Facing a Slippery Slump

The real estate sector is often used as an indicator to measure a nation’s economic growth. Flourishing economies in China and Dubai for instance, are represented by booming real-estate markets. The housing industry in Bangladesh, especially in Dhaka, has made remarkable progress in the last ten years. With apartment-sale charts consistently displaying positive curves, many predicted the housing industry to be the next golden sector of the country. However, an assessment of the sector, based on an annual survey conducted by Sheltech, one of the leading Real-Estate firms of the country, indicates a disturbing slump in the number of apartments sold in Dhaka last year.

According to Toufiq M Seraj, MD of Sheltech, the sale of apartments dropped by almost forty percent last year. One of the main reasons behind this drop, he claims, is the fast- increasing price rate of the apartments. “The cost of flats in Bangladesh is now one of the highest in the world and is completely disproportionate to the country‘s falling economy.” While there are several reasons behind the mounting price-rates of the flats, the high influx of developing firms and the increasing rates of construction materials, in the last five years, are some of the more prominent causes.

Booming Prices

“After 2007, the economy was in a very bad state. This eventually led to an increase in prices of raw materials like cement, rods etc.” explains Seraj. Apart from increasing costs of construction materials, the sector also witnessed the entry of several developing firms guilty of accepting housing projects at high prices and eventually contributing to the increasing cost of the apartments. “Today there are more than a 1000 developing firms in the city, but only 20 of them can be considered professional,” explains F R Khan, MD, Bulding Technology and Ideas Ltd.

Apart from covering costs incurred due to economic reasons, firms also reserve a portion of their budget in order to adhere to governmental legislations. Officials of real estate firms claim that developing companies are forced to bribe government officials in order to get their approval, without which they cannot continue their projects. “The rules laid down by RAJUK states that we need to get approvals from several departments: traffic, environment, electricity etc.

Their approvals are impossible to get unless you bribe them,” said an official of a real estate firm who preferred to remain anonymous.

He further said that the costs incurred due to the above mentioned approvals also contribute to the prices of the apartments.

A former official of Rajdhani Unnayan Katripakkha (RAJUK), when asked about these occurrences, says that although RAJUK plans a ‘one-sit agreement’ where all the approvals could be agreed upon in a meeting with the respective heads of the departments, it never works. “Every department raises objections during the meeting. After which they meet the developers separately and come to an agreement,” he explains.

The over-dependence on the Real Estate sector, according to Farhad-uz-Zamman, Marketing Manager, Eastern Housing, has increased the demand for flats; another reason behind the galloping price rates in the city. “Just like the other metro-cities in the world, the government should take some steps to decentralize Dhaka,” he says.

Price of construction materials increasing in Bangladesh

Prices of different construction materials have been increased as the cost of the raw items of the materials has been higher compared to previous two years. Cement, a key kind of construction materials has many factories in our country where different quality of cement based on price is produced. The price of different brand cement has been more than usual price in two years.

Shah cement, country’s leading cement now is sold per bag tk 370 which was sold two years ago less than tk 350. Brand cement Holcim sells per bag tk 360 and one year ago the price of this cement was tk 330. The price of ‘seven Ghora’ cement is now per bag tk 335-tk340 which was sold two years ago slightly more than tk 300.

Another leading cement named Akij cement is sold now per bag tk 370 which was sold last year at cheaper price than present. Seven Rings and Mir cement are being sold at higher price than previous record and the price of per bag of Seven Rings and Mir cement is tk 360.

Table XI: Price of construction materials from 1988-2010 | |||||

| Year | Price of Brick per piece (Tk) | Price of Sand, per sq. ft. (tk) | Price of Cement per bag(tk) | Rod, per ton (Tk) | |

| local | Sylhet | ||||

| 1988 | 1.00 | 3.60 | 5.25 | 105 | 11,000 |

| 1998 | 2.00 | 7.10 | 9.00 | 182 | 17,500 |

| 2000 | 2.50 | 7.80 | 10.50 | 193 | 21,300 |

| 2004 | 3.25 | 9.00 | 15.00 | 240 | 37,000 |

| 2005 | 3.15 | 8.00 | 22.00 | 283 | 39,700 |

| 2006 | 3.90 | 9.00 | 20.00 | 313 | 42,700 |

| 2007 | 4.20 | 9.50 | 21.50 | 337 | 49,200 |

| 2008 | 4.80 | 10.00 | 22.00 | 345 | 50,000 |

| 2009 | 5.20 | 11.00 | 22.50 | 355 | 51,500 |

| 2010 | 6.00 | 13.00 | 25.00 | 370 | 53.700 |

Rod, another major kind of construction materials is vastly produced in our country but the prices of rod are increasing day by day. Per tonne rod based on quality is sold tk 45000-tk55000 but seven days ago which was sold tk 40000 to tk 45000. Haroon- Al –Rashid, dealer of Meghna Steel Agency told the FE there is no fixed law to increases price of rod in our country. He also said during care taker government per tonne rod was sold tk 70000 which was completely out of middle class people to buy at this price.

An employee of BSRRM told the FE correspondent that the price of per tonne rod is now tk 53700 but the price of seven days ago was tk 51200. Prices of Bricks, basic construction materials have also increased than previous years.

Best quality of one thousand peices bricks are being sold tk 6000 to tk 6500 at a retail price which are sold at wholesale price tk 5500 to tk 6000.

Medium quality Bricks of one thousand peices are sold tk 5000 to tk 5500. Two years ago one thousand best quality Bricks were sold tk 4000 to tk 4500. Forhad, manager of Dhaka Bricks field said the price of coal, soil has been increased more than previous years that is why Bricks price are higher now.

The prices of sand have so far been increased as carrying cost of sand per truck or cargo has been higher compared to previous year. Now per truck sand is being sold tk 1700 to tk 1800 but six months ago which price was tk 1400 to tk 1500 per truck said a sand dealer. Sharif, a sand trader told the FE that higher labor cost and carrying cost are responsible for increasing sand price.

Tiles, one kind of construction and beatification materials are used hugely though its price is increasing. Per piece tiles is sold tk 90 –tk 500 based on qualities which was sold at less price than present before coming this government. Manager of Aspara Trading said tiles are imported from different countries mainly from China, Malaysia, Italy and Span. He also said present government has asked tiles importers to certify tiles through BSTI at Chittagong port that is why importers have failed to deliver tiles soon to the consumers. Excess increasing price of tiles are responsible for BSTI clearance from the port also said manager.

Land Scarcity:

Due to the large number of migrants and industrial activities, total amount of available land have been decreasing overtime. At a certain point in time Dhaka become too crowded and some people argued that this city is not eligible to live in. In reality Dhaka city has not been properly managed when it started to expand. In a modern city there should be at least 15% spaces allotted to the transportation system. Dhaka does not have that amount and the transportation system suffers. There are terrific traffic jams in the city along with the pollution. However random constructions in the city have not been stopped.

Though there were regulations about the construction activities, they have not been followed properly. As a result efficiency of land use could not be gained followed by the scarcity of lands. Lands scarcity helped booming of the real estate sectors because people wanted to secure the living place anyhow.

Hazards in purchasing land:

Bureaucratic process of land purchasing motivated people not to buy lands. Therefore they started to depend on the developers who manage everything including land acquisition.

Increasing Land Value

Dhaka has experienced an unprecedented increase in land value since the early seventies. In the past decade Dhaka has mainly developed along the two main axes towards the north of Dhaka. Due to huge increase in the population of Dhaka, the pressure on land for residential use has been very high. Since the sixties until today RAJUK has provided less than ten thousand plots at subsidized rate mainly for the middle and upper income groups. The value of land in Dhaka City, mainly in the central area, has increased at a rate much higher than the increase in cost of living in Dhaka. The price of high-class residential land has increased 100 times (approx.) during the period 1975-2000.

It has been stated that the big real estate companies are mainly responsible for the high price of land in the central area because they pay a much higher price for a good piece of land. It is argued that due to this reason middle and upper middle class families are being unable to buy land in Dhaka.

Prices of land and apartments were increasing rapidly day by day. So people wanted to ensure their living place as soon as possible which puts a pressure in the supply side.

Table XII: Area wise Land Price in Dhaka city from 1975 to 2010 (in BDT) | |||||

| Area | 1975 | 1990 | 2000 | 2007 | 2010 |

| Baridhara | 25000/- | 60000/- | 250000/- | 9000000/- | 20000000/- |

| Gulshan | 25000/- | 60000/- | 220000/- | 8000000/- | 15000000/- |

| Banani | 25000/- | 60000/- | 200000/- | 8000000/- | 14000000/- |

| Dhanmondi | 25000/- | 60000/- | 200000/- | 9500000/- | 20000000/- |

| Uttara | 20000/- | 30000/- | 100000/- | 3500000/- | 9000000/- |

| Mirpur | 10000/- | 30000/- | 700000/- | 2000000/- | 4500000/- |

| Mohakhali | 9000/- | 25000/- | 120000/- | 2500000/- | 8000000/- |

| Baddah | 15000/- | 40000/- | 170000/- | 3500000/- | 15000000/- |

| Motijheel | 17000/- | 55000/- | 200000/- | 7500000/- | 17500000/- |

| Shahabug | 9000/- | 20000/- | 100000/- | 3500000/- | 9500000/- |

| Mohammadpur | 7000/- | 17000/- | 90000/- | 3000000/- | 7000000/- |

Reason behind increasing land price in Dhaka city

We are of the opinion; however, that Real Estate companies are just one among several reasons for the rise in price as the value of urban land is actually determined and fixed through competition in a complex economic process. Besides, there are other factors, which influence urban land value.

It has been stated that the big real estate companies are mainly responsible for the high price of land in the central area because they pay a much higher price for a good piece of land. It is argued that due to this reason middle and upper middle class families are being unable to buy land in Dhaka. These are social values, customs and others. On carefully analyzing the land value trend of Dhaka City and the suburbs for the last thirty years, a number of causes of high land value have been identified as follows:

a) Lack of investment opportunity in other sectors of economy.

b) Rapid urbanization and consequent scarcity of urban land.

c) Uncontrolled land market.

d) Lack of comprehensive land policy.

e) Inappropriate taxation policy.

f) Political instability.

g) High rate of inflation.

h) Land speculation and the role-played by brokers.

i) Land ownership being regarded as a symbol of social prestige.

j) Inflow of foreign remittances earned by Bangladeshis abroad, especially from the Middle East.

k) Land purchase by real estate developers.

Hazards in construction of building:

To construct a house one has to deal with all the stakeholders including engineers, financing institutions, architects, construction workers, brick companies, cement companies, municipal corporations, tax authority etc. This brings lots of complexities to one’s life and to get rid of that one does not do by oneself. Rather one like to depend upon the developers.

Security:

This is one of the most important reasons for which people used to depend on the developers rather than constructing by themselves. Well this is a socio cultural phenomenon. One could not be sure that one can construct the building even though one has land and all other relevant stuffs to build the house. One had to satisfy some other parties to get the final green signal.

These parties include some corrupted officials from different administrative sections like tax department, municipal office, local loafers etc. Local loafers could be so dangerous sometimes that people had to think about the total loss. To get rid of this insecurity people started to depend on the developers. Developers have power and capacity to manage all these parties and the risk becomes low. Above all in the post construction periods developers help in arranging the better security system in the buildings.

Public Sector Failure:

Though according to Bangladesh constitution and United Nations resolution shelter is the fundamental right of any citizen of the country. But due to the resources scarcity Bangladesh government could not meet the growing demand of houses let alone houses for the people who lack affordability. So alternatives came out from the private sectors and there is now a formal real estate sector in the country. Almost all the firms are private in this sector and they are trying to meet the growing demand of housings. But not necessarily they try to meet the demand of houses for the people who lack affordability.

Decrease in bank interest rate:

Decrease in the bank interest rate has an inverse relationship with the real estate activities. So when rate was decreasing demand for the houses were increasing. Decreasing bank interest rate is pretty much helpful for the people who have the access to the financing system of the country.

Increased population:

Dhaka as one of the major suppliers of jobs and educational services among others attracted lots of people from the rural areas and the migration rate was very high. Increased population puts a pressure on the demand side and developers increased the supply. New investors also took this chance to get into the market.

Rent variation:

To meet the growing demand for houses developers developed lots of houses because rent in apartments is comparatively higher than the rent of privately constructed flats. It worked as a motivating factor.

Complimentary services:

Complimentary service facilities such as garbage disposal, central satellite TV connection, apartment’s services, roof top facilities, lift and so on are well managed by the developers. It reduces the complexity of the daily life and people liked it much.

Commercial Real Estate

The boom in the Commercial Real Estate (CRE) segment is being fuelledby a robust demand from MNCs and corporate Bangladesh alike, particularly from IT/ITeS, BFSI, Telecom and Pharmacy companies.

Key Growth Drivers

- Entry of MNCs from different country

- Growth in knowledge and technology intensive sectors

- Growing number of domestic company.

- The primary growth driver of commercial real estate is the MNCs, which, is growing at 9.5-12 per cent annually. According to a survey industry is expected to grow to US$ 120 billion by 2012. As per estimates this translates into in excess of 180 million sq. ft of commercial office space requirement by 2012 -13

Residential Real Estate

In Bangladesh residential real estate is driven by increasing urbanization, rising incomes and decreasing household sizes, the residential segment has been on an upswing over the past few years. Several other sectors such as financial services, biotechnology, telecom, pharmacy, insurance, and consulting businesses are witnessing strong growth and have added to the rising demand.

Key Growth Drivers

- Growing number of first-time home buyers

- Increasing income levels

- Increasing number of households

- Increasing affordability of homes

- Affordability of housing

- Penetration of mortgage finance

Why Apartment Selling Decreasing?

Recently the real estate in Bangladesh is in a trouble because the apartment selling in Dhaka City decreasing day by day. After 2010 the apartment selling going down that is harmful for the real estate sector.

Dissatisfied Customers

While a combination of the above mentioned reasons continue to increase the prices of apartments, a large section of dwellers remain dissatisfied.

For 34-year-old Robin Akhtar, an employee at a telecom company, the vicious increase in the prices of flats has made it almost impossible for him to buy an apartment of his choice. “Four years ago, I planned to buy an apartment for around Tk 25 lakhs, but I didn’t have the necessary funding. Today, the cost of the very same apartment is more than Tk 1 crore! That’s just ridiculous,” he exclaims. He adds that taking a bank loan was not an option due to the high interest rates.

A similar fate awaited Dr Mamun, a non-resident Bangladeshi from Canada, as he arrived in Dhaka with an aim to buy a suitable apartment for his family. “It’s difficult to afford an appropriate apartment in a good area with my budget. The prices of flats here are almost similar to the apartments in Canada,” he says.

Unlike Robin and Mamun, Shihab-ud-din, a banker from Dhanmondi, had booked his flat in 2005 and considers himself extremely lucky to have bought an apartment at the right time. “Honestly speaking the current scenario in the real estate sector is not too good. Loan requests from developers and firms are being rejected every other day,” he says. According to Mustafa K Mujeri, former Chief Economist of the Bangladesh Bank, the increased levels of uncertainty amongst investors during the caretaker government’s reign, contributed to the sudden ‘jump’ in the price- rate of apartments after 2008. “The yearlong intervention by the caretaker government discouraged business. Thus investors tried to recuperate for the losses that took place during the emergency period.”

| Inconsistency in the provision of utilities such as gas and electricity has discouraged buyers. |

Apart from increasing prices, inconsistency in the provision of utilities like gas and electricity has also hampered the sale of apartments. The provision of gas lines have been stopped in many apartments with dwellers being compelled to depend on gas cylinders. A new law requires the use of a certain percentage of solar energy in order to receive the electricity-approval for a housing project. The forcible presence of solar materials in housing projects has caused various financial problems for developers. “It is impractical for the government to expect us to re-design our flats to suit the new rules that have been enacted. Making changes in flats that have already been built will cost extra money and our customers won’t be willing to pay more than what they agreed to,” explains Farhad-uz-zamman.

The Rise and fall of the linkage industries

The recent developments in the housing sector have affected more than just the buyers; various linkage industries have suffered dramatic declines in their sales over the last few years. “There are more than 20 lakh people working in this industry and the survival of their livelihood depends upon these apartments,” claims F R Khan. According to reports, the glass and furniture markets in Dhaka have taken a hammering due to the decline in sales. A recent report published in the Daily Star on December 11, 2011 states that the sales of glass manufacturers have been affected due to the new rules that have been enacted for the provision of electricity in the upcoming apartments. Forced to adapt to the new situation, the report states that several glass industries are now planning to produce ‘tempered, low-emission and solar control glasses in order to increase their revenue.

A similar depression took place in the tiles industry as the demand for tiles decreased due to the slump in the sale of apartments. According to Fazlul Karim Bhuiyan, Marketing Manager of Arman tiles, sales have dropped by over 60 per cent in this year. “A number of developers who have already ordered tiles from us can’t afford to pay us since not many flats are being sold. They aren’t even getting bank loans to continue their projects,” says Bhuiyan

Markets linked to the real-estate sector such as the tile shops have been affected by the lack of sales.

Contrary to the situation of the various linkage industries, the unavailability of gas and electricity have surged the sales of ready-made apartments. According to Mushfiqur Rehman, who works for Flatbazar, a firm specializing in the sale of used-apartments, there has been an increase in the number of firms dealing with such flats. “ This business started in 2006; at that point of time there weren’t many firms selling ready-made flats, now however, the number of firms in this business have increased, mainly due to the unavailability of the necessary utilities,” explains Rehman. He further said that although there wasn’t much of a difference in terms of the costs of these flats, the availability of gas and electricity have encouraged people to invest in such apartments. “The main areas in Dhaka are almost full, so if someone wants to shift to a specific area, he has to come to us,” he says.

Undeclared Wealth: To be used or not to be used?

With the increased prices and the utility-inconsistencies creating a negative trend in the sales charts, developers have looked towards the government for legislations that would support the Real Estate sector. The re-enactment of section 19B of the finance act which legitimizes undeclared wealth by investing in the purchase of apartments after having paid a certain amount of tax, is one such law that developers in the city have been vouching for. The provision which was abolished after 1/11 has, according to firms, discouraged people to invest in the real estate sector. “The usage of undeclared wealth will help the real estate sector by stimulating cash-flow,” explains Khan. He says that in order to maintain the flow of cash and support the twenty lakh people working in the Real Estate sector, the provision to invest undeclared wealth in the sector was a necessity. “The heavy losses incurred by potential buyers, in other sectors, has left very little money in the system, and people who have money won’t come forward since they have to declare their source of income,” explains Khan. Supporting the enactment of the law, several developers claim that if the undeclared wealth is not used in the real estate sector in Bangladesh, the money will go to real estate developers abroad.

Responding to the claims of the finance act, the ex-chairman of RAJUK, KAM Harun, states that the re-enactment of such a law would be un-democratic and would send a completely wrong message to the future investors of the country. “It’s a criminal offence and legalizing it can further de-stabilize the economy,” he explains. Officials against the clause argue that one of the main reasons behind the fast-increasing land price of Dhaka was the enactment of the very same clause which was legitimate from 1999 to 2007. “I don’t think the law will benefit the economy since it doesn’t provide a level-field for investors,” says Mujeri.

Land prices raised 3-4 times in metropolitan areas

In one of some major moves made by the new government, land prices have been jacked up three to four times in metropolitan areas of the country while land tax, and registration and other fees lowered for three years, reports UNB. The new rates of land value, fees and tax will be effective from September 1.

As per the re-fixed rates, in Dhaka and Chittagong cities land price has been increased four times and in Rajshahi, Khulna, Sylhet and Barisal cities three times.

Land prices in the pourashavas (municipalities) at district headquarters have been raised 2.5 times. Besides, buyers will have to pay three times higher for buying lands in municipalities having business importance, namely, Bogra, Narayanganj, Gazipur, Tongi and Savar. Stamp and registration fees, local-government tax, and the tax on income at source have been lowered to 8.0 per cent of the land price from the present rate of 14.50 per cent in Dhaka, Chittagong, Rajshahi, Khulna, Sylhet and Barisal cities and municipalities of district headquarters.

Land price difference within country

Land price has not been raised in upazilas, but stamp, registration fee, local-government tax have been re-fixed at 6.0 per cent of the land price against the present 9.5 per cent.

Reason behind price discrimination

Lack of infrastructural facility is the main obstacle for the land developers to expand real estate business in rural areas. The land developers do not get convenient land of large size from one single owner for abstaining from the legal problems and the higher carrying cost of materials for building the flat. Low income people live in rural areas and most of the high income groups are concentrated in urban area.

Rural areas are not so important for trade and investment and so government pays more attention to urban area compared to rural areas. The flat builder faces local hoodlum and they demand illegal subscription. The life is more comfortable in urban areas as gas, electricity, water and recreation places are available here and hence people are rushing to the cities. The concern for environmental issue has been increased. Now the environmentalists are more aware of not demolishing the agricultural land as they think there is possibility of decreasing cultivating land.

Bangladesh VS India

The real estate sector in India assumed greater prominence with the liberalization of the economy, as the consequent increase in business opportunities and labor migration led to rising demand for commercial and housing space. Now a day’s India have a great position in real estate sectors in the world. Apartment price in India is to four times more than Bangladesh.

Corruption, Opaque Regulations, Use of Black Money

Real Estate in India is a Cesspool of Corruption and even India’s Prime Minister has also accepted it saying that high Stamp Duty on Real Estate Buys result in the preponderance of Black Money in Real Estate Deals. Due to the massive price appreciation and huge valuations,Land Scams have become quite common with Chief Ministers,Generals,Top Bureaucrats all involved in the murky environment of Real Estate in India.The most recent scam related to bribing of top public banks officials in the LIC Housing Finance Scandal has again put question mark on the fundamentals of the industry. Valuing the industry and making a real estate investment remains one of the most difficult investing tasks in the Indian Stock Market. Even Fund Managers are staying away from the Sector due to lack of trust in the Financial Statement given by the industry.

Global Real Estate Bubbles

One of the reasons for the sharp price rise in Real Estate in India is that Real Estate in many parts of the world is a bubble. Allowing Foreign Money into Real Estate in India has made these PE investors pay the same valuation for properties in India as outside. Note many of these “Real Estate” Private Equity Investors have yet to recover from the fall in property prices in the 2008 crash though many have been saved by the Bernake reinflation.

Tax Laws and Policy Stupidity

India’s Tax Laws impose high capital gains on land that is sold and not reinvested back into real estate again. That keeps the huge sums from gains in the real estate to be funneled back again. Otherwise a lot of the money would have gone elsewhere bringing the Real Estate back to earth again. India also allows an exemption of Rs 1.5 laks ceiling on interest payments on Real Estate Payment giving an impetus to investing in RE.Note such misguided laws were a leading cause of trouble for the Real Estate in USA.

Local, State Laws on Real Estate prevent Market Forces of Demand/Supply to Operate:

India’s Local and State Laws dealing with Real Estate are as bad if not worse than Laws at the central Level. These Laws in most cases prevent the normal working of the Market Forces of Supply and Demand. The biggest proof of this in the fact that the Rental Yields on properties on India are way lower than if you took out money from selling the real estate investment and putting in a safe government bond. People in Mumbai the biggest real estate bubble market in India have stopped buying houses and going for rental leases.

