Accounting Methods of Recording Hire Purchase Transactions

Hire purchase is an agreement between two parties in which one party purchase any asset from other parties. Because he has no money to pay, so he pays per month hire charges. For the accounting point of view, both hire purchase and installment payment systems are the same. If the buyer will become defaulter, the vendor has the right to get his asset from hire purchaser.

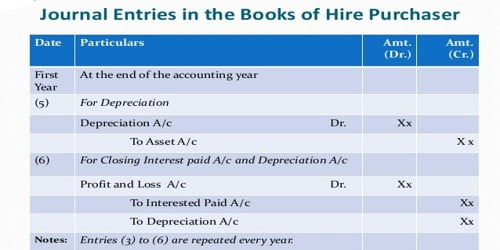

Journal Entries in the Books of Hire Purchaser –

There are two methods of recording hire purchase transactions in the books of the hire purchaser:

- When the asset is recorded in full cash price: full cash price method

- When the asset is recorded at cash price actually paid in each installment-: Actual cash price method.

(1) For the purchase of an asset:

First Method

Asset A/C (full cash price)………..Dr.

To vendor A/C

Second Method

No entry

(2) For the payment made for ‘down payment’

First Method

Vendor A/C………….Dr.

To bank A/C

Second Method

Asset A/C…………Dr.

To Bank A/C

(3) For installment due

First Method

Interest A/C…………Dr.

To vendor A/C

Second Method

Asset A/C (part of cash value)…………Dr.

To Interest A/C

4. For the payment of the installment (both method)

Vendor A/C…………Dr.

To Bank A/C

(5) For charging depreciation( on the basis of cash value) (both methods)

Depreciation A/C……………….Dr.

To Asset A/C

(6) For transfer of interest and depreciation(both methods)

Profit and loss A/C…………Dr.

To depreciation A/C

To interest A/C

Note: entries 3,4,5 and 6 will be repeated year after year until the final installment is paid.

Journal Entries in the Books of Vendor

The vendor has the possession of the asset. When a buyer pays the total price of assets in the form of hire charges, then the asset is transferred to its purchaser. The vendor may also transfer assets before the last payment of an installment on his own risk.

(1) For selling goods on hire purchase

Hire purchase A/C………..Dr.(full cash price)

To sales/hire purchase sales A/C

(2) For receiving down payment

Cash/bank A/C……………..Dr.

To hire purchaser A/C

(3) For installment due

Hire purchaser A/C…………Dr.

To Interest A/C

(4) For receiving the installment

Cash/bank A/C ………….Dr.

To hire purchaser A/C

(5) For transferring interest

Interest A/C…………Dr.

To profit and loss A/C.

[Note:

- Depreciation will not charge by hire vendor.

- Entries 3,4 and 5 will be repeated year after year until the first installment is paid.]

Information Source: