A VAT is tolerated by final consumers, so it is a consumption tax. A huge amount of revenue is generated on a low tax rate through VAT. But, a VAT is like a sales tax in that ultimately only the end consumer is taxed.

Advantages of Value Added Tax (VAT)

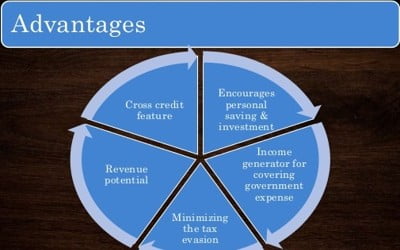

Following are the advantages of VAT:

(1) As compared to other taxes, there is less chance of tax evasion. VAT minimizes tax evasion due to its catch-up effect. Due to the catch-up effect of VAT, it minimizes avoidance.

(2) The VAT is simple to administer as compared to other indirect tax. Compared to other indirect tax VAT is easy to manage.

(3) A VAT is transparent and has a minimum burden to consumers as it is collected in small fragments at various stages of production and distribution.

(4) A VAT is based on value-added, not on the total price. So, price does not increase as a result of VAT. As the VAT is collected in small installments so the consumers have a minimal burden.

(5) There is mass participation of taxpayers. As VAT is a consumption tax the revenue generated will be constant.

(6) The VAT is a neutral tax so it can be imposed on all types of business.