Peers Pressure, Cultural Factors

A lot of people buy real estate seeing other people buying at inflated prices. Not exactly a classical economic argument given that it assume people are rational and make decisions based on value. It has become acceptable to pay a huge amount of income as EMIs seeing other people do the same. Does not matter the benefits are hardly worth the costs. Cultural factors like buying real estate preference also have played a big role. In India people avoid stocks, bond but prefer real estate and bank fixed deposits.

Real estate Scenario in Bangladesh & SriLanka

Housing demand in Srilanka is increasing day by day, and their real estate is booming comparatively well than other countries. Though the apartment and land price in Srilanka is lower than Bangladesh. Though the housing industry in Bangladesh, especially in Dhaka, has made remarkable progress in the last ten years. With apartment-sale charts consistently displaying positive curves.

Reasons for Development of the Industry:

The main reasons why real estate business developed in Dhaka City are as follows:

a) Scarcity of open space in the important areas of the city

b) Hazards of purchasing land

c) Hazards of building construction

d) Rapid increase in population of Dhaka

e) Decrease in the bank interest rate

f) Increasing price of land and apartments

g) Increasing remittance of foreign currency

h) Security

i) Service facilities such as garbage disposal, central satellite TV connection, and roof top facilities, elevators and so on

Though the real estate business is going well in Bangladesh, but the property price in Srilanka is rising up.

Demand for housing rising!

Economic growth is returning. The Sri Lankan economy is likely to grow by 7.5% to 8% in 2010, more than double 2009’s 3.5% GDP growth rate, according to the Central Bank (CBSL). The forecast is supported by robust domestic demand and strong consumer and investor confidence, following the end of the 3-decade civil war.

From 2003 to 2008, the country experienced impressive average annual GDP growth of 6.3%. There’s now a severe housing shortage, which could reach 650,000 units in 2010, in a country of around 5 million households, according to the Ministry of Housing and Plantation Infrastructure.

A fall in housing construction approvals in recent years exacerbated the situation. In Greater Colombo, approvals plunged 28.1% in 2009 to 7,890 units, after a decline of 22.4% in 2008 and a drop of 10.6% in 2007. The drop in approvals is attributable to rising construction costs, corruption and red tape, and security problems. About 76% of the total housing stock in Sri Lanka is owner-occupied. Around 90% is single houses. Annual housing demand is estimated at around 80,000 to 100,000 units.

Inflation down, interest rates down!

The housing loan interest rate was slashed to 12% in May 2010, from a high of 20% in October 2009, by the Bank of Ceylon, Sri Lanka’s largest bank, following a decline in inflation. The Central Bank of Sri Lanka’s reverse repo rate was 9% in November, the lowest for six years. Inflation was 6.6% in October 2010. Consumer prices rose by just 3.4% in 2009, down from an annual average of 12.6% from 2001 to 2008.

Private commercial banks, which control about 75% of the market, offer adjustable-rate mortgage loans, introduced earlier during the high-inflation era. State-owned banks usually offer fixed-rate mortgage loans. Lanka’s mortgage market is very small – around 3.5% of GDP in 2009. Mortgage loan maturities range from 15 to 25 years.

The average commercial bank loan is LKR1 million (US$8,987); state-owned company loans are on average smaller.

The rental market is dominated by the luxury segment

Sri Lanka’s small rental market – only 5.4% of the total housing stock is rented – is dominated by high-end luxury apartments. The market for middle- and low-income renters is almost non-existent. In recent years rents have risen by an average of 11% annually, according to local real estate analysts. Average rental yields are about 5% to 6%, according to local developers. These yields are low, considering the 10.6% prime lending rate and mortgage interest rates of around 12%.

Bangladesh and Nepal real estate Market

The cost of flats in Nepal is lower than Bangladesh.

- While there are several reasons behind the mounting price-rates of the flats, the high influx of developing firms and the increasing rates of construction materials, in the last five years.

- Increasing income levels

- Increasing number of households

- Increasing affordability of homes

- Affordability of housing

Barriers for real estate in Nepal

The land market is being flourished because the financial institutions are using land as collateral for loans and are making economic focuses. Due to unskilled brokers and lack of spatial planning people are suffering from land disputes.

The unskilled or illiterate land developers are damaging good fertile agri-land for residential plots without any spatial planning and are making easy money. The provision of utility services in the planning area is very poor due to unscientific land development planning. Land administration seems weak because of the non-priority to improve them seriously. The emerging real estate industry is not functioning in a systematic way so it has to be streamlined as priority. Land development is progressing in urban areas but not in rural areas that has created a long gap between rural and urban life.

In order to address these issues, effective land management with accurate, reliable and timely land information is an essential prerequisite.

The reliability and accuracy of data/information depends upon the method of data acquisition, equipments and quality of the person involved in the process. The other fact is that the land data status is scattered diversely in different organizations. The government has to recognize the importance of sharing land data/information in a structured way so that it results in a National Spatial Data Infrastructure.

Necessity of Effective Land Management for Sustainable Real Estate Market in Nepal. It will ease to access land data to all diverse users and end-users within their domain and real estate professionals will not remain beyond this mechanism. Therefore we need to promote the land or real estate professionals in public and private sector through:

– Training to the concerned people for real estate business

– Preparing clear guidelines and directives

– Work hand-in-hand with land administration and management institutions, town and village development authorities and planners-developers.

Real Estate in Bangladesh and Pakistan

At present, real estate in Bangladesh has better position than Pakistan. Because

In Bangladesh three decades back the city dwellers were reluctant to live in flats while ten years back someone would have thought twice before buying an apartment/flat. But in the last couple of years people have shown an increased interest in owning apartments. As mentioned earlier the main reason is economic due to increased land cost as well as construction cost. There are also other reasons such as reluctance of individuals to spend time and energy in house construction, increased awareness of apartment living, and western influence. As a result apartment-owning is becoming increasingly popular. Moreover the absentee i.e. the wage earners in Middle East and other countries are also a major contributing factor towards the increasing demand for apartments.

As a result of increased demand, many apartment builders have appeared in the market in recent years. Twenty years ago there were fewer than five companies in Bangladesh engaged in developing apartments while today there are more than 1000 developers.

Major factors posing a burden on Pakistan real estate

Nowadays dealing in Pakistan properties is not considered profitable by many due to the bad impression created in result of poor performance and continuous decline in its overall real estate market.

Pakistani Government is obviously taking effective measures to stabilize the real estate prices in Pakistan but there are various factors which need to be checked before thinking about bringing any improvement in this sector. Following are discussed a few major factors which pose a burden on Pakistan real estate market and are constantly preventing it from setting foots on the path of recovery.

Inflationary pressure:

Inflation is the first and foremost problem of Pakistan posing great burden on real estate sector. Due to inflation, price hike of Pakistan properties is on the top these days. Inflation has derived property rents and prices in Pakistan upward making them out of reach of the buyers. Rents and prices of property in Lahore, Karachi and Islamabad are sky high due to which people are reluctant to make investment in this sector. Not only the increase in real estate prices have forced the people to stop buying but the increase in prices of basic necessities have also shrunk their budgets to think of investing somewhere else.

Devaluation of Pak Rupee:

Devaluation of Pak Rupee has also distressed the property sector. The overseas investors are hesitant to invest in Pakistan properties due to this reason. Not only devaluation of Pak Rupee but other factors have also forced the foreign investors to hold off their investments and wait for stability and recovery. They no longer forecast lucrative returns by investing in Pakistan properties due to the fear of losing their money.

Political instability:

Pakistan is under a constant threat of political instability that has shown its daunting affects in all of its major sectors. Real estate sector is not an exception to this. Continuous political instability brings rapid changes in government policies making it tough for the real estate brokers, agents, buyers or investors to attract profitable investment for them. Potential investors consider Pakistan property market a risky investment due to quick changes in policies and laws. They are more likely to keep their money safe with them rather them suffering from loss as a result of any abrupt political change.

High mortgage rates:

To curb the affect of inflation, State bank of Pakistan has devised stringent monetary policies resulting in high rate of interest on loans. LIBOR & KIBOR are extremely high as compared to other inter-bank exchange rates of other countries. Mortgage loans are given on the basis of tight lending conditions at very high rates of interest. This has discouraged the investors to engage in time consuming complex lending procedures based on strict rules and regulations. Besides that, due to inflation they are unable to meet the heavy interest expenses within their limited budgets.

In this regard, the government should take precautionary measures to lessen the affect of these factors which are posing a burden on Pakistan real estate sector. The government should improve the political situation and should advise the banks to relax the terms and conditions of mortgage loans. Government should also take steps to curb the affect of inflation, bring stability and value in Pak Rupee and introduce attractive policies and rules to uplift the confidence of investors for investing in Pakistan.

Overall Comparison of Real Estate within South Asian Countries

From the overall comparison I can say that India has a great position not only in the South Asian countries but also over the world. At present flat price in India is highest within South Asian Countries. But within South Asian countries at present, real estate sector of Bangladesh is a one of the leading growth sector and is providing remarkable contributions to the GDP in Bangladesh and creating employment opportunities for the unemployed people of Bangladesh.

Indian real estate is in the leading position within South Asian countries

At present, the real estate and construction sectors are playing a crucial role in the overall development of India’s core infrastructure. The real estate industry’s growth is linked to developments in the retail, hospitality and entertainment (hotels, resorts, cinema theatres) industries, economic services (hospitals, schools) and information technology (IT)- enabled services (like call centers) etc and vice versa. The Indian real estate sector has traditionally been dominated by a number of small regional players with relatively low levels of expertise and/or financial resources.

Historically, the sector has not benefited from institutional capital; instead, it has traditionally tapped high net-worth individuals and other informal sources of financing, which has led to low levels of transparency. This scenario underwent a change with in line with the sector’s growth, and as of today, the real estate industry’s dynamics reflect consumers’ expectations of higher quality with India’s increasing integration with the global economy.

Residential real estate industry has witnessed stupendous growth in the past few years owing to the following reasons:

Continuous growth in population

Migration towards urban areas

Sample job opportunities in service sectors

Growing income levels

Rise in nuclear families

Easy availability of finance

Demand for houses increased considerably whilst supply of houses could not keep pace with demand thereby leading to a steep rise in residential capital values especially in urban areas.

Foreign Funds

The Government has allowed FDI in the real estate sector with certain caveats. Recently the Cabinet Committee on Economic affairs has decided to permit 100% FDI in forms of housing, hotels, resorts, commercial premises, educational institutions, recreational facilities, hospitals and city and regional level infrastructure in order to attract higher investments. Earlier, restrictive norms were imposed on foreign investments with their presence permitted only in the integrated townships. They invest in urban infrastructure like hotels, shopping malls, large scale residential complexes in new townships, InfoTech parks and special economic zones. Over a half a dozen domestic realty funds have been setup so far with a corpus of over Rs. 3,500 crore.

Investment by IDFC

The Infrastructure Development Finance Company (IDFC) plans to invest Rs.1,000 crore every over five years on township projects, InfoTech parks, hotels, retail and transport sectors.

Commercial Boom

According to an expert to a real estate consultancy, there are currently 18 malls in New Delhi, Gurgaon, Nodia and Faridabad, with approximately built up space of 3 million sq. ft. While 66 new mall projects have been announced, the crush in the meantime is on the existing space. Abhijit Das, head, Ansalplaza Mall Management Company, confirms the rental increase. Shops on the first and second floors of the mall, he says which were being leased at rates between Rs. 175 and Rs. 225 per sq. ft. two months ago are now being out at a minimum of Rs. 250 per sq. ft.

Ten-Year Tax Holiday

The finance Ministry has announced a 10-year tax holiday for developers of Industrial parks set up from April 1, 2006 to March 31, 2009. According to the Industrial Park Scheme 2008 notified by the Central Board of Direct Taxed (CBDT), the industrial park developers will be eligible for 100% tax deduction which is to be provided for 10 consecutive assessment years out of 15 years after the commencement of operations of such units.

The developers will be free to choose the 10 consecutive years for the purpose of availing themselves of the tax holiday

Industry and services

- India has one of the world’s fastest growing automobile industries.

- Textile manufacturing is the second largest source of employment after agriculture and accounts for 20% of manufacturing output, providing employment to over 20 million people.

- India is 13th in services output. The services sector provides employment to 23% of the work force and is growing quickly, with a growth rate of 7.5% in 1991–2000, up from 4.5% in 1951–80. It has the largest share in the GDP, accounting for 55% in 2007, up from 15% in 1950.

- Information technology and business process outsourcing are among the fastest growing sectors, having a cumulative growth rate of revenue 33.6% between 1997–98 and 2002–03 and contributing to 25% of the country’s total exports in 2007–08. The growth in the IT sector is attributed to increased specialization, and an availability of a large pool of low cost, highly skilled, educated and fluent English-speaking workers, on the supply side, matched on the demand side by increased demand from foreign consumers interested in India’s service exports, or those looking to outsource their operations. The share of the Indian IT industry in the country’s GDP increased from 4.8 % in 2005–06 to 7% in 2008. In 2009, seven Indian firms were listed among the top 15 technology outsourcing companies in the world.

Infrastructure

India has the world’s third largest road network, covering more than 4.3 million kilometers and carrying 60% of freight and 87% of passenger traffic. Indian Railways is the fourth largest rail network in the world, with a track length of 114,500 kilometers. India has 13 major ports, handling a cargo volume of 850 million tones in 2010. India has a national teledensity rate of 74.15% with 926.53 million telephone subscribers, two-thirds of them in urban areas, but Internet use is rare, with around 13.3 million

Source: CRISIL RESEARCH: INDIA REAL ESTATE OVERVIEW

broadband lines in India in December 2011. However, this is growing and is expected to boom following the expansion of 3G and wimax services.

The Future of Real Estate of Bangladesh

With firms in the real estate sector expecting difficult years ahead, several steps are being taken in order to maintain the market. “We might have to compromise on luxurious flats in the future and build apartments that are more affordable to the buyers,” says Seraj. With the situation getting worse with time, developers hope that the government cans strategize a ‘bailout’ plan in order to support the sector. Some of the suggestions provided by developers include the smooth working of the processes laid down by RAJUK, selling of plots at cheaper rates and the provision of bank loans at cheap interest rates.

The current scenario is simple, the real estate sector is in trouble; the suspension of 21 housing companies last month and the fact that RAJUK has rejected a number of plans with respect to plots located in outer Dhaka, are indicators of the desperate measures taken by developing firms in order to survive in the market. As Haroon puts it, “Real estate companies often don’t adhere to the plan that they submit to RAJUK. Sometimes they don’t keep the required open spaces, or build buildings instead of mosques or other structures etc.”

The downfall of the real estate sector has taken place due to a combination of factors and it will take a while before the sector can re-group from such a setback.

However, keeping aside the nitty-gritty economic details, the one thing that overshadows all the above reasons is the fact that the housing industry in Bangladesh breeds corruption. And while the real estate sector and the government continue to play the blame-game, the common man faces the music, be it through the falling linkage industries or through the distant dreams of the middle-class to be able to afford a decent home in their own backyard.

Findings in the real estate business of Bangladesh:

Apartment development in Dhaka City, as mentioned earlier, has become increasingly popular in recent days and is likely to continue for some time. It has a number of plus points regarding solving housing problems of the city. But at the same time it has certain demerits

- Lack of customer faith

The most difficult job for the most marketing executives is to create faith on customer mind. They always hesitate to make such purchase decision. They hardly believe the company and its projects for following reasons.

- There is no direct government supervision in this sector. So they feel insecure to make purchase decision from the company.

- There is no government policy to guide the business.

- Failure in commitment

Sometimes the company fails to hand over the plot or flat within the specified period due to several factors like storage in raw materials, legal building, deadly in preparation of necessary papers etc.

- Political Instability

Political Instability: The major problem of real estate business in Bangladesh is the instability of political situation. The changes in government affect the political situation of Bangladesh which also affects the real estate business. Because of the political instability, the real estate companies cannot conduct their business smoothly and they cannot attain their targets or goals within a specified period of time. Sometimes these causes create a severe long-term effect on the real estate business in

Bangladesh.

- Timing of Sales:

The frequently changes in government rules & regulations and political situations in Bangladesh which sometimes causes the real estate companies to stop their constructions. For these reasons, they cannot sell their products just-in-time. As a result, they suffer huge amount of loss and become dissatisfied.

- High interest rate: The interest rate on housing loan is very high in Bangladesh. The borrowers sometimes fail to take the loans because of high interest rate. Some might be able to take the loan but after some periods they fail to pay the loan installments and become loan defaulters. As a result, they fail to acquire own real estate property.

| Country name | Interest rate |

| Bangladesh | 14%-16% |

| India | 8%-10% |

| Pakistan | 9%-10% |

| China | 4.14%-5.76% |

| Japan | 2.37%-3.05% |

| Malaysia | 6%-6.60% |

| USA | 4.86%-6.00% |

| UK | 5.25%-7.39% |

| Australia | 7.34%-8.22% |

| France | 3%-5% |

| NewZeeland | 7.25%-9.25% |

- High Promotional Cost:

In Bangladesh, real estate companies have to advertise their products so that they have to bear high promotional costs. Most of the companies can not afford to give advertisement because of high costs. There are more than 580 real estate companies in Bangladesh. Out of them only a few (for example, Bashundhara, Amin Mohammad Foundation etc.) can afford the high costs of promotion. These companies use newspapers, radio, television and billboard for the promotional campaign of their products.

- Loss of Collection:

Sometimes few customers become unable to buy the promised property because of some unavoidable circumstances. Again, sometimes customers may change their minds about one particular real estate company. For these reasons, the real estate companies have to face the loss because the property cannot be sold within a specified period of time. So, in that case, the real estate companies in Bangladesh have to face the collection loss.

- Changes in Government Rules & Regulations:

When the government changes any rule & regulation, it creates a tremendous effect on the profitability of real estate companies. In 2009, there are some changes of real estate law 2008. It has tremendously hampered the interest of real estate companies. So, they are reluctant to accept the real estate law 2009.

- Lack of Real Estate Education: Construction labor is relatively easy to obtain in Bangladesh. But they do not have proper education in real estate. In our country, there is no much scope for education in real estate. Both the public and private universities except ‘Daffodil International University’ lack the education regarding real estate. ‘Daffodil International University’ in 2008, first established a separate department named as ‘Department of Real Estate’. Under this department, Bachelor of Real Estate (BRE) program has been introduced. The students are showing more interest about this program as there are lots of job opportunities in this field

- Lack of Skills:

In Bangladesh, the construction labors are available. But they are unskilled. They are not properly trained. Not only the labors but also the personnel working in this field do not have prior knowledge about this field. They have different educational backgrounds. Most of them do not have idea about the real estate investment and management. This field requires expertise personnel.

- Natural Climate

Natural climate like heavy rainfall, flood, storm, earth quake, usually delayed the project work. So, unfavorable natural climates one of the main problems in this business.

- Miscellaneous

Disturbance of illegal, collectors of subscription, corruption from the government and non- government bodies is also major problem in this sector.

Recommendations

Based on the above challenges involved in real estate business in Bangladesh, the following recommendations can be proposed to accelerate the real estate business in

Bangladesh:

- A congenial political culture needs to be developed throughout the country. Political parties have a role in this regard. They should prevent all unavoidable circumstances for the greater interest of the country.

- Necessary steps should be taken by the govt. to protect the frequently changing rules & regulations which sometimes create pressure on the real estate companies to stop their constructions. In this case, at present the government of Bangladesh should pass the Real Estate Management Ordinance 2008 in the parliament after proper discussion with all the stakeholders involved with the real estate business in Bangladesh so that the real estate companies can complete their constructions smoothly and can handover the apartments or office according to the agreement with the customers.

- In order to keep the customers satisfaction and keen interest on real estate business in Bangladesh, the real estate companies should maintain all the factors well at hand and try to meet the satisfaction of customers. Otherwise, they will not survive long-run in the market.

- In order to reduce the collection loss, the real estate companies should be more careful about the customers when they will make agreement. In this regard, the real estate companies may conduct a small survey on the potential customers about their sources of income, family status, culture, norms attitudes and so on.

- Real estate is a capital intensive business; it is quite impossible for individual real estate company to operate in this sector without the support of the proper authority. All support services should be provided by the government to the real estate companies because real estate business provided remarkable contribution to the GDP in Bangladesh.

- Government should provide available loan and land facilities to the real estate business. If govt. takes initiative to acquire the land and if financial organizations provide sufficient loan at lower interest rate to the real estate companies, the problem may be reduced.

- Lack of infrastructural facility is one of the most important problems of expanding real estate business in Bangladesh. Better communication such as phone, internet, fax etc., physical infrastructures such as school, mosque, playground, park, landscape, shopping center, gymnasium, roads, etc., utility services such as electricity, water, gas sewerage etc. Should be provided by the government to the real estate companies.

- Government should be encouraged to the real estate developers with necessary incentives (such as tax holiday for investment in real estate business) for its greater participation in the real estate business in Bangladesh.

- The government and private universities should open a separate real estate department as soon as possible in order give the higher education to the people who are working in this sector and to produce the required number of potential graduates. Here it is noticeable that the Daffodil International University has already opened a separate Real Estate Department in 2008. Beside these, the government and private owners may establish a sufficient real estate polytechnics and real estate technical school in order to give the proper training and education to the employees of real estate sectors of Bangladesh. In addition to that the real estate companies may also enhance the skills of labors through apprenticeship training.

Opportunities of Real Estate Business in Bangladesh

Firstly, real estate business is one of the fastest growing industrial sectors of Bangladesh. It is also a very potential sector in Bangladesh because the population growth rate is very high. People will need more houses, working places, educational institutions, medical centers etc. In this case, the real estate companies should utilize the lands properly and make high mount buildings to meet the shelter/ housing problems of people who are living in the urban areas of Bangladesh. As a result, the real estate companies can enhance their creativity.

Secondly, there is a huge number of Bangladeshi who lives outside Bangladesh. All of them have a dream to buy the land or apartment in home country. In this regard, the real companies have a great opportunity to expand their business.

Finally, now real estate sector is a booming sector of Bangladesh. At present, there are near about 90 thousand people involved in this sector. This is one of the wide employment sectors of Bangladesh and will be increased day- by -day. As a result, real estate business helps to reduce the unemployment problems in Bangladesh.

Concluding Remarks

There is no question that real estate industry is one of the most potential industries in Bangladesh. The industry has been witnessing an investment boom for the last couple of years. The current environment in Bangladesh is not congenial for the real estate business. But a favorable environment can be created if correct steps are taken in a number of areas. Needless to mention, such steps will be time-consuming and these will require concerted efforts at different levels.

5.1 Facing a Slippery Slump

The real estate sector is often used as an indicator to measure a nation’s economic growth. Flourishing economies in China and Dubai for instance, are represented by booming real-estate markets. The housing industry in Bangladesh, especially in Dhaka, has made remarkable progress in the last ten years. With apartment-sale charts consistently displaying positive curves, many predicted the housing industry to be the next golden sector of the country. However, an assessment of the sector, based on an annual survey conducted by Sheltech, one of the leading Real-Estate firms of the country, indicates a disturbing slump in the number of apartments sold in Dhaka last year.

According to Toufiq M Seraj, MD of Sheltech, the sale of apartments dropped by almost forty percent last year. One of the main reasons behind this drop, he claims, is the fast- increasing price rate of the apartments. “The cost of flats in Bangladesh is now one of the highest in the world and is completely disproportionate to the country’s falling economy.” While there are several reasons behind the mounting price-rates of the flats, the high influx of developing firms and the increasing rates of construction materials, in the last five years, are some of the more prominent causes.

Source: Copyright (R) thedailystar.net 2012

Flat Price in Dhaka city (in BDT)

|

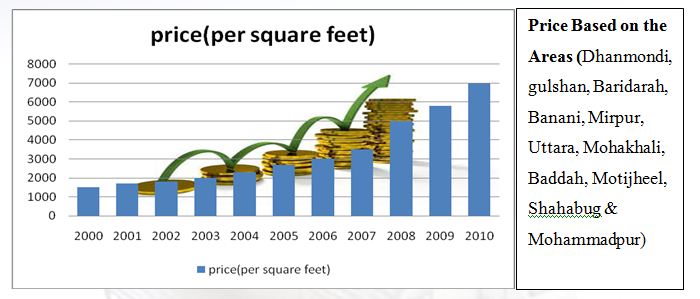

Figure 3: Flat Price of Dhaka city from 2000 to 2010

5.2 Booming Prices

“After 2007, the economy was in a very bad state. This eventually led to an increase in prices of raw materials like cement, rods etc.” explains Seraj. Apart from increasing costs of construction materials, the sector also witnessed the entry of several developing firms guilty of accepting housing projects at high prices and eventually contributing to the increasing cost of the apartments. “Today there are more than a 1000 developing firms in the city, but only 20 of them can be considered professional,” explains F R Khan, MD, Bulding Technology and Ideas Ltd.

Apart from covering costs incurred due to economic reasons, firms also reserve a portion of their budget in order to adhere to governmental legislations. Officials of real estate firms claim that developing companies are forced to bribe government officials in order to get their approval, without which they cannot continue their projects. “The rules laid down by RAJUK states that we need to get approvals from several departments: traffic, environment, electricity etc.

Their approvals are impossible to get unless you bribe them,” said an official of a real estate firm who preferred to remain anonymous.

Source: Copyright (R) thedailystar.net 2012

He further said that the costs incurred due to the above mentioned approvals also contribute to the prices of the apartments.

A former official of Rajdhani Unnayan Katripakkha (RAJUK), when asked about these occurrences, says that although RAJUK plans a ‘one-sit agreement’ where all the approvals could be agreed upon in a meeting with the respective heads of the departments, it never works. “Every department raises objections during the meeting. After which they meet the developers separately and come to an agreement,” he explains.

The over-dependence on the Real Estate sector, according to Farhad-uz-Zamman, Marketing Manager, Eastern Housing, has increased the demand for flats; another reason behind the galloping price rates in the city. “Just like the other metro-cities in the world, the government should take some steps to decentralize Dhaka,” he says.

5.2.1 Reason for the real estate booming

5.2.1.1 Price of construction materials increasing in Bangladesh

Prices of different construction materials have been increased as the cost of the raw items of the materials has been higher compared to previous two years. Cement, a key kind of construction materials has many factories in our country where different quality of cement based on price is produced. The price of different brand cement has been more than usual price in two years.

Shah cement, country’s leading cement now is sold per bag tk 370 which was sold two years ago less than tk 350. Brand cement Holcim sells per bag tk 360 and one year ago the price of this cement was tk 330. The price of ‘seven Ghora’ cement is now per bag tk 335-tk340 which was sold two years ago slightly more than tk 300.

Another leading cement named Akij cement is sold now per bag tk 370 which was sold last year at cheaper price than present. Seven Rings and Mir cement are being sold at higher price than previous record and the price of per bag of Seven Rings and Mir cement is tk 360.

Source: Copyright (R) thedailystar.net 2012

Table XI: Price of construction materials from 1988-2010 | |||||

Year | Price of Brick per piece (Tk) | Price of Sand, per sq. ft. (tk) | Price of Cement per bag(tk) | Rod, per ton (Tk) | |

local | Sylhet | ||||

1988 | 1.00 | 3.60 | 5.25 | 105 | 11,000 |

1998 | 2.00 | 7.10 | 9.00 | 182 | 17,500 |

2000 | 2.50 | 7.80 | 10.50 | 193 | 21,300 |

2004 | 3.25 | 9.00 | 15.00 | 240 | 37,000 |

2005 | 3.15 | 8.00 | 22.00 | 283 | 39,700 |

2006 | 3.90 | 9.00 | 20.00 | 313 | 42,700 |

2007 | 4.20 | 9.50 | 21.50 | 337 | 49,200 |

2008 | 4.80 | 10.00 | 22.00 | 345 | 50,000 |

2009 | 5.20 | 11.00 | 22.50 | 355 | 51,500 |

2010 | 6.00 | 13.00 | 25.00 | 370 | 53.700 |

Rod, another major kind of construction materials is vastly produced in our country but the prices of rod are increasing day by day. Per tonne rod based on quality is sold tk 45000-tk55000 but seven days ago which was sold tk 40000 to tk 45000. Haroon- Al –Rashid, dealer of Meghna Steel Agency told the FE there is no fixed law to increases price of rod in our country. He also said during care taker government per tonne rod was sold tk 70000 which was completely out of middle class people to buy at this price.

An employee of BSRRM told the FE correspondent that the price of per tonne rod is now tk 53700 but the price of seven days ago was tk 51200. Prices of Bricks, basic construction materials have also increased than previous years.

Source: Copyright (R) thedailystar.net 2012

Best quality of one thousand peices bricks are being sold tk 6000 to tk 6500 at a retail price which are sold at wholesale price tk 5500 to tk 6000.

Medium quality Bricks of one thousand peices are sold tk 5000 to tk 5500. Two years ago one thousand best quality Bricks were sold tk 4000 to tk 4500. Forhad, manager of Dhaka Bricks field said the price of coal, soil has been increased more than previous years that is why Bricks price are higher now.

The prices of sand have so far been increased as carrying cost of sand per truck or cargo has been higher compared to previous year. Now per truck sand is being sold tk 1700 to tk 1800 but six months ago which price was tk 1400 to tk 1500 per truck said a sand dealer. Sharif, a sand trader told the FE that higher labor cost and carrying cost are responsible for increasing sand price.

Tiles, one kind of construction and beatification materials are used hugely though its price is increasing. Per piece tiles is sold tk 90 –tk 500 based on qualities which was sold at less price than present before coming this government. Manager of Aspara Trading said tiles are imported from different countries mainly from China, Malaysia, Italy and Span. He also said present government has asked tiles importers to certify tiles through BSTI at Chittagong port that is why importers have failed to deliver tiles soon to the consumers. Excess increasing price of tiles are responsible for BSTI clearance from the port also said manager.

5.2.1.2 Land Scarcity:

Due to the large number of migrants and industrial activities, total amount of available land have been decreasing overtime. At a certain point in time Dhaka become too crowded and some people argued that this city is not eligible to live in. In reality Dhaka city has not been properly managed when it started to expand. In a modern city there should be at least 15% spaces allotted to the transportation system. Dhaka does not have that amount and the transportation system suffers. There are terrific traffic jams in the city along with the pollution. However random constructions in the city have not been stopped.

Source: Copyright (R) thedailystar.net 2012

Though there were regulations about the construction activities, they have not been followed properly. As a result efficiency of land use could not be gained followed by the scarcity of lands. Lands scarcity helped booming of the real estate sectors because people wanted to secure the living place anyhow.

5.2.1.3 Hazards in purchasing land:

Bureaucratic process of land purchasing motivated people not to buy lands. Therefore they started to depend on the developers who manage everything including land acquisition.

5.2.1.4 Increasing Land Value

Dhaka has experienced an unprecedented increase in land value since the early seventies. In the past decade Dhaka has mainly developed along the two main axes towards the north of Dhaka. Due to huge increase in the population of Dhaka, the pressure on land for residential use has been very high. Since the sixties until today RAJUK has provided less than ten thousand plots at subsidized rate mainly for the middle and upper income groups. The value of land in Dhaka City, mainly in the central area, has increased at a rate much higher than the increase in cost of living in Dhaka. The price of high-class residential land has increased 100 times (approx.) during the period 1975-2000.

Land Price per katha in Dhaka City (in BDT millions)

|

Figure 4: Land Price in Dhaka city from 1975 to 2010

Source: Copyright (R) thedailystar.net 2012

It has been stated that the big real estate companies are mainly responsible for the high price of land in the central area because they pay a much higher price for a good piece of land. It is argued that due to this reason middle and upper middle class families are being unable to buy land in Dhaka.

Prices of land and apartments were increasing rapidly day by day. So people wanted to ensure their living place as soon as possible which puts a pressure in the supply side.

Table XII: Area wise Land Price in Dhaka city from 1975 to 2010 (in BDT) | |||||

Area | 1975 | 1990 | 2000 | 2007 | 2010 |

Baridhara | 25000/- | 60000/- | 250000/- | 9000000/- | 20000000/- |

Gulshan | 25000/- | 60000/- | 220000/- | 8000000/- | 15000000/- |

Banani | 25000/- | 60000/- | 200000/- | 8000000/- | 14000000/- |

Dhanmondi | 25000/- | 60000/- | 200000/- | 9500000/- | 20000000/- |

Uttara | 20000/- | 30000/- | 100000/- | 3500000/- | 9000000/- |

Mirpur | 10000/- | 30000/- | 700000/- | 2000000/- | 4500000/- |

Mohakhali | 9000/- | 25000/- | 120000/- | 2500000/- | 8000000/- |

Baddah | 15000/- | 40000/- | 170000/- | 3500000/- | 15000000/- |

Motijheel | 17000/- | 55000/- | 200000/- | 7500000/- | 17500000/- |

Shahabug | 9000/- | 20000/- | 100000/- | 3500000/- | 9500000/- |

Mohammadpur | 7000/- | 17000/- | 90000/- | 3000000/- | 7000000/- |

5.2.1.4.1 Reason behind increasing land price in Dhaka city

We are of the opinion; however, that Real Estate companies are just one among several reasons for the rise in price as the value of urban land is actually determined and fixed through competition in a complex economic process. Besides, there are other factors, which influence urban land value.

Source: Dhaka Mirror

It has been stated that the big real estate companies are mainly responsible for the high price of land in the central area because they pay a much higher price for a good piece of land. It is argued that due to this reason middle and upper middle class families are being unable to buy land in Dhaka. These are social values, customs and others. On carefully analyzing the land value trend of Dhaka City and the suburbs for the last thirty years, a number of causes of high land value have been identified as follows:

a) Lack of investment opportunity in other sectors of economy.

b) Rapid urbanization and consequent scarcity of urban land.

c) Uncontrolled land market.

d) Lack of comprehensive land policy.

e) Inappropriate taxation policy.

f) Political instability.

g) High rate of inflation.

h) Land speculation and the role-played by brokers.

i) Land ownership being regarded as a symbol of social prestige.

j) Inflow of foreign remittances earned by Bangladeshis abroad, especially from the Middle East.

k) Land purchase by real estate developers.

5.2.1.5 Hazards in construction of building:

To construct a house one has to deal with all the stakeholders including engineers, financing institutions, architects, construction workers, brick companies, cement companies, municipal corporations, tax authority etc. This brings lots of complexities to one’s life and to get rid of that one does not do by oneself. Rather one like to depend upon the developers.

5.2.1.6 Security:

This is one of the most important reasons for which people used to depend on the developers rather than constructing by themselves. Well this is a socio cultural phenomenon. One could not be sure that one can construct the building even though one has land and all other relevant stuffs to build the house. One had to satisfy some other parties to get the final green signal.

Source: Dhaka Mirror

These parties include some corrupted officials from different administrative sections like tax department, municipal office, local loafers etc. Local loafers could be so dangerous sometimes that people had to think about the total loss. To get rid of this insecurity people started to depend on the developers. Developers have power and capacity to manage all these parties and the risk becomes low. Above all in the post construction periods developers help in arranging the better security system in the buildings.

5.2.1.7 Public Sector Failure:

Though according to Bangladesh constitution and United Nations resolution shelter is the fundamental right of any citizen of the country. But due to the resources scarcity Bangladesh government could not meet the growing demand of houses let alone houses for the people who lack affordability. So alternatives came out from the private sectors and there is now a formal real estate sector in the country. Almost all the firms are private in this sector and they are trying to meet the growing demand of housings. But not necessarily they try to meet the demand of houses for the people who lack affordability.

5.2.1.8 Decrease in bank interest rate:

Decrease in the bank interest rate has an inverse relationship with the real estate activities. So when rate was decreasing demand for the houses were increasing. Decreasing bank interest rate is pretty much helpful for the people who have the access to the financing system of the country.

5.2.1.9 Increased population:

Dhaka as one of the major suppliers of jobs and educational services among others attracted lots of people from the rural areas and the migration rate was very high. Increased population puts a pressure on the demand side and developers increased the supply. New investors also took this chance to get into the market.

Source: Dhaka Mirror

5.2.1.10 Rent variation:

To meet the growing demand for houses developers developed lots of houses because rent in apartments is comparatively higher than the rent of privately constructed flats. It worked as a motivating factor.

5.2.1.11 Complimentary services:

Complimentary service facilities such as garbage disposal, central satellite TV connection, apartment’s services, roof top facilities, lift and so on are well managed by the developers. It reduces the complexity of the daily life and people liked it much.

5.2.1.12 Commercial Real Estate

The boom in the Commercial Real Estate (CRE) segment is being fuelledby a robust demand from MNCs and corporate Bangladesh alike, particularly from IT/ITeS, BFSI, Telecom and Pharmacy companies.

5.2.1.12.1 Key Growth Drivers

- Entry of MNCs from different country

- Growth in knowledge and technology intensive sectors

- Growing number of domestic company.

- The primary growth driver of commercial real estate is the MNCs, which, is growing at 9.5-12 per cent annually. According to a survey industry is expected to grow to US$ 120 billion by 2012. As per estimates this translates into in excess of 180 million sq. ft of commercial office space requirement by 2012 -13

5.2.1.13 Residential Real Estate

In Bangladesh residential real estate is driven by increasing urbanization, rising incomes and decreasing household sizes, the residential segment has been on an upswing over the past few years. Several other sectors such as financial services, biotechnology, telecom, pharmacy, insurance, and consulting businesses are witnessing strong growth and have added to the rising demand.

Source: Dhaka Mirror

5.2.1.13.1 Key Growth Drivers

- Growing number of first-time home buyers

- Increasing income levels

- Increasing number of households

- Increasing affordability of homes

- Affordability of housing

- Penetration of mortgage finance

5.3 Why Apartment Selling Decreasing?

Recently the real estate in Bangladesh is in a trouble because the apartment selling in Dhaka City decreasing day by day. After 2010 the apartment selling going down that is harmful for the real estate sector.

|

Figure 5: Apartment Sales in the last five years in Dhaka city

5.3.1 Reason for Decreasing Apartment Selling

5.3.1.1 Dissatisfied Customers

While a combination of the above mentioned reasons continue to increase the prices of apartments, a large section of dwellers remain dissatisfied.

Source: Sheltech

For 34-year-old Robin Akhtar, an employee at a telecom company, the vicious increase in the prices of flats has made it almost impossible for him to buy an apartment of his choice. “Four years ago, I planned to buy an apartment for around Tk 25 lakhs, but I didn’t have the necessary funding. Today, the cost of the very same apartment is more than Tk 1 crore! That’s just ridiculous,” he exclaims. He adds that taking a bank loan was not an option due to the high interest rates.

A similar fate awaited Dr Mamun, a non-resident Bangladeshi from Canada, as he arrived in Dhaka with an aim to buy a suitable apartment for his family. “It’s difficult to afford an appropriate apartment in a good area with my budget. The prices of flats here are almost similar to the apartments in Canada,” he says.