Executive summary

This report evaluates the different corporate investment standards of Islamic and non Islamic banks in Bangladesh and its effects ion the banks performance. It was assigned as a partial fulfillment of the requirements for the Masters of Business Administration (MBA), Bangladesh University of Professionals, supervised by Major Asaduzzaman.

Corporate investment is one of the more popular and visible function of bank in all over the world. It is a generic term given to different banking services that large companies, governments, or other big institutions need in order to carry out their functions. Corporate banking consists of simple business of issuing loans to more complex matters. Bank provides financial and technical assistance to broaden the private as well as public sector industrial base of the country. It prioritizes, especially, Export Oriented/Export Linkage industrial units, Efficient Import Substitution, Joint Ventures, Commercialization of local technology and promotion of agro-based industry.

The Corporate investment facilities are varying from bank to bank in terms of conditions, eligibility, eligible item or goods, security and the necessary documentations. Bank has introduced standards which are to improve the opportunity and interest of the entrepreneurs of the country.

Development of the country mainly depends on the growth of the industrial sector and growth of the business. Today set up a large business or industry become a dream for the entrepreneurs. But it is not possible for an individual entrepreneur to arrange the full capital for the investment. In recent days financing has become an important area for Commercial Banks in Bangladesh.

A good number of Islamic and non Islamic Banks in our country are successfully operating this program. But the standards such as requirements, document, interest rate, installment system of the corporate investment of different banks are different. Considering the popularity of corporate investment it will try to identify comparison its various aspects, which are directly related, with the corporate investment customers and corporate investment providing bankers and its effect on the providing banks performance. Again, most of the aspects are related with the salient features of corporate investment in the relevant sample banks

This research has deal the corporate investment of different Islamic and non Islamic banks in Bangladesh banking sector and its effect on the banks performance. Therefore my working area is whole banking sector of Bangladesh. But this kind of research needs lot of time. For convenient and complete the research with the limited time the research will be conducted competitive analysis of corporate investment standards of six privet Islamic and non Islamic bank.

The report has discussed mainly in eight chapters. Literature review and overview of Shajalal Islami Bank are discussed in the second and third chapter. Fourth chapter talks about the corporate investment standers of different Islamic and non Islamic banks of Bangladesh. The project part of the research has discussed at chapter five. Summary of findings and recommendation are discussed briefly in chapter six and seven respectively. And finally the chapter eight is the conclusions.

A lot of theoretical researches have been done on the performance of the Islamic bank and non Islamic bank. This paper will endeavor to present and analyze standard of corporate investment and to identify its effects on banks performance. Questionnaires has been used to collect information.

This is an explicit research where I have analyzed secondary data to find out the present situation of issuing corporate investment. A primary survey has conducted to find out the opinions of different bank executives and corporate clients. Non-probability Sampling Technique (convenient Sampling)has used for this study.

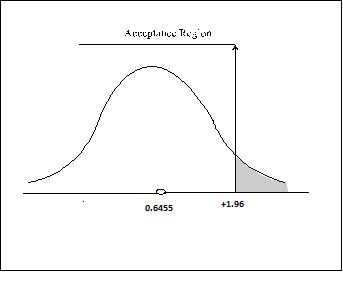

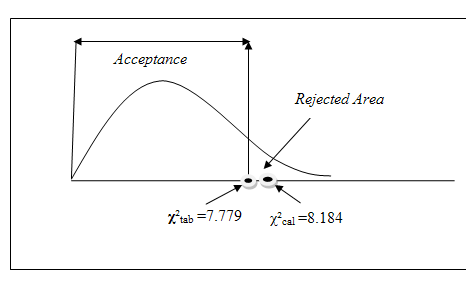

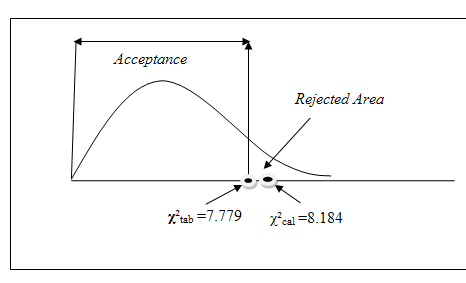

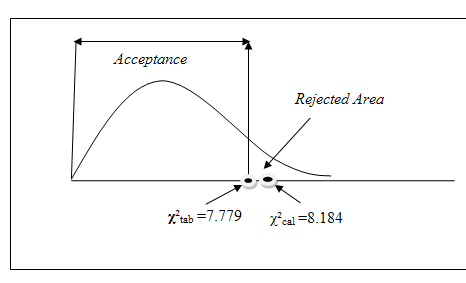

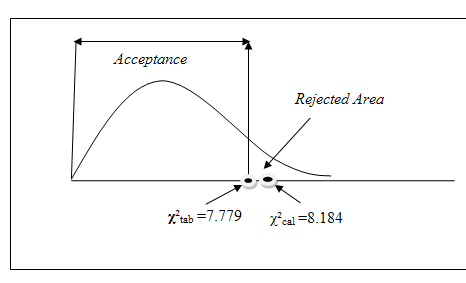

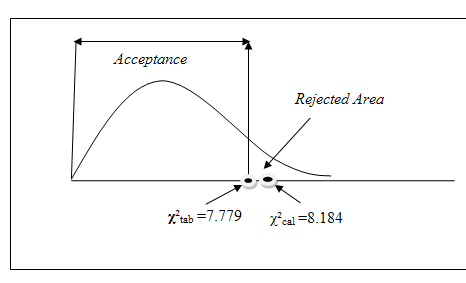

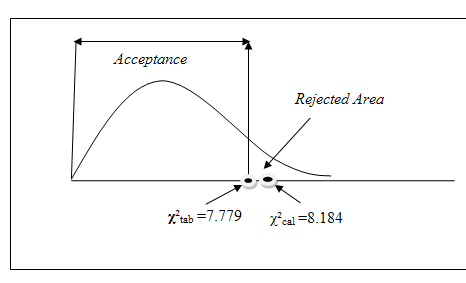

The raw data has analyzed by suitable form of statistical analysis. To analyze the data, at first raw data was coded. After coding the data, raw data analyzed using SPSS. Testing of the hypotheses have done through the use of one and two tail Z and Chi square test. Based on these tests hypotheses has been accepted or rejected.

The finding of the research is:

- Clients are not satisfied with procedural obligation (Security Documents and acceptable Security) for obtaining a corporate lending from both Islamic and non Islamic Bank.

- A significant difference has been found in corporate investment processing period of Islamic and non Islamic Banks. Non Islamic banks processes loan so quickly.

- Disbursement system of Islamic and non Islamic banks is different and clients prefer payment order system of Islamic banks more than the non Islamic banks cash payment system.

- The repayment system of Islamic bank preferable for the client than the non Islamic banks because of gress period facility.

- Corporate investment has a positive impact on the banks performance. Almost more than 50% annual income of the banks comes from the corporate investment.

Though both the Islamic and non Islamic banks have the corporate investment program for the business people but there is some limitations in their corporate investment standards. If they can overcome these limitations then both the Islamic and non Islamic banks will be facilitate because the main source of income of the banks comes from the corporate investment program.

Evaluation of Corporate Investment standards of different Islamic and non Islamic banks in Bangladesh and its overall effect in Bank’s Performance

- 1. Introduction and Background

Corporate Investment is a generic term given to different banking services that large companies, governments, or other big institutions need in order to carry out their functions. Corporate banking consists of simple business of issuing loans to more complex matters, such as helping minimize taxes paid by overseas subsidiaries, managing changes in foreign exchange rates, or working out the details of financing packages necessary for the construction of a new office, plant or other facility.

Corporate investment has the bankers who typically help clients raise money through loans. When necessary, corporate bankers will bring in the expertise of their capital markets colleagues.

In addition Commercial banking, Bank provides financial and technical assistance to broaden the private as well as public sector industrial base of the country. It prioritizes, especially, Export Oriented/Export Linkage industrial units, Efficient Import Substitution, Joint Ventures, Commercialization of local technology and promotion of agro-based industry. Corporate investment is one of the more popular and visible function of bank in all over the world. Corporate investment is a facility for the corporate clients to purchase goods or service for their business use on the assumption that the company has a stable source of income over the next few years. It enables the consumers have access to their desire goods and service based on future purchasing power.

The Corporate investment facilities are varying from bank to bank in terms of conditions, eligibility, eligible item or goods, security and the necessary documentations. Bank has introduced standards which are to improve the opportunity and interest of the entrepreneurs of the country and this function is known as corporate investment.

In Bangladesh corporate investment program of different banks have made a significant change in the corporate client group for providing loans. This loan is very much convenient for client as well as profitable for the offering banks. corporate investment facility play a vital role to create a distinctive image in consumer’s mind because it deals with one to one consumer, so by corporate investment it’s very easy to come near to consumer and to know their perception about a bank.

