1.1 Introduction of the Jamuna Bank Limited:

Jamuna Bank Limited being a progressive and dynamic Private sector Bank having very successful and proven track record should have a pragmatic Credit policy guidelines to efficiently and professionally manage risks arising out of its Credit operation. The purpose of this document is to improve risk management culture, establish minimum standard for segregation of duties and responsibilities relating to Credit Operation of the Bank. With a view to bringing about an effective risk management system in Credit operation of the Bank and in compliance to the Directives/Guidelines of Bangladesh Bank given vide BRPD Circular No-17 dated 07.10.2003, the following policy and guidelines are framed. This policy replaces all previous ones, which set out Credit policies of Jamuna Bank Limited.

Jamuna Bank Limited is a new generation Bank. It is committed to provide high quality financial services/products to contribute to the growth of G.D.P. of the country through stimulating trade & commerce, accelerating the pace of industrialization, boosting up export, creating employment opportunity for the educated youth, poverty alleviation, raising standard of living of limited income group and over all sustainable socio-economic development of the country. In achieving the aforesaid objectives of the Bank, Credit Operation of the Bank is of paramount importance. The greatest share of total revenue of the Bank is generated from it, maximum risk is centered in it and even the very existence of Bank depends on prudent management of its Credit port-folio. The failure of a commercial Bank is usually associated with the problems in Credit port-folio and is less often the result of shrinkage in the value of other assets. As such, Credit port-folio not only features dominant in the assets structure of the Bank, it is critically important to the success of the Bank also.

1.2 Origin of the Jamuna Bank Limited:

Dissertation is a prerequisite for acquiring BBA Degree in National University of Bangladesh. The entire BBA program divided into eight semesters. It is executed in the last semester and it has got the same weight as other semester in the evaluation process. As the classroom discussion alone cannot make a student perfect in the real business situation. It is the opportunity for the students to know about real life situation through this program.

As a Student of BBA, Of Daffodil Institute of IT, I take my project to do my Internship under Jamuna Bank Limited at Ashullia branch, Dhaka and enter as an internee for a period of two months commencing from 1st January to 31 28 February. And I have expired this internship period successfully. I compared this report from my practical experience.

1.3 Objectives of the Report:

The ultimate objectives of the study are to gain real life exposure in the Banking sector get a clear idea about banking operation. The study has been carried out with the following objectives:

1. To identify problems & challenges of credit management & Credit activities of Jamuna Bank Limited.

2. To gain knowledge of standard SME banking service of Jamuna Bank Limited.

3. Besides fulfilling the degree requirement, the study intends to cover a comprehensive analysis of overall activities.

4. To present an overview of Jamuna Bank Limited.

5. To fulfill the requirement of the BBA Program.

1.4 Methodology of the Report:

Methodology includes direct observation, face-to-face discussion with officers or employees of different departments, study of files, circulars, etc. and practical work. In preparing this report, both primary and secondary sources of information have been used and to analyze those data Excel have been used.

Sources of the Report:

The following sources were used for the purpose of gathering and collecting data are given below:

The primary sources are-

- Direct communication with the clients

- Structured questionnaire

- Exposure on different desk of the bank

The secondary sources are-

- Annual Report of Jamuna Bank Limited.

- Different ‘Procedure Manual’ published by Jamuna Bank Limited.

- Periodicals published by the Bangladesh Bank.

- Searching related information from Internet

Different publications regarding banking functions, credit policies and SME banking of Jamuna Bank Limited.

2.1 Profile of Jamuna Bank Limited:

Jamuna Bank Limited (JBL) is a Banking Company registered under the Companies Act, 1994 with its Head Office at 3 Dilkusha C/A, Dhaka-1000.The bank started its operation from 3rd June 2001. Jamuna Bank Limited is a highly capitalized new generation Bank with an Authorized Capital & Paid-up Capital of Tk.400.00 crore & 200.00 respectively. Forty Four Branches & One SME Center are doing business & five more branches will be opened soon.

2.2 Visions:

To become a leading banking institution & to play vital role in the development of the country & service so that sustainable growths, reasonable return & contribution to the development of the country can be ensured with a motivated & professional work force.

2.3 Mission:

The bank committed to satisfy diverse need of its customers through an array of products at a competitive price by using appropriate technology and providing timely services so that a sustainable growth, reasonable return & contribution to the development of the country can be ensured with a motivated and professional workforce.

2.4 Corporate Culture of JBL:

Employees of Jamuna Bank Limited share common values, which helps to create JBL culture:

¶ The client first.

¶ Search for professional excellence.

¶ Openness to new ideas and new methods to encourage creativity.

¶ Quick decision making.

¶ Flexibility and promote response.

¶ A séance of professional ethics

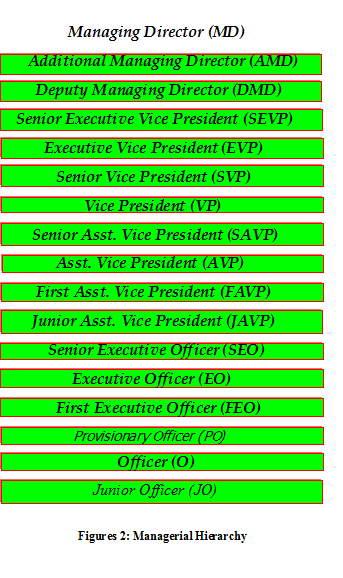

2.5 Management Body:

Jamuna Bank limited is managed by highly professional people. The present Managing Director of the bank is a forward-looking senior banker having decades of experience and multi discipline knowledge to his credit both at home and abroad. He is supported by an educated and skilled professional team with diversified experience in finance and banking. The management of the bank constantly focuses on the understanding and anticipating customer’s needs and offers solutions thereof Jamuna Bank Limited has already achieved tremendous progress within a short period of its operation. The bank is already ranked as one of the quality service providers & known for its reputation. Management of Jamuna Bank Limited is headed & leaded by the renowned banking persnality Mr. Motiur Rahman.

2.6 Hierarchy

2.7 Depository Products and Services:

- a. All types of Depository Accounts:

Jamuna Bank offers different types of Corporate and Personal Banking Services involving all segment of the society within the purview of the rules and regulations as laid down by the Central Bank and other Regulatory Authorities.

The client can maintain different types of deposit accounts i.e. Current Savings, STD, FDR and Foreign Currency Account according to his necessity and convenience.

- b. Special Deposit Schemes:

- Ananta Account 17. Small Saving Scheme

- FD Chamak 18. Senior Citizen Benefit Scheme

- Abashon Deposits Scheme 19. Rural Deposit Scheme

- Student’s Sevings Scheme 20. NRB Gift Cheque

- Pension Deposit Scheme 21. Tuition Savings Deposit Scheme

- Car Deposit Scheme 22. Special Service Savings Account For

- Travel Deposit Scheme Housewives

- Money Multiplier 23. Mudaraba Hajj Savings Scheme

- Quarterly Benefit Scheme 24. Crorpati Deposit Scheme

- Daily Profit Savings Account 25. Education Savings Scheme

- Sangshar Deposit Scheme 26. Millionaire Deposit Scheme

- Easy Account 27. Lacpati Deposit Scheme

- Hi-Fi-FDR 28. Marriage Deposit Scheme

- Overseas Earner’s Deposit Scheme 29. Double Growth Deposit Scheme

- Household Durable Deposit Scheme 30. Triple Growth Deposit Scheme

- Jaqmuna Bank Paribar 31. Monthly Benefit Scheme

32. Monthly/Travel/Abashon/Household Durable/Tuition Savings Scheme

2.8 Loan Products and Services:

- General Loan Facility

Letter of Credit, Bank Guarantee, Cash Credit, SOD, Loan(general) Hire Purchase, Lease Finance, LIM, LTR, Work-order Finance, Export Finance, House Building Loan, LDBP and FDEBP.

- Retail Credit Products

Any purpose lifestyle loan

Loan against salary

CNG conversion loan

Household durable load

Car loan

Travel loan

Consumer loan

Study loan

JBL Debit & Credit Card

Doctor’s loan

Marriage loan

- Electronic Products:

Real time On-Line any branch banking

24 hours ATM

Debit card

Credit card

Telephone banking

SMS banking

Internet banking

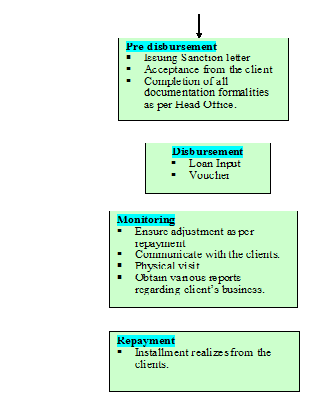

2.9 Processing of Credit Approval

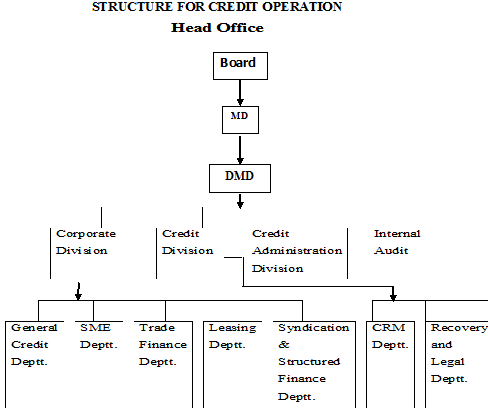

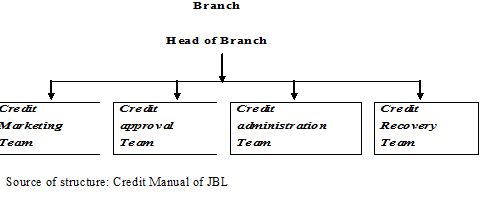

2.10 ORGANIZATIONAL STRUCTURE FOR CREDIT OPERATION

3.1 Definition of Real Estate Finance :

Real estate is a term that encompasses land along with improvements to the land, such as fences, wells and other site improvements that are fixed in location immovable. Real estate law is the body of regulations and legal codes which pertain to such matters under a particular and include things such as commercial and residential real property transactions. Real estate to often considered synonymous with real property in contrast with personal property.

3.2 History of Real Estate Finance :

DhakaCity, born during the Mughal Empire and grown with the British rule, is expanding rapidly. From the beginning of the 20th Century its growth and latter development is marked with sheer lack of proper and far-reaching planning. The impact is now being felt at the beginning of the new century. DhakaCity is undergoing terrific growth phase throughout the last two decades.

Real estate business especially apartment projects has started in late 1970s in DhakaCity. But from early ’80s the business started to grow and flourish. In 1990s the industry became a major part of our economy. In 1988 there were 42 such developers working in Dhaka and now in 2004 there are about 500 large and small companies engaged themselves in real estate business.

The initial concept of real estate in Bangladesh evoked probably in the hand of Eastern Housing Limited by undertaking their first land development project for housing in Mirpur area of Dhaka city known as “Pallabi Project”. During 1970s there were fewer than 5 companies engaged in this business. In 1988 there were 42 such developers working in Dhaka and now in 2009 there are about 558 listed in REHAB and more than 600 not enlisted companies engaged in this business. And at present, the concept of real estate is getting expanded not only around developing apartments but also model cities, shopping malls, major infrastructure, commercial set-up with elaborate view of high profit margin.

The population of Dhaka city is increasing day by day. With that increase in all respect the demand for apartments are also increasing in a rapid manner. A study conducted by research in 2008, shows that about 73.3% people do not have any apartments or house in Dhaka city. Among those people about 26.7% are willing to buy apartments at that time. And 60.5% of the people who are willing to buy apartments want some sort of financial assistance. And the rest people were ready at that time to purchase apartments by their own funds. With the increase in population in the last two years and fluctuation in bank interest rate and availability of housing finances, the demand for apartments must have increased.

To satisfy the housing need of this huge explosive population Dhaka has attempted to expand vertically. Particularly in Dhaka this demand is estimated at 60000 thousand units of real estate apartments combined with 200000 units of replacement plus backlogs. The approximate turnover in the real estate sector has been BDT.12.50 million, which contributes revenue of BDT.1 billion to the government. The real estate developers and builders have already supplied approximately 5000 units to this sector market in the past 20 years. The sector now employs 1.6 million of people which include architects, engineer, management official, direct and indirect labor. According to the Labor Force Survey (LFS), in 1999-2000, 2.1 per cent of the labor force was engaged in construction, whereas for 1995-1996 the figure was 1.8 per cent respectively (CPD, 2003). This sector has a strong contribution to the development of other forward and backward linkage sector like furniture, ceramics, consultancy, paints, aluminum, and many others. This is opening opportunities of large employment and enhancing revenue of the government.

3.3 Why Bank Need to Participate in REF :

i. Bank are financing to the purchasing of flat for getting refinance facility from central bank on the other hand.

ii. Banks are financing to the developers company’s as short term loan for the developing the projects.

iii. Diversification of the loan portfolio for the reduce of sectoral risk.

iv. Bank are financing in RE under retail banking for short period/ term and higher rate of return (interest rate).

v. But in REF there have maximum level of uncertainty the loan. Because any time hampered the cash inflows of the customer.

3.4. JBL Contribution of REF :

Bangladesh is one of the least developed countries of the world, where the basic needs of the people are not addressed effectively. At the present, with the constitution of our country being extensively and exhaustively discussed by people at all levels, the crucial issues like shelter for all which is one of the basic rights of all citizens still remains on the back burners. To all intent and purposes it is not possible for the Government alone to ensure shelter for its people. Therefore the role of the Financial Institution becomes crucial.

Home ownership is a basic need and a dream of every individual. In recent years housing problem in urban areas especially in all the metropolitan areas of residential and commercial has become acute. Many individual of different professions have limited capacity to construct or purchase flat/readymade house. But once the construction/purchase is completed, they acquire the capacity to repay installment.

Since housing industry plays a vital role in the national economy, our bank has come forward for Real Estate financing for Individual as well as Developers. The main objective of Real Estate Financing is to promote Real Estate Developers and Individuals.

In order to diversify and promote the base of Bank’s loans portfolio, the investment on Real Estate sector is being made to the affluent, potential and eligible clients to construct/ purchase/ renovate/ improve their residential/ commercial houses/ building apartment/ flats, office spaces, chamber, shops and for developers etc through five program such as:

A. Real Estate Financing for Construction of Residential Building [CRB]

B. Real Estate Financing for Construction of Commercial Building [CCB]

C. Real Estate Financing for Flat Purchase [FPI

D. Real Estate Financing for Building Purchase [BP]

E. Real Estate Financing for Developers [DEV]

The eligibility criteria, purpose, ceiling amount and age limit are incorporated based on present situation and past experience. The Real Estate Financing Wing shall be responsible to plan, develop, manage and maintain Real Estate portfolio of the bank.

3.5 Gide lines of JBL of REF :

PRODUCT PROGRAM GUIDELINE [PPG] FOR REAL ESTATE FINANCING

Product Program Guideline (PPG) provides a short description of a specific product and its relevant documents. These fundamental guidelines will be the key elements that would support bank’s credit culture and will dictate bank’s behavior when dealing with customers and managing lending portfolio of such loans. Any deviations from these guidelines must in all cases, will require approval from Managing Director / appropriate competent authority.

Fundamentally, credit policies and procedures can never sufficiently capture all the complexities of the product. Therefore, the following credit principles are the ultimate reference points for all real estate financing decisions:

- Assess the customer’s character for integrity and willingness to repay

- Only lend when the customer has capacity and ability to repay

- Only extend credit if bank can sufficiently understand and manage the risk

- Use common sense and past experience in conjunction with thorough evaluation and credit analysis.

- Do not base decisions solely on customer’s reputation, accepted practice, other lender’s risk assessment or the recommendations of other officers

- Be proactive in identifying, managing and communicating credit risk

- Be diligent in ensuring that credit exposures and activities comply with the requirement set out in Product Program

- Product Program Guideline (PPG) for real estate product shall be framed based on market demand, necessity and prospect.

Primary Selection criteria:

- Income, Age, Educational Qualification, Number of Dependants, Spouse’s income, Assets Liabilities stability, Monthly Income Expenditure, Continuity of Occupation, Savings history, conduct and commitment, nature of profession/business etc.

- Nature, Size and quality of construction.

- Rental Income / earnings forecast / cash flow from the proposed building/flat/project.

- Debt-Service Coverage ratio

- Debt Burden ratio

- Debt-Equity ratio

- Communicational advantages and infra-structural facilities of the project

- Socially reputed & financially sound/strength.

Banks may alter/ amend these guidelines in terms of the policy without compromising the fundamentals of credit principles.

A- CONSTRUCTION OF RESIDENTIAL BUILDING (CRB) :

Real Estate market primarily concentrated in Dhaka, Chittagong and Sylhet metropolitan areas-as these three cities have a large number of middle and higher middle class population. However real estate may also be sanctioned to eligible clients wherever JBL has its operations.

| Target Customer Segment | Preferred customer segments are: a) Salaried Individuals and Professionals of reputed institutions with minimum 03 [three] years of continuous service. Service length may be relaxed able in case of high net worth individuals and professionals. |

| b) Self —Employed professionals who are self -employed and have at least 03[three] years of practice in relevant profession. c) Businessman having high net worth with at least 5 [five] years of continuous operation in relevant line of business. d) Wage Earners or other professional serving abroad having good income. Other specific criteria, security and documentation formalities shall depend on the overall status of the applicant. e) Permanent Officers of Government, Semi Government and Autonomous Bodies, Reputed Multinational Companies, International Financial Organizations, Donor Agencies, Foreign Embassies, Local Established and reputed Public Limited Companies. f) Teachers of Universities including established Private Universities and established private colleges.

In case of service holders, unexpired period of service shall have to be minimum 5[five] | |

| Discouraging Group | Negative listed individuals as per JBL credit policy. |

| Purpose | Construction/Extension/Renovation/Refurbishing/Installation of Lift/Generators of residential building. |

| Nationality | Bangladeshi by Birth. |

| Age Limit |

|

| Minimum Income | Net Income/Take home salary will be at least Tk. 40,000/-[forty thousand] per month. However the customer must have sufficient net cash flow to repay the loan installment based on Debt Burden Ratio. |

| Net Worth | Minimum 150% of the loan amount. |

| Loan size | Minimum loan amount should not be less than Tk.5,00,000 (five lac) and Maximum loan amount should not exceed Tk. 75,00,000/- (Seventy Five lac). |

| Debt Equity Ratio | Maximum 60:40 |

| Loan pricing ratio | Financing upto maximum 60% of construction cost. |

| Security/ collateral | i) Registered Mortgage /Registration of Assets in the name of the Bank. ii) Registered Irrevocable Power of Attorney (RIPA) empowering the bank to sell the mortgaged property. iii) Post- Dated Cheques favoring the bank for each Installment (at least six) and one undated cheque for full loan amount. iv) Personal Guarantee of the customer and his/her spouse combined Personal Net Wealth statement duly signed. v) Insured with ‘Bank Mortgage Clause” for a sum of 10% above the sanctioned limit covering the risks of fire & RSD only at Construction cost. The Customer shall provide an undertaking to bear any loss arising out of the risk of flood and cyclone. |

| Charge documents | v Demand promissory note v Letter of Revival v Letter of Arrangement v Letter of Installment v Letter of Disbursement vLetter of Disclaimer v Letter of Authorization v General Loan Agreement v Complete standard Loan Document v Other Usual Charge Documents duly executed |

| Interest Rate and : Other Fees Structure | a) Interest Rate: Current indicative rate is 13% Per annum. However Interest rate may be changed by ALCO from time to time based on market conditions and to ensure product competitiveness in the market. b) Loan Processing Fee: 0.50% of the approved loan amount or maximum Tk.10,000/- [Ten thousand]. c) Stamp Charges: All relevant stamp charge, VAT etc. expenses should be borne by the customer and wifi be debited from his/her account at the time of disbursement. d) Installment Failure Charge: Penal interest of 2% Per annum on the past due amount will be realized. e) Early Paymeni/Pre-Payment and Applicable Fee: i) Final Settlement: The Customer may settle the loan before the end of the loan tenure. A charge for early full and final settlement is 0.25% (flat) of the outstanding loan amount or Maximum Tk 5,000/-[five thousand]. ii) Partial Pre-payment: Customer may make partial pre-payment only after 06[six] months from the due date of 1st installment. Partial pre-payment amount must be at least 25% of the outstanding loan amount. f) Expenditure for Survey/Vetting/Mortgage related Fees, Charges/Insurance Premium: Expenses incurred for this purpose to be borne by the applicant at actual. |

| Loan Tenure | Minimum tenure of JBL Real Estate loan would be 03 [three] years and maximum tenure would be 15 [fifteen] years including grace period but total tenure of loan wifi not exceed the un-expired period of service of the borrower or beyond the age of 65 (sixty five) |

| Grace Period | Depend on construction status but not to exceed maximum 12(twelve) months. |

| Repayment Method | Repayment [EMIs]. System will automatically debit the equated monthly installment [EMI] amount from the customer’s personal/ company account [Current/ Savings/ STD] maintained with JBL through standing instruction. In order to realize EMI amount, customers must ensure sufficient balance in the account each month.

|

| Disbursement pre-condition | All documentation formalities should be fully completed as per approved terms and conditions before disbursement of the loan. Prior approval must be obtained for any deferrals, waiver/change of documents, waiver/change of terns and conditions etc. before disbursement. Disbursement permission should be obtained from the CAD prior to loan disbursement. |

| Disbursement Mode | Loan amount will be disbursed through account transfer from our concerned branch under the following phases: Phase-I: 30% of total loan will be disbursed after utilization of at least 50% of equity of the customer/ Completion of Ground Floor. Phase-Il: 30% of total loan will be disbursed after proper utilization of previous disbursed amount and at least 70% of equity of the customer/Completion of all Roof Casting. Phase-Ill: 40% of total loan for the finishing works will be disbursed after proper utilization of previous disbursed amount and 100% of equity of the customer. |

| Visit report | i) The Branch must submit visit report with photograph of the proposed project and collateral securities containing photograph of the visiting officials. However Head Office official finally visit the proposed project before sanction. ii) Before each and every disbursement Branch Official should visit the site to ensure that the project is running and fund utilized as per schedule. A visit report should be there in respective file for branch record. |

| Validity of Sanction | Upto 90 (ninety) days from the date of sanction. |

| Debt Burden Ration (DBR %) | Primarily 30% of monthly take home salary/ monthly net income and 70% from the rental income of the proposed construction. |

B. CONSTRUCTION OF COMMERCIAL BUILDING (CCB) :

Construction of commercial/ commercial cum residential building concentrated in Dhaka, Chittagong and Sylhet metropolitan areas-as these three cities have a large number of corporate office and Business House. However real estate may also be sanctioned to eligible clients wherever JBL has its operations.

| Target Customer Segment | Preferred customer segments are: a) Corporate Offices and Renowned business house. b) Any other professional acceptable to the ban. |

| Discouraging Group | Negative listed Customers as per JBL credit policy. |

| Purpose | a) Construction of Commercial Building. b) Construction/ Extension/ Renovation/ Refurbishing of commercial cum residential building. c) Installation of Lift/ Generators/ Sub station etc. d) Office spaces, Chamber, shops etc. |

| Nationality | Bangladeshi by Birth. |

| Age | Minimum 25 (twenty five) years. |

| Minimum Income | The customer must have sufficient net cash flow to repay the loan installment based on Debt Burden Ratio. |

| Net Worth | Minimum 150% of the loan amount. |

| Loan size | Minimum loan amount should not be less than Tk.10,00,000 (Ten lac) and Maximum loan amount should not exceed Tk. 5,00,00,000/- (Five crore). |

| Debt Equity Ratio | Maximum 50:50 |

| Loan pricing ratio | Financing upto maximum 50% of construction cost. |

| Security/ collateral | i) Registered Mortgage /Registration of Assets in the name of the Bank. ii) Registered Irrevocable Power of Attorney (RIPA) empowering the bank to sell the mortgaged property. iii) Post- Dated Cheques favoring the bank for each Installment (at least six) and one undated cheque for full loan amount. iv) Personal Guarantee of the customer and his/her spouse combined Personal Net Wealth statement duly signed. v) Insured with ‘Bank Mortgage Clause” for a sum of 10% above the sanctioned limit covering the risks of fire & RSD only at Construction cost. The Customer shall provide an undertaking to bear any loss arising out of the risk of flood and cyclone. vi) Notarized Irrevocable power of Attorney empowering the bank to sell the hypothecated stock of construction materials. vii) Corporate Guarantee of other reputed business firm (if possible) |

| Charge documents | v Demand promissory note v Letter of Arrangement v Letter of Installment v Letter of Disbursement vLetter of Disclaimer v Letter of Authorization v General Loan Agreement v Complete standard Loan Document v Other Usual Charge Documents duly executed |

| Interest Rate and : Other Fees Structure | a) Interest Rate: Current indicative rate is 13% Per annum. However Interest rate may be changed by ALCO from time to time based on market conditions and to ensure product competitiveness in the market. b) Loan Processing Fee: 0.50% of the approved loan amount or maximum Tk.10,000/- [Ten thousand]. c) Stamp Charges: All relevant stamp charge, VAT etc. expenses should be borne by the customer and wifi be debited from his/her account at the time of disbursement. d) Installment Failure Charge: Penal interest of 2% Per annum on the past due amount will be realized. e) Early Paymeni/Pre-Payment and Applicable Fee: i) Final Settlement: The Customer may settle the loan before the end of the loan tenure. A charge for early full and final settlement is 0.25% (flat) of the outstanding loan amount or Maximum Tk 5,000/-[five thousand]. ii) Partial Pre-payment: Customer may make partial pre-payment only after 06[six] months from the due date of 1st installment. Partial pre-payment amount must be at least 25% of the outstanding loan amount. f) Expenditure for Survey/Vetting/Mortgage related Fees, Charges/Insurance Premium: Expenses incurred for this purpose to be borne by the applicant at actual. |

| Loan Tenure | Depends on construction status but maximum tenure would be 05 (five) years including grace period. |

| Grace Period | Depend on construction status but not to exceed maximum 24(twenty four) months. |

| Repayment Method | Repayment should be made through equated monthly installment (EMIs)/ Quarterly rest or deal-to-deal basis (one year). System will automatically debit the equated monthly installment (EMI) amount from the customer’s company account (Current/ Savings/ STD) maintained with JBL through standing instruction. IN order to realize EMI amount, customes must ensure sufficient balance in their account each month/ quarter/ Due date.

|

| Disbursement pre-condition | All documentation formalities should be fully completed as per approved terms and conditions before disbursement of the loan. Prior approval must be obtained for any deferrals, waiver/change of documents, waiver/change of terns and conditions etc. before disbursement. Disbursement permission should be obtained from the CAD prior to loan disbursement. |

| Disbursement Mode | Loan amount will be disbursed through account transfer from our concerned branch under the following phases: Phase-I: 40% of total loan will be disbursed after utilization of at least 50% of equity of the customer/ Completion of Ground Floor. Phase-Il: 40% of total loan will be disbursed after proper utilization of previous disbursed amount and at least 70% of equity of the customer/Completion of all Roof Casting. Phase-Ill: 20% of total loan for the finishing works will be disbursed after proper utilization of previous disbursed amount and 100% of equity of the customer. |

| Visit report | i) The Branch must submit visit report with photograph of the proposed project and collateral securities containing photograph of the visiting officials. However Head Office official finally visit the proposed project before sanction. ii) Before each and every disbursement Branch Official should visit the site to ensure that the project is running and fund utilized as per schedule. A visit report should be there in respective file for branch record. |

| Validity of Sanction | Upto 90 (ninety) days from the date of sanction. |

| Debt Burden Ration (DBR %) | Primarily 30% of monthly take home salary/ monthly net income and 70% from the rental income of the proposed construction. |

| Proof of Income | Customer should properly substantiate all claims in the financial information section of the Loan Application Form. Generally, the bank will accept original or true copy of the original documents for this purpose. |

3.6 Terms & Condition of JBL :

In consideration of Jamuna Bank Ltd. (herein after called ‘the Bank” unless the context otherwise requires where such expression shall mean and include its successors and assignees) allowing me/us, (hereinafter referred to as “the Customer” unless the context otherwise requires where such expression shall mean and include its successors and assigns) to apply for the loan facility (the facility) under “Real Estate loan” program I/We agree that I/we shall be bound by the following terms and conditions:

i) The Facility shall be made available to the customer from date of the Bank’s acceptance of the Banking Arrangement Letter by the Customer until such time as stipulated in any letter and this Facility shall be a continuing one until full adjustment with the Bank with interest and other charges.

ii) The above Facility will be made available to the Customer subject to a Clean CIB report from Bangladesh Bank and compliance of Bangladesh Bank formalities (if any).

iii) As per Govt. rules the bank will realize VAT on all sorts of commission & fees for the service.

iv) Customer will not use the Facility for any purpose other than those for which it is granted.

v) Customer hereby confirms that Customer is not engaged in activities that may be appropriate authorities as money laundering and the Bank may safely accept such confirmation as authenticate and true.

vi) Customer cannot prepay any part of whole of the facility within 06 (six) months from the date of first installment due.

vii) Any repayment or prepayment of facility whether in part or full will be attributable first to cost, charges and expenses, then to interest, which has accrued on the facility, and then to principal.

viii) All fees charges and other costs including legal fees incurred by the Bank in connection with this facility and security documentation will be at the account of the customer.

ix) Customer hereby undertakes to the bank that customer will provide all documents related with his/her income wherever appropriate on demand of the Bank.

x) Customer declares that there is no suit or proceeding against the customer by any person is pending in any court of law that may affect the ability of the customer for repayment of the facility and the customer has been adjudged as an insolvent or convicted by any appropriate court of law and no receiver or administrator has been appointed over any property or assets of the customer by any court of law or authority as the case may be.

xi) Customer hereby represents and warrants that the information which customer has provided in this application forms are true and correct to the best of his/her knowledge and the Bank may safely rely on such information.

xii) The bank is authorized to open and maintain Facility account(s) for the purpose of administering and recording payments by the customer in respect of the facility.

xiii) Payment under the facility (in case of Flat/Apartment/Ready House/Purchase) shall be made directly to the Developer or owner of the property (as the case may be), on the instruction of the customer and as agreed by the bank considering the purpose of the facility.

xiv) If the bank demands at any time, Customer undertakes to deposit his/her/their salary/wages/honorarium payable by his/her/their employer to the designated account maintained with the Bank.

xv) The Bank’s statements and records shall be binding on the Customer and shall constitute conclusive evidence of debt for all purposes.

xvi) If at any time, any provision hereof becomes ifiegal, invalid or unenforceable iii any respect neither the legality, validity nor enforceability of the remaining provisions shall be affected or impaired thereby.

xvii) Any notice made by the Bank in respect of the Facility shall be writing and made to the address given by the Customer to the Bank and shall be deemed to have been served to the customer within 24 hours from the date of posting.

xviii) If the declaration below is signed by more than one person as customer, the liability of each such person there under, and these terms and conditions shall be joint and several.

xix) These terms and conditions shall be governed by and construed in accordance with the laws of Bangladesh and the Bank and the Customer hereby irrevocably submit to the non-exclusive jurisdiction of the court of Bangladesh.

4.1 Amount of Credit Offer :

| Amount of Loan | Name of the Bank | |||

Jamuna Bank Ltd. | Mercantile Bank Ltd. | Southeast Bank Ltd. | Exim Bank Ltd. | |

| Credit offer | 60% | 70% | 60% | 0 |

Table- 1 : Credit offered by different banks in real estate loan.

4.2 Rate of Interest :

Name of the Bank | ||||

Jamuna Bank Ltd. | Mercantile Bank Ltd. | Southeast Bank Ltd. | Exim Bank Ltd. | |

| Rate of Interest | 13% | 13% | 13% | 13% |

Table- 2 : Teh rate of intrest of different banks on real estate finance.

4.3 Down Payment :

Name of the Bank | ||||

Jamuna Bank Ltd. | Mercantile Bank Ltd. | Southeast Bank Ltd. | Exim Bank Ltd. | |

| Down Payment | 0 | 0 | 0 | 20% |

Table- 3 : Down payment of different banks on real estate finance.

4.4 Loan Disburse Ratio :

Jamuna Bank Ltd. | ||||

2010 | 2009 | 2008 | 2007 | |

| Disburse Ratio of JBL | 100% | 100% | 100% | 100% |

Table- 3 : Disburse ratio of JBL

4.5 Problem by the landers for financing in real estate :

- Its a long term investment.

- Its a unproductive loan item

- Difficult to realize loan by selling the mortage or real estate property.

- Inadequate education of the borrower.

4.6 Problem by the borrowers :

- Approved plan on building from appropriate authority.

- Lack in land related.

- TIN numbers.

- In ability of means of finance of the borrower as per bank requirement.

- Education of the borrowers.

4.7 SWOT Analysis

STRENGTH

Stable Source of Funds

Largest Portfolio among PCBs

Strong Liquidity Position

Low Cost Fund

Satisfactory profitability

WEAKNESS

Marginal Capital Adequacy

Lack of Strong Initiative to Explore Investment Opportunity Through Research And Marketing

IT & E-Banking Status Dose Not Match With Other Banks

OPPORTUNITY

Scope of Whole Sale Banking with NBFIs

Increasing Awareness of Banking System

Credit Card Business

THREATS

Increased Competition In The Market For Quality Assets

Supply Gap of Foreign Currency

Overall Liquidity Crisis In Money Market

5.1 Recommendations

Based on the evaluation of different aspects of the credit process of Jamuna Bank, the following recommendations have been made:

* In the face of competitive and borrower dominated credit scenario Jamuna Bank must come up with innovative loan products to meet up the demand of time. In this connection Jamuna Bank can focus on some more loan products like:

- Ø Leasing

- Ø Apartment loan

- Ø Marriage loan

- Ø Education loan

- Ø Credit card

* To combat the problem of mobilizing deposit in the form of credit, Jamuna Bank should focus on intensive marketing effort.

* Entrepreneurship lending should be given due emphasis.

* As borrower selection is the key to successful lending, Jamuna Bank should focus on the selection of true borrower. But at the same time it must be taken into account that right borrower selection does not mean that Jamuna Bank has to adopt conservative lending policy but rather it means that compliance with the KYC or Know Your Customer to ascertain the true purpose of the loan.

* Care should also be taken so that good borrowers are not discarded due to strict adherence to the lending policy.

* At the branch level credit department must be adequately capable of collecting the correct and relevant information and analyzing the financial statements quickly and precisely.

* Credit officer must be skilled enough to understand the manipulated and distorted financial statements.

* Credit committees at all levels must work in co-ordination with each other for quick approval of loans and to reduce the loan processing cost.

* To expedite the lending process, board credit committee meeting should be held twice a month instead of once a month.

* Monitoring of a loan should be conducted at regular interval to enhance the borrower is properly maintaining the mortgage property and utilizing the borrowing money. The bank should benchmark the monitoring techniques practiced by the successful and established banks in Bangladesh. It should take the counseling service from the experienced expatriate to further improve the monitoring techniques. Furthermore it should also aware of the monitoring techniques adopted by the established banks around the world.

* In case of mortgage, care must be taken to accept collateral on second charge.

* In case of assignment the bank must ensure that the assignment debtor has given undertaking.

* Reporting of all loans should be periodically made to Bangladesh Bank

* Loan monitoring is a continuous task and requires expert manpower. Therefore it is suggested that Jamuna Bank should set up a separate loan monitoring cell, which will be responsible for monitoring its total loan portfolio with special care to the problem loan.

During 2009, the entire economy’s growth was increased to 5.5%, which helped the banking industry to widen their business at different sectors. The success of banks depends on how effectively they can deliver their services to the customers and earn maximum amount of profit. Hence, to achieve the objective of credit services the monitoring techniques should be updated and the assessment financial information provided by the customers should be done carefully.

5.2 Conclusion

As an organization the Jamuna Bank Limited has earned the reputation of top banking operation in Bangladesh. The organization is much more structured compared to any other banks operating local or foreign in Bangladesh. It is unyielding in pursuit of business innovation and improvement. It has a reputation as a partner of consumer growth.

With a bulk of qualified and experienced human resource, Jamuna Bank Limited can exploit any opportunity in the banking sector. It is pioneer in introducing many new products and services in the banking sector of the country. Moreover, in the overall-banking sector, it is unmatched with any other banks because of its wide spread branch networking thought the country.

This report tries to figure out most of the indicators of problems and strengths of Jamuna Bank Limited as a valid pretender in the competitive banking sector of Bangladesh. A severe cut throat competition is going on currently in this sector and that’s why Jamuna Bank Limited has to work out with different dimensions like – product diversification, market forecasting, proactive activities undertaken by Jamuna Bank Limited and some suggestion to get rid of the predicaments that exist.

JAMUNA Bank is trying to create an overall climate for the introduction of large scale Islamic Banking environment in Bangladesh. It has taken up a program to spread its operations throughout the country as early as possible. It is playing a significant role in various fields of economy such as industry, agriculture, trade and commerce, transportation and many other fields. It is acting as trigger to boost the economy by creating employment opportunity. It also undertakes various welfare programs for the benefit of the society.

Private Banks play a significant role to meet up the needs of the society such as capital formation, large scale Production, industrialization, growth of trade and economy etc. JAMUNA Bank is an unconditional and specialized financial institution that performs most of the standard banking service and investment activities on the basis of profit-loss sharing system conforming to the principles. JAMUNA Bank does not pay interest to depositors. Instead depositors participate in the profitability of the bank. The bank participate in financing long term projects on the basis of profit loss sharing instead of granting credit facilities with interest. JAMUNA Bank also performs various social welfare activities.

Development is a continuous process. Development of few without the development of vast majority is not meaning full. Various form of Development models have so far been experimented in various part of the globe. The plight of the poor and the marginalized in the developing countries, unfortunately continued, rather worsened. Search for an effective development model is still on. The model is hidden in Islamic Economic System. JAMUNA Bank is a partner of this system and it creates its paws in this for ensuring the success of Islamic goal.

I am hopeful that time may emerge in near future when this poor nation will come into the light of development if the conventional banks working in our country advance along with JAMUNA Bank to take part into various welfare programs.

So it can be said that JAMUNA Bank was a dream in the past, it is the reality in the present and it will be a concrete symbol of hope and aspirations for the future.

![Report on L/C Tracking System of HSBC [part-3]](https://assignmentpoint.com/wp-content/uploads/2013/03/hsbc1-200x100.jpg)