Cross-checking accounting reports with physical inventory and records is the method of auditing inventory. Auditors and other parties will complete it. Physical inventory counts are likely to be the most critical aspect of the inventory audit process. This is because of actual stock check can give proof on presence and culmination. A stock review can be pretty much as straightforward as taking an actual check of stock and stock to confirm a match to the bookkeeping records.

Since these audits can disrupt regular business activities, it’s best to schedule them for when business is usually slow or non-productive, such as the end of the year after the holiday season. Examining is the way toward checking that the monetary records of an element are precise and genuinely addressed. Exchanges in monetary records should reasonably address the element’s monetary situating and real working exercises. An audit cannot be conducted in a one-size-fits-all manner. It’s just a matter of choosing the treatment that best suits the company’s and inventory requirements.

It is likewise significant for us to assess whether the stock detailed in the budget summaries is effectively esteemed. The misquote on stock influences the monetary record as well as the pay explanation. Since financial documentation and documents are created internally, there is a high risk of insiders tampering with them. When preparing financial reports, insiders may make mistakes or purposefully change details, which is called fraud. Auditing guarantees that these errors do not occur.

Here are some of the inventory audit procedures that they may follow:

- Cutoff analysis. The auditors will look at your procedures for stopping any more receiving into the warehouse or shipments out of it during the physical inventory count to ensure that no extraneous inventory products are present. They regularly test the last not many getting and transportation exchanges before the actual tally, just as exchanges quickly following it, to check whether you are appropriately representing them.

- Physical Inventory Count. To save you the wait, this is where you literally count your inventory so you know exactly how many you have on hand. In order to record data electronically, you can use a barcode scanner. In case you’re doing this with an expert inspector, they will watch and accommodate your sum with an overall record to guarantee the numbers match.

- Freight Cost Analysis. If your company ships goods to several locations, this process will help you calculate shipping costs. It keeps track of when your things were sent and when they arrived at their intended locations. This is also a great way to keep track of things that are lost or damaged along the way.

- Test high-value and error-prone items. In the event that there are things in the stock that are of uncommonly high worth, the evaluators will probably invest additional energy including them in stock, guaranteeing that they are esteemed effectively, and following them into the valuation report that conveys forward into the stock equilibrium in the overall record. If auditors have found an error pattern for specific inventory items in previous years, they are more likely to evaluate these items again.

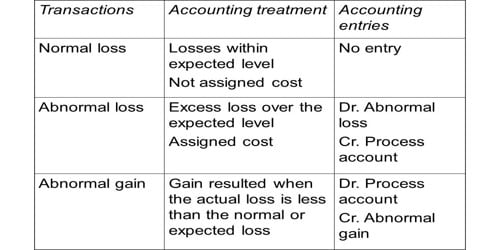

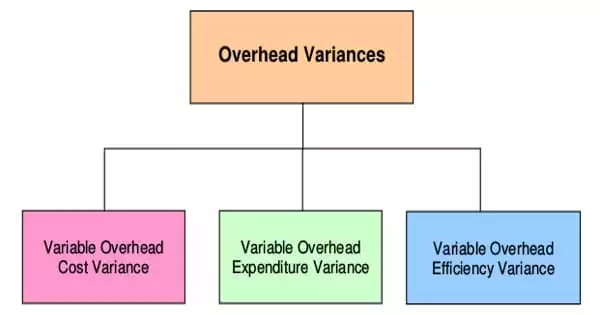

- Overhead Analysis. Despite the fact that it is an optional technique, it is still very common. Rent and power are examples of overhead costs. Analyzing these costs allows you to forecast indirect business costs, which will help you prepare for the coming year. This method is, once again, optional and only useful if you include these costs in your inventory calculations.

- Finished goods cost analysis. On the off chance that a huge extent of the stock valuation is involved completed merchandise, at that point the inspectors will need to audit the bill of materials for a choice of completed products things, and test them to check whether they show a precise aggregation of the parts in the completed merchandise things, just as right expenses.

- Direct labor analysis. If the cost of inventory includes direct labor, the auditors will want to link the labor paid during production on time cards or labor routings to the inventory cost. They’ll also look at whether the labor costs in the valuation are backed up by payroll records.

- Inventory allowances. The examiners will decide if the sums you have recorded as stipends for outdated stock or scrap are sufficient, in view of your methodology for doing as such, verifiable examples, “where utilized” reports, and reports of stock utilization (just as by actual perception during the actual check). On the off chance that you don’t have such recompenses, they may expect you to make them.

- Freight cost analysis. Determining the shipping or freight costs for moving inventory to various places is part of the freight cost study. Freight costs are usually included in the inventory value, so it’s necessary to keep track of them as well.

Audits also ensure that companies follow accounting standards such as the International Financial Reporting Standards (IFRS), Generally Accepted Accounting Principles (GAAP), and other applicable accounting standards. In the audit of inventory, presence or event attestation tests whether the stock on accounting report genuine exists and whether stock exchanges really occurred. Proof is expected to decide if budget summaries or records have been set up as per guidelines and liberated from material blunder. It is also important to encourage audit report accuracy, accountability, and independence.

Auditors need evidence to check the accuracy of financial statements. It can either confirm or substantiate the financial data that is presented. The proof, on the other hand, could contradict the financial data, indicating errors or fraudulent conduct. Fulfillment statement in the review of stock tests whether all the stock at year-end is remembered for the asset report and all buys and deals of stock are recorded. One high danger of stock is that the organization purchased the stock however the buys were not recorded into the stock record. This may be the product of either deliberate or accidental theft, both of which result in inventory understatement.

Inventory audit software helps you to monitor, register, and archive all of your inventory data in one location, regardless of where it is kept. The app will also tell you if your company’s audit procedures are working or if they need to be improved. Different advantages incorporate precise information following, shrinkage in robbery and quicker appraisals so you can get back to normal long periods of activities. An independent auditor issues an opinion on whether the financial statements of inventory correctly reflect the physical inventory being transported, which is a commonly recognized auditing practice.

Inventory auditing is an essential part of gathering evidence, especially for manufacturing and retail businesses. It may reflect a large asset or capital balance. When auditing inventory, it’s important to check not just the quantity but also the quality and condition of the stock to see if the value of the stock is accurately reflected in financial reports and statements.

Information Sources: