The definition of actuarial gains or losses refers to an increase or a reduction in the estimates used to calculate the defined benefit pension plan commitments of a company. It happens when the ability to change an assumption is revealed by this reevaluation. An actuarial loss, on the other hand, is when the rewards are smaller than expected. Employers must make actuarial adjustments when actuarial gains or losses arise to represent improvements to their original pension projections. A pension plan’s actuarial assumptions are specifically influenced by the discount rate used to measure the present value of the benefit payments and the estimated rate of return on the assets of the plan.

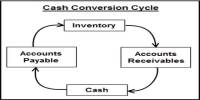

At the point when an actuarial gain or loss is caused, managers must alter their evaluations in a cycle known as an actuarial alteration. Contingent upon plan support rates, market execution, and different elements, the annuity plan may encounter an actuarial addition or misfortune in their extended advantage commitment. Organizations furnish workers with an annuity plan as a feature of a bigger exhibit of business benefits. While such accounting rules mandate that pension assets and liabilities be labeled for marketing on the balance sheet of a company, they allow actuarial gains and losses, or adjustments in actuarial assumptions, to be amortized, rather than immediately flowing into the statement of income, by comprehensive profits in shareholders ‘ equity.

Actuarial Gains or Losses

Calculating the forecast benefit responsibility of the organization, or PBO requires the ability of an actuarial to perform. A small percentage of their paycheck is withheld and added to their pension plans for several workers. The elements utilized by an actuarial to decide an organization’s PBO incorporate death rates, representative retirements, pay builds, plan interest, program rules, expansion, and the pace of profit for speculations. The annuity plan guarantees that once a worker resigns, they will get standard benefits installments to help their everyday costs. With some offering a lump-sum payment at retirement, pension schemes may differ greatly, whereas other schemes have a monthly payment for life.

Subsidized status speaks to the network resource or risk identified with an organization’s characterized advantage plans and equivalents the distinction between the estimation of plan resources and the projected benefit obligation (PBO) for the arrangement. Yearly, organizations will reconsider the presumptions utilized in the assurance of their PBO. The installment sum additionally shifts relying upon the particulars of the business’ benefits plan. Factors that can influence the payment amount include the retirement age of the individual, annual income, contribution length, and amount of contribution. In addition to government-provided retirement programs such as Social Security, the workplace pension also serves as a secondary source of funding.

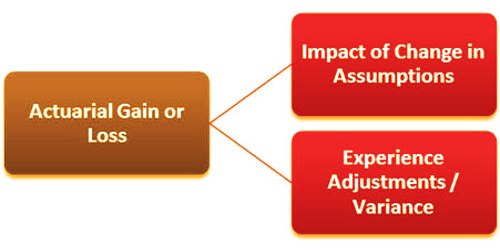

The assessment of plan assets, the investments set aside to finance the benefits of the plan, involves judgment but does not include the use of actuarial estimates. However, the use of actuarial estimates is necessary to calculate the PBO, and it is these actuarial estimates that give rise to actuarial gains and losses. A change within the assumptions utilized in developing an estimate of the PBO leads to an actuarial gain or loss. For instance, an expansion in futures, early retirements, increments to the markdown rate, higher than plan pay increments, and lower than anticipated profits for the arrangement’s ventures will build the organization’s PBO. Then again, an expansion in death rates, delays in retirements, diminishes to the rebate rate, lower than plan compensation increments, and higher than anticipated profits for the arrangement’s benefits will diminish the organization’s PBO.

In addition, when the employer spends more than the expected cost, an actuarial loss occurs. In situations where employees plan to retire early or a greater number of employees decide to retire than originally expected, it may occur. There are two essential sorts of presumptions: financial suspicions that model how market powers influence the arrangement and segment suppositions that model how member conduct is required to influence the advantages paid. Key financial presumptions incorporate the loan fee used to limit future money outpourings, expected pace of profit for plan resources, and expected compensation increments. Life expectancy planned service cycles, and estimated retirement ages are the main demographic assumptions. When an actuarial benefit or loss is sustained, in a method known as an actuarial adjustment, companies have to change their figures.

Notwithstanding the arrangement’s gain and looses, the general degree of annuity financing relies upon factors, for example, the profit for plan resources, intrigue costs, administration costs, earlier assistance expenses, and changes to the arrangement’s recipe. Bookkeeping rules require point by point exposures identified with benefits resources and liabilities, remembering period-to-period action for the records and the key presumptions used to quantify financed status. As firms plan for actuarial gains or losses, rises or decreases must be amortized over time in such a way that any adjustments are matched with current beneficiaries’ planned pension payments. The disclosure of pension data will also offer a better understanding of a company’s financial status to investors and regulators.

Information Sources: