EXECUTIVE SUMMERY

Over the decades, RMG sector is the prime source of export earnings as well as the prime source of industrial employment in Bangladesh. This sector basically introduces Bangladesh positively over its boundary. However from its inception, RMG sector still faces threats as well as some weaknesses too. Threats are basically from external sources like post MFA challenges, but weaknesses, like lack of backward linkage industry, also fuels the threats to be more devastating for the industry. This report basically focuses on the importance of establishing backward linkage industry.

By nature of business, RMG sector basically integrating commodities of some other industries like fabrics, interlinings etc. So to achieve strong growth, this sector requires sufficient internal supply of its raw materials. Backward linkage industry can do the job. This was and stills now the biggest challenge for Bangladesh in this sector. Since we did not have any strong industrial exposure in our economy, RMG sector could not get sufficient support from backward linkage industry. Most of time, we need to depend upon external sources i.e. import for its raw materials. In such cases, though we earned substantial export earnings through this sector, but value addition to the economy was not satisfactory. Most of the earnings went back to over the boundary and more over we are loosing confidence over our production capacity in terms of timely shipment, price etc. So we need deeply establishment of backward linkage industry which support RMG sector to sustain its growth pace as well as increase in value addition process to our export earnings. This report tries to understand the trend of RMG sector and how backward linkage can help to boost up RMG’s performance and finally explore the opportunities of setting up backward linkage industries in Bangladesh.

Introduction

Bangladesh is the fifth largest garment exporter to the European Union and among the top ten apparel suppliers to the US.

In the past two decades Bangladesh has emerged as a very successful manufacturer and exporter of quality ready made garments (RMG). Thanks to its competitive prices and access to US market with quota facilities, the volume of garment exports has been growing spectacularly, from one million US dollar in 1970, $31.57m in 1983 to $4.91bn in 2002-03 and $10.69 bn in 2007-08.

RMG accounts for more than 75% of Bangladeshi export earnings. Among some 24 major apparel exporting countries, none has grown faster than Bangladesh since 1980s; and since 1990, no other major Asian exporter of clothing has achieved higher growth rates. Bangladesh is the fifth largest garment exporter to the European Union and among the top ten apparel suppliers to the US. European Union (EU) countries were the major importers of readymade garments in 2007-08 worth $12.88bn, followed by the US $3.22bn, Canada $ 467 m, Japan $28.03m and Australia $21.92 m.

Some 90 countries import apparels from Bangladesh: the US is the single largest importer followed by EU countries. Bangladesh is trying to expand its market in countries like Australia, Canada, Japan, Norway, New Zealand etc., which allow duty free imports.

The sensitivity of RMG exports to external factors became obvious after 11 September, 2001. Export to the US suffered a major setback following the terrorist attacks on the world trade centre, leading to global recession and phasing out of quota facilities there. It declined by 2.34% in 2003 and by 13.04% in the first five months of 2004.

Responding to the fears and concerns of Bangladesh Garments Manufacturers and Exporters Association (BGMEA), the government is preparing a guideline for a fund to protect the country’s textile and garments industries after the phase-out MFA and current world recession. BGMEA represents over 4700 apparel manufacturing companies. Its primary function is to protect the interest of the sector and promote trade negotiations in the international market, global trade bodies like the World Trade Organization (WTO), concerned UN agencies like International Labor Organization (ILO), and the United Nations Conference on Trade and Development (UNCTAD) etc. The importance of the RMG sector cannot be overemphasized as it is ‘the engine of growth’ for Bangladesh in so many ways, including development of society as a hole. A huge local consumer market has emerged as a result of increase in the buying capacity of the RMG work force. Others to benefit from the ever expanding garment sector are banking, insurance, packaging, transport and allied industries.

In the initial years the RMG sector was heavily dependent upon imports. Imports were as much as 80% of the export value. In addition to fabrics, all other accessories like interlining, labels, buttons and sewing thread, all the packaging materials like neck boards, backboards, plastic collar stays, tissue papers, hangtags, pins and clips, hangers and poly bags, zippers and draw strings and export cartons used to be imported. Over the last decade, a large number of accessories industries have come up to fill in this gap to the extent of about 70% of the total requirement of the industry. While the country has more or less achieved self-reliance in supply of accessories, the progress is less noticeable in the fabric manufacturing, especially the woven fabric.

OBJECTIVES

Broad Objective:

To identify the importance of establishing Backward Linkage of RMG Sector in Bangladesh

SPECIFIC OBJECTIVES:

● To identify the growth possibility of RMG Sector in Bangladesh.

● To find out the factors influencing towards the growth of this sector.

● To identify the demand and supply status of the supplies to produce the finished Ready Made Garments.

● To find out the weaknesses of this sector in Bangladesh.

● To identify the possible threats- Bangladesh going to face in this sector.

● To find out the scope of potential development to combat the weaknesses and threats.

