The accounts payables turnover ratio, also known as the creditor’s turnover ratio, is a short-term liquidity metric that quantifies how quickly a company pays off its suppliers. A larger payable turnover ratio is more advantageous, as it is an indicator of short-term liquidity. Accounts payable turnover really shows how frequently an organization takes care of its records payable during a period. To put it another way, the accounts payable turnover ratio is the number of times a company can pay off its average accounts payable balance in a year.

Accounts payable are short-term debts owed to suppliers and creditors by a corporation. The accounts payable turnover ratio aids creditors in determining a company’s liquidity by determining how readily it can pay off its existing suppliers and vendors. It demonstrates how well a company pays its suppliers and short-term debts. Organizations that can take care of provisions often over time show to bank that they will actually want to make normal premium and rule installments also.

A shift in the turnover ratio could suggest a change in payment conditions with suppliers, however this has a minor impact on the ratio. This percentage is often used by vendors when deciding whether or not to establish a new line of credit or floor plan for a new customer. For example, vehicle sales centers and music stores regularly pay for their stock with floor plan financing from their merchants. Merchants need to ensure they will be paid on schedule, so they regularly dissect the organization’s payable turnover ratio.

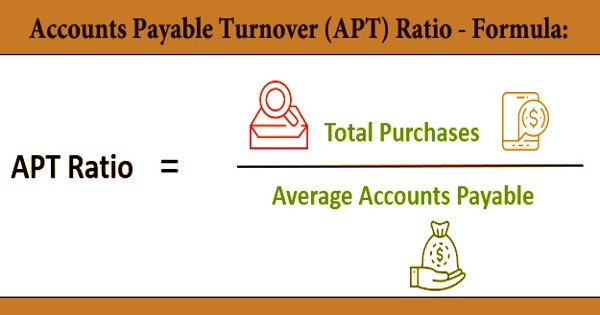

The formula for the accounts payable turnover ratio is as follows:

Accounts Payable Turnover Ratio = Total Purchases / Average Accounts Payable

In some circumstances, instead of total purchases, the numerator is cost of goods sold (COGS). Most businesses keep track of their supplier purchases, therefore this calculation may not be necessary. Because accounts payable fluctuate over the year, the average payables is employed. Because the final amount may not be reflective of the entire year, an average is calculated. The sum of accounts payable at the beginning and end of an accounting period is divided by two to get the average accounts payable.

On the off chance that an organization is paying its providers rapidly, it might imply that the providers are requesting quick installment terms, or that the organization is exploiting early installment limits. A company’s goal should be to create enough revenue to pay off its accounts payable fast, but not so rapidly that it misses out on chances by not investing that money in other ventures. The average number of days a payable goes outstanding is shown by the accounts payable turnover in days.

Financial backers can utilize the records payable turnover ratio to decide whether an organization has sufficient money or income to meet its momentary commitments. Leasers can utilize the ratio to quantify whether to stretch out a credit extension to the organization. The accounts payable turnover ratio is used by suppliers and creditors to determine whether or not to give credit to a firm since it reveals how rapidly a company pays off its vendors. A larger ratio, like other liquidity ratios, is almost always preferable than a lower ratio.

The records payable turnover ratio demonstrates to loan bosses the momentary liquidity and, to that degree, the financial soundness of the organization. A higher ratio shows providers and leasers that the organization covers its bills much of the time and routinely. It also suggests that new merchants will receive prompt payment. A high turnover ratio can be used in the future to negotiate better borrowing conditions.

A low ratio indicates sluggish payment of credit purchases to suppliers. This could be owing to attractive lending terms, or it could indicate cash flow issues and, as a result, a deteriorating financial situation. While a declining ratio may signal that a corporation is in financial trouble, this isn’t always the case. A diminishing ratio could flag that an organization is in monetary trouble. Then again, a diminishing ratio could likewise mean the organization has arranged diverse installment plans with its providers.

The accounts payable turnover, like all ratios, is unique to each industry. Every industry has its own set of standards. This ratio is best used to compare companies in the same industry that are similar. A company’s goal should be to create enough revenue to pay off its accounts payable fast, but not so rapidly that it misses out on chances by not investing that money in other ventures. The easiest way to evaluate a company’s turnover ratio, like with other financial measures, is to compare it to similar companies in its industry.

Information Sources: