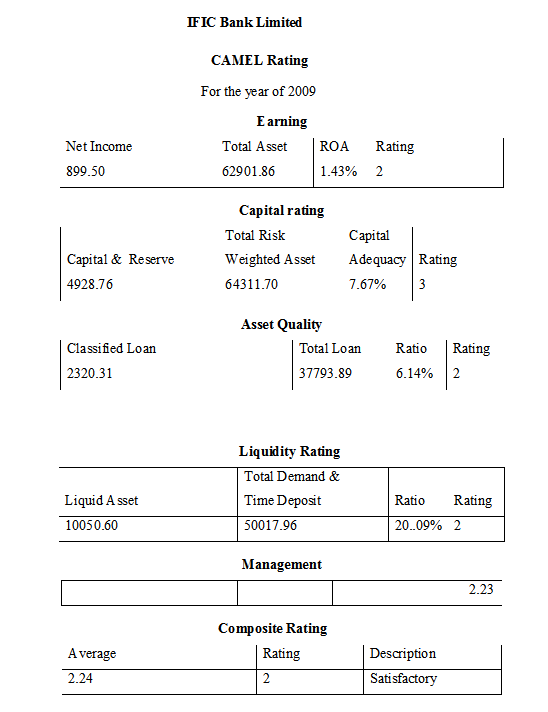

The CAMEL rating system provides a general frame work for evaluating and assimilating all significant financial operational and compliance factors in order to assign a seminary or composite supervisory rating to each regulated commercial bank. The purpose of the rating system is to effect in a comprehensive and uniform fashion on institutions financial condition, compliance with laws and regulations and overall operating soundness. In addition it serves as a useful tool for the standard of a financial institution. It is the other operator to assess the grade of banks.

From the quantitative analysis it is found that the average rating of IFIC is 2.24 which is between 1.5 to 2.49. According to standard rating the rating of those banking institution having this range is 2, i.e., the rating is satisfactory.

SWOT Analysis of the IFIC Bank:

Strengths:

IFIC bank has already established a favorable reputation in the banking industry of the country. It is one of the leading private sector commercial bank in Bangladesh. The bank has already shown a tremendous growth in the profits and deposits sector.

IFIC Bank Ltd. has a long-term reputation in the banking industry as it is one of the oldest players here. So, their enduring good will in the field works as a vital strength.

IFIC bank has an interactive corporate culture. The working environment is very friendly, interactive and communicate provides as a great motivation factor among the potential customer.

It has excellent Management.

It has high commitment of customer, qualified and experienced Human Resource.

It has sophisticated automated banking system in most of its branches which foster the overall banking activity.

Weakness:

Lack of motivation among the workers.

Heavy dependency on Head Office in decision making sometimes slower the work process.

Lack of extrinsic and intrinsic reward & incentives for the employees from management sometimes result to job burn out.

High dependency on ‘word of mouth’ strategy instead of obtaining any marketing strategy.

Absence of teamwork between branches.

Opportunity:

Other unexplored district where branches can be set up.

High awareness among all level of people to deposit money in the banks.

Increasing the demand of customer finance.

Investment potential of Bangladesh.

Relationship Management.

Threats:

Some commercial/ Foreign Bank as well as private bank are increasing

Similar type of retail banking products, such as insurance company, stock exchange, financial institution etc.

Frequent changes in rules and regulations from Bangladesh Bank.

Customer awareness of pricing and service.

Operation of IFIC

- General Banking Division

- Account Opening Section

- Types of Accounts

- Transfer of an Account to Another Branch

- Closing Procedure of an Account

- Deposit Product

- Pension Saving Scheme

- Income Tax Rebate

- Fixed Deposit Receipt

- Local Remittance

- Money Transfer

Operation of IFIC:

The importance of the mobilization of savings for the economic development of our country can hardly be over emphasized. The bank considers savings and deposits as lifeblood of the bank. More the deposit greater is the strength of the bank. So they intend to launch various new savings schemes with prospect of higher return duly supported by a well-orchestrated system of customer services. Technologies such as computer, ATM, telecommunication etc. all would be harmonized and adapted to the system in order to provide found the clock and any branch services to the clients.

The Three main operating divisions of IFIC Bank Ltd. are as follows:

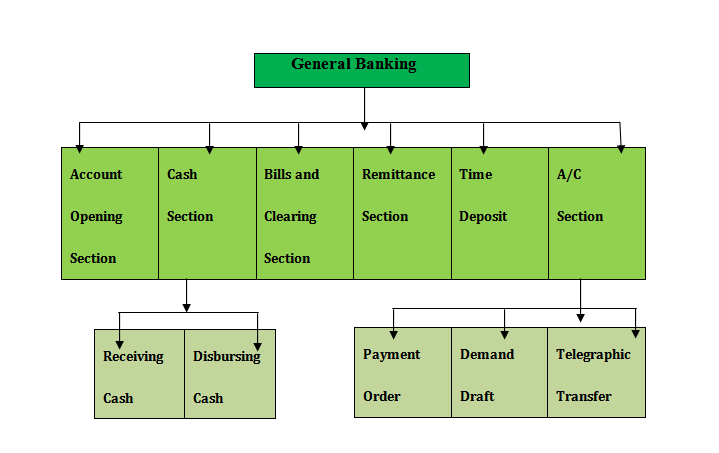

General banking Division:

A wide range of products and services different type of deposits such as SB, CD, FDR etc are offered by this department. Local private banks is biggest threat a they offer higher interest rate and better services.

| G |

eneral banking is the heart of banking activities. Total banking procedure start with this department. General banking department perform the core function of bank operation and it is known as “Retail Banking”. They take the deposits from the customer and meet their demand for cash honoring their checks. It opens new accounts, remit funds, issues bank draft and pay order. Account opening section, Remittance, Checks clearing, Cash, FDR, Accounts section are part of general banking.