1.1 Origin of the Report

This report is an individual assignment as part of the internship program for the completion of the MBA course at Bangladesh University of Professionals. The internship program of 10 week has been conducted at Shajalal Islami Bank Limited from November 28, 2011 to February 3, 2011. The internal supervisor of the internship Major Asaduzzaman of Bangladesh University of Professionals and the external internship supervisor FAVP Mr. Lutful Haque of, Shajalal Islami Bank Limited, Kawran Bazar Branch assigned the research topic jointly on December 18, 2010. The research topic for the internship is “Evaluation of Corporate investment standards of different Islamic and non Islamic banks in Bangladesh and its overall effect in Bank’s Performance – A study based on Shahjalal Islami Bank Limited (SJIBL)” .With the proper guidance of both the supervisors, this report could come to an existence.

1.2 Problem Statement

Development of the country mainly depends on the growth of the industrial sector and growth of the business. For development intensive efforts should be undertaken to accelerate the rate of industrialization in the country. In order to attain this objective, large amount of industrial credit was funneled to the industrial sector. Today set up a large business or industry become a dream for the entrepreneurs. But it is not possible for an individual entrepreneur to arrange the full capital for the investment. Nowadays entrepreneur takes loan from different financial institute

In recent days financing has become an important area for Commercial Banks in Bangladesh. To align its corporate policy with the regulation of Central Bank, banks have become more concerned about corporate investment and opened windows to conduct business or set up industry in particular area.

A good number of Islamic and non Islamic Banks in our country are successfully operating this program. But the standards such as requirements, document, interest rate, installment system of the Corporate investment of different banks are different. Considering the popularity of Corporate investment it will try to identify comparison its various aspects, which are directly related, with the Corporate investment customers and Corporate investment providing bankers and its effect on the providing banks performance. Again, most of the aspects are related with the salient features of corporate investment in the relevant sample banks

1.3 Objectives of the Research

Broad Objectives

To evaluate the different present standards of corporate Investment of different Islamic and non Islamic banks and its effect on the banks overall performance, and a competitive analysis between Shahjalal Islami Bank Limited and other banks.

Specific Objectives

- To know in details about the corporate loan standards of different Islamic and non Islamic banks in Bangladesh.

- To find out the different factors clients consider for selecting bank.

- To find out the corporate clients awareness about prerequisite for corporate loan by Islamic and non Islamic banks.

- To find out the clients perception about the interest charge and other charges or expenses charged by Islamic and non Islamic banks for corporate investment.

- To find out the clients perception about loan processing time of different Islamic and non Islamic banks.

- To find out clients perception about the procedural obligation of Banks for corporate loan.

- To find out the clients perception about corporate loan disbursement system of different Islamic and non Islamic banks in Bangladesh.

- To find out the corporate clients preference towards Islamic and non Islamic bank for taking their loan.

- To find out the perception about corporate loan repayment system of different Islamic and non Islamic banks in Bangladesh

- To find out the present situation of corporate loan of different Islamic and non Islamic banks in Bangladesh.

- To find out rules and regulations of Bangladesh bank regarding corporate investment for Commercial Banks.

- To know the effect of corporate investment on Islamic and non Islamic banks performance.

1.4 Research Questions

Research Questions 1: What are the factors that are important for corporate loan of different Islamic and non Islamic bank?

Justifications: This question will help me to know the difference important factors like interest rate, payment system, loan amount, mode of repayment, securities, step taken for defaulters etc of Islamic and non Islamic bank.

Research Questions 2: What is the relationship between corporate loan program and Islamic and non Islamic Banks Performance?

Justifications: This question will help me to know what the effect of corporate loan on banks performance is.

Research Questions 3: What are the clients awareness about prerequisite of corporate loan that borrower need for loan of Islamic and non Islamic Banks?

Justification: This question will help me to know whether or not clients are well known with prerequisite documents and what procedural obligation and charges clients face for Islamic and non Islamic Banks for corporate loan.

Research Questions 4: What is the satisfaction level of required documents or securities that clients need to submit for obtaining loan of Islamic and non Islamic Banks?

Justifications: This question will help me to know how hassle client have to face for submitting required documents of Islamic and non Islamic Banks.

Research Questions 5: What are the Bangladesh Bank’s guidelines or policy about corporate loan?

Justification: This question will help me to know whether or not the Islamic and non Islamic Banks are following guidelines given form Bangladesh bank.

Research Questions 6: What is corporate client’s perception about loan disbursement system of Islamic and non Islamic Banks?

Justification: This question will help me to understand the existing loan disbursement system of Islamic and non Islamic Banks.

Research Questions 7: What is the satisfaction level of the clients about profit/interest rate, loan processing time, documentation and other factors of selected bank?

Justification: This question will help me to understand the client’s awareness about banks profit/interest rate charged loan processing time, documentation and other factors

Research Questions 8: What is corporate client’s perception about service charge or processing cost of Islamic and non Islamic Banks for corporate lending?

Justification: This question will help me to understand the client’s opinion about service charge and processing cost for corporate lending of Islamic and non Islamic Banks.

Research Questions 9: What is corporate client’s perception about repayment system of Islamic and non Islamic Banks?

Justification: This question will help me to understand the existing loan repayment system of Islamic and non Islamic Banks

1.5 Research Hypotheses

The hypothesis for this research will be formulated in details after exploratory research. However, the model of hypothesis may be as follows:

Hypotheses-1:

Null Hypothesis H0: 40 % or more of the corporate clients are aware about prerequisite corporate loan.

Alternative Hypothesis H1: less than 40 % of the corporate clients are aware about prerequisite corporate loan.

Hypotheses-2:

Null Hypothesis H0: Profit charged or interest rates of Islamic banks significantly differ from non Islamic banks for corporate investment.

Alternative Hypothesis H1: Profit charged or interest rates of Islamic banks insignificantly differ from non Islamic banks for corporate investment.

Hypotheses-3:

Null Hypothesis H0: There is an association between service charge or processing cost and corporate investment standard of Islamic and non Islamic bank.

Alternative Hypothesis H1: There is no association between service charge or processing cost and corporate investment standard of Islamic and non Islamic bank.

Hypotheses-4:

Null Hypothesis H0: There is no significant difference in corporate investment documentation process of Islamic banking and non Islamic bank.

Alternative Hypothesis H1: There is significant difference in corporate investment documentation process of Islamic banking and non Islamic bank.

Hypotheses-5:

Null Hypothesis H0: Islamic and non Islamic banks corporate investment loan processing time insignificantly differs insignificantly.

Alternative Hypothesis H1: Islamic and non Islamic banks corporate investment loan processing time insignificantly differs significantly

Hypotheses-6:

Null Hypothesis H0: Corporate investment disbursement system of Islamic bank (Payment order) is more preferable than Non Islamic Bank (Cash).

Alternative Hypothesis H1: Corporate investment loan disbursement system of Islamic bank (Payment order) is not preferable than Non Islamic Bank (Cash).

Hypotheses- 7:

Null Hypothesis H0: There is a significant difference repayment system of corporate investment standard of Islamic and non Islamic banks.

Alternative Hypothesis H1: There is no significant difference between repayment system of corporate investment standard of Islamic and non Islamic banks

Hypotheses- 8:

Null Hypothesis H0: There is a positive association between corporate loan standard and Banks performance.

Alternative Hypothesis H1: There is no positive association between corporate loan standard and Banks

Hypotheses-9:

Null Hypothesis H0: there is a significant relationship between corporate loan standard and Banks positive performance.

Alternative Hypothesis H1: There is no significant relationship between corporate loan standard and Bank positive performance

1.6 Scope of the Research

This research has deal the corporate investment of different Islamic and non Islamic banks in Bangladesh banking sector and its effect on the banks performance. Therefore my working area is whole banking sector of Bangladesh. But this kind of research needs lot of time. For convenient and complete the research with the limited time the research will be conducted competitive analysis of corporate investment standards of six privet Islamic and non Islamic bank names Shajalal Islami Bank, Social Investment Bank limited, Islami Bank Limited, Trust Bank Limited, Bank Asia and AB Bank. A primary survey has been conduct to find out the opinions of different bank executives, consumers and government regulatory authorities. It has focused on the very limited comparable credit practices of selected Banks.

1.7 Limitations of the study

The limitations of the study are as follows

- The credit policies and manuals of Banks are of confidential nature and thus it is difficult to collect the necessary literature and documents within this short time.

- The bank officials though helpful in every respect do not have much time to explain the internal procedures.

- Many operations relating to the credit extension run simultaneously by different credit officials and it will be difficult to capture the sequence of any particular credit proposal.

- Borrowers do not often have the time to cooperate in the information gathering process.

1.8 Benefits of the study

Commercial banks are both Islamic and non Islamic providing different types of investment for profit form lending of their deposits. Besides there are many business clients who looking for a suitable lending opportunities. This report will help the management of Islamic and non Islamic Banks to know the opinions of the clients about policy of corporate investment and as results banks will be able to give a suitable investment program that will attract more business people for taking financial help from their banks.

1.9 Report preview

The report has discussed mainly in eight chapters. Literature review and overview of Shajalal Islami Bank are discussed in the second and third chapter. Fourth chapter talks about the corporate investment standers of different Islamic and non Islamic banks of Bangladesh. The project part of the research has discussed at chapter five. Summary of findings and recommendation are discussed briefly in chapter six and seven respectively. And finally the chapter eight is the conclusions.

2. Literature Review

The primary objectives for the formation of the first Islamic bank, Bank Islam Malaysia Berhad was to strive in its operation as a commercial bank based on Shariah laws in facilitating and banking services to both the Muslim and non-Muslim societies in this country by achieving strength and capacity to develop from time to time. Therefore, the bank has to operate its business without Riba or usury as an alternative to the conventional banking operating based on usury or interest. In order to operate a banking business and other financial dealings, the bank has to operate based on profit and loss sharing mechanism. This is to ensure better social justice in the distribution of the added created wealth of the bank to the depositors, customers benefiting from financings and the equity holders of the bank. In this regard, the bank has to ensure it may become strong financially and expanding in all aspects of its operation as this will then become the measure on the ability of Shariah laws and rules as well as capabilities of the Muslims in offering an alternative way of life when dealing with banking business (Mohd Nasir and Amirul Hafiz, 2006).

The key characteristic of Islamic finance is the prohibition of Riba, Islamic Financial ethics and law. The literal meaning of Arabic word, Riba is increase, addition of growth. However, it is usually translated as usury. Riba or usury is defined as extra or excess in lending and borrowing or additional in terms of weight or measurement in an exchange or buying and selling transaction. All transactions and contracts must be free from elements of Riba. The prohibition of Riba in Islamic finance is form based traditions (habith) and relates to prohibition of Riba in loan, sale or exchange contracts or exchange sale contract. Those who earn from usury stand only like one who is struck by the devil’s touch. This is because they claim that usury is a form of trade. Therefore the act of giving and taking as well as managing usury or interest is forbidden in Islam. Usury is any fixed percentage of earnings in return for funds deposited (Mohd Nasir and Amirul Hafiz, 2006) Islamic banking is an activity based on Islamic Syariah principles, which do not allow the paying and receiving of interest and promotes profit sharing in the conduct of banking. The most important difference between Islamic and conventional banking is the prohibition of interest in Islamic banking. Islamic banking activity is based on the trading principles of buying and selling of assets. Following that, in conventional financing, customer’s outstanding loan consists of principal plus the interest charged then onwards. The interest is actually the financial institution’s cost in obtaining the funds and its profit. Islamic financing work on the concept of buying and selling where the financial institution purchases the property and subsequently sells it to customers above the purchase price (Mohd Nasir and Amirul Hafiz, 2006).

The “Islamic banking system has gained momentum worldwide”. Citibank opened one new branch in Bahrain and Sudan adhering to Islamic Sharia’h principles. When a customer borrows money from a bank, it may lead to the interest rate. Thus, Islamic bank will use Shariah principles and specially offer the product and services like conventional banks. Customer pleasure has been a critical perception in contemporary marketing related to buyer behaviour. If customers are satisfied with a particular product or services offering after its use, then they are likely to engage in a repeat purchase. Then, the customer satisfaction is often described as being related to factors such as service quality and future services like convenience, competitiveness, location of service providers and a form of attitude that results from the comparison of expectation with performance. The Islamic banking system is expected to face strong competition not only from the Islamic banks but also from well-established conventional banks offering Islamic products and services (Naser and Pendlebury, 1997).

Modern banking system was introduced into the Muslim countries at a time when they were politically and economically at low ebb, in the late 19th century. The main banks in the home countries of the imperial powers established local branches in the capitals of the subject countries and they catered mainly to the import export requirements of the foreign businesses. The banks were generally confined to the capital cities and the local population remained largely untouched by the banking system. The local trading community avoided the “foreign” banks both for nationalistic as well as religious reasons. However, as time went on it became difficult to engage in trade and other activities without making use of commercial banks. Even then many confined their involvement to transaction activities such as current accounts and money transfers. Borrowing from the banks and depositing their savings with the bank were strictly avoided in order to keep away from dealing in interest which is prohibited by religion.[1]

In 1963, Islamic banking came into existence on an experiment basis on a small scale in a small town of Egypt. The success of this experiment opened the doors for a separate and distinct market for Islamic banking and finance and as a result, in 1970s Islamic banking came into existence at a moderate scale and a number of full-fledge Islamic banks was introduced in Arabic and Asian countries. Most of these Islamic banks were in Islamic countries. Having started on a small scale, Islamic banks and non-banking financial institutions are now in operation even on more intensive scale. Today, Islamic banks are operating in more than sixty countries with assets base of over $166 billion and a marked annual growth rate of 10%-15%. In the credit market, market share of Islamic banks in Muslim countries has risen from 2% in the late 1970s to about 15 percent today (Aggarwal and Yousaf 2000). These facts and figures certify that Islamic banking is as viable and efficient as the conventional banking.

To adhere to the teachings of Islamic Law (Shari’ah) – avoid paying and receiving Riba, avoid Gharar, investing in profit-sharing ventures, avoid investing in such business that are unethical and impermissible, and making socially responsible investments – are the distinguishing points as well as goals of all Islamic banks. How well these Islamic financial institutions have performed and to what extent they have been successful in achieving these goals have been the question marks for the scholars, researchers, and the stakeholders.

Where Islamic banking, on the one side, is being regarded as a fastest growing market, on the other side, it is not free from issues, problems, and challenges. Numerous studies have been performed since the inception of the modern Islamic banking and finance. Conceptual issues underlying interest free financing (Ahmad 1981, Karsen 1982) have been the prime focus of these previous studies on Islamic banks. It is hard to find enough coverage in the existing literature on the issues of viability of Islamic banks and ability to mobilize saving, pool risk and facilitate transactions (Hassan & Bashir 2003). However, there are few studies that have focused on policy implications of eliminating interest payments [see for example, Khan (1986) and Khan & Mirakhor (1987)].

Although the phenomenon of Islamic Banking and finance has emerged in recent yearsand despite the considerable development of Islamic banking sector, the studies focusing on the efficiency of the Islamic banks are still limited in number [see, for example, Yudistira (2003) and Sufian (2007)]. Most of the studies that have been conducted, generally evaluate the performance of Islamic banks with regards to the relationship between profitability and bank characteristics. Bashir (2000) and, Hassan & Bashir (2003) employ bank level data and perform regression analysis to determine the underlying determinants of Islamic performance. Samad & Hassan (2003) and Kader & Asarpota (2007) apply financial ratio analysis to assess the performance of the Malaysian Islamic bank and UAE Islamic banks respectively. Similarly, to measure efficiency of Islamic banks in Bangladesh, Sarker (1999) utilizes Banking efficiency model and claims that Islamic banks can stay alive even within a traditional banking architecture in which Profit-and-Loss Sharing (PLS) modes of financing are less dominated. Sarkar (1999) further claims that Islamic financial products have different risk characteristics and consequently different prudential regulations should be in place.

Samad and Hassan (2000) evaluate intertemporal and interbank performance in profitability, liquidity, risk and solvency, and community involvement of an Islamic bank (Bank Islamic Maalysia Berhad (BIMB) over 14years for the period 1984-1997. The study is intertemporal in that it compares the performance of BIMB between the two time period 1984-1989 and 1990-1997. This is not a new method (Elyasiani 1994). To evaluate interbank performance, the study compares BIMB with two conventional banks (one smaller and one larger than BIMB) as well as with 8 conventional banks. Using financial ratios to measure these performance and F-test and T-test to determine their significance, the results show that BIMB make statistically significance improvement in profitability during 1984-1997, however, this improvement when compared with conventional banks is lagging behind due to several reasons. This result is consistent with that of Samad (1999) and Hassan (2003). The study also reveals that BIMB is relatively less risky and more solvent as compared to conventional banks. These results also conform to risk-return profile that is BIMB is comparatively less profitable and less risky. Performance evaluation of BIMB indicates that it is more liquid as compared to the group of 8 conventional banks. Results of the primary data gathered by surveying 40% to 70% bankers identify that lack of knowledgeable bankers in selecting, evaluating and managing profitable project is a significant cause why Musharka and Mudarabah are not popular in Malaysia.

Survey and analysis by Ismail and Abdul Latif (2001) on financial reporting of Islamic banks shows that the main difference between standards produced by Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) and selected Islamic banks in Malaysia including Islamic bank is in classification of deposits funds and the particular prominence that is given to restricted investment accounts and unrestricted investment accounts from other deposits like current and saving. Most of the intellectual activity over the past few decades has been geared toward into developing Shari’ah-compliant alternatives for bank financing. The deposits side attracted little attention. A closer look at the matters reveals that the line of distinction between Islamic banks and their interest-based counterparts is thin. Tahir (2007)

Abdus Samad (2004) in his paper examines the comparative performance of Bahrain’s interest-free Islamic banks and the interest-based conventional commercial banks during the post Gulf War period 1991-2001. Using nine financial ratios in measuring the performances with respect to (a) profitability, (b) liquidity risk, and (c) credit risk, and applying Student’s t-test to these financial ratios, the paper concludes that there exists a significant difference in credit performance between the two sets of banks. However, the study finds no major difference in profitability and liquidity performances between Islamic banks and conventional banks.

Kader and Asarpota (2007) utilize bank level data to evaluate the performance of the UAE Islamic banks. Balance sheets and income statements of 3 Islamic banks and 5 conventional banks in the time period 2000 to 2004 are used to compile data for the study. Financial ratios are applied to examine the performance of the Islamic banks in profitability, liquidity, risk and solvency, and efficiency. The results of the study show that in comparison with UAE conventional banks, Islamic banks of UAE are relatively more profitable, less liquid, less risky, and more efficient. They conclude that there are two important implications associated with this finding: First, attributes of the Islamic profit-and-loss sharing banking paradigm are likely to be associated as a key reason for the rapid growth in Islamic banking in UAE. Second, UAE Islamic banks should be 18 regulated and supervised in a different way as the UAE Islamic banks in practice are different from UAE conventional banks.

Saleh and Rami (2006) in order to evaluate the Islamic banks’ performance in Jordon, examine and analyze the experience with Islamic banking for the first and second Islamic bank, Jordan Islamic Bank for Finance and Investment (JIBFI), and Islamic International Arab Bank (IIAB) in Jordon. The study also highlights the domestic as well as global challenges being faced by this sector. Conducting profit maximization, capital structure, and liquidity tests as performance evaluation methodology, the paper finds several interesting results. First, the efficiency and ability of both banks have increased and both banks have expanded their investment and activities. Second, both banks have played an important role in financing projects in Jordan. Third, these banks have focused on the short-term investment. Fourth, Bank for Finance and Investment (JIBFI) is found to have high profitability. Finally, the study concludes that Islamic banks have high growth in the credit facilities and in profitability.

Bashir (2000) examines the determinants of Islamic banks’ performance across eight Middle Eastern countries between 1993 and 1998. Using cross-country bank-level data on income statements and balance sheets of 14 Islamic banks in eight Middle Eastern countries for each year in the 1993-1998, the study closely examines the relationships between profitability and the banking characteristics. After controlling for economic and financial structure indicators such as – macroeconomic environment, financial market structure, and taxation – the study shows some very important and interesting results. First, the profitability measures of the Islamic banks react positively to the increases in capital and loan ratios, which is intuitive and consistent with previous studies. Second, the study highlights the empirical role that adequate capital ratios and loan portfolios play in explaining the performance of Islamic banks. Third, the results indicate that customer and short-term funding, non-interest earning assets, and overhead are also important for promoting banks’ profits. Fourth, the results reveal that foreign-owned banks are more profitable than their domestic counterparts. Fifth, keeping other things constant, there is evidence that implicit and explicit taxes affect the bank performance measures negatively. Sixth, favorable macroeconomic conditions have positive effect on performance measures of the bank. Finally, the results of the study show that stock markets are complementary to bank financing.

A similar study performed by Hassan and Bashir (2003) analyzes how the performance of the Islamic banks is affected by bank characteristics and the overall financial environment. They utilize cross-country bank level data on Islamic banks in 21 countries for each year in 1994-2001 to closely examine the performance indicators of Islamic banks. In general, they find their analysis of determinants of Islamic banks profitability consistent with previous findings. The study indicate that controlling for macroeconomic environment, financial market structure, and taxation, the high capital and loan-to-asset ratios lead to higher profitability. Everything remaining equal, the regression result of the study reveals that there is negative effect of implicit and explicit taxes on the bank performance measures, while there is positive impact of favorable macroeconomic conditions on bank performance measures. That is, favorable macroeconomic environment appears to kindle higher profit margins. Results also show surprisingly a 19 strong positive correlation between profitability and overhead. That is in the Islamic banking market expense preference behavior appears to hold. They also find in their study that size of the banking system has negative impact on the profitability except net on interest margin.

Yudistira (2003) in his study makes an empirical analysis on efficiency and provides new evidences on the performance of 18 Islamic banks over the period 1997-2000. Panel data set for this time period is extracted from non-consolidated balance sheets and income statements of these Islamic banks with specific purpose of seeing the impact of recent financial crises on efficiency of Islamic banks. This study is different from previous studies in that it utilizes non-parametric approach, Data Envelopment Analysis (DAE) to analyze the technical efficiency, pure technical efficiency, and scale efficiency of Islamic banks. Being in line with the principle of Islamic financial system, the intermediation approach is used to specify input-output variables of Islamic banks. The study finds several results. First, the overall efficiency results indicate that there is a small (at just over 10%) inefficiency across 18 Islamic banks, which is considerable as compared to many conventional counterparts. Similarly, global crisis in 1998-1999 badly affected the performance of Islamic banks; however, they performed better afterwards. Second, the results show that small and medium sized Islamic banks faced diseconomies of scale which suggests that M&A should be encouraged. Moreover, as compared to their nonlisted counterparts, publicly listed Islamic banks are found to be less efficient. Lastly, Country specific factors mainly determined the efficiency differences across sample data.

Sufian (2007) performs a similar study to provide new evidence on the relative efficiency between the domestic and foreign banks Islamic banking operation in Malaysia during the period of 2001-2004. Non-parametric Data Envelopment Analysis (DEA) methodology has been utilized to distinguish between three different types of efficiency: technical, pure technical and scale efficiencies. The study also used intermediation approach to specify input-output variables of Islamic banks. A series of parametric and non-parametric tests were performed to examine whether the domestic and foreign banks were drawn from the same population, as most of the most of the results could not reject the null hypothesis at 5% level of significance. Finally, Spearman Rho Rank-Order and the Parametric Pearson correlation coefficients were employed to examine the association between the efficiency scores derived from the DEA results with the traditional accounting ratios. Several results are drawn form the study. The results from the DEA show that efficiency of Malaysian Islamic banks recovered slightly in years 2003 and 2004 after declining in year 2002. The domestic Islamic banks are found marginally more efficient than foreign Islamic banks. The study examines that operating at the wrong scale of operations has been the main reason for the Malaysian Islamic banks inefficiency. The dominance of scale in determining the technical efficiency of Malaysian Islamic banks is further confirmed from the results of the correlation coefficients. The results of the study also indicate that profitability is significantly and positively correlated to all efficiency measures.

A similar study performed by Bashir (2000), In general, our analysis of determinants of Islamic bank profitability confirms previous findings. Controlling for macroeconomic environment, financial market structure, and taxation, the results indicate that high leverage and large loans to asset ratios lead to higher profitability. The results also indicate that foreign-owned banks are more profitable than their domestic counterparts. Everything remaining equal, there is evidence that implicit and explicit taxes affect the bank performance measures negatively. Furthermore, favorable macroeconomic conditions impact performance measures positively.

3. Overview of Shajalal Islami Bank Limited

Banks play an important role in economy of any country. At Bangladesh Muslim constituted more than about 90% of its population. This population possesses strong faith on Allah and wants to lead their lives as per the constructions given in the holy Quran and the way shown by the prophet Hazrat Muhammad (Sm). But No Islamic Banking system was developed here upto 3983. The traditional banking is fully based on interest it is commonly meant as commercial banks. But interest is absolutely prohibited by Islam. As a result people of Bangladesh have been experiencing such a no-Islamic and prohibited banking system against their normal values and faith.

In the Islamic banking system the bank receive no interest. In this case bank receives its entire deposit from the investment of the clints on the basis of profit sharing places it to the actual entrepreneurs on the basis of profit sharing. So it is clear that in case of the traditional banking system, a fixed percentage of interest, irrespective of income earned is paid to the depositors. The depositors of Islamic banking are never deprived of excess income, which the bank may make at the end of year. Not only has this traditional bank given fixed interest rate even when they incur operational loss. The critics of Islamic Banking system are of the opinion that both are found same in terms of deposits mobilization and advances investment.

The number of banks in all now stands at 49 in Bangladesh. Out of the 49 banks, four are Nationalised Commercial Banks (NCBs), 28 local private commercial banks, 12 foreign banks and the rest five are Development Financial Institutions (DFIs). Among these banks only six local banks have fully Islamic banking system, Shajalal Islami Bank Limitd is one of the Islami Bank.

3.1 Background of SJIBL

Bangladesh is one of the largest Muslim countries in the world. The people of this country are deeply committed to Islamic way of life as enshrined in the Holy Qur’an and the Sunnah. Naturally, it remains a deep cry in their hearts to fashion and design their economic lives in accordance with the precepts of Islam.

The establishment of Shahjalal Islami Bank Limited (SJIBL) on 2001 is the true reflection of this inner urge of its people, which started functioning with effect from 10th May 2001. It commenced its commercial operation in accordance with principle of Islamic Shariah on the 10th May 2001 under the Bank Companies Act, 1991. It is committed to conduct all banking and investment activities on the basis of interest-free profit-loss sharing system. In doing so, it has unveiled a new horizon and ushered in a new silver lining of hope towards materializing a long cherished dream of the people of Bangladesh for doing their banking transactions in line with what is prescribed by Islam. With the active co-operation and participation of Islamic Development Bank (IDB) and some other Islamic banks, financial institutions, government bodies and eminent personalities of the Middle East and the Gulf countries, Islami Bank Bangladesh Limited has by now earned the unique position of a leading private commercial bank in Bangladesh. Shahjalal Islami Bank Limited” offers the full range of banking services for personal and corporate customers, covering all segments of society within the framework of Banking Company Act and rules and regulations laid down by our central bank. Diversification of products and services include Corporate Banking, Retail Banking and Consumer Banking right from industry to agriculture, real estate to software and is backed by the latest technology.

The Bank is managed by a Team of professional Executives and Officials having profound banking knowledge & expertise in different areas of management and operation of Banks. During the short span of time, Shahjalal Islami Bank so far introduced a good number of attractive deposit products to broaden the resource base and also Investment products to deploy the deposit resources so mobilized. Some more schemes covering the deposits, Investments & Services will be introduced gradually in near future suiting to the taste and requirement of the clients. The Bank has a strong Shariah Council consisting of prominent Ulama, Fuquah & Economists who meet periodically to confer decisions on different Shariah issues relating to Banking Operation & to address them and to give necessary guidance to the management on Shariah Principle. Since inception, Bank has been performing in all the sectors i.e. general Banking, Remittance, Import, Export & Investment. All our branches are fully computerized having on line Banking facility for the clients.

During last nine years SJIBL has diversified its service coverage by opening new branches at different strategically important locations across the country offering various service products both investment & deposit. Islamic Banking, in essence, is not only INTEREST-FREE banking business, it carries deal wise business product thereby generating real income and thus boosting GDP of the economy. Board of Directors enjoys high credential in the business arena of the country, Management Team is strong and supportive equipped with excellent professional knowledge under leadership of a veteran Banker Mr. Muhammad Ali.

Company Profile in Brief | |

| Name | Shahjalal Islami Bank Limited |

| Chairman | Alhaj Engr. Md. Towhidur Rahman |

| Managing Director | Muhammad Ali |

| Registered Office | 2/B, Uday Sanz,, Gulshan South Avenue, Gulshan-1,Dhaka-1216 |

| Auditors | M/S. Syful Shamsul Alam & Co |

| Tax Advisor | M/S K.M Hasan & Co. |

| Legal Advisor | Hasan & Associates |

| Legal Status | Public Limited Company. |

| Nature of Business | Commercial, Corporate, Investment & Retail Banking |

| First meeting of the promoters held on | 4th September, 2000. |

| Date of Certificate of Incorporation | 1st April, 2001. |

| Date of Certificate of Commencement of Business | 1st April, 2001. |

| Banking License received on | 18th April, 2001. |

| First Branch License received on | 24th April, 2001 |

| Inauguration held on | 10th May, 2001. |

| Authorized Capital | Tk.80.00 crore. |

| Paid up Capital | Tk.20.50 crore. |

| Number of Branches (as on 20.06.2010) | 52 |

| Telephone No. | 88-02-9570812, 7160591 |

| Fax No. | 88-02-9570809, 9553562 |

| Website | www.shahjalalbank.com.bd |

3.2 Vision of Shajalal Islami Bank Limited

To be the unique modern Islami Bank in Bangladesh and to make significant contribution to the national economy and enhance customers’ trust & wealth, quality investment, employees’ value and rapid growth in shareholders’ equity.

3.3 Mission of Shajalal Islami Bank Limited

To expand Islamic banking through welfare oriented banking system, ensure equity and justice in economic activities, extend financial assistance to poorer section of the people and achieve balanced growth & equitable development.

- To provide quality services to customers.

- To set high standards of integrity.

- To make quality investment.

- To ensure sustainable growth in business.

- To ensure maximization of Shareholders’ wealth.

- To extend our customers innovative services acquiring state-of-the-art technology blended with Islamic principles.

- To ensure human resource development to meet the challenges of the time.

3.4 Moto of Shajalal Islami Bank Limited

Committed to Cordial Service.

3.5 Objectives of Shajalal Islami Bank Limited

From time immemorial Banks principally did the functions of moneylenders or “Mohajans” but the functions and scope of modern banking are now-a-days very wide and different. They accept deposits and lend money like their ancestors, nevertheless, their role as catalytic agent of economic development encompassing wide range of services is very important. Business commerce and industries in modern times cannot go without banks. There are people interested to abide by the injunctions of religions in all sphere of life including economic activities. Human being is value oriented and social science is not value-neutral. Shahjalal Islami Bank believes in moral and material development simultaneously. “Interest” or “Usury” has not been appreciated and accepted by “the Tawrat” of Prophet Moses, “the Bible” of Prophet Jesus and “the Quran” of Hazrat Muhammad (sm).

Efforts are there to do banking without interest Shahjalal Islami Bank Limited avoids “interest” in all its transactions and provides all available modern banking services to its clients and want to contribute in both moral and material development of human being. No sustainable material well being is possible without spiritual development of mankind. Only material well-being should not be the objective of development. Socio-economic justice and brotherhood can be implemented better in a God-fearing society.

Other objectives of Shahjalal Islami Bank include:

- To establish interest-free and welfare oriented banking system.

- To help in poverty alleviation and employment generations.

- To contribute in sustainable economic growth.

- To remain one of the best banks in Bangladesh in terms of profitability and assets quality.

- To earn and maintain a ‘Strong’ CAMEL Rating

- To ensure an adequate rate of return on investment.

- To maintain adequate liquidity to meet maturing obligations and commitments.

- To play a vital role in human development and employment generation.

- To develop and retain a quality work force through an effective Human Resources Management System.

- To pursue an effective system of management by ensuring compliance to ethical norms, transparency and accountability at all levels.

3.6 Strategies of Shahjalal Islami Bank include

- To strive for customers best satisfaction & earn their confidence.

- To manage & operate the Bank in the most effective manner.

- To identify customers needs & monitor their perception towards meeting those requirements.

- To review & updates policies, procedures & practices to enhance the ability to extend better services to the customers.

- To train & develop all employees & provide them adequate resources so that the customers needs are reasonably addressed.

- To promote organizational efficiency by communicating company plans, polices & procedures openly to the employees in a timely fashion

3.7 Management Strategy of Shahjalal Islami Bank include

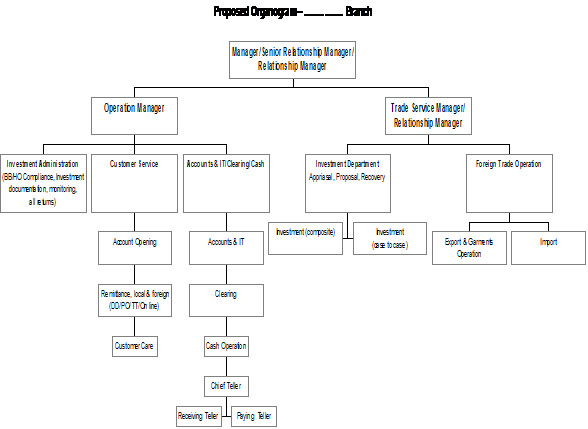

The entire employees are divided into two categories at large:

a) Bank Official

b) Bank staff

The hierarchy of the Management is as follows:

The whole management functions as per following Organogram:

3.8 Financial Strategy

Shahjalal Bank limited started it’s business operation when the world had just experienced the deterioration in the overall economy and declining growth for almost all major regions of the world. The overall economic scenario in Bangladesh was also under crucial situation. Confronting many different difficulty of our economy the bank has successfully established a track of steady growth and desired level of achievement. Within five months of inception, the Bank could attain “breakeven” position. As on 20.12.2003, the Bank has achieved profit worth of Tk.19.00 crore. Besides, the bank is increasing asset financing. The Board of Directors of the Bank does not compromise on the quality of assets and the management, within many obstacles has shown their ability to generate steady growth in business. In the process, the Bank has been able to maintain a satisfactory capital adequacy ratio. As per guideline of the central bank, limit on portfolio concentration has necessitated diversification of it’s investment. As a result, small and medium enterprises have been receiving financial assistance.

The management has become more strength in servicing the clients by developing its technology, human resources and service policy.

3.9 Stock Summary of SJIBL

Authorized Capital : Tk. 4,000 million

Paid up Capital : Tk. 2,245.98 million

Face Value per Share : Tk. 100

3.10 Board of Directors of SJIBL

| Chairman | Alhaj Engr. Md. Towhidur Rahman |

| Vice Chairmen | Alhaj Mohiuddin Ahmed Alhaj Md. Sanaullah Shahid |

| Directors | Alhaj Sajjatuz Jumma, Alhaj Mohammed Faruque, Alhaj Anwer Hossain Khan, Alhaj Tofazzal Hossain, Alhaj Md. Harun Miah, Alhaj Mohammed Farooq, Alhaj Mohammed Hasan, Alhaj Abdul Halim |

| Independent Directors | Alhaj Nazmul Islam Nuru |

| Sponsors | Alhaj Md. Abdul Mannan |

| Managing Director | Mohammad Ali |

3.11 Shariah Council of SJIBL

Shariah Council of the Bank is playing a vital role in guiding and supervising the implementation and compliance of Islamic Shariah principles in all activities of the Bank since its very inception.

Members of the Shariah Council meet frequently and deliberate on different issues confronting the Bank on Shariah matters. They also conduct Shariah inspection of branches regularly so as to ensure that the Shariah principles are implemented and complied with meticulously by the branches of the Bank.

3.12 Management Hierarchy of SIBL

3.13 Activities of Shajalal Islami Bank Limited

The major actives of SJIBL is exchanges of right to possession of money and exchange of money from credit for exchange of money from credit for money. As a banking business it includes deposits taking, extending credit to corporate organization, retail and small and medium enterprise, leases and hire purchase financing, issuance of local and international credit cards etc.

The mode of banking included interest based conventional and shariah based Islamic Banking. It also performs Merchant Banking function under the license issued by Securities and Exchange Commission, Dhaka , Bangladesh which offers portfolio management, Issuemanagement, underwriting, lease financing, lending at share purchase.

The main function of SJIBL are-

- Retail / Personal Banking

- Foreign Remittance

- Credit Facilities and Programme

- Utility Service

- Micro Enterprise and Special Credit

- Rural Banking & Credit Programme

- Merchant Banking

- Bank Guaranty

3.14 Product and Services of Shajalal Islami Bank Limited

Shajalal Islami Bank Ltd. has launched several financial products and services considering the needs and requirements of the cuslomer SJIBL have classified the product under different head as below:

3.14.1 General Banking:

General Banking is the starting point of all banking operation. General banking division aids in taking deposits and simultaneously provide some ancillaries services. It provides those customers who come frequently and who come one time in banking for enjoying ancillary services. It is the department which provides day to day services to customers. Everyday it receives deposits from the customers and meets their demands for cah honoring check. General banking consist of the following sections:

- Customer service

- Account opening/ Closing

- Payment Order Issue

- Demand draft issue/ Collection

- T.T Issue and collect

- Account Transfer

- Deposit

- Clearing etc

3.14.2 Deposit Scheme

Deposit comes from saving and according to investment scheme able fund theory, the four source of saving are house hold, business, government and companies retain earning. Among these as a low cost sensitive and large source house hold savings is the most important for bank. Considering the demography, income, and other variables SJIBL has introduce the following deposit schemes:

- Mudaraba Monthly Income

- Mudaraba Double Money

- Mudaraba Monthly Deposit

- Mudaraba Millionaire

- Mudaraba Haji Deposit

- Mudaraba Housing Deposit

- Mudaraba Small Business

- Mudaraba Cash Waqf Deposit

- Mudaraba Lakhopoti Deposit

- Mudaraba Bibaho Deposit

- Mudaraba Mohor Deposit

- Mudaraba Shikhkha Deposit

- Mudaraba Special Term Deposit

Deposit schemes are classified by above categories as policy to meet the customers need and diversification of sources of financing.

3.14.3 Investment Scheme

Bank has to invested the collected fund at higher rate than the depositors rate and difference between the deposit and investment rare is known as spread. SJIBL offers several investment scheme considering customers occupation, business and other requirements. These are called SME and Customer Credit (CC) which have more Return on Investment (ROI) than the corporate investment. SJIBL has introduce the following investment schemes:

- Small & Medium Enterprise Investment

- Small Business Investment

- Housing Investment

- Household Durable

- Car Investment

- CNG Conversion Investment

- Overseas Employment Investment

- Investment Scheme for Doctors

- Investment Scheme for Marriage

- Investment Scheme for Education

3.14.4 Foreign Exchange Service

Foreign exchange department of SIBL is one of the most important department of all department this department deals the following activities

- Import section

- Export section

- Foreign Remittance section

3.15 Corporate Investment Processing of SJIBL:

Since Shahjalal Islami Bank is running Shariya based banking system, so they exercise islamic term for Deposit Scheme, Loan .etc. For example “loan” term is used as Investment. The bank offers a wide range of Islamic financial products like

a) Short Term financial

b) Mid term financial

c) Long term financial – Up to 5 years

d) Long term financial -Above 5 years.

But the processing system of all investment products is same. Here we give a short overview about the whole process in theoretically.

3.15.1 Life Cycle of Loan Products:

- The investment-client starts repayment as per schedule in regular manner for the disbursed amount. In parallel, the Branch Investment Officer starts monitoring. If any deviation founds in compliance of terms and condition and Investment financial health he prepares an early alert and send it to Investment Administration Division, HO.

- If the customer repays the Investment regularly the account is adjusted at maturity. Sometime it may require restructuring of the repayment schedule at any time during the validity period. It is possible at any time. If repayment is irregular, it becomes overdue and/or classified.

- At the end of month, the Profit of the all accounts (except BAD/LOSS marked) applies to the Investment account and the Profit for the regular Investment is credited to the income account. In case of classified account (except BAD/LOSS), the Profit is credited to the Suspense Account.

- The classified Investment information must be reported to the central bank at the month end and quarter end by submitting the CL, CIB and SBS3 report

- Whenever the Investment account is marked BAD/LOSS, the Profit calculation continues but the Profit application to Investment account stops.

- If the Classified Investment account seems recoverable, then as per Head office approval Investment account proceeds to rescheduling. If the Investment account is rescheduled it gets a newer life. The rescheduled Investment information must be kept in the system for Central bank reporting.

- During the rescheduling, the suspense Account balance for that Investment account must be recovered first. Sometimes it may hold some balance after the rescheduling and declassification of the Investment account if the recovered amount is less than the suspense balance for that Investment.

- If the Classified Investment account seems unrecoverable, then the HO recovery unit proceeds to Lawsuit filing. After lawsuit filing the system stops Profit calculation. And capitalize all unapplied Profit to the Investment account while marking Lawsuit. And System just holds the account status open until the Court gives any resolutions.

- As per court order, recovery unit of Head office liquidates the collaterals of the customer and adjusts the Investment.

- Meanwhile, if the Investment is not rescheduled, the Recovery Unit writes off the Investment and transfers the Investment to a separate Written-off Investment Register. Though it is washed out from the balance sheet of the Bank, the recovery process continues.

3.15.2 Process Work Flow:

- Prospective customer collects application form from the respective Branch and submits the Investment application to the relationship officer/Branch Investment officer.

- The relationship officer / Branch Investment officer scrutinizes the application form, collects necessary information, if any required and assess the investment worthiness of the investment-client. If the proposal is not worth /bankable he returns a refusal letter to the customer immediately. If it is acceptable he forwards the same to Branch investment committee.

- If the Branch Investment committee founds viable then they will approve the Investment and forward the application to the Investment Division, Head office, otherwise they will reject the proposal.

- Head office Investment Official will scrutinize the application, analyze and prepare a memo with due diligence along with their observations/ results of analysis and to place it to the HO Investment Committee. He also submits “One Obligor Report” for the customer if the customer has other liabilities with the Bank.

- After full satisfaction, the proposal will be approved by the existing delegated authority of head office (Head of investment Committee-> Managing Director-> Executive Committee-> Board). If not, then he will decline the proposal. If the Proposal is approved, the sanction letter of the Investment is sent to branch along with required terms and Documentation list. And Investment administration division will setup an approval limit for the customer of sanctioned/approved Investments.

- After getting the approval, branch offers the Investment to the customer. And collects the customer’s acceptance along with required security documents. Branch then informs the head office with a list of document those have received from the customer and puts the documents in safe custody and records the entry in Safe in/ Safe out register.

- Branch then initiate the Investment commitment and request for disbursement authority from Head office Investment Administration division.

- Head Office Investment Administration Division sets up the Disbursement Limit and render authority to the Branch.

Getting the disbursement authority, Branch creates the Investment Account/Deal for the Investment against the Investment limit and disburses the amount to Customer by crediting Pay order or Service account and debiting the Investment Account and generates a repayment schedule as per HO sanction

3.15.3 Steps in Approval Process:

Step-1: A potential customer collects prescribed Investment Application Form (Annexure -1) from the Relationship Officer of Branch/Regional Corporate Banking Department/Corporate Banking Division, Head Office/Web address of the Bank. Later, he/she submits the filled in Investment Application Form along with necessary papers and documents.

Step-2: The Relationship Officer scrutinizes the Investment Application Form and other documents submitted by the customer and make a preliminary assessment on creditworthiness of the potential investment-client. He/she collects further information from the customer if it is felt necessary. And, if he/she finds the proposal not bankable, he/she sends a refusal letter to the customer immediately. On the other hand, if he/she finds it acceptable, he/she forwards the application to the concerned Relationship Manager.

Step-3: The Relationship Manager, singly or jointly with Relationship Officer, visit the customer’s business premise and try to acquire proper understanding about the business position, actual investment requirement, repayment capacity etc. Besides, he/she negotiates with the customer about the structure of the proposed investment facility. Apart from this he/she assesses the value of the security to be offered and prepares Valuation Report. Finally, the Relationship Manager summarizes all these information in the Pre-sanction Inspection Report/Call Report/Visit Report in the Bank’s prescribed format in which he/she recommends for some specific investment facility for the customer.

Step-4: The Relationship Manager sends the Pre-sanction Inspection Report (Annexure-3) to the Corporate Banking Division, Head Office or to the Regional Corporate Banking Department, if any. The Head of Corporate Banking Division/Regional Corporate Banking Department assesses the investment proposal. He/she might contact with the Relationship Manager or directly to the customer for any query. Finally, if he/she decides to refuse the proposal or to proceed further with the proposal and communicates his /her decision to the Relationship Manager.

Step-5: If the Head of Corporate Banking Division/Regional Corporate Banking Department refuses, the Relationship Manager sends a refusal letter to the customer. If he/she is positive, the Relationship Officer collects duly filled in CIB Inquiry Form from the customer and submits it to the Investment Information Bureau of Bangladesh Bank for latest CIB Report through Investment Administration Department, Head Office. Everything may stop here if CIB report shows that the customer has classified liability in its name and/or in the name of its sister concern(s). In that case, the customer is regretted accordingly.

Step-6: Meanwhile, the Relationship Officer rates the customer as per Risk Grading System of the Bank. Finally, the Relationship Manager originates a formal Investment Proposal in which the Head of Corporate Banking Division affixes his/her recommendation regarding the proposal.

Step-7: The Head of Corporate Banking Division, Head Office then forwards the proposal to the Investment Risk Management Department, Investment Division along with necessary papers. The concerned Investment Officer conducts in-depth Investment Analysis (Due Diligence) and affixes his/her comments/observations/findings.

Step-8: The Investment Officer places the proposal along with his/her comments/observations/findings before the Head of Investment/Head Office Investment Committee. The Head of Investment may contact with the Head of Corporate Banking for his/her queries. He/she may also express his/her reservation on a particular issue/risk and ask the Head of Corporate Banking to clarify his/her position and/or risk minimization technique(s). Finally, he might decline the proposal. And, if he/she is fully satisfied he/she may approve the facility if it is within his/her delegated authority. If it is beyond his/her delegated authority, he /she would recommend the proposal to the Managing Director.

Step-9: The Managing Director may decline the proposal if he/she is not satisfied about the proposal. If he/she is satisfied and if it is within his/her delegated power, he/she approves the proposal. If the proposal exceeds his/her delegated authority, he/she recommends it to the Executive Committee of the Board of Directors, which has the supreme authority to sanction any investment.

Step-10: If the facility is approved (whoever is the approval authority), the Investment Risk Management Department of Investment Division issues sanction letter to the Corporate Banking Division/Branch along with a Documentation Check List which clearly spells out what are the documentation formalities required to be completed before disbursement. A copy is sent to Investment Administration Department, Investment Division.

Step-11: The Corporate Banking Division/Branch then issues sanction letter to the customer in line with the letter of Investment Risk Management Department and requests the customer to complete documentation formalities.

3.15.4 Phases of Disbursement:

During the disbursement the following steps will follow:

Ø Create Customer profile

- Entry to the Sanction Register after the proper approval of the TERM Investment.

- Branch will collect the entire necessary document and the documents submitted by the Customer would be entered in Safe-In and Safe-Out register and linked with the sanction ID.

- Investment Administration Division official will check the document status from the Document register.

- Investment Administration Division Official will give the disbursement approval to the branch.

- Branch will then create the Investment account and disburse the Investment by Pay order and debiting the Customer Investment Account. Disbursement of the Investment is done as single disbursement or in Phases in accordance with the Sanction terms of the Investment.

- At the same time the repayment schedule is created and linked with Investment account.. In some cases tailor made schedule would be prepared. Schedule will tailor made with respect to principal, Profit, grace period etc.

- In repayment schedule Grace period may be allowed and Profit during grace period is either collected at actual or capitalized in the Investment account.

3.16 Capital Market Services Division

The capital market showed notable progress during 2008. The monthly average price index at the Dhaka Stock Exchange (DSE) showed an upward trend along with substantial improvement of turnover value. The monthly average of all share price index (DSI) DSEG, and DSE20 increased buy 55.1 percent, 49.6 percent, and 39.6 percent respectively in June 2008 over June 2007. The daily average turnover stood at Tk. 2.3 billion in the year 2008 against Tk. 0.7 billion in the year 2007 showing a healthy growth of 223.4 percent. The increased market turnover in 2008 was largely contributed by trading of shares of banks, insurance companies, mutual funds, and power sector companies. At the end of 2008, market capitalization at DSE was 17.8 percent of the country’s GDP compared with 16.1 percent in June 2007. However, volatility in the stock market seems to have magnified recently, which needs careful investigation and monitoring by the stock market regulators.

Shahjalal Islami Bank commenced its Brokerage House operation in the year 2008 through a separate division named ‘Capital Market Service Division’ (CMSD). CMSD provides BO Account facility and margin facility to its customers to invest in the secondary markets. Diversified products with different category of investment ceiling and other value added services are also available for customers.

The customers were also provided with assisted services facilities on the basis of published information and accounts. The division managed portfolio value of more than 833 million under margin accounts. As a result, profitability of CMSD shown significant positive trend during 2008. Divisional contribution was 2.21% percent to total operating profit before Provision and taxes of the Bank. The Bank has established a well decorated and highly technology based trading facilities for the connivance of the customers.

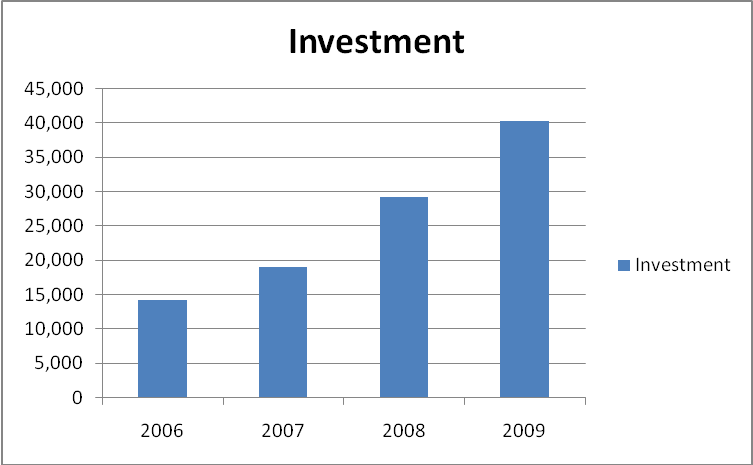

3.17 Performance of SJIBL

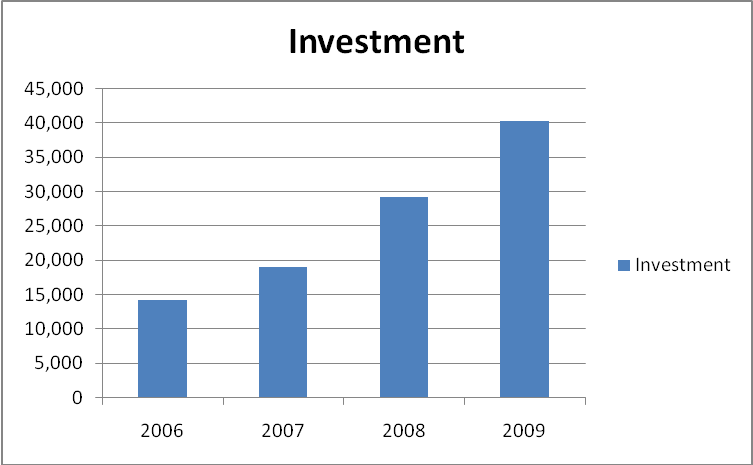

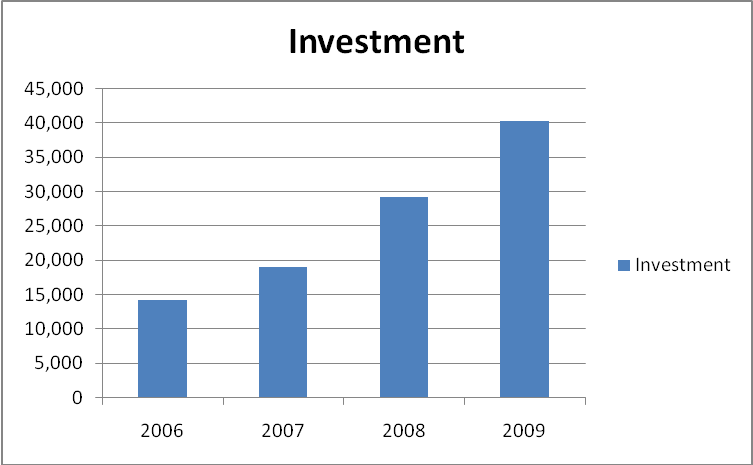

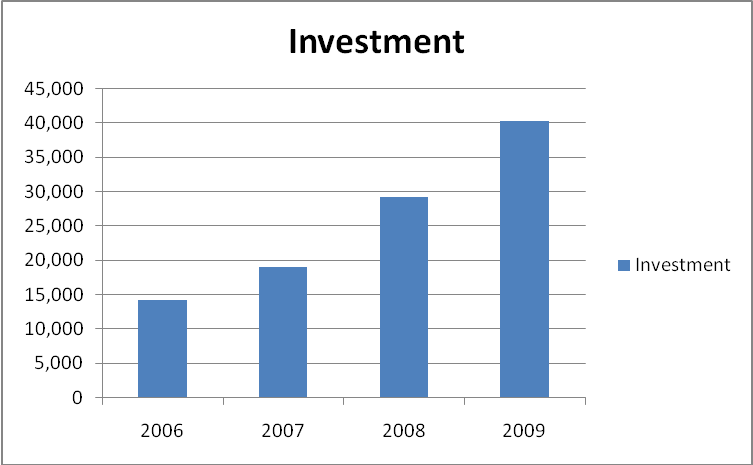

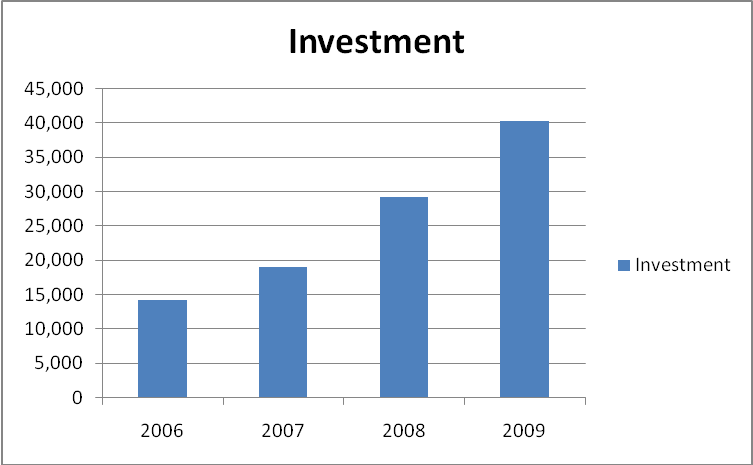

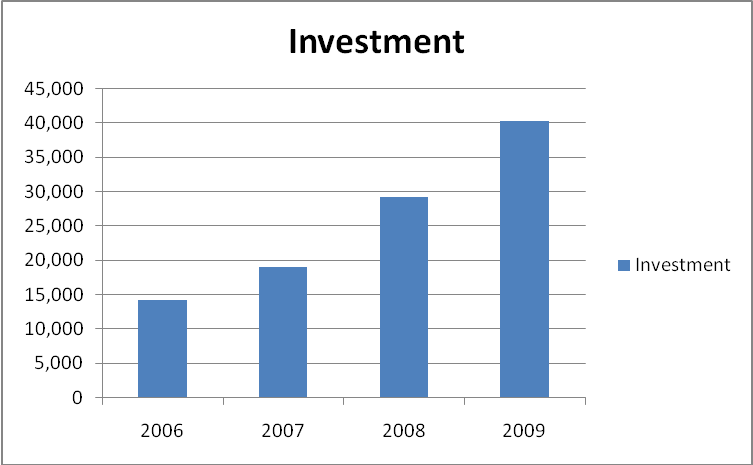

Despite changing macro-economic condition and volatile money market and foreign exchange market, Shahjalal Islami Bank Limited was successful in achieving much higher than national growth in deposit, Investment (loan), export and remittance business. AS on 31st December 2009 total deposit of the Bank stood at Tk. 47,459 million showing a growth rate of 61.31%, total amount of Investment of the Bank stood at Tk. 43,958 million with a growth rate of 59.67%. During the year import volume stood at Tk. 42,551 million with a growth rate of 66.93% compared to that of the precious year.

Operational Performance of SJIBL of last 3 years

PARTICULARS | 2007 | 2008 | 2009 |

| Paid up Capital | 1,871,650,000 | 2,245,980,000 | 2,740,095,600 |

| Total Capital ( Core + Supplementary) | 3,040,882,802 | 4,069,092,335 | 5,429,972,779 |

| Capital Surplus | 1,189,432,802 | 1,122,699,335 | 1 ,546,690,779 |

| Total Assets | 28,346,996,395 | 44,109,502,922 | 58,920,895,401 |

| Total Deposit | 22,618,187,303 | 34,279,739,993 | 47,459,231,493 |

| Total Investment (Loans & Advance) | 20,616,605,335 | 32,918,773,668 | 43,958,260,711 |

| Total Contingent Liabilities and Commitment | 20,616,605,335 | 10,771,113,500 | 14,475,137,526 |

| Investment Deposit Ratio ( % ) | 91.15% | 90.23% | 92.62% |

| Percentage of Classified Investment against total Investments | 0.62% | 0.44% | 0.94% |

| Profit after Tax and Provision | 646,992,691 | 817,709,533 | 1,070,568,293 |

| Amount of Classified Investment | 128,246,000 | 143,243,000 | 413,234,220 |

| Provisions kept against classified Investment | 23,009,403 | 28,009,403 | 118,009,403 |

| Provisions surplus | 10,723,827 | 20,801,366 | 98,703,709 |

| Cost of Fund | 10.40% | 10.99% | 11.07% |

| Profit Earning Assets | 25,303,841,268 | 39,889,424,692 | 53,131,793,268 |

| Non-Profit Earning Assets | 3,043,155,127 | 5,327,543,961 | 5,789,102,133 |

| Return on Investment in Securities (ROI) | 11.41% | 16.84% | 11.74% |

| Return on Assets (ROA) | 2.60% | 2.22% | 2.08% |

| Income from Investment in Securities | 97,974,405 | 192,717,942 | 409,019,391 |

| Earnings Per Share | 28.81 | 29.84 | 3 9.07 |

| Net Income Per Share | 28.81 | 29.84 | 39.07 |

| Price Earning Ratio (Times) | 10.58 | 8.55 | 9.79 |

4. Corporate Investment Standard of Islamic and Non Islamic Banks in Bangladesh

Investment is esteemed as the key that unlocks the possibilities of economic progress. It has great importance in wealth creation. Investment is important to the ordinary consumer at the local shop as well as to the multi-national organizations. Indeed credit has assumed the status of an institution in commercial relation.

Investments constitute the major revenue earning asset of a Bank. Banks lend mostly depositors money. Investment fund having cost implications and repayment obligations to the depositors have to be managed efficiently with minimum possible Investment (default) risk.

4.1 Corporate Investment of Shajalal Islami Bank Limited

Since Shahjalal Islami Bank is running Shariya based banking system, so they exercise islamic term for Deposit Scheme, Loan .etc. For example “loan” term is used as Investment. The bank offers a wide range of Islamic financial products like

- Short Term Investment

- Midterm Investment

- Long term Investment – Up to 5 years

- Long term Investment -Above 5 years.

But the processing system of all investment products is same. Purpose of the Investment is moral. The main purpose of the investment is to provide finance facilities to the large companies, governments, or other big institutions need in order to carry out their functions and to boost up the economic condition of the county. This will help to solve poverty problem by providing and upgrading basic infrastructure. It will improve the quality of business. It provides easy terms and minimum profit charged and flexible repayment schedule, disbursed in a prompt way.

Target Market

Investment project provides business people’s basic need business development priorities. So people from different business group can be comprised under investment project. Many financial institutions in our country are providing such facilities. SJIBL (Shajalal Islami Bank Limited) boelongs to that class.Their target customer groups are.

- Higher income group privet large companies, governments, or other big institutions which having sufficient flows of income. Higher income group privet large companies, governments, or other big institutions which having sufficient flows of income. which are fully secured i.e. fully cash covered

- Medium income group companies or self invested of middle earning bracket that can participate with own equity. For example government, semi government organization, businessmen, private firms etc. Having strong repayment capacity of the borrower.

- Lower income group business people but the company demonstrates consistently strong earnings and cash flow certainty.

The provided fund can be used

- In construction of factory building on land already owned / to be purchased.

- In purchase of goods, machineries, vehicles , land etc that to be used for business purpose

- For innovation / extension / finishing of the business.

- Any other business related project that may consider viable for finance.

Eligibility

Banker evaluates the proposal of customer and they decide whether the project approval is possible or not. In case of allocation Investment, they judge the eligibility of investment. To get the investment facility things are required.

- The company demonstrates consistently strong earnings and cash flow certainty.

- Borrower has well established, strong market share.

- Borrowers have adequate liquidity, cash flow and earnings.

- Acceptable company guarantee

- Strong repayment capacity of the borrower

Ceiling of Loan

The amount of the loan or facility should be based upon the realistic need of the borrower. This need must be analyzed carefully given the data provided by the borrower coupled with a realistic assessment of the projected cash flows to repay the loan.

For SJIBL the highest amount of loan allowable for single client is 15% of paid-up capital for funded and 50%of paid-up capital for funded and non funded business.

Here we can find the eligible mortgage loan to value ratio which means the ratio of the eligible mortgage loan as determined by the borrower’s or an independent appraiser.

Types of Credit Facilities

The Bankers extend credit facilities to their clients in various forms matching with the purpose and repayment status. Credit facilities are allowed to the client mainly in 02 (two) forms:

Funded Facility (Overdraft, Time Loan, Trust Receipt (TR), Inland Bill Purchase (IBP))

Non-funded Facility (Letter of Credit (L/C), Back to Back L/C, Letter of Guarantee)

Loan Disbursement

- Disbursement system is through payment order not in cash.