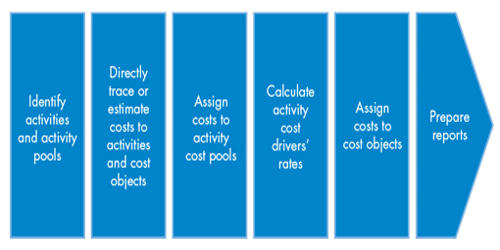

Activity-based costing provides a more accurate method of product/service costing, leading to more accurate pricing decisions. This is important for businesses offering customized services or products. It enables the effective challenge of operating costs to find better ways of allocating and eliminating overheads. Activity-Based Costing helps to reduce costs by providing meaningful information on the opportunities available for reducing costs. Traditional absorption costing is based on the principle that production overheads are driven by the level of production.

Advantages of Activity-Based Costing (ABC)

(1) Product cost determination under activity-based costing is more accurate and reliable because it focuses on the cause and effect linkage of costs and activities in the context of producing goods. It recognizes that it is activities which cause costs, not products and it is a product which consumes activities.

(2) Fixation of selling price for multi-products under activity-based costing is fair and correct because overheads are allocated on the basis of relevant cost drivers. The accurate allocation of costs to various products leads to a proper pricing policy.

(3) Control of overheads consisting of fixed and variable becomes possible by controlling and monitoring activities. The linkage between cost and activities are clearly identified in activity-based costing and thus provides opportunities to control overhead costs.

(4) Sufficient information can be obtained to make decisions about the profitability of different product lines. ABC identifies the real nature of cost behavior and helps in reducing costs and identifying activities that do not add value to the product.

(5) Fair allocation of overheads occupies a considerable portion of the total cost components. Further, ABC is concerned with all activities within and beyond the factory to trace more overheads to the products.

(6) It can help you identify, for example, profitable products, services, processes, activities, customer segments, distribution channels, contracts, and projects. This should help you when making pricing, product/service mix, and design decisions.

(7) More accurate product costing, more effective cost control, and better focus on the relevant factors for decision making. One can easily identify the cost drivers for each activity thereby allowing you to control costs at their source.

(8) The management can take make or buy decisions by considering the cost of manufacture of a product or sub-contract the same with an outside agency through Activity-Based Costing analysis.

ABC helps usefully in fixing selling prices of products as more correct data of product cost is now readily available. This system can provide better costing information and help management manage efficiently and gain a better understanding of the firm’s competitive advantages, strengths, and weaknesses.