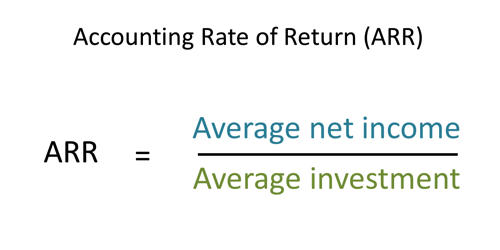

Concept of Accounting Rate of Return (ARR)

The accounting rate of return (ARR) is also known as the average rate of return. It is the ratio of the estimated accounting profit of a project to the average investment made in the project. It is the percentage rate of return expected on investment or asset as compared to the initial investment cost. ARR is based upon accounting information rather than on cash flow. It can be used when considering multiple projects since it provides the expected rate of return from each project. In other words, the Accounting rate of return (ARR) refers to the rate of earning or rate of net profit after tax on investment. The ARR is a formula used to make capital budgeting decisions.

The key advantage of ARR is that it is easy to compute and understand. It is helpful in determining the annual percentage rate of return of a project. The main disadvantage of ARR is that it disregards the time factor in terms of the time value of money or risks for long term investments. ARR does not consider the time value of money or cash flows, which can be an integral part of maintaining a business.

ARR consider profitability rather than liquidity. Under the ARR technique, the average annual expected book income is divided by the average book investment in the project. It is the average net income an asset is expected to generate divided by its average capital cost, expressed as an annual percentage. It is the percentage rate of return that is expected from an investment or asset compared to the initial cost of investment.

ARR = (Average net income/Average investment) x 100

Where,

- Average net income= Total net income/No. of years

- Average investment= Net investment/2

- Calculation of Accounting Rate Of Return (ARR)

Illustration:

The initial investment of the project is $30,000. The net profit after tax is as follows:

Year……………………….Net profit after tax($)

1………………………………25000

2………………………………30000

3……………………………….20000

4………………………………..25000

5………………………………..40000

Required: Accounting rate of return.

Solution

Calculation of ARR:

ARR = (Average net income/Average investment) x 100 = (28000/15000) x 100 = 18.67%.

Where,

Average net income = Total net income/No, of years = 25000+30000+20000+25000+40000/5 = 28000

Average Investment = Net investment/2 = 30000/2 = 15000

If the ARR is equal to 5%, this means that the project is expected to earn five cents for every dollar invested per year.

Decision Rules Of Accounting Rate Of Return (ARR)

A. If projects are independent

- Accept the project which has a higher ARR than standard.

- Reject the project which has lower ARR than standard.

B. If projects are mutually exclusive

- Accept the project which has highest ARR

- Reject other projects.