PROPOSITIONS & HYPOTHESIS:

PROPOSITIONS

1. The industry growth is significant

2. The backward linkage is very poor

3. The Bonded Wear Housing Facility is a threat to establishment of backward linkage industry

4. Lead time to import the supplies is an opportunity for the backward linage industry

5. Achieving competitive advantage over the base materials will have direct relationship with Price advantage

HYPOTHESIS

1. The industry growth is positively correlated with the strong Backward Linkage

2. The backward linkage establishment is positively correlated with the infrastructure of the country and the government rules and policies

3. Increase of Bonded Wear Housing Facility is negatively correlated with the growth of Backward linkage

4. Longer Lead time to import the supplies is negatively correlated with the growth of backward linage industry

5. Achieving competitive advantage over the base materials is positively correlated with the Product Price

COMPANY PROFILE

BACKGROUND

R. M. Interlinings Ltd. is one of the largest and the 1st interlining manufacturer in Bangladesh. The inception idea of the company was generated in 1996 and it was in the operation in 1999. Before 1999 there were no interlining factory in Bangladesh and it was in deed a challenging and risky project for any entrepreneur. Mr. Mohd. Mozharul Hoq the managing director of the company has incepted this challenging project into reality. In the beginning it was quite difficult to survive hence most of the base materials needed to be imported from outside the country.

As the time passed by Mr. Hoq started to gain confidence in the industry. He understood that without vertical integration it is not possible to sustain in the market. Then he started the vertical integration and as a result the inception of R. M. Fabitech Ltd. (a sister concern of R. M. Interlinings Ltd.) has taken into effect in the year 2004. As a result now 80% of the base materials for woven interlining is being procured locally. The most concentration is given on the quality while procuring the base materials so that the out put can be a standard product.

The highest level of concentration is given on the client requirement. R. M. Interlinings Ltd always ensures the best support to their client by providing technical service and many other services. The company put most emphasizes on listening to the requirement of the clients carefully and provide them the best solution. In a word

Products

All types of Interlinings are produced in the company for:

• Readymade Garments

• Shirts

• Ladies Wear

• Baby Wear

• Caps

• Hats

• Shoes

The company produces basically three types of interlining

• Woven Interlining

• Non Woven Interlining

• Knitted Interlining

Woven Interlining:

R. M. Interlinings Ltd. is specialized in producing woven interlinings. Most of the woven interlinings are being manufactured in R. M. Interlinings Ltd. In the product mix the company has 100% cotton interlinings, Polyester Cotton Interlining and Polyester Interlinings. The product varieties are given below

Fusible Interlining (one side coated)

Both sided coated Interlining

Basic interlinings (Non Fusible or Non Coated)

Different colors and shades (e.g. white, off-white, grey, black, etc.)

Different touch interlining (e.g. soft, medium, medium-hard, hard, etc.)

In order to produce woven interlining most of the base materials are procured locally. As a result the company achieves the competitive advantage of lead time over it’s competitors. As the vertical integration is there the product quality is always under close monitoring. Thus the company is assuring the best quality.

Non Woven Interlining:

There are around 200 types of non woven interlining in the product line of R. M. Interlinings Ltd. The company always concentrates more on procuring the base materials

from the best sources and maintaining a unique output. The company has different type of non woven interlinings from non fusible, dotted and scattered coating series.

• Polyester Non Woven Interlining

• Polyester Polyamide Non Woven Interlining

• Polyamide Non Woven Interlining

In non woven as well the company can provide various color interlining. On the basis of client requirement the company also supply both sided coated non fusible interlining.

Knitted Interlining:

The Company has a wide range of knitted interlining. The company has the best source of procuring knitted interlining for which the quality is always ensured. The company can supply the following types of interlining from knit category

• Fusible Interlining (one side coated)

• Basic interlinings (Non Fusible or Non Coated)

• Different colors and shades (e.g. white, off-white, grey, black, etc.)

Price:

R. M. Interlinings Ltd. has set standard price for the customer. The price is very much competitive. It has been possible for the vertical integration and expertise in procuring base materials over years without compromising the quality. R. M. Interlinings Ltd. has different grade in its product line which gives flexibility to the client to choose the best price for them in terms of quality. It has been observed that some of the clients are highly price sensitive and they are ready to accept a bit compromise in the quality. For them R. M. has developed a separate graded interlining by doing research to reduce the cost and still maintain the expected quality of the client.

Quality:

Quality is characterized by more than just a good product. It also includes countless invisible features which make an interlining dependable even under the most extreme processing conditions. R. M. Interlinings Ltd. put the maximum weight age in the consistent quality output. Quality assurance in all the stages of production is a must to achieve the best output. Through the vertical integration the quality in all stages of production is highly embedded in R. M. Interlinings Ltd.

In order to achieve the consistent quality in the output the company is using the world’s best machineries both for finishing and coating purpose. The world’s best brand for coating interlining CAVITECH is used for coating purpose and the one of the best finishing machines BRUKNER is used for finishing purpose.

A very high skilled and trained group of people are working in the production department to ensure the quality output. No product comes out from the plant without passing through a high scale of quality control.

Service:

R. M. Interlinings Ltd. has a very young, energetic, innovative and cordial workforce in its business development team. Our experienced members of production teams are always on hand to provide our customer with solutions. Besides we have a very equipped Research and Development department, which is continuously working to come up with different types of product or different aspects of an existing product which can satisfy the need of our clients. The company has been giving ceaseless efforts to offer a wide range of products with latest inventions, which are composed with experiences of foreign and local specialists.

R. M. Interlinings Ltd. quality standard meets the ISO: 9001-2000.

Besides providing the mentioned support R. M. Interlinings Ltd. also provides fusing support. Most of the time it has been found that client’s are facing problem in fusing.

Checking of Temperature with Fusing Strips:

It is recommended to use temperature-strips to check the accurate temperature inside the fusing machine. Place fusing strips on the left, in the middle and on the right-hand side of the fusing belt to confirm equal temperature throughout the width of the machine. In case a heating element inside the machine is malfunctioning, it will show in the temperature-strips.

Cleaning of Fusing Belt:

Often the Teflon belt of the fusing machine is not properly or not regularly cleaned. There might be some residue of a previous fusing operation. This will contaminate the surface of the piece of fabric to be fused, thus showing up as “strike-through” – especially on dark fabrics

Replacing Damaged Belts:

Old belts should be replaced. If they are only repaired by sticking patches over the damaged part, this will subsequently give an imprint on the shirt collar which is hard to remove.

Correct Fusing Time:

The fusing time can easily be checked with a stopwatch.

JOB RESPONSIBILITIES:

Major Responsibilities:

• To increase the sales and expansion of market share

• To Generate, Compile and report marketing data regularly

• To practice all written, instructed and basic marketing management procedure

• To developing and executing marketing strategies

• To develop and implement marketing plan

• To lead a team of business development officer

• To prepare sales budget and forecast

• To handle critical situation

INDUSTRY BACKGROUND

The major backward linkage is related with Textile Sector. The Textile sector covers both fabric and interlinings. These are must for the garments manufacturers in Bangladesh. Therefore it is very much essential to take a look into the present condition of the Textile Industry if it is needed to identify the condition of RMG sector in Bangladesh.

TEXTILE SECTOR IN BANGLADESH:

Textiles have been an extremely important part of Bangladesh’s economy for a very long time for a number of reasons. The textile industry is concerned with meeting the demand for clothing, which is a basic necessity of life. It is an industry that is more labor intensive than any other in Bangladesh, and thus plays a critical role in providing employment for people. Currently, the textile industry accounts for 45% of all industrial employment in the country and contributes 5% of the total national income.

However, although the industry is one of the largest in Bangladesh and is still expanding, it faces serious problems, principally because the country does not produce enough of the raw materials necessary, unfavorable trade policies, and inadequate incentives for expansion. As a result, Bangladesh’s textile industry relies heavily on imports, and the country does not earn as much foreign exchange from its textile industry as it should.

HISTORY OF THE TEXTILE INDUSTRY IN BANGLADESH:

Traditionally, artisans working in small groups, in what are often referred to as cottage industries, produced most of the textile in the sub-continent. There were many such artisans in the area that was to become Bangladesh. In fact, from prehistoric times until the Industrial Revolution in the eighteenth century, East Bengal was self-sufficient in textiles. Its people produced Muslin, Jamdani, and various cotton and silk fabrics. These were all well regarded even beyond the region as very skilled craftsmen manufactured them.

The material produced by the artisans of Bengal started facing vigorous competition beginning in the eighteenth century after the growth of mechanized textile mills in the English Midlands. This eventually led to a great decline in the number of Bengali workers skilled enough to produce such high quality fabrics. According to popularly held beliefs, as the region’s spinners and weavers meant competition for their emerging textile industry, the British imperialists responded by trying to force the artisans to stop production. They were said to have sometimes used methods as harsh as cutting off the thumbs of the craftsmen so they would never be able to spin or weave again.

Not only were huge amounts of fabric produced in Bengal, the area was also a prime producer of the indigo plant, from which the indigo dye was extracted. This natural dye was widely used before the advent of chemical dyes in the nineteenth century. In fact, the rich blue color provided by the dye is still sometimes used for dyeing denim. Bengali dye masters had special recipes for producing the desired colors, just as chefs have recipes for achieving desired flavors. However, as was the case with the traditional handloom fabrics, indigo dye production also gradually declined.

The problems of the indigo industry were principally a result of two factors. First, because indigo was a cash crop, the British administrators in this part of the empire forced farmers to grow the indigo plant in order to increase the administrators’ profits. Unfortunately, the indigo plant is nitrogen depleting and thus exhausted the soil very quickly. The farmers received little real income from the crop since the British kept most of the profits, and in times of economic hardship, such as when the indigo price fell, they were unable to survive by eating their produce, unlike farmers who grew staples such as rice or wheat.

Another reason for indigo’s gradual disappearance as a dyestuff was the unpredictable nature of the plant. Sometimes one farmer would have a good harvest, while his neighbor would not be able to produce anything. The combination of poor yields and the unpredictability of the crop gradually led farmers to cease growing the plant and moving on to other, more profitable crops.

The fabric produced and dyed in British factories flooded the Indian markets. In time, its importation became one of the points of contention in the growing Independence Movement of the Sub-Continent. As separation from Great Britain was becoming a foreseeable reality and local production again profitable, the textile industry was reorganized as new methods of production were adopted. Water, a necessity for the chemical processes involved in processing the modern dyes now used, was abundant in East Bengal. This contributed to the establishment of mechanized textile factories in the area.

However, after 1947 and the partition of East and West Pakistan from India, most of the capital and resources of Pakistan came under the control of West Pakistanis. The textile industry thus stagnated in East Pakistan as momentum for development shifted from the eastern part of the country to the west. The west also grew more cotton than the east, which was used as a plea for developing the industry in the west instead of in the east. The majority of all industries in the east were also owned by West Pakistani industrialists.

When Bangladesh gained its independence from Pakistan in 1971, the new government nationalized the textile industry, as it did with many other businesses in which West Pakistanis had been the principal owners. Although there were some Bangladeshi industrialists, they did not form a large or politically powerful group and thus had to surrender control of their factories to the government as well. All of the country’s textile factories were then nationalized and organized under the Bangladesh Textile Mills Corporation, or BTMC.

THE PRODUCTION OF TEXTILES:

The textile industry has seen the application of many new technologies over the centuries. However, the basic steps have remained the same. What is known as the textile industry includes all the steps necessary to transform fiber into fabric that is ready for stitching, sold either in the market or used in the RMG, or ready made garment, sector. These basic steps are spinning, weaving or knitting, and a combination of dyeing, printing and finishing.

Spinning :

The principal materials used in the spinning sub-sector are raw cotton and synthetic fibers such as viscose and polyester staple fibers. None of these materials, however, are produced in Bangladesh on a large enough scale to supply a significant part of the demand. The reasons for this are complex.

Cotton needs to be grown in fields, and then ginned, which is the removal of seeds from cotton. At present, the cotton produced in Bangladesh is of an acceptable standard. However, the increased cultivation of cotton in this country is not feasible because the crop requires large amounts of land for a substantial yield. In overcrowded Bangladesh, farmers choose to grow rice over cotton. Locally grown cotton currently meets only 4-5% of the total requirement. The remaining 95% of the cotton needed must be imported at very high prices. The production of the synthetic/man-made fibers used in the textile industry requires fairly advanced technology and investment.

Once the raw materials have been obtained, spinning is the first step in textile production. This is the process by which natural or synthetic fibers are cleaned and twisted into yarn.

The raw materials first move through the blow room where all impurities are removed, for natural fibers only and the fibers are rolled into laps. The laps then go through a carding machine, where they are cleaned further and formed into slivers, thick and loosely spun yarn. In order to produce combed yarn, the fibers need to undergo further processing in the comber machine where the short strands are removed, and the remained processed into sliver. The sliver is then fed to the draw frame, and speed/roving frames where they are twisted to form what are called roving. The roving is finally placed in spinning frames where further twisting and drafting take place, and yarn is produced. The yarn is then spun around a bobbin or cone, using autocorners or cone winding/reeling machines, packed and marketed.

Fabric Forming: Weaving and Knitting:

Next the yarn is made into gray, the early stage of fabric processed using looms or knitting machines. The name indicates that the material has no color at this point. These are fairly simple procedures and can even be done by hand, as they were for many centuries in cottage industries. Weaving produces cloth that has a rigid structure, such as the material used for making trousers, shirts, bed sheets, etc.

Prior to weaving the yarn is wrapped around beams and dipped in a size, an adhesive, which when dries gives the yarn a rigid and uniform structure. This yarn is then fed into the looms and called the warp. A thread of yarn, called the weft, passes between alternating warp yarn with the aid of a shuttle, air jet, or rapiers.

Knitting, however, can also be used to make gray. Instead of looms, circular knitting machines are used for knitting. These machines use needles fed with yarn those move in an up and down motion and knit interlocking arrangements of yarn. Knit fabric is much softer and more flexible than that produced on looms, and is commonly used for producing articles of casual wear such as tee shirts, and under garments.

Dyeing, Printing, And Finishing:

The gray then undergoes the three steps of dyeing, printing, and finishing. I had the opportunity to learn about these processes in great depth on my various visits to textile mills. After the gray is inspected, it goes through a process called the batch method when it undergoes scouring, bleaching, and dyeing. Scouring is the treatment of gray in chemical solutions in order to remove the size, natural fats, waxes, proteins, and other impurities, and to make the fabric hydrophilic, which means it no longer repels water.

The bleaching process is next. It is essential in giving the cloth a clean white color. It is done using one of two different methods: bleaching with dilute hypo-chloride solution at room temperature, or by using hydrogen peroxide solution at elevated temperatures, usually 80 to 90 degrees Celsius. The latter method usually results in better and longer lasting whiteness, however is the more expensive of the two methods.

The scoured cloth is then dyed, and then printed on. Printing is done using perforated rollers that allows certain chemicals and colors to diffuse through the holes. After the printing has been completed, the fabric is washed, soaked in chemicals under elevated temperatures for color fixation, and then washed again.

Knitted fabrics are loaded on to a jigger machine, which performs the processes of scouring, bleaching, or dyeing. The fabric then moves on to a machine called either de-watering or de-twisting machine, which removes water from the fabric. The fabric then goes through a shrinkage tensionless drier which is designed for drying, shrinking, and relaxing the knitted fabrics.

The final process before the fabric is ready for stitching is compacting. During this step the fabric is steamed and ironed between roller assemblies. The fabric is then folded and is ready for marketing.

THE CURRENT POSITION OF THE TEXTILE INDUSTRY IN BANGLADESH

Today, the textile industry of Bangladesh can be divided into the three main categories: the public sector, handloom sector, and the organized private sector. Each of these sectors has its advantages and disadvantages. Currently, the organized private sector dominates, and is also expanding at the fastest rate.

Public Sector:

The public sector is that portion of the industry controlled by organizations that are part of the government. The factories in the public sector enjoy certain privileges such as government funding. However, in Bangladesh, factories in the public sector are not well supervised. There are frequent changes in officers, and many of these officials do not have a personal interest in the factory for which they are responsible. In addition, the equipment in this sector is not well maintained, as much of the money allocated for this purpose is not spent as planned, but is wasted through corruption and poor accounting.

Handloom Sector:

The rural group of textile producers includes operators of handlooms and a number of organizations which employ rural women, such as BRAC, or the Bangladesh Rural Advancement Committee. The Handloom industry provides employment for a large segment of the population of Bangladesh. The industry also supplies a large portion of the fabric required by the local market. Factories in this sector are usually well looked after by the owners and are quite productive, considering the equipment available. However, the inferiority of their machinery, mostly due to their narrow width, means that the fabric production is slow, and usually falls short of the quality needed for export.

Private Sector :

The most productive of the three categories is the private sector. This, as the term suggests, is made up of those factories owned by companies or entrepreneurs. Since the owners of such factories are directly affected by their performance, they take an active part in planning, decision making, and management. Most of these factories also have machinery that is superior to those in the two other sectors because the owners are well aware of the connection between their equipment and their profits.

DEMAND SUPPLY GAP

The phenomenal expansion of the RMG industry in Bangladesh and the dramatic increase in the population in addition to an increased standard of living in the country has led to a large demand-supply gap as shown by the following table. Only 21% of the total demand for yarn is met locally in Bangladesh. The figures for gray are not much better as only 28% of the total demand is met locally. The finishing sub-sector currently is able to process the entire locally produced gray, but will need to expand at as with the weaving and knitting sub-sectors.

All sectors of the textile industry face many of the same challenges. These problems include lack of power, obsolete technology, low capacity utilization, lack of machinery maintenance, a workforce that is not adequately trained, problems with labor unrest and militancy, political unrest causing disruption such as hartals, and a lack of working capital. The problems with electricity were evident to me on my visit to the Rahim Textile Mills; I was told that it is more efficient to power the factory continuously by a generator, instead of letting production be hampered by power failures. In addition, each of the sub-sectors faces various other problems.

The Spinning Sub-Sector:

One of the main causes of this under production in the spinning sub-sector is the fact that approximately 38% of the spinning mills in the country are more than twenty-five years old and therefore are not able to produce as much yarn as their initial capacity. The principal reason behind the machinery being so outdated and poorly maintained is the high import duty on textile machinery and their spare parts. Many have not been maintained or repaired as they should have been because in addition to the high cost of the spare parts, there is a shortage of technicians in this field, resulting in both very expensive and sub-standard repairs. Other reasons for the low production figures include frequent power failures, a shortage of raw materials, a high import duty on raw materials used for local consumption, and a high percentage of wastage.

The labor productivity in the spinning sub-sector is also lower than that in competing countries. The output of labor in the industry is about 0.65 kg per man-hour. A recent World Bank survey indicated that the number of spindles installed in Bangladeshi spinning mills could produce twice as much yarn while using only 10% of the labor force. Obviously, obsolete machinery is having an extremely negative impact on Bangladesh’s textile industry.

The Weaving Sub-Sector:

The weaving sub-sector is plagued by a lack of organization and coordination. There are many small-scale manufacturers dispersed all over the country, which results in replication and a lack of specialization. Instead of working in organized groups, many of the small producers try to do everything on their own, leading to an end product of inferior quality.

The Handloom Sub-Sector :

The handloom industry, traditionally an important part of the textile industry in Bangladesh, is still responsible for a very high percentage of the nation’s economy. It is the second largest source of rural employment after agriculture. Even without being dependent on electricity, there are numerous problems faced by the handloom industry.

Many of the weavers cannot work steadily due to the irregular supply of the yarn, dyes, and chemicals they require. The primary reason for this is that many of these producers are located in places with poor access to transportation. Most of these weavers obtain their raw materials from brokers at their local levels. These brokers gather money from many small scale manufacturers and travel to the urban centers to purchase the required materials, which they then take back to the weavers. Unfortunately, not all of these brokers are very experienced and some are dishonest. Those in the handloom industry are very vulnerable; even a minor problem such as a heavy rainfall might prevent them from obtaining their raw materials or selling their finished product.

Most export oriented garment factories reject a large quantity of the gray produced by the rural handlooms in Bangladesh. When I examined fabrics of similar type and patterns, one of which was produced using handlooms, and the other on power looms, the superiority in uniformity and quality of the cloth produced using the power looms was obvious. In addition, handlooms also have a narrower width than power looms, and usually cannot produce fast enough to meet the deadlines set by export oriented customers.

Knitting/Hosiery:

The hosiery industry produces different types of products such as undergarments, socks, stockings, and other soft apparel. These factories were originally designed for the local market, but recent improvements in quality have propelled them to enter the export market and knitting has become another rapidly growing textile sub-sector. The Knitting and Hosiery sub-sector is faced with the lack of modern facilities needed for producing quality fabric.

There is also a shortage of raw materials in the sub-sector. However, the factor that has the most negative impact on the industry is the lack of working capital. Even though the sub-sector has to overcome some obstacles, it has been extremely successful recently. Currently the demand for knit gray can be met locally. The quality of the local knit gray is also competitive as most of the knitting units have been installed recently and the machinery is not obsolete.

Dyeing, Printing, and Finishing:

Dyeing, printing, and finishing, the final steps in the textile industry, are also the most complicated processes. It is the quality of this work that determines the appearance of the fabric and thus its marketability. In order to be competitive in the future, this sub-sector of the textile industry will need to expand at the same rate as the weaving sub-sector, in order to make the country self-sufficient in gray production.

The dyeing, printing, and finishing sub-sector has improved dramatically over the last five years. However, due to a lack of modern equipment and facilities, the majority of dyeing, printing, and finishing units are still unable to meet the standard of quality demanded by the export-oriented RMG industries, or the export market. Those that are producing fabric suitable for export are heavily dependent on imported gray. As is the case with most imported goods, they face a number of restrictions, such as import taxes, transportation, and various others. However, the successful expansion of the knitting sub-sector has made the country self-sufficient in all knit gray.

THE STRUCTURE OF THE DOWNWARD SUPPLY CHAIN OF RMG

Prior to analyzing the service requirements of RMG from its downward supply chain i.e., from the backward linkage industry, it would be beneficial to look once again at the basic structure of the export-Oriented RMG manufacturing units in Bangladesh which is divided into following two categories:

• Woven RMG units

• Knit RMG units

The knit-RMG could be further sub divided into knitting and knitwear (Sweater/Jumpers and others) manufacturing unit.

Each category requires inputs from following 2 kinds of backward industries. These are:

• Primary Textiles

• Accessory Industries

The accessory industries could be sub-divided into Triming/Accessories and Packaging industries.

Primary textiles include:

Processing Industry

Fabric Forming Industry

Yarn Manufacturing Industry

Processing i.e. dyeing/printing-finishing industry:

Dyeing/printing-finishing processes grey fabrics into dyed/printed-finished textiles for ready consumption in the garments; but there is another type of processing industry in linkage namely yarn processing unit which process grey yarn into dyed for use directly in knitwear manufacturing units and also in weaving and in knitting.

STRUCTURE OF WOVEN PROCESSING INDUSTRY

From value addition point of view, woven processing is most prospective activity of the backward linkage industry. According to MOT&J and recently published reports, there are 300 woven processing units in the country of which 193 units are semi-mechanize having combined capacity of turning some 100 million meter per annum and 107 mechanized processing units capacity of 620 million meter. There are two types of processing unit such as:

WEAVING COMPOSITE:

Integrated/Composite weaving mills:

These weaving mills are associated either with spinning or process mills or with both and generally have complete range of machinery including sizing & warping. The ultimate buying are the garment companies, dealing directly or through buying houses to them. These companies (15-20) do not have well organized marketing departments and sales organizations and the marketing and selling in these units are passive and work as per buyer’s instructions. They are generally members of BTMA and BGFFMEGA.

Independent weaving mills:

These (in excess of 2000) are predominantly small and medium size weaving mills not attached to spinning mills or fabric processing. Majority of these units are members of BSTMPIA followed by BGFFMEA. Most of these units do not have required back process capacity (mostly lack of sizing and partly lack of warping) and dependent on services provider sizing units for sizing of the warp yarn. Majority of them supply fabrics for domestic consumption in the export-oriented RGM units. Processing house carry out the dyeing and finishing for and finishing for these fabrics on jobs-order basis.

Moreover, there are more than 350000 indigenous technology based handloom units scattered throughout the country, which serve mainly the domestic markets. A tiny number of those units in Sirajgonj are supply check fabrics for some RMG units. On the other hand, some handloom and power loom based silk weaving units in Rajshahi area supply fabrics to some tailoring house the product of which non-formally exported with L/C or so called through. Luggage export. Some of these units supply small size order to some RMG units in cash

FINDINGS OF THE STUDY

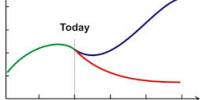

The level of integration of the textile and clothing sectors has varied differently for the knit and the woven sub-sectors. While the knit-fabric sector saw a significant degree of integration in building production capability to meet almost 70% of the requirement of the knit-garment sector, the woven fabric sector lagged far behind. The primary reason for faster integration in the knit sub-sector was due to relatively low investment requirement and simpler manufacturing and process technology that could be adopted easily. For example, a knit fabric manufacturing, dyeing and finishing unit of a minimum economic size could be set up at a cost of about US$ 3.5 million while investment requirement for establishing a woven fabric manufacturing plant of minimum economic size with appropriate dying and finishing facilities would cost at least US$ 35 million.

As mentioned earlier, the Textile Sector in Bangladesh is dominated by the RMG industries. In June 2000 as indicated in Table 2, the sector consists of about 3000 RMG units producing 150 million dozen garments, 141 spinning mills (units) with a production capacity of 335 million kg of yarn, 117 weaving and composite mills with a capacity of 420 million meters of fabric, 282 dyeing, printing and finishing units capable of processing 677 million meters of woven fabric and 155 knitting, dyeing and finishing composite units capable of producing 225 million kg of knit fabric. Investment in the sector is gaining momentum. As many as ten spinning units and a number of composite knit fabric mills have been added to the sector in the year 2001 alone.

FACTORS CONTRIBUTING TO GROWTH OF RMG INDUSTRY

Multi Fiber Arrangement (MFA), 1973

This factor really pushed the RMG sector upwards in Bangladesh. After enactment of this agreement it was very easy for Bangladesh to collect the necessary things to produce finished goods. However, this arrangement is going to be phased out from 01 January 2005.

To Protect Textile Industry of LDCs.

Major exporters of Textile & Clothing investment in Bangladesh.

Trade Policy LIBERALIZATION Macro-economic

Liberalization.

Benefit from Quota Allocation to small and new entrants.

This is another very important factor, which helped Bangladeshi Garments Sector a lot.

Initiative of local entrepreneurs.

In Bangladesh the local entrepreneurs are challenging and they used to take challenges and that is why they have succeeded in the past.

Cheap and abundant supply of labor.

This is another really very vital advantage of Bangladesh. Bangladesh has the comparative advantage on the cheap and skilled labor.

Conducive package of facilities and incentives of government.

WEAKNESSES OF THE SECTOR

There are several weaknesses of the RMG sector in Bangladesh. These are listed below:

Over dependence on imported raw materials

In Bangladesh the present capacity of meeting the demand of raw materials locally is only limited to 20%. Previously it was even less. Recently Bangladesh Government has taken some strategies to give subsidies to the back ward linkage industries. As a result the huge number of garments manufacturer needs to depend on the imported raw materials for production.

Lack of development of Backward Linkage Industries

In Bangladesh there are only few textiles mills. Those, which are producing, even not close to satisfy the demand. However, this is the pick time to concentrate on establishing more Textiles, Interlinings and other accessories manufacturing concerns.

Inadequate infrastructure and supported services

A country like Bangladesh always suffers from appropriate infrastructure facility and the supported service. Bangladesh is a developing country. As a result Bangladesh has lack of resources. Therefore even if the Government wants some times it becomes impossible for them to ensure the infrastructure.

Inadequate institutional & legal reforms in the light of WTO

According to World Trade Organization the legal procedure is not up to date. They think that Bangladesh needs lots of Amendment in the institutional and legal reforms of WTO.

Besides these there are other weaknesses in RMG sectors. These are listed below.

Lack of capacity building

Weak and inadequate government apparatus

Lack of knowledge of

Manufacturers/exporters of RMG

THREATS OF RMG SECTOR

The 2005 Challenge

In the year 2005, some of the international policies regarding the export of textiles and garments will change, which may present the Bangladeshi textile industry the greatest challenges it has had to face so far. There is much speculation at present about the situation of the RMG exporters in the post-MFA period, when the World Trade Organization, or WTO, instead of GATT will control the sector. Under the WTO all quotas will be removed, resulting in a free market worldwide.

Bangladesh’s garment and textile manufacturers will have to face steep competition from countries such as India, Pakistan, China, and Thailand, from whom the country now imports fabric to meet the demands of its RMG sector. When the WTO free market is established, all these countries will be able to expand their RMG exports, now limited by quotas.

Enactment of US Trade Development Act 2000

The Trade and Development Act 2000 more popularly known as US Trade Development Act 2000 was enacted in the USA on May 19, 2000. This act consisting of the African Growth and Opportunity Act (AGOA) and the United States-Caribbean Basin Trade Partnership Act was aimed to introduce a new trade and investment policy for Sub-Saharan Africa (SSA), expand trade benefits to countries in the Caribbean Basin Initiative (CBI), enhance the GSP and strengthen the US Trade adjustment assistance programs. The US TDA 2000 provides preferential trade access, especially in textile and apparel sectors, to the countries of Africa and Caribbean Basin.

The US Trade Development Act 2000 provides duty-free and quota-free access to 48 countries of Africa and 24 countries of the Caribbean Basin for exporting textile and apparel products to the US market on certain eligibility criteria. It may be noted here that some of the beneficiary countries, especially in the Caribbean Basin, are Bangladesh’s direct competitors in the US apparel market.

The majority of countries benefiting from the US Trade Development Act belong to the group of Least Developed Countries (LDC). This enactment has thus created a division within the LDCs as the LDCs outside this scheme have lost their strength for bargaining duty free and quota free access, being now a small minority. It may be mentioned here that for quite some time now, Bangladesh has been actively campaigning in various multilateral forums, including the WTO, for providing favourable treatments to all the LDCs. Between the two groups of countries covered under the US Trade Development Act 2000, it is the Caribbean countries that are more important as a source of apparel import into USA.

RECOMMENDATIONS

For long the BGMEA had been pressing the government to set up a central bonded warehouse so that the exporters could meet the demands of the international buyers who had reduced the shipment of goods from 120 to 30-35 days. This issue and related matters have become even more urgent as the end of preferential market access poses a threat to the garments industry. BGMEA leaders are concerned about the nearly two million women workers who would be worse affected by the garments industry in ruins.

To protect the industry, BGMEA wants the government to take a number of important measures in this regard. These include: setting up a central bonded warehouse; establishing linkage industries with priority on dyeing, printing and finishing factories; providing loans with low interest rate to set up backward linkage industries; and doing everything to achieve global cumulating to boost export. There is also the suggestion to extend tax holiday for RMG exports to the year 2008 and withdraw some restrictions on the tax waiver.

Though exporters fear that Bangladesh would lose the market because of sharper global competition, ‘the full effect of the MFA phase-out can’t be predicted with certainty’, as an official of the commerce ministry pointed out. Since ‘the RMG sector needs to develop strategies to deal with the changing market place after 2004’, the ministry has undertaken a one-year study project to assess the global market Bangladeshi garments products in the post MFA period.

Most of the least developed countries have duty and quota free access to the US market; Vietnam, Laos and Cambodia are negotiating with the US government to get the status. Recently, US Congress tabled a bill offering duty and quota free access to 18 Muslim countries including Bangladesh. Therefore, the BGMEA has called upon the government to make necessary diplomatic efforts to earn duty and quota free status to the US and the non-EU countries in Europe.

Once quota is phased out from 2005 competition will be stiff; only the most efficient companies and countries will be able to continue supply to the EU and US markets after 2004. As it is, international buyers want quick and efficient delivery.

If Bangladesh fails to develop backward linkage industries to face the challenge, thousands of garment workers, mostly women (they constitute 80% of the work force in the sector), will face the pinch of post-MFA regime. The government and the industry need to join forces to pursue the preferential market access issue with the US government. Some countries are striving to get access, and Bangladesh government has strong reasons to pursue the case ‘quickly and aggressively’.

To aid the expansion of the textile industry in Bangladesh, the government is currently providing numerous incentives.

Bonded warehouse facilities

These facilities allow export-oriented factories to import their raw materials duty free. However, the bonded warehouses privileges have not been monitored closely enough, which has resulted in them being abused. The materials imported duty free to be used for producing garments intended for export are sometimes released into the local market. The leakage of these inexpensive items into the local market cause unfair competition for local producers.

Duty Exemption Drawback Organization, or DEDO

Factories which do not take advantage of the bonded warehouse facilities and import their raw materials independently can claim the duty they paid under the Duty Exemption Drawback Organization, or DEDO. Provided that the finished goods are being exported. This system is mostly applicable for the dyeing sub-sector of the textile industry.

CONCLUDING REMARKS

Though there is no concrete data available on investment made in the textile sector in the last couple of decades, the above dissertation of circumstantial parameters amply suggests that investment has taken place in the sector and the growth was noteworthy. A number of factors like the existence of a large RMG export base creating a large demand for the textile, the incentive package especially the cash subsidy given by the government, and the cry of the RMG sector for local raw materials in order to be able to respond quickly to the need of the ultimate garment buyers, appeared to have boosted this growth. There is awareness amongst the entrepreneurs to create and for those who are already in the textile sector, to enhance their capacity to service this growing demand. In addition to the capacities discussed above, many new mills and capacity expansion of the existing mills are in the pipeline in spinning, weaving, knitting and dyeing and finishing sectors.

The emergence of new labor and environmental standards and the RMG sector’s spontaneous response to implement them suggest that the RMG sector is gearing them up to cope with the emerging requirements as demanded by their customers. Under pressure of competition, they are also upgrading their technology of production, learning to cut costs and improve productivity and invest in backward and forward linkages to sharpen their competitive ability. Though the growth is declining, new investments are taking place in RMG as a means to harness economics of productivity and production. In the process, some smaller units that are unable to cope with the changing requirement of the market may perish.

Thus, the assured market for backward linkage industries is likely to remain robust in the years to come. However, proliferation of these industries will depend upon continuation of the government policy framework to support such development, an appropriate and enabling investment environment and availability of adequate financing for these projects at internationally competitive rates of interest and other service charges.

Questionnaire Survey:

1. R. M. Interlinings Ltd is the largest Interlinings manufacturer ?……………………Y/N

2. Do you know the name of all types of Interlinings of RMIL ?……………………….Y/N

3. Do you know the construction of Interlinings?…………………………………………..Y/N

4. Is the interlinings price is high ?……………………………………………………………. Y/N

5. Are you satisfied about the delivery of RMIL ?………………………………………… Y/N

6. Is our Backward linkage industry is strong ?……………………………………………. Y/N

7. Do you agree to work with RMIL ?…………………………………………………………..Y/N

8. Government assistance is essential for this sector ?………………………………….Y/N

9. Are you satisfied about government past assistance?………………………………..Y/N

10. Is government alert about this sector?……………………………………………………. Y/N

11. Are you satisfied about the current growth of backward linkage industry?…. Y/N

12. Do you know the future interlinings of RMIL?……………………………………………Y/N

13. Is it the highest foreign currency achiever sector of our country ?………………..Y/N

14. Entrepreneur of Garments should help to establish

Backward linkage industry?…………………………………………………………………..Y/N

15. Do you think RMG sector will grow very smoothly in future?………………………Y/N

16. Do you know how many currency are achieved in last year ?……………………..Y/N

17. Do you agree to give support to Backward linkage industry ?……………………. Y/N

18. Are you interested to establish a vertical integration in your company ?……… Y/N

19. Do you think RMIL will be the Leader of interlinings arena ?……………………….Y/N

20. Think economy, Think RMG sector………………..Agree?…………………………..Y/N