Loan against Trust Receipt (LTR):

There may be situation where storage of collateral in an independently controlled filled where house is impractical and improper may require the Goods for further processing of for display the merchandise in order to make the final sale. In such cases a financing institution that as a great degree of trust in the importer may be willing to release the negotiable bill of landing and thereby also the good to the importer against the signing of trust receipt. After the importer has made his/her final sale and received the proceeds, he/her can pay the financing institution that he/ she received as advance.

Loan against imported Merchandise (LIM):

If the importer does not come to negotiate the shipping documents from the issuing Bank then it creates LIM though the Bank clears the goods from the port and holds the goods in its go down. Beside the above as soon as the imported goods come to the port the party may fall into financial crisis and requests the Bank to clear the goods from the port making payment to the exporter. In this case the party late may take the goods partly or fully from the Bank by making require payment (if he/ she takes the goods time to time payment will be adjusted simultaneously).

Export section:

This section negotiates the export documents and collects and purchases the export in relation to export credit.

○Pre-shipment finance

○Post shipment finance

Export finance arises from trade between two traders trading in two different countries. A brief idea of the both categories is given below:

Pre-shipment finance:

When an exporter intends to ship the goods to an oversea buyer he/ she need fund for purchasing goods to be exported. He/ she may also depend upon the bank for arranging credit for he supplies of goods.

Post shipment finance:

Post shipment finance is more concerned with Banks than pre-shipment finance. This type of finance starts after the goods have already been shipped.

Function of export section:

Export section performs different types of tasks such as:

■Back to Back L/C open

■Foreign Document Bill for Collection (FDBC)

■Foreign Document Bill for purchase (FDBP)

■Local Documentary Bill for purchase (LDBP)

■Secured Overdraft (SOD) export

■Export Cash credit (ECC)

■pacing Credit (PC)

■Accepted Bills Payable (ABP)

Back to Back L/C Open:

It is secondary letter of credit opened by the advising bank in favor of a domestic/ foreign supplier on behalf of the beneficiary originals foreign L/C.

As the original letter of credit of Bank by import letter, it is called back to back L/C. The second L/C is opened on he strength of the original for a smaller amount i.e. maxlmum75% is shipped under lien and 10% under packing credit. There is three of Back L/C opened by EXIM bank of Bangladesh ltd.

Back to Back L/C (Foreign):

When the BTB L/c is opened in a foreign country supplier it is called BTB L/C (Foreign). It is general payable within 120 days at sight.

Back to Back L/C (EDF):

EDF stands for Export development fund that is provided by the ADB to Bangladesh Bank for Export promotion of 3’d world country like Bangladesh. When the Bank is not in a position to support the amount of Back L/C then apply for loans to the Bangladesh Bank for Back L/C (EDF).

Back to Back L/C (Local):

When the Back to Back L/C is opened for local purchase of materials is called Back to Back L/C (Local). It is generally payable within 90 days at sight.

Procedures for Back to Back L/C:

□Exporter should apply for Back to Back L/C.

□Exporter L/C or master V under is lien.

□Opening of Back to Back L/C.

□Terms and conditions for Back to Back L/C.

□That the customer has credit lien facility.

□That L/C is issued as per UCPAD 500.

□That on the export L/C negotiation clause in present.

□That there is no provision for Blank endorsement of B/1.

□That payment clause is thereon the L/C issuing Bank ensuring payment.

Consideration for a back L/C.

▪Whether client can manufacture within the time period

▪The unit of the finished pro-forma invoice should be considering while allowing margin.

▪Consider the expiry date and shipment date.

▪On-side inspection whether manufacturing is carried out.

Payment under Back to Back L/C:

Deferred payment is made in cause of Back to Back L/C as 6, 90,120,180 date of maturity period. Payment will be given after realizing export proceeds from the L/C issuing Bank from the abroad.

Reporting of Bangladesh Bank:

At the end of every month reporting of Bangladesh Bank is mandatory regarding the whole months export operation. The procedures in this respect are as follows:

■To fill up the E-e schedule of S-l category. The whole month import amount, quality, goods category, country, currency etc. all are mentioned. Respective IMP forms are also attached with the scheduled to fill up the E-3/P-3 for all invisible payment.

■Original IMP is forwarded to Bangladesh Bank with mentioning novice value.

■Duplicate IMP is skipped with the Bank along with the Bill of entry.

Export Procedures:

A person desirous to exports should apply to obtain ERC from CCLNE. Then the person should take step for export purpose into he Bank for obtaining EXP from. He/ she must submit the following documents:

■Trade license

■ERC

■Certificate from concerned government organization

After satisfaction on the documents the Banker will issue EXP from to the Exporter. Now the exporter will be getting shipping and other documents from the shipment procedure. Exporter should submit all these documents alone with letter of indemnity to the Bank for negotiation.

Documents of Export:

Following major documents are required for export purpose.

■Commercial invoice.

■Bill of lading.

■EXP from.

■Bill of exchange.

■L/C Copy.

■Packing list.

■Certificate of origin.

■Quality control certificate.

■Weight list.

■Inspection Certificate.

Procedures for collection of export Bill:

There are two types of procedures regarding collection of export Bill

Foreign Documentary Bill for collection (EDBC)

Foreign Documentary bill for Purchase (EDBP).

Foreign Documentary bill for Collection (FDBC):

Exporter cans collection the Bill through negotiating banks on the basis of collection. Exporter in this case will submit al the documents to the negotiating Bank for collection of Bill from inspector, the exporter will get money only when the issuing Bank gives payment. In this connection Bank will scrutinize all the documents as per terms and conditions mentioned in L/C.

FDBC Register:

Entry given twice in this register

-When document is forwarded to the issuing Bank.

-When proceeds realized.

Foreign Documentary Bill for purchase (FDBP)

When exporter sale all the export documents to the negotiating Bank it is as FDBP. In this case the exporter will submit all the documents to the Bank. The Bank gives 60%-80% amounts to the exporter against total L/C value.

Local Documentary Bill for purchase (LDBP):

◊Incoming of LIC customer with the L/C to negotiate.

◊Documents given with L/C.

◊Scrutinizing documents as per L/C terms and conditions.

◊Forward the documents to L/C opening Bank.

◊L/C issuing Bank gives acceptance and forward acceptance letter.

◊Payment given to the party by collection basis or by purchasing documents.

Packing Credit (PC):

It is one kind of credit sanctioned by export department to meet the exported goods shipment timely. The Bank will give the facility after decoction of Back to Back L/C from total L/C value.

Secured Overdraft (SOD):

Secured overdraft is one kind of facility enjoying by the exporter from the export section. It is generally given to meet the Back to Back L/C claim Sometimes it is given to the exporter by force for meeting the Back to Back L/C claim due to delay of Master L/C payment.

Foreign remittance section:

Different funds are mobilized form foreign country to our thought the foreign remittance section. Purchase of foreign currencies constitutes inward foreign remittance and sales of foreign currencies constitute outward foreign remittance. EXIM Bank has a rich environment where funds flow from different countries.

The transaction of the authorized dealer in foreign exchange involves either inward or outward remittances of foreign exchange between the tow countries

EXIM Bank bas authorize dealership. Different branch of EXIM Bank such as Motijheel branch, Mirpur branch etc. is providing the foreign remittance services to its customers. But EXIM Bank Gazipur chowrasta branch has no authorized dealership. For this reason this branch can not provide the foreign remittance services to its customer. EXIM Banks foreign remittance facilities include FBC, LFBC purchase and sales of FCY, FTT, and traveler cheque, FBP.

Way of transferring the funds:

■NOSTRO Account

■VOSTRO Account

■LORO Account

Nostro Account:

An Account of the branch named which in a multinational Bank for the Transferring of the fund called NOSTRO Accounts. Just this account use only this Branch

ostro Account:

VOSTRO Account is the opposite of NOSTRO Accounts where a multinational Bank maintains account in the local Bank to meet the requirements of sending fund. These accounts are not use able.

Remittance procedures of foreign currency:

There are two types of remittance:

- Inward remittance

- Outward remittance.

1. Inward Foreign Remittance:

Inward remittance covers purchase of foreign currency in the form of foreign T.T., D.D, and bills, T.C. etc. sent from abroad favoring a beneficiary in Bangladesh. Purchase of foreign exchange is to be reported to Exchange control Department of Bangladesh bank on Form-C.

2. Outward Foreign Remittance: Outward remittance covers sales of foreign currency through issuing foreign T.T. Drafts, Travelers Check etc. as well as sell of foreign exchange under L/C and against import bills retired.

Working of this department:

- Issuance of TC, Cash Dollar /Pound

- Issuance of FDD, FTT & purchasing, Payment of the same.

- Passport endorsement.

- Encashment certificate.

- F/C Account opening &filing.

The remittance process involves the following four modes

| Cash RemittanceDollar/ Pound | Sell | Bank sells Dollar / Pound for using in abroad by the purchaser. The maximum amount of such sell is mentioned in the Bangladesh Bank publication of ‘Convertibility of Taka for Currency Transactions in Bangladesh’. |

| Purchase | Bank can purchase dollar from resident and non – resident Bangladeshi and Foreigner. Most dollars purchased comes from realization of Export Bill of Exchange. | |

| Traveler’s Cheque(TC) | Issue of TC | TC is useful to traveler abroad. Customers can encash the TC in abroad from the drawee bank. TC is alternative to holding cash and it provides better security than holding cash in hand. |

| BuyingOf TC | If any unused leaf of TC is surrendered bank buys it from the customer. All payments are made in local currency. Banks generally buy only those TC. | |

| Telex Transfer | Outward TT | It remits fund by tested TT via its foreign correspondence bank in which it is maintaining its NOSTRO Account. |

| Incoming TT | It also makes payment according to telegraphic message of its foreign correspondence bank from the corresponding VOSTRO Account. | |

| Foreign Demand Draft | Bank issue Demand Draft in favor of purchaser or any other according to instruction of purchaser. The payee can collect it for the drawee bank in which the Issuing bank of Demand Draft holds its NOSTRO Account. Bank also makes payment on DD drawn on this bank by its foreign correspondence bank through the VOSTRO Account. | |

Telegraphic Transfer (TT):

TT is one of the important tools of transferring foreign currency from one country to another. The persona who wants to send TT to the abroad at first he/ has to submit an application from duly mentioned it TT amount and he /she has to deposit amount mentioned in voucher to the cash department. It is generally performed by the Bank branch through their respective NOSTRO account who is maintaining any foreign Bank account outside the country. The originating Bank sends a message to the paying foreign Bank for making payment against the mentioned TT accounts number. The foreign make payments to the party and also make debit account against respective Bank. At him same time foreign Bank send advice to head office ID division for acknowledging the debited amount. Head officer ID division sends debit advice to the respective branch for acknowledging the payment.

Outward remittance

Outward remittance includes sales of TC and FC notes etc.

Dales of IC and FC notes:

To get TC and FC notes at least the customer has to submit an application from Filling up the required column, which is formatted by the Bank, is caped T/M from. After checking up the from the desk officer passes voucher and issues a TC and gives cash dollar to the customer. In both the cases the Bank endorse total amount in customer’s passport. The Bankers required photocopy of customer’s passport (page-l -7) and endorsement paper. The charge of endorsement taken by the branch is Tk. 200 only. Sale of TC and FC note amount varies from different countries:

5. COMPETITIVE POSITION OF EXPORT IMPORT BANK OF BANGLADESH LIMITED WITH PREMIER BANK LIMITED.

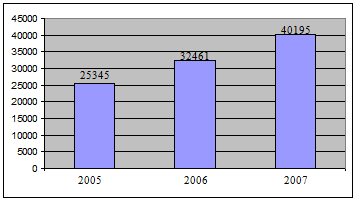

The performance of the bank is more significant in both development and achievements of continuous growth rate in all the areas of banking operations. If we see the balance sheet of 2007 of Exim Bank Ltd., we can say that in all over Exim Bank Ltd. performing better than other banks in Bangladesh. In the year of 2007 the bank has successfully earned a pre-tax profit of Tk.1,618.80 Million registering an annual growth of 34.96% than that of the previous year. It has successfully mobilized Tk.41,546.57 million deposit from depositors and has arranged disbursement of Tk.40,195.24 million as investment through its 35 Branches. The return on assets after tax was 2% well above the banking-industry average.

Below we compare the performance of Exim Bank Ltd. with Premier Bank Ltd. in some of the areas of banking operations.

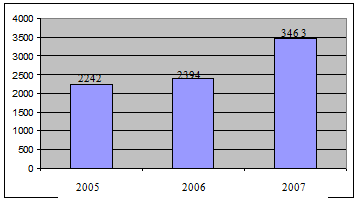

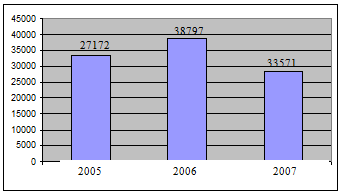

Capital and Reserve Fund:

Exim Bank Ltd.

Amount in Million.

Premier Bank Ltd.

Amount in Million.

Comparative Interpretation:

Above the chart shows that capital and reserve fund of Exim Bank Ltd. is much better than the Premier Bank Ltd.

Assets:

Exim Bank Ltd.

Amount in Million

Premier Bank Ltd.

Amount in Million

Comparative Interpretation:

Assets position of Export Import Bank of Bangladesh Limited is good compare to Premier Bank Ltd. The growth rate of assets of Exim Bank Ltd. is better than the Premier Bank Ltd. For the year of 2007 the growth rate of assets of Exim Bank Ltd. was 23.23% instate of Premier Bank Ltd. 19.88%.

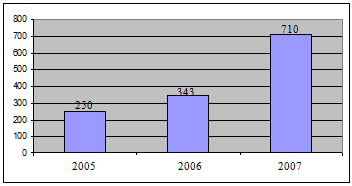

Investment:

Exim Bank Ltd.

Amount in Million

Premier Bank Ltd.

Amount in Million

Comparative Interpretation:

Investment of Exim Bank Ltd. is much better than the investment of Premier Bank Ltd. But the growth rate of investment of Premier Bank Ltd. is better than the Exim Bank Ltd. For the year of 2007 the growth rate of investment of Premier Bank Ltd. was 44.65% instate of Exim Bank Ltd. 23.83%.

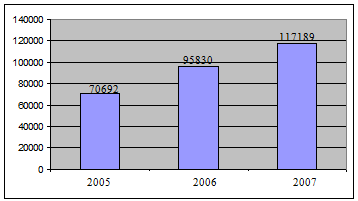

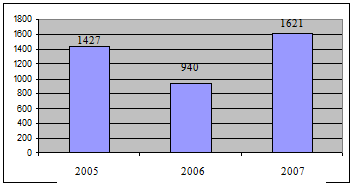

Foreign Trade

Exim Bank Ltd.

Amount in Million

Premier Bank Ltd.

Amount in Million

Comparative Interpretation:

Foreign Trade business of Exim Bank Ltd. is much better than Premier Bank Ltd. Foreign Trade business of Exim Bank Ltd. increasing year by year but Foreign Trade business of Premier Bank Ltd. decrease in year 2007 from 2006.

Foreign Remittance of Premier Bank Ltd. is much better than the Exim Bank Ltd. Although foreign remittance of Exim Bank Ltd. is increasing year by year but the Premier Bank Ltd foreign remittance receive amount always higher than the Exim Bank Ltd.Comparative Interpretation:

Conclusion of Competitive Position:

From the above circumstances we can say that in overall Exim Bank Ltd. financial position is much better than the Premier Bank Ltd. Their reserve fund, asset position, investment position, foreign trade business, very well position rather than the Premier Bank Ltd. position. But foreign remittance position is not that much well. They should try to develop this sector and to develop the sector the bank need to take initiatives to make remittance arrangements with some leading exchange houses at abroad because foreign remittance effect the export-import business.. And Exim Bank Ltd. mainly focus on export-import business, that’s way their name is Export Import Bank of Bangladesh Limited.

6.1 SWOT ANALYSIS

SWOT analysis is the detailed study of an organization’s exposure and potential in perspective of its. This facilitates the organization to make their existing line of performance and also foresee the future to improve their performance in comparison to their competitors. As though this tool, an organization can also study its current position, it can also be considered as an important tool for making changes in the strategic management of the organization.

- “S” -strengths

- “W” -weakness

- “O” -opportunities

- “T” -threats

Strengths

- EXIM Bank Limited has already established a favorable reputation in the banking industry of the country. It is one of the leading private sector commercial banks in Bangladesh. The bank has already shown a tremendous growth in the profits and deposits sector.

- EXIM Bank has provided its banking service with a top leadership and management position. The top management officials have all worked in reputed banks and their years of banking experience, skill, and expertise will continue to contribute towards further expansion of the bank.

- EXIM Bank Limited has already achieved a high growth rate accompanied by an impressive profit growth rate in 2007. The number of deposits and the loans and advances are also increasing rapidly.

- EXIM Bank has an interactive corporate culture. The working environment is very friendly, interactive and informal. And, there are no hidden barriers or boundaries while communicate between the superior and the employees. This corporate culture provides as a great motivation factor among the employees.

- EXIM Bank has the reputation of being the provider of good quality services too its, potential customers.

Weaknesses

- The main important thing is that the bank has no clear mission statement and strategic plan. The banks not have any long-term strategies of whether it wants to focus on retail banking or become a corporate bank. The path of the future should be determined now with a strong feasible strategic plan.

- The bank failed to provide a strong quality-recruitment policy in the lower and some mid level position. As a result the services of the bank seem to be Deus in the present days.

- The poor service quality has become a major problem for the bank. The quality of the service at EXIM Bank is higher than the Dhaka Bank, Prime Bank or Dutch Bangla Bank etc. But the bank has to compete with the Multinational Bank located here.

- Some of the job in EXIM Bank has no growth or advancement path. So lack of motivation exists in persons filling those positions. This is a weakness of EXIM Bank that it is having a group of unsatisfied employees.

- In terms of promotional sector, EXIM Bank has to more emphasize on that. They have to follow aggressive marketing campaign.

Opportunities

- In order to reduce the business risk, EXIM Bank has to expand their business portfolio. The management can consider options of starting merchant banking or diversify into leasing and insurance sector.

- The activity in the secondary financial market has direct impact on the primary financial market. Banks operate in the primary financial market. Investment in the secondary market governs the national economic activity. Activity in the national economy controls the business of the bank.

- Opportunity in retail banking lies in the fact that the country increased population is gradually learning to adopt consumer finance. The bulk of our population is middle class. Different types of retail lending products have great appeal to this class. So a wide variety of retail lending products has a very large and easily pregnable market.

- A large number of private banks coming into the market in the recent time. In this competitive environment EXIM Bank must expand its product line to enhance its sustainable competitive advantage. In that product line, they can introduce the ATM to compete with the local and the foreign bank. They can introduce credit card and debit card system for their potential customer.

- In addition of those things, EXIM Bank can introduce special corporate scheme for the corporate customer or officer who have an income level higher from the service holder.

- At the same time, they can introduce scheme or loan for various service holders. And the scheme should be separate according to the professions, such as engineers, lawyers, doctors etc.

Threats

- All sustaining multinational banks and upcoming foreign and private banks pose significant threats to EXIM Bank Limited. If that happens the intensity of competition will rise further and banks will have to develop strategies to compete against these local and foreign banks.

- The default risks of all term loans have to be minimized in order to sustain in the financial market. Because of default risk the organization may become bankrupt. EXIM Bank has to remain vigilant about this problem so that proactive strategies are taken to minimize this problem if not eliminate.

- The low compensation package of the employees from mid level to lower level position is not able to keep the employee motivation. As a result, good quality employees leave the organization and it effects the organization as a whole.

6.2 RATIO ANALYSIS

Analyzing the financial performance (also called financial analysis) is so much essential for each and every business institution as well as for the Banking institutions to assess their past financial performance and to identify the sources, where the necessary improvement is needed to perform better in the future and to meet the future challenges by taking effective business strategy. Financial analysis typically is associated with ratio analysis. Ratio analysis involves the methods of calculating and interpreting the financial ratios to analyze the firm’s relative financial performance. The main purpose of this analysis is to analyze and monitor the firm’s financial performance, so, that the interested parties (both the external and internal) can realize the firm’s actual performance easily and conveniently, which is so much essential for the parties. There are several ratios that help a particular analyst to analyze the past performance of a particular firm and to diagnose the various relevant variables, which are important for improving the future operation of that firm. The financial ratios, that are useful for analyzing the past financial performance of a financial institution, such as

- Current Ratio

- Return on Investment(ROI)

- Return on Equity(ROE)

- Debt Ratio

Now we are going to comparison above the ratio EXIM Bank Ltd. with Premier Bank Ltd.

Current Ratio: A measure of liquidity, calculated by dividing the current assets by current liabilities. It shows the level of current assets that a particular firm has against per Taka of current liabilities of that firm. So the equation becomes:

Current ratio = Current Assets / Current Liabilities

EXIM Bank Ltd.

Year | 2005 | 2006 | 2007 |

| Current Assets | 5,985,651,254 | 6,812,603,369 | 10,346,601,403 |

| Current Liabilities | 5,098,881,890 | 5,464,547,548 | 7,731,940,908 |

| Current ratio | 1.17 | 1.25 | 1.34 |

Interpretation:

We know that, the current ratio measures a firm’s liquidity by measuring the portion of its current asset relative to its current liabilities and the higher the ratio, the higher the liquidity of the firm. So, after observing the graph shown above, it can be said that the company’s current ratio is up warding year by year and Bank’s current ratios are always below the standard level (2), which is not good and risky for the firm – EXIM Bank. In 2007 it was highest. But in the year 2005 to 2006 Bank’s current ratio as well as the liquidity is increasing at slow rate, which is good for the Bank and the reason is that the Bank has maintained a steady level of current liabilities during this period of time.

Premier Bank Ltd.

Year | 2005 | 2006 | 2007 |

| Current Assets | 19,800,668,766 | 23,604,592,387 | 27,157,453,829 |

| Current Liabilities | 5,522,887,752 | 6,147,668,656 | 6,382,994,366 |

| Current ratio | 3.5 | 3.8 | 4.2 |

Interpretation:

We know that, the current ratio measures a firm’s liquidity by measuring the portion of its current asset relative to its current liabilities and the higher the ratio, the higher the liquidity of the firm. So, after observing the graph shown above, it can be said that the company’s current ratio is up warding year by year and it is the highest in the year 2007.

Comparative Interpretation:

We know that, the current ratio measures a firm’s liquidity by measuring the portion of its current asset relative to its current liabilities and the higher the ratio, the higher the liquidity of the firm. We can say that Premier Bank Ltd. current ratio is better than EXIM Bank Ltd. current ratio.

Return on Investment (ROI):

The Return on investment (ROI), which is often called the firm’s return on total assets, measures the overall effectiveness of management in generating profits with its available assets. The higher the ratio, the better performance of the organization is ensured.

It is calculated as follows: ROI = Net Profit after Tax / Total Asset

EXIM Bank Ltd.

Year | 2005 | 2006 | 2007 |

| Net Profit | 555335174 | 650,292,342 | 930,843,607 |

| Total Asset | 33,716,699328 | 41,793,540,962 | 51,503,027,985 |

| Ratio | 1.65% | 1.56% | 1.81% |

Interpretation:

After having a careful view on the graph I am able to say that the Bank’s effectiveness to generate return by using its available assets is fluctuating year to year and the Bank has generated maximum amount of ROI in the year of 2007 and due to lack of efficiency in utilization of assets the Bank’s ROI falls in the minimum level in the year of 2006.

Premier Bank Ltd.

| Year | Net Profit after Taxes | Total Assets | Return on Investment |

| 2005 | 180931236 | 22767840000 | 0.80% |

| 2006 | 368677624 | 27170450000 | 1.36% |

| 2007 | 78756227 | 32573190000 | 0.24% |

know that, The Return on investment (ROI), which is often called the firm’s return on total assets, measures the overall effectiveness of management in generating profits with its available assets. In graphical presentation; the ROI is 0.0080 in the year 2005, increasing in 2006 and again decreasing in 2007. So bank should be concerned with this matter.

Comparative Interpretation:

We know that, The Return on investment (ROI), which is often called the firm’s return on total assets, measures the overall effectiveness of management in

generating profits with its available assets. After having a careful view on the above data, I am able to say that the Bank’s effectiveness to generate return by using its available assets is fluctuating year to year. But comparatively EXIM Bank Ltd. ROI is much better than ROI of Premier Bank Ltd.

Return on Equity (ROE): It measures the return earned by the funds invested by the common stockholders.

It is calculated as follows:ROE=Net Profit after Tax/Shareholder’s Equity

EXIM Bank Ltd.

Year | 2005 | 2006 | 2007 | |

| Net Profit | 381798163 | 555335174 | 650,292,342 | |

| Equity Capital | 1,400,004,740 | 1,912,421,914 | 3,111,685,079 | |

| Ratio | 29.04% | 20.90% | 23.03% | |

Interpretation:

The Company’s return on equity is decreasing over the time, which is not good for the Bank. The EXIM Bank has generated maximum amount of ROE in the year 2003, which is 34.05% but after that, the Bank’s ROE is decreasing year to year, which is not favourable for the EXIM Bank. The ROE is decreasing from the year 2004 to year 2006 as the amount of proposed dividend and paid up capital of the Bank has increased lot during this period of time but compare to that the amount of net profit is not increasing that much as the operating income of the Bank is increasing as the Bank as established some new branches during this period of time.

Premier Bank Ltd.

| Year | Net Profit after Taxes | Stockholders’ Equity | Return on Equity |

| 2005 | 180931236 | 1133532329 | .159 |

| 2006 | 368677624 | 1626109953 | .226 |

| 2007 | 78756227 | 2465361210 | .032 |

Interpretation:

We know that, The Return of Equity (ROE) measures the return earned on the owner’s (both preferred and common stockholders’) investment. In graphical presentation; the ROE is increasing in 2006 and decreasing in 2007. So bank should be concerned with this matter.

Comparative Interpretation:

The Return of Equity (ROE) measures the return earned on the owner’s (both preferred and common stockholders’) investment. Generally, the higher this return, the better off the owner’s. So, to see the above data we can say that ROE of EXIM Bank is better than the Premier Bank

Debt Ratios: The ratio analyzes a firm’s debt position, which indicates the amount of other people’ money being used in the firm to generate profits by measuring the portion of total asset financed by the firm’s creditor.

This ratio is calculated as follows:Debt Ratio=Total Liabilities/Total Asset

EXIM Bank Ltd

Year | 2005 | 2006 | 2007 | |

| Total Liabilities | 31,804,277,414 | 38,681,855383 | 47,460,499,299 | |

| Total Asset | 33,716,699328 | 41,793,540,962 | 51,503,027,985 | |

| Ratio | 94.33% | 92.55% | 92.15% | |

Interpretation:

After having a careful view on the graph, we can see that the company, EXIM Bank has financed on an average of above 94% of its total assets with debt in every year but from the year 2005 the Bank’s debt position is started to fall, as the Bank is now emphasizing on equity capital financing and the Bank has lowest level of debt ratio in the year 2007 as the Bank has increased its paid up capital of Tk. 214.22 crore.

Premier Bank Ltd.

| Year | Total Liabilities | Total Assets | Debt Ratio |

| 2005 | 21634309082 | 22767840000 | .95 |

| 2006 | 25544335980 | 27170450000 | .940 |

| 2007 | 30107825347 | 32573190000 | .924 |

Interpretation:

We know that, the debt-equity ratio indicates the relationship between the long-term funds provided by creditors and those provided by the firm’s owners. The results of debt ratio are low in 2005, lowest in 2006 and better in 2007.so bank recover the problem in last year.

Comparative Interpretation:

We know that, the debt ratio measures the proportion of total assets provided by the firm’s creditors. So, after observing the both banks graph shown above, it can be said that the EXIM bank debt ratio is better than the Premier bank .

Conclusion of Ratio Analysis:

Financial analysis typically is associated with ratio analysis. Ratio analysis involves the methods of calculating and interpreting the financial ratios to analyze the firm’s relative financial performance. The main purpose of this analysis is to analyze and monitor the firm’s financial performance, so, that the interested parties (both the external and internal) can realize the firm’s actual performance easily and conveniently, which is so much essential for the parties. From the above circumstances we can say that, although all over performance of Exim Bank Ltd. is much better than the Premier Bank Ltd. but to develop more the bank need to develop and achieve continuous in all the areas of banking operations. Because the performance of the bank is more significant in both development and achievements of continuous growth rate in all the areas of banking operations.

Other parts of the post-

Report On Export Import Bank Limited (Part-1)