General Banking is designed to serve the general people is saving money, smoothing transactions for commercial people and ensure security of the precious wealth of the clients lot of important activities. IFIC Bank has all the required sections of general banking activities come under General Banking section of IFIC Bank are as follows:

Account Opening Section:

This section opens Current Deposit (CD), Savings account (SB), STD, FDR. Most vital work starts from here as selection of customer is very important for the bank success and failure. If the account holder do money laundering through this account than the bank will be legally responsible for that and bank has to answer to Bangladesh bank or customer may occur fraud and forgery by this account and thus destroy goodwill of bank’s. In branch account opening officer follow some rules which are guided by IFIC Bank manual and senior opening form signature is must in this case. Manager’s signature is must on every account opening form as permission for opening the account. All these help to stop adverse situation. (See Appendix: B)

Target Customer of IFIC Bank:

| Individual person | Public limited company |

| Sole proprietorship firm | Government Organization |

| Partnership firm | Semi Government Organization |

| Private limited company | Bank employee |

Types of Accounts:

Deposit is life-blood of a commercial bank. Since commercial bank deals with other people’s money, without deposit there is no business for the commercial bank. Accepting deposit is one of the main functions of commercial bank. IFIC bank’s deposits can be broadly classified as follows:

Current Account:

Current Account is most suitable for private, individuals, traders, merchants, importers and exporters, mill and factory owner etc. For opening of a current minimum deposit of TK. 2000.00 is required along with introductory reference. No interest is given the current account deposited money. One can enjoy maximum flexibility and convenience when s/he opens a current account with IFIC bank limited. This account offers:

- Any number of transactions a day

- Free check book

- Statement of account at any desired frequency

- Statement by fax on demand

Savings Account:

The saving account is primarily for small-scale savers. The main objective of this account promotion is thrift. Hence, there is restriction on withdrawals are permitted only against prior,

- Minimum amount of TK. 1000.00 is required as initial deposit.

- Frequent withdrawal is not encouraged.

- 7 days is required for withdrawal of large amount

- The rate of interest is 6.00 % against SB account.

Short-Term Deposit (STD) Account:

In short term deposit account, the deposit should be kept for at least six month to get the interest. The STD account is a very important class of account in this bank. The minimum amount of balance has to be maintained with STD account is TK. 25000 Interest is given at a rate of 4.5 percent which is less than savings account. Normally various big companies, organizations, government departments keep money in STD account. For this type of account, frequent withdrawal is discouraged. Deposit should be kept for at least seven days to get interest. Prior notice is required for the withdrawal of money from STD account. The account holder must give seven days before the withdrawal that is why STD is also called ‘Seven days notice’ current account.

Fixed Deposit Receipt (FDR):

Fixed period specified in advance. These deposits are time deposit. Normally the money on a fixed deposit is not repayable before the maturity date of a fixed period. At the time of opening the deposit account, the banker issued a receipt acknowledging the receipt of money on deposit account. It is popularly known as FDR. An interest rate ranging from 10.50 percent to 11.50 percent is offered depending on different amount and tenure of deposit. Fixed deposits are the deposits in which an amount of cash is deposited in bank for a

Transfer of an account to another Branch:

Sometimes the customer wants to transfer his account to another branch due to various reasons. IFIC Bank, Dhanmondi Branch, also gives this kind of facility to the customer. In this case, they will have to submit an application to the branch manager stating the reasons. The officer verifies the signature and finds out the balance of the account holder. The holder also submits the rest check leaves along with the application. Then the officer issues an Inter Branch Credit Advice (IBCA) to that branch and a debit voucher with the balance of deposit in that account. He also sends the account opening form and specimen signature card to that new branch. The new branch officer verifies the customer signature with account opening form supplied to him. The amount mentioned in the (IBCA) considered as the initial deposit of the new branch.

Closing Procedure of an account:

For two reasons account can be closed –

By Banker: banker has the right to close the account if the customer does not maintain any transaction six years and the balance is become lower than the minimum balance.

By Customer: if the customer wants to close his account he will write an application to the manager and the manager then close the account.

Firstly, the concerned customer has to apply for closing his/her account. Then to close the account the cheque book is to be returned to the bank. After charging the account closing charge the Manager will close the account. Closing charges are as follows:

For below 6 months 100 tk.

For over 6 months 200 tk.

The rest amount of money laid in the respective account is paid to the customer by a payment order. In case of payment order certain commissions and vat are cut off from the account.

Deposit Product:

IFIC Bank offers a wide variety of deposit products to meet your financial needs. From current and savings accounts to Fixed Deposits and Pension Schemes each account is designed to give you the best value for your money.

Savings Account:

IFIC Bank offering the most attractive interest rate of 5% on your Savings Account:

a) Initial Deposit: Tk. 500.00 at rural branches & Tk. 1000/- for urban branches which should be considered as minimum balance.

b) Competitive Interest Rate.

c) No extra hidden charge.

d) Debit Card facility.

e) SMS Banking Facility.

f) ATM facility.

g) Online banking facility.

h) Utility payment service.

i) Transfer of fund from one branch to another.

j) Opportunity for availing locker facility.

Pension Savings Scheme (PSS):

IFIC Bank is pleased to offer 3(three) / 5(five) Years Monthly Savings plan with higher return and monthly pension option at maturity. Monthly Installment option and Payment after maturity, now being offered under the scheme, are as under:

| Monthly Instalment | 3 years Terms | 5 years Terms |

| Amount payable After maturity | Amount payable After maturity | |

| Tk. 500 | Tk. 20,781 | Tk. 38,134 |

| Tk. 1,000 | Tk. 41,562 | Tk. 76,268 |

| Tk. 2,000 | Tk. 83,125 | Tk. 1,52,536 |

| Tk. 3,000 | Tk. 1,24,687 | Tk. 2,28,804 |

| Tk. 5,000 | Tk. 2,07,812 | Tk. 3,81,340 |

| Tk.10,000 | Tk. 4,15,624 | Tk. 7,62,680 |

| Tk.15,000 | Tk. 6,23,435 | Tk. 11,44,020 |

| Tk.20,000 | Tk. 8,31,247 | Tk. 15,25,360 |

| Tk.25,000 | Tk. 10,39,059 | Tk. 19,06,699 |

| Tk.50,000 | Tk. 20,78,118 | Tk. 38,13,399 |

You can receive full payment at maturity or option for a pension on monthly basis to meet your needs. The scheme entitles you to have Income Tax Rebate to make your savings even more valuable.

Income Tax Rebate:

Monthly installments of our PSS will qualify as allowable investment in Yearly Income Tax Return. The account under this scheme will also be exempted from deduction of tax on interest payable at source. However, If any tax or other Govt. Levy is payable under this Scheme in future the same shall be deducted from the account.

Credit facilities:

The A/c holder can avail loan / Secured Overdraft (maximum 80% of the deposited principal amount but not less than Tk.20, 000/-) against lien of the PSS account to meet the personal need, educational expenses of his/her children or for medical treatment.

Current Account:

a) Minimum required balance Tk. 2000.

b) Debit Card facility.

c) ATM facility.

d) Online Banking facility.

e) SMS Banking Facility.

f) Utility payment service.

g) Transfer of fund from one branch to another.

h) Opportunity for availing locker facility.

i) No extra hidden charge.

Fixed Deposit Receipt (FDR):

Fixed deposit gives you higher interest than other forms of deposits. IFIC Bank is offering competitive interest rate in FDR:

Fixed Deposit Rate:

| FDR (Tenure 3 months) | 8.25% | |

| FDR (Tenure 6 months) | 8.00% | |

| FDR (Tenure 1 year) | 8.00% |

Short Term Deposit (STD):

Short Term Deposit account is opened for any individual/firm/company/Financial institutions /societies/clubs/Trust/NGOs/Banks/Corporations/Autonomous bodies /government organizations. Initial Deposit for opening account Tk. 25,000/- which should be considered as minimum balance.

STD Interest Rate:

| Short Term Deposit(STD) | 2.00% | |

| Short Term Deposit(STD)-Bank to bank/Non-Banking Financial Institutions (NBFI) | 0.20% |

.Local Remittance:

Sending money from one place to another place for the customer is another important service of banks. And this service is an important part of country’s payment system. For this service, people, especially businessmen can transfer funds from one place to another place very quickly. There are five kinds of techniques for remitting money from one place to another place. These are:

1) Demand Draft

2) Pay Order

3) Telegraphic Transfer

4) Telephone Transfer

5) Mail Transfer – Time consuming and not frequently used

Money Transfer:

IFIC Bank Ltd. earns a huge amount of money by selling several customer services. The IFIC Bank Ltd. offers the following services to its customer:

Demand Draft (DD):

DD is the most popular instrument of remitting fund. It is an order to pay money drawn by one branch of a bank upon another branch of the same bank for a particular sum of money which is payable to order and demand.

Commission of DD as under:

Postal charge 10/=

Amount of DD Commission (TK)

Minimum charge 25

Payment Order (PO):

A payment order is an instrument from one branch to another of the same bank to pay specified sum of money to the person named therein of his order. Unlike cheque, there is no possibility of dishonoring pay order because before issuing bank takes our money of the pay order in advance.

Amount of DD Commission (TK)

TK 0 to TK. 1000 10

TK. 1000 to TK. 100000 25

TK 100000 to TK 500000 50

Above TK. 500000 100

Telegraphic Transfer (TT):

TT is the fastest means of money transfer between two branches of the same bank. The formalities of TT is as same as MT, there are taken some extra charge for telephone.

Telegraphic and Telephone transfer are almost the same, both are them are known as TT in short. IFIC bank helps people transfer their money from one district to another in the quickest possible time at the lowest service charge.

CHAPTER-IV

ADVANCED AND LOAN DEPARTMENT

Introduction

Credit Policy of IFIC Bank Limited

Sound Principles of Lending

Financial Data Analysis

Credit Facilities Extended by IFIC

Credit Rating on IFIC Bank Limited

Technology

Nature of the Loan

Types of Borrowers

Disbursement Situation of Different Types of Loan

Classification of Loan and Advances

CREDIT PROFILE OF IFIC BANK

Introduction:

The basic functions of bank are deposit extraction and credit extension. Credit is the hub of banking business. It helps this kind of organizations to earn more than 50% of the total revenue. Managing credit operation, thus, is the crying need for any bank. In case of failure in credit management, a bank may face extinction. It is, therefore, necessary that a bank has a proper credit profile that guides the credit operation of the bank in an effective manner. For proper management of credit each and every bank follows the profile for smooth approval, direction, monitoring and review of lending operation.

Credit Policy of IFIC Bank Limited:

A credit policy includes all rules relating to loans and advances made by the bank to the borrowers. It includes types of credit extended by banks, method of judging the credit worthiness of borrowers, the collateral or securities that are accepted by the banks and so on. This policy guidelines refer to all credit facilities extended to customers including placement of funds on the inter bank market or other transactions with financial institutions. IFIC Bank Limited Credit policy contains the views of total macro-economic development of the country as a whole by way of providing financial support to the Trade, Commerce and Industry. Throughout its credit operation IFICBL goes to every possible corner corners of the society. They are financing large and medium scale business house and industry. At the same time, they also takes care entrepreneur through its operation of Lease Finance and some Micro Credit, Small Loan Scheme etc. As a part of its Credit Policy IFICBL through its credit operation maintains commitment for social welfare. The bank is coming up with a scheme where the under privileged children will be given financial support for education and self-employment.

From operational aspects it is observed that as a matter of policy—

- Charging of interest is flexible depending on the proposal and the customer.

- It takes care in maintaining proper mix of short medium and long term finance for a period not exceeding 5 years.

- IFICBL puts emphasis on the customers, ie, the man and business not on the security in selecting borrowers.

- It takes care of diversity in credit portfolio.

Sound Principles of lending:

Sound principle of lending is obvious to avoid loan default tendency and risk elements to safeguard of public money as well as business of a bank. So, there must be a principle of advance and efforts should be made to make it a sound one for which in depth study must be made on the following points by this bank.

a) When the loan is to be given

b) Why the loan is to be given

c) How the loan is to be given

d) What may happen after disbursement of the loan

e) Generally what happen (from past experience) after disbursement of the loan

f) Is it hopeful that the borrower will repay the loan?

g) Whether loan should be given only in private sector or also in government sector as well.

h) Whether only secured loan will be extended or provision should be kept for clean loan also

i) Whether only short term and mid term loan will be considered or long term will also be considered?

j) Whom to be financed?

k) Whether loan will be extended to trading sector only or industrial sector will also be considered.

Besides the above mentioned decision, the managers must ensure materialization of following safe guards for proper use and timely realization of loans, commission. Interest etc and minimize the risk and hazards:

a) Safety of Fund: Safety means the assurance of repayment of distributed loans. This depends mainly on integrity, business behavior, reputation, past experience in the particular line of business, financial solvency, quantum of own equity in business, capability to run business efficiently, capacity and willingness to repay the loan etc. of the loan.

b) Security: It must be ensured that repayment of the loan is secured and for this purpose manager must retain security against loan to fall back upon incase of borrower’s default. The securities must possess required basic qualities such as possession, title deed, parches etc.

c) Liquidity: The borrower should have liquid assets so that he can adjust liability on demand and as much as possible loan itself should be quasi liquid so that it can be realized on demand in case of need.

d) Purpose: Purpose of a loan should be production, development and economic benefit oriented.

e) Profitability: This is applicable both for bank and the borrower.

f) Diversification: Diversification means to distribute the loan to a large number of borrowers rather to a small number of borrowers. This will increase the services of the bank and it will reduce the risk of loan recovery.

g) National Interest: Nothing can be done legally if it jeopardizes national interest in any way.

h) Credit restriction imposed by Central Bank: At the time of sanctioning loan, the commercial banks must have to follow the restrictions that are imposed by Bangladesh Bank from time to time.

