The Transfer Price is the price charged by related parties to each other. In layman’s terms, it is the cost at which various departments within a company transfer goods to one another. When different departments in a company operate as separate entities, transfer pricing comes into play.

Transfer pricing is beneficial for tax purposes, resulting in tax savings. Tax authorities dislike such pricing because it allows businesses to reduce their tax liability. Transfer pricing takes advantage of loopholes in different countries’ tax systems and is thus subject to intense scrutiny from the tax department. With such pricing, a company hopes to make more money in countries with lower tax rates.

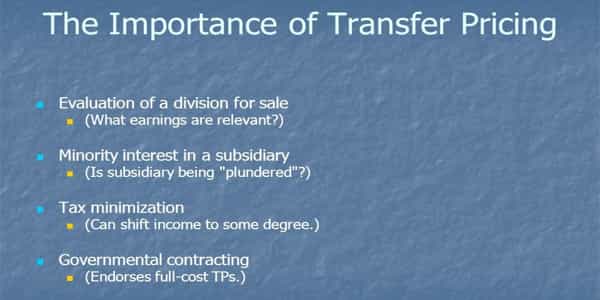

Importance of Transfer Pricing –

Multinational corporations (MNCs) have some leeway in determining how to distribute profits and expenses to subsidiaries located in various countries for the purposes of management accounting and reporting.

As previously stated, transfer pricing allows a company to easily avoid paying a significant amount of tax. A company accomplishes this by transferring the value of the products to a company or subsidiary operating in a lower-tax country. Furthermore, a company can use transfer pricing to avoid tax liability even within the same country. Transfer pricing can also be used by a company to shift profits from one jurisdiction to another. Moreover, this pricing could also help a company if it wants to make one of its subsidiaries or affiliate look more profitable.

A subsidiary of a company may be divided into segments or accounted for as a separate business. In these cases, transfer pricing assists in properly allocating revenue and expenses to such subsidiaries.

When a transaction occurs between two common entities, a transfer price is also required to arrive at a fair and equitable price. It aids in the accounting of transactions involving known entities. This, in turn, aids in determining their profit or loss. It also aids in the accurate and fair reporting of transactions between common entities.

The profitability of a subsidiary is determined by the prices at which inter-company transactions take place. Governments are increasingly scrutinizing inter-company transactions these days. When transfer pricing is used, it can have an impact on shareholder wealth because it affects the company’s taxable income and after-tax free cash flow.

It also fosters a sense of competitiveness among different divisions because they are aware of the revenues and costs they are incurring. The documentation that a company keeps supporting transfer pricing allows tax authorities to quickly assess the tax liability.

It is critical for a company that conducts cross-border intercompany transactions to understand the transfer pricing concept, particularly in order to meet legal requirements and avoid the risk of noncompliance.