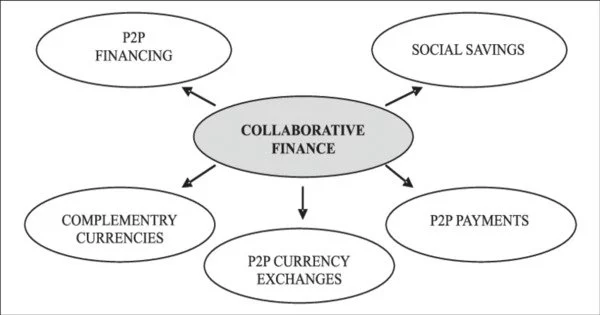

Collaborative finance, also known as peer-to-peer (P2P) finance, refers to a type of financial system in which individuals and businesses can lend and borrow money from each other directly without the involvement of traditional financial institutions like banks. It is a type of financial transaction that occurs directly between individuals without the use of a traditional financial institution as a middleman. Social media and peer-to-peer online platforms have enabled this new way of managing informal financial transactions.

In collaborative finance, borrowers and lenders are matched through online platforms that facilitate the process of borrowing and lending money. These platforms provide borrowers with access to loans at lower interest rates than those offered by traditional financial institutions, while lenders can earn higher returns on their investments than they would through other types of investments like savings accounts.

The wide range of collaborative finance resources may differ not only in organizational and operational aspects, but also by geographical region, financial market share, and so on. It is precisely because of this heterogeneity that informal savings and credit activity can profitably reach income groups that commercial banks and other financial institutions do not serve. It is their informality, adaptability, and flexibility of operations that reduce transaction costs and give them a comparative advantage and economic rationale.

Collaborative finance can be used for a variety of purposes, including personal loans, business loans, real estate financing, and even crowdfunding for creative projects. However, it is important to note that collaborative finance comes with some risks, as borrowers may default on their loans and lenders may lose their investment. Therefore, it is essential to conduct thorough research and due diligence before participating in collaborative finance.

Crowdfunding is another form of collaborative finance in which a large number of individuals invest small amounts of money in a project or venture, typically through an online platform. This can include investing in a new startup, supporting a creative project, or even investing in real estate.

Collaborative Finance is distinguished by highly personalized loan transactions that involve face-to-face interactions with borrowers and flexibility in loan purpose, interest rates, collateral requirements, maturity periods, and debt rescheduling.

Overall, collaborative finance can provide access to financing for individuals and businesses who may not have been able to secure traditional loans or investment opportunities, while also offering investors the opportunity to diversify their portfolio and potentially earn higher returns.