Financial Data Analysis: The credit manager has to compare financial statements of at least three years. For this s/he takes help of different ratios such as liquidity ratio, solvency ratio, profitability ratio and activity ratio. S/he also needs to examine bank account statement of the applicant very keenly. In addition to analysis, the manager should visit the business concern to get a true picture of it.

Industry Analysis: In this part, the manager is required to study the business behavior, which includes market demand, competitors and government barriers.

Lending Risk Analysis: It is a systematic and structural way to assess lending risk, which covers all the factors described above. Here a form has to be completed by the lending officer. If lending risk is found to be low, financing can be done and vice versa.

Finally based on the above information provided by the loan applicant and after analyzing all the information and information provided by Credit Information Bureau. (CIB) a credit committee of a bank takes the lending decision.

Credit Facilities Extended by IFIC:

Lending of money to different kinds of borrowers is one of the most important functions of IFIC Bank Limited. Major amount of income of this Bank comes from its lending. IFIC makes advances to different sectors for different purposes, such as financing in trade and commerce, imports and exports, industries, transport, house building, agriculture etc.

General Loan:

When an advance is made in a lump sum repayable either in fixed monthly installment or in lump sum and no subsequent debit is ordinarily allowed except by way of interest, incidental charges, etc it is called a loan. The whole amount of loan is debited to the customers name on a loan account to be opened in the ledger and is paid to the borrower either in cash on by way of credit to his current/ savings account. It is given against Personal guarantee, hypothecation of goods and land & building.

Eligibility: Loans are normally allowed to those parties who have either fixed source of income or who desire to pay it in lump-sum.

Interest Rate: 16%

Consumer Durable Loan:

IFIC creates an opportunity to satisfy customers’ desire to purchase consumer durables like – computer, television, refrigerator, washing machine, air conditioner, music systems, motor cycle and a lot of other things by Consumer Durable Loan. IFIC Bank is providing maximum 1.00 lac taka to be repayable in by 12 to 36 monthly installments. Consumer Durable Loan Repayment Schedule

| Loan Amount | Interest Rate | Monthly installment | |||

| 36 months | 24 months | 12 months | |||

| Maximum Tk. 100,000/- | @16.50% | Tk. 3,542/- | Tk. 4,922/- | Tk. 9,099/- | |

4.5.3.Parua (Education Loan): IFIC Bank offers Education Loan that can make a student’s dream comes true. IFIC Bank firmly believes that expense for education is an investment for future. Only education can fulfill the dreams of an individual as well as a nation. IFIC Bank is providing maximum Tk. 8.00 lac to be repayable in 12 to 48 monthly Installments.

Parua (Education Loan) Repayment Schedule

| Loan Amount | Interest Rate | Monthly installment | |||

| 48 months | 36 months | 24 months | 12 months | ||

| Tk. 100,000/- or multiple | @16.50% | Tk. 2,861/- | Tk. 3,542/- | Tk. 4,922/- | Tk. 9,099/- |

Thikana (Home Loan):

Home is an address, a shelter for entire life, and this is what one leaves behind for the family. A house is the single biggest investment that you will make in your lifetime. To own a home from savings takes a long time and full payment at a time is difficult too. Don’t wait your entire life saving. Trust us, take a Home loan from IFIC and realize your dreams now. IFIC Bank is providing maximum Tk.75.00 lac to be repayable in 12 to 180 monthly installment. Thikana (Home Loan) Repayment Schedule

| Loan Amount | Interest Rate | Monthly installment (Tk.) | |||

| 15 years | 14 years | 13 years | 12 yearss | ||

| Tk.1,00,000/- or Multiple | @ 15.00% p.a. | 1,401/- | 1,429/- | 1,462/- | 1,503/- |

| 11 years | 10 years | 09 years | 08 yearss | ||

| 1,553/- | 1,615/- | 1,694/- | 1,796/- | ||

| 07 years | 06 years | 05 years | 04 yearss | ||

| 1,932/- | 2,117/- | 2,381/- | 2,785/- | ||

| 03 years | 02 years | 01 years | |||

| 3,469/- | 4,851/- | 9,029/- | |||

Any Purpose Loan:

If you’re looking for a personal loan to meet any financial requirement that’s easy to get, your search ends with us. IFIC Any Purpose Loan caters to various needs of salaried people. With minimum formalities you can get a loan for an amount upto Tk.3.00 lac to be repayable at 12 to 36 monthly installment. The loans are easy & absolutely hassle free.

Any Purpose Loan Repayment Schedule

| Loan Amount | Interest Rate | Monthly installment | ||

| 36 months | 24 months | 12 months | ||

| Tk. 100,000/- | @16.50% | Tk. 3,542/- | Tk. 4,922/- | Tk. 9,099/- |

IFIC Marriage Loan:

The single most important day of your life, begin you new family in style. Money is only an object for such an important event and shouldn’t be a barrier to its perfection. If you need extra funds to ensure your special day is one to remember than come into on IFIC Bank branch and trust us to help you realize your dreams.

IFIC Bank is providing maximum Tk. 3.00 lac to be repayable in 12 to 36 monthly installments.

Marriage Loan Repayment Schedule

| Loan Amount | Interest Rate | Monthly installment | ||

| 36 months | 24 months | 12 months | ||

| Maximum Tk. 100,000/- | @16.50% | Tk. 3,542/- | Tk. 4,922/- | Tk. 9,099/- |

CNG Conversion Loan:

Due to price hike of fuel, CNG conversion has become the necessity of time. IFIC Bank understands the needs and offers you the best suitable loan for CNG conversion of your vehicle.

IFIC Bank is providing maximum Tk. 1.00 lac to be repayable in 12 to 36 monthly installments.

CNG Conversion Loan Repayment Schedule

| Loan Amount | Interest Rate | Monthly installment | ||

| 36 months | 24 months | 12 months | ||

| Maximum Tk. 100,000/- | @16.50% | Tk. 3,542/- | Tk. 4,922/- | Tk. 9,099/- |

IFIC Home Renovation Loan:

What to turn a home into your own? If you need to renovate your home, either from necessity because your family has grown, or if you just have a vision that you want to have realized from your old house, then come into an IFIC branch and trust that we will help you realize your dreams.

IFIC Bank is providing maximum Tk. 3.00 lac to be repayable in 12 to 36 monthly installment.

Home Renovation Loan Repayment Schedule

| Loan Amount | Interest Rate | Monthly installment | |||

| 36 months | 24 months | 12 months | |||

| Maximum Tk. 100,000/- | @16.50% | Tk. 3,542/- | Tk. 4,922/- | Tk. 9,099/- | |

4.5.9.IFIC Medical Loan IFIC Bank lets you to focus on Medicare of your family and yourself – taking away the worry of finance. IFIC Medical Loan caters hospitalisation or other emergency medical needs to salaried people. The loans are easy & absolutely hassle free. IFIC Bank is providing maximum Tk. 3.00 lac to be repayable in 12 to 36 monthly instalment. Medical Loan Repayment Schedule

| Loan Amount | Interest Rate | Monthly installment | ||

| 36 months | 24 months | 12 months | ||

| Maximum Tk. 100,000/- | @16.50% | Tk. 3,542/- | Tk. 4,922/- | Tk. 9,099/- |

IFIC Holiday Loan:

When you plan to visit overseas with family or friend for taking a break from routine, enjoying nature, making a holiday – all these can happen through IFIC Holiday Loan. IFIC Holiday Loans are easy & absolutely hassle free.

IFIC Bank is providing maximum Tk. 3.00 lac to be repayable in 12 to 36 monthly. Installments.

IFIC Holiday Loan Repayment Schedule:

| Loan Amount | Interest Rate | Monthly installment | ||

| 36 months | 24 months | 12 months | ||

| Maximum Tk. 100,000/- | @16.50% | Tk. 3,542/- | Tk. 4,922/- | Tk. 9,099/- |

IFIC Peshajeebi Loan (Loan for Professional Loan):

Whether you are a Doctor/ Engineer/ IT professional/ Management Consultant or any other professional, sometimes you just need that little bit extra money for whatever reason? Don’t make yourself worry about it. Come to us at IFIC Bank and trust that we’ll help you to realize your dreams.

IFIC Bank is providing Maximum Tk. 10.00 lac to repayable in 12 to 48 monthly installments.

Quick Processing & Least Formalities.

IFIC Peshajee Loan Repayment Schedule:

| Loan Amount | Interest Rate | Monthly installment | |||

| 48 months | 36 months | 24 months | 12 months | ||

| Tk. 100,000/- or multiple | @16.50% | Tk. 2,861/- | Tk. 3,542/- | Tk. 4,922/- | Tk. 9,099/- |

IFIC Auto Loan:

Owning a car means freedom of convenience for moving out, affords punctuality, shelter from rain and heat during traveling and above all guarantees the much needed safety. Owning a car is a dream of many people. To materialize your dream, now we have Auto Loan with more flexible, affordable and convenient package option.

IFIC Bank is providing maximum Tk. 20 lac to be repayable in 12 to 60 monthly installments.

Auto Loan Repayment Schedule

| Loan Amount | Interest Rate | Monthly installment (TK.) | ||||

| 60 months | 48 months | 36 months | 24 months | 12 months | ||

| Tk.1,00,000/- or Multiple | 15.50% p.a. | 2,407/- | 2,810/- | 3,493/- | 4,874/- | 9,051/- |

| Tk.20,00,000/- maximum | 15.50% p.a. | 48,140/- | 56,200/- | 69,860/- | 97,480/- | 1,81,020/- |

Easy Commercial Loan:

To meet business requirement of individual business enterprises (other than public limited company) against pledge of financial instruments i.e. FDR, ICB Unit Certificate, WEDB, NFCD, PSS Account, MIS & Share Certificates & any other Govt. security eligible for credit facilities.

| Interest Rate | |

| IFIC Bank FDR | 2.00% above the FDR Rate but not less than 10.50% p.a. with quarterly rest or as revised from time to time. |

| Other Banks FDR | 2.00% above the Other FDR Rate but not less than 10.50% p.a. with quarterly rest or as revised from time to time. |

| ICB Unit certificate, WEDB & and other Financial Instruments. | 13.00% p.a. with quarterly rest or as revised from time to time. |

| NFCD | 13.00% p.a. with quarterly rest or as revised from time to time. |

| Pension Saving Scheme | 13.00% p.a. with quarterly rest or as revised from time to time. |

| MIS | 13.00% p.a. with quarterly rest or as revised from time to time. |

| Share | 13.00% p.a. with quarterly rest or as revised from time to time |

Retailers Loan :

To meet working capital /capital finance for any small & retail entrepreneur with successful business record, having a valid trade license are eligible for Retailers loan.

Eligibility:

Transport Loan :

To purchase of Road/Water transport for commercial use individual, business enterprises (other than public limited company) engaged in transport business at least two years experience are eligible for transport loan.

Interest Rate:

Commercial House Building Loan:

Individual, business enterprises (other than public limited company) having commercial plot are eligible for construction of commercial building.

Possession Right Loan:

For financing fixed working capital proprietorship concern having no collateral security to offer other than possession right of shop and at least two years experience in the line of business are eligible for possession right loan.

Contractor’s Loan:

Individual, business enterprises (other than public limited company) engaged in construction and supply business are eligible for secured over draft to execute work order awarded by Govt./Semi Govt. & Autonomous Bodies.

Interest Rate:

Bidder’s Loan:

Individuals, business enterprises (other than public limited company) engaged in construction and supply business can avail Bidder’s loan for issuing Payment Order/Demand Draft etc. to participating in tenders

Working Capital Loan :

Business Enterprises (other than public limited company) engaged in manufacturing/ trading business are eligible to avail Working Capital Loan to meet day to day expenses for processing of manufacturing and selling product.

Project Loan:

Business Enterprises (other than public limited company) engaged in manufacturing/ service industry can avail Project Loan to set up /BMRE of manufacturing /service unit.

Letter of Guarantee:

Business Enterprises (other than public limited company) engaged in construction, supply and other business enterprise can avail Letter of Guarantee facility for issuing guarantee to participate tenders, execute job order and to meet any other obligation.

Letter of Credit:

Business Enterprises (other than public limited company) can avail Non-funded facility for import / procurement of merchandise.

Commission

Loan against Imported Merchandize (LIM):

Business Enterprises (other than public limited company) engaged in import merchandise can avail working capital for retirement of import documents.

Loan against Trust Receipt:

Business Enterprises (other than public limited company) engaged in import of merchandise can avail working capital for retirement of import documents.

Muldhan:

Any business purpose loan for business enterprises (other than Public Limited Company) incorporated in Bangladesh engaged in manufacturing or trading or service business.

Women Entrepreneur’s Loan (Protyasha):

Any business purpose loan for Small and Medium sized business, owned by women entrepreneurs.

Agriculture Credit:

Bangladesh is an agro-based country and majority of our population dependant on Agriculture. Although maximum of the total population is dependant on agriculture, its contribution to GDP has gradually come down. Moreover, every year a huge amount of food grain and other agricultural products are imported to meet the demand of the country. In order to achieve desired growth in agriculture sector of the country, we are committed to increase our present loan portfolio in agricultural sector. IFIC Bank is offering Agriculture Loan products namely i) Krishi Saronjam Rin – for Agriculture Equipments ii) Shech Saronjam Rin – for irrigation equipments iii) Poshupokkhi & Motsho Khamar Rin – for Live Stock & Fish Culture & iv) Phalphasali Rin – for Fruit Orchard for individuals & group at micro level.

Krishi Saronjam Rin (for Agriculture Equipments):

IFIC Bank offers Krishi Saronjam Rin to individual /Group at micro level for purchasing of agricultural machinery like new power tiller/power tiller with plough (tractor), single cylinder tractor with plough, power tiller with trolley, Rotavator etc.

Eligibility

| Any individual /Group (minimum 02 member maximum 10) aged above 18 years and below 60 years at the time of sanction of loan. | |

| At least 3 years involved in agro-based production. | |

| Having homestead and permanently living in the area. |

Shech Saronjam Rin (for Irrigation Equipments):

IFIC Bank offers Shech Saronjam Rin to individual /Group at micro level for purchasing of irrigation machinery like Shallow tube well, Deep tube well, Motor pump, Generator etc.

Eligibility:

| Any individual /Group (minimum 02 member maximum 10) aged above 18 years and below 60 years at the time of sanction of loan. | |

| At least 3 years involved in agro-based production. | |

| Having homestead and permanently living in the area. |

Loan Size:

| Minimum Tk.20,000/- | |

| Maximum Tk.1,000,000/- |

Nature of the Loan:

| Term Loan |

Poshupokkhi & Motsho Khamar Rin (for Live Stock & Fish Culture):

IFIC Bank offers Poshupokkhi & Motsho Khamar Rin to individual /Group at micro level To meet financial needs of live stock development/ fish culture (including shrimp) excluding intensive cultivation.

Eligibility:

| Any individual /Group (minimum 02 member maximum 10) aged above 18 years and below 60 years at the time of sanction of loan. | |

| At least 3 years involved in agro-based production. | |

| Having homestead and permanently living in the area. |

Loan Size:

| Minimum Tk.20,000/- | |

| Maximum Tk.300,000/- |

Phalphasali Rin (for Fruit Orchard):

IFIC Bank offers Phalphasali Rin to individual /Group at micro level to meet financial needs of maintenance expenses of fruit orchard (owned/rental/leased).

Eligibility:

| Any individual /Group (minimum 02 member maximum 10) aged above 18 years and below 60 years at the time of sanction of loan. | |

| At least 3 years involved in agro-based production. | |

| Having homestead and permanently living in the area. |

Loan Size:

| Minimum Tk.20,000/- | |

| Maximum Tk.300,000/- |

Repayment:

| Lump sum within expiry or as per acceptable term. |

CREDIT RATING ON IFIC BANK LIMITED:

| Long Term | Short Term | |

| Surveillance Rating 2008 | A | ST – 2 |

| Entity Rating – 2007 | A | ST – 3 |

| Outlook | Stable | |

| Date of Rating | June 29, 2009 | |

Credit Rating Information and Services Limited (CRISL) has assigned A (pronounced as single A) rating in the long term and ST – 2 in the short term to International Finance Investment and Commerce (IFIC) Bank Limited for the year 2008. The above rating has been given in consideration of the Bank’s good fundamentals such as good capital adequacy, good financial performance, sound liquidity position, increasing trend in market share and decreasing trend in NPL. However, the above has been constrained, to some extent, by high loan deposit ratio, decline in internal capital generation ratio and dependence on term deposits. Bank/ Financial Institutions rated in this category are adjudged to offer adequate safety for timely repayment of financial obligations. This level of rating indicates a corporate entity with an adequate credit profile. Risk factors are more variable and greater in periods of economic stress than those rated in the higher categories. The short term rating indicates high certainty of timely payment. Liquidity factors are strong supported by good fundamentals and the risk factors are very small.

Credit Rating Information and Services Limited (CRISL) also viewed the bank with “stable outlook” on the basis of its consistent increase in operational efficiency.

Mentionable that the above ratings were based on the position of the bank as of December 31, 2008 and the date of rating by CRISL was June 29, 2009.

Technology:

Since the beginning of its journey as a commercial bank in 1983, IFIC Bank has been giving great emphasis on the adoption of modern technology. It became the pioneer in the field of automation by introducing computerized branch banking right in the same year. Subsequently, all the branches were brought under similar automated platforms with upgraded software applications to offer all the critical banking features. At present all 65 domestic branches are fully computerized under networked environment.

The Bank has taken up a new project with Misys International Banking System Inc. (UK) to further upgrade its banking operation to state-of-art world class on-line banking solutions to provide faster and even more convenient centralized services to the clients.

Besides, the Bank is also operating fully on-line Automated Teller Machine (ATM) services under the banner Q-Cash at a number of locations in Dhaka and Chittagong. The ATM facilities are available to the customers at Q-Cash booth.

Since the importance of Web presence in the Internet is absolutely critical, IFIC Web Site www.ificbankbd.com has long been launched for the convenience of the customers, where all the activities and information are constantly being posted and updated. A Central Mailing System is operational at the Head Office to let the customers have direct electronic access to the selected staff.

Nature of the Loan:

Bank advances loans for short, medium and long terms. The term of the loan is determined on the basis of gestation period of a project and generation of income by use of the loan.

Nature of Loan at a glance

| Loan Type | Short Term ( up to 1 year) | Medium Term (over 1year to 5 years) | Long Term (over 5 years ) |

| Name of Loan | Cash Credit Hypothecation, |

LTR,PAD,SOD,L/C

SOD work Order,PLS,CCS,Car Loan,Doctors Credit Scheme,Small LoanGeneral Loan, HouseBuilding Loan, Staff Loan , Lease Finance.

Here

LTR=Loan against Trust Receipt L/C=Letter of Credit

PLS=Personal Loan Scheme PAD=Payment against Documents

CCS=Consumer Credit Scheme SOD=Secured Overdraft

Types of Borrowers :

A borrower should be legally competent to enter into a contract, as borrowing is a contract between the lender and the borrower. Minors, lunatics, drunkards and insolvents cannot enter into a valid contract and cannot, therefore, be entertained as borrowers. Before entertaining an application for loans and advances, banker should verily borrowers’ capacity to contract and, his power to borrow, so as to effectively charge the security offered as a cover for the advances.

There are certain conditions to be fulfilled by the consumer to apply for the loan. Consumer should be eligible to apply for a loan. Service person get loan only when the retirement date must be after the date of expiry of loan. The target customer of the Bank is all people. Business, service, doctors, suppliers, contractors are he customers. Now it can be classified into four types:

Types of Borrower at a glance

| SI No. |

Borrowers

Name of the Loan

%

1.

Business

General Loan, Cash Credit (CC) Hypothecation, Packing Credit, LTR (Loan against Trust receipt), PAD (Payment against document). Lease Finance, Small Loan, Letter of Credit

50

2.

Service

Personal Loan

5

3.

Both

HouseBuilding Loan, Consumer Credit Scheme, Car Loan

20

4.

Others (Doctors, Suppliers, Contractors, Deposit holders. Staff and Executive)

Doctors Credit Loan, Secured Overdraft, Staff Loan

25

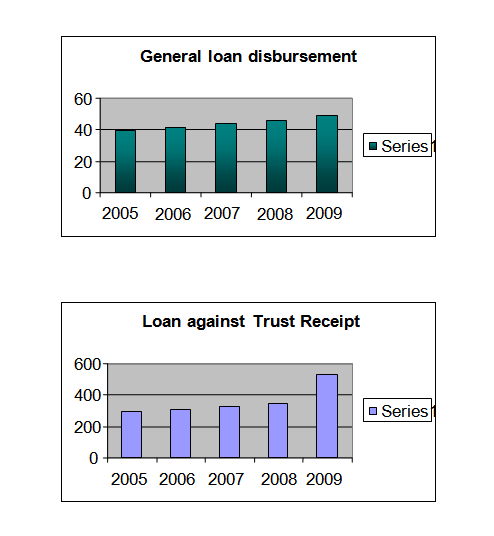

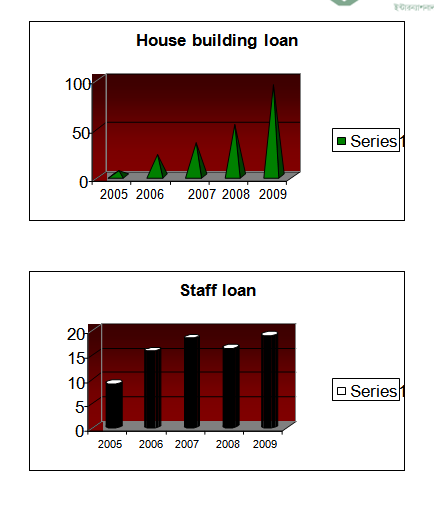

Disbursement Situation of Different Types of Loan:

| Particulars | 2005 | 2006 | 2007 | 2008 | 2009 |

| General Loan Disbursement | 39..58 | 41.57 | 43.89 | 45.48 | 48.83 |

| Loan against Trust Receipt | 290.46 | 304.32 | 326.73 | 348.27 | 533.70 |

| Payments against Documents | 39.45 | 47.54 | 63.98 | 68.07 | 56.53 |

| Cash Credit (HYPO) | 29.9 | 31.7 | 32.58 | 26.7 | 42.7 |

| Consumers Credit | 43.57 | 47.23 | 35.47 | 15.26 | 000 |

| HouseBuilding Loan | 6.38 | 22.01 | 34.29 | 52.91 | 94.027 |

| Staff Loan | 9.13 | 15.85 | 18.47 | 16.44 | 19.09 |

| Other Credit Scheme | 11.98 | 13.07 | 11.07 | 17.07 | 60.71 |

Disbursement Situation:The bank has many loans from the beginning of the bank. The total disbursement of loans within 2006 to2009 from this bank is given below

| Year | 2006 | 2007 | 2008 | 2009 |

| Total no of Loan | 17438.9 | 21366.73 | 37793.89 | 20536.26 |

Funded and Non-Funded Loan:

Mercantile bank Limited offers more type of funded loan than Non-funded loan. But disbursement, non-funded loan more disburse than funded loan.

| Name of Loan | 2007 | 2008 | 2009 |

| Funded | 1309.45 | 1621.16 | 1420.59 |

| Non-funded | 1109.21 | 918.27 | 903.27 |

Figure: Trends of Funded and Non-funded Loan

The above figure shows that no of non-funded loan which includes letter of credit and bank guaranty is always more than no of funded loan. Through this data it can be said that the bank is better in performing its foreign exchange division as most of the non-funded loan is comprised of letter of credit.

Classification of Loans and Advances:

The management of the institution as well as their supervising authority i.e. the Central Bank evaluates the assets of the institution keeping in view the aforesaid aspects. This evaluation at stipulated intervals is called “Classification of Advances”. It is in fact, placing all loans and advances under pre-determined different heads/ classes based on the depth of risk each and every loan has been exposed to and to bring discipline in financial sector so far risk elements concerned in credit portfolio of banks.

At present loans and advances are classified under three heads according to degree of risk element involved these are-

- Sub-standard

- Doubtful

- Bad

1.Substandard: A loan value of which is impaired by evidence that the borrower is unable to repay but where there is a reasonable prospect that the loan’s condition can be improved is considered as substandard.

2. Doubtful: A loan is doubtful when its value is impaired by evidence that it is unlikely to be repaid in full but that special collection efforts might eventually result in partial recovery.

3. Bad: A loan is considered as bad when it is very unlikely that the loan can be recovered.

Good loans are classified as un-classified loans. Naturally depth of risk is more in doubtful or bad loans than unclassified ones.

Figure: Status of Classified Loan

CHAPTER-V

CONCLUDING PART

Literature Review:

Analysis and Results

Interpretation of the Results

Recommendation

Rectify the Existing Problems

Implementation

Conclusion

Literature Review:

To find out the various aspects related with measuring credit worthiness of the potential borrowers in IFIC Bank. Literature is conducted through searching published books and journals, financial statement, data from bank website.

With better understanding of the borrower’s credit worthiness, bank can determine the actions required .They can identify their own strengths weaknesses, where they stand for their goal and chart out path future progress and improvement.

Credit worthiness of the potential borrowers can help to loan disbursement.

Analysis and Results:

For analysis of the study multiple regression model especially stepwise regression analysis has been adopted .For the purpose of regression analysis, twenty four variables have been taken. The simple regression models that have been drawn can be expressed as the following:-

Y=bO +b1X1+b2X2+b3X3+…………..+bnXn

The above multiple regression models have been fitted using the data collected through survey on thirty borrowers of IFIC Bank. The statistical package SPSS version 15.00 has been used for necessary calculation.

Interpretation of the results:-

INT=f(X1,X2,X3,X4,X5,X6,X7,X8,X9,X10,X11,X12,X13,X14,X15,X16,X17,X18)

X1=Purpose of loan

X2=Repayment period

X3=Interest rate

X4=No of installment

X5=Penalty rate

X6=Amount of loan

X7=Repayment

X8=Overdue

X9=Outstanding

X10=Occupation

X11=Age

X12=Education

X13=District

X14=Family size

X15=Co applicant

X16=Gender of the applicant

X17=Net worth

X18=Loan rationing

Dependent Variable: Interest rate

I=f(X1,X2…………….Xn)

Here n=18

INT=6.581+(-.017)X1+.297X2+(-.026)X3+.068X4+.103X5+1.301X6+(-.510)X7+(-.027)X8+(-.050)X9+(-.088)X10+(-.o19)X11+.002X12+.111X13+.092X14+.535X15+(-.026)X16+.250X17+(-.483)X18

6.581 is a constant rate.X1 is negatively related with interest rate. If interest rate is increased then X1 is decreased by -1.7%.X2 is positively related and it is increased with interest rate by 29.7%. X3,X7,X8, X9,X10,X11,X16 and X16 are also negatively related with interest rate and if interest rate is increased then these variables are decreased and if interest rate is decreased then these variables are increased.X4,X5,X6,X12,X13,X14,X15 and X17 are positively related with interest rate and it is increased with interest rate.

Dependent variable: loan rationing

Loan rationing=f(X1, X2, X3,…………….Xn )

Here n=19

loan rationing=1.00+(2.66E-014)X1+(8.01E-016)X2+(1.83E-015)X3+(-2.57E-015)X4+(-1.14E-014)X5+(-1.10E-014)X6+(-9.57E-015)X7+(-4.53E-014)X8+(9.07E-015)X9+(-1.31E-015)X10+(-2.36E-016)X11+(2.10E-016)X12+(8.70E-017)X13+(-2.08E-015)X14+(7.28E-015)X15+(2.37E-014)X16+(-8.52E-015)X17+(2.837)X18+(-2.839E)X19

Here 1.oo is constant rate. And X1,X2,X3,X9,X12,X13,X15,X16,X18 are positively related with loan rationing and X4,X5,X6,X7,X8,X10,X11,X14,X17,X19 are negatively related with loan rationing.

Recommendation

Rectify the Existing Problems:

As there is no classified loan, branch should monitor the loans & advances closely to avoid classification in future.

Dhanmondi Branch should extend with their all out effort to increase the credit portfolio and to procure more low cash deposit, increase non funded business so as to minimize dependency on interest earning from IFIC Bank general account and to improve overall business performance of the branch to maintain earning.

Dhanmondi Branch should set up more CC camera in the branch to hold more control of manager in the branch. It can install CC camera in accounts department and clearing department as it is an important past of the branch and it is not always possible for the manager to visit all departments which has become important.

Dhanmondi Branch can contact with the existing customers to make the dormant accounts operative.

When a joint stock company comes to open an account if it’s an existing one, the account opening officer should ask the copies of the Balance Sheet and Income Statement. These will reflect the financial growth of the company and its soundness but in practice bank do not do this. If they have all these that will help them to examine money laundering risk.

There are numbers of new private banks and some have already activated with their extended customer service pattern in a completely competitive market. Where as IFIC Dhanmondi branch is far behind. They are not competitive in customer service because the officers do not behave in professional manner in fort of customer. Some time they are late in there service, which ultimately disturbs the respective customer.

Dhanmondi branch personnel should train up about all sort of information regarding SWIFT and its service. Due to lack of proper knowledge about the operation procedures and services provided to the customers by SWIFT, certain customers are facing problem, as they have to wait for certain time to get service as there was one officer know about the procedure of SWIFT. He is not fully independent of handling SWIFT. Official training is the solution to this problem. For customer’s convenience in Foreign Exchange Department of IFIC Bank Ltd. should provide more personnel to deliver faster services to their honorable customer.

Now a day conventional banking concept is outmoded. Now banks are offering more ancillary services like credit card, online services and many others. IFIC Bank Ltd. should differentiate its services through adopting the modern facilities and implementing in the branch level.

To deliver quality service top management of this breach should try to mitigate the gap between customer’s expectation and employee’s perception and customer’s convenience should give priority.

Administrative cost of this branch is on the high side, which has a major impact on profitability. Te manager should bring down the administrative cost and take all effective steps, strategy and action plan to reduce the cost at the desired level.

IFIC Bank should always monitor the performance of its competitors in the field of Foreign Trade.

Without proper knowledge in different laws, rules which set by Bangladesh Bank efficiency of employees cannot be optimize. Bank can arrange training program on these subjects and can test its employees which will improve their qualities.

IFIC Bank Ltd. should focus on their promotional activities. They should also focus on the marketing aspects to let customers know about their products and offerings and more promotion is should be given to attract new customer.

IFIC Bank Ltd. must develop electronic banking system to moderate the service. Technological advantage of a bank ensuring its competitive edge in the market place which can only be achieved by improved technology, efficient manpower and better services. If bank get more market share through all these than it will reduce operating cost and generate new revenue. The bank can offer to its customer better service if all of its departments are computerized and incorporated under local area network (LAN).

Without using modern technology no bank can even think of remaining in the business in near future. So the bank must decide right now how it can equip its branches with modern technology. Use of modern technology in one sense can increase cost but another sense it increase higher productivity and it attract big clients. It can introduce ATM service again in all branches which will bring speed in banking services.

Bank is providing both internal and external training for the officers but bank should be scrupulous about the training facilities so that officials can implicate this in their job. People are very choosy about environment now a day, so bank premises should be well decorated and IFIC Bank Ltd. should look into the matter very seriously as well. Side by side it will give customers better felling about the bank.

Implementation:

Some other important factors that should be focused on the development process:

Time consumed at service level should be minimized at optimum level.

Evaluate customer’s needs from their perspective and explain logically the shortcomings.

Customer’s convenience should receive priority over other.

Improve office atmosphere to give customers better feeling.

Use of effective management information systems.

Use appropriate techniques in evaluating customer need professionally.

To deliver quality service top management should try to mitigate the gap between customer’s expectation and employee’s perception.

Comments: