Audit on behalf of a Sleeping Partner

A partner who does not take any part in the business is known as a sleeping partner. He invests his capital, he is entitled to profits, his liability is unlimited and so on. For example, a Chartered Accountant firm, it would mean that such a partner does not sign any Financial Statements/ Assurance Reports/ Tax Reports. When this liability is unlimited and he cannot take an active part in the business, naturally he would like to know as to how the business is being carried on, and that his co-partners are not handling the business in such a way that ultimately he may lose his capital. It is highly recommended that every partnership firm should go for an audit of his accounts. The audit of a partnership is not normally required by statute and so the auditor must agree with the client what his rights and duties are going to be.

Therefore, he may appoint an auditor to examine the accounts to safeguard his interest. The term sleeping partner means a partner who is not actively involved in the running of a firm. Of course, this is possible when there is a provision in the Partnership Agreement to that effect or all the other partners agree for such audit. He will continue to share the profits and losses of the firm and even bring in his share of capital like any other partner. The auditor so appointed should see that the interest of his client, viz, the sleeping partner, is not sacrificed and that it is safe. If such a dormant partner retires he need not give public notice of the same. The auditor should pay particular attention to the following points:

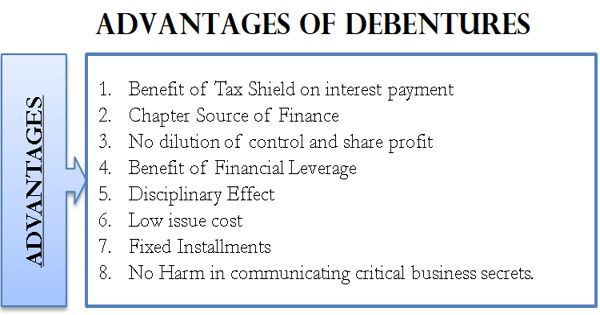

- No excessive reserve is created or over-depreciation is provided as it will reduce the amount of profit to be distributed to the partners.

- Capital expenditure is not charged to revenue account as it will have the same effect on the divisible profit.

- The active partners do not withdraw more money on account of profit or capital than that which is allowed by the partnership agreement.

- The active partners do not indulge in speculative transactions which do not form part of the ordinary business.

- He does not take an active part in the daily activities of the firm. He is however bound by the action of all the other partners.

Information Source: