Evaluation of Loan Product Marketing and Risk Management Process of BRAC Bank

BRAC Bank Limited is a scheduled commercial bank in Bangladesh. It was established in Bangladesh under the Banking Companies Act, 1991 and incorporated as a private limited company on 20th May 1999 under the Companies Act, 1994. BRAC Bank Ltd is a bank of new generation as its one step ahead from other banks not only in making profit but also to serve people in an effective way to meet customer needs and demand. The bank was launched some attractive products and services that show their deed orientation toward marketing philosophy. BRAC Bank, for the first time among local commercial banks, starts providing loan facilities to small and medium trading, manufacturing and service oriented enterprises all over the country.

Banking system of Bangladesh has undergone major changes over the last few decades. The country moved towards a relatively market-based open economy away from state control by adopting a major stabilization, liberalization and deregulation program under the influence of the World Bank and the IMF against the backdrop of serious macroeconomic imbalances in the early 1980s. After 90’s the banking sector was opened to greater competition by the entry of new private banks and more liberal entry of foreign banks in line with the recommendations of this program. With increased adoption of the internet as a delivery channel contributes to a gradual reduction in overhead expenses of the banks by providing a high level of quality services through ATM, POS (Point of Sale), Online/Internet-banking. These factors have changed the market structure of Bangladesh banking industry significantly. As a result, in recent years, the state-owned public banks have lost market share to the private commercial banks. BRAC Bank is one of such emerging private bank emerged in the industry 2001.

Overview of BRAC Bank Ltd

BRAC Bank Limited, with institutional shareholdings by BRAC, International Finance Corporation (IFC) and Shorecap International had been the fastest growing Bank in 2004 and 2005. The Bank operates under a “double bottom line” agenda where profit and social responsibility go hand in hand as it strives towards a poverty-free, enlightened Bangladesh. BRAC Bank Limited is a scheduled commercial bank in Bangladesh. It was established in Bangladesh under the Banking Companies Act, 1991 and incorporated as a private limited company on 20th May 1999 under the Companies Act, 1994. The primary objective of the Bank is to provide all kinds of banking business. At the very beginning the Bank faced some legal obligations because the High Court of Bangladesh suspended activity of the Bank and it could fail to start its operations till 3rd June 2001.Eventually, the judgment of the High Court was set aside and dismissed by the Appellate division of the Supreme.

A fully operational Commercial Bank, BRAC Bank focuses on pursuing unexplored market niches in the Small and Medium Enterprise Business, which yet has remained largely untapped within the country. In the last five years of operation, the Bank has disbursed over BDT 1500 crore in loans to nearly 50,000 small and medium entrepreneurs. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh.

The Bank has started its operations from July 04, 2001. The Chairman of the Bank is Mr. Fazle Hasan Abed. Now the Managing Director of the bank is Mr. Syed Mahbubur Rahman. The bank has made a reasonable progress due to its visionary management people and its appropriate policy and implementation. BRAC Bank is a commercial scheduled bank extending full range of banking facilities as per the directives of Bangladesh bank. It intends to set standards as the absolute market leader by providing efficient, friendly and modern, fully automated on‐ line service on a profitable basis. BRAC Bank in surviving in the large banking arena through its unique and competitive products and it is the first local bank that started providing 100% integrated online banking facility.

The bank has made a reasonable progress due to its visionary management people and its appropriate policy and implementation. A fully operational commercial bank, BRAC Bank focuses on pursuing unexplored market niches in the Small and Medium Enterprise Business, which till now has remained largely untapped within the country. In its last several years of operation, the Bank has disbursed over BDT 9750 cores in loans to nearly 300,000 small and medium entrepreneurs. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh.

The Bank is mainly owned by the largest NGO in Bangladesh‐ BRAC .The Bank has positioned itself as a new generation Bank with a focus to meet diverse financial need of a growing and developing economy. With local and international shareholding by BRAC, International Finance Corporation and Shore cap International, BRAC Bank is listed in both the Dhaka and Chittagong Stock Exchanges.

Ironically, more than ¾th of the economy is out of the reach of formal banking. BRAC Bank took a step to break this tradition of banking and tapped into the true suburb entrepreneurial initiatives. More than half of BRAC Bank’s lending is for this small and medium enterprises – popularly known as ‘SME’. These businesses are the dreams and achievements of individual Bangladeshis.

Product Offerings:

The making of loan and advance is always profitable to a bank. As the bank mobilizes savings from the general people in the form of deposit, the most important task of it is to disburse the said deposit as loan or advance to the mass people for the development of commercial, industrial who are in need of fund for investment. Like other business firm, the main purpose of the commercial bank is to make profit. The profitability of the banks depends on the efficient manner and avenues in which the resources are employed. BRAC bank has made so far efficient use of the deposit and has the classified rates under control. The Bank disburses loan in different form. It varies in purpose wise, mode wise and sector wide.

The varieties used by BRAC Bank Ltd are briefly described below with the common terms and condition and performance in each mode.

Classification of Advance:

- Corporate Credit Scheme

- Retail Credit Scheme

- SME Credit Scheme

Corporate Credit Scheme:

The bank is entrusted with the responsibility of providing short, medium and long term loans and other financial assistance for promotion of industrial sectors. There are 10 types of corporate credit schemes:

Corporate loan products:

- Overdraft

- Short Term loan

- Lease Finance

- Loan against trust Receipt (LATR)

- Work order finance

- Emerging Business

- Syndication

- Term Loan

- Project Finance

- Bank Guarantees

Retail Credit Schemes:

The bank also provides retail loan to individual customers. There are different types of retail loan which helps customer to fulfill their dream. There are 5 types of loan in retail credit scheme:

- Home Loan

- Personal Loan (Salaried Individuals and Businessman)

- Personal loan for Doctors

- Nijer Bari

- Auto loan

- Life Style plus

- Cash secured

- Study Loan

- Motorcycle Loan

SME Credit Schemes:

BRAC Bank being the youngest bank among third generation banks of that time took a step to break away from usual tradition and tapped into the true sub-urban entrepreneurial initiatives. With over 220,139 million of loans disbursed till now, BRAC Bank is country’s largest SME financier that has made more than 411,000 dreams come true. There are 6 types of SME Loan Scheme:

- Anonno Rin

- Apurbo Rin

- Prothoma Rin

- Durjoy

- Shomriddhi Rin

- Shompod Rin

- Shokti Rin

Business Divisions of BRAC Bank Limited

BRAC Bank Limited consists of five major business divisions: They are

- Retail Banking Division

- Corporate Banking Division

- Small and Medium Enterprise (SME)

- Treasury

- Remittance Services

Retail Banking Division

Retail Division offers a wide array of lucrative and competitive banking products to the individual customers of the bank. It offers different types of term deposit scheme and attractive STD and Savings deposit schemes giving interest on daily balance. Retail Banking Division has the following departments:

- Branch Banking

- Alternative Delivery Channels (ATM, Apon Somoy, Cash deposit machine (CDM), Phone banking, e-statement)

- Cards Department

- Retail Risk

- Products and Marketing

- Value Centers

Currently BRAC Bank has re-organized its retail business according to customer profile. This segmentation has been done to deliver more standardized services and reduce operating costs as well. The segments are as follows-

- Premium Banking

- Supreme Banking

- Excel Banking

- Easy Banking

Segments of Retail Banking

Premium Banking

Guest who maintains at least BDT 50 lacs (6 month average) is called premium customers. They are highly prioritized. They also enjoy different gift and discount through BRAC Bank. Currently BRAC Bank has around 1000 premium customers.

Supreme Banking

Guests who maintain a balance between BDT 10 lacs to below 50 lacs (6month average) are treated as supreme clients. They enjoy separate service booth and cash deposit booth in the branch along with many other services.

Excel Banking

Client who maintains a balance between BDT 50 thousand to below 10 lacs in an average of 6 months are called excel group of guest.

Easy Banking

These are the general customers who do day to day and traditional banking with the bank. They only require a minimum balance in the account (up to BDT 50 thousand). Products and Services of Retail Banking

Retail Loans are consumer’s loan. Based on the customer demand these loans are given. BRAC

Bank has a wide range of retail loan

- Car loan

- Doctor’s loan

- Secured Loan/OD

- High flyer loan

- Top up loan

- Credit card loan

- Study loan

- Salary loan

BRAC Bank’s Retail Division is being operated centrally. Under the Retail Banking Division all the branches, which acts as sales and service center, are reportable to Head of Retail Banking. Different products of Retail Banking are as follows:

- Deposit Products

- Loan Products

- Cards

- Locker Services

- Foreign exchange and related Service

The product and services that are currently available are given below-

Depository Products

BBL is now offering 6 depository products for mobilizing the savings of the general people:

Savings A/C

- Triple Benefits Savings Account

- Savings Classic Account

- Aporajita Account

- Future Star Account

Current A/C

- Current Classic Account

- Current Plus

- EZee Account

- Salary Account

- Campus Account

- Prapti Account

- STD A/C

- Fixed Deposit A/C

- DPS A/C

Loan Products

BRAC Bank is offering the following loan and advance product to the client for financing different purpose that fulfill the requirements of the bank and have good return to the investment as well as satisfy the client. The loan and advance products are:

- Secured Overdraft

- Secured loan

- Life Style loan

- Professional loan

- Credit card loan

Cards

With over 150 outlets, over 300 ATMs and over 500,000 plastics in the market, BRAC Bank offers a wide range of financial solutions to meet people’s everyday need.

Credit Card

- Platinum Card

- Universal Card

- Universal Visa/MasterCard Classic

- Universal Visa/MasterCard Gold

- Co-branded Universal ICDDRB Card

Debit card

- Visa/MasterCard Planet Card

- BRAC Bank RFCD Debit Card

Prepaid Card

- Hajj Card

- Travel Card

P@y Flex Programs

- Regular P@y Flex

- Interest free P@y Flex

Locker Service

- Locker Services are available in over 20 branches.

- Foreign exchange and related Service

- Travel Related Services deals with the sale of Cash FCY against Individual’s Travel Quota and

- Medical File. This entitlement is for a Calendar Year i.e. from 1st January to 31st December.

- Corporate Banking Division

- Corporate Division provides full range of commercial banking products and services to any potential corporate clients including multinationals, large or medium local corporate, NGOs, institutional bodies.

The Corporate Banking Division has a centralized structure through on-line banking system. Any credit facility is processed at the Corporate Banking Division, Head office. After sanctioning of the facility, the limit is put on line and the customer can enjoy the facility from any of the BRAC Bank branches. Strict adherence to internal control guidelines and other legal and statutory compliance are followed. The Credit approval process involves separate Credit Division, the Managing Director and finally the Board.

Other departments like Foreign Trade, Treasury, and Credit Administration etc. play the support role for a comprehensive range of service to the Corporate Banking Division. The facilities of corporate Division lies into two categories-

Corporate Loan Products

- Overdraft

- Short Term Loan

- Lease Finance

- Loan against Trust Receipt (LATR)

- Work Order Finance

- Emerging Business

- Syndication

- Term Loan

- Project Finance

- Bill Purchase

- Bank Guarantees

Trade Finance

Trade Finance are those type of facilities where customers don’t get fund on their hand rather get Banks Guarantee service to do international trading-import and export. Letters of Credit, Bank guarantees etc. are the examples of the non-funded facilities.

Treasury Division

Treasury Division is one of the major divisions of BRAC Bank. Treasury Division deals with money market. All treasury related products are processed in conformity with the Bank’s Operational, Trading, Money market, Overnight, Term placing, Deal settlement, Commercial position keeping, Treasury, Credit, Finance and other applicable policies.

Treasury Operations calculates investment figure, prepares the auction application, forwards the application to Bangladesh Bank for Bid and Treasury Operations maintains and reconciles all accounts with foreign and local banks. BRAC Bank has a strong presence in the Treasury Market in Bangladesh. The Money Market Desk of the Treasury Division mainly deals in Bangladeshi Taka transactions. The basic activities undertaken by the Money Market Desk are:

- Management of Statutory Reserves viz. Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR).

- Daily Funds and Liquidity Management

- Investment Management

- Treasury Services

- Call/Overnight Lending and Borrowing

- Term Money Borrowing and Lending

- Repurchase Agreement

- Treasury Bills (T-Bills)

Secured Remittance Services (SRS)

BRAC bank has introduced an innovative remittance services for Bangladeshis living abroad with some unique features compared to any of the existing remittance program. Bangladeshi expatriates can now send their money to their relatives anywhere in Bangladesh even to the remotest part within 24 hours at a reasonable cost and competitive exchange rate.

Accounts and Deposits

- Probashi Current Account

- Probashi Savings Account

- Probashi Fixed Deposit

- Probashi Abiram

- Probashi DPS

Investments

- Probashi Wage Earners’ Bond

- US Dollar Premium and Investment Bond

- Probashi Biniyog

Objectives of the study

With the growing demand of loan products, credit risk rating/management is becoming an increasingly important element for the commercial banks’ measurement and management of credit risk.

The report is based on my critical observation on the loan products of BRAC Bank Ltd. The report reveals the various types of loan scheme and the criterion to get the loan and the risk grading system. This report will not only help the management of the bank, but also the stakeholders as a whole.

This report also attempts to investigate the extent to which the credit rating systems are used in context of BRAC Bank Ltd based on my working experience over the years. Several risks relevant to this are:

- Credit Risk

- Process Risk

- IT System Risk

- Foreign Exchange Risk

- Credit Sensitivity

- Compliance Risk

- Internal and External Fraud Risk

- Documentation Risk

- Operational Risk

Lending is one of the main functions for any commercial Bank. In formulating a credit judgment, the credit officers of BRAC Bank must be equipped with all information needed to evaluate a borrower.

In all kinds of business dealings, officers and employees must be guided by the principles of honesty, integrity and safeguard the interest of the depositors and shareholders of the Bank. They should strictly adhere to the Banking Laws, Rules and Regulations of the Govt. of Bangladesh, the instructions issued by the Bangladesh Bank or Head Office from time to time that affects the business practices of the Bank.

The scope of the study will be as follows:

- Making a clear overview of the financial performance measurement criteria

- Overview of bank’s financial performance in aspect of BARC Bank Ltd

- Find out overall situation of BRAC Bank Ltd in the aspect of financial performance

- Earnings and profitability of the bank by the financial activity

Credit risk

Credit risk means, the risk of loss of principal or loss of a financial reward stemming from a borrower’s failure to repay a loan or otherwise meet a contractual obligation. Credit risk arises whenever a borrower is expecting to use future cash flows to pay a current debt. Investors are compensated for assuming credit risk by way of interest payments from the borrower or issuer of a debt obligation. Jarrow, Lando and Turnbull (1997) study the term structure of credit risk spreads in a model with the bankruptcy process following a discrete state space Marko chain in credit rating. Crouhy , Galai and mark(2000) make a comparison of Credit Risk to the other models, they state that credit risk is easy to apply as it drive a closed form solution for the loss distribution of a credit portfolio. There is no market risk in credit risk because both market risk and credit migration are ignored in this model, each borrowers exposure is the same changes in its credit quality do not affect its exposure.

Credit monitoring

Credit monitoring plays crucial role in achieving financial goals. With a healthy score and responsible past credit behavior, you’ll make it more likely for lenders to offer you lower interest rates on mortgages, auto loans, other loans and credit cards – even your property and insurance rates can benefit. Christopher J. Cowton, Peter C. Ho, (1985) “Credit Control The success of a credit system, in terms of both effectiveness and cost, is largely determined by policy established within the company. Too conservative a policy will entail high opportunity cost through loss of business, but too liberal a policy results in the cost of tying up funds in debtors and the increased possibility of bad debts. A survey investigating building merchants’ practices in Wales (1984), conducted by questionnaire, reflects some variety in approaching the provision of trade credit, but a relatively high degree of uniformity and lack of sophistication in monitoring systems. Stigitz and Weiss(1988) are the example of papers advancing the idea that banks are institutions “specializing suggest that monitoring the behavior of customers over time including repayment of loans and other transactions, provides banks with an information advantage they can use to successfully perform the function of resource allocation in an economy.

Reliability

Risk has become a key concept in modern society. Growing concern about the environment and a number of disasters has served to focus attention on the hazards and risks involved in a wide range of activities. There is a wide range of techniques available to assess risk and reliability, both in relation to safety and in the wider sense. These techniques now underpin new legislation on safety and have relevance over a broad spectrum of activities, including environmental and other systems, where risk and reliability are key concerns. Chee Tong (2001) Structural risk and reliability analysis has been identified as the potential tool for satisfying these requirements. It is capable of identifying the sources of variables affecting the fatigue life and fatigue strength of the structure in terms of risk.

Assurance

Douglas L. King and Rocie C. Wellman (1995) A system and method of accepting risk though contractual obligations transfer a portion of the risk to investors and includes means for absolute assurance of timely payment to contract holders, and segregation, of interests of particular investors to specifically identified risk in a risk to capital matching system, the system creates agreements which promise payments, Based on loss from risk including investment risk. Data processing provides legally segregated relationship management links, supervising and balancing the interests of professionals in a Risk transfer and diversification system.

Main Concentration

Retail Loan Products

Home Loan and Home Credit:

Home loan is a term loan facility for middle class and upper class people and greater Dhaka, Chittagong, Sylhet, Comilla, Khulna, Narayangonj City, Saver, Gazipur, Tongi, Bogra Municipal area.

It is given to purchase of under-construction/completed flats/Apartments or to construct/extend/renovate of house or flats. Under this scheme, Bank secures the facility through mortgaging the property or through any other form of security accepted by the prevailing law of the country.

Customer segment:

- Salaried: All salaried individuals (Type A and B) and BBL payroll companies

- Self Employed and BBL payroll companies

- Self Employed Professional /Businessman: Self Employed professionals i.e. Doctor, Architect Engineer, Chartered accountant etc who are engaged in independent profession. Businessmen means owner/partner/director/shareholder of proprietorship/partnership/private limited company.

- Land lord: landlords having a stable source of earnings from rented properties.

- 100% cash covered: this segment consists of wage earners/ Non-resident Bangladeshis (NRB) maintaining resident a/c with us or any other banks, any person wants to avail Home loan against cash security.

- Age Limit: Min 25 to maximum 65 years.

Minimum Income:

Salaried: BDT 20000

Self Employed/ Businessman: BDT 30,000

Landlord: BDT 25,000

Job/Business Experience:

3 years works experience for service holder and businessman. There should be one main applicant and another joint applicant. Owner of the property should be main applicant. Loan amount: Minimum 10 lac to 1.2 crore

Home Credit:

Maximum 70% of property value or BDT 1,00,00,000 whichever is lower.

Personal Loan:

Personal loan is an unsecured term loan facility to individual Salaried/Businessman/Self-employed person for catering their personal or professional needs.

- Minimum age: 23 years at the time of application

- Maximum age: Retirement age or 60 years at the time of loan maturity, whichever is earlier.

- Work Experience: Confirmed employment with minimum 6 months in current organization but total length of service of 2 years (continued services).

- Size of the Company: Minimum 5 years in operation and minimum 10 permanent staff employed at any time.

- Minimum Income: BDT 17,000 for salaried person and BDT 25,000 for Business person.

- Loan Size: Minimum BDT 1,00,000 to maximum BDT 10,00,000

Personal Loan for Doctors:

Personal loan for doctors is a term loan facility under “Loan for Professionals” category designed to fulfill the personal requirements of the individual doctors living in the cities/ towns where the Bank has its operations.

Customer segments

Type A

Assistant professor/Associate professor or equivalent designation having post graduate degree working in any Type A hospitals.

Type B

Doctors of Type A hospitals not meeting above the qualifying criteria and doctors of type B hospitals.

Type C

All other doctors having minimum MBBS degree will be fall under this category (i.e., salaried doctors, self-employed).

- Loan Tenure: 12 months to 5 years

- Personal Loan for land lord:

- Minimum Age: 35 years at the time of loan underwriting

- Minimum Age: 65 years at the time of loan maturity

- Minimum Rental income: BDT 50,000 monthly

Rental Reflection in Account Statement:

- At least amount equivalent to EMI should be credited to bank account for Last 6 months as rental reflection if rental income is below 1 lac.

- If the rental income is more than 1 lac then at least 30% of rental income should be reflected in the account statement

- In any case, latest 1 year continuous bank statement should be available.

Loan Tenure:

- Maximum 36 months

- Minimum 18 months

Auto Loan:

Auto loan is a term loan facility for the middle class to upper class people of the cities, where the bank has its operations, to buy automobiles for their personal use. Under this scheme, the vehicle is hypothecated to the bank only. In addition to this registration requirement, the loan may also partially secured by the commonly acceptable form available in the market as hypothecation.

Loan size:

- Minimum: 2 lac

- Maximum: 40 lac (including insurance)

- Tenure: 12 to 60 months

- Monthly Income: 25,000 for salaried and 35,000 for businessman

Type of Vehicle:

Category – 1:

New and reconditioned automobiles: all sedan cars, SUV, Jeep and up to 9 seater micro bus for personal use.

Category – 2:

New automobiles and reconditioned automobiles: all pick up, up to 11 seater and low grade microbus for personal use.

Approved Brands:

Brand new vehicle: any brands

Reconditioned vehicle:

- Toyota (Including lexus), Honda, Nissan, Mitsubishi, Mazda, Hyundai and KIA

- Minimum Margin: 50% down payment required prior to loan disbursement.

Executive Study Loan:

Features:

- Target Segment : Only Salaried Individuals (Type A and B Companies) and Contractual employees of only Type A

- Target Areas: Customer must reside in the city/town where listed educational institutions are located. However, in addition customer’s residence must be situated within 10 KM of any BBL Branch/SME Service Center

- Loan Amount: BDT 25,000 to BDT 5 Lac

- Loan Tenure: 12 months to 36 months

Minimum Monthly Net Income:

BDT 15,000 for Type A and BDT 17,000 for Type B

- Minimum Age: 28 years

- Maximum Age: 50 years the time of loan maturity

- Interest Rate: 13% (Corporate Clients and Type A); 14% (Type B)

- Processing Fee: 0.25% of the loan amount

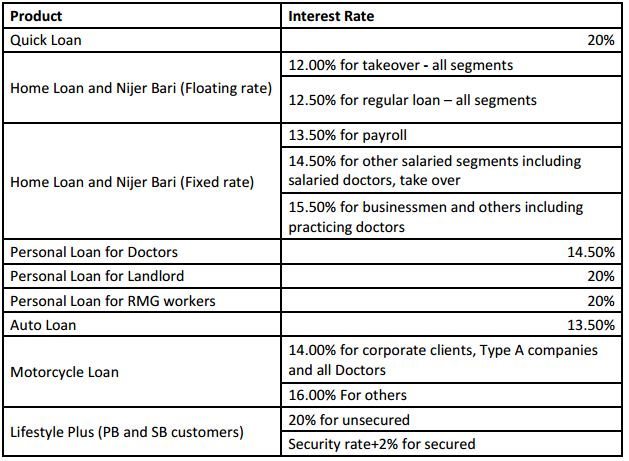

Interest Rates of Loan Products:

Credit Card:

BRAC bank credit card is a universal credit card. So it is accessible through all VISA/Master card linked ATMs and POS around the globe. It is tie up with renowned shops and outlets for Payflex. Having facilities of reward point, card cheque, Discount at lifestyle/Hotel/ Restaurant etc.

Types of Credit card:

- Classic card (VISA/Master) : Credit limit BDT 10,000 to BDT 75,000

- Gold card (VISA/Master) : Credit limit BDT 80,000 to BDT 5 Lac

- Platinum Card (VISA/Master) : Credit limit BDT 2,50,000 to BDT 5 Lac

Benefits of Platinum Credit card:

- Priority passes for world’s largest independent airport lounge access program over 600 airport lounge.

- Buy one get one free buffet at the Westin Dhaka and the Peninsula Chittagong

- Enjoy round-the-clock access to the VISA platinum Customer Center.

- Discount in many local and global retail stores, hotels, hospitals etc.

- Free access for 2 (including card holder) at BALAKA VIP LOUNGE in Hazrat Shahjalal International Airport

- Free priority Welcome Service in Hazrat Shahjalal International Airport

- 100%/50% annual fee reversal with 8000/ 4000 reward points.

Income: BDT 25,000

Minimum Age: 21 Years for primary card and 18 years for supplementary card

Maximum age: 62 years for any cards

Overall Credit Management Process of BRAC Bank Ltd:

- Wholesale Credit receives Credit Proposal with documents from Corporate Banking and SME Medium Business

- Wholesale Credit Analysts checks the Proposals for consistency and completeness

- If any discrepancy is found, Wholesale Credit informs the respective RM about the discrepancy through lotus mail.

- RM rectifies the discrepancies and sends the docs/rectified proposals to CRM.

Credit Control Point:

Wholesale Credit receives the following to ensure credit control:

- Credit Proposal

- CRG Sheet

- FSS

- Search Report

- CIB Report

Then, it checks the following things:

- Emerging Unit Credit Proposals are checked by Credit Analyst (Emerging)

- Large Unit Credit Proposals are checked by Credit Analyst (Large)

- Credit may ask for documents related to additional analysis (if and when needed)

- If everything is found ok, Credit Analysts make recommendations (approve/ decline) of the Credit proposals depicting loan amount, tenor, Interest Rate and additional terms and condition (if any) and forward the Proposals to the Head of Credit Wholesale Banking and Medium Business.

- Head of Credit Wholesale Banking and Medium Business approves/ decline/ recommends to Chief Credit Officer if not within the approval authority.

- Chief Credit Officer approves/declines/ recommends to the Managing Director and CEO if not within the approval authority.

Individual Credit Proposals other than Board’s approval authority are placed at Credit Committee Meeting on a case to case basis for decision of Managing Director/CEO:

- Managing Director/CEO approves/declines/ recommends to the Board if not within the approval authority

- Board approves/ declines the Credit Proposal at the monthly Board Meeting Individual Credit Proposals other than Board’s approval authority are placed at Credit Committee Meeting on a case to case basis for decision:

- The loans get approved as per Delegated Approval Authority subject to creditworthiness

- Wholesale Credit sends back the declined Credit Proposal to Corporate Banking Division/ SME Medium Business

- Wholesale Credit forward the approved Credit Proposals to the respective RM of Corporate Banking or SME Medium Business

- RM prepares Sanction Advice as per approval term and conditions and mails to Wholesale Credit for validation

- Wholesale Credit validates the sanction (Following the maker checker concept) and mails back to RM for print out and sign off.

Collecting CIB Report from Bangladesh Bank

After receiving the application for credit line, Bank sends a letter to Bangladesh Bank for obtaining a report from there. This report is called CIB (Credit Information Bureau) report. Basically branch seeks this report from the head office for all kinds of loans. The purpose of this report is to being informed that whether the borrower the borrower has taken loan from any other bank; if ‘yes’, then whether the party has any overdue amount or not.

Making Credit proposal (CP)

Branch then has to find the right borrower by considering the following 6 C’s. These are character, capital, capacity, cash, collateral, condition (economic). If the branch thinks that the project is feasible then he will prepare a Proposal. Bank prepares the proposal in a specific from called credit proposal. Significance the proposal branch sends it to head office for approval.

Credit assessment

A thorough credit and risk assessment needs be conducted prior to the granting of loans, and at least annually thereafter for all facilities. The results of this assessment should be presented in a credit application that originates from the Relationship Manager, and is recommended by Branch Credit Committee (BCC). The RM should be the owner of the customer relationship, and must be held responsible to ensure the accuracy of the entire credit application submitted for approval. RMs must be familiar with the bank’s Lending Guidelines and should conduct due diligence on new borrowers, principals and guarantors.

Credit Applications should summarize the results of the RMs risk assessment and include as a minimum, the following details:

- Amount and type of loan(s) proposed

- Purpose of loans

- Loan structure (Tenor, Covenants, Repayment Schedule, Interest)

- Security arrangements

In addition, the following risk areas are analyzed:

- Borrower analysis

- Industry analysis

- Supplier/ Buyer analysis

- Historical financial analysis

Risk Grading

Bank should adopt a credit risk grading system. The system should define the risk profile of borrower’s to ensure that account management, structure and pricing are commensurate with the risk involved. Risk grading is a key measurement of a Bank’s asset quality, and as such, it is essential that grading is a robust process. All facilities should be assigned a risk grade. Where immediately changed. Borrower Risk Grades should be clearly stated on Credit Applications.

Project Appraisal

It is the pre‐investment analysis done by the officer before approval of the project.

Project appraisal in the banking sector is needed for the following reasons:

- To justify the soundness of an investment

- To ensure repayment of bank finance

- To achieve organizational goals

- To recommend if the project is not designed properly

Documentation of loans and advances

In spite of the fact that banker lends credit to a borrower after inquiring about the character, capacity and capital of the borrower, he must obtain proper documents executed from the borrower to protect him against willful defaults. Moreover, when money is lent against some security of some assets, the document must be executed in order to give the banker a legal and binding charge against those assets. Documents contain the precise terms of granting loans and they serve as important evidence in the law courts if the circumstances so desire. That is why all approval procedure and proper documentation shall be completed before the disbursement of the facilities. The documents for loans and advances can be classified into two categories, namely Charge documents and Security documents.

Disbursement

After verifying all the documents the branch disburses the loan to the borrower. A loan repayment schedule is also prepared by the bank and given to the borrower.

Follow up

After the disbursement of the loan bank officials time to time monitor the loan by physical observation of the activities of the party. It is done in the following manner.

- Constant supervision

- Working capital assessment

- Stock report analysis

Credit Monitoring

Monitoring is a process of taking care of loan cases starts from the selection of the borrower and remains live throughout the life of a loan.

To minimize credit losses, monitoring procedures and systems should be in places that provide an early indication of the deteriorating financial health of a borrower. At a minimum, systems should be in place to report the following exceptions to relevant executives in CRM and RM team:

- Past due principal or interest payments, past due trade bills, account excesses, and breach of loan covenants;

- Loan terms and conditions are monitored, financial statements are received on a regular basis, and any covenant breaches or exceptions are referred to CRM and the RM team for timely follow‐

- Timely corrective action is taken to address findings of any internal, external or regulator inspection/audit.

- All borrower relationships/loan facilities are reviewed and approved through the submission of a Credit Application at least annually.

Issues to be considered during Credit Management:

Credit Risk:

Credit risk is the possibility that a borrower or counter party will fail to meet its obligations in accordance with agreed terms (e.g. overdue / classified loans due to irregular repayments).

Mitigation

Following absconding borrower declaration process gives BRAC Bank the idea of how Bank should have managed their Credit assessment process in selecting their borrowers and approving their credits.

Process Risk:

It arises from loopholes and shortfall in existing process or from having inadequate /no process manuals for daily routine activities.

Mitigation:

Development of an end‐to‐end Absconding Declaration Process mitigates the shortfall or absence of process to carry out daily routine activities in this area.

Compliance Risk:

It arises from delayed/ wrong response to queries and wrong returns and information submitted to Bangladesh Bank and other regulatory authorities which may cause for penalty imposition and also affects bank’s reputation.

Mitigation:

Respective Business Finance should promptly reply to query or send reports to Bangladesh Bank for Absconding Borrowers as per this approved process.

IT System Risk:

This risk is caused from faulty system design, malfunctioning, lack of data / network / software / hardware security and disaster recovery, protection of copyrights and other intellectual property rights etc.

Mitigation:

Legal Support MIS team of SAM should maintain sufficient and accurate data in BBL system properly, so that no data get lost due to malfunction or for system disruption.

Remedy

BRAC Bank Limited recently signed a memorandum of understanding on Identification Verification Services with Election Commission Bangladesh.

Under the agreement, Election Commission Bangladesh will provide National ID Card verification services for valued customers of BRAC Bank Limited. BRAC Bank and Dutch-Bangla Bank are first two commercial banks to have signed with Election Commission for the verification services.

With the agreement, BRAC Bank will be able to verify National ID of all customers for transparency and accountability in account opening and banking services. It will help prevent identity fraud and ensure authenticity of ‘Know Your Customer’ form. It will also facilitate smooth operations of mobile banking services as bKash will also avail the verification services through BRAC Bank.

With support of Election Commission and guidance of Bangladesh Bank, the banking sector will benefit from rich data bank of NID Project which is a valuable asset of the country.

This verification process will definitely help to minimize credit risk factors drastically in the coming days.

Recommendations

- The bank should immediately establish integration with N.ID data base (as per MoU with Election Commission) in order to get competitive advantage on risk monitoring and prevention

- The Bank need to establish a strong “Credit Manual”

- The Bank need to go through back ground investigation for all parties and it should be strictly maintained

- All the loan documentations have to be done completely and comprehensively

- All the document verifications have to be done before loan approval

- The Bank need to implement a long term and strong investment policy

- The Loan and Advance section has to be strong enough and the employees have to be devoted towards the Bank

- The Bank has to give emphasis on the individual loan section

- The Bank should introduce more attractive loan products to be competitive in the market

Conclusion

BRAC Bank Ltd started its banking services with a view to minimize customer’s needs by offering different products and services which are easy and affordable for all level of customers and they have divided their customer into four segmentations – easy, excel, supreme, premium to provide easy and better service.

To that extent, BRAC Bank Ltd always emphasized its customer services, product development, resource management, branch networking and towards the contribution to the economic development of the country.

BRAC Bank Limited is one of the most potential Banks in the banking sector of Bangladesh. It has a very large portfolio with vast assets to meet up its liabilities and management of this bank is equipped with the quality bankers and managers in all level of management.

With the recent MoU (Memorandum of Understanding) with Bangladesh Election Commission, BRAC bank will definitely get competitive advantages over other commercial banks to closely monitor fraudulent activities as well as to prevent them.