Concept of Cash Break-Even Point

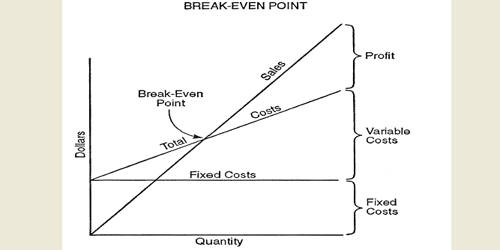

Break-Even Point tells about the volume of sales needed to cover all operating expenses. This concept is used to model the financial structure of a business. If sales equal to Break-even point then the company neither earns profit nor suffers from loss. A cash break-even analysis uses an equation that is similar to a standard break-even calculation. If a company can not achieve BEP, the company suffers from loss. The contribution margin is equal to the sales price for one unit of the product minus the variable costs needed to produce that unit.

The cash break-even point shows a firm’s minimum amount of revenue from sales that are required to provide the business with positive cash flow. If the company suffers from loss, does it mean that company faces difficulties in paying its monthly bills for rent, salary, suppliers, and labors? Not necessarily, the issue can be resolved by computing cash Break-even point. A cash break-even analysis starts with the cash break-even point equation. To calculate, start with a company’s fixed costs and subtract depreciation.

A form that the BEP formula can be taken on the basis.

BEP in units = Fixed costs/Selling price per unit- variable costs per unit.

Fixed costs include certain non-cash expenses like depreciation and amortization of expenses, for which no cash is needed in short-run. Therefore, a company can exclude depreciation and other non-cash expenses in the short-run. If only the cash costs are included in fixed costs we get cash BEP.

Cash BEP= Fixed costs- Non-cash expenses/Selling price per unit – variable cost per unit.

A break-even analysis is used to forecast the point based on the operating budget and projected sales revenue. In accounting, the break-even point formula is determined by dividing the total fixed costs associated with production by the revenue per individual unit minus the variable costs per unit. Cash Break-Even Point is the point in the ongoing operation of a business at which sales revenue equals fixed and variable costs and cash flow is neither positive nor negative. The accounting breakeven point is the sales level at which a business generates exactly zero profits, given a certain amount of fixed costs that it must pay for